Market Overview

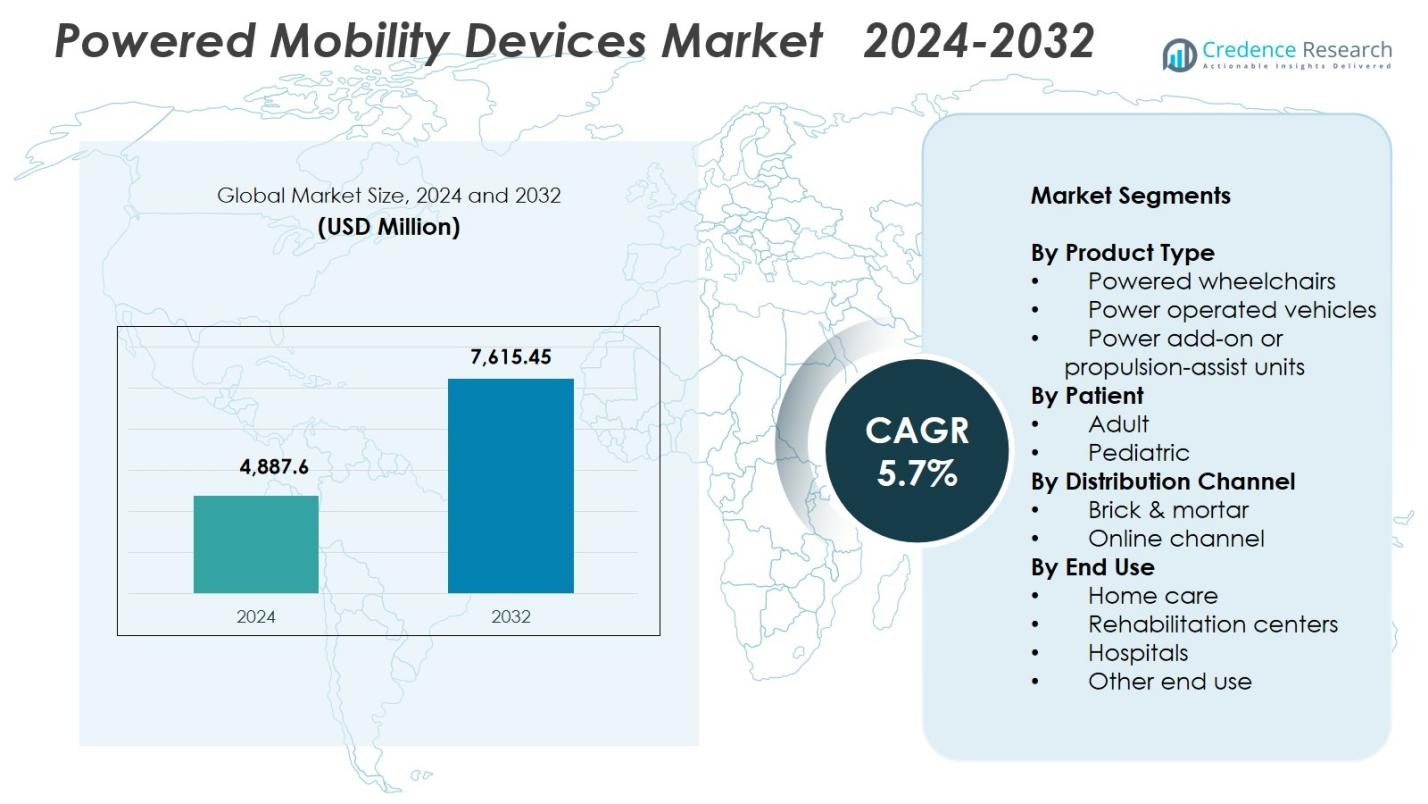

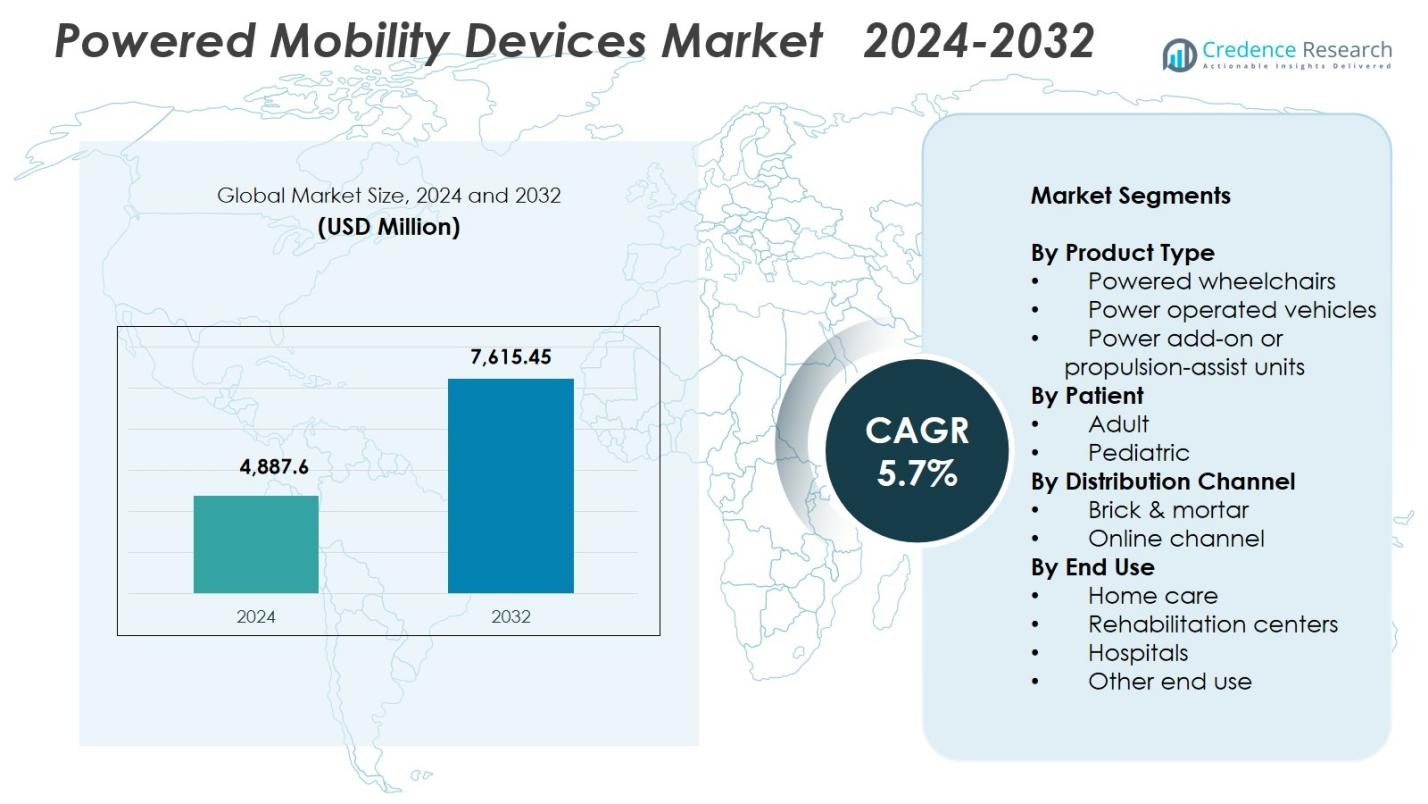

Powered Mobility Devices Market size was valued at USD 4,887.6 Million in 2024 and is anticipated to reach USD 7,615.45 Million by 2032, at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Powered Mobility Devices Market Size 2024 |

USD 4,887.6 Million |

| Powered Mobility Devices Market, CAGR |

5.7% |

| Powered Mobility Devices Market Size 2032 |

USD 7,615.45 Million |

Powered Mobility Devices Market features strong participation from leading manufacturers such as GOLDEN, Frido, LEVO, Airwheel, Merits, Hoveround Mobility Solutions, Drive DeVilbiss Healthcare, Invacare, Karman, and Decon, all of which focus on advancing device ergonomics, intelligent control systems, and premium mobility performance. These companies strengthen their presence through expanded product portfolios and technologically enhanced powered wheelchairs and mobility units designed for homecare and clinical use. Regionally, North America leads the market with 41.8% share, supported by high mobility aid adoption and strong healthcare infrastructure, while Europe and Asia-Pacific follow as significant contributors driven by rising disability support programs and growing elderly populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Powered Mobility Devices Market recorded USD 4,887.6 Million in 2024 and will grow at a CAGR of 5.7% through 2032.

- Rising prevalence of mobility disorders and a growing geriatric population accelerate demand, with powered wheelchairs holding 52.4% share as the dominant product segment.

- Smart mobility trends such as AI-assisted navigation, remote diagnostics, and customizable ergonomic designs continue to reshape product innovation and expand adoption across homecare and rehabilitation settings.

- Key players including GOLDEN, Frido, LEVO, Airwheel, Merits, Hoveround Mobility Solutions, Drive DeVilbiss Healthcare, Invacare, Karman, and Decon strengthen the market through technological upgrades and broader channel expansion.

- North America leads with 41.8% share, followed by Europe at 29.6% and Asia-Pacific at 20.7%, while brick-and-mortar channels dominate distribution with 67.3% share due to strong patient preference for in-person evaluation and professional fitting services.

Market Segmentation Analysis:

By Product Type

The Powered Mobility Devices Market by product type is led by powered wheelchairs, holding 52.4% share in 2024, driven by rising adoption among individuals with permanent mobility impairments and growing demand for advanced maneuverability in indoor and outdoor environments. Manufacturers increasingly integrate AI-driven navigation, joystick enhancements, long-range lithium batteries, and customizable seating systems, strengthening the preference for powered wheelchairs over power-operated vehicles and propulsion-assist units. Power-operated vehicles captured 34.7% share, supported by elderly users seeking stability, while propulsion-assist units held 12.9% share, driven by hybrid mobility needs.

- For instance, Mobilis Drive Assist equips powered wheelchairs with an AI co-pilot sensor attached to the joystick bottom, analyzing objects within 2 meters ahead in real time for steering assistance and collision avoidance while users direct via joystick.

By Patient

The Powered Mobility Devices Market by patient segment is dominated by adult users, accounting for 78.6% share in 2024, driven by the high prevalence of age-related mobility disorders, increased disability incidence, and rising rehabilitation needs across long-term care settings. Adults increasingly choose powered wheelchairs and POVs due to improved comfort features, enhanced safety technologies, and broader reimbursement coverage in many regions. The pediatric segment, representing 21.4% share, grows as clinical adoption expands for children with neuromuscular disorders and congenital conditions, supported by lightweight frames, customizable seating, and ergonomic control systems designed for younger users.

- For instance, Pride Mobility’s Jazzy Air 2 power wheelchair elevates up to 12 inches in 11 seconds for easier access to counters and improved eye-level interaction, while offering a lower seat-to-floor height for table use.

By Distribution Channel

The Powered Mobility Devices Market by distribution channel is led by brick-and-mortar outlets, commanding 67.3% share in 2024, driven by consumer preference for in-person product trials, clinical assessments, and professional fitting services. Hospitals, mobility clinics, and specialty retailers offer personalized consultations and after-sales maintenance, strengthening physical channel dominance. The online channel, with 32.7% share, expands rapidly as digital purchasing platforms, virtual product demos, and doorstep delivery options improve convenience. E-commerce adoption is further supported by broader product availability, transparent pricing, and rising consumer confidence in remote decision-making for mobility solutions.

Key Growth Drivers

Rising Prevalence of Mobility Disorders

The increasing incidence of mobility-impairing conditions such as arthritis, spinal cord injuries, multiple sclerosis, and age-related musculoskeletal disorders significantly drives demand for powered mobility devices. As global disability rates rise, healthcare systems prioritize accessible mobility support to enhance patient independence and quality of life. Advancements in clinical rehabilitation practices and wider adoption of power wheelchairs in hospitals and long-term care facilities further accelerate market expansion. The growing geriatric population plays a major role in strengthening long-term demand for these mobility solutions.

- For instance, Sunrise Medical introduced the QUICKIE Q50 R Carbon in March 2024, a foldable power wheelchair weighing 32 lbs with a 300 lbs user capacity and up to 15-mile range on dual batteries.

Expanding Geriatric Population

Rapid global aging remains a major catalyst for powered mobility device adoption, particularly in regions with rising life expectancy and an increasing share of elderly individuals requiring movement assistance. Older adults experience higher rates of mobility loss, prompting greater use of powered wheelchairs, POVs, and propulsion-assist units. Governments and private healthcare providers expand elderly care programs, home-care services, and insurance coverage to support mobility independence. Improved device ergonomics, lightweight frames, and customizable controls enhance safety and usability for seniors, reinforcing sustained market growth.

- For instance, Pride Mobility’s Jazzy Elite HD power wheelchair provides front-wheel drive with 14-inch drive wheels for superior uphill climbing and tight indoor turns, aiding elderly outdoor freedom.

Technological Advancements in Mobility Solutions

Continuous innovation in mobility technology significantly boosts market growth as manufacturers integrate AI-based navigation, improved joystick control systems, long-lasting lithium battery packs, and advanced seating ergonomics. These enhancements improve user comfort, maneuverability, and device efficiency across indoor and outdoor environments. Smart connectivity features, tilt-and-recline systems, and customizable user interfaces broaden adoption across clinical and homecare settings. Technological improvements also support rehabilitation outcomes, enabling users with severe disabilities to achieve greater independence, thereby strengthening market acceptance and long-term device utilization.

Key Trends & Opportunities

Integration of Smart and Connected Mobility Features

A leading trend in the Powered Mobility Devices Market is the rapid integration of smart mobility technologies, including IoT-enabled monitoring, remote diagnostics, GPS navigation, and adaptive driving controls. These capabilities enhance safety, optimize battery performance, and allow real-time tracking for caregivers and healthcare providers. Manufacturers increasingly adopt sensor-based obstacle detection and AI-driven navigation systems, expanding opportunities for premium device offerings. The shift toward connected mobility solutions supports personalized rehabilitation plans and opens new avenues for subscription-based remote support services.

- For instance, Sunrise Medical integrates Bluetooth modules in its power wheelchairs, such as those with R-Net electronics, enabling connection to smartphones for IoT-based environmental control and the Switch-It Remote Seating App, which tracks seating angles to prevent pressure sores through acoustic and visual alerts.

Growing Demand for Customizable and Ergonomic Designs

Rising consumer preference for personalized mobility solutions creates strong opportunities for manufacturers offering modular, ergonomically enhanced, and highly customizable powered devices. Users increasingly require adjustable seating systems, compact frames, and adaptive control interfaces tailored to specific disabilities and lifestyle needs. Advances in lightweight materials, foldable designs, and hybrid indoor-outdoor wheelbases expand usability across diverse environments. Rehabilitation specialists and healthcare providers also emphasize device customization to improve posture, safety, and long-term clinical outcomes, positioning ergonomic innovation as a major growth opportunity.

- For instance, Invacare’s AVIVA FX Power Wheelchair leverages a compact base and customizable control interfaces, allowing users to select joystick styles and program control responses for specific clinical conditions.

Key Challenges

High Cost of Advanced Mobility Devices

The high cost of powered mobility devices remains a key barrier to widespread adoption, particularly in low- and middle-income regions. Premium powered wheelchairs and POVs equipped with advanced control systems, smart features, and durable components often exceed affordability thresholds for individual patients. Limited reimbursement coverage in several markets further restricts access. Manufacturers face the challenge of balancing technological advancements with cost-efficiency, while healthcare providers struggle to widen adoption among economically disadvantaged groups, slowing overall market penetration.

Limited Infrastructure and Accessibility Barriers

Inadequate infrastructure, such as poorly designed public spaces, limited wheelchair-friendly transportation, and barriers within residential and commercial buildings, continues to hinder effective use of powered mobility devices. Many regions lack standardized accessibility regulations, restricting mobility independence despite device availability. These limitations reduce user confidence and limit the functional benefits of powered devices, especially in developing regions. Insufficient maintenance support, limited service networks, and uneven distribution channels further compound challenges, making accessibility enhancement critical for broader market adoption.

Regional Analysis

North America

North America leads the Powered Mobility Devices Market with 41.8% share in 2024, supported by advanced healthcare infrastructure, strong reimbursement frameworks, and high adoption of powered wheelchairs among aging populations. The U.S. accounts for the largest demand, driven by increased prevalence of mobility disorders, strong purchasing power, and continuous product innovations from regional manufacturers. Rising home-care utilization and adoption of electronic mobility aids strengthen growth. Canada contributes steady expansion due to supportive public funding programs, growing geriatric demographics, and increasing integration of smart mobility technologies across rehabilitation centers and long-term care facilities.

Europe

Europe holds 29.6% share in 2024, driven by expanding assistive technology programs, strong regulatory emphasis on patient mobility rights, and increasing usage of powered wheelchairs in rehabilitation and geriatric care settings. Germany, the U.K., and France represent major markets with high mobility aid penetration, supported by structured insurance coverage and national disability support schemes. Innovations in lightweight power-assisted units and indoor-outdoor hybrid wheelchairs accelerate adoption. Rising chronic disease burden, demand for ergonomic mobility equipment, and the presence of leading manufacturers contribute to continued market expansion across Western and Northern Europe.

Asia-Pacific

Asia-Pacific accounts for 20.7% share in 2024, fueled by a rapidly aging population, expanding healthcare access, and rising demand for affordable powered mobility solutions in China, Japan, India, and South Korea. Government-backed disability support programs and increasing urbanization strengthen adoption of powered wheelchairs and power-operated vehicles. Local manufacturing growth and the availability of cost-efficient devices broaden accessibility for middle-income users. Japan leads technologically advanced solutions, while China sees surging domestic production. Growing rehabilitation infrastructure and digital sales channels further accelerate market penetration across emerging economies.

Latin America

Latin America captures 5.3% share in 2024, with growth supported by increasing incidence of mobility-limiting conditions and expanding rehabilitation services across Brazil, Mexico, Chile, and Argentina. Adoption rises as governments enhance disability inclusion programs and invest in mobility assistive technologies. Brazil leads regional demand due to large patient populations and expanding private healthcare. Import-driven availability of powered wheelchairs and POVs supports broader access, while rising e-commerce penetration enhances product reach. Economic recovery and increasing medical tourism strengthen opportunities for international manufacturers.

Middle East & Africa

The Middle East & Africa region holds 2.6% share in 2024, driven by increasing investments in healthcare modernization, growing demand for assistive devices in urban centers, and rising disability awareness initiatives. Gulf countries such as Saudi Arabia and the UAE lead adoption due to strong healthcare spending and government-backed mobility support programs. Africa shows gradual growth as rehabilitation infrastructure improves and NGOs expand mobility assistance programs. Import-driven availability, technological upgrades in hospitals, and growing emphasis on patient-centric mobility solutions contribute to steady but developing market expansion across the region.

Market Segmentations:

By Product Type

- Powered wheelchairs

- Power operated vehicles

- Power add-on or propulsion-assist units

By Patient

By Distribution Channel

- Brick & mortar

- Online channel

By End Use

- Home care

- Rehabilitation centers

- Hospitals

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Powered Mobility Devices Market includes key players such as GOLDEN, Frido, LEVO, Airwheel, Merits, Hoveround Mobility Solutions, Drive DeVilbiss Healthcare, Invacare, Karman, and Decon. The market features strong innovation-driven activity as manufacturers focus on expanding product portfolios, enhancing device ergonomics, and integrating smart mobility technologies to meet evolving patient needs. Companies emphasize lightweight materials, AI-assisted navigation, long-range battery systems, and customizable seating configurations to strengthen clinical and homecare applications. Strategic collaborations with healthcare providers, rehabilitation centers, and insurance networks support wider market penetration. Producers also invest heavily in R&D to introduce compact, foldable, and hybrid indoor-outdoor mobility solutions. Growing online sales channels and regional distribution partnerships enable companies to broaden customer reach. Additionally, manufacturers increasingly adopt patient-centric designs and cost-efficient production models to address accessibility challenges and meet rising global demand for powered mobility assistance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GOLDEN

- Frido

- LEVO

- Airwheel

- merits

- Hoveround Mobility Solutions

- drive DeVilbiss Healthcare

- INVACARE

- KARMAN

- decon

Recent Developments

- In July 2025 Sunrise Medical acquired neuro-rehabilitation specialist Made for Movement (MfM), strengthening its powered mobility and therapeutic device offerings.

- In December 2025 ALIMCO launched a new three-wheeled electric scooter and a “clip-on” motorised device converting manual wheelchairs into battery-powered mobility aids, marking a shift toward affordable assistive mobility in India.

- In May 2025 Sunrise Medical launched the Empulse® M90 power-add-on unit to convert manual wheelchairs into powered mobility devices, enhancing accessibility for existing wheelchair users.

- In April 2024 Golden launched the GP303 Golden Ally™, a lightweight foldable power wheelchair, expanding its mobility product line and improving portability for users.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Patient, Distribution Channel, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady adoption as aging populations drive long-term demand for powered mobility solutions.

- Technological advancements will strengthen product capabilities, with AI-driven navigation and smart connectivity becoming standard features.

- Manufacturers will expand customization options, enabling users to personalize controls, seating, and mobility configurations more effectively.

- Lightweight materials and compact foldable designs will gain traction, improving portability and user convenience.

- Healthcare reimbursement frameworks will evolve, supporting broader access to advanced mobility devices across multiple regions.

- Online distribution channels will expand rapidly as virtual demos and remote purchasing options increase consumer confidence.

- Integration of remote diagnostics and tele-rehabilitation support will enhance device performance monitoring and patient outcomes.

- Emerging markets will show stronger adoption as local manufacturing improves affordability and accessibility.

- Partnerships between mobility device companies and healthcare providers will accelerate product innovation and clinical acceptance.

- Sustainability-focused design initiatives will influence material selection, battery systems, and production processes across the industry.