Market Overview

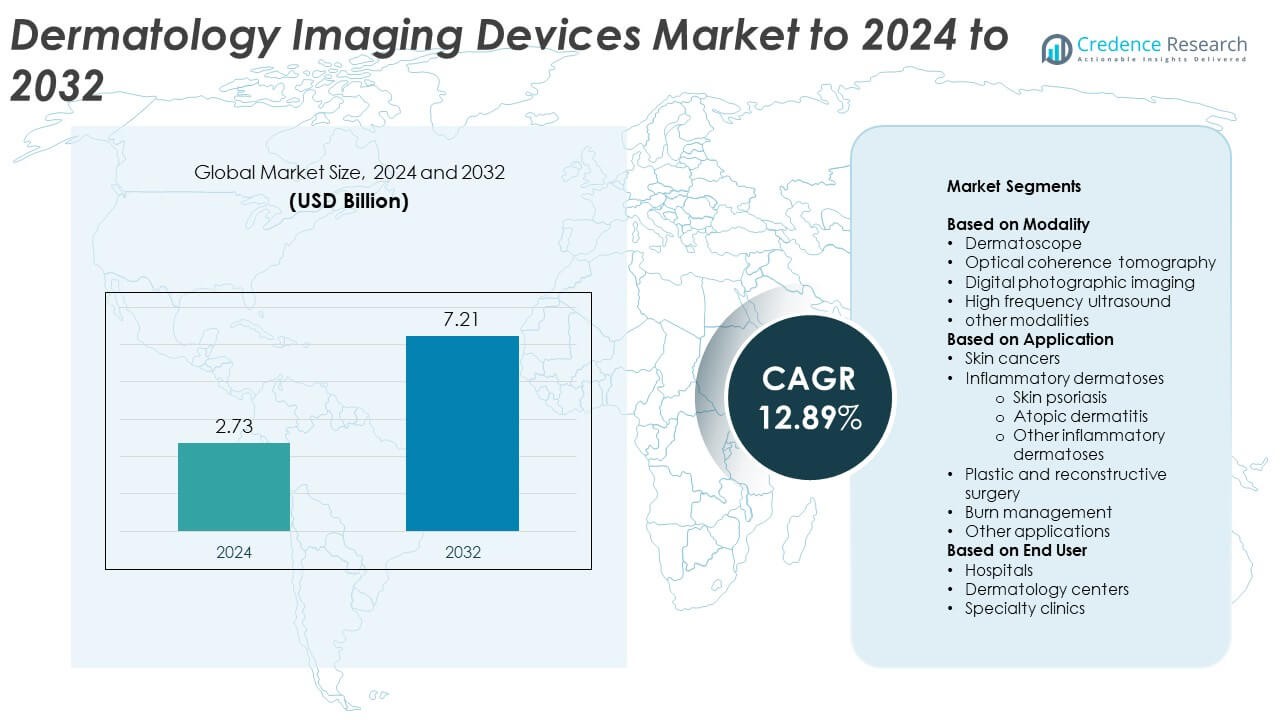

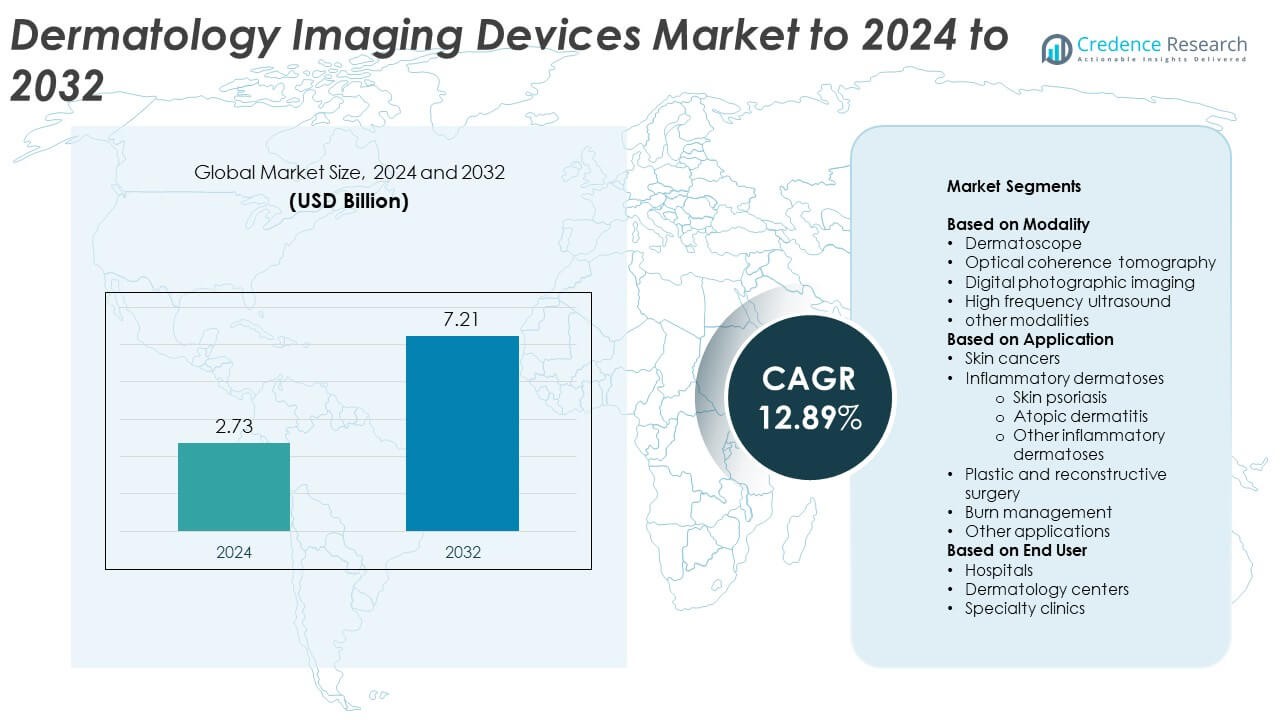

Dermatology Imaging Devices Market size was valued USD 2.73 Billion in 2024 and is anticipated to reach USD 7.21 Billion by 2032, at a CAGR of 12.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dermatology Imaging Devices Market Size 2024 |

USD 2.73 Billion |

| Dermatology Imaging Devices Market, CAGR |

12.89% |

| Dermatology Imaging Devices Market Size 2032 |

USD 7.21 Billion |

The dermatology imaging devices market is driven by major players such as GE Healthcare Technologies, Inc., DermLite, Fotofinder Systems GmbH, Koninklijke Philips N.V., Caliber Imaging and Diagnosis, and Canfield Scientific, Inc. These companies focus on advanced diagnostic imaging solutions, integrating artificial intelligence and digital platforms to enhance accuracy and workflow efficiency. Innovations in dermatoscopes, optical coherence tomography, and high-frequency ultrasound systems have strengthened their market presence. North America dominated the global market with a 39% share in 2024, supported by advanced healthcare infrastructure, early technology adoption, and growing demand for AI-enabled skin diagnostic systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The dermatology imaging devices market was valued at USD 2.73 billion in 2024 and is projected to reach USD 7.21 billion by 2032, growing at a CAGR of 12.89%.

- Rising cases of skin cancer and other chronic skin disorders are driving the adoption of advanced diagnostic imaging systems across hospitals and specialty clinics.

- Increasing integration of AI and teledermatology platforms is transforming diagnostic accuracy and enabling remote consultations globally.

- The market is moderately competitive, with players focusing on portable imaging devices, digital data integration, and strategic partnerships to expand their presence.

- North America held 39% of the global share in 2024, followed by Europe at 28% and Asia Pacific at 22%, while the dermatoscope segment led with 37% of total market revenue.

Market Segmentation Analysis:

By Modality

Dermatoscopes held the largest share of the dermatology imaging devices market in 2024, accounting for around 37% of total revenue. Their dominance is driven by rising demand for handheld, non-invasive diagnostic tools for melanoma and pigmented lesion detection. The ease of integration with digital imaging and teledermatology platforms further enhances their use among dermatologists. Optical coherence tomography and digital photographic imaging are also gaining momentum due to their precision in structural skin analysis and early disease detection, supported by growing technological innovation and AI-assisted image interpretation.

- For instance, HEINE DELTA 30 lists a 32 mm lens, >25,000 lx illuminance, and CRI ≥ 90.

By Application

Skin cancer diagnosis dominated the application segment, capturing nearly 45% of the market share in 2024. The growth is primarily driven by increasing global incidence of melanoma and non-melanoma cancers, along with heightened public awareness of early skin screening. Technological advancements in imaging resolution and lesion classification have strengthened early diagnostic capabilities. Applications in inflammatory dermatoses and reconstructive surgery are expanding as AI-based diagnostic tools support accurate disease mapping and treatment monitoring across diverse dermatological conditions.

- For instance, Skin Analytics assessed over 170,000 NHS patients and removed need for many urgent in-person appointments.

By End User

Hospitals emerged as the dominant end-user segment, contributing around 42% of market revenue in 2024. Their leadership stems from advanced infrastructure, wider adoption of integrated imaging systems, and higher patient inflow for complex diagnostic procedures. The expansion of dermatology departments and multi-specialty collaborations has fueled adoption of high-end imaging devices. Dermatology centers and specialty clinics are expected to grow rapidly, supported by the availability of portable and cost-efficient devices, improved accessibility for outpatient care, and rising demand for aesthetic and reconstructive dermatology services.

Key Growth Drivers

Rising Prevalence of Skin Cancer and Disorders

The increasing incidence of skin cancer and chronic dermatological conditions such as psoriasis and eczema is a primary growth driver. Rising awareness about early diagnosis and preventive screening has boosted demand for advanced imaging systems. Healthcare facilities are rapidly adopting dermatoscopes and digital imaging technologies to improve accuracy in lesion detection. Government-supported skin health programs and AI-enabled diagnostic tools are further accelerating the uptake of imaging devices across hospitals and dermatology centers worldwide.

- For instance, Castle Biosciences’ DECIDE study reported a 25% reduction in unnecessary SLNB when DecisionDx-Melanoma informed decisions.

Advancements in Imaging and Artificial Intelligence Integration

Technological innovations in imaging accuracy, coupled with AI-driven analysis, are transforming dermatological diagnostics. Modern imaging platforms now deliver real-time visualization and automated lesion classification. AI integration enhances diagnostic confidence by reducing human error and improving workflow efficiency. These developments have led to faster diagnosis and treatment planning. Increasing R&D investments from key industry players continue to support the integration of machine learning and digital imaging in dermatology practice.

- For instance, earlier clinical evaluations of a version of the CE-marked SkinVision app reported 80% sensitivity and 78% specificity for detecting malignant or pre-malignant lesions in a dataset of 267 lesions.

Growing Adoption in Aesthetic and Reconstructive Procedures

Expanding demand for cosmetic and reconstructive dermatology procedures is boosting the use of advanced imaging devices. Imaging technologies assist surgeons in pre-procedural assessments, treatment mapping, and post-operative monitoring. Rising consumer focus on skin health and appearance, combined with the availability of high-resolution imaging for precision-based procedures, drives growth. Clinics and specialty centers increasingly rely on digital systems to ensure effective visual documentation and enhance patient satisfaction.

Key Trends & Opportunities

Expansion of Teledermatology and Remote Diagnostics

The rise of teledermatology services presents major opportunities for dermatology imaging device adoption. Digital dermatoscopes and mobile-compatible imaging systems enable remote consultations and diagnosis, especially in underserved areas. Cloud-based data sharing allows dermatologists to collaborate globally for expert evaluations. This trend supports improved access to skin care services while reducing costs and diagnostic delays. Increased use of telehealth platforms following the pandemic has further accelerated this opportunity.

- For instance, a specific online screening campaign conducted by First Derm in partnership with the Charles SLBG Foundation, which provided free teledermatology access to over 3,000 individuals in the UK from February 2022 to August 2024.

Shift Toward Portable and AI-Powered Imaging Solutions

The growing preference for compact and AI-integrated imaging devices is reshaping market dynamics. Portable systems support quick assessments in outpatient settings, home care, and mobile clinics. AI algorithms integrated within imaging platforms assist dermatologists in identifying complex skin abnormalities with greater precision. The trend aligns with the industry’s focus on user-friendly, data-driven, and affordable imaging solutions that enhance workflow efficiency and expand patient reach.

- For instance, Longport EPISCAN digitizes ultrasound at up to 200 MSPS and operates with probes to 50 MHz for skin imaging.

Key Challenges

High Equipment Costs and Limited Accessibility

The significant upfront cost of advanced imaging systems remains a key restraint for smaller clinics and low-resource regions. Many healthcare providers find it challenging to justify high investment costs due to limited reimbursement coverage for dermatology imaging. In developing economies, insufficient infrastructure and shortage of trained dermatologists further restrict market penetration. These factors collectively slow adoption despite the growing clinical importance of dermatological diagnostics.

Data Management and Diagnostic Accuracy Concerns

Integrating AI-based imaging systems introduces challenges in data management, security, and standardization. Variability in imaging protocols and data quality can affect diagnostic consistency across platforms. Privacy concerns related to patient image storage in cloud-based systems also pose regulatory hurdles. Ensuring algorithm transparency and achieving physician trust in automated image interpretation are ongoing challenges that companies must address to support long-term market growth.

Regional Analysis

North America

North America dominated the dermatology imaging devices market in 2024 with a 39% share. The region’s growth is fueled by a strong healthcare infrastructure, early adoption of AI-integrated imaging technologies, and high awareness of skin cancer prevention. The United States leads due to a large patient population, advanced diagnostic centers, and supportive reimbursement policies. Increased investments in teledermatology and mobile imaging platforms further enhance market expansion. Continuous innovation from key manufacturers and research collaborations across dermatology institutes sustain the region’s technological leadership in dermatological imaging.

Europe

Europe accounted for around 28% of the global market share in 2024. The region benefits from a high prevalence of skin disorders, strong clinical research networks, and growing use of non-invasive imaging tools. Countries such as Germany, France, and the United Kingdom lead adoption due to robust public health programs promoting early skin cancer detection. Supportive regulatory frameworks for AI-based medical devices and increased investment in hospital infrastructure strengthen market penetration. Expansion of dermatology clinics and digital diagnostic systems further supports regional growth across both Western and Central Europe.

Asia Pacific

Asia Pacific held a 22% share of the dermatology imaging devices market in 2024. Rapid growth in healthcare infrastructure, rising disposable incomes, and increasing awareness of aesthetic treatments drive market expansion. Countries such as Japan, China, and India are adopting AI-enabled dermatoscopes and mobile imaging systems for faster skin disease diagnosis. Government efforts to enhance dermatological care access and local manufacturing initiatives are contributing to cost reduction and adoption. The region is expected to witness the fastest growth rate, supported by strong demand for advanced diagnostic solutions.

Latin America

Latin America represented around 7% of the global market share in 2024. The market is supported by rising skin disorder cases linked to UV exposure and growing awareness of preventive skin health. Brazil and Mexico are leading adopters due to improving healthcare infrastructure and increasing access to digital diagnostic tools. Collaborations between public and private healthcare providers are enhancing the use of teledermatology across rural areas. However, high device costs and limited trained specialists continue to constrain wider adoption in certain parts of the region.

Middle East and Africa

The Middle East and Africa captured a 4% share of the dermatology imaging devices market in 2024. Growth is primarily driven by the expansion of private healthcare facilities and increasing investment in dermatology centers. Gulf countries, including the United Arab Emirates and Saudi Arabia, are leading adoption through technology-driven healthcare modernization. Rising prevalence of skin conditions caused by extreme climate exposure further increases diagnostic demand. However, limited infrastructure and high import dependency pose challenges to broad adoption, particularly across African nations with lower healthcare spending.

Market Segmentations:

By Modality

- Dermatoscope

- Optical coherence tomography

- Digital photographic imaging

- High frequency ultrasound

- other modalities

By Application

- Skin cancers

- Inflammatory dermatoses

- Skin psoriasis

- Atopic dermatitis

- Other inflammatory dermatoses

- Plastic and reconstructive surgery

- Burn management

- Other applications

By End User

- Hospitals

- Dermatology centers

- Specialty clinics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The dermatology imaging devices market features several prominent players including GE Healthcare Technologies, Inc., DermLite, Cortex Technology, Fotofinder Systems GmbH, DermaSensor, Inc., Courage+Khazaka Electronic GmbH, Caliber Imaging and Diagnosis, Michelson Diagnostics Ltd., Longport, Inc., Canfield Scientific, Inc., Clarius, Draminski S.A., VisualSonics, Koninklijke Philips N.V., and e-con Systems Inc. The market is characterized by continuous innovation in high-resolution imaging, AI integration, and digital data management for enhanced diagnostic precision. Companies are investing heavily in research and development to introduce portable, AI-powered, and connected imaging solutions that improve early skin cancer detection and clinical efficiency. Strategic collaborations with hospitals, dermatology centers, and research institutes are fostering technology validation and commercial adoption. Furthermore, product differentiation through teledermatology compatibility, advanced image analytics, and real-time visualization capabilities continues to define competition. Expansion into emerging markets and integration of cloud-based data platforms are expected to strengthen global market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- GE Healthcare Technologies, Inc.

- DermLite

- Cortex Technology

- Fotofinder Systems GmbH

- DermaSensor, Inc.

- Courage+Khazaka Electronic GmbH

- Caliber Imaging and Diagnosis

- Michelson Diagnostics Ltd.

- Longport, Inc.

- Canfield Scientific, Inc.

- Clarius

- Draminski S.A.

- VisualSonics

- Koninklijke Philips N.V.

- e-con Systems Inc.

Recent Developments

- In 2023, Canfield Scientific introduced the VISIA Skin Analysis, an AI-integrated facial imaging device.

- In 2023, Canfield Scientific highlighted its imaging solutions, including the IntelliStudio, VEOS, DermaGraphix, and VECTRA WB360 at the 25th World Congress of Dermatology.

- In 2023, FotoFinder launched the portable meesma imaging solution for aesthetics and the fourth-generation FotoFinder ATBM master, which features an AI assistant named AIMEE for total body dermoscopy.

Report Coverage

The research report offers an in-depth analysis based on Modality, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Integration of artificial intelligence will enhance diagnostic accuracy and workflow efficiency in dermatology imaging.

- Portable and handheld imaging devices will gain popularity among dermatology centers and outpatient clinics.

- Teledermatology adoption will expand, enabling remote consultations and faster diagnosis in underserved regions.

- High-resolution imaging and 3D visualization technologies will improve lesion mapping and treatment planning.

- Cloud-based data storage and analytics will support image sharing and collaborative diagnosis among specialists.

- Increased focus on early skin cancer detection will drive the use of advanced dermatoscopes and OCT systems.

- Aesthetic and reconstructive dermatology will increasingly rely on imaging for pre- and post-procedure evaluation.

- AI-driven software upgrades will enable predictive analysis for disease progression and treatment response.

- Strategic collaborations between device makers and hospitals will strengthen product accessibility and innovation.

- Regulatory approvals for AI-enabled imaging platforms will accelerate commercialization across developed and emerging markets.