Market Overview

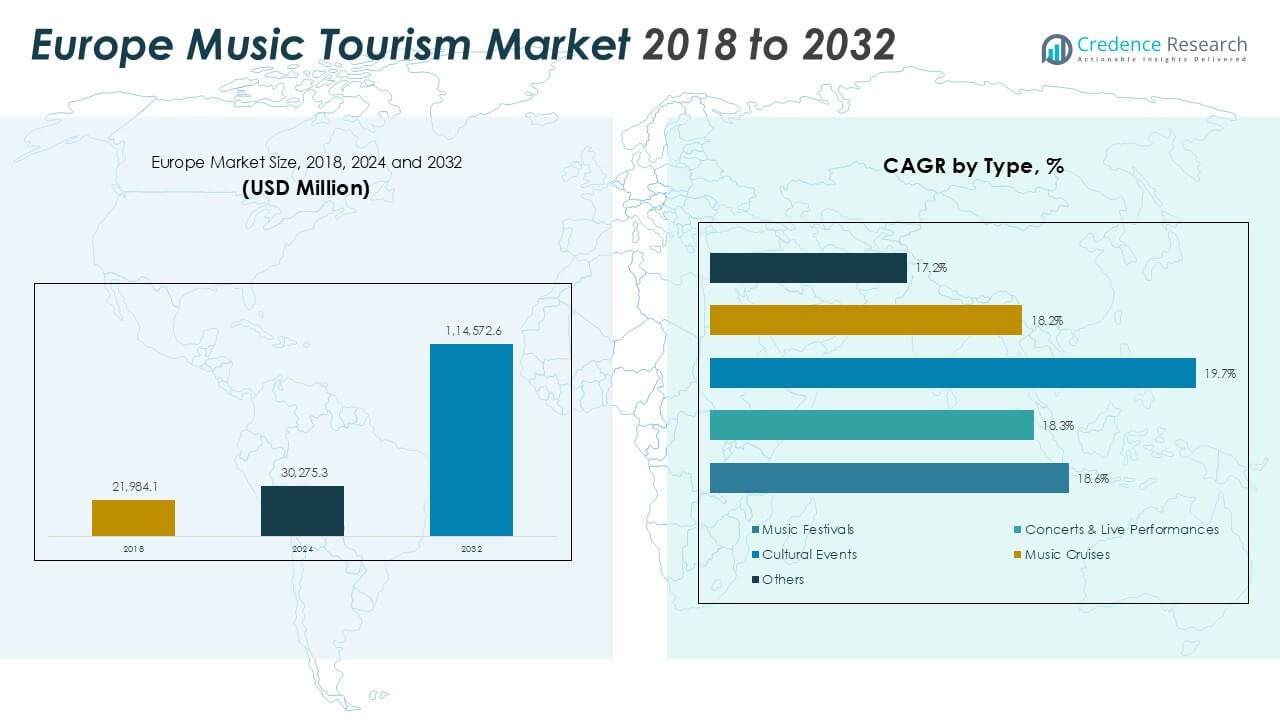

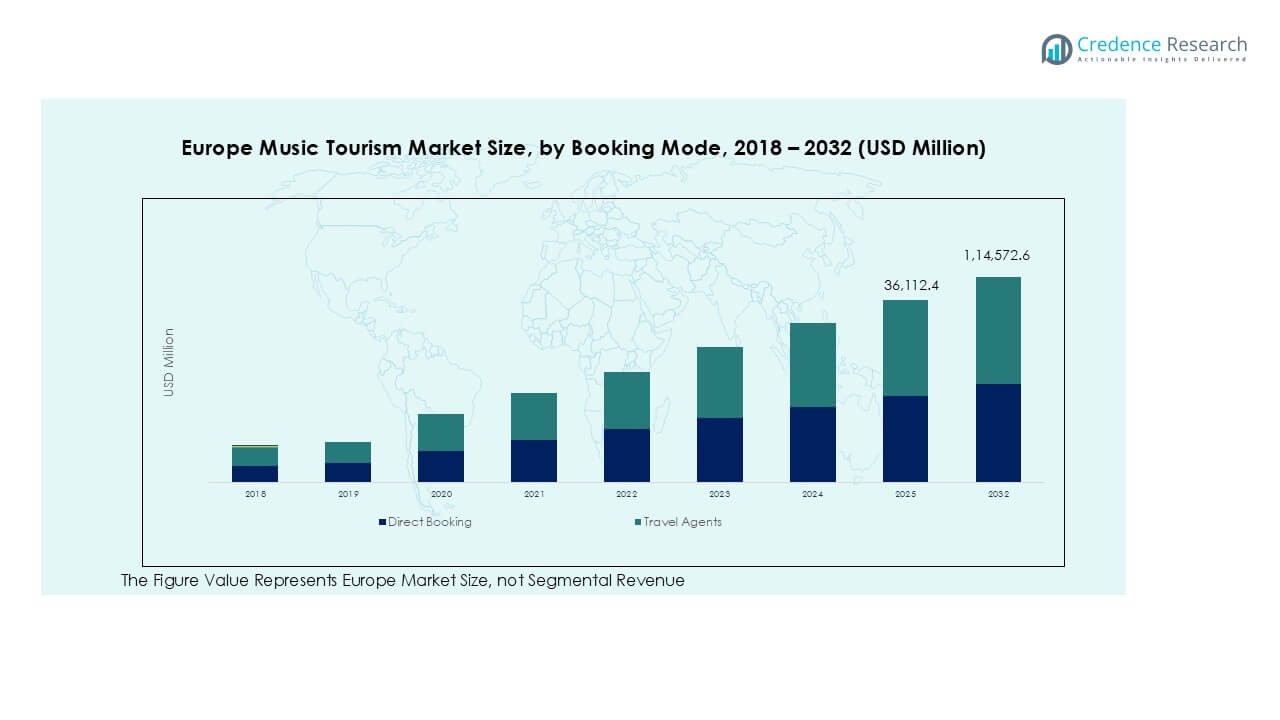

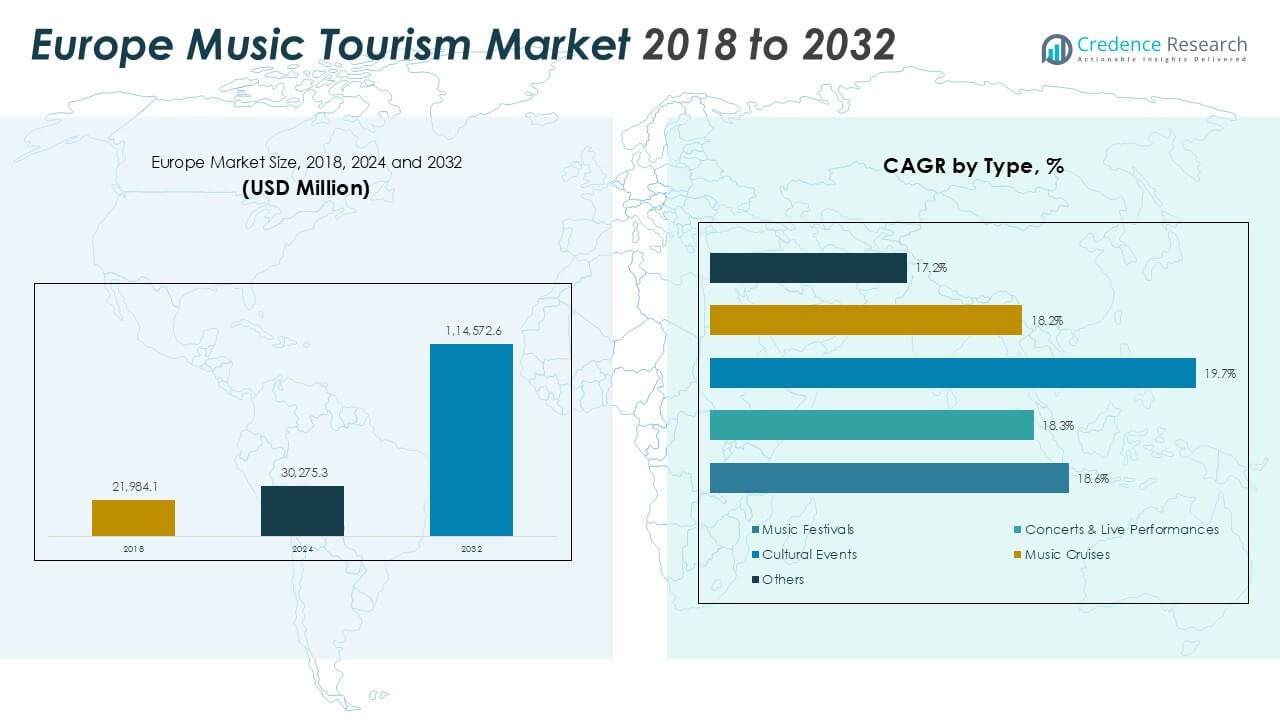

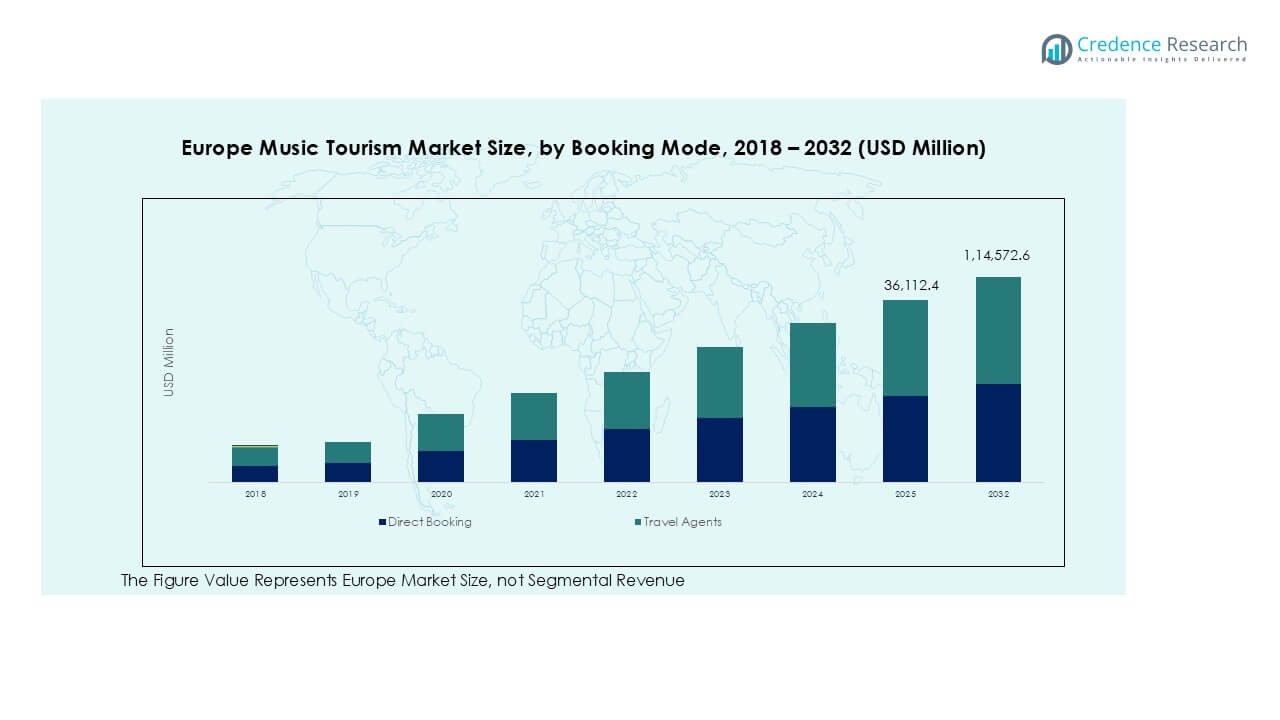

The Europe Music Tourism Market was valued at USD 21,984.1 million in 2018 and increased to USD 30,275.3 million in 2024. It is expected to reach USD 114,572.6 million by 2032, registering a CAGR of 17.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Music Tourism Market Size 2024 |

USD 30,275.3 Million |

| Europe Music Tourism Market, CAGR |

17.93% |

| Europe Music Tourism Market Size 2032 |

USD 114,572.6 Million |

The Europe Music Tourism market is led by major players such as Live Nation Europe, AEG Europe, CTS Eventim AG & Co. KGaA, Festival Republic, and DEAG Deutsche Entertainment AG. These companies dominate through large-scale event management, venue ownership, and digital ticketing integration. Supporting players like Superstruct Entertainment, Mojo Concerts, and Sziget Cultural Management enhance market diversity by hosting iconic regional festivals. The United Kingdom leads the regional market with a 26% share in 2024, driven by globally recognized events and strong music infrastructure. France and Germany follow with 19% and 18% shares, respectively, supported by thriving festival networks and rising international visitor participation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Music Tourism Market was valued at USD 21,984.1 million in 2018, grew to USD 30,275.3 million in 2024, and is projected to reach USD 114,572.6 million by 2032, expanding at a CAGR of 17.93%.

- Rising popularity of large-scale music festivals, live concerts, and cross-border cultural tourism drives steady market growth across Europe.

- Key trends include sustainable event management, digital ticketing adoption, and the rise of hybrid and experiential music experiences.

- The market is highly competitive, with major players like Live Nation Europe, AEG Europe, and CTS Eventim dominating through diversified event portfolios and partnerships.

- Regionally, the UK leads with a 26% share, followed by France at 19% and Germany at 18%, while music festivals remain the top segment with a 42% market share in 2024.

Market Segmentation Analysis:

By Type

The music festivals segment dominated the Europe Music Tourism market in 2024 with a 42% share. Large-scale events such as Glastonbury, Tomorrowland, and Primavera Sound attract millions of visitors annually, generating strong regional revenue through accommodation, transport, and local spending. Growth is supported by rising cross-border travel and festival tourism packages offering immersive cultural experiences. Increasing investments in multi-day events and digital ticketing platforms further enhance accessibility and engagement, positioning festivals as the leading driver of Europe’s growing music tourism ecosystem.

- For instance, Tomorrowland 2024 hosted over 400,000 attendees from 200 countries and featured 16 stages with more than 800 artists, while Glastonbury 2024 recorded 210,000 attendees and deployed over 6,000 volunteers to support operations, reflecting Europe’s large-scale festival capacity.

By Age Group

The 18–34 years segment led the market with a 47% share in 2024, driven by younger travelers’ higher interest in live entertainment and experiential tourism. These demographic favors international music events and social media-driven travel trends, boosting participation in major festivals and concerts across the UK, Germany, and Spain. Online ticketing, budget-friendly travel options, and influencer promotions are expanding reach among millennials and Gen Z audiences. Additionally, rising disposable income and preference for cultural experiences sustain the segment’s dominance within the region.

- For instance, Data for Primavera Sound Barcelona 2024 shows an overall attendance of 268,000, including repeat visitors over the main weekend. Of the 130,000 unique attendees, 59% were international visitors. The festival’s organizers estimated its economic impact on Barcelona to be more than €200 million.

By End User

Leisure travelers accounted for the largest share of 52% in 2024, reflecting strong participation from domestic and international tourists seeking recreational experiences. This segment benefits from package deals combining music events with city tours, dining, and local attractions. Travel operators and event organizers collaborate to design themed itineraries, enhancing visitor engagement and spending. Growing interest in short-break music tourism and government support for cultural festivals also contribute to market expansion. The segment’s flexibility and wide appeal make it the leading driver of Europe’s music tourism growth.

Key Growth Drivers

Expanding Festival Tourism and Cross-Border Travel

Europe’s extensive network of international music festivals is a major growth catalyst for music tourism. Events such as Tomorrowland in Belgium, Glastonbury in the UK, and Sziget in Hungary draw millions of visitors annually, creating significant demand for hospitality, transportation, and entertainment services. The growing availability of affordable flights and rail connectivity within the EU encourages cross-border attendance, particularly among young travelers. Governments and tourism boards are increasingly integrating music festivals into destination branding strategies, which helps extend tourist stays and boost regional economic activity across Europe’s cultural hubs.

- For instance, Tomorrowland 2024 in Boom, Belgium, hosted over 400,000 attendees from 200 countries and partnered with Brussels Airlines to operate 175 themed flights, while Sziget Festival in Budapest welcomed 420,000 visitors across seven days, generating an estimated 60% of its attendance from international travelers.

Digital Integration and Online Ticketing Platforms

The rise of digital ticketing, mobile apps, and social media promotions has transformed the way tourists engage with music events. Platforms like Eventbrite and Ticketmaster simplify ticket purchases and event discovery, enhancing user convenience and expanding audience reach. Social media campaigns, influencer marketing, and virtual event previews further amplify global visibility for European music destinations. Integration of data analytics also enables organizers to forecast demand, personalize offers, and optimize travel partnerships. These advancements streamline logistics and encourage international participation, strengthening Europe’s competitive edge in global music tourism.

- For instance, Tomorrowland’s One World Radio app offers live set previews and a stream of the radio station, enhancing the experience for fans worldwide.

Government Support and Cultural Promotion Initiatives

European governments and cultural agencies are actively promoting music tourism as part of their broader creative economy strategies. Funding for local festivals, artist collaborations, and infrastructure upgrades has strengthened event diversity and global appeal. Countries such as France, Spain, and the Netherlands have launched grants and partnerships to preserve musical heritage while attracting foreign visitors. Public–private partnerships help enhance venue capacities, sustainability standards, and safety measures. These efforts not only stimulate local economies but also reinforce Europe’s reputation as a vibrant hub for cultural and musical experiences.

Key Trends and Opportunities

Growing Demand for Experiential and Sustainable Tourism

Music tourists increasingly seek immersive experiences that combine entertainment, culture, and sustainability. Eco-friendly festival practices such as waste reduction, renewable energy use, and carbon offset programs are becoming standard across Europe. Events like Øya Festival in Norway and Roskilde in Denmark highlight sustainability leadership, appealing to environmentally conscious travelers. Moreover, demand for local food, art, and community engagement enhances visitor experiences beyond performances. This shift toward responsible, experiential tourism offers opportunities for organizers and destinations to differentiate themselves through innovative, green-focused event strategies.

- For instance, Roskilde Festival, a non-profit organization, donates all profits to social and environmental causes, having given over 420 million DKK (more than €56 million) to charity throughout its history. Øya Festival has also been a pioneer in sustainability, notably transitioning away from polluting generators. By 2011, it was powered by 100% renewable energy through a “Green Tariff” from the local grid, a project that began in 2009.

Integration of Technology and Hybrid Music Experiences

Advancements in AR, VR, and live-streaming technologies are reshaping how audiences participate in music tourism. Hybrid formats allow travelers to experience concerts virtually while promoting physical attendance through enhanced pre-event engagement. Tech-driven innovations—such as AI-based crowd management, interactive ticketing, and personalized travel recommendations—improve convenience and safety. Partnerships between event organizers, travel companies, and tech firms are expanding access for remote audiences and international fans. These innovations create new monetization avenues and strengthen Europe’s position as a leader in digital music tourism experiences.

Key Challenges

Rising Costs and Infrastructure Constraints

The expansion of large-scale music events across Europe has intensified pressure on logistics and infrastructure. Rising costs for venue rentals, artist fees, and accommodation impact event profitability and ticket affordability. Smaller cities often struggle with limited transport capacity and hospitality infrastructure during peak festival seasons. Additionally, inflation and fluctuating travel costs can deter budget-conscious visitors. Addressing these challenges requires coordinated investment in event infrastructure, sustainable mobility, and regional accommodation networks to maintain accessibility and ensure long-term growth of the music tourism sector.

Environmental Impact and Over-Tourism Risks

High visitor volumes at popular music destinations contribute to environmental degradation, noise pollution, and local congestion. Festivals generate significant waste and emissions, challenging sustainability goals despite green initiatives. Over-tourism in cities such as Barcelona and Amsterdam has led to stricter event regulations and caps on visitor numbers. Balancing economic benefits with environmental preservation is becoming critical for organizers and local authorities. Implementing circular waste systems, promoting local travel alternatives, and encouraging responsible tourist behavior are essential to mitigate ecological strain and sustain Europe’s music tourism growth.

Regional Analysis

UK

The United Kingdom dominated the Europe Music Tourism market with a 26% share in 2024. The country hosts globally recognized festivals such as Glastonbury, Reading & Leeds, and the Isle of Wight, which attract millions of domestic and international visitors each year. Strong infrastructure, rich musical heritage, and well-connected transport networks make the UK a key hub for music-based travel. Government support for creative industries and city-level tourism promotion further strengthens its position. The rise of live concerts and event-driven tourism continues to boost local economies and enhance the UK’s global cultural influence.

France

France accounted for a 19% share of the Europe Music Tourism market in 2024, supported by its diverse range of music events and cultural attractions. Paris, Lyon, and Marseille host major international festivals such as Rock en Seine and Les Vieilles Charrues, drawing large crowds annually. The country’s strong arts scene, combined with luxury tourism and gastronomy, enhances visitor experiences. France’s investment in cultural tourism and festival infrastructure drives participation among both domestic and European travelers. The blend of traditional and contemporary music offerings ensures France’s steady market expansion.

Germany

Germany held an 18% share in 2024, driven by its strong live performance culture and electronic music scene. Cities such as Berlin, Munich, and Hamburg are renowned for hosting events like Lollapalooza Berlin and Wacken Open Air, which attract international attendees. The country’s efficient transport system, affordability, and thriving nightlife further support visitor growth. Government initiatives promoting creative industries and local partnerships have enhanced festival accessibility. Germany’s focus on sustainability and community-based music experiences positions it as a leading player in Europe’s evolving music tourism ecosystem.

Italy

Italy captured a 12% share in the Europe Music Tourism market in 2024. The country’s music tourism is anchored in its classical heritage and contemporary festival culture, blending art, history, and performance. Events such as the Lucca Summer Festival and Umbria Jazz attract global tourists seeking cultural immersion. Italy’s picturesque settings and rich heritage enhance the appeal of live music experiences. The rise of regional festivals and improved travel connectivity have expanded tourism flows. Strong collaboration between cultural institutions and local governments continues to strengthen Italy’s role in Europe’s music tourism sector.

Spain

Spain represented a 10% share in 2024, supported by world-renowned festivals and coastal concert events. Major attractions such as Primavera Sound in Barcelona and Mad Cool Festival in Madrid draw large international audiences. The country’s warm climate, tourism-friendly policies, and thriving nightlife culture make it a preferred destination for young travelers. Spain’s focus on combining music events with local food and cultural experiences enhances visitor satisfaction. Ongoing investments in venue infrastructure and event promotion are expected to sustain strong market performance through the forecast period.

Russia

Russia accounted for a 7% share of the Europe Music Tourism market in 2024. The country’s growing interest in large-scale music events and cultural festivals is fueling steady market expansion. Moscow and St. Petersburg host internationally recognized performances such as Park Live and Alfa Future People, attracting both domestic and regional visitors. Despite regulatory and logistical challenges, Russia’s music scene continues to evolve with increased private investment. Enhanced international collaborations and government-backed cultural initiatives are helping position Russia as an emerging destination in Europe’s music tourism landscape.

Rest of Europe

The Rest of Europe segment held an 8% share in 2024, encompassing countries such as the Netherlands, Belgium, Norway, and Switzerland. This region benefits from a mix of international festivals and niche cultural events that attract diverse audiences. Belgium’s Tomorrowland and the Netherlands’ Amsterdam Dance Event exemplify global appeal, driving cross-border visitor participation. Strong regional connectivity and support for sustainable event management boost competitiveness. Expanding digital marketing campaigns and partnerships with local tourism boards are expected to drive further growth across these European countries in the coming years.

Market Segmentations:

By Type

- Music Festivals

- Concerts & Live Performances

- Cultural Events

- Music Cruises

- Others

By Age Group

- 18 and Less

- 18–34 Years

- 34–54 Years

- 55+ Years

By End-User

- Leisure Travelers

- Music Enthusiasts

- Corporate Clients

By Technology

- Online Ticketing Platforms

- Event Promotion Tools

- Mobile Apps

- Augmented Reality Experiences

- Others (AI-Powered Personalization & Analytics)

By Booking Mode

- Direct Booking

- Travel Agents

- Online Travel Agencies

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Music Tourism market is highly competitive, featuring a mix of global entertainment groups, independent festival organizers, and digital ticketing platforms. Major companies such as Live Nation Europe, AEG Europe, and CTS Eventim dominate through extensive event portfolios, strategic venue ownership, and cross-border partnerships. Firms like Festival Republic, Superstruct Entertainment, and DEAG Deutsche Entertainment AG play key roles in organizing large-scale festivals across multiple countries. Ticketing and technology-driven firms including Ticketmaster UK, Dice FM, and Festicket enhance consumer engagement through digital platforms and personalized event experiences. Independent operators such as Sziget Cultural Management and Primavera Sound strengthen regional diversity, offering unique cultural value to Europe’s music tourism ecosystem. The market’s competitiveness is intensifying with increased investments in sustainability, digital event management, and immersive audience experiences, driving innovation and collaboration among leading players to maintain long-term profitability and visitor loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Live Nation Europe

- AEG Europe

- Sziget Cultural Management

- DF Concerts & Events

- Festival Republic

- Superstruct Entertainment

- Mojo Concerts

- DEAG Deutsche Entertainment AG

- Eventim (CTS Eventim AG & Co. KGaA)

- Ticketmaster UK

- Dice FM

- Festicket

- Primavera Sound

- Glastonbury Festival

- Roskilde Festival

Recent Developments

- In February 2025, Busan Concert Hall launched its official website to provide classical music enthusiasts with a seamless platform for ticket reservations, venue rentals, and academy schedules. Designed with responsive technology, the site ensures accessibility across devices and features a mobile ticketing service for quick entry via barcode scanning. The initiative enhances convenience and enriches the cultural experience for visitors in Busan.

- In August 2024, Brightline launched “The Big Concert Sweepstakes,” offering tickets to Taylor Swift’s sold-out Miami concert on October 20. The prize included two concert tickets, four round-trip Brightline tickets on a special “Tay-keover Sing-Along” train, and exclusive lounge perks. Participants entered by following Brightline on Instagram and signing a rail safety pledge, with the winner announced during Rail Safety Week in late September.

- In May 2024, Live Nation brought back its annual Concert Week promotion, offering USD 25 all-in tickets for over 5,000 shows across North America. Featuring artists like Janet Jackson and 21 Savage, the week-long event made live music more accessible to fans. Tickets, available from May 8 to May 14, could be purchased online without a promo code, allowing fans to enjoy significant savings on select concerts and festivals. The initiative aimed to enhance the summer touring season with budget-friendly options.

Report Coverage

The research report offers an in-depth analysis based on Type, Age Group, End-User, Technology, Booking Mode and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as international festival participation and travel connectivity continue to grow.

- Digital platforms and mobile ticketing will simplify event access and enhance traveler convenience.

- Sustainability initiatives will become central, with festivals adopting renewable energy and waste management systems.

- Government partnerships will strengthen through tourism incentives and cultural promotion programs.

- Experiential tourism will rise, combining music with food, art, and heritage experiences.

- Hybrid and virtual concert formats will attract remote global audiences alongside in-person attendees.

- Data analytics and AI-driven personalization will improve visitor engagement and spending patterns.

- Emerging destinations in Eastern Europe will gain prominence through affordable and niche music events.

- Strategic mergers and collaborations among event organizers will expand cross-border festival networks.

- Increased investment in security, logistics, and crowd management will enhance visitor safety and satisfaction.