Market Overview

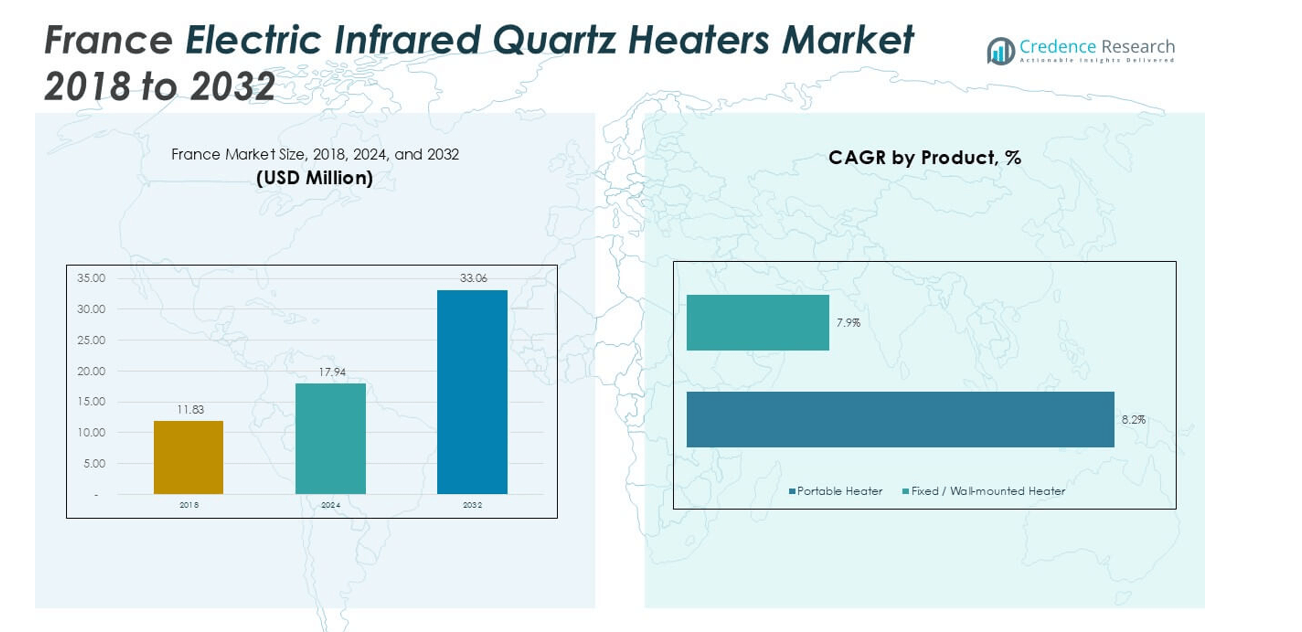

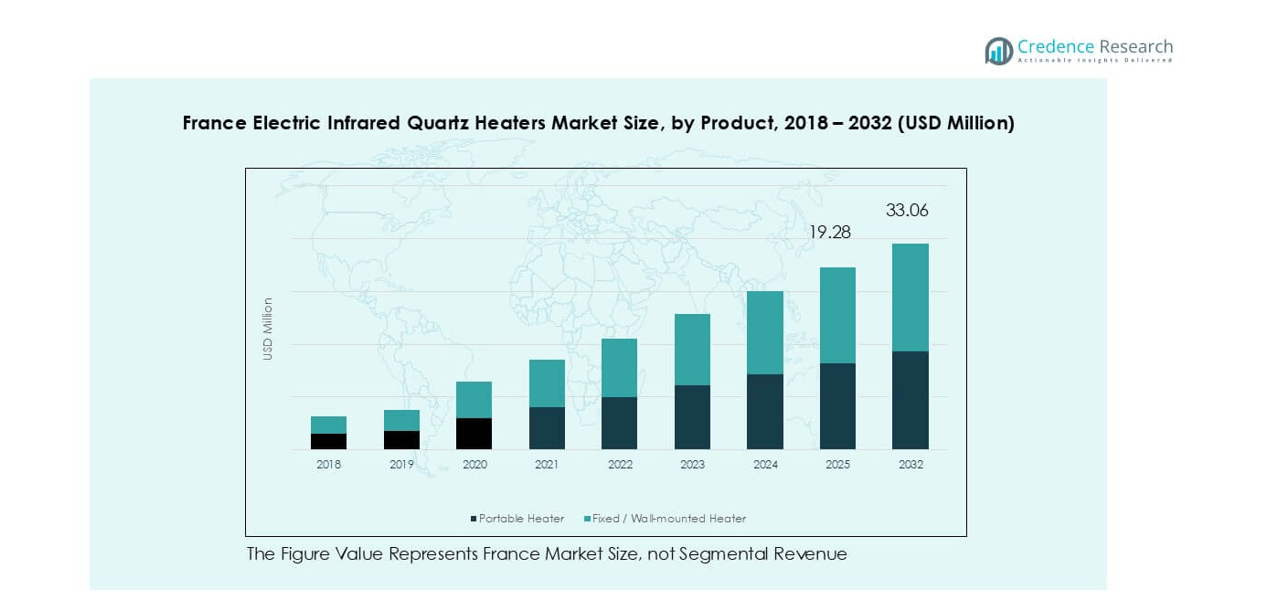

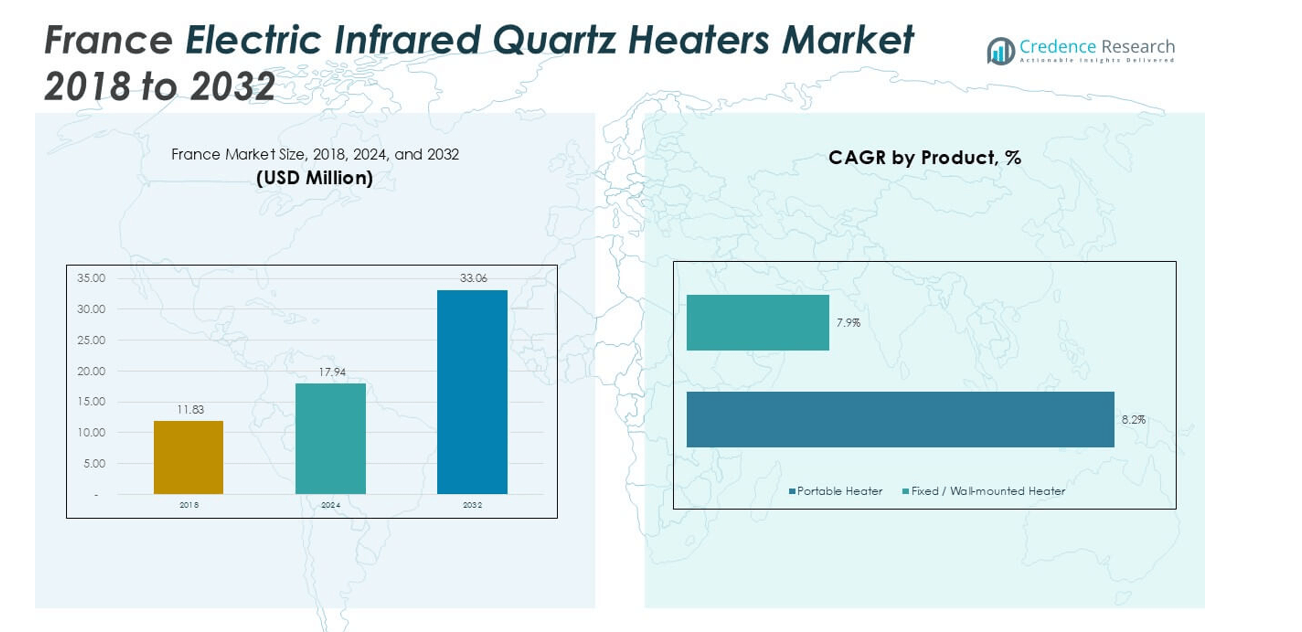

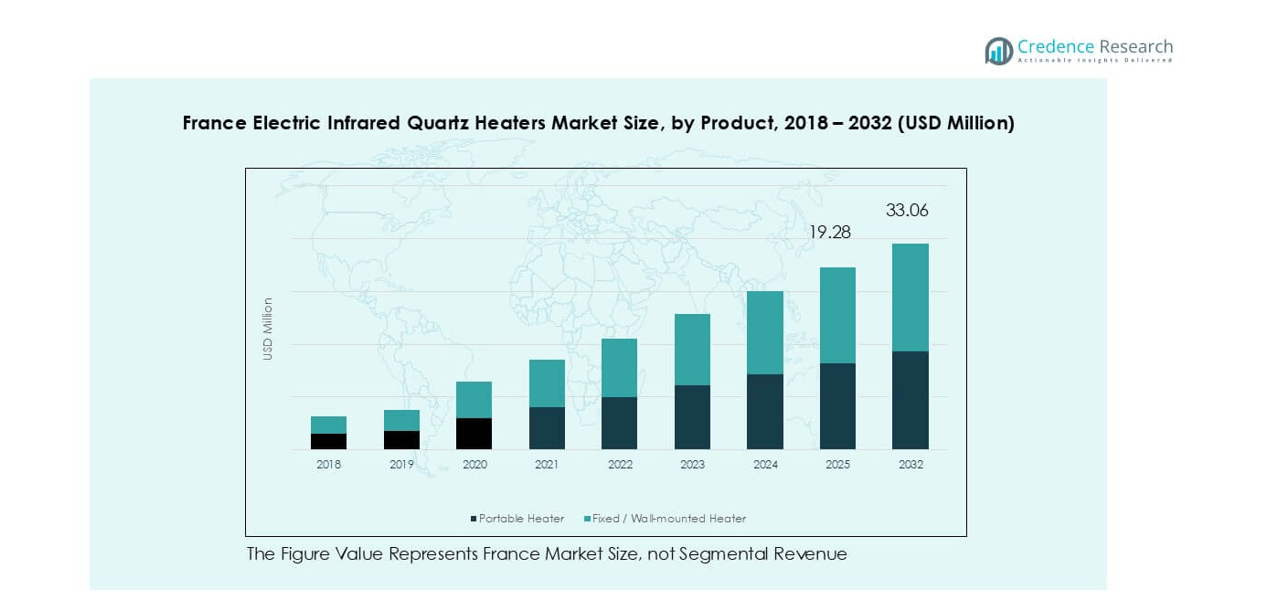

The France Electric Infrared Quartz Heaters market size was valued at USD 11.83 million in 2018, rising to USD 17.94 million in 2024, and is anticipated to reach USD 33.06 million by 2032, growing at a CAGR of 8.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Electric Infrared Quartz Heaters Market Size 2024 |

USD 17.94 million |

| France Electric Infrared Quartz Heaters Market, CAGR |

8.12% |

| France Electric Infrared Quartz Heaters Market Size 2032 |

USD 33.06 million |

The France Electric Infrared Quartz Heaters market is led by key players such as Acim Jouanin, Tansun, Tempco Electric Heater Corporation, Döbeln Elektrowärme GmbH, and Lasko Products, LLC, supported by established brands like TPI Corporation, Pelonis Technologies, Ceramicx, and Quarz-Elektro-Bauelemente GmbH. These companies compete through energy-efficient designs, smart control systems, and durable heating technologies tailored for both residential and commercial applications. Northern France emerged as the leading region, accounting for 29% of the total market share in 2024, driven by its colder climate and high adoption in urban and hospitality sectors. Continuous innovation, strong distribution networks, and emphasis on sustainable heating solutions define the competitive advantage of leading firms across France.

Market Insights

- The France Electric Infrared Quartz Heaters market was valued at USD 17.94 million in 2024 and is projected to reach USD 33.06 million by 2032, growing at a CAGR of 8.12%.

- Growing demand for energy-efficient and portable heating systems is driving adoption across residential and commercial sectors, supported by rising electricity costs and stricter emission norms.

- Smart and Wi-Fi-enabled heaters, aesthetic wall-mounted models, and sustainable product designs are key emerging trends shaping product innovation and consumer preference.

- The market is moderately consolidated, with leading players such as Acim Jouanin, Tansun, and Tempco Electric Heater Corporation focusing on design efficiency, safety features, and regional expansion.

- Northern France accounted for 29% of total market share in 2024, while the portable heater segment dominated with 61% share, driven by flexible usage, easy installation, and growing popularity among urban households and hospitality venues.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The portable heater segment dominated the France Electric Infrared Quartz Heaters market in 2024 with a 61% share. Its popularity is driven by easy installation, mobility, and suitability for small or temporary heating needs. Consumers favor portable models for energy-efficient operation in compact spaces, such as offices and apartments. Fixed or wall-mounted heaters, while efficient for continuous use, remain secondary due to higher installation costs and limited flexibility. Rising demand for plug-and-play systems and quick heat generation continues to reinforce the dominance of portable units across the residential sector.

- For instance, the De’Longhi HFX30C18.AG is a ceramic fan heater weighing 1.3 kilograms that provides circulating convective heat for home and office use, with a noise level of 41 dB.

By Wattage

The 1000–1500-watt category led the market in 2024, holding a 54% share. This wattage range offers an ideal balance between energy consumption and heating performance, making it suitable for most mid-sized rooms. Consumers prefer these models for their efficiency and affordability compared to high-wattage variants. Below-1000-watt heaters serve smaller spaces, while above-1500-watt units cater to industrial or large-area heating needs. The segment’s growth is supported by increasing residential adoption and the integration of smart thermostatic controls that enhance comfort and safety.

- For instance, a Veito Aero S 1500W quartz infrared heate provides dual 750 W/1,500 W settings with a built-in thermostat to help regulate energy use.

By Distribution Channel

The offline segment accounted for 68% of the market share in 2024, driven by consumer preference for in-store product demonstrations and instant availability. Retail chains and specialty appliance stores play a major role in expanding market reach through seasonal promotions. However, the online segment is rapidly growing, supported by e-commerce expansion and product comparisons offered by platforms like Amazon and Cdiscount. The shift toward online sales is further fueled by competitive pricing, broader model availability, and rising trust in digital purchasing for home appliances.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Solutions

The growing preference for energy-efficient appliances is a major driver of the France Electric Infrared Quartz Heaters market. Consumers are shifting toward infrared quartz heaters as they convert almost all electrical energy into heat, reducing power wastage. These systems offer zone heating, allowing users to warm specific areas instead of entire spaces, further improving efficiency. France’s focus on reducing residential and commercial carbon footprints aligns with EU energy directives, boosting demand for low-emission electric heaters. Moreover, rising electricity costs and government awareness campaigns encouraging energy conservation enhance adoption rates across households and small businesses.

- For instance, the Atlantic Group introduced the Tatou Digital 2 radiant heater, rated at 1,500 W, which includes a precise electronic thermostat and occupancy and open-window detection sensors. These advanced features allow the device to intelligently adapt to the user’s lifestyle and avoid heating an empty room.

Increasing Adoption in Residential and Commercial Spaces

Infrared quartz heaters are gaining traction across homes, offices, and hospitality establishments due to their compact design and fast heating capabilities. The ability to deliver radiant warmth similar to natural sunlight makes them more comfortable and health-friendly. In residential areas, they are used for supplemental heating, especially in older buildings lacking modern insulation. The commercial segment, including restaurants and outdoor cafés, increasingly relies on these systems to maintain ambient comfort during colder months. Rapid urbanization and rising living standards in cities like Paris, Lyon, and Marseille also contribute to market growth, supported by interior-friendly and aesthetically appealing heater designs.

- For instance, in France, outdoor heating is now banned for most café terraces as part of the country’s climate and energy policies. The ban on heated terraces, which was originally delayed to assist businesses impacted by the COVID-19 pandemic, came into effect on March 31, 2022.

Technological Advancements and Smart Integration

Innovation in heater design and control systems has strengthened product appeal among French consumers. Manufacturers are integrating smart thermostats, motion sensors, and Wi-Fi-enabled controls to improve user convenience and energy management. For instance, smart infrared heaters can be controlled remotely via mobile apps, allowing precise temperature adjustments and scheduling. These advancements also enhance safety features, including automatic shut-off and overheat protection. Such technological upgrades meet the demand for modern, intelligent home appliances while aligning with France’s smart home adoption trend. The increasing availability of connected home ecosystems supports the integration of these advanced heating solutions.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Heating

The French market is witnessing a shift toward eco-friendly heating systems as consumers prioritize sustainable living. Electric infrared quartz heaters are increasingly replacing fossil-fuel-based heating methods, contributing to carbon reduction goals. Manufacturers are developing models with recyclable materials and longer lifespans, aligning with France’s circular economy initiatives. The trend also supports the national target to phase out gas and oil boilers in residential buildings by promoting cleaner alternatives. This sustainability-driven transition presents strong opportunities for companies investing in energy-efficient, low-emission heater technologies across both residential and commercial segments.

- For instance, Thermor launched the Equateur 4 range with a high-performance cast iron core combined with a fast-acting heating facade. The heater is available in several power ratings, including 1,500 W. As with all electric resistance heaters, the appliance converts nearly 100% of the electrical energy it consumes into heat at the point of use.

Expansion of Online Retail Channels

E-commerce is becoming a significant growth opportunity for heater manufacturers in France. Online channels offer broad accessibility, transparent pricing, and convenient product comparisons that appeal to tech-savvy consumers. Retailers such as Amazon, Leroy Merlin, and Cdiscount are expanding their appliance categories to include advanced infrared models. Promotional discounts and easy return policies further encourage online purchases. The post-pandemic surge in digital shopping has also accelerated this transition, allowing brands to reach customers in smaller cities and rural areas. The online marketplace thus provides a scalable platform for manufacturers to expand market penetration cost-effectively.

Product Customization and Aesthetic Appeal

Customization and design aesthetics are emerging as differentiating factors in the French market. Consumers increasingly prefer heaters that blend with modern interiors, offering both functionality and style. Manufacturers are responding with sleek, wall-mounted, and glass-panel models that complement home décor. Additionally, the demand for customizable heat settings and multi-mode operations enhances user satisfaction. This design-centric approach helps brands capture attention in a competitive market and appeals particularly to the urban middle class. As design innovation continues, companies focusing on premium finishes and space-saving models will gain a stronger foothold in the market.

Key Challenges

High Product Cost and Limited Awareness

Despite growing popularity, electric infrared quartz heaters face adoption challenges due to higher upfront costs compared to traditional heaters. Many consumers in rural and low-income areas remain unaware of the long-term energy savings and operational benefits these systems offer. Additionally, the availability of cheaper convection or fan heaters limits adoption among budget-conscious buyers. Lack of widespread education on the safety and environmental advantages of infrared heating further hampers market expansion. Overcoming this challenge will require stronger marketing strategies and government incentives promoting energy-efficient appliances among consumers.

Competition from Alternative Heating Technologies

The France Electric Infrared Quartz Heaters market faces intense competition from heat pumps, convection heaters, and hybrid heating systems. These alternatives often come with strong government backing due to their energy efficiency and renewable integration potential. Heat pumps, in particular, are widely promoted under France’s national renovation and decarbonization programs. This policy support creates a competitive barrier for electric infrared heaters in certain residential applications. To counter this, manufacturers must emphasize unique benefits such as portability, faster heating, and zero maintenance. Strategic partnerships with retailers and eco-label certifications can help strengthen market positioning against competing technologies.

Regional Analysis

Northern France

Northern France held a 29% share of the Electric Infrared Quartz Heaters market in 2024, driven by cold climatic conditions and high heating demand during extended winters. The region’s urban areas, including Lille and Amiens, show strong adoption across residential and commercial sectors. Growing installation in outdoor cafés and hospitality venues also supports market growth. Government incentives for low-emission and energy-efficient appliances further promote adoption. The increasing replacement of gas-based systems with electric models continues to boost regional sales, particularly in suburban households seeking cost-effective and portable heating solutions.

Western France

Western France accounted for a 23% share of the market in 2024, supported by growing use in residential properties and small offices. Cities like Nantes and Rennes are witnessing increased installations due to the region’s humid coastal climate, requiring quick and efficient heating. Portable heaters dominate due to convenience and affordability. The tourism industry, including outdoor restaurants and lodges, also contributes to demand. Rising energy efficiency awareness and product availability through large retail networks such as Leroy Merlin strengthen the region’s position in the national market.

Southern France

Southern France represented 21% of the market share in 2024, primarily driven by its expanding hospitality and tourism sectors. While the region has milder winters, seasonal use of electric infrared quartz heaters in outdoor dining areas and hotels remains high. Cities such as Marseille and Nice favor wall-mounted and design-centric models that complement modern interiors. The shift toward sustainable heating and increased availability of smart-controlled systems further support demand. Manufacturers focusing on energy-saving and visually appealing products are gaining a competitive advantage in this region.

Central France

Central France captured a 15% market share in 2024, fueled by the rising adoption of compact electric heating systems across residential buildings. The colder interior climate, particularly in cities like Clermont-Ferrand and Limoges, supports consistent year-round use. Consumers prefer mid-range wattage models that balance performance and affordability. Government-led awareness programs encouraging the use of eco-friendly appliances further support sales. Expansion of e-commerce channels has also enhanced access to advanced heater models, allowing consumers in smaller towns to purchase energy-efficient solutions conveniently.

Eastern France

Eastern France accounted for 12% of the Electric Infrared Quartz Heaters market in 2024, with demand led by industrial and commercial users. The region’s colder climate, particularly in Strasbourg and Dijon, increases heating requirements during extended winters. Fixed and high-wattage models dominate due to their efficiency in large spaces. The presence of several manufacturing facilities and logistic centers also drives usage in workplace environments. Energy efficiency initiatives under regional sustainability programs encourage industries to adopt low-emission electric heaters, ensuring continued market growth in the eastern provinces.

Market Segmentations:

By Product

- Portable Heater

- Fixed / Wall-mounted Heater

By Wattage

- Below 1000 Watt

- 1000–1500 Watt

- Above 1500 Watt

By Distribution Channel

By Geography

- Northern France

- Western France

- Southern France

- Central France

- Eastern France

Competitive Landscape

The France Electric Infrared Quartz Heaters market features a moderately consolidated competitive landscape, with both domestic manufacturers and international brands focusing on innovation and energy efficiency. Leading players such as Acim Jouanin, Tansun, and Tempco Electric Heater Corporation emphasize product reliability, advanced heat control, and eco-friendly performance to strengthen market presence. Companies are investing in smart heating technologies, including Wi-Fi connectivity and automatic temperature regulation, to attract residential and commercial buyers. Strategic partnerships with retail distributors and e-commerce platforms are expanding brand visibility across major French cities. Additionally, firms are focusing on compact, portable, and design-oriented models tailored to urban consumers seeking comfort and energy savings. The competition remains strong in pricing, product aesthetics, and safety certifications. Local players continue to gain traction through customization and quick service, while international brands leverage their global expertise and extensive distribution networks to maintain leadership in this fast-evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Acim Jouanin

- Tansun

- Tempco Electric Heater Corporation

- Döbeln Elektrowärme GmbH

- Lasko Products, LLC

- TPI Corporation

- Pelonis Technologies, Inc.

- Ceramicx

- Quarz-Elektro-Bauelemente GmbH

- CLARKE INTERNATIONAL

- Other Key Players

Recent Developments

- In August 2025, Pelonis is referenced as a key player in energy-efficient, budget-friendly heaters, with recent product updates focusing on improved safety features, digital controls, and portable formats to address shifting consumer demand in North America and Asia-Pacific.

- In 2025, Twin-Star International continued leading the U.S. electric fireplace and heater market, with innovations including the 3D Flame Effect, PanoGlow®, CoolGlow®, Safer Plug®, and Safer Sensor™

Report Coverage

The research report offers an in-depth analysis based on Product, Wattage, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and low-emission heating systems will continue to rise across households.

- Smart and connected infrared heaters with app-based controls will gain wider adoption.

- Portable models will dominate due to flexibility and ease of installation in compact spaces.

- Aesthetic and space-saving wall-mounted heaters will attract urban consumers and hotels.

- Manufacturers will focus on recyclable materials and sustainable designs to meet green standards.

- Online retail channels will expand faster than offline sales, driven by digital purchasing habits.

- Product customization and multi-mode heating options will enhance user comfort and brand loyalty.

- Increased use in hospitality and outdoor commercial spaces will boost overall consumption.

- Government support for eco-friendly appliances will encourage further market penetration.

- Competitive pricing and innovation in safety features will define future brand differentiation.