Market Overview

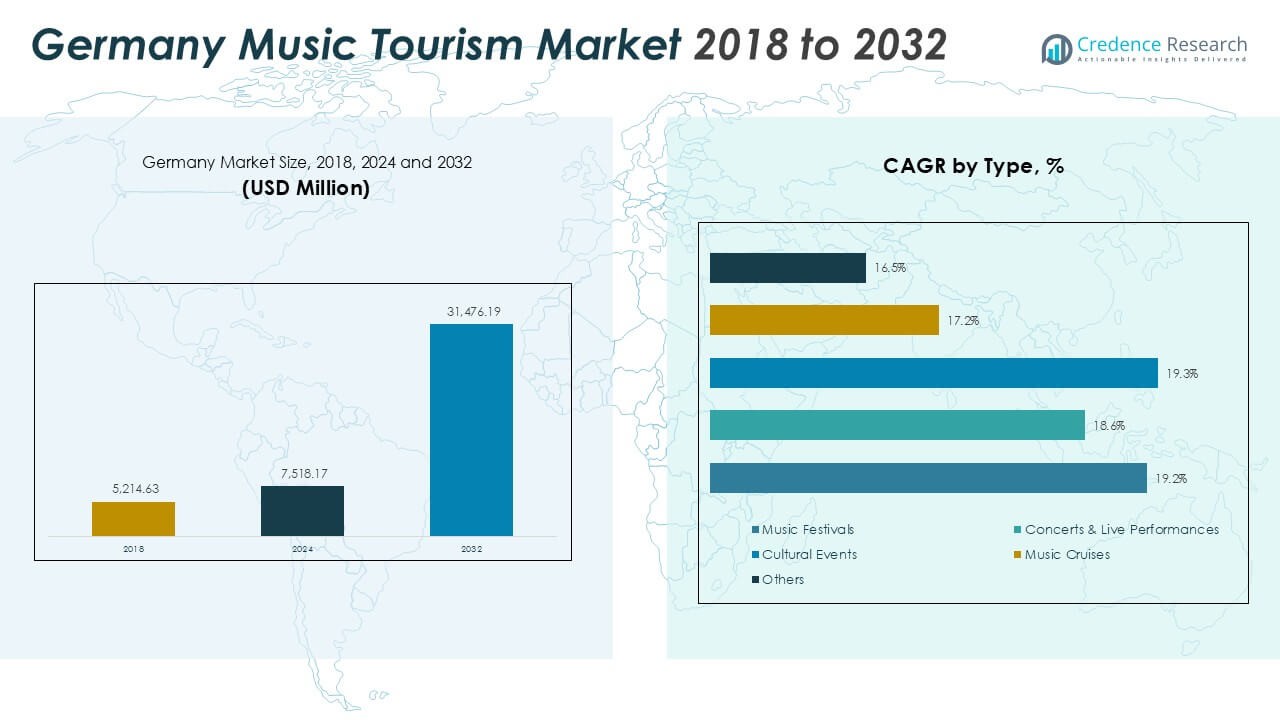

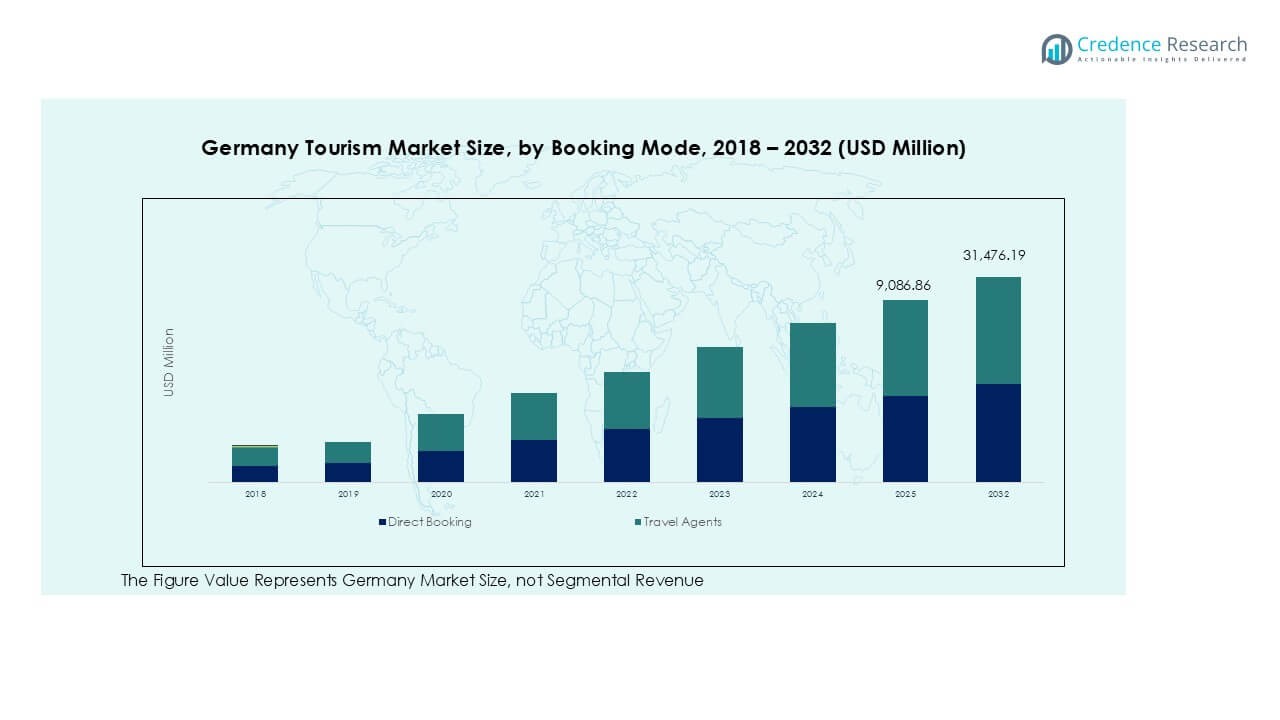

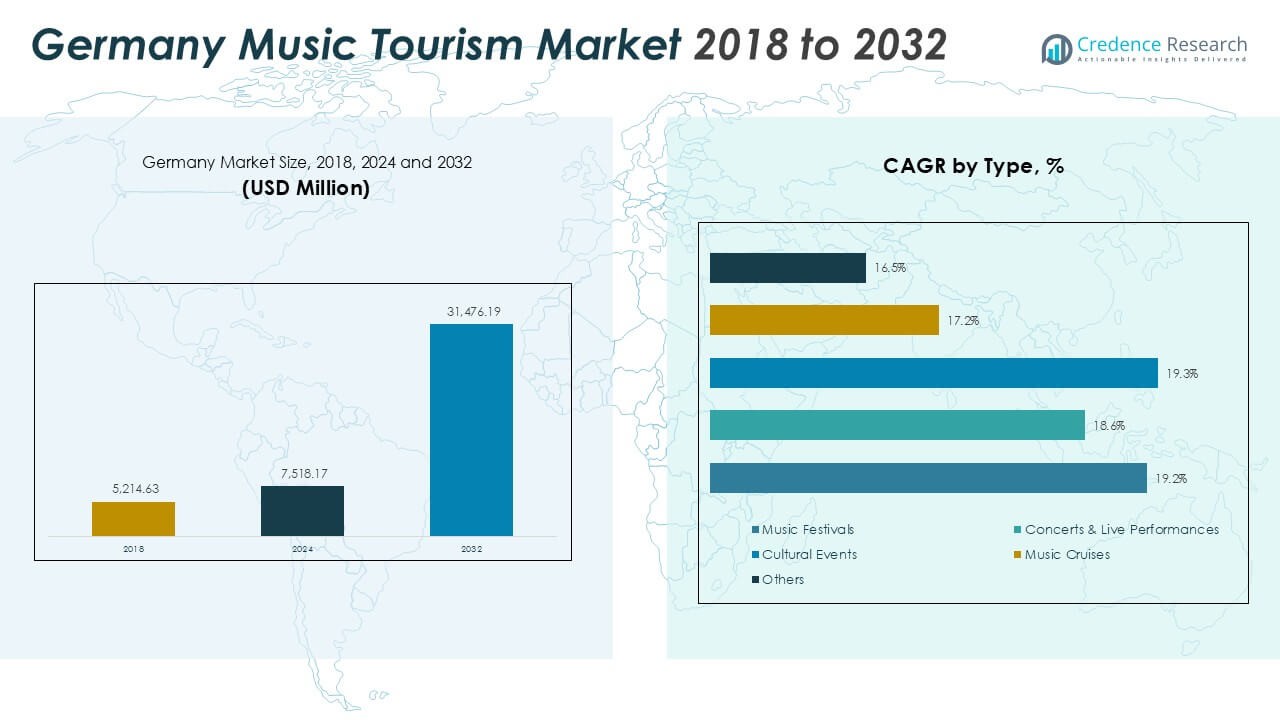

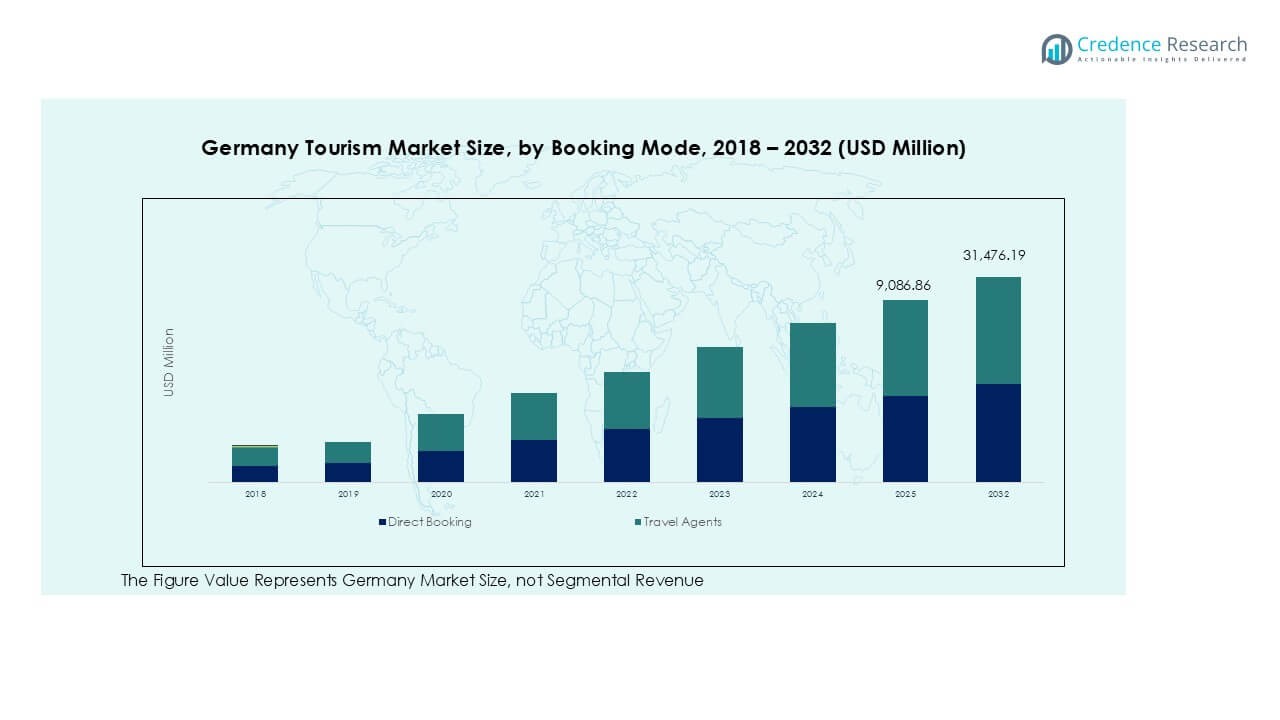

Germany Music Tourism market size was valued at USD 5,214.63 million in 2018, increasing to USD 7,518.17 million in 2024, and is anticipated to reach USD 31,476.19 million by 2032, growing at a CAGR of 19.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Music Tourism Market Size 2024 |

USD 7,518.17 Million |

| Germany Music Tourism Market, CAGR |

19.42% |

| Germany Music Tourism Market Size 2032 |

USD 31,476.19 Million |

Leading companies in the Germany music tourism market include Live Nation GSA, DEAG Deutsche Entertainment AG, FKP Scorpio Konzertproduktionen, CTS Eventim AG & Co. KGaA, and Semmel Concerts Entertainment. These firms dominate through large-scale festival organization, artist management, and digital ticketing solutions. Live Nation and CTS Eventim together account for over 35% of the organized live event market, supported by strong international networks and advanced event platforms. Regionally, Southern Germany leads with a 29% share, driven by major venues in Munich and Stuttgart, followed by Northern Germany at 27%, anchored by Hamburg’s thriving festival scene. These regions attract the highest tourist influx due to their infrastructure, cultural diversity, and event density.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Music Tourism market was valued at USD 7,518.17 million in 2024 and is projected to reach USD 31,476.19 million by 2032, growing at a CAGR of 19.42% during the forecast period.

- Market growth is driven by expanding festival infrastructure, rising participation from the 18–34 age group, and growing demand for experiential travel combining music, culture, and leisure.

- Key trends include the rise of eco-friendly festivals, digital ticketing integration, and hybrid concert experiences blending live and virtual elements.

- The market is competitive, with major players such as Live Nation GSA, CTS Eventim AG & Co. KGaA, DEAG Deutsche Entertainment AG, and FKP Scorpio Konzertproduktionen focusing on sustainability, technology, and audience engagement.

- Southern Germany led with a 29% share, followed by Northern Germany at 27%, while the music festivals segment dominated with a 42% share, reflecting strong domestic and international tourist participation.

Market Segmentation Analysis:

By Type

The music festivals segment dominated the Germany music tourism market in 2024 with a 42% share. Large-scale events such as Rock am Ring, Wacken Open Air, and Lollapalooza Berlin attract millions of domestic and international visitors each year. The segment benefits from Germany’s strong infrastructure, diverse music culture, and government support for creative tourism. Increasing investments in sustainable and digital festival experiences further enhance engagement. Growth is driven by younger audiences seeking immersive outdoor events and by festival organizers expanding lineups across genres to attract wider audiences.

- For instance, in 2024, Wacken Open Air hosted 85,000 attendees and featured over 200 metal bands. The festival’s “Green Wacken” initiative is a sustainability program that has included the use of smaller-scale renewable energy sources, such as hydrogen fuel cells and solar panels, in recent years.

By Age Group

The 18–34 years segment accounted for the largest share of 46% in 2024, making it the most active demographic in Germany’s music tourism market. This group frequently travels for live music events and festivals, driven by social media influence and digital ticketing convenience. They value experiential tourism, blending travel, entertainment, and cultural immersion. Major cities like Berlin, Hamburg, and Munich remain key hubs for this age group. Increasing disposable income and flexible work cultures further encourage travel spending on concerts and international music festivals.

- For instance, CTS Eventim, which is involved in promoting festivals like Rock am Ring, markets over 300 million tickets per year. The Rock am Ring festival itself sold 90,000 tickets for its 2025 and 2026 events, a figure that represents a small fraction of CTS Eventim’s overall annual sales volume.

By End-User

The leisure travelers segment led the market with a 51% share in 2024, supported by rising participation in music-based holidays and event-driven travel. Tourists increasingly plan trips around iconic festivals or tours of famous concert venues. The segment’s growth is supported by strong collaborations between travel agencies and event organizers offering bundled music-tour packages. Affordable airfare within Europe and Germany’s efficient rail connectivity enhance accessibility. The rising popularity of themed itineraries, such as classical music heritage tours and contemporary live show circuits, continues to attract repeat visitors.

Key Growth Drivers

Expanding Festival Infrastructure and Global Appeal

Germany’s strong event infrastructure and diverse music culture continue to fuel growth in music tourism. Iconic festivals such as Rock am Ring, Fusion Festival, and Wacken Open Air attract millions of domestic and international travelers. Investments in large-capacity venues, digital ticketing platforms, and sustainable festival operations have made Germany a preferred global destination for music tourism. Local governments also support music-based cultural initiatives to boost regional economies. Additionally, collaborations between tourism boards and private organizers enhance international promotion, positioning Germany as a hub for live music experiences across genres and demographics.

- For instance, in 2024, energy-as-a-service company GP JOULE provided temporary power systems for Wacken Open Air, contributing to the festival’s overall power consumption of 12 MW. The power generated included some from renewable sources like green hydrogen.

Rising Demand from Young Travelers

Young adults between 18–34 years are the leading demographic driving Germany’s music tourism expansion. This group values experiential travel, blending entertainment, culture, and leisure. The availability of affordable intra-European flights and efficient local transport makes Germany easily accessible. Digital engagement through streaming platforms and social media further influences travel decisions toward live performances. Younger audiences also favor eco-friendly and boutique festivals, pushing organizers to innovate with sustainable setups. The trend toward music-centered vacations, combined with flexible work cultures, continues to strengthen youth-driven market growth across major cities like Berlin and Hamburg.

- For instance, Music streaming trends on platforms like Spotify likely saw a rise in engagement with festival-themed playlists during Germany’s 2024 summer season, particularly coinciding with major events such as Melt Festival and Lollapalooza Berlin.

Growing Integration of Technology in Music Tourism

Technology is reshaping Germany’s music tourism market through digital ticketing, mobile engagement, and virtual experiences. Smart event management systems improve visitor convenience, while AR/VR tools enhance interactive participation at live performances. Streaming partnerships and social media campaigns extend event visibility to global audiences. Moreover, mobile apps offering real-time updates, personalized itineraries, and location-based promotions help tourists plan seamless travel experiences. These innovations reduce operational bottlenecks and enhance audience satisfaction. As technology continues to evolve, the integration of immersive and connected event solutions will further boost visitor engagement and repeat tourism.

Key Trends & Opportunities

Sustainability and Eco-Friendly Festival Practices

Sustainability has become a central focus in Germany’s music tourism sector. Organizers are adopting waste reduction, renewable energy use, and green mobility initiatives at major events. Festivals like Melt! and Wacken have already implemented comprehensive sustainability frameworks. Eco-conscious attendees increasingly prefer destinations and events that demonstrate social and environmental responsibility. This shift has opened new opportunities for local suppliers of green technologies and sustainable hospitality services. The focus on reducing carbon footprints not only supports Germany’s environmental goals but also attracts international tourists who value responsible and ethical travel experiences.

- For instance, in 2024, Wacken Open Air partnered with GP Joule to use renewable energy, including powering the bandstand with green hydrogen via fuel cells and testing solar cubes for smaller energy needs.

Cultural Integration and Regional Diversification

Germany’s regional diversity offers opportunities to expand music tourism beyond major cities. Smaller towns and heritage sites are developing niche events focused on classical music, local folklore, and regional artists. Initiatives linking music with gastronomy, art, and history appeal to both domestic and international visitors seeking authentic cultural immersion. Regional music trails and interactive museum experiences enhance the year-round appeal of music tourism. These developments decentralize tourism demand, benefiting local economies and creating new investment avenues in underexplored areas. The blend of modern and traditional experiences strengthens Germany’s cultural tourism ecosystem.

Key Challenges

Rising Operational and Logistical Costs

Increasing costs for event logistics, artist fees, and security are posing major challenges for Germany’s music tourism sector. Inflation, energy prices, and supply chain disruptions have raised expenses for equipment transport, staffing, and venue maintenance. Smaller festival organizers struggle to maintain profitability under these conditions. Additionally, insurance and compliance costs for large gatherings have increased due to stricter safety regulations. These financial pressures can lead to higher ticket prices, potentially limiting accessibility for younger travelers. Effective cost management, government support, and long-term partnerships are critical to maintaining market competitiveness.

Regulatory and Environmental Compliance Issues

Germany’s stringent regulations on environmental impact, noise control, and crowd management can constrain event planning. Organizers must adhere to multiple layers of municipal and federal approval processes, often leading to delays or cancellations. Events in natural or urban-sensitive areas face stricter sustainability assessments, increasing planning complexity. Moreover, balancing safety protocols with attendee experience remains a challenge. These regulatory hurdles can discourage smaller operators and limit festival diversity. Streamlined permit systems and coordinated public-private frameworks are essential to ensure sustainable growth while maintaining high compliance and safety standards.

Regional Analysis

Northern Germany

Northern Germany accounted for 27% of the Germany music tourism market in 2024, driven by major events in Hamburg, Bremen, and Schleswig-Holstein. The region’s ports and cultural hubs host festivals such as Hurricane and Reeperbahn, which attract large international audiences. Strong maritime tourism and excellent infrastructure enhance connectivity for visiting travelers. Hamburg’s reputation as a music capital, with landmarks like the Elbphilharmonie and Beatles-Platz, supports steady growth. The region benefits from cruise-based tourism and cross-border visitors from Scandinavia, reinforcing its role as a leading destination for music-related travel experiences.

Southern Germany

Southern Germany held a 29% market share in 2024, led by Bavaria and Baden-Württemberg. Cities such as Munich and Stuttgart host large-scale concerts, opera festivals, and open-air music events. The region’s strong economy and high-income population drive domestic participation in premium music tourism experiences. Venues like Munich’s Olympiapark and Gasteig attract diverse audiences, while traditional folk and classical music events appeal to cultural travelers. The area’s integration of mountain and lake tourism with music festivals provides a unique travel offering. Ongoing urban development projects further strengthen its position as a vibrant music tourism hub.

Western Germany

Western Germany captured a 25% market share in 2024, with key contributions from North Rhine-Westphalia, Hesse, and Rhineland-Palatinate. Cologne, Frankfurt, and Bonn host numerous pop, rock, and electronic music events. The region benefits from its dense population and central location, making it easily accessible from neighboring countries. Large-scale venues such as Lanxess Arena and Commerzbank-Arena attract international performers and global audiences. The growing presence of music conferences and digital entertainment fairs also supports sustained visitor inflow. Western Germany’s modern infrastructure and multicultural environment continue to drive consistent music tourism growth.

Eastern Germany

Eastern Germany accounted for 19% of the market in 2024, led by Berlin, Leipzig, and Dresden. Berlin remains the cultural heart of Europe’s electronic and alternative music scene, attracting visitors from across the world. Events like Berlin Music Week and Melt! Festival strengthen the city’s global recognition. Leipzig’s classical music heritage, including Bach festivals, enhances its appeal to cultural tourists. Dresden’s baroque architecture and historic concert venues attract older audiences and international classical enthusiasts. Continued investments in urban rejuvenation, cultural districts, and music education further elevate Eastern Germany’s importance in the national music tourism landscape.

Market Segmentations:

By Type

- Music Festivals

- Concerts & Live Performances

- Cultural Events

- Music Cruises

- Others

By Age Group

- 18 and Less

- 18–34 Years

- 34–54 Years

- 55+ Years

By End-User

- Leisure Travelers

- Music Enthusiasts

- Corporate Clients

By Technology

- Online Ticketing Platforms

- Event Promotion Tools

- Mobile Apps

- Augmented Reality Experiences

- Others (AI-Powered Personalization & Analytics)

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

By Geography

- Northern Germany

- Southern Germany

- Western Germany

- Eastern Germany

Competitive Landscape

The Germany music tourism market is highly competitive, featuring a blend of global entertainment giants and strong domestic organizers. Key players such as Live Nation GSA, DEAG Deutsche Entertainment AG, and FKP Scorpio Konzertproduktionen dominate through extensive event portfolios and partnerships with international artists. Companies like CTS Eventim AG & Co. KGaA and Ticketmaster Germany lead in ticketing technology and distribution networks, enhancing accessibility for travelers. Local firms including Goodlive GmbH and Semmel Concerts focus on niche festivals and regional events, catering to diverse audience preferences. Strategic collaborations between promoters, digital platforms, and tourism boards strengthen market integration. Investments in sustainability, immersive experiences, and smart event management tools are becoming major differentiators. Competition increasingly revolves around audience engagement, hybrid concert formats, and brand collaborations with travel service providers. Overall, consolidation, innovation, and data-driven marketing strategies are shaping the future dynamics of Germany’s evolving music tourism ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Live Nation GSA

- DEAG Deutsche Entertainment AG

- FKP Scorpio Konzertproduktionen

- Semmel Concerts Entertainment

- Marek Lieberberg Konzertagentur (MLK)

- Goodlive GmbH

- Karsten Jahnke Konzertdirektion

- Scorpio Konzertproduktionen GmbH

- Loft Concerts

- Ticketmaster Germany

- CTS Eventim AG & Co. KGaA

- Eventim Live

- io

Recent Developments

- In February 2025, Busan Concert Hall launched its official website to provide classical music enthusiasts with a seamless platform for ticket reservations, venue rentals, and academy schedules. Designed with responsive technology, the site ensures accessibility across devices and features a mobile ticketing service for quick entry via barcode scanning. The initiative enhances convenience and enriches the cultural experience for visitors in Busan.

- In August 2024, Brightline launched “The Big Concert Sweepstakes,” offering tickets to Taylor Swift’s sold-out Miami concert on October 20. The prize included two concert tickets, four round-trip Brightline tickets on a special “Tay-keover Sing-Along” train, and exclusive lounge perks. Participants entered by following Brightline on Instagram and signing a rail safety pledge, with the winner announced during Rail Safety Week in late September.

- In May 2024, Live Nation brought back its annual Concert Week promotion, offering USD 25 all-in tickets for over 5,000 shows across North America. Featuring artists like Janet Jackson and 21 Savage, the week-long event made live music more accessible to fans. Tickets, available from May 8 to May 14, could be purchased online without a promo code, allowing fans to enjoy significant savings on select concerts and festivals. The initiative aimed to enhance the summer touring season with budget-friendly options.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, End-User, Technology, Booking Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Music festivals will continue to attract international visitors, boosting tourism-related revenue across Germany.

- Digital ticketing and mobile engagement platforms will streamline event access and enhance visitor convenience.

- Sustainability initiatives such as green venues and low-emission transport will gain stronger adoption.

- Younger travelers aged 18–34 will remain the primary audience driving experiential music tourism demand.

- Regional cities beyond Berlin and Munich will host more themed music events to diversify tourism.

- Collaborations between travel agencies and event organizers will expand music-focused tour packages.

- Integration of AR and VR technologies will enhance live and hybrid concert experiences.

- Partnerships with hospitality and transport providers will improve bundled festival and travel offerings.

- Cultural music trails and heritage festivals will attract older and international cultural tourists.

- Data analytics and AI-driven marketing will optimize event planning and audience targeting strategies.