Market Overview

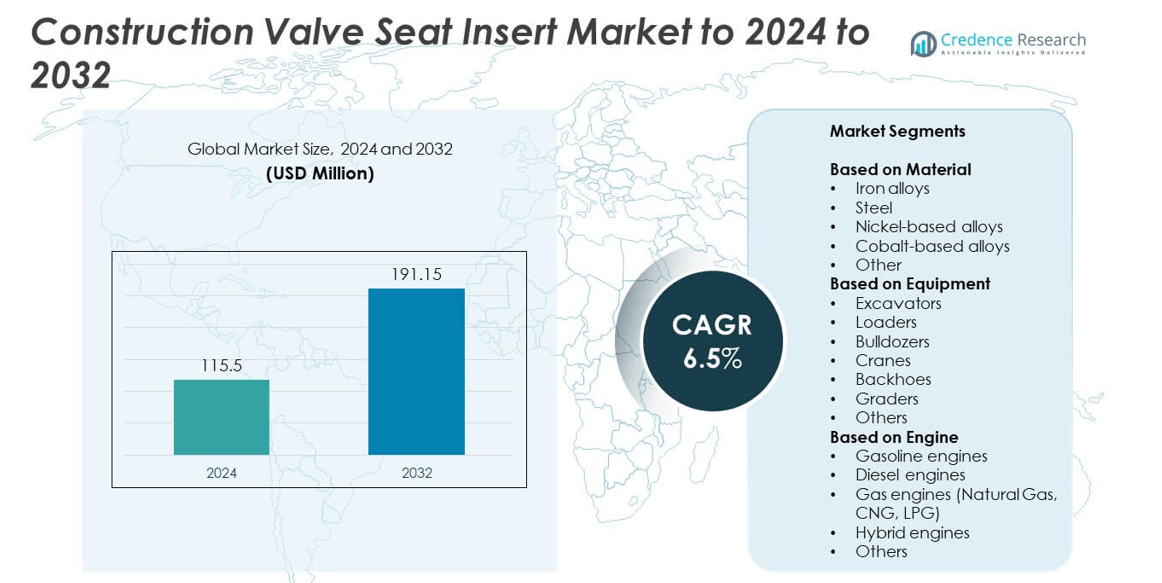

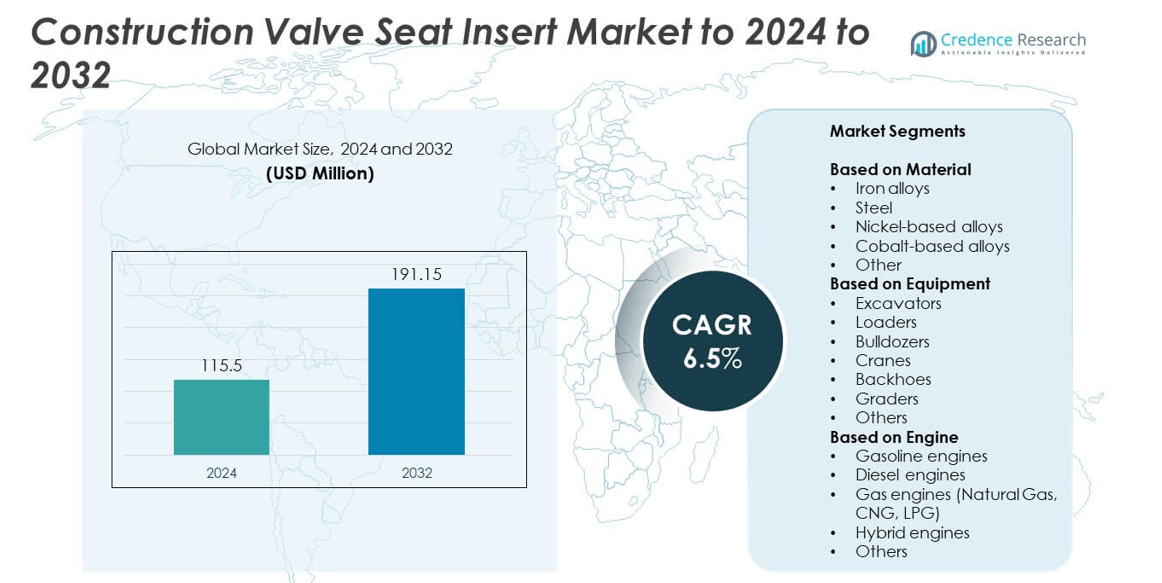

The Construction Valve Seat Insert Market size was valued at USD 115.5 million in 2024 and is anticipated to reach USD 191.15 million by 2032, at a CAGR of 6.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Construction Valve Seat Insert Market Size 2024 |

USD 115.5 million |

| Construction Valve Seat Insert Market, CAGR |

6.5% |

| Construction Valve Seat Insert Market Size 2032 |

USD 191.15 million |

The Construction Valve Seat Insert Market is driven by prominent players such as Eaton, Nippon Piston Ring, Forvia SE (Faurecia), BorgWarner, MAHLE, GKN Automotive, Mitsubishi Materials, AVL List, and Tenneco. These companies focus on developing durable, high-performance valve seat inserts that enhance engine efficiency and comply with evolving emission standards. Continuous investments in advanced alloys and precision manufacturing are strengthening their market presence globally. North America led the market with a 36% share in 2024, supported by robust construction activity and strong demand for heavy-duty machinery, followed by Europe with 29% and Asia-Pacific with 25%.

Market Insights

- The Construction Valve Seat Insert Market was valued at USD 115.5 million in 2024 and is projected to reach USD 191.15 million by 2032, growing at a CAGR of 6.5%.

- Rising infrastructure development and demand for heavy-duty construction equipment are major drivers fueling market growth worldwide.

- Key trends include the adoption of emission-compliant engine technologies, use of advanced alloys, and integration of lightweight materials for improved efficiency.

- The market is competitive, with leading manufacturers focusing on innovation, sustainability, and partnerships with construction equipment OEMs to strengthen global reach.

- North America led the market with a 36% share in 2024, followed by Europe at 29% and Asia-Pacific at 25%, while the iron alloys segment dominated with 39% of the total market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Iron alloys dominated the Construction Valve Seat Insert Market with a 39% share in 2024. Their strong heat resistance, cost efficiency, and durability make them ideal for heavy-duty construction machinery. Steel alloys followed closely, driven by higher tensile strength and longer operational life in high-load conditions. Nickel- and cobalt-based alloys are gaining traction in advanced engines for their superior corrosion resistance. Increasing demand for durable and low-maintenance materials in high-temperature environments continues to drive innovation across alloy compositions, supporting performance and engine longevity.

- For instance, Caterpillar rates the 390F L excavator with a Cat C18 ACERT engine, which produces an engine power of 405 kW under the ISO 14396 standard. The excavator has a maximum operating weight of approximately 86,275 kg, making it suitable for heavy-duty digging and construction tasks

By Equipment

Excavators led the market with a 33% share in 2024, supported by their wide use in earthmoving and mining activities. The consistent operation of these machines in heavy-duty applications requires durable valve seat inserts for extended engine life. Loaders and bulldozers also contributed significantly due to infrastructure expansion and road construction projects. Technological upgrades in hydraulic and diesel systems are enhancing performance efficiency. Rising adoption of high-horsepower excavators in large-scale construction and quarrying operations remains a major factor sustaining segment growth.

- For instance, Cummins Stage V B6.7 engines deliver up to 1,375 N·m peak torque, highlighting sealing and thermal demands on valve seats in construction equipment.

By Engine

Diesel engines held the largest market share of 46% in 2024, driven by their high torque output, durability, and fuel efficiency. These engines remain the preferred choice for heavy construction machinery such as excavators, cranes, and loaders. Gas and hybrid engines are emerging as sustainable alternatives, supported by stricter emission regulations and cleaner fuel adoption. The growing shift toward hybrid-powered machinery in developed markets is expected to boost innovation in insert materials compatible with mixed-combustion systems, ensuring optimal sealing and thermal performance under varied operating loads.

Key Growth Drivers

Rising Infrastructure Development Worldwide

Global infrastructure projects, including roads, bridges, and urban development, are fueling demand for heavy construction machinery, boosting the use of valve seat inserts. Increased public and private investments in construction across Asia-Pacific and the Middle East are accelerating equipment production. The need for durable components that enhance engine performance and lifespan continues to drive demand for high-quality valve seat inserts. Manufacturers are focusing on materials that offer heat resistance and wear durability to meet the growing requirements of heavy-duty construction engines.

- For instance, Volvo Construction Equipment reported 56,043 construction-equipment deliveries in 2024, evidencing sustained machine demand tied to global projects.

Advancements in Engine Efficiency and Durability

Manufacturers are integrating high-performance materials and precision machining to improve engine life and reduce maintenance. Valve seat inserts play a vital role in maintaining combustion efficiency and preventing valve leakage under extreme temperature and pressure. Technological innovations in metallurgy and surface treatment are extending the replacement cycle for valve seats. This focus on operational reliability and lower downtime in heavy equipment is driving the consistent adoption of advanced insert materials across construction engine applications.

- For instance, Federal-Mogul Powertrain (now Tenneco) showed HTC/TIM valve-seat tech cutting exhaust valve head temperatures by up to 70 °C, improving durability.

Shift Toward Emission-Compliant Construction Equipment

Stringent emission standards are prompting engine manufacturers to redesign systems that comply with environmental regulations. Valve seat inserts designed for high-temperature resistance and cleaner combustion are critical in meeting these standards. The growing transition toward hybrid and low-emission diesel engines in construction equipment supports market expansion. Manufacturers are investing in eco-friendly materials that maintain performance while reducing carbon footprint, aligning with global sustainability initiatives and the push for greener construction machinery.

Key Trends & Opportunities

Adoption of Hybrid and Gas-Powered Machinery

The increasing shift toward hybrid and natural gas-powered construction equipment is creating new opportunities for valve seat insert manufacturers. These engines require inserts that can handle varying combustion temperatures and mixed fuel conditions. As more construction firms prioritize lower emissions and fuel savings, suppliers are focusing on developing adaptive materials. The trend aligns with the industry’s move toward energy-efficient and environmentally responsible solutions, positioning hybrid-compatible valve seat inserts as a key growth area.

- For instance, Komatsu says its HB365LC-3 hybrid excavator can deliver up to 20 % fuel savings versus non-hybrid models, supporting hybrid adoption on jobsites.

Material Innovation and Lightweight Design

Ongoing research into lightweight and high-strength alloys is revolutionizing the valve seat insert market. Companies are developing advanced composites and coated materials that improve thermal conductivity and reduce friction. This innovation supports both performance enhancement and compliance with evolving emission norms. As machinery manufacturers seek higher efficiency and fuel economy, material advancements in nickel and cobalt-based inserts are expected to open new market avenues and strengthen competitive differentiation.

- For instance, Dura-Bond’s powder-metal valve seat inserts list micro-hardness 20–43 HRC and defined alloy composition, reflecting material advances for high-temperature wear resistance.

Key Challenges

High Production Costs and Complex Manufacturing

Developing valve seat inserts that withstand extreme engine conditions involves advanced metallurgy and precision engineering. The production process demands specialized equipment and costly raw materials such as nickel and cobalt. This results in higher manufacturing costs, especially for small-scale producers. The need to maintain consistent quality and performance standards further increases operational expenses, creating pricing pressure in a competitive market dominated by large, technology-driven manufacturers.

Fluctuating Raw Material Prices

The volatility of raw material prices, particularly for steel and specialty alloys, poses a significant challenge for manufacturers. Sudden changes in global metal supply chains impact production planning and profit margins. Dependence on imports for certain alloys further intensifies cost risks. This fluctuation complicates pricing strategies and long-term contracts with construction equipment manufacturers, limiting smaller companies’ ability to sustain competitive pricing in the global market.

Regional Analysis

North America

North America held the largest share of 36% in 2024, driven by strong demand from the construction equipment industry in the United States and Canada. Ongoing investments in infrastructure modernization and highway expansion projects continue to support the market. The presence of major construction machinery manufacturers and advanced engine component suppliers enhances regional growth. Stringent emission regulations are further encouraging the adoption of efficient and durable valve seat inserts. Technological innovation, coupled with a well-established supply chain, ensures steady market performance throughout the forecast period.

Europe

Europe accounted for 29% of the global Construction Valve Seat Insert Market in 2024. The region benefits from increased infrastructure renovation and sustainable construction initiatives supported by the European Union. Demand for emission-compliant and high-performance equipment engines is rising, encouraging the adoption of advanced alloy-based inserts. Germany, France, and the United Kingdom remain key contributors due to their established construction and heavy machinery sectors. The shift toward hybrid engine technologies and green construction practices continues to create opportunities for European component manufacturers.

Asia-Pacific

Asia-Pacific captured a 25% market share in 2024, propelled by rapid urbanization and expanding construction activities across China, India, and Southeast Asia. Government-led infrastructure investments and smart city projects are driving machinery demand, particularly for excavators and loaders. The region is witnessing significant adoption of durable and heat-resistant valve seat inserts to improve equipment performance in harsh conditions. Local production capabilities and cost-effective manufacturing practices also strengthen market competitiveness. Rising industrialization and equipment exports from countries such as Japan and South Korea further enhance regional growth prospects.

Latin America

Latin America held an 8% share in 2024, supported by infrastructure development and growing construction activity in Brazil, Mexico, and Chile. Increasing investments in public works, mining, and commercial projects are boosting demand for durable engine components. The region’s preference for cost-effective yet high-performance materials favors the adoption of iron and steel-based valve seat inserts. However, limited technological advancement and dependence on imported machinery slightly restrain market expansion. Regional governments’ focus on urban modernization and sustainable construction is expected to create gradual growth opportunities.

Middle East & Africa

The Middle East & Africa accounted for a 7% share in 2024, led by major infrastructure projects in Saudi Arabia, the UAE, and South Africa. Ongoing developments in smart cities, oil and gas infrastructure, and transport systems are driving the demand for heavy construction equipment. The market benefits from increasing adoption of diesel and hybrid engines that require high-performance valve seat inserts. However, fluctuating economic conditions and supply constraints pose challenges. Despite this, expanding construction investments and rising industrial diversification continue to support steady market growth across the region.

Market Segmentations:

By Material

- Iron alloys

- Steel

- Nickel-based alloys

- Cobalt-based alloys

- Other

By Equipment

- Excavators

- Loaders

- Bulldozers

- Cranes

- Backhoes

- Graders

- Others

By Engine

- Gasoline engines

- Diesel engines

- Gas engines (Natural Gas, CNG, LPG)

- Hybrid engines

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The Construction Valve Seat Insert Market features key players such as Eaton, Nippon Piston Ring, Forvia SE (Faurecia), BorgWarner, Cooper Machinery Services, MAHLE, MAPAL, Mitsubishi Materials, GKN Automotive, AVL List, L.E. Jones, and Tenneco. The market remains highly competitive, with companies focusing on advanced material innovation, manufacturing precision, and engine efficiency enhancement. Firms are investing in high-strength alloys, surface treatments, and thermal-resistant coatings to meet the performance requirements of next-generation engines. Strategic collaborations with equipment manufacturers are expanding global reach and improving component integration. Many participants are emphasizing sustainability through low-emission, lightweight materials aligned with evolving environmental standards. Research efforts also focus on extending product lifespan and optimizing fuel combustion in heavy-duty machinery. Continuous technological development, coupled with expansion into emerging construction markets, is expected to sustain competition. The leading companies are prioritizing operational reliability, localized production, and digital manufacturing to strengthen their position in this growing market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Eaton

- Nippon Piston Ring

- Forvia SE (Faurecia)

- BorgWarner

- Cooper Machinery Services

- MAHLE

- MAPAL

- Mitsubishi Materials

- GKN Automotive

- AVL List

- E. Jones

- Tenneco

Recent Developments

- In 2025, MAPAL Released new and expanded cutting tools for precision machining, including drills and milling solutions used in valve-seat/guide manufacturing.

- In 2025, MAPAL launched its HNHX indexable inserts to improve the cost-effectiveness and performance of valve seat machining.

- In 2024, Cooper Machinery Services, a U.S.-based industrial equipment supplier, acquired Tucker Valve Seat Company for an undisclosed amount.

Report Coverage

The research report offers an in-depth analysis based on Material, Equipment, Engine and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by global infrastructure expansion and equipment modernization.

- Increasing demand for fuel-efficient and low-emission engines will boost advanced insert adoption.

- Hybrid and gas-powered construction equipment will create new opportunities for material innovation.

- Nickel and cobalt-based alloys will gain popularity for their superior thermal and wear resistance.

- Asia-Pacific will remain the fastest-growing region due to large-scale urbanization and manufacturing growth.

- Manufacturers will focus on developing lightweight, durable, and emission-compliant valve seat materials.

- Digital manufacturing and precision machining technologies will improve product consistency and performance.

- Strategic partnerships between engine OEMs and component suppliers will strengthen global supply chains.

- Increasing investment in research for eco-friendly alloys will align with sustainability goals.

- Aftermarket demand for replacement valve seat inserts will expand due to extended equipment life cycles.