Market Overview

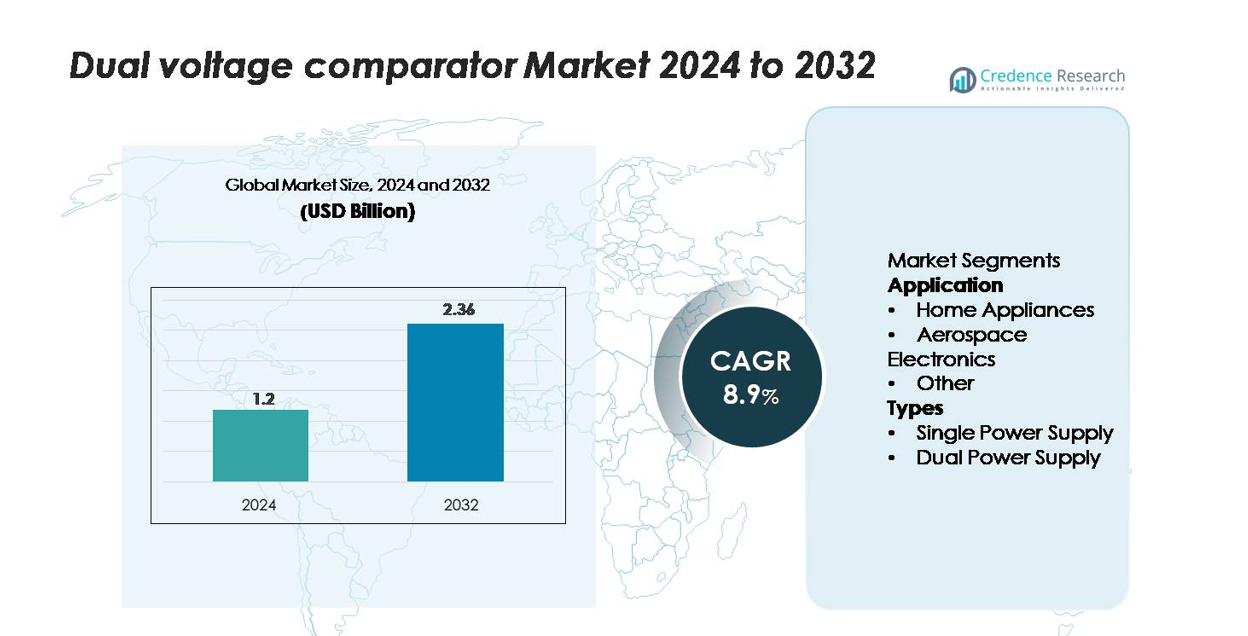

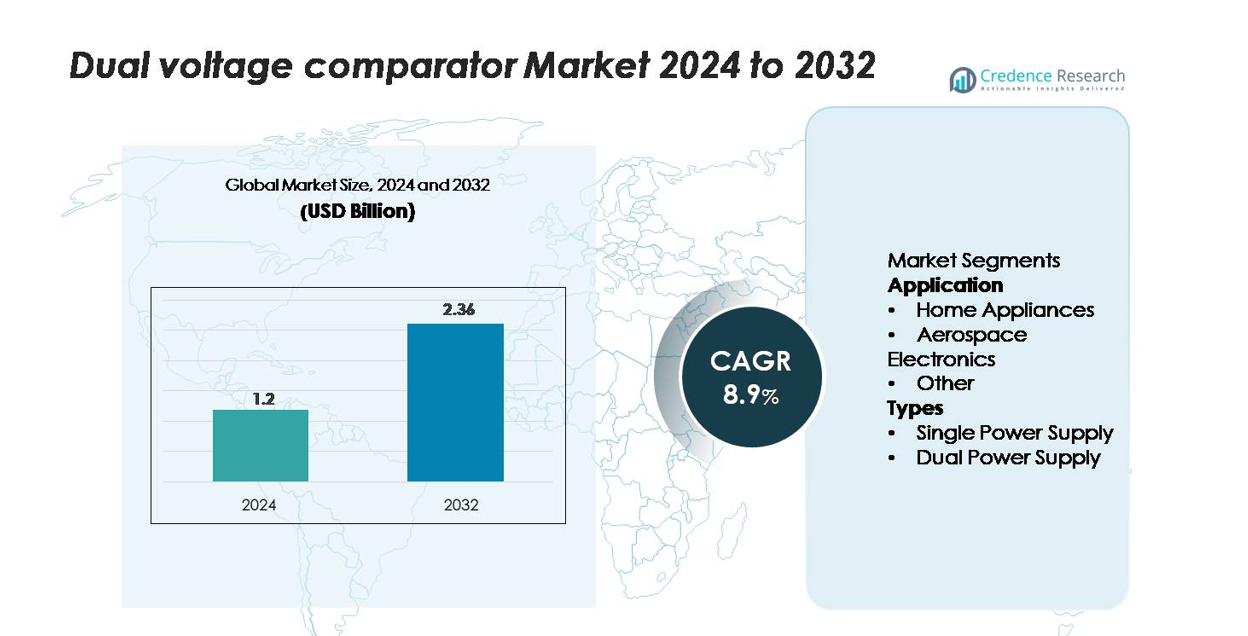

The dual voltage comparator market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.36 billion by 2032, expanding at a CAGR of 8.9% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dual Voltage Comparator market Size 2024 |

USD 1.2 billion |

| Dual Voltage Comparator market, CAGR |

8.9% |

| Dual Voltage Comparator market Size 2032 |

USD 2.36 billion |

The dual voltage comparator market is shaped by leading global semiconductor manufacturers that drive innovation in precision analog components. Key players—including Texas Instruments, Analog Devices, STMicroelectronics, ON Semiconductor, NXP Semiconductors, and Microchip Technology—focus on developing low-power, high-accuracy comparator solutions for consumer electronics, industrial automation, automotive systems, and aerospace electronics. North America leads the market with 35% share, supported by strong R&D capabilities and high adoption of advanced analog ICs. Asia-Pacific follows closely with 32%, driven by large-scale electronics manufacturing and expanding EV production, while Europe holds 27%, benefiting from robust automotive and aerospace sectors.

Market Insights

- The dual voltage comparator market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.36 billion by 2032, expanding at a CAGR of 8.9% during the forecast period.

- Market growth is driven by rising adoption in home appliances and industrial automation, with the home appliances segment holding nearly 50% share, supported by increased use in motor control, power management, and safety circuitry.

- Key trends include increased demand for low-power analog ICs, miniaturized components for IoT devices, and expanding integration in automotive and aerospace electronics, particularly for precision monitoring and protection functions.

- The market is competitive with major players such as Texas Instruments, Analog Devices, STMicroelectronics, and ON Semiconductor focusing on product innovation, broader voltage range support, and enhanced reliability across mission-critical applications.

- Regionally, North America leads with 35% share, followed by Asia-Pacific at 32% and Europe at 27%, while Latin America and MEA jointly contribute the remaining share through gradual adoption in consumer and industrial sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Application

In the application segment, home appliances hold the dominant position with an estimated 45–50% market share, driven by rising demand for compact and energy-efficient control circuits in refrigerators, washing machines, and HVAC systems. Dual voltage comparators enable precise threshold detection, motor protection, and power-saving modes, supporting their wide integration in consumer electronics. Aerospace electronics represent a growing high-value niche, supported by advancements in avionics monitoring, redundancy systems, and safety-critical detection modules. The “other” category, including industrial tools and smart meters, continues to expand as manufacturers adopt comparators for automation and fault-diagnostics functions.

- For instance, Texas Instruments’ LM393B dual comparator operates with a typical supply current of 200 µA per channel and has a wide supply voltage range with a maximum rating up to 38 V, making it suitable for inverter-controlled appliances.

By Types

Within the types segment, single power supply comparators account for the largest share at approximately 55–60%, supported by their ease of integration, low power consumption, and suitability for battery-powered and consumer electronic devices. Their broad adoption in household appliances, portable gadgets, and basic control circuits strengthens their dominance. Dual power supply comparators serve applications requiring wider input ranges and higher precision, particularly in aerospace electronics and advanced industrial instrumentation. Their uptake is driven by increasing requirements for noise immunity, stable reference detection, and support for high-reliability analog signal processing environments.

- For instance, Microchip’s MCP6541 single-supply comparator operates from 1.6 V and consumes only 600 nA of quiescent current, making it ideal for low-power consumer applications.

Key Growth Drivers

Rising Adoption in Consumer Electronics and Home Appliances

The growing penetration of smart home appliances and compact consumer electronics significantly drives demand for dual voltage comparators, which support core functions such as threshold detection, power management, and motor control. Manufacturers increasingly integrate comparators into devices like refrigerators, air conditioners, induction cooktops, and smart washing machines to enhance energy efficiency and operational reliability. As appliance platforms adopt more advanced automation and connectivity features, they require precise analog-to-digital interfacing and low-power signal conditioning, areas where dual voltage comparators excel. The shift toward inverter-based appliances further accelerates their use, as comparators play a crucial role in monitoring voltage fluctuations and protecting circuits. Expanding urbanization, rising disposable incomes, and rapid replacement cycles in consumer electronics collectively sustain this growth driver.

- For instance, Texas Instruments’ LM393B dual comparator operates with a low typical supply current of 200 µA per channel and is robust enough to withstand input voltages up to a maximum absolute rating of 38 V (though the recommended operating common-mode range is typically – 1.5 V). These characteristics, particularly its wide voltage tolerance, make it suitable for use in industrial applications such as compressor-drive and fan-control circuits.

Expanding Use in Aerospace and High-Reliability Electronics

Dual voltage comparators are increasingly deployed in aerospace electronics due to their ability to provide precise signal evaluation, fault detection, and redundancy monitoring in mission-critical systems. Avionics, navigation units, flight control modules, and environmental monitoring systems rely on high-accuracy comparators that can operate across wide temperature ranges and withstand electromagnetic disturbances. Growing investments in commercial aviation, defense modernization programs, and satellite electronics strengthen the demand for high-reliability analog components. The aerospace industry also favors dual-supply architectures that enhance noise immunity and ensure stable reference thresholds, supporting advanced diagnostic and safety mechanisms. As aircraft systems migrate toward more electric architectures, the need for efficient analog monitoring circuits fuels steady comparator adoption.

- For instance, Texas Instruments’ TLV1702 dual comparator supports operation from 2.2 V to 36 V and maintains functionality across –40 °C to +125 °C, making it suitable for industrial and automotive applications such as power-distribution systems.

Integration Within Industrial Automation and Smart Infrastructure

Industrial automation platforms increasingly incorporate dual voltage comparators to support sensing, protection, and control functions within robotics, power distribution units, industrial drives, and monitoring equipment. Smart factories rely on precise analog feedback loops for process optimization, making comparators essential for detecting voltage deviations, ensuring system safety, and enabling real-time performance tuning. The expansion of smart grids, energy management systems, and IoT-enabled industrial monitoring drives further adoption. Comparators support condition-based maintenance, fault diagnostics, and sensor signal processing, contributing to enhanced operational continuity. As industries transition toward digitalized, high-efficiency production frameworks, the need for robust analog components—capable of handling harsh environmental conditions—remains a critical growth catalyst for the dual voltage comparator market.

Key Trends & Opportunities

Increasing Shift Toward Low-Power and Miniaturized Analog Components

A major trend shaping the dual voltage comparator market is the strong shift toward low-power, miniature analog ICs suited for compact electronics, wearables, and portable devices. Manufacturers prioritize solutions that reduce standby consumption while delivering fast response times and stable threshold performance. This trend creates opportunities for next-generation comparator designs featuring nano-amp quiescent currents, rail-to-rail input capability, and higher integration levels. The rise of multi-sensor IoT ecosystems further boosts demand for ultra-efficient analog components that extend battery life and enhance device reliability. As miniaturization accelerates, vendors investing in advanced CMOS processes, packaging innovations, and integrated analog front-end design stand to gain competitive advantage.

- For instance, Microchip’s MCP6541 nano-power comparator operates at just 600 nA of supply current and supports inputs down to 1.6 V, enabling long battery life in miniaturized sensors.

Growing Opportunities in Automotive and EV Power Electronics

The electrification of vehicles opens strong opportunities for dual voltage comparators within battery management systems, onboard chargers, motor controllers, and safety mechanisms. Comparators support essential functions such as cell balancing, thermal monitoring, overvoltage detection, and current protection within EV subsystems. As vehicles incorporate more electronic control units and autonomous functionalities, the requirement for robust analog monitoring circuits expands rapidly. The transition toward 48V architectures, intelligent power switches, and advanced driver assistance systems strengthens comparator adoption. Vendors capable of offering AEC-Q100-qualified devices and wide-temperature-range performance stand to capture growing opportunities in the automotive electronics domain.

- For instance, Texas Instruments’ TLV1702-Q1 dual comparator—AEC-Q100 qualified—operates across 2.2 V to 36 V, provides a 560 ns propagation delay, and maintains functionality from –40 °C to +125 °C, making it suitable for EV battery monitoring and 48V architectures.

Key Challenges

Design Complexity and Integration Constraints in Advanced Systems

As electronic devices become more compact and feature-rich, integrating dual voltage comparators into dense circuit architectures becomes increasingly challenging. Designers must manage noise sensitivity, input offset considerations, reference stability, and compatibility with mixed-signal environments. Advanced systems—particularly in aerospace, automotive, and industrial automation—require comparators to operate across wide temperature ranges and under varying load conditions, increasing the complexity of component selection and PCB layout. The need for precise calibration, protection circuitry, and optimized power consumption further complicates integration. These technical constraints slow adoption among manufacturers lacking strong analog engineering capabilities.

Price Pressure and Availability of Low-Cost Alternatives

Despite growing demand, the market faces persistent price pressure due to the availability of low-cost discrete comparators and integrated analog front-end modules that replace standalone components. In consumer electronics and entry-level appliances, manufacturers often opt for cheaper alternatives or incorporate comparator functions into microcontroller peripherals, reducing standalone comparator demand. Additionally, supply chain constraints, semiconductor material costs, and fluctuations in fab capacity influence pricing and availability. As competition intensifies, vendors must balance cost optimization with the need to maintain high reliability and performance, particularly in safety-critical segments such as aerospace and automotive.

Regional Analysis

North America

North America holds the leading position in the dual voltage comparator market with an estimated 32–35% share, supported by strong adoption across consumer electronics, industrial automation, and aerospace systems. The region benefits from a mature semiconductor ecosystem, extensive R&D investment, and high integration of analog ICs in smart appliances and automated manufacturing platforms. Growth is further enabled by increasing defense electronics modernization and the rapid expansion of EV power electronics requiring high-reliability comparators. The presence of major analog semiconductor companies strengthens supply capability and accelerates technological advancements.

Europe

Europe accounts for approximately 25–27% of the market, driven by advanced automotive electronics, robust aerospace programs, and stringent energy-efficiency regulations influencing appliance design. The region’s strong automotive sector—particularly in Germany, France, and Italy—relies on precise voltage monitoring and protection circuits, boosting comparator integration within EVs and power control units. Industrial automation and smart factory initiatives further elevate demand for accurate analog signal processing components. Additionally, Europe’s growing focus on sustainable and high-efficiency household appliances supports wider comparator usage in power-management and control systems.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, capturing roughly 30–33% of the dual voltage comparator market, driven by strong semiconductor manufacturing capacity and expansion in consumer electronics production. China, South Korea, Japan, and Taiwan anchor regional demand through large-scale appliance manufacturing, automotive electronics, and industrial systems. The rapid penetration of low-cost, smart home devices and increasing adoption of automation in small and medium industries accelerate comparator utilization. Rising EV production and government-backed electronics manufacturing programs further strengthen APAC’s position as a global center for high-volume comparator deployment.

Latin America

Latin America holds a smaller yet steadily expanding share of around 5–6%, supported by growing consumer electronics consumption and increased industrial automation investments in countries like Brazil and Mexico. As appliance manufacturers upgrade to energy-efficient and digitally controlled platforms, demand for comparators rises within motor controllers, safety circuits, and voltage-monitoring functions. The region also benefits from the gradual adoption of EVs and renewable energy systems, which require analog monitoring components. Despite limited semiconductor manufacturing, improved imports and expanding electronics assembly operations contribute to growth.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for approximately 3–4% of the market, with demand concentrated in industrial infrastructure, energy projects, and emerging consumer appliance markets. Countries in the Gulf Cooperation Council (GCC) increasingly adopt automation technologies and smart energy systems that rely on precise analog signal monitoring. Expanding investments in aviation and defense electronics further support comparator usage in mission-critical systems. However, limited local semiconductor production and reliance on imported electronic components moderate growth, though rising digitalization and modernization initiatives create long-term opportunities.

Market Segmentations:

By Application

- Home Appliances

- Aerospace Electronics

- Other

By Types

- Single Power Supply

- Dual Power Supply

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the dual voltage comparator market is characterized by the strong presence of global semiconductor manufacturers that prioritize precision, efficiency, and integration flexibility. Leading players such as Texas Instruments, Analog Devices, STMicroelectronics, ON Semiconductor, NXP Semiconductors, and Microchip Technology focus on developing low-power, high-speed comparator families tailored for consumer electronics, automotive systems, aerospace electronics, and industrial automation. Competition intensifies as companies invest in advanced CMOS processes, wider input-voltage support, improved offset performance, and rail-to-rail architectures to strengthen their portfolios. Strategic moves—including product launches, design collaborations with OEMs, and expansion into high-growth segments like EV power electronics and smart appliances—further enhance market positioning. Additionally, the shift toward miniaturized and energy-efficient analog ICs drives companies to optimize manufacturing capabilities and deliver cost-effective solutions while maintaining high reliability standards required in mission-critical applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Renesas Electronics Corporation

- Austin Semiconductor Inc.

- HTC Korea

- Jameco Electronics

- STMicroelectronics

- AVNET

- NXP Semiconductors

- Microchip Technology Inc.

- Texas Instruments

- NTE Electronics

Recent Developments

- In December 2024, TI introduced the TLV1921/TLV1922 family of single and dual comparators rated to 65 V fail-safe inputs, with integrated 2.5 V reference and a −40 °C to +125 °C temperature range.

- In 2023, Avnet published an article emphasizing the crucial role of analog front-end components (which include comparators) in bridging sensor outputs to digital systems, thereby highlighting growing demand for dual-voltage-range comparator solutions among their supplier ecosystem.

Report Coverage

The research report offers an in-depth analysis based on Application, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand rises for precision analog components in smart appliances and consumer electronics.

- Adoption will increase in EV power electronics, especially in battery management and inverter control systems.

- Aerospace and defense electronics will integrate more high-reliability comparators to support advanced monitoring and safety functions.

- Miniaturization trends will drive development of ultra-low-power comparator ICs for IoT and wearable devices.

- Industrial automation upgrades will boost usage in sensing, protection, and real-time control circuits.

- Advancements in CMOS design will enhance comparator speed, offset performance, and energy efficiency.

- Automotive ADAS and autonomous platforms will create new demand for robust voltage monitoring components.

- Suppliers will focus on wider temperature-range and radiation-resistant devices for harsh-environment applications.

- Integration into multifunction analog front-end modules will increase as OEMs seek compact solutions.

- Regional manufacturing expansion in Asia-Pacific will strengthen supply capabilities and accelerate market penetration.