Market Overview

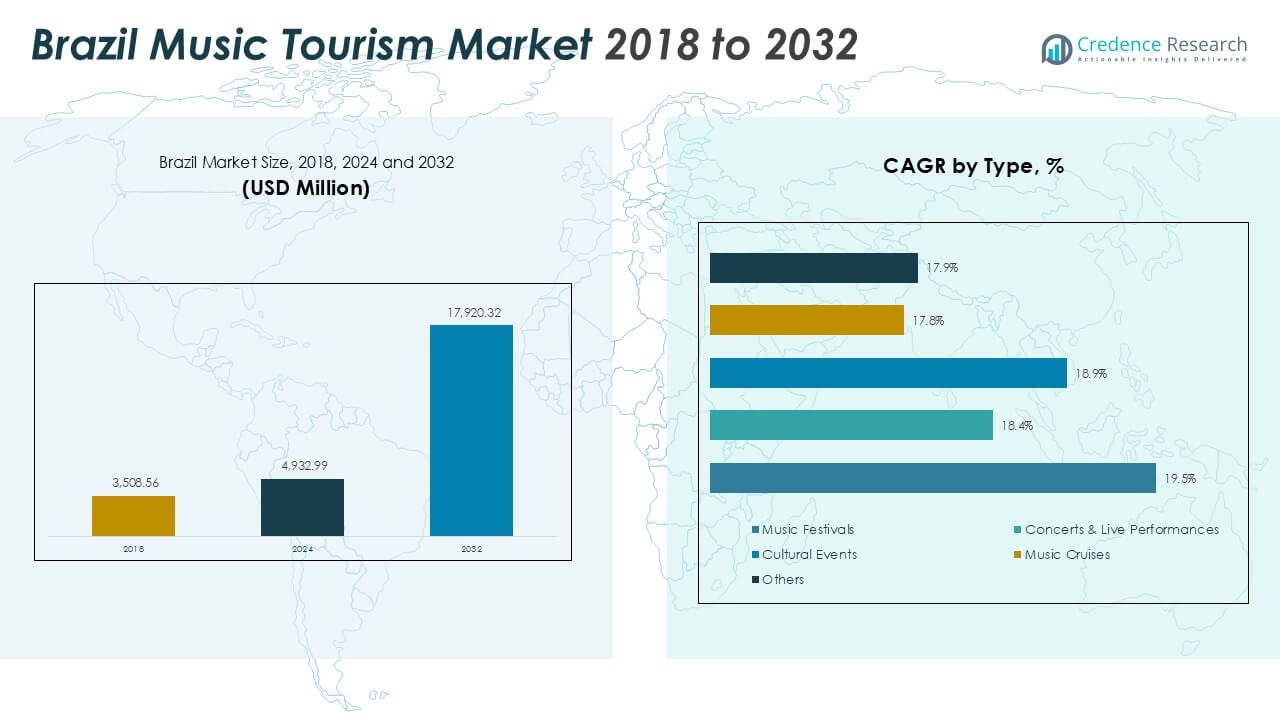

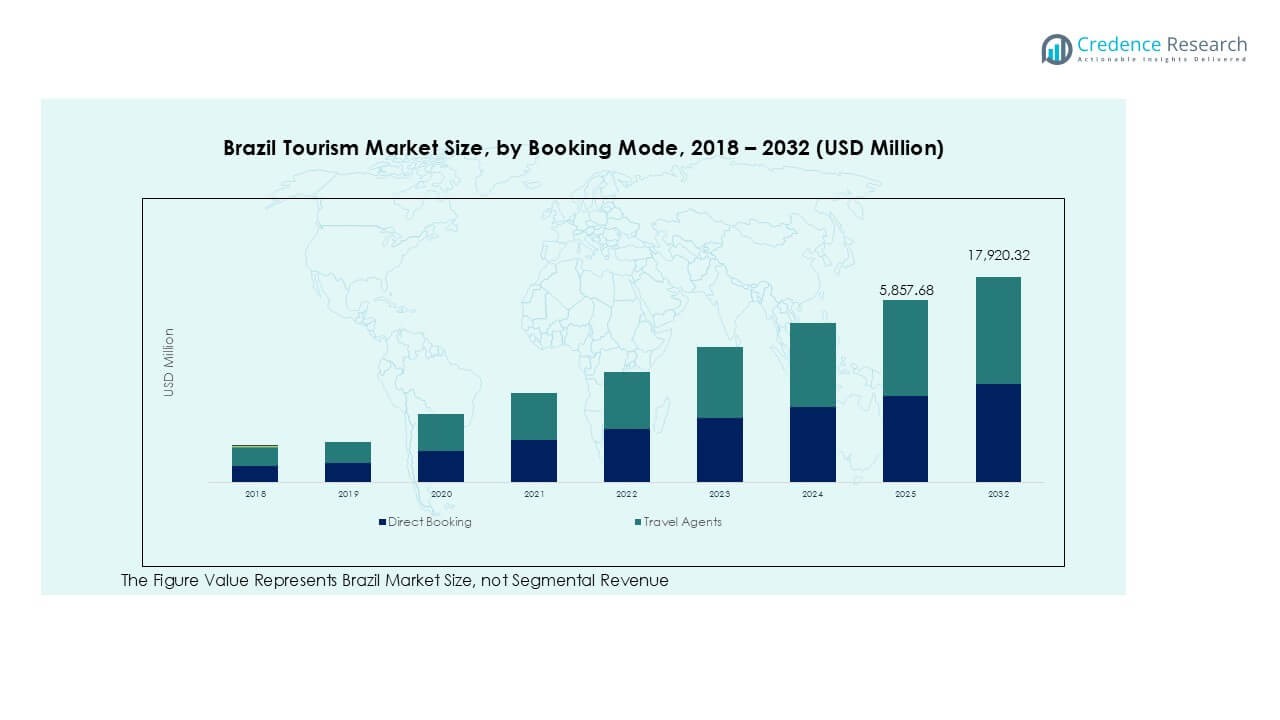

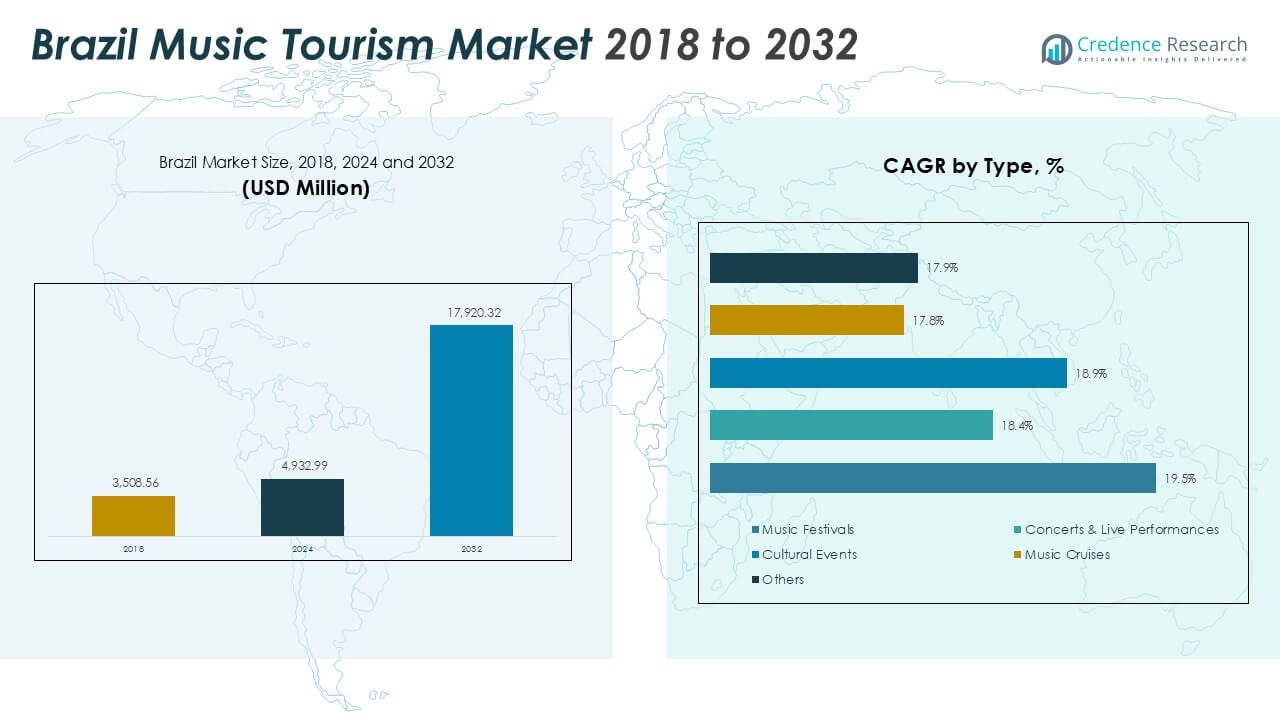

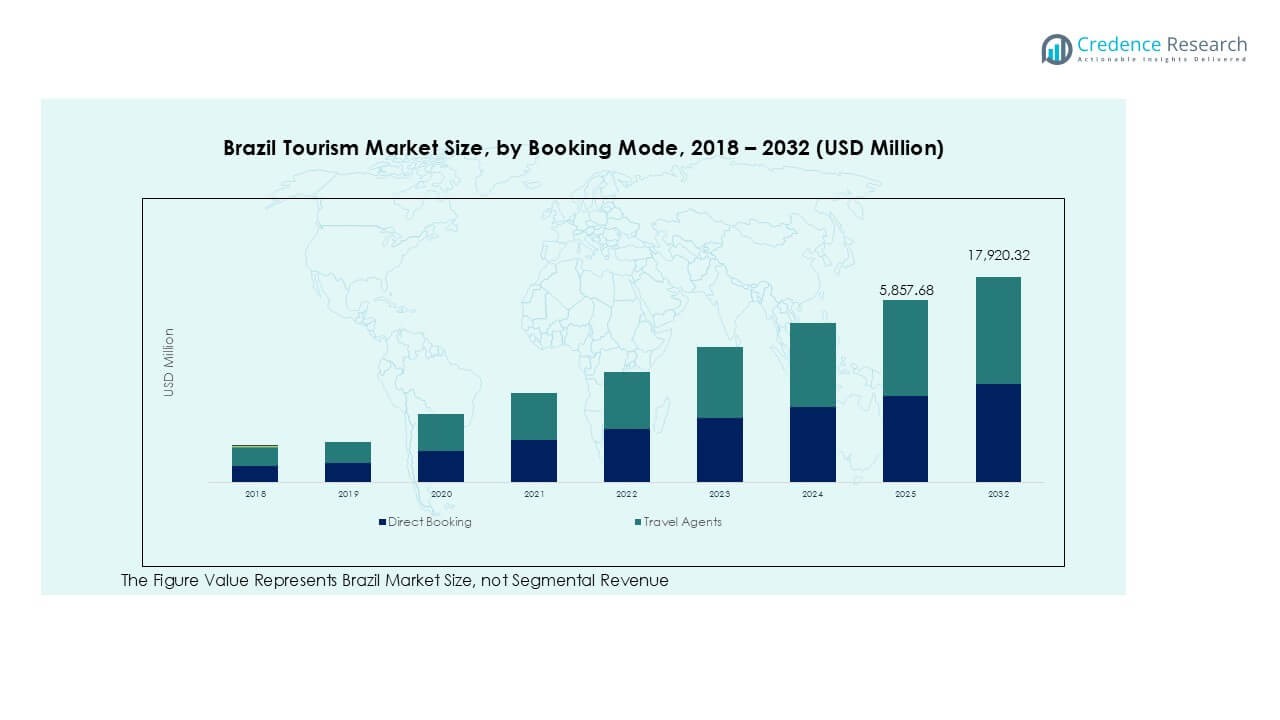

The Brazil Music Tourism market size was valued at USD 3,508.56 million in 2018 and grew to USD 4,932.99 million in 2024. It is anticipated to reach USD 17,920.32 million by 2032, expanding at a CAGR of 17.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Brazil Music Tourism market Size 2024 |

USD 4,932.99 Million |

| Brazil Music Tourism market, CAGR |

17.32% |

| Brazil Music Tourism market Size 2032 |

USD 17,920.32 Million |

The Brazil Music Tourism market is led by prominent companies such as Live Nation Brazil, Time For Fun (T4F), Move Concerts Brazil, Rock in Rio, and Lollapalooza Brazil. These firms dominate large-scale festival organization, concert promotion, and international artist management, shaping Brazil’s global reputation as a top music destination. Live Nation Brazil and T4F hold strong positions through exclusive partnerships and extensive event portfolios, while Move Concerts Brazil enhances regional outreach. The Southeast region remains the leading hub, capturing around 48% of the total market share in 2024, supported by robust infrastructure, world-class venues, and high tourist inflow across São Paulo and Rio de Janeiro.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Brazil Music Tourism market was valued at USD 4,932.99 million in 2024 and is projected to reach USD 17,920.32 million by 2032, growing at a CAGR of 17.32% during the forecast period.

- Strong festival culture and growing youth participation drive market expansion, supported by international events like Rock in Rio and Lollapalooza Brazil that attract millions of visitors annually.

- Emerging trends include digital ticketing, virtual concert experiences, and sustainable “eco-festival” initiatives promoting green tourism and local cultural integration.

- The market is highly competitive, with leading players such as Live Nation Brazil, Time For Fun (T4F), and Move Concerts Brazil investing in large-scale event management and technology-driven audience engagement.

- Regionally, the Southeast dominates with a 48% share, followed by the Northeast at 26%, while the music festivals segment leads by type with 42% share, supported by urban infrastructure and international sponsorship growth.

Market Segmentation Analysis:

By Type

The music festivals segment dominated the Brazil Music Tourism market in 2024, accounting for nearly 42% of total revenue. The segment’s growth stems from Brazil’s rich cultural heritage and globally recognized events such as Rock in Rio, Lollapalooza Brazil, and Salvador Carnival. These festivals attract both domestic and international tourists seeking immersive musical and cultural experiences. Rising sponsorship from global brands and increasing digital promotion of live events further strengthen festival attendance. Additionally, the country’s strong infrastructure for large-scale outdoor concerts continues to support this segment’s leadership across urban and coastal destinations.

- For instance, Rock in Rio 2024 hosted over 730,000 attendees across seven days and featured 250 international and local acts, while Lollapalooza Brazil generated more than 35,000 hotel bookings in São Paulo during its three-day run, underscoring its strong tourism influence.

By Age Group

The 18–34 years segment led the Brazil Music Tourism market with around 46% share in 2024. This demographic actively participates in concerts, electronic dance festivals, and cultural events, driven by social media engagement and growing disposable income. Young travelers seek unique music experiences that combine entertainment, nightlife, and adventure. The segment benefits from budget-friendly travel options, online ticketing platforms, and group tour packages. Increased popularity of music-based social tourism among millennials and Gen Z further drives participation, making this group the largest contributor to market expansion.

- For instance, Rock in Rio’s 2024 edition in Brazil attracted approximately 730,000 attendees over seven days, generating R$2.9 billion in economic impact for the city.

By End-User

The leisure travelers category held the dominant share of about 49% in 2024. Rising interest in combining vacations with live music experiences is boosting this segment’s appeal. Leisure tourists frequently attend music festivals, beach concerts, and cultural parades during seasonal breaks. Growing popularity of musical destinations such as Rio de Janeiro and São Paulo enhances travel bookings during major music events. Affordable flight connections, event-based tourism packages, and collaboration between music promoters and travel agencies are key drivers supporting sustained growth of the leisure traveler segment in Brazil’s music tourism landscape.

Key Growth Drivers

Expanding Festival Infrastructure and Global Recognition

Brazil’s expanding music festival infrastructure remains a core growth driver for its music tourism market. Events such as Rock in Rio, The Town, and Lollapalooza Brazil attract millions of visitors annually, positioning Brazil as a global entertainment hub. The government and private sector are investing heavily in stage technology, safety systems, and event logistics to enhance visitor experience. Improved accessibility through air and road networks, coupled with urban redevelopment near major venues, further boosts participation. Growing international sponsorships and digital marketing campaigns have also amplified the country’s visibility as a leading destination for music-driven travel experiences.

- For instance, The Town Festival 2023 in São Paulo drew more than 500,000 attendees over five days, featuring 235 artists and utilizing a 360° LED stage system developed by Robe Lighting.

Rising Youth Participation and Cultural Engagement

Youth engagement plays a vital role in expanding Brazil’s music tourism market. The 18–34 age group represents the largest segment, drawn to immersive musical experiences and vibrant nightlife. Increasing disposable income among millennials and Gen Z supports higher spending on concert tickets, travel, and accommodations. Social media platforms amplify awareness and event attendance, with influencers promoting festivals and live performances. Domestic and regional tourism programs now focus on promoting local artists and genres such as samba, bossa nova, and funk carioca. This cultural connection between modern and traditional music continues to attract a diverse youth audience.

- For instance, Lollapalooza Brazil 2024 took place from March 22 to 24 in São Paulo, attracting an estimated 240,000 visitors over the three days.

Government Support and Tourism Integration Initiatives

Government-led initiatives promoting cultural and entertainment tourism have strengthened Brazil’s position as a music destination. Programs by the Ministry of Tourism encourage collaboration between event organizers, local governments, and international promoters. Simplified visa processes, infrastructure upgrades, and targeted marketing under campaigns like “Visit Brazil” have boosted inbound tourism for music events. Partnerships with airlines and hospitality providers offer discounted travel packages during major festivals. Additionally, regional governments are investing in smaller-scale music events to promote lesser-known destinations, diversifying tourism income beyond major cities. These efforts collectively enhance Brazil’s competitiveness in the global music tourism landscape.

Key Trends and Opportunities

Integration of Digital Platforms and Virtual Engagement

Digital transformation is shaping the future of Brazil’s music tourism industry. Event organizers are adopting advanced ticketing platforms, mobile apps, and AI-driven marketing tools to improve user convenience and engagement. Virtual concerts and hybrid music festivals gained traction post-pandemic, allowing fans to experience performances remotely while planning future trips. Influencer-led campaigns and real-time social media interactions have enhanced event visibility globally. The trend toward digital engagement provides opportunities for streaming partnerships, immersive AR experiences, and real-time travel coordination, expanding revenue beyond physical event attendance.

- For instance, Rock in Rio 2024 embraced digital integration, partnering with platforms like YouTube and TikTok to livestream performances and expand its global reach. Similarly, ticket vendors like Eventim Brasil used their mobile platforms to process a large volume of digital transactions, reflecting the growing trend of integrating digital and on-site engagement.

Sustainable Tourism and Eco-Music Experiences

Sustainability has become a defining trend in Brazil’s tourism sector, influencing how music events are organized and promoted. Festival organizers are adopting eco-friendly practices such as waste reduction, renewable energy use, and carbon-neutral logistics. Destinations like Bahia and Florianópolis are introducing “eco-festivals” that blend music with environmental education and cultural preservation. Travelers increasingly prefer socially responsible events that minimize ecological impact while promoting local artisans and communities. This shift presents opportunities for brands and promoters to align with sustainability goals, enhancing brand loyalty and long-term tourism growth.

Key Challenges

Infrastructure Limitations and Event Management Issues

Despite progress, infrastructure gaps remain a major barrier to consistent music tourism growth in Brazil. Smaller cities often lack adequate transport connectivity, accommodation, and event safety measures. During large-scale festivals, overcrowding and logistical inefficiencies can strain local systems and affect visitor satisfaction. Weather-related disruptions and inconsistent local coordination further challenge event execution. Addressing these gaps requires sustained investment in transportation, crowd management, and smart venue planning. Enhanced collaboration between public authorities and private stakeholders is crucial to ensure safety, efficiency, and positive tourist experiences.

Economic Volatility and Currency Fluctuations

Economic instability and currency fluctuations continue to pose challenges for Brazil’s music tourism market. Periodic inflation and exchange rate shifts increase travel and operational costs, discouraging both domestic and international visitors. Event organizers face difficulties in pricing tickets and managing import costs for equipment and international artists. Moreover, reduced consumer confidence during downturns can lower discretionary spending on entertainment and travel. Maintaining affordability while ensuring quality event experiences remains a balancing act. Strategic pricing, partnerships, and flexible travel packages can help mitigate these financial challenges in the evolving tourism landscape.

Regional Analysis

Southeast Brazil

The Southeast region dominated the Brazil Music Tourism market in 2024, accounting for around 48% of total revenue. Cities like São Paulo and Rio de Janeiro serve as the country’s primary music tourism hubs, hosting global festivals such as Rock in Rio and The Town. The region’s strong infrastructure, international flight connectivity, and hospitality sector support large-scale music events. Government-backed cultural programs and private sponsorships continue to attract both domestic and international travelers. Expanding urban nightlife and diverse music genres, including samba, funk, and rock, further solidify the Southeast’s leadership in Brazil’s music tourism landscape.

Northeast Brazil

The Northeast region captured nearly 26% of the market share in 2024, driven by vibrant cultural festivals and strong local participation. Popular destinations like Salvador, Recife, and Fortaleza attract large crowds through Carnival celebrations, Axé music festivals, and beach concerts. The region’s fusion of Afro-Brazilian music traditions and modern rhythms enhances its cultural appeal. Tourism boards actively promote sustainable and community-driven events, boosting regional economic impact. The combination of scenic coastal venues, rich heritage, and festive atmosphere continues to make the Northeast a dynamic center for music-inspired tourism growth in Brazil.

South Brazil

The South region accounted for about 14% of Brazil’s music tourism market in 2024, supported by rising demand for regional music festivals and open-air concerts. Cities such as Curitiba, Porto Alegre, and Florianópolis have gained attention for hosting indie, electronic, and folk music events. The area’s cooler climate and organized urban structure attract both young domestic travelers and international visitors. Growth in boutique festivals and university-led cultural initiatives is further strengthening tourism potential. Improved transport links and increased hotel capacity continue to position the South as an emerging contributor to Brazil’s diversified music tourism ecosystem.

Central-West Brazil

The Central-West region represented nearly 8% of the national market in 2024. Brasília, Goiânia, and Campo Grande are emerging destinations known for sertanejo and country music festivals. The region’s expanding event calendar and affordable travel options attract domestic tourists from neighboring states. Infrastructure development and government-backed tourism initiatives are improving accessibility to remote event locations. Growing collaboration between local artists, sponsors, and municipalities fosters community engagement and new cultural experiences. Although smaller than coastal markets, Central-West Brazil shows strong potential as an inland hub for authentic and regionally themed music tourism.

North Brazil

The North region held an estimated 4% share of the Brazil Music Tourism market in 2024. Cities like Manaus and Belém host culturally rich events blending indigenous, folk, and Amazonian musical traditions. Festivals such as Festival Folclórico de Parintins attract both local audiences and international visitors seeking unique cultural immersion. Limited infrastructure and accessibility challenges have restrained broader market expansion, but ongoing investment in eco-tourism and river-based music cruises is creating niche growth opportunities. The North’s distinctive soundscapes and cultural authenticity position it as a promising frontier for experiential music tourism in Brazil.

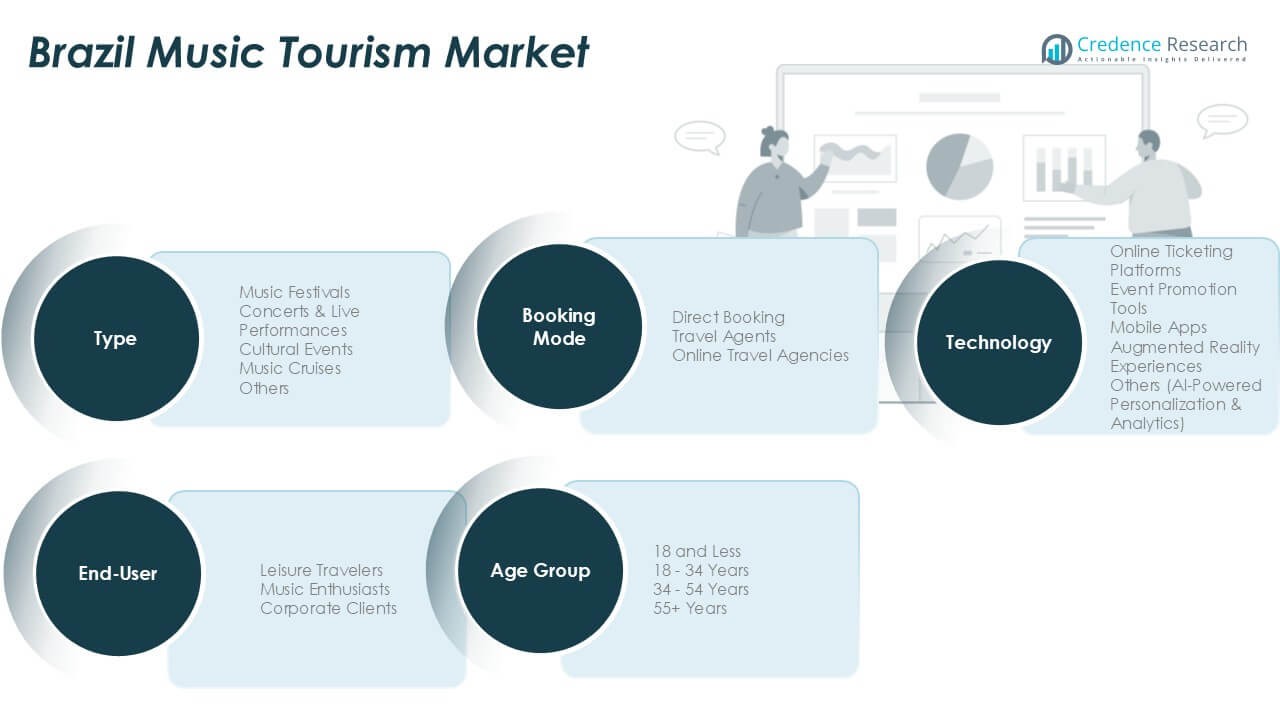

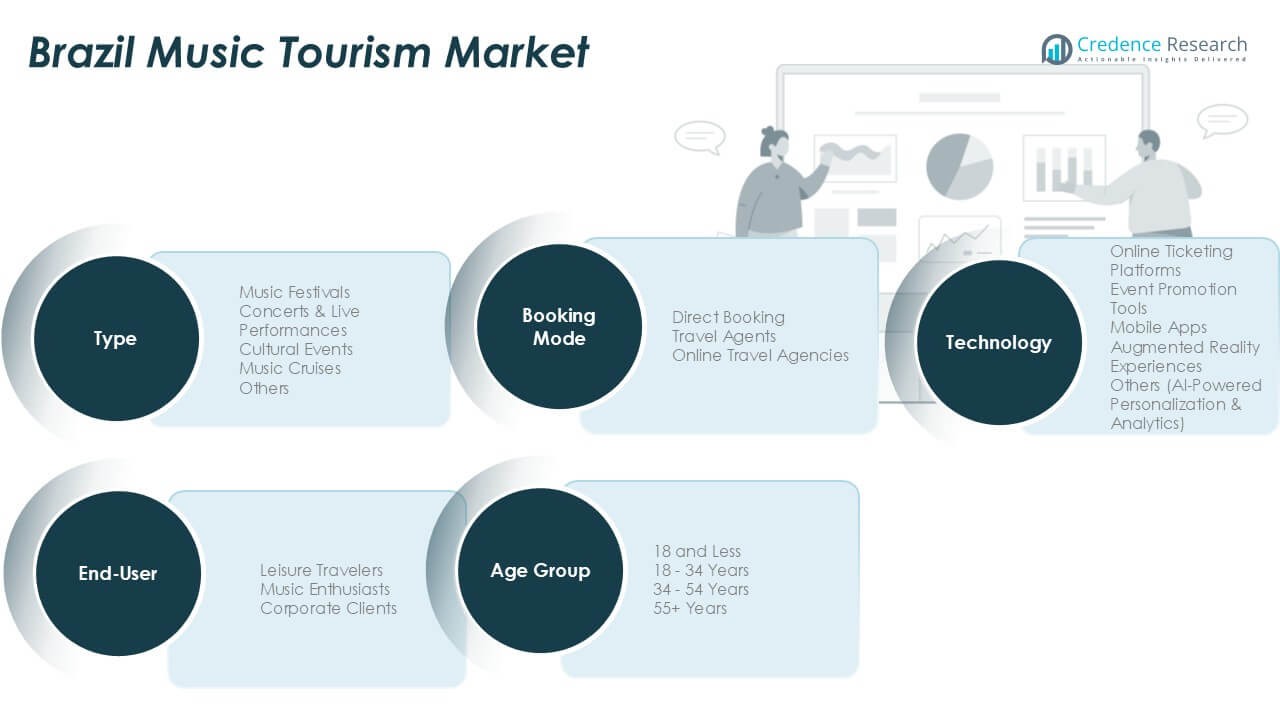

Market Segmentations:

By Type

- Music Festivals

- Concerts & Live Performances

- Cultural Events

- Music Cruises

- Others

By Age Group

- 18 and Less

- 18–34 Years

- 34–54 Years

- 55+ Years

By End-User

- Leisure Travelers

- Music Enthusiasts

- Corporate Clients

By Technology

- Online Ticketing Platforms

- Event Promotion Tools

- Mobile Apps

- Augmented Reality Experiences

- Others (AI-Powered Personalization & Analytics)

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

By Geography

- Southeast Brazil

- Northeast Brazil

- South Brazil

- Central-West Brazil

- North Brazil

Competitive Landscape

The Brazil Music Tourism market features a dynamic and competitive landscape dominated by event organizers, promoters, and ticketing platforms that shape the nation’s entertainment ecosystem. Major players such as Live Nation Brazil, Time For Fun (T4F), and Move Concerts Brazil lead large-scale concert and festival management, leveraging global partnerships and advanced logistics. Prominent event brands like Rock in Rio, Lollapalooza Brazil, and The Town Festival anchor the market, drawing millions of domestic and international attendees annually. Ticketing giants Ticketmaster Brazil and Eventim Brazil enhance accessibility through digital platforms, while local firms such as Opus Entretenimento and AudioMix Entertainment focus on regional music genres and artist promotion. Growing competition is driving innovation in event production, digital engagement, and audience experience. Strategic collaborations between promoters, tourism boards, and sponsors continue to strengthen Brazil’s global position as a leading destination for music-centered tourism experiences.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Live Nation Brazil

- Time For Fun (T4F)

- DC Set Group

- XYZ Live

- Move Concerts Brazil

- Planmusic

- Opus Entretenimento

- AudioMix Entertainment

- 30E (Thirty Entertainment)

- Ticketmaster Brazil

- Eventim Brazil

- Rock in Rio

- Lollapalooza Brazil

- The Town Festival

Recent Developments

- In February 2025, Busan Concert Hall launched its official website to provide classical music enthusiasts with a seamless platform for ticket reservations, venue rentals, and academy schedules. Designed with responsive technology, the site ensures accessibility across devices and features a mobile ticketing service for quick entry via barcode scanning. The initiative enhances convenience and enriches the cultural experience for visitors in Busan.

- In August 2024, Brightline launched “The Big Concert Sweepstakes,” offering tickets to Taylor Swift’s sold-out Miami concert on October 20. The prize included two concert tickets, four round-trip Brightline tickets on a special “Tay-keover Sing-Along” train, and exclusive lounge perks. Participants entered by following Brightline on Instagram and signing a rail safety pledge, with the winner announced during Rail Safety Week in late September.

- In May 2024, Live Nation brought back its annual Concert Week promotion, offering USD 25 all-in tickets for over 5,000 shows across North America. Featuring artists like Janet Jackson and 21 Savage, the week-long event made live music more accessible to fans. Tickets, available from May 8 to May 14, could be purchased online without a promo code, allowing fans to enjoy significant savings on select concerts and festivals. The initiative aimed to enhance the summer touring season with budget-friendly options.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, End-User, Technology, Booking Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth driven by increasing international music festival participation.

- Digital ticketing and mobile app integration will enhance traveler convenience and engagement.

- Rising youth travel for cultural and live music experiences will expand tourism demand.

- Sustainable and eco-friendly festival practices will gain more attention among organizers and travelers.

- Collaboration between event promoters and tourism boards will strengthen cross-regional music travel packages.

- Hybrid and virtual concert formats will continue to attract remote audiences and new revenue streams.

- Local and regional artists will gain higher exposure through global event partnerships.

- Expanding air connectivity and tourism infrastructure will improve accessibility to major music destinations.

- Growing corporate sponsorship and brand partnerships will boost event funding and promotion.

- Brazil’s diverse cultural heritage will continue to position the country as a leading global music tourism hub.