Market Overview

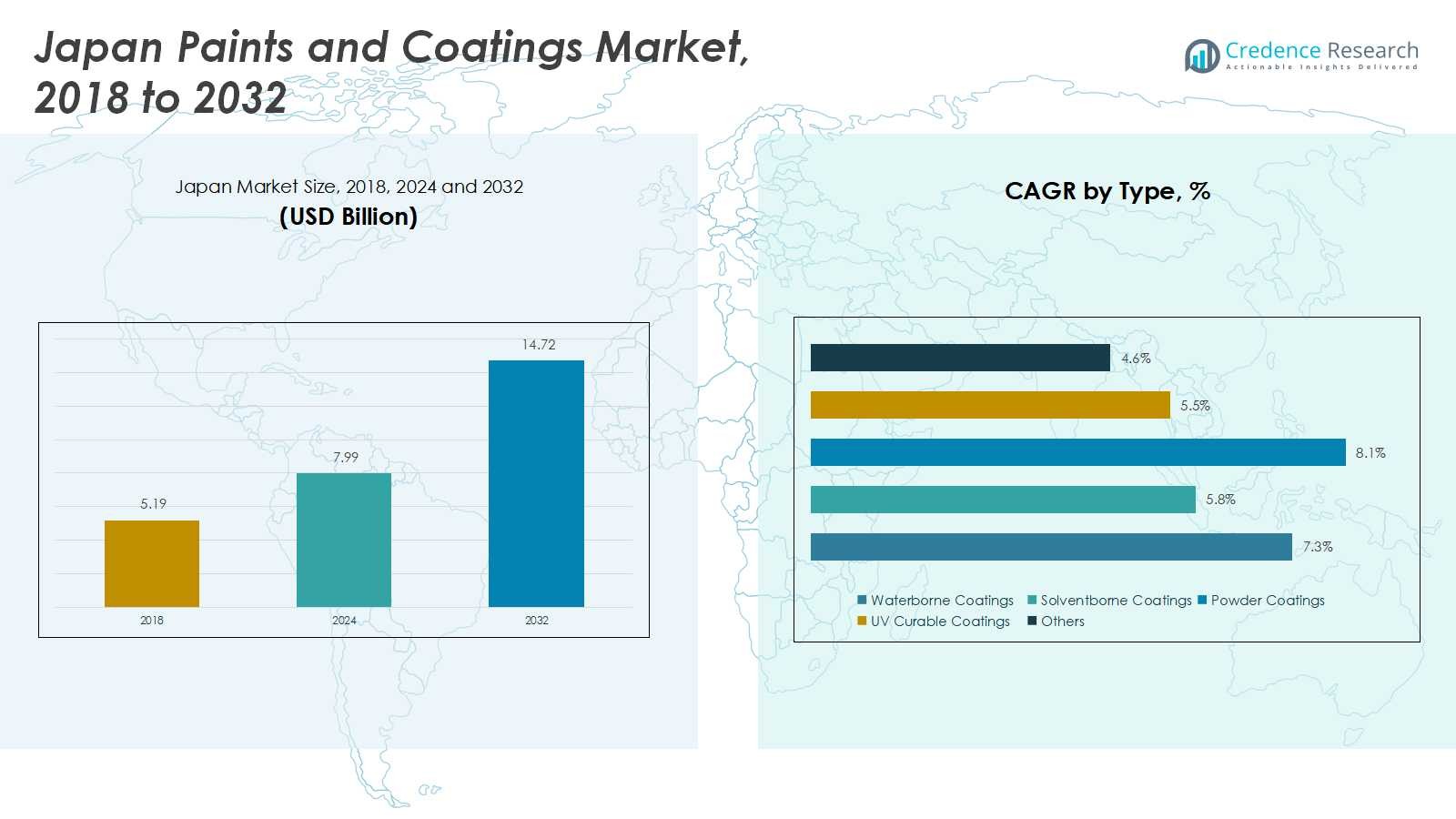

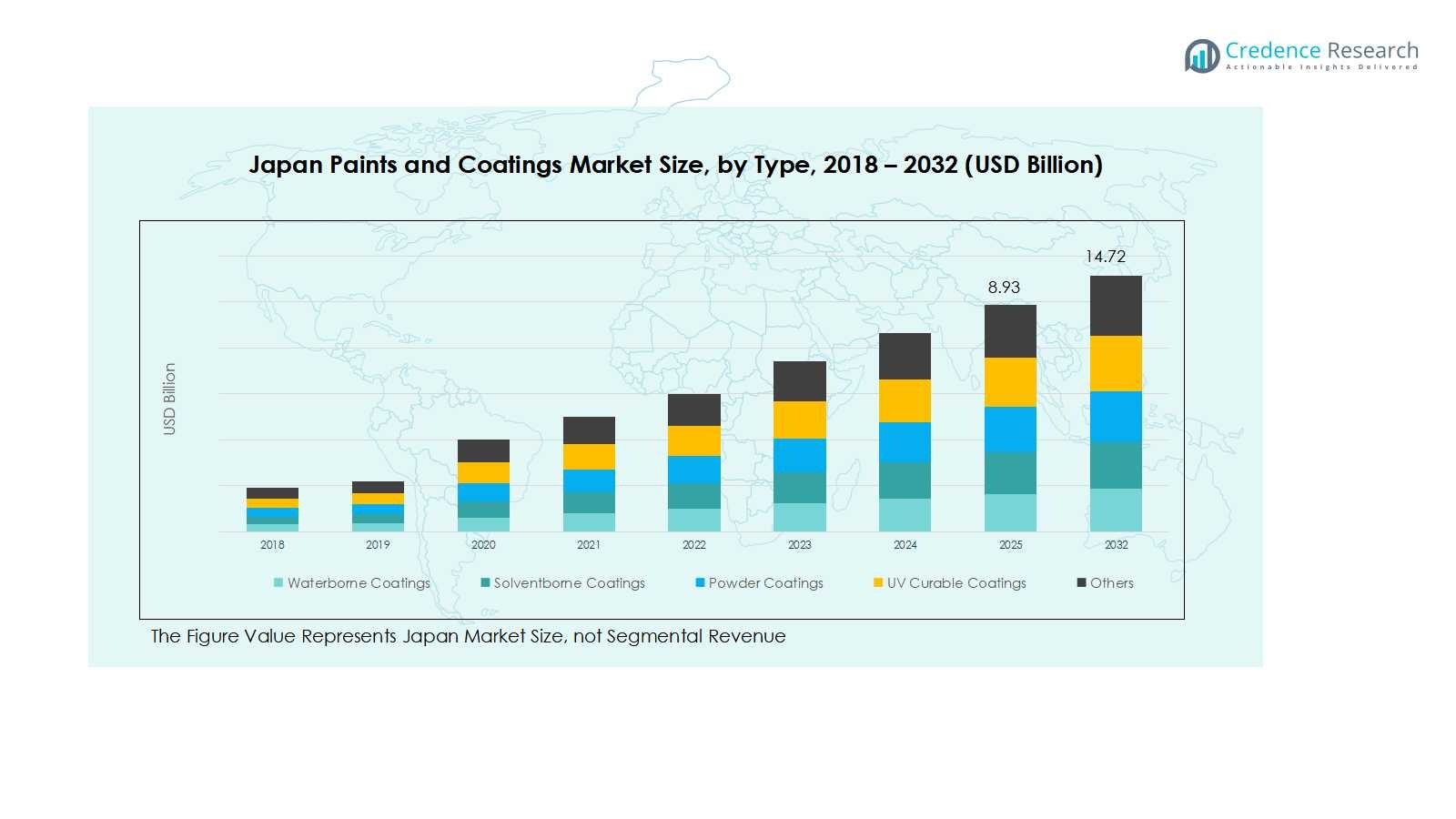

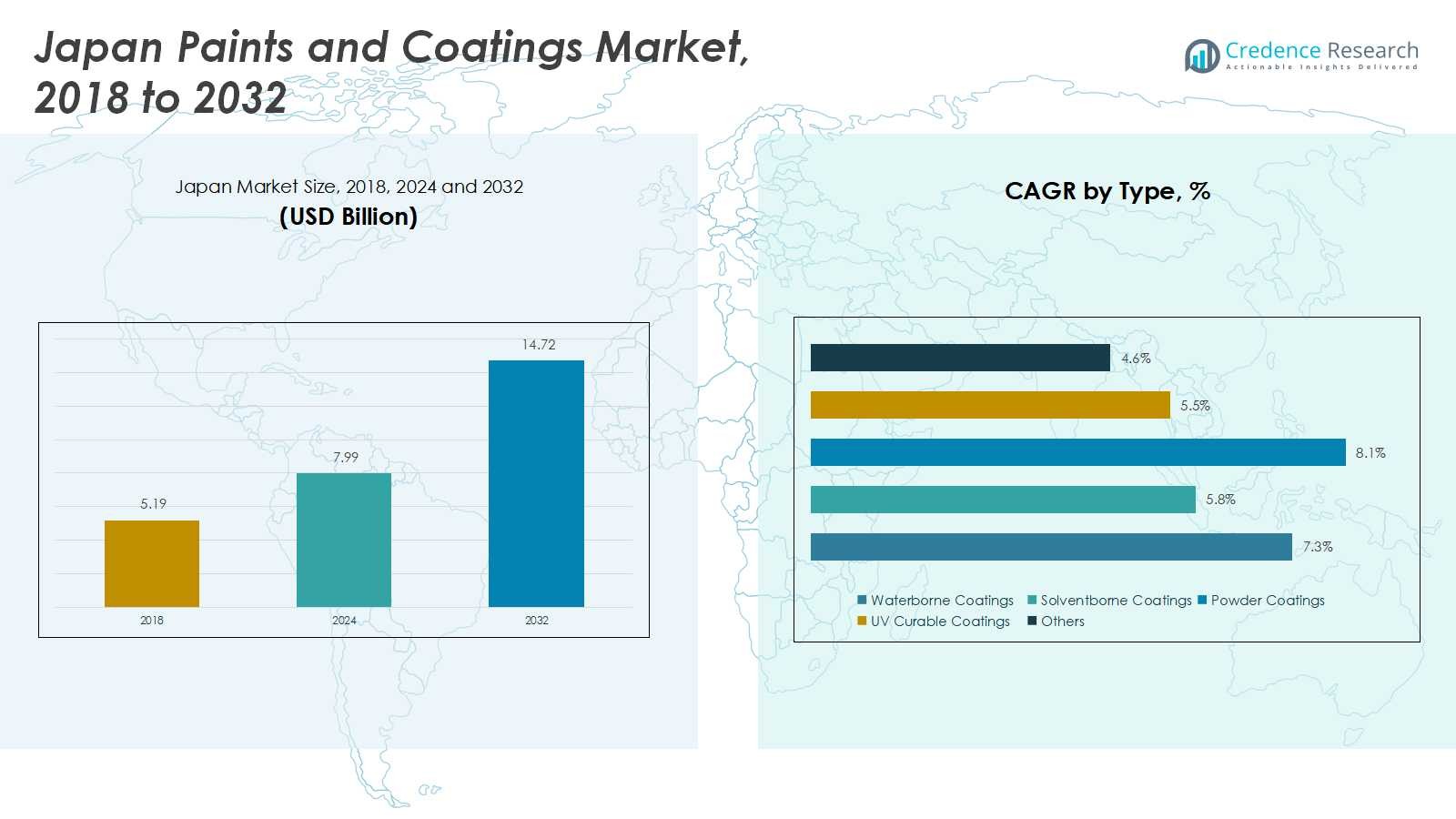

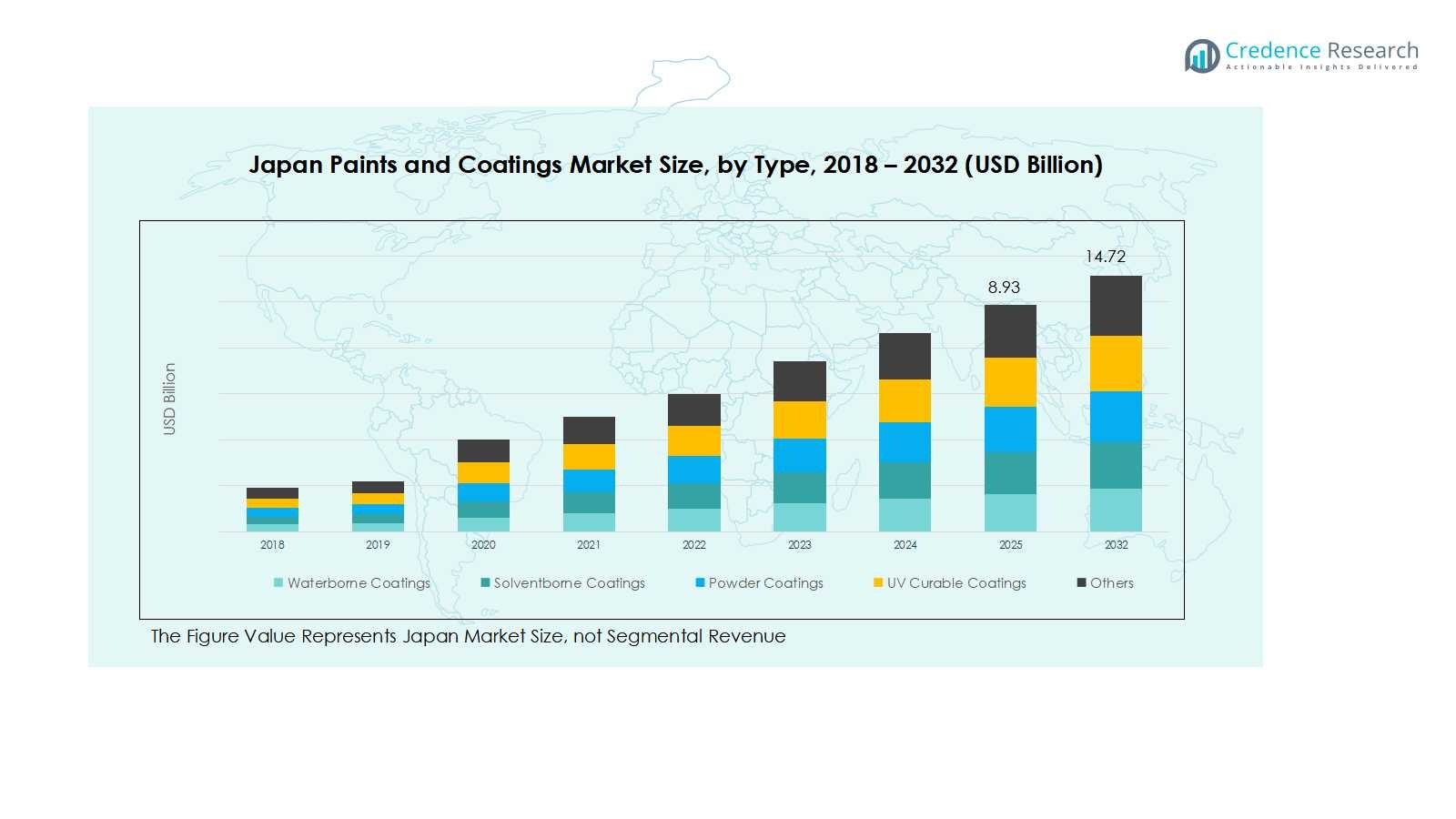

Japan Paints and Coatings market size was valued at USD 5.19 billion in 2018, growing to USD 7.99 billion in 2024, and is anticipated to reach USD 14.72 billion by 2032, registering a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Paints and Coatings market Size 2024 |

USD 7.99 Billion |

| Japan Paints and Coatings market, CAGR |

7.4% |

| Japan Paints and Coatings market Size 2032 |

USD 14.72 Billion |

The Japan Paints and Coatings market is dominated by key players such as Nippon Paint, Kansai Paint, JXTG Nippon Oil & Energy, Chugoku Marine Paints, SHOWA DENKO, Taikisha Ltd., DIC Corporation, Sony Chemicals, Sekisui Chemical, and Taiyo Kogyo. These companies lead the market through strategic investments in R&D, product innovation, and sustainable, low-VOC coatings that meet stringent environmental regulations. They focus on expanding manufacturing capabilities and distribution networks to strengthen regional presence. Among regions, Kanto emerges as the largest contributor, holding 32% of the market share, driven by robust urbanization, residential and commercial construction, and industrial development. Kansai and Chubu follow with 24% and 18% market shares, respectively, supported by automotive, industrial manufacturing, and infrastructure projects. The combined efforts of these top players in key regions ensure a competitive and innovation-driven market landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Paints and Coatings market was valued at USD 7.99 billion in 2024 and is projected to reach USD 14.72 billion by 2032, growing at a CAGR of 7.4%. Waterborne coatings hold the largest type share at 42%, and epoxy coatings lead the technology segment with 35%, while residential construction dominates end-user applications with 38% share.

- Growth is driven by rapid urbanization, increasing residential and commercial construction, and expansion in automotive and industrial manufacturing, which fuel demand for high-performance and eco-friendly coatings.

- Key trends include rising adoption of specialty and decorative coatings, technological advancements such as UV-curable and nano-based formulations, and strong demand for sustainable, low-VOC solutions across sectors.

- The market is highly competitive with major players like Nippon Paint, Kansai Paint, and JXTG Nippon Oil & Energy focusing on R&D, product innovation, and strategic expansions to strengthen regional and segment presence.

- Market restraints include volatility in raw material prices and intense competition, which limit pricing flexibility, while regional growth is led by Kanto (32%), Kansai (24%), and Chubu (18%).

Market Segmentation Analysis:

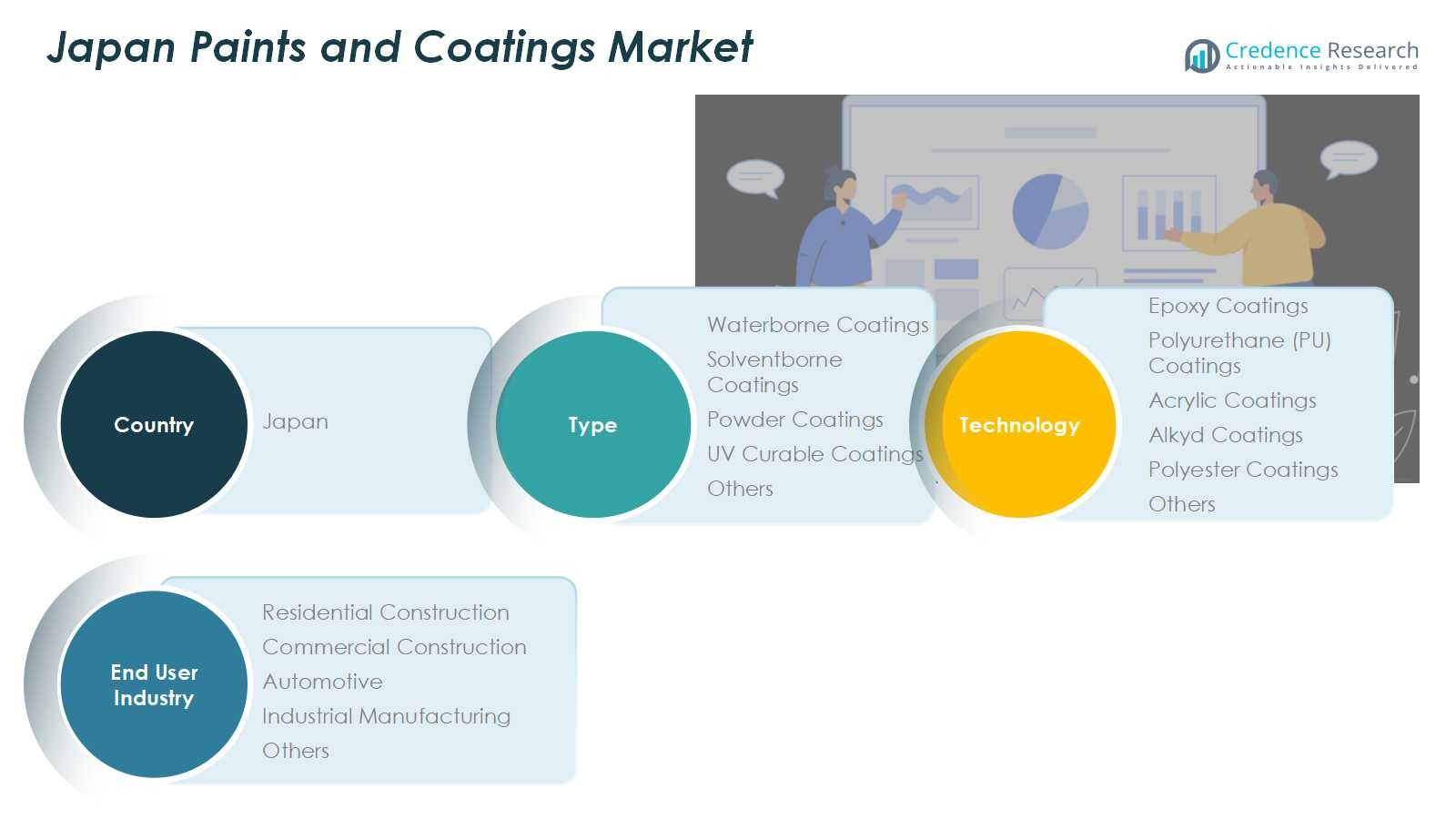

By Type:

In the Japan Paints and Coatings market, waterborne coatings dominate the type segment, accounting for 42% of the market share in 2024. Growth in this sub-segment is driven by increasing environmental regulations and demand for low-VOC and eco-friendly products. Waterborne coatings are widely adopted across residential and commercial construction projects due to their superior adhesion, faster drying times, and minimal environmental impact. Solventborne, powder, UV curable, and other coatings are also expanding steadily, supported by industrial applications and specialized performance requirements, but waterborne remains the key growth engine.

- For instance, Nippon Paint Co Ltd focuses on waterborne coatings that comply with local environmental regulations in industrial zones like Osaka, where VOC limits are strict, promoting safer and eco-friendlier finishing solutions.

By Technology:

Among technology segments, epoxy coatings lead with a 35% market share, fueled by strong demand in industrial manufacturing and protective applications. Epoxy coatings provide exceptional corrosion resistance, chemical stability, and durability, making them preferred for infrastructure, automotive, and machinery coatings. Polyurethane (PU), acrylic, alkyd, polyester, and other coatings are witnessing moderate adoption, supported by architectural and automotive applications, but epoxy maintains dominance due to its high-performance properties and versatility across diverse end-user industries.

- For instance, Sherwin-Williams launched Heat-Flex ACE, an ultra-high-solids epoxy novolac coating specifically engineered to mitigate corrosion under insulation in petrochemical plants, demonstrating epoxy’s critical role in extreme environments.

By End User Industry:

The residential construction sector dominates the end-user industry segment, capturing 38% of the market share in 2024. This growth is supported by urban housing development, renovation projects, and rising consumer preference for aesthetically appealing and durable interior and exterior finishes. Commercial construction, automotive, industrial manufacturing, and other sectors are also contributing to market expansion, but residential projects drive the bulk of demand, with coatings selected for low environmental impact, ease of application, and long-term performance.

Key Growth Drivers

Increasing Urbanization and Construction Activities

Rapid urbanization in Japan has significantly fueled the demand for paints and coatings, particularly in residential and commercial construction projects. Expansion of urban housing, infrastructure development, and renovation initiatives drives the adoption of high-performance coatings. Eco-friendly and low-VOC waterborne coatings are especially in demand, aligning with regulatory requirements. This trend is boosting overall market consumption, with both architectural and industrial coatings experiencing steady growth, making construction-related applications the primary growth engine for the paints and coatings market.

- For instance, Nippon Paint launched ‘Mastercraft’ in April 2024, a sustainable automotive paint and repair service offering eco-friendly coating solutions that align with urban construction trends.

Rising Automotive Production and Industrial Manufacturing

The automotive and industrial manufacturing sectors are major contributors to the paints and coatings market. Growing production of vehicles, machinery, and industrial equipment drives demand for protective and durable coatings such as epoxy and polyurethane. Manufacturers prefer high-performance solutions that enhance corrosion resistance, chemical stability, and longevity. This industrial demand not only increases volumes but also encourages innovation in coating technologies, reinforcing the market’s expansion across both automotive OEMs and industrial applications.

- For instance, leading companies like Henkel have introduced new lines of sustainable corrosion-resistant coatings tailored for automotive and industrial applications, demonstrating ongoing innovation to meet durability and environmental standards.

Stringent Environmental Regulations and Sustainability Initiatives

Environmental regulations promoting low-VOC and eco-friendly products are driving growth in waterborne and powder coatings. Japanese government initiatives and green building standards encourage the adoption of sustainable coatings, boosting demand for products that minimize environmental impact. Manufacturers are investing in R&D to develop environmentally compliant coatings without compromising performance, creating new market opportunities. Sustainability-focused solutions are increasingly preferred by end-users, supporting both residential and industrial applications and reinforcing long-term growth prospects in the paints and coatings market.

Key Trends & Opportunities

Technological Advancements in Coating Formulations

Innovation in coating technologies, including UV-curable and nano-based formulations, is emerging as a key market trend. These advanced coatings offer faster curing, superior durability, and enhanced aesthetics, catering to industrial, automotive, and decorative applications. Companies are investing in R&D to develop next-generation coatings that meet performance and environmental standards. Adoption of smart coatings and multifunctional solutions presents significant growth opportunities, allowing players to differentiate products and expand into high-value industrial and commercial applications across Japan.

- For instance, SDC Technologies’ CrystalCoat® UV-curable coatings deliver exceptional abrasion, scratch, and chemical resistance while supporting fast, eco-friendly curing processes for industries such as automotive and architectural applications.

Expansion of Specialty and Decorative Coatings

Rising consumer preference for premium and aesthetically appealing interior and exterior finishes is driving demand for specialty and decorative coatings. Innovations in textures, colors, and finishes create opportunities in residential, commercial, and hospitality segments. Demand for durable, weather-resistant, and easy-to-apply coatings is increasing, especially in urban housing and commercial infrastructure projects. Companies that focus on niche, high-margin decorative coatings can capture market share while aligning with evolving consumer tastes and sustainability requirements.

- For instance, Armstrong Chemicals’ Rainseal Hfc-5 is a fiber-reinforced acrylic elastomeric coating that offers high waterproofing, crack resistance, and UV protection specifically designed for roofs.

Key Challenges

Volatility in Raw Material Prices

Fluctuating costs of key raw materials such as resins, pigments, and solvents pose a significant challenge to manufacturers. Price volatility affects production costs and can impact profitability, especially for smaller players. Companies must manage supply chain risks while maintaining competitive pricing. This challenge drives investment in alternative raw materials and cost-efficient technologies, but persistent price fluctuations remain a constraint for consistent market growth.

Intense Competition and Market Fragmentation

The Japan paints and coatings market is highly competitive, with numerous domestic and international players vying for market share. Intense competition limits pricing flexibility and pressures companies to invest heavily in R&D, marketing, and distribution channels. Market fragmentation requires firms to differentiate through product innovation, sustainability, and service quality. While large players maintain dominance, smaller and mid-sized companies face challenges in scaling operations and capturing significant market share.

Regional Analysis

Kanto

The Kanto region leads the Japan paints and coatings market, holding a market share of 32% in 2024. Rapid urbanization, residential and commercial construction projects, and industrial development drive demand for high-performance coatings. The region is a hub for automotive manufacturing and infrastructure projects, boosting consumption of epoxy, polyurethane, and waterborne coatings. Strong presence of major paint manufacturers and advanced distribution networks further reinforce growth. Rising focus on eco-friendly and low-VOC products supports adoption in both architectural and industrial applications, making Kanto the dominant contributor to Japan’s overall paints and coatings market.

Kansai Region

The Kansai region contributes 24% of the market share, driven by industrial manufacturing, residential construction, and commercial infrastructure projects. Coatings demand is particularly strong in automotive and machinery production, where epoxy and PU coatings are extensively used. Urban renovation projects and increasing consumer preference for durable and decorative finishes are expanding waterborne and specialty coatings adoption. The region’s established industrial base, combined with sustainable building initiatives, encourages the uptake of environmentally friendly products. Strategic investments by domestic and international manufacturers in Kansai’s growing construction and manufacturing sectors continue to strengthen its position as a key market contributor.

Chubu

The Chubu region accounts for 18% of Japan’s paints and coatings market, supported by a strong automotive and industrial manufacturing presence. Coatings for corrosion protection, chemical resistance, and durability are in high demand, particularly epoxy and PU coatings. Residential and commercial construction activities, along with rising interest in decorative and sustainable coatings, are driving growth. Local manufacturers are increasingly focusing on eco-friendly waterborne and powder coatings to comply with environmental regulations. The combination of industrial and construction-led demand positions Chubu as a critical growth region, with steady expansion in both high-performance industrial coatings and architectural applications.

Hokkaido

Hokkaido contributes 10% of the market share, primarily driven by residential and commercial construction projects, along with cold-climate protective coatings. The demand for weather-resistant and durable coatings, including waterborne and solventborne products, is significant due to harsh environmental conditions. Industrial applications, though limited compared to other regions, continue to support market growth. The region presents opportunities for specialty coatings, such as UV-curable and powder coatings, for energy-efficient construction. Manufacturers are focusing on expanding distribution and promoting eco-friendly products to align with sustainability initiatives, reinforcing Hokkaido’s role as a stable, growing segment within the Japan paints and coatings market.

Other

Other regions of Japan, including Shikoku, Kyushu, and Okinawa, collectively hold 16% of the market share, driven by smaller-scale construction, industrial, and automotive activities. Growth is supported by increasing urban development, residential renovations, and niche industrial projects. Adoption of eco-friendly waterborne and powder coatings is rising in response to environmental regulations. Specialty and decorative coatings are gaining traction in commercial and hospitality sectors. While individual contributions are lower than major regions, these areas present opportunities for market expansion through localized distribution networks and targeted product offerings, helping manufacturers diversify their presence across Japan.

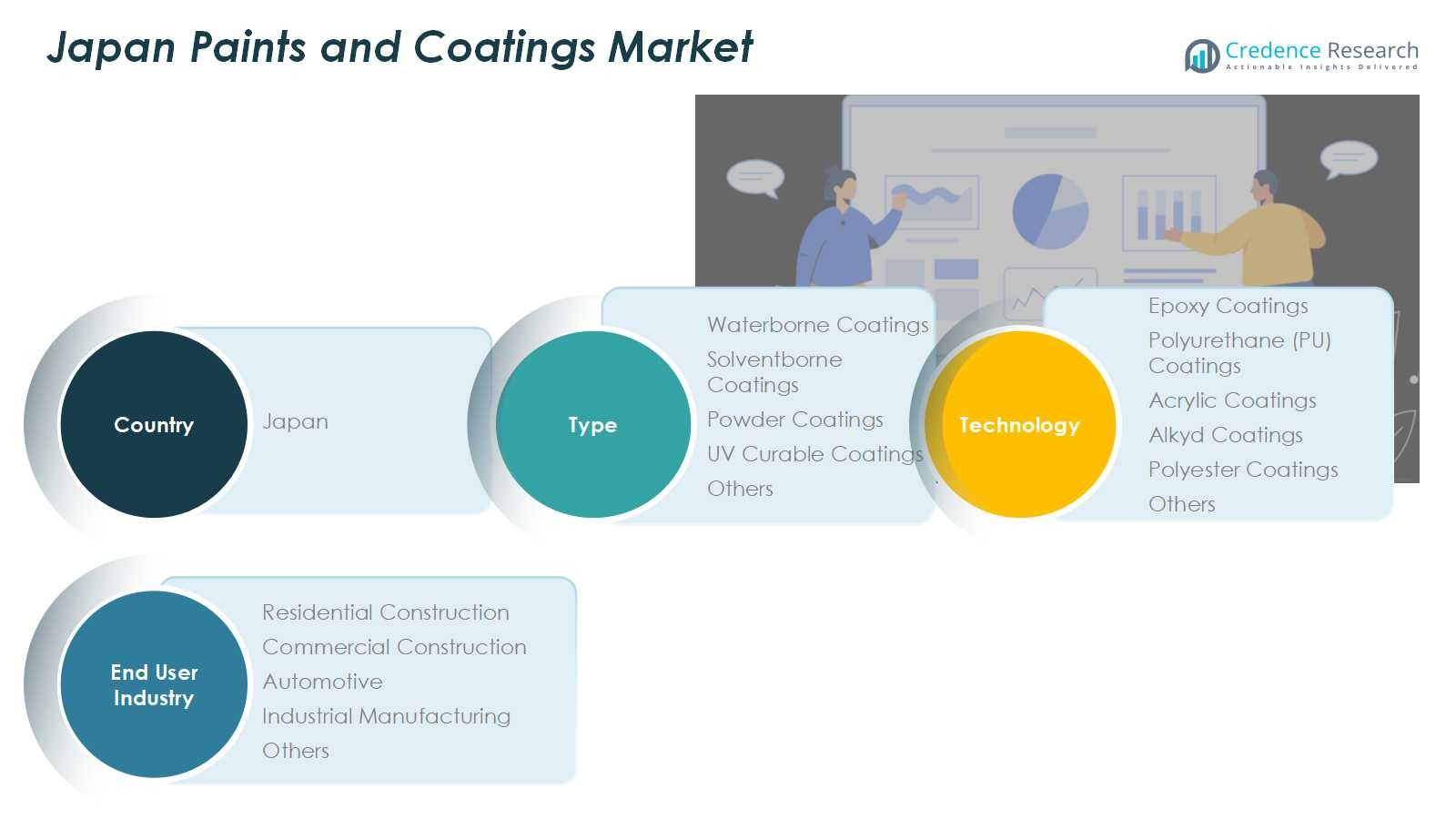

Market Segmentations:

By Type:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology:

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End User Industry:

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- Kanto

- Kansai

- Chubu

- Hokkaido

- Others

Competitive Landscape

The competitive landscape of the Japan Paints and Coatings market includes key players such as Nippon Paint, Kansai Paint, JXTG Nippon Oil & Energy, Chugoku Marine Paints, SHOWA DENKO, Taikisha Ltd., DIC Corporation, Sony Chemicals, Sekisui Chemical, and Taiyo Kogyo. The market is highly competitive, characterized by the presence of both domestic and international manufacturers investing heavily in R&D, product innovation, and sustainability initiatives. Companies focus on developing eco-friendly, low-VOC, and high-performance coatings to meet stringent environmental regulations and evolving consumer preferences. Strategic partnerships, mergers, acquisitions, and expansions of manufacturing and distribution networks are commonly employed to enhance market presence. The competition drives innovation in specialty coatings, UV-curable solutions, and decorative finishes, enabling firms to capture diverse end-user segments across residential, commercial, automotive, and industrial applications. Market leadership depends on product quality, technological advancement, and the ability to respond swiftly to changing regulatory and market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nippon Paint

- Kansai Paint

- JXTG Nippon Oil & Energy

- Chugoku Marine Paints

- SHOWA DENKO

- Taikisha Ltd.

- DIC Corporation

- Sony Chemicals

- Sekisui Chemical

- Taiyo Kogyo

Recent Developments

- In March 2025, Nippon Paint Holdings completed the acquisition of AOC, a U.S.-based specialty chemical formulator, for $2.3 billion, enhancing its global presence and specialty coatings portfolio.

- In February 2025, Chugoku Marine Paints acquired Italo Belge Colori S.r.l., an Italian coatings manufacturer, to expand its European market presence and product offerings.

- In 2024, Kansai Paint announced the acquisition of WEILBURGER, a company specializing in industrial coatings.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan paints and coatings market is expected to grow steadily, driven by rising demand in residential and commercial construction.

- Adoption of eco-friendly and low-VOC coatings will continue to accelerate due to stringent environmental regulations.

- Waterborne and powder coatings are likely to maintain dominance in the type segment.

- Epoxy and polyurethane coatings will remain key technologies for industrial and automotive applications.

- Specialty and decorative coatings will see increased demand in urban housing and commercial projects.

- Innovation in UV-curable and advanced functional coatings will create new market opportunities.

- Growth in automotive production and industrial manufacturing will support high-performance coating demand.

- Companies will focus on strategic partnerships, expansions, and product innovations to strengthen market position.

- Sustainability initiatives will drive R&D investment in environmentally compliant coatings.

- Regional expansion in secondary urban areas will contribute to overall market growth.