Market Overview

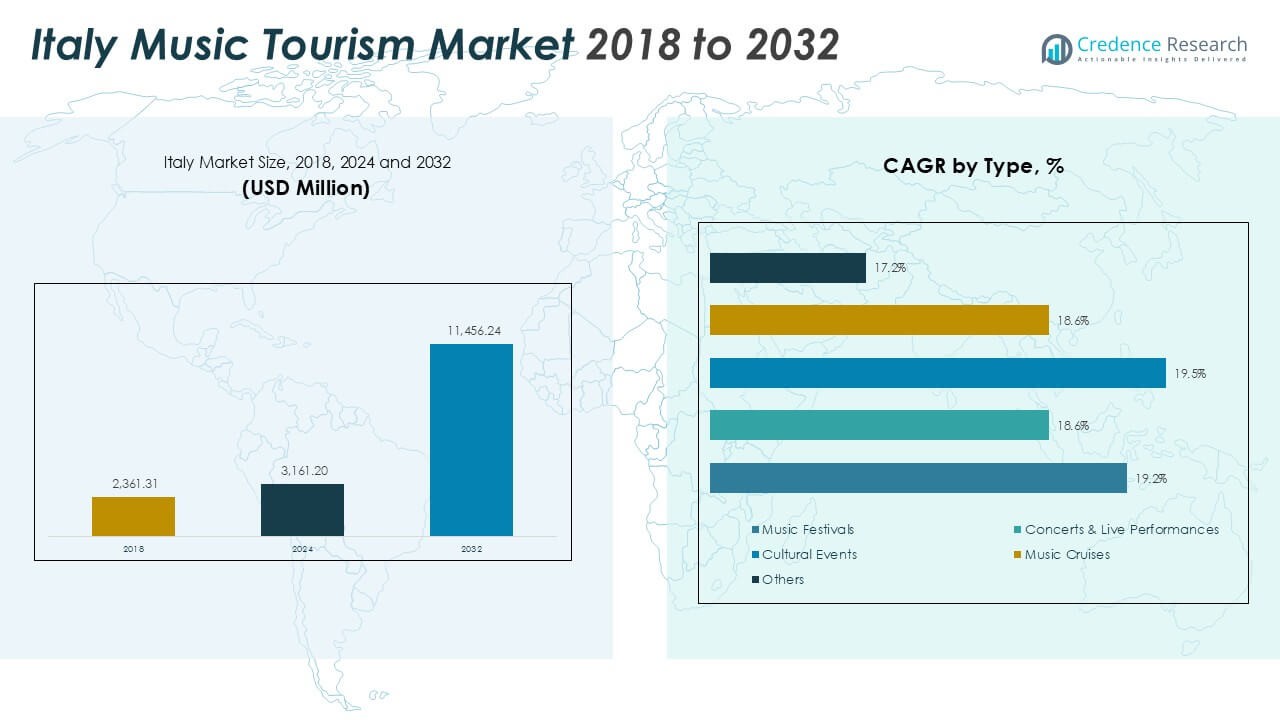

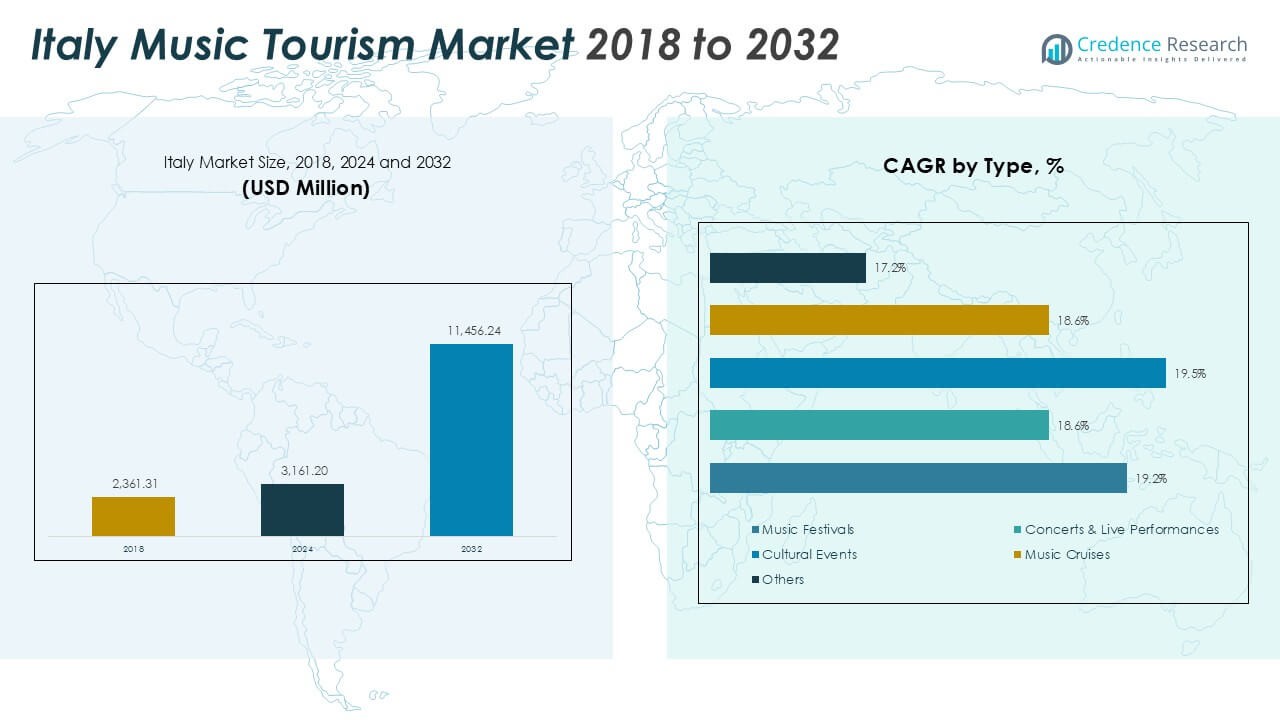

Italy Music Tourism Market size was valued at USD 2,361.31 million in 2018, increasing to USD 3,161.20 million in 2024, and is anticipated to reach USD 11,456.24 million by 2032, growing at a CAGR of 17.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Music Tourism Market Size 2024 |

USD 3,161.20Million |

| Italy Music Tourism Market , CAGR |

17.29% |

| Italy Music Tourism Market Size 2032 |

USD 11,456.24 Million |

The Italy music tourism market is led by major companies such as Live Nation Italy, Vivo Concerti, Friends & Partners, and Trident Music, which collectively account for over 55% of the organized event segment. These firms dominate through large-scale festival management, artist promotion, and international concert partnerships. Supporting players like Vertigo SRL, D’Alessandro e Galli (D&G), and Barley Arts Promotion enhance regional diversity with genre-specific festivals and touring events. Northern Italy remains the leading region with a 46% market share in 2024, driven by high visitor inflows to Milan, Turin, and Venice. Central Italy follows with 33%, anchored by Rome and Florence’s strong cultural tourism base.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

• The Italy Music Tourism market was valued at USD 3,161.20 million in 2024 and is projected to reach USD 11,456.24 million by 2032, growing at a CAGR of 17.29%.

• Growth is driven by the rising popularity of large-scale music festivals, increasing international artist participation, and strong government support for cultural tourism development.

• Key trends include digital ticketing, virtual concert streaming, and sustainable event practices that enhance audience engagement and accessibility.

• The market is competitive, with major players such as Live Nation Italy, Vivo Concerti, Friends & Partners, and Trident Music holding a significant presence across event management and promotion.

• Northern Italy led the market with a 46% share in 2024, followed by Central Italy at 33% and Southern Italy at 21%, while the music festivals segment dominated the market with a 38% share.

Market Segmentation Analysis:

By Type

The music festivals segment dominated the Italy music tourism market in 2024 with a 38% share. Major events such as Lucca Summer Festival, Firenze Rocks, and Umbria Jazz attract large domestic and international audiences. The surge in international headliners and multi-day festivals enhances visitor spending and local tourism revenue. Growing investments in open-air venues, digital ticketing, and sponsorships from global brands further boost attendance. Increasing collaboration between municipalities and event organizers supports infrastructure development, making music festivals the primary driver of Italy’s music tourism growth.

• For instance, the Lucca Summer Festival 2024 featured global artists like Ed Sheeran and Lenny Kravitz and attracted thousands of visitors to the city over several weeks.

By Age Group

The 18–34 years segment held the largest share of 42% in 2024, reflecting strong participation among younger travelers seeking immersive cultural experiences. This demographic is highly engaged with live performances and music festivals, driven by social media influence and experiential travel trends. Affordable air connectivity and the rise of short-haul European trips also encourage cross-border attendance. Younger visitors favor digital booking platforms and eco-friendly accommodations, supporting sustainable tourism models. The group’s preference for festival tourism and nightlife experiences solidifies its dominance in the age-based segmentation.

• For instance, Italy did host major festivals like Firenze Rocks from June 13 to June 16, 2024, and the Milano Summer Festival, featuring numerous concerts from June 19 to July 27. Firenze Rocks is known for attracting a large audience and features international artists.

By End-User

Leisure travelers accounted for the largest share of 47% in 2024 within Italy’s music tourism market. Their dominance stems from the integration of music experiences into broader vacation itineraries across cities like Rome, Milan, and Florence. Tourists increasingly combine concerts, local sightseeing, and cultural festivals for extended stays. The availability of customized travel packages and partnerships between tour operators and event organizers enhances accessibility. Moreover, rising disposable income and the growing appeal of Italy’s heritage-linked music venues continue to attract leisure travelers, reinforcing their leadership among end-user groups.

Key Growth Drivers

Rising Popularity of International Music Festivals

The growing success of international music festivals is a major driver of Italy’s music tourism market. Events such as Milano Summer Festival and Firenze Rocks attract global audiences, featuring renowned artists and diverse genres that boost visitor inflows. Local authorities are investing in improved transport, accommodation, and digital ticketing to support rising attendance. Partnerships between tourism boards and private organizers are expanding Italy’s reputation as a cultural hub for live performances. Additionally, the growth of multi-day outdoor festivals and hybrid events featuring both live and virtual participation enhances accessibility, supporting consistent annual tourism revenue.

• For instance, Firenze Rocks 2024 took place from June 13 to 15 at the Visarno Arena in Florence. The festival, which featured headliners Avenged Sevenfold and Tool, was promoted by Live Nation, a long-term partner and producer of the event, and drew thousands of fans.

Government Support for Cultural Tourism Development

Government initiatives aimed at promoting Italy’s cultural and creative economy play a critical role in market growth. The Ministry of Tourism and regional administrations fund restoration of historic venues and provide tax incentives for music event organizers. Programs under Italy’s “Strategic Plan for Tourism” encourage destination diversification, integrating music events with heritage tourism. These measures enhance global visibility and attract both domestic and international visitors. Furthermore, collaboration between municipalities and cultural associations helps maintain traditional music events, ensuring long-term sustainability and balanced regional development within the Italian music tourism ecosystem.

• For instance, in 2024, the Italian government announced it would allocate €45 million to restore six cultural heritage sites in Odesa, Ukraine. That same year, a separate €14 million restoration project for the Arena di Verona began, funded by private donations.

Technological Advancements in Event Management

Technological innovation is transforming the way music events are planned and experienced across Italy. Digital ticketing systems, mobile apps, and AI-based crowd management tools improve visitor convenience and operational efficiency. Live streaming and virtual reality experiences enable global participation, extending event reach beyond physical venues. Moreover, the integration of data analytics helps organizers personalize offerings, manage logistics, and optimize pricing strategies. The use of cashless payment systems and augmented reality-driven marketing enhances audience engagement, attracting tech-savvy travelers. These advancements collectively support higher profitability and broader international exposure for Italy’s music tourism industry.

Key Trends & Opportunities

Integration of Music Tourism with Cultural Heritage Travel

A growing trend involves combining music events with Italy’s vast cultural and historical attractions. Tourists increasingly seek holistic experiences, attending concerts in historic amphitheaters, piazzas, and opera houses. The blending of classical and contemporary genres in such heritage-rich settings amplifies appeal among diverse audiences. Regions like Tuscany, Veneto, and Lazio are leveraging music tourism to extend visitor stays and promote local craftsmanship and gastronomy. This integration creates a multi-sensory travel experience, supporting sustainable tourism and diversifying revenue streams for both urban and rural communities.

• For instance, Tuscany’s Teatro del Silenzio in Lajatico, founded by Andrea Bocelli, hosted a special three-night event in July 2024 to celebrate Bocelli’s 30th career anniversary. This series of open-air concerts featured performances by Bocelli and various musical guests.

Sustainability and Eco-Friendly Event Practices

Environmental consciousness is reshaping music tourism operations across Italy. Event organizers are adopting green logistics, renewable energy setups, and waste-reduction initiatives to minimize ecological impact. Festivals such as Home Festival in Treviso have pioneered sustainable event management by using reusable materials and eco-certified vendors. Travelers increasingly prefer destinations and events that align with sustainability goals, boosting demand for green-certified venues. Additionally, eco-friendly transportation and carbon-offset travel packages offer new opportunities for innovation and brand differentiation within the Italian music tourism sector.

Key Challenges

Infrastructure Limitations in Secondary Cities

Despite Italy’s strong tourism appeal, infrastructure gaps in smaller cities remain a key challenge. Limited public transport connectivity, outdated venue facilities, and insufficient accommodation options hinder event scalability outside major hubs like Milan and Rome. These constraints restrict the equitable spread of music tourism benefits across regions. Local administrations are under pressure to improve accessibility and digital infrastructure to support event logistics. Without strategic investment in secondary cities, the market risks overdependence on established metropolitan centers, limiting overall growth potential and regional inclusivity.

Seasonality and Dependence on International Visitors

The Italy music tourism market faces significant seasonality, with most events concentrated in summer months. This uneven distribution leads to inconsistent revenues and workforce utilization. Moreover, reliance on international tourists makes the market vulnerable to external shocks such as travel restrictions or economic downturns. Fluctuating airfare costs and unpredictable geopolitical conditions further impact attendance rates. To counter this, event organizers are exploring off-season indoor concerts, corporate partnerships, and digital event formats to stabilize revenue streams and ensure long-term resilience against tourism seasonality.

Regional Analysis

Northern Italy

Northern Italy dominated the Italy music tourism market in 2024 with a 46% share. Cities such as Milan, Turin, and Venice host globally recognized festivals and concerts that attract both domestic and international travelers. Milan leads with large-scale events like Milano Summer Festival and Fashion Week concerts, supported by advanced infrastructure and luxury accommodations. Turin’s electronic and jazz festivals enhance the region’s cultural mix, while Venice offers unique music experiences in heritage venues. The region benefits from strong transport connectivity, cross-border tourism from Central Europe, and partnerships between local authorities and event organizers.

Central Italy

Central Italy accounted for a 33% share of the Italy music tourism market in 2024, driven by cities like Rome, Florence, and Bologna. Rome’s open-air concerts and classical opera events continue to draw global attention, leveraging its iconic landmarks for large-scale performances. Florence contributes through cultural festivals blending art, music, and heritage tourism. Bologna, known for its UNESCO “City of Music” status, promotes diverse live performances and educational programs. The region’s strategic position and historical richness attract both leisure travelers and cultural enthusiasts, reinforcing its status as a vibrant center for music-based tourism.

Southern Italy

Southern Italy captured a 21% share of the Italy music tourism market in 2024, supported by vibrant cities such as Naples, Palermo, and Bari. Naples remains a hub for traditional and contemporary music events, including Neapolitan folk festivals that appeal to cultural tourists. Palermo enhances its presence with summer jazz and opera performances in historic theaters, while Bari attracts younger audiences through coastal music festivals. Growing regional investments in tourism infrastructure and sustainable event promotion are expanding visitor interest. The region’s blend of cultural authenticity and scenic appeal continues to strengthen its emerging role in Italy’s music tourism landscape.

Market Segmentations:

By Type

• Music Festivals

• Concerts & Live Performances

• Cultural Events

• Music Cruises

• Others

By Age Group

• 18 and Less

• 18–34 Years

• 34–54 Years

• 55+ Years

By End-User

• Leisure Travelers

• Music Enthusiasts

• Corporate Clients

By Technology

• Online Ticketing Platforms

• Event Promotion Tools

• Mobile Apps

• Augmented Reality Experiences

• Others (AI-Powered Personalization & Analytics)

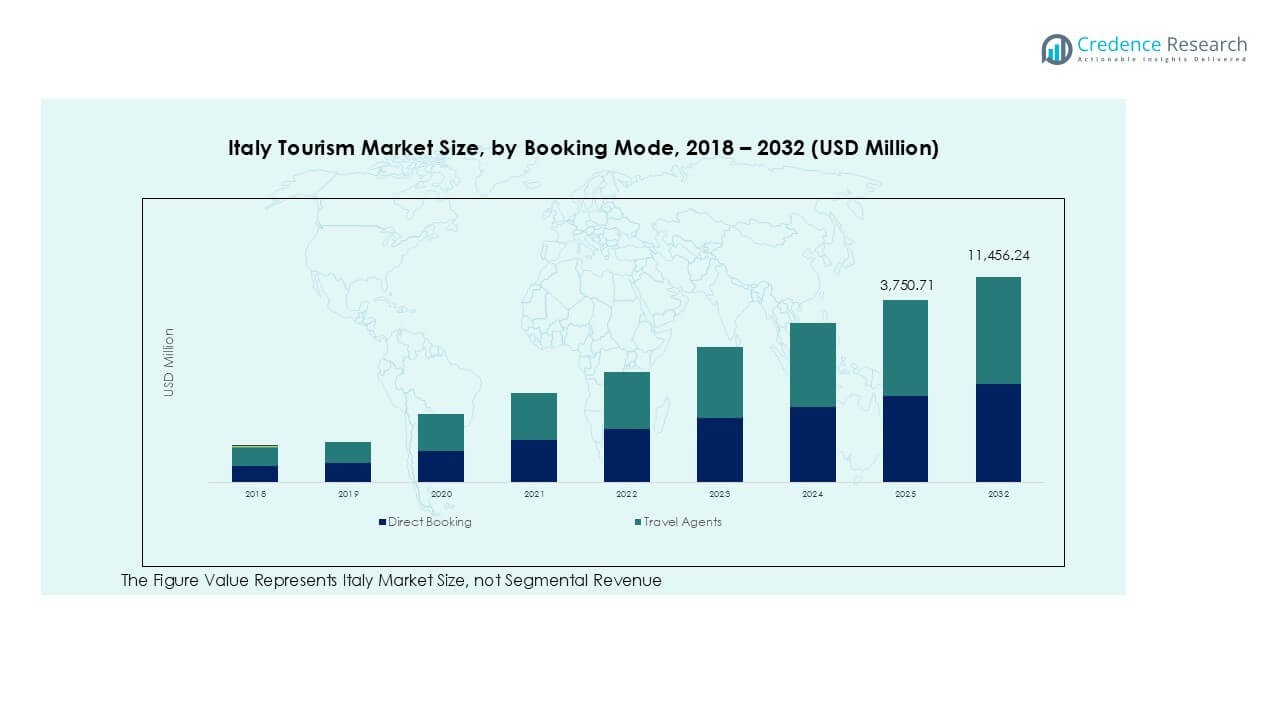

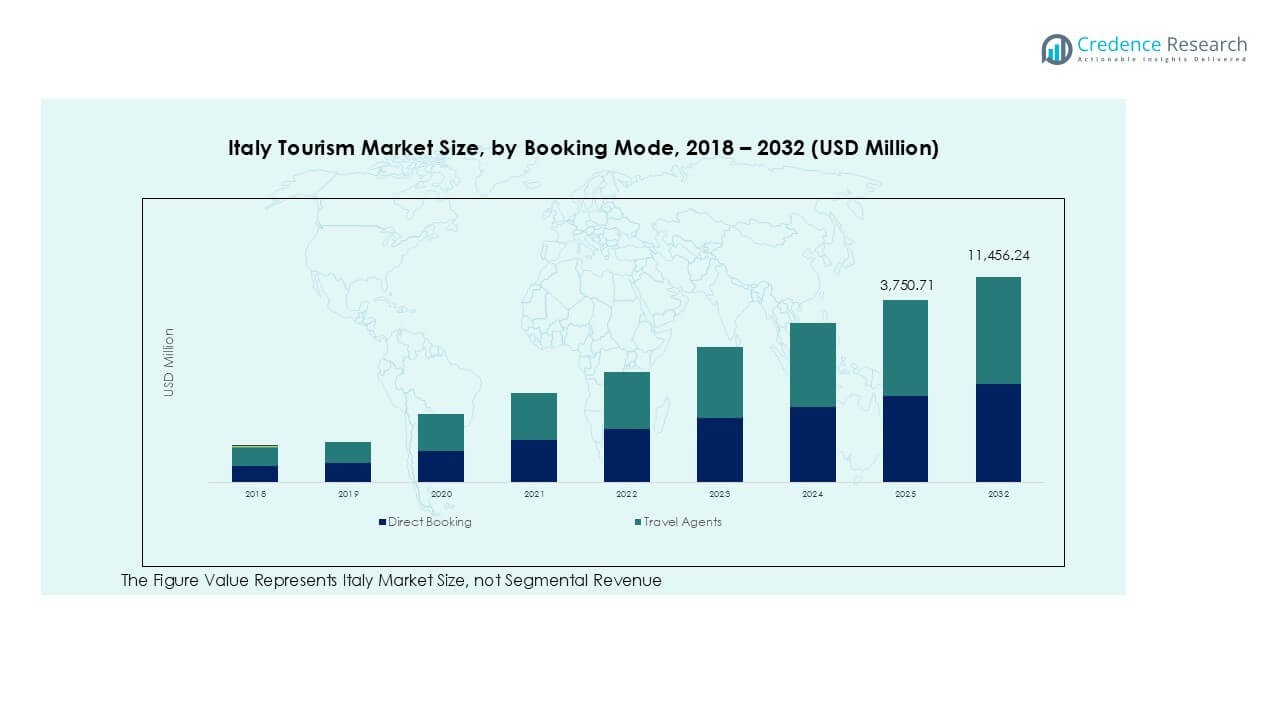

By Booking Mode

• Direct Booking

• Travel Agents

• Online Travel Agencies

By Geography

• Northern Italy

o Milan

o Turin

o Venice

• Southern Italy

o Naples

o Palermo

o Bari

• Central Italy

o Rome

o Florence

o Bologna

Competitive Landscape

The Italy music tourism market is highly competitive, featuring a blend of global promoters, regional organizers, and ticketing platforms that drive event accessibility and audience engagement. Leading companies such as Live Nation Italy, Vivo Concerti, and Friends & Partners dominate large-scale concert organization and international artist management. Firms like Vertigo SRL, Trident Music, and D’Alessandro e Galli (D&G) specialize in festival curation and live performance production across diverse genres. Meanwhile, ticketing platforms including TicketOne, Ticketmaster Italy, and Vivaticket play a vital role in digital distribution and consumer outreach. Strategic collaborations between event promoters, tourism boards, and cultural institutions are strengthening Italy’s position as a premier European destination for music-based travel. Continuous innovation in digital ticketing, sustainability initiatives, and cross-border festival partnerships further intensify competition, encouraging firms to differentiate through exclusive event rights, immersive audience experiences, and regional expansion into emerging music hubs across the country.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

• Live Nation Italy

• Vivo Concerti

• Friends & Partners

• Vertigo SRL

• Trident Music

• D’Alessandro e Galli (D&G)

• Barley Arts Promotion

• Indipendente Concerti

• TicketOne (CTS Eventim Italy)

• Ticketmaster Italy

• Vivaticket

• Firenze Rocks

Recent Developments

• In February 2025, Busan Concert Hall launched its official website to provide classical music enthusiasts with a seamless platform for ticket reservations, venue rentals, and academy schedules. Designed with responsive technology, the site ensures accessibility across devices and features a mobile ticketing service for quick entry via barcode scanning. The initiative enhances convenience and enriches the cultural experience for visitors in Busan.

• In August 2024, Brightline launched “The Big Concert Sweepstakes,” offering tickets to Taylor Swift’s sold-out Miami concert on October 20. The prize included two concert tickets, four round-trip Brightline tickets on a special “Tay-keover Sing-Along” train, and exclusive lounge perks. Participants entered by following Brightline on Instagram and signing a rail safety pledge, with the winner announced during Rail Safety Week in late September. • In May 2024, Live Nation brought back its annual Concert Week promotion, offering USD 25 all-in tickets for over 5,000 shows across North America. Featuring artists like Janet Jackson and 21 Savage, the week-long event made live music more accessible to fans. Tickets, available from May 8 to May 14, could be purchased online without a promo code, allowing fans to enjoy significant savings on select concerts and festivals. The initiative aimed to enhance the summer touring season with budget-friendly options.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, End-User, Technology, Booking Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

1. Italy’s music tourism market will expand with increasing demand for international music festivals.

2. Digitalization of ticketing and event management will improve accessibility and visitor experience.

3. Partnerships between tourism boards and private organizers will boost large-scale festival promotion.

4. Integration of cultural heritage and music tourism will attract diverse traveler segments.

5. Sustainable and eco-friendly event practices will gain higher importance among organizers.

6. Regional cities beyond Milan and Rome will emerge as new music tourism destinations.

7. Investment in digital marketing and immersive technologies will enhance audience engagement.

8. Cross-border collaborations with European artists will strengthen Italy’s global festival appeal.

9. Hybrid live and virtual event formats will sustain participation from global audiences.

10. Government initiatives promoting creative industries will continue supporting long-term market growth.