Market Overview

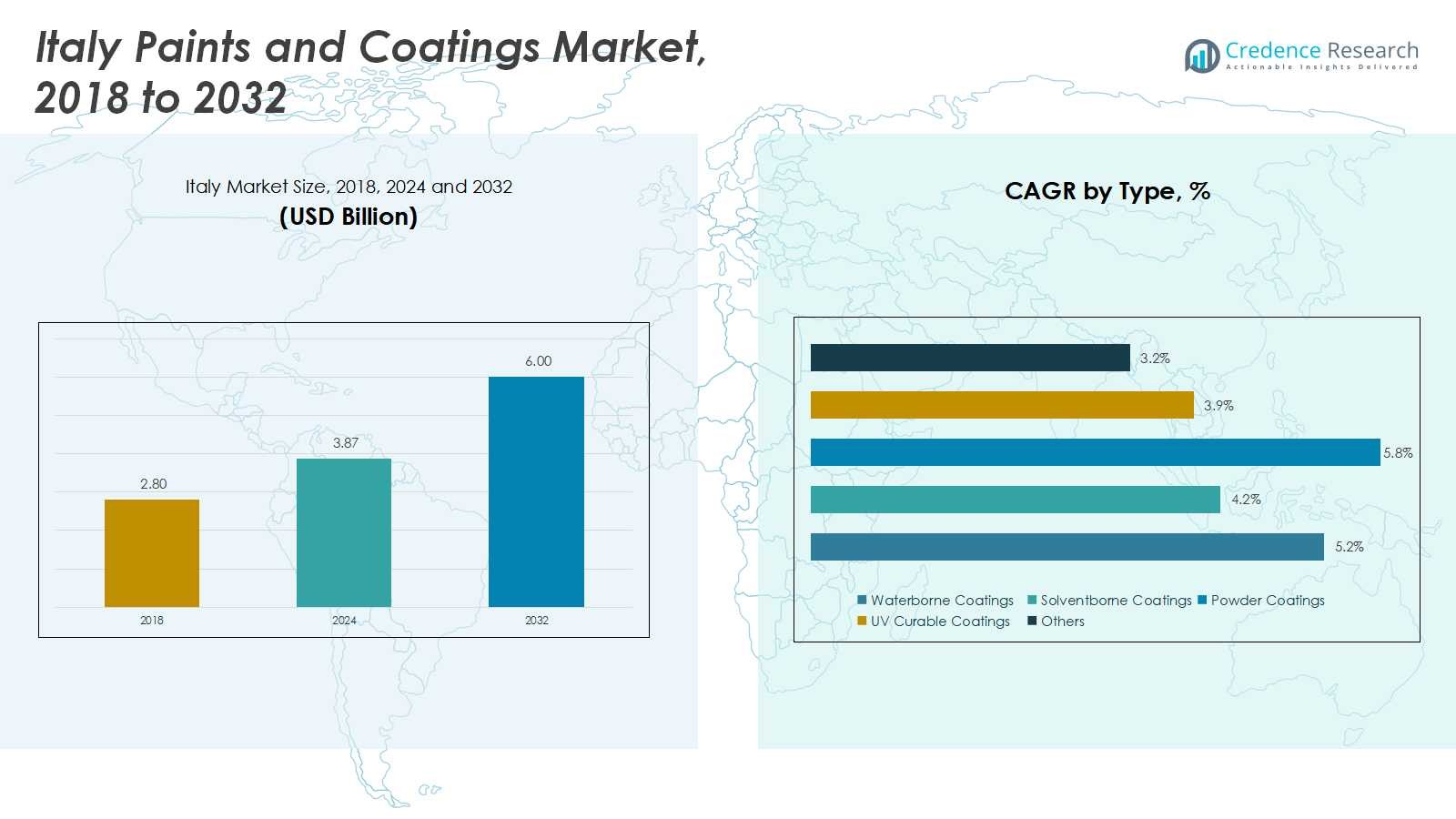

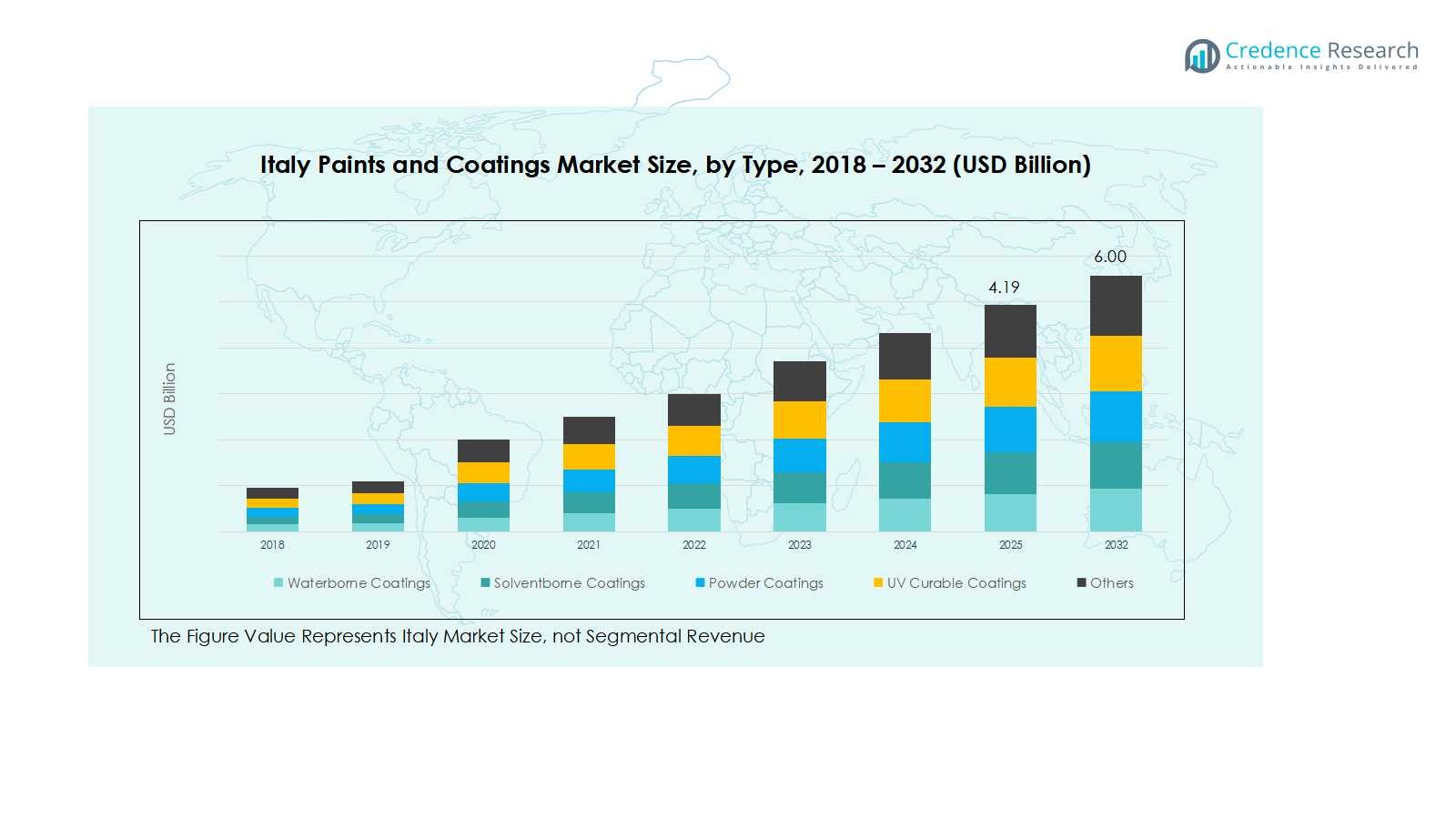

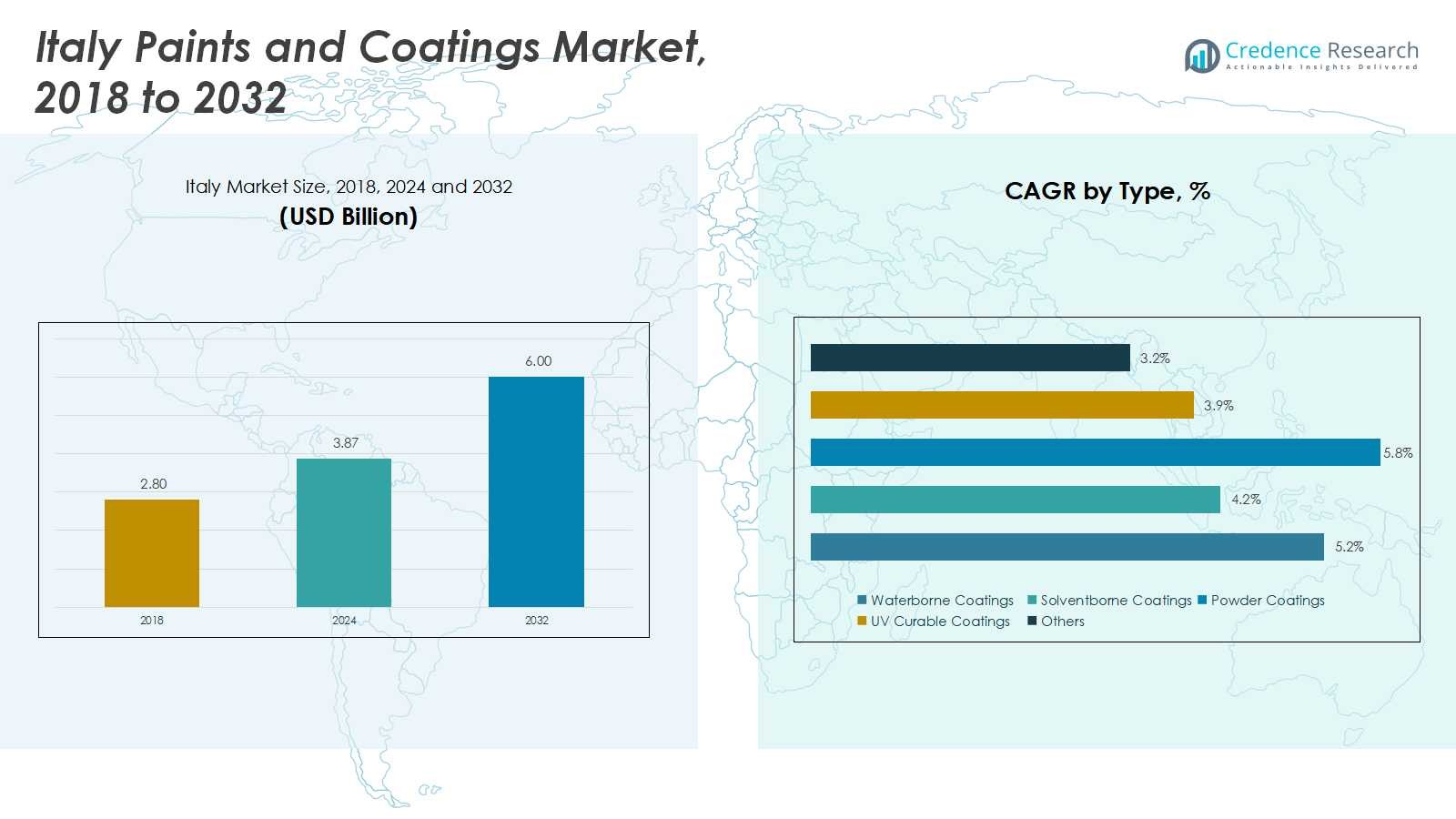

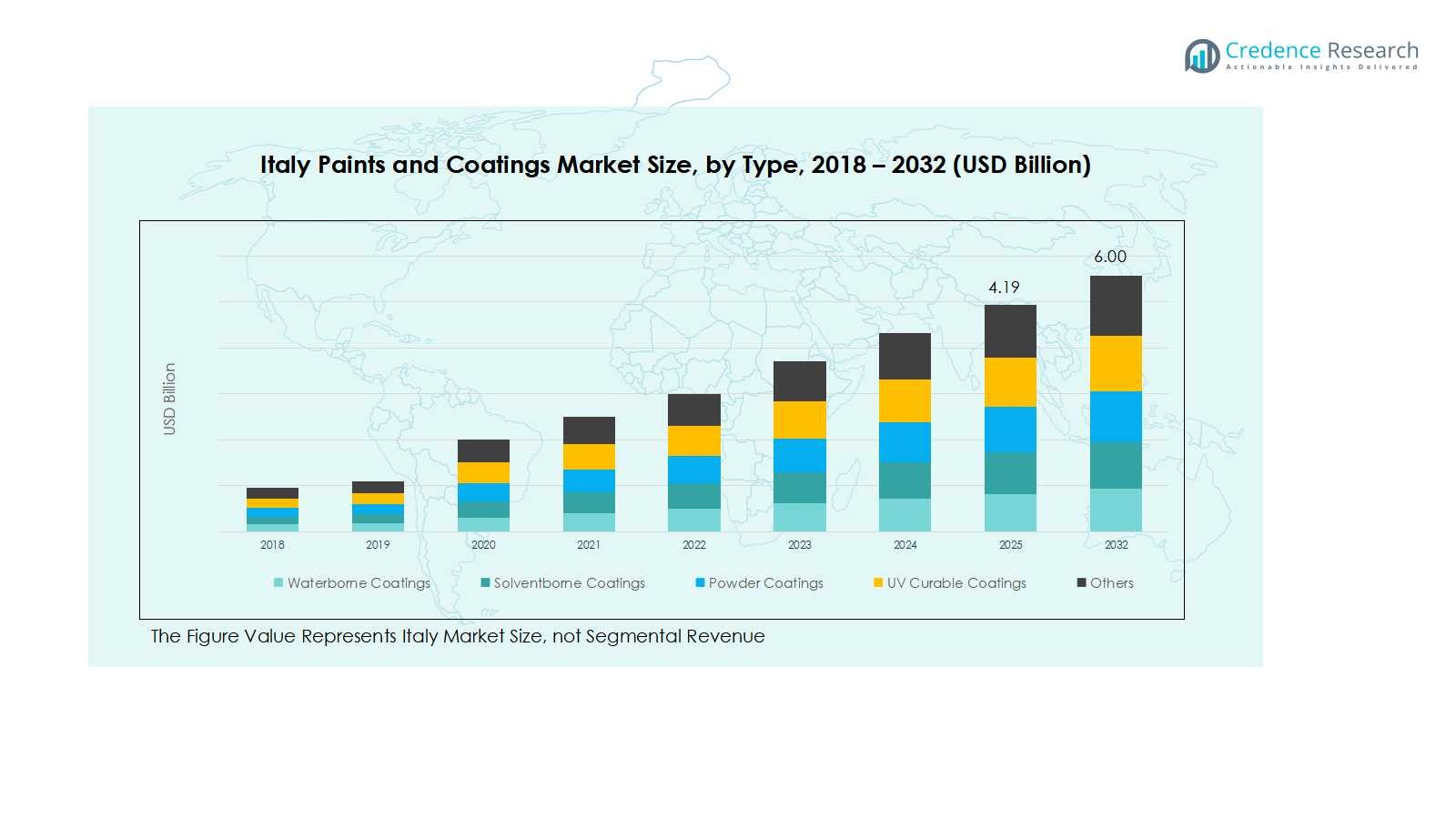

Italy Paints and Coatings market size was valued at USD 2.80 billion in 2018, growing to USD 3.87 billion in 2024, and is anticipated to reach USD 6.00 billion by 2032, registering a CAGR of 5.26% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Paints and Coatings market Size 2024 |

USD 3.87 Billion |

| Italy Paints and Coatings market , CAGR |

5.26% |

| Italy Paints and Coatings market Size 2032 |

USD 6.00 Billion |

The Italy paints and coatings market is highly competitive, with key players including Boero Bartolomeo S.p.A., Settebello S.p.A., Itebe Vernici S.r.l., Colorobbia Italia S.p.A., ICD Group, Sherwin-Williams Italy, PPG Industries Italy, Jotun Italy, Akzo Nobel Italy, and Kansai Paint Italy. These companies are focusing on product innovation, eco-friendly formulations, and expansion of distribution networks to maintain and grow their market presence. Northern Italy is the leading region, commanding 45% of the market share in 2024, driven by strong industrial manufacturing, automotive production, and urban construction projects. Central Italy follows with 25%, fueled by residential and commercial development, while Southern Italy and Insular Italy account for 20% and 10%, respectively, supported by infrastructure projects and tourism-driven construction. Strategic investments in waterborne, low-VOC, and high-performance coatings are shaping competitive dynamics across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Italy Paints and Coatings market was valued at USD 3.87 billion in 2024 and is projected to reach USD 6.00 billion by 2032, growing at a CAGR of 5.26%. Waterborne coatings lead the market with a 40% share, followed by solventborne coatings at 30%.

- Rising demand for eco-friendly and low-VOC coatings is driving growth, supported by stringent environmental regulations and increased awareness of sustainable solutions in residential, commercial, and industrial projects.

- Technological advancements, including UV-curable, powder, and epoxy coatings, are key trends, enabling faster curing, enhanced durability, and cost-efficient applications, particularly in automotive and industrial sectors.

- Competitive intensity is high, with players like Boero Bartolomeo S.p.A., Sherwin-Williams Italy, PPG Industries Italy, and Akzo Nobel Italy focusing on product innovation, distribution expansion, and strategic partnerships to strengthen market position.

- Northern Italy dominates with 45% market share, followed by Central Italy 25%, Southern Italy 20%, and Insular Italy 10%, driven by industrial hubs, construction growth, and regional infrastructure projects.

Market Segmentation Analysis:

By Type:

In Italy, waterborne coatings dominate the paints and coatings market, accounting for approximately 40% of the market share in 2024. The segment’s growth is driven by increasing environmental regulations, low VOC emissions, and rising demand for eco-friendly coatings in residential and commercial projects. Solventborne coatings follow with around 30% share, benefiting from their high durability and chemical resistance, especially in industrial applications. Powder coatings, UV curable coatings, and other niche types collectively hold 30%, with growth supported by automotive and high-performance industrial sectors seeking efficient, energy-saving finishing solutions.

- For instance, AkzoNobel integrates waterborne and solventborne technologies in their wood coating portfolio in Italy, with products such as Aqualit and SolidoColor aimed at sustainable, high-performance finishes.

By Technology:

Within the technology segment, epoxy coatings lead the market with a 35% share, favored for corrosion protection in industrial manufacturing and infrastructure projects. Polyurethane (PU) coatings hold around 25%, driven by demand in automotive and construction for their flexibility and weather resistance. Acrylic coatings account for 20%, widely used in residential and commercial buildings due to aesthetic versatility and quick-drying properties. Alkyd, polyester, and other coatings contribute the remaining 20%, gaining traction in specialty applications such as furniture, decorative finishes, and industrial machinery.

- For instance, 3M’s epoxy-based adhesives are widely employed in aerospace and electronics industries due to their high strength and resistance to environmental stress.

By End-User Industry:

The residential construction sector is the dominant end-user, capturing approximately 38% of the market share, fueled by urban housing growth, renovation activities, and rising home improvement trends. Commercial construction represents 25%, supported by investments in office, retail, and hospitality projects requiring durable and decorative coatings. The automotive industry holds 20%, driven by protective coatings for vehicles and aftermarket applications. Industrial manufacturing and others collectively account for 17%, with growth propelled by heavy machinery, infrastructure projects, and specialized industrial applications demanding high-performance coatings.

Key Growth Drivers

Rising Demand for Eco-Friendly Coatings

Increasing environmental awareness and stringent government regulations on volatile organic compounds (VOCs) are driving the adoption of eco-friendly paints and coatings in Italy. Waterborne and low-VOC coatings are witnessing strong demand in residential, commercial, and industrial segments. Manufacturers are investing in sustainable formulations that reduce environmental impact while maintaining performance, which is encouraging wider adoption and boosting overall market growth. This trend is particularly significant in urban construction projects and industrial applications where regulatory compliance is critical.

- For instance, Renner Italia’s Pure Bio Coatings use over 80% renewable, plant-based raw materials with zero or very low VOC emissions, supporting industrial efficiency and sustainability.

Growth in Construction and Infrastructure

The expansion of residential, commercial, and industrial construction projects across Italy is a major driver for the paints and coatings market. Rising urbanization, renovation initiatives, and government-supported infrastructure development are increasing the demand for high-performance coatings, including protective and decorative finishes. This growth is fueled by both private and public sector investments, with builders and contractors seeking durable, aesthetically appealing, and cost-efficient solutions that ensure long-lasting performance in diverse applications.

- For instance, San Marco Group offers the PAINTOP line, a washable quartz-based exterior wall paint widely used in residential and commercial exteriors in Italy, praised for its durability and aesthetic appeal.

Technological Advancements in Coatings

Innovation in coating technologies, such as UV-curable, powder, and advanced epoxy formulations, is stimulating market growth. These technologies offer enhanced durability, faster curing, and improved chemical and weather resistance, making them ideal for automotive, industrial, and specialty applications. Manufacturers are increasingly adopting automated application methods and smart coatings that improve efficiency and reduce operational costs. These technological advancements attract new customers and open opportunities for premium coatings, reinforcing the overall growth trajectory of the Italy paints and coatings market.

Key Trends & Opportunities

Expansion of Waterborne and Low-VOC Coatings

Waterborne and low-VOC coatings are gaining momentum due to regulatory support and growing consumer preference for sustainable solutions. This trend is creating opportunities for manufacturers to introduce innovative, eco-friendly products that combine performance with environmental compliance. The adoption of such coatings is not only rising in residential and commercial projects but also in automotive and industrial sectors, offering significant growth potential for market players investing in green formulations and sustainable production processes.

- For instance, PPG Industries launched a new waterborne coating system in China that meets stringent low-VOC standards while offering performance comparable to traditional coatings, specifically designed for automotive refinish applications.

Rising Focus on Decorative and Aesthetic Finishes

Increasing demand for premium and customized finishes in residential and commercial construction presents significant opportunities. Consumers and architects are seeking coatings that enhance aesthetics, offer texture variety, and provide durability against weathering and wear. This trend is driving innovation in high-quality decorative paints, metallic finishes, and textured coatings. Manufacturers focusing on design-oriented solutions and color personalization are expected to capture a larger share, particularly in urban housing and luxury commercial projects.

- For instance, Birla Opus has launched a range of high-quality decorative paints that allow architects and consumers to achieve superior aesthetic appeal with enhanced durability, specifically catering to urban housing and luxury projects.

Key Challenges

High Raw Material Costs

Fluctuations in raw material prices, including pigments, resins, and solvents, pose a significant challenge for the Italy paints and coatings market. These cost variations can impact profit margins and limit the affordability of premium or specialty coatings. Manufacturers may face increased production costs, which could slow market growth or lead to price-sensitive customer segments opting for cheaper alternatives. Effective supply chain management and strategic sourcing are essential to mitigate the impact of raw material volatility.

Regulatory Compliance and Environmental Restrictions

Strict environmental regulations concerning VOC emissions and hazardous chemicals increase operational complexity for manufacturers. Compliance with these laws requires continuous investment in R&D, reformulation, and testing, which can be costly and time-consuming. Non-compliance can lead to penalties, recalls, or market restrictions, challenging smaller players in particular. Adapting to evolving environmental standards while maintaining performance and cost-effectiveness remains a key obstacle in sustaining growth across Italy’s paints and coatings market.

Regional Analysis

Northern Italy

Northern Italy dominates the paints and coatings market, capturing 45% of the total market share in 2024. The region’s growth is driven by strong industrial manufacturing hubs, automotive production, and urban residential and commercial construction projects. High demand for waterborne, epoxy, and polyurethane coatings is evident due to stringent environmental regulations and the focus on durable, high-performance finishes. The presence of major market players and established distribution networks further strengthens the region’s position. Northern Italy remains a key growth area as manufacturers continue to invest in innovative coatings and sustainable solutions for industrial and construction applications.

Central Italy

Central Italy holds a 25% share of the market, supported by growth in residential and commercial construction and urban development projects. Decorative and aesthetic coatings, including acrylic and alkyd formulations, are witnessing rising demand for home renovation and commercial real estate projects. The region benefits from a blend of industrial activity and tourism-driven infrastructure development, which fuels demand for protective and high-performance coatings. Manufacturers are increasingly introducing eco-friendly and low-VOC coatings to meet regional regulatory requirements and consumer preferences, positioning Central Italy as a critical area for market expansion and innovation.

Southern Italy

Southern Italy accounts for 20% of the total paints and coatings market, driven primarily by infrastructure projects, industrial manufacturing, and residential construction in urban and suburban areas. The adoption of waterborne and UV-curable coatings is growing, supported by environmental regulations and increasing awareness of sustainable solutions. Limited industrial density compared to Northern Italy is offset by rising demand for decorative and protective coatings in the residential and commercial sectors. Market players are focusing on partnerships with local distributors and targeted marketing to capitalize on emerging construction and renovation projects, ensuring steady growth in Southern Italy’s paints and coatings segment.

Insular Italy (Sicily & Sardinia)

Insular Italy, including Sicily and Sardinia, represents 10% of the market share, with demand concentrated in residential construction, tourism infrastructure, and small-scale industrial applications. The adoption of waterborne, epoxy, and polyurethane coatings is increasing due to environmental awareness and the need for durable, weather-resistant finishes in coastal and humid regions. Market growth is supported by public infrastructure initiatives and private residential developments. Manufacturers are expanding their regional presence through local distribution networks and product customization to suit climatic conditions, creating opportunities for both decorative and protective coatings in this strategically important region of Italy.

Market Segmentations:

By Type:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology:

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End-User Industry:

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- Northern

- Central

- Southern

- Insular Italy (Sicily & Sardinia)

Competitive Landscape

The competitive landscape of the Italy paints and coatings market features key players such as Boero Bartolomeo S.p.A., Settebello S.p.A., Itebe Vernici S.r.l., Colorobbia Italia S.p.A., ICD Group, Sherwin-Williams Italy, PPG Industries Italy, Jotun Italy, Akzo Nobel Italy, and Kansai Paint Italy. Market competition is intense, with players focusing on product innovation, expansion of distribution networks, and sustainable coating solutions to maintain market share. Companies are increasingly investing in waterborne, UV-curable, and low-VOC coatings to meet environmental regulations and customer preferences. Strategic partnerships, acquisitions, and collaborations are also shaping the competitive dynamics, enabling companies to enhance their regional presence and diversify product offerings. The market emphasizes high-performance coatings for industrial, automotive, residential, and commercial applications, driving continuous R&D and marketing efforts to gain a competitive edge in Italy’s evolving paints and coatings sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 18, 2024, PPG Industries formed a strategic partnership with SARO/Siccardi, Italy’s leading distributor of powder coatings, to strengthen its distribution network and enhance access to premium products across the Italian market.

- In May 2024, KANSAI HELIOS expanded its presence in Italy by acquiring Weilburger Coatings, reinforcing its position as a key system supplier and broadening its footprint in the Italian paints and coatings market.

- In September 2024, TER Chemicals announced its acquisition of the modified Fischer-Tropsch Wax business from Evonik. This acquisition allows TER Chemicals to expand its product portfolio and strengthen its position in the European coatings market.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily, driven by increasing demand for eco-friendly coatings.

- Waterborne and low-VOC coatings will see significant adoption across residential and commercial segments.

- Technological advancements such as UV-curable and powder coatings will enhance efficiency and durability.

- Expansion in industrial and automotive sectors will create new growth opportunities.

- Decorative and aesthetic finishes will continue to attract investment in urban housing projects.

- Manufacturers will focus on sustainable production and compliance with environmental regulations.

- Partnerships and acquisitions will strengthen regional presence and product portfolios.

- Demand in Northern Italy will remain dominant, with Southern and Insular regions catching up.

- Premium and customized coatings will gain traction among high-end residential and commercial clients.

- Continuous innovation and R&D will drive the development of high-performance and specialty coatings.