Market Overview

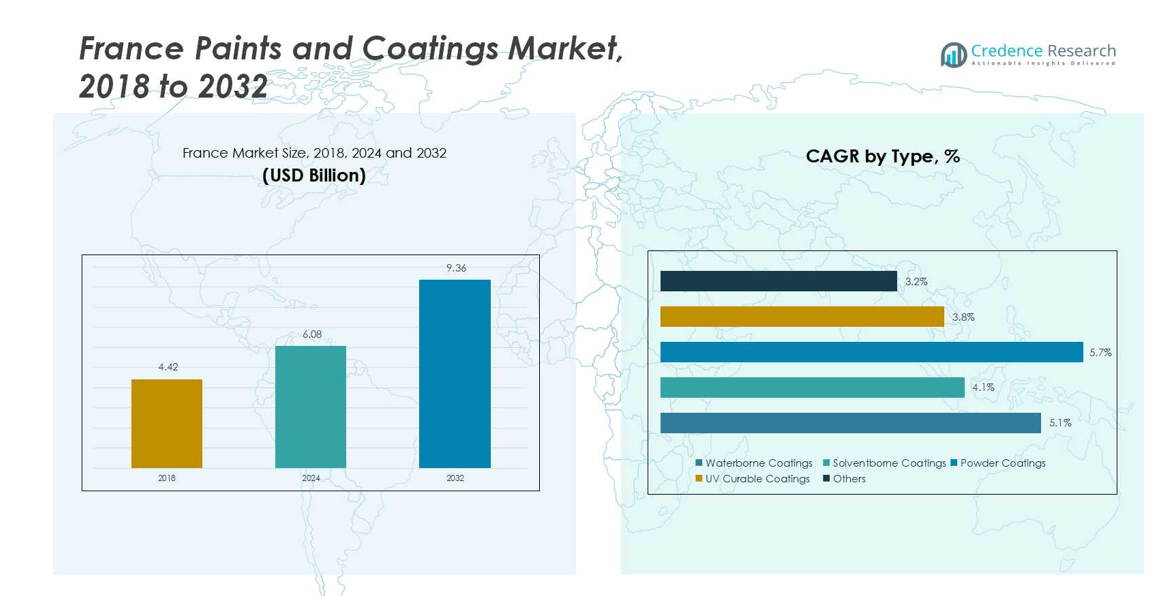

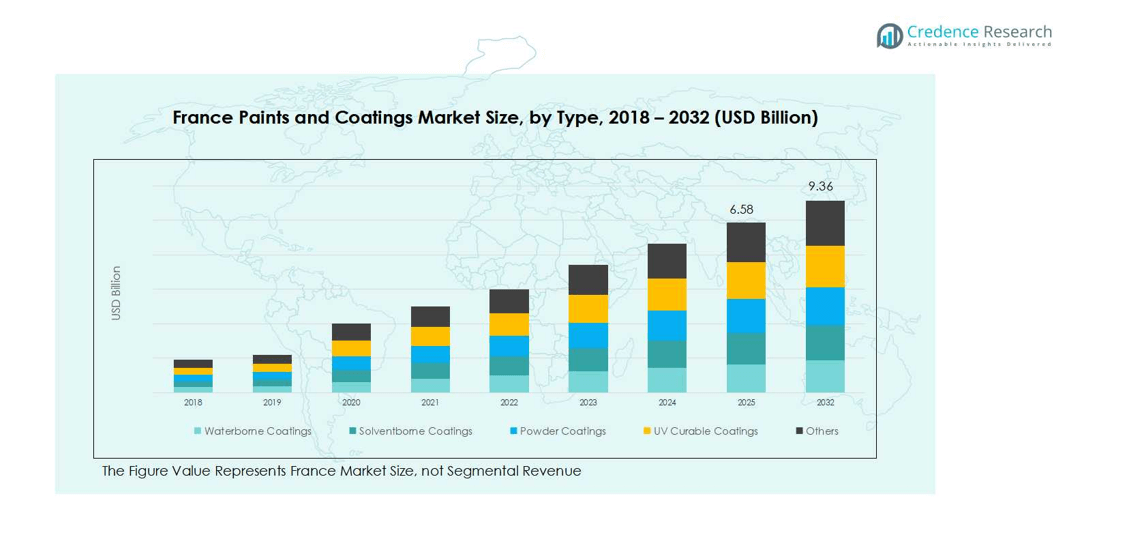

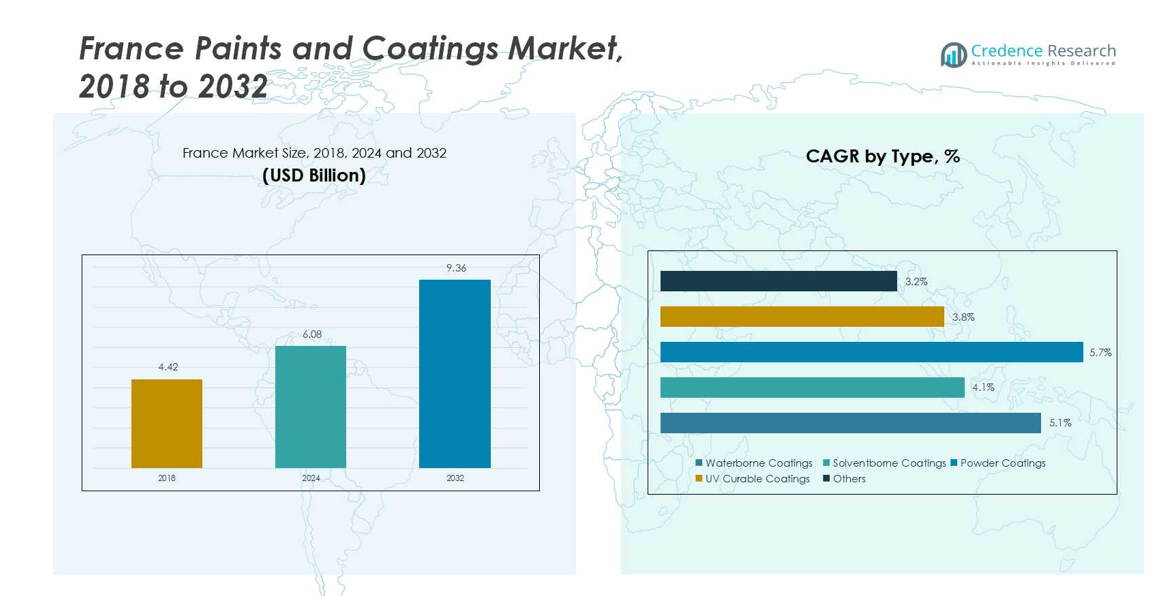

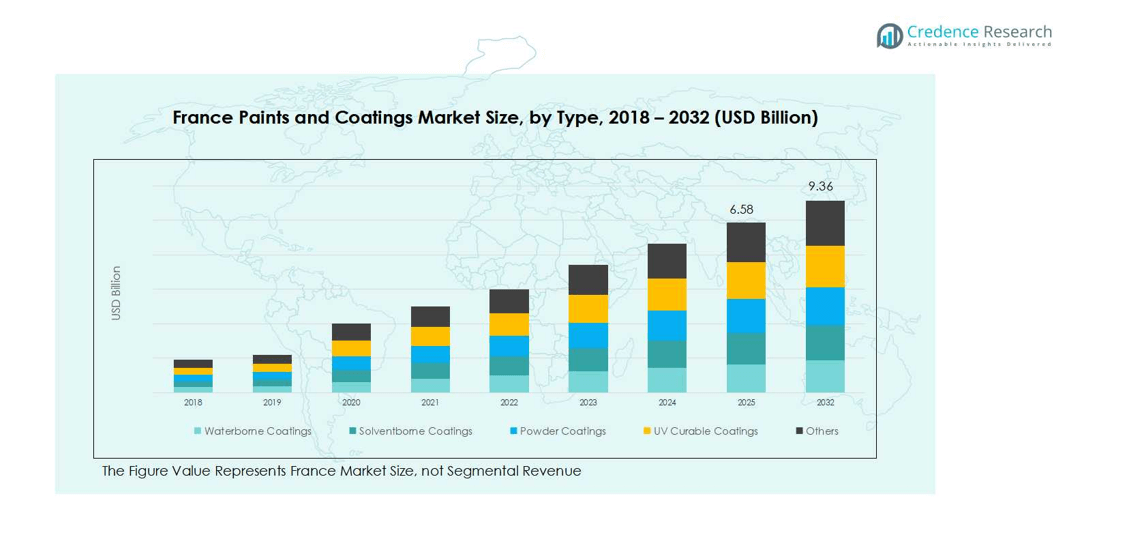

France Paints and Coatings market size was valued at USD 4.42 billion in 2018, growing to USD 6.08 billion in 2024, and is anticipated to reach USD 9.36 billion by 2032, at a CAGR of 5.16% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Paints and Coatings Market Size 2024 |

USD 6.08 billion |

| France Paints and Coatings Market, CAGR |

5.16% |

| France Paints and Coatings Market Size 2032 |

USD 9.36 billion |

The France paints and coatings market is highly competitive, with top players including Arkema, PPG Industries France, Cromology, Akzo Nobel France, Axalta France, Jotun France, Hempel France, Sherwin-Williams France, RPM International France, and Sigma Coatings. These companies are leveraging product innovation, eco-friendly formulations, and strategic partnerships to strengthen their market positions. Arkema and PPG Industries France are particularly prominent in industrial and high-performance coatings, while Akzo Nobel France and Cromology focus on decorative and waterborne solutions. Île-de-France leads as the dominant regional market, commanding a 28% share, driven by extensive residential, commercial, and industrial construction activities. Provence-Alpes-Côte d’Azur and Auvergne-Rhône-Alpes follow with 18% and 15% shares, respectively, supported by tourism infrastructure, automotive manufacturing, and urban development projects. Collectively, these key players and high-demand regions are shaping growth dynamics and driving innovation across the France paints and coatings market.

Market Insights

- The France paints and coatings market was valued at USD 6.08 billion in 2024 and is projected to reach USD 9.36 billion by 2032, growing at a CAGR of 5.16%. Waterborne coatings lead the type segment with a 45% share, while epoxy coatings dominate the technology segment at 30%. Residential construction is the largest end-user, holding a 40% share.

- Growth is driven by rising residential and commercial construction activities, urbanization, and infrastructure development, which boost demand for durable and protective coatings.

- Market trends include increasing adoption of eco-friendly, low-VOC coatings, technological advancements in UV-curable and powder coatings, and rising demand from automotive and industrial sectors.

- The market is highly competitive, with key players such as Arkema, PPG Industries France, Cromology, Akzo Nobel France, Axalta France, and Jotun France focusing on innovation, sustainability, and strategic partnerships to expand market presence.

- Île-de-France leads regional demand with a 28% share, followed by Provence-Alpes-Côte d’Azur at 18% and Auvergne-Rhône-Alpes at 15%, driven by construction and industrial activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

In the France Paints and Coatings market, waterborne coatings dominate the type segment, capturing 45% of the market share in 2024. Their rising adoption is driven by stringent environmental regulations, low VOC emissions, and growing preference for eco-friendly construction solutions. Solventborne coatings follow, valued for their durability and performance in industrial applications. Powder coatings and UV curable coatings are gaining traction due to energy efficiency and faster curing times, while other specialized coatings serve niche applications. Overall, environmental sustainability and regulatory compliance remain key drivers for the waterborne coatings sub-segment.

- For instance, AkzoNobel introduced low-bake architectural powder coatings in 2024 with enhanced weather resistance to reduce carbon emissions, supporting sustainability commitments and extended product performance in harsh environments.

By Technology:

The technology segment is led by epoxy coatings, holding a market share of 30% in 2024. Epoxy’s superior corrosion resistance and mechanical strength make it widely used across industrial manufacturing and infrastructure projects. Polyurethane (PU) coatings and acrylic coatings also account for a significant portion, favored for aesthetics and flexibility. Alkyd and polyester coatings serve traditional applications in residential and commercial construction. Innovation in hybrid formulations and growing demand for high-performance, long-lasting coatings continue to drive growth across the technology segment.

- For instance, Jotun’s waterborne epoxy coatings are widely utilized in industrial manufacturing, providing excellent protection against harsh environments without harmful emissions.

By End User Industry:

Within end-user industries, residential construction dominates with an estimated market share of 40% in 2024, fueled by urbanization, housing development, and renovation projects. Commercial construction and automotive sectors also contribute substantially, driven by infrastructure expansion and automotive production. Industrial manufacturing coatings are gaining importance for protective and functional applications. The “others” sub-segment includes marine, aerospace, and specialty applications, benefiting from niche innovations. Overall, construction activities and industrial growth remain the primary growth drivers across end-user industries in France.

Key Growth Drivers

Rising Construction and Infrastructure Activities

The growth of the France paints and coatings market is strongly supported by increasing residential and commercial construction projects. Urbanization and housing renovations have led to higher demand for interior and exterior coatings. Infrastructure development initiatives, particularly in public and commercial spaces, further boost the requirement for durable and protective coatings. Waterborne and epoxy coatings benefit the most due to their environmental compliance and longevity, making construction expansion a primary driver of market growth and contributing to rising revenue across all type and technology segments.

- For instance, Sherwin-Williams supplies a range of protective coatings specifically designed for infrastructure projects in France, including corrosion-resistant and quick-drying systems used in public buildings, transport hubs, and commercial facilities to ensure long-lasting protection and safety.

Stringent Environmental Regulations

Environmental regulations in France have significantly influenced market growth, encouraging the adoption of low-VOC and eco-friendly coatings. Manufacturers are shifting toward waterborne, UV-curable, and powder coatings to comply with emission standards. This regulatory push not only limits solventborne coatings but also fosters innovation in sustainable products. The increasing preference for green solutions by both industrial and residential customers is driving demand, positioning environmentally compliant coatings as a dominant and profitable sub-segment in the market.

- For instance, allnex’s UCECOAT® range of waterborne UV curable resins combines ecological benefits with high performance, merging waterborne and energy-curable technologies that reduce emissions and drying time.

Technological Advancements and Product Innovation

Continuous R&D and technological advancements in coating formulations drive market expansion in France. Innovations in UV-curable, hybrid, and high-performance epoxy coatings provide enhanced durability, corrosion resistance, and aesthetic appeal. Manufacturers are increasingly developing specialized coatings for automotive, industrial, and marine applications, opening new revenue streams. Such advancements allow penetration into high-value sectors and strengthen market competitiveness. Product innovation is particularly crucial in capturing end-user preference shifts toward long-lasting and multifunctional coatings, fueling growth across type and technology segments.

Key Trends & Opportunities

Growth in Eco-Friendly and Sustainable Coatings

Sustainability trends are shaping the France paints and coatings market, with increasing demand for low-VOC, bio-based, and waterborne coatings. Consumers and businesses are actively choosing environmentally responsible products, creating opportunities for manufacturers to expand their green product lines. This trend is complemented by government incentives and regulatory support, encouraging adoption across construction and industrial sectors. Companies leveraging sustainable solutions can gain competitive advantage, establish brand credibility, and cater to growing eco-conscious market segments, particularly in residential and commercial applications.

- For instance, Stahl’s Relca® portfolio features sustainable and bio-based polyurethane coatings designed to meet strict environmental and quality standards, illustrating industry innovation in eco-friendly formulations.

Expansion in Automotive and Industrial Applications

The automotive and industrial manufacturing sectors present significant growth opportunities. Coatings that offer corrosion resistance, chemical durability, and aesthetic finishes are increasingly required in vehicle manufacturing and machinery protection. Demand for high-performance epoxy and polyurethane coatings in automotive components, industrial equipment, and infrastructure applications is rising. This trend enables manufacturers to diversify their portfolios and target high-value sectors. Strategic partnerships with OEMs and industrial clients further enhance market penetration, providing avenues for revenue growth beyond traditional construction-focused segments.

- For instance, technological innovation in automotive coatings continues with developments such as Uchihamakasei Corp. and Nippon Paint’s joint creation of next-generation in-mold coating technology for thermoplastic automotive exteriors in 2025.

Key Challenges

Fluctuating Raw Material Prices

Volatility in raw material costs, including resins, pigments, and solvents, poses a significant challenge for the France paints and coatings market. Price fluctuations directly impact production costs, potentially reducing profit margins for manufacturers. Companies are pressured to balance cost efficiency with maintaining product quality, particularly in high-performance and eco-friendly coatings. This challenge can also limit investment in innovation and capacity expansion, affecting market competitiveness. Manufacturers must adopt strategic sourcing, cost optimization, and alternative material usage to mitigate these impacts and sustain growth.

Regulatory Compliance and Stringent Standards

While environmental regulations drive market growth, they also present challenges for manufacturers. Compliance with low-VOC emission standards, hazardous substance restrictions, and product safety norms requires continuous adaptation and investment. Non-compliance can result in penalties, product recalls, or market access limitations. Smaller players may struggle with these regulatory demands, limiting their competitiveness. Ensuring adherence while maintaining profitability necessitates innovation, process optimization, and strategic partnerships, particularly in high-demand sectors such as residential construction and industrial manufacturing.

Regional Analysis

Île-de-France

The Île-de-France region leads the France paints and coatings market, holding a market share of 28% in 2024. The region’s dominance is driven by high residential and commercial construction activities, coupled with industrial infrastructure development. Demand for waterborne and epoxy coatings is particularly strong due to environmental regulations and durability requirements. Urbanization, renovation projects, and government-supported infrastructure expansion have fueled consistent growth. Key players are increasingly targeting this region with innovative, sustainable coatings solutions, making it the most lucrative sub-market. The presence of major corporate headquarters also facilitates industrial and automotive coatings demand.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur captures a market share of 18%, supported by a robust tourism sector and commercial construction projects. The region exhibits strong demand for decorative and protective coatings, particularly acrylic and polyurethane formulations. Luxury residential developments and hospitality infrastructure drive adoption of high-quality, aesthetic coatings. Additionally, increasing awareness of eco-friendly and low-VOC coatings among commercial establishments strengthens growth. Regional industrial manufacturing activities contribute to epoxy and solventborne coatings demand. Manufacturers are focusing on strategic partnerships and tailored product offerings to leverage the growth potential in this southern French market.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes holds a market share of 15% in the France paints and coatings market, driven by a balanced mix of residential, commercial, and industrial applications. The region’s expanding automotive and machinery sectors fuel demand for high-performance epoxy and polyurethane coatings. Residential and commercial construction projects further stimulate the adoption of waterborne and powder coatings. Manufacturers are leveraging technological advancements and sustainability trends to cater to environmentally conscious customers. Local regulations favor low-VOC coatings, enhancing demand for eco-friendly solutions. Investment in industrial infrastructure and urban housing ensures sustained growth across all major coating types and technologies.

Hauts-de-France

Hauts-de-France contributes a market share of 12%, driven by industrial manufacturing and infrastructure modernization. The automotive and heavy machinery sectors increase demand for durable epoxy and polyurethane coatings. Residential and commercial construction projects support waterborne and acrylic coatings adoption. Regional initiatives for energy-efficient and sustainable buildings create opportunities for powder and UV-curable coatings. The presence of several industrial hubs encourages strategic collaborations between manufacturers and local contractors. Focus on environmentally compliant products positions the region as a growing market for eco-friendly solutions, while technological innovation in high-performance coatings further strengthens its competitive landscape.

Nouvelle-Aquitaine

Nouvelle-Aquitaine holds a market share of 10%, with steady growth fueled by residential construction and commercial infrastructure projects. Coastal urban development and tourism-related facilities drive demand for decorative and protective coatings, particularly waterborne and acrylic variants. Industrial manufacturing activities contribute to epoxy and solventborne coatings uptake. The region’s increasing awareness of eco-friendly solutions boosts adoption of low-VOC and powder coatings. Manufacturers are introducing innovative, sustainable product lines to capture market opportunities. Investment in urban expansion and renovation projects ensures consistent demand across all major coating technologies, establishing Nouvelle-Aquitaine as a key regional market.

Occitanie

Occitanie accounts for a market share of 8%, driven by residential, commercial, and industrial construction activities. The region exhibits strong adoption of waterborne coatings in housing projects and epoxy coatings in industrial applications. Sustainable building practices and government-backed infrastructure initiatives further encourage low-VOC and eco-friendly coatings adoption. Manufacturers are actively promoting UV-curable and powder coatings for industrial and specialty applications. Regional demand is supported by urbanization, renovation projects, and expanding commercial establishments. Investment in technological innovation and environmentally compliant solutions strengthens the region’s contribution to the overall France paints and coatings market.

Grand Est

Grand Est contributes a market share of 7%, primarily supported by industrial manufacturing and automotive sectors. Demand for epoxy, polyurethane, and solventborne coatings is high due to protective and corrosion-resistant requirements. Residential and commercial construction projects also drive waterborne and acrylic coatings adoption. Environmental compliance regulations encourage low-VOC and sustainable coating solutions. Regional manufacturers are focusing on product innovation and strategic collaborations to strengthen market presence. Expansion of industrial infrastructure, along with rising urban housing and renovation projects, ensures continued demand for high-performance and decorative coatings across all major type and technology segments.

Market Segmentations:

By Type:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coating

- UV Curable Coatings

- Others

By Technology:

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End User Industry:

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- Île-de-France

- Provence-Alpes-Côte d’Azur

- Auvergne-Rhône-Alpes

- Hauts-de-France

- Nouvelle-Aquitaine

- Occitanie

- Grand Est

Competitive Landscape

The competitive landscape of the France paints and coatings market includes key players such as Arkema, PPG Industries France, Cromology, Akzo Nobel France, Axalta France, Jotun France, Hempel France, Sherwin-Williams France, RPM International France, and Sigma Coatings. The market is characterized by high competition driven by product innovation, sustainability, and brand differentiation. Leading companies are focusing on eco-friendly coatings, low-VOC solutions, and high-performance formulations to meet regulatory requirements and evolving customer preferences. Strategic initiatives such as mergers, acquisitions, partnerships, and expansion of production capacities are strengthening market positions. Additionally, investments in R&D enable the development of advanced coatings for industrial, automotive, and construction applications. The emphasis on sustainability, coupled with urbanization and industrial growth, intensifies competitive pressures while offering opportunities for companies to capture market share through technological leadership and tailored product offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Arkema

- PPG Industries France

- Cromology

- Akzo Nobel France

- Axalta France

- Jotun France

- Hempel France

- Sherwin-Williams France

- RPM International France

- Sigma Coatings

Recent Developments

- In April 2024, Elgato introduced the Stream Deck Neo, expanding its productivity and developer-focused controller lineup with enhanced customization and workflow automation tools.

- In mid-2025, Telycam launched a new plug-in integration with Elgato’s Stream Deck, designed to streamline live video production and enhance AV control capabilities for content creators and broadcasters.

- In June 2025, Hebbia (AI platform focused on finance) acquired FlashDocs, a startup specializing in generative slide deck / presentation creation

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising residential and commercial construction activities.

- Demand for eco-friendly and low-VOC coatings will continue to increase, driven by environmental regulations.

- Waterborne and epoxy coatings will remain the dominant sub-segments across type and technology categories.

- Technological advancements in UV-curable and powder coatings will enhance durability and application efficiency.

- Industrial manufacturing and automotive sectors will provide significant growth opportunities for high-performance coatings.

- Urbanization and renovation projects will sustain demand for decorative and protective coatings in residential buildings.

- Manufacturers will focus on product innovation and sustainable solutions to capture market share.

- Strategic partnerships, mergers, and acquisitions will shape the competitive landscape.

- Adoption of multifunctional and hybrid coatings will increase in specialty applications.

- Regional markets with high construction and industrial activity will continue to drive overall market growth.