Market Overview

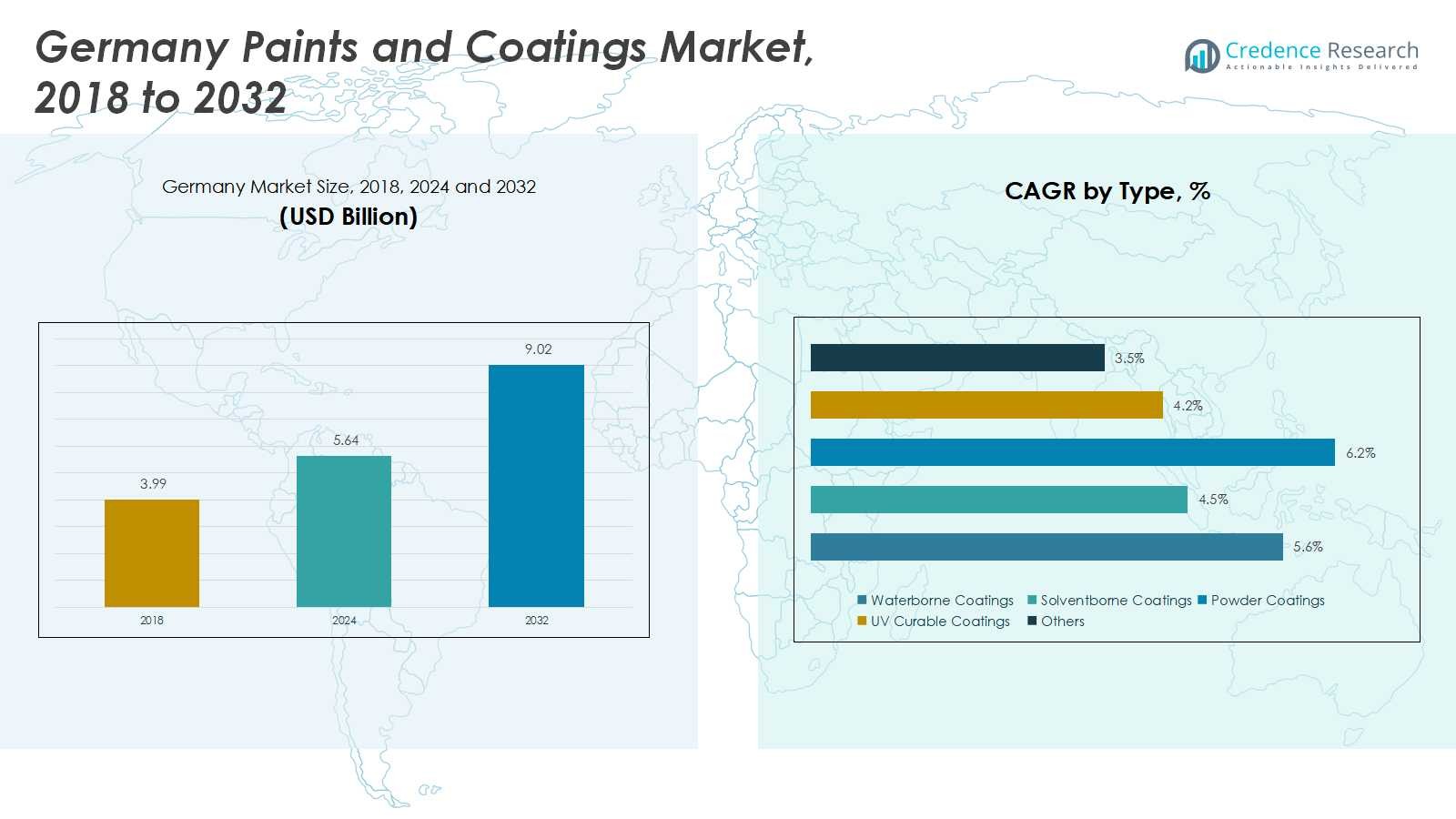

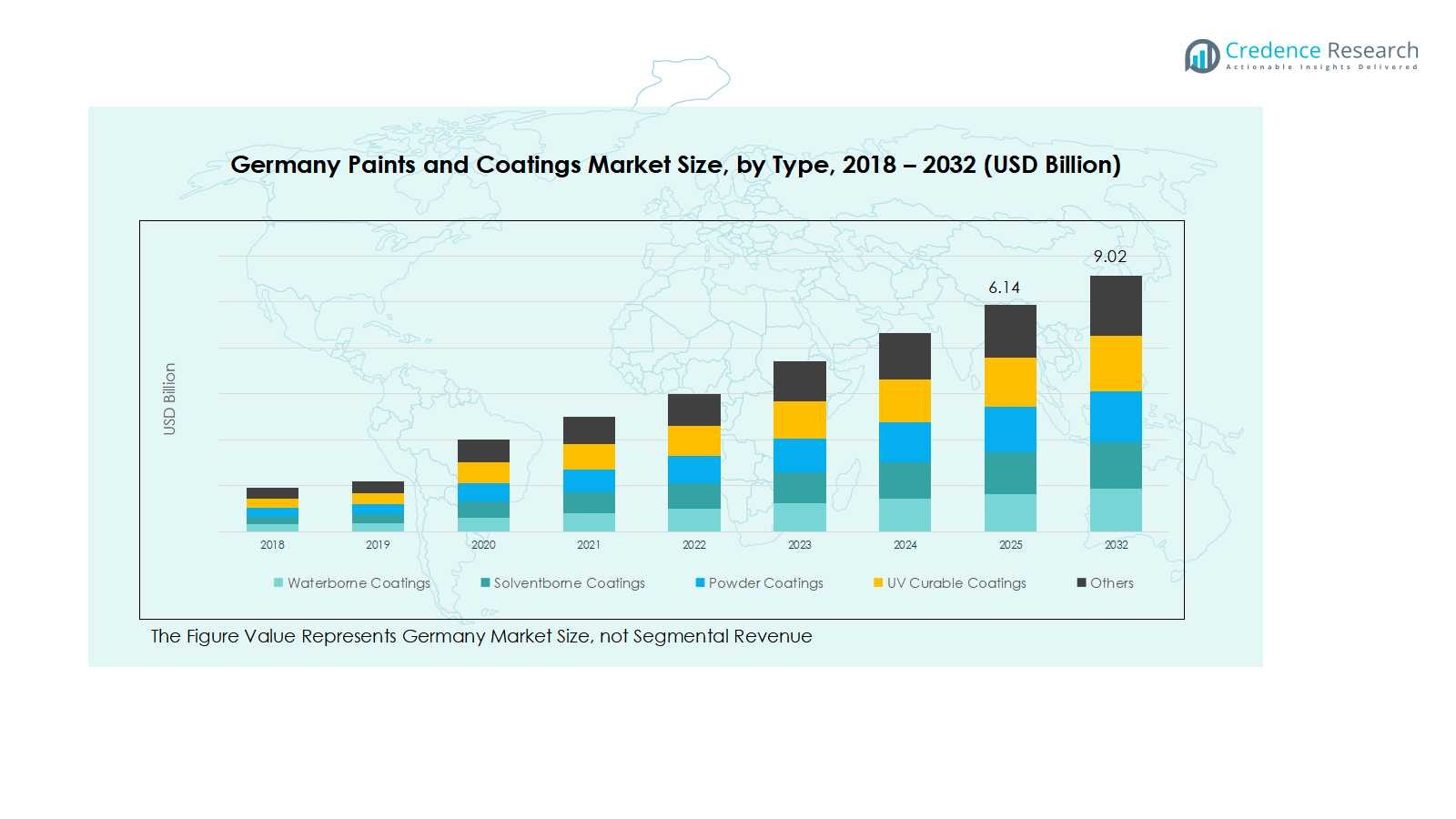

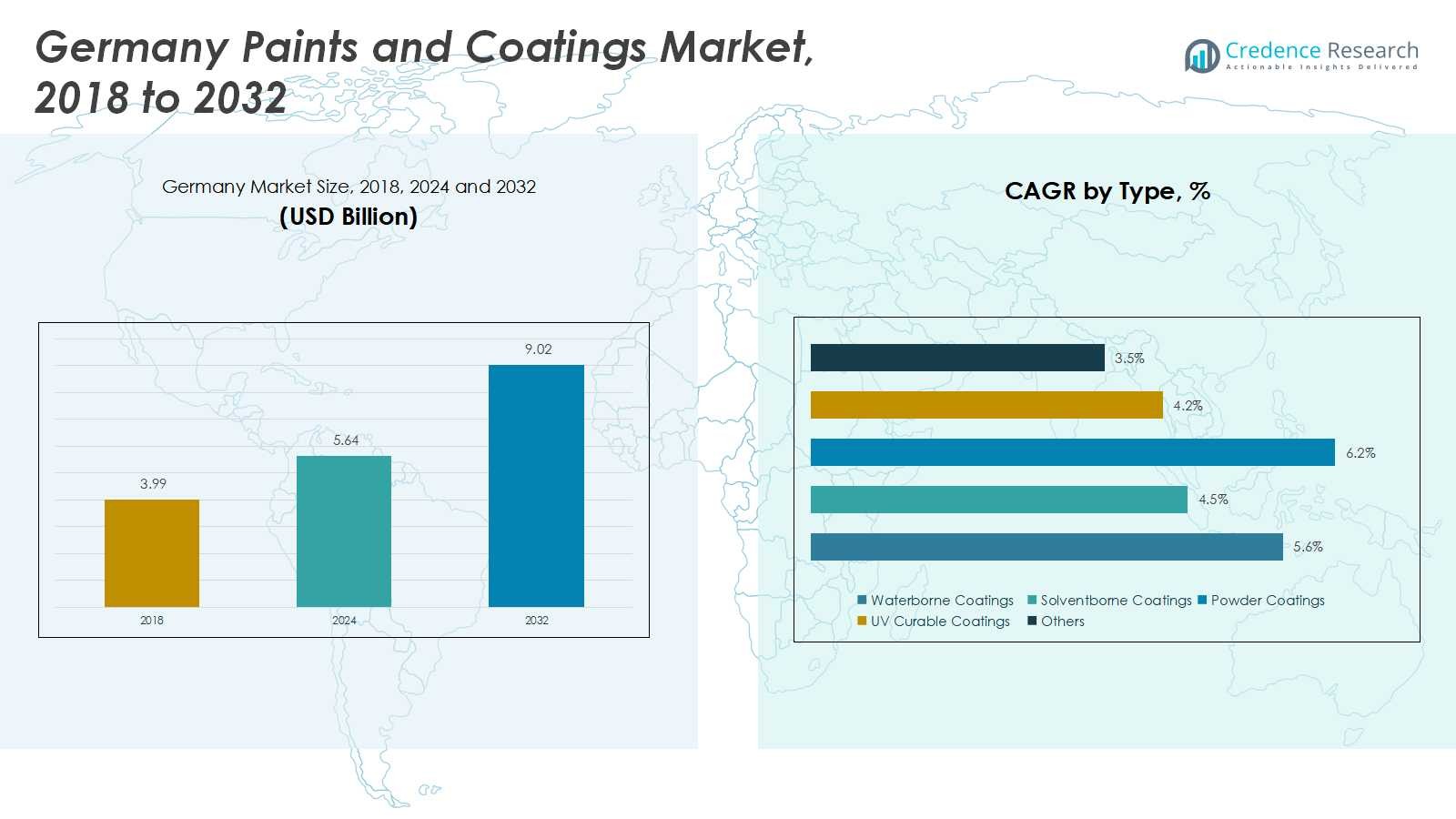

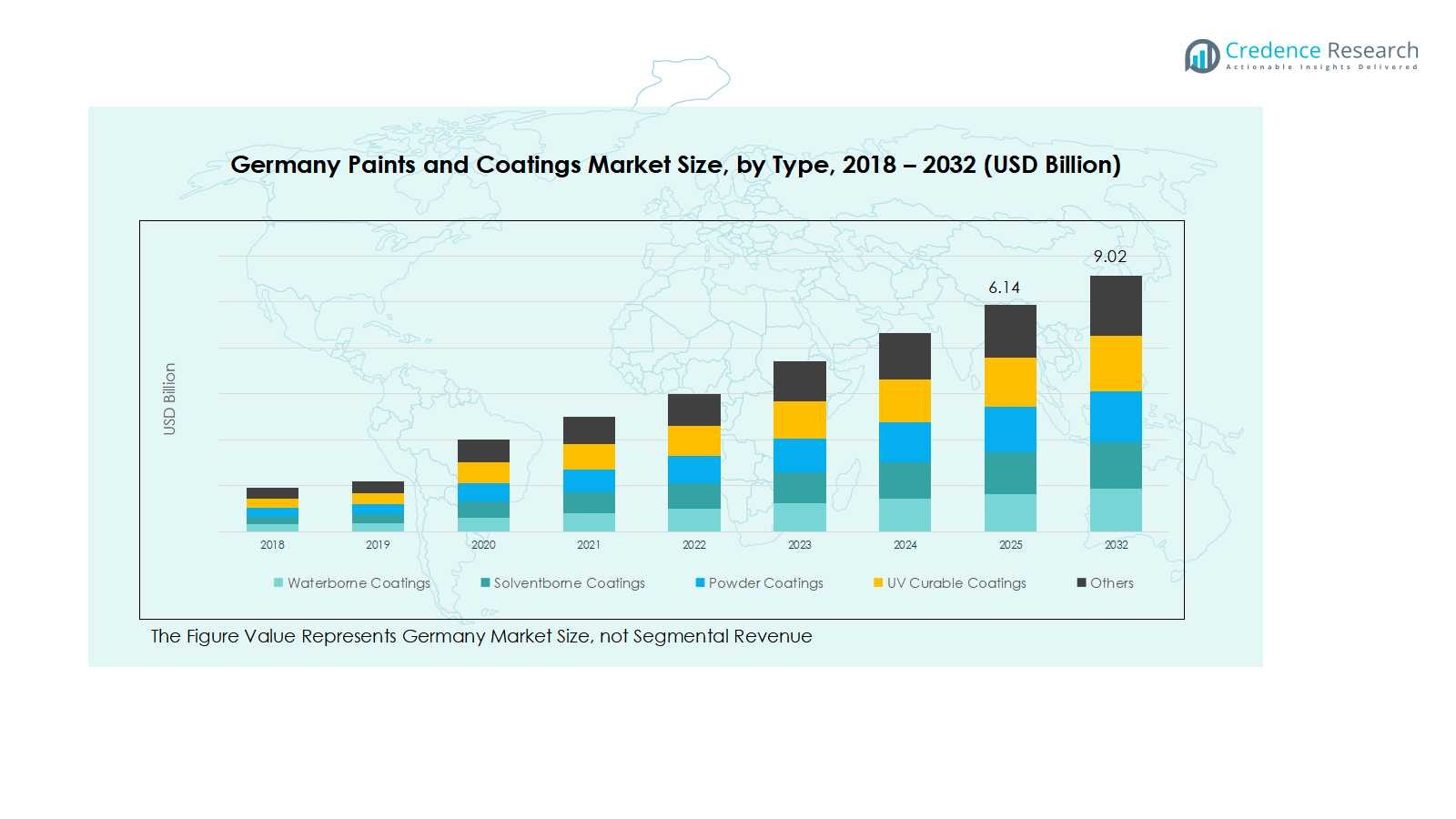

Germany Paints and Coatings market size was valued at USD 3.99 billion in 2018, growing to USD 5.64 billion in 2024, and is anticipated to reach USD 9.02 billion by 2032, at a CAGR of 5.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Paints and Coatings market Size 2024 |

USD 5.64 Billion |

| Germany Paints and Coatings market, CAGR |

5.64% |

| Germany Paints and Coatings market Size 2032 |

USD 9.02 Billion |

The Germany Paints and Coatings market is dominated by major players such as BASF SE, Wacker Chemie AG, Sto SE & Co. KGaA, Akzo Nobel Germany, Jotun Germany, Hempel Germany, Sherwin-Williams Germany, PPG Industries Germany, RPM International Germany, and Mankiewicz Gebr. & Co. These companies lead the market through strategic investments in research and development, eco-friendly and high-performance coatings, and expansion across industrial and urban hubs. South Germany emerges as the leading region, commanding 32% of the market share, driven by automotive manufacturing, commercial construction, and industrial clusters. North Germany follows with 28%, supported by strong industrial manufacturing and residential construction activities. West Germany holds 20%, while East and Central Germany account for 12% and 8%, respectively, reflecting growing urbanization, infrastructure development, and increasing adoption of sustainable coating solutions across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Paints and Coatings Market was valued at USD 5.64 billion in 2024 and is projected to reach USD 9.02 billion by 2032, growing at a CAGR of 5.64%. Waterborne coatings lead the type segment with 42% market share, while acrylic coatings dominate the technology segment at 38%, and residential construction accounts for 40% of end-user demand.

- Rising residential and commercial construction, along with government initiatives for sustainable buildings, is driving the adoption of waterborne, powder, and eco-friendly coatings across Germany.

- Technological innovations such as UV curable, nano-enhanced, and smart coatings are creating new opportunities in automotive, industrial, and commercial sectors, with a focus on durability, weather resistance, and low VOC emissions.

- The market is highly competitive, with key players including BASF SE, Wacker Chemie AG, Akzo Nobel Germany, Sto SE & Co. KGaA, and Sherwin-Williams Germany investing in R&D, partnerships, and geographic expansion.

- South Germany holds the largest regional share at 32%, followed by North Germany at 28%, West Germany 20%, East Germany 12%, and Central Germany 8%, reflecting strong industrial and construction activity.

Market Segmentation Analysis:

By Type:

In the Germany paints and coatings market, waterborne coatings dominate the type segment, accounting for 42% of the market share. Their growth is driven by stringent environmental regulations, low VOC emissions, and increasing demand for eco-friendly and sustainable coatings across residential and commercial construction. Solventborne coatings, powder coatings, UV curable coatings, and others collectively make up the remaining share, with powder coatings gaining traction in industrial applications due to durability and corrosion resistance. Rising construction activity and automotive refurbishments are also boosting demand for waterborne solutions.

- For instance, BASF has advanced waterborne coatings for automotive OEMs, focusing on formulations that meet Germany’s low-VOC standards while improving adhesion and durability.

By Technology:

Among technology types, acrylic coatings lead the segment with 38% market share, attributed to their superior weather resistance, versatility, and cost-effectiveness for both decorative and protective applications. Epoxy and polyurethane (PU) coatings follow, widely used in industrial manufacturing and automotive sectors due to high mechanical strength and chemical resistance. Alkyd, polyester, and other coatings maintain niche applications. Market growth is further supported by innovations in low-VOC formulations, enhanced performance features, and rising investments in infrastructure and automotive refinishing projects across Germany.

- For instance, Pidilite Industries produces epoxy coatings like ZORRIK 201 that offer high chemical resistance and corrosion protection for steel and concrete in industrial environments.

By End User Industry:

The residential construction sector dominates the end-user segment, capturing 40% of the market share, driven by increasing urban housing projects and renovation activities. Commercial construction, automotive, and industrial manufacturing sectors also contribute significantly, with automotive refinishing and industrial protective coatings supporting sustained demand. Market drivers include ongoing construction modernization, rising disposable income, and government initiatives promoting energy-efficient and sustainable buildings. Others, including furniture and specialty applications, are expanding steadily as technological advancements enhance coating durability and aesthetic appeal.

Key Growth Drivers

Rising Construction and Infrastructure Development

Germany’s expanding residential and commercial construction projects are fueling demand for paints and coatings. Urban housing development, renovation activities, and large-scale infrastructure projects drive significant consumption, particularly in waterborne and acrylic coatings. Increased government investments in energy-efficient and sustainable building practices are further promoting eco-friendly coatings. Industrial construction, including factories and warehouses, also boosts demand for high-performance protective coatings, making construction growth a primary driver of market expansion across multiple segments.

- For instance, PPG Industries, active in Germany, supplies advanced protective and marine coatings used extensively in industrial construction projects like factories and warehouses, catering to the rising need for durable, high-performance coatings.

Automotive Industry Expansion

The automotive sector in Germany is a crucial driver for the paints and coatings market. Rising vehicle production, coupled with increased automotive refurbishing and customization, is driving demand for solventborne, PU, and epoxy coatings. High-performance coatings that offer durability, corrosion resistance, and aesthetic appeal are increasingly sought after. Electric vehicle adoption also stimulates demand for lightweight and eco-friendly coatings, as manufacturers prioritize low-VOC solutions that meet environmental standards, supporting consistent market growth in automotive applications.

- For instance, AkzoNobel’s advanced powder coatings protect electric vehicle battery systems by electrically insulating and protecting components against overheating and corrosion, aligning with the industry’s shift to low-VOC, eco-friendly solutions.

Environmental Regulations and Sustainability Initiatives

Stricter environmental regulations in Germany are pushing the shift toward low-VOC, waterborne, and eco-friendly coatings. Manufacturers are investing in sustainable product innovations to comply with government mandates and reduce carbon footprints. Growing consumer preference for environmentally responsible products further accelerates adoption. Sustainability initiatives across residential, commercial, and industrial sectors encourage the use of coatings with reduced hazardous emissions, driving technological innovation and broadening the market for advanced waterborne, UV curable, and powder coatings.

Key Trends & Opportunities

Technological Innovations in Coatings

Germany’s paints and coatings market is witnessing rapid innovation, including high-performance, UV curable, and nano-enhanced coatings. These advancements improve durability, weather resistance, and chemical protection, opening opportunities across automotive, industrial, and construction sectors. Adoption of smart coatings with self-cleaning and anti-corrosion features is growing, creating new niches. Manufacturers investing in R&D to enhance functional and sustainable coatings are capturing market share, positioning technology-driven innovation as a key growth trend in both decorative and protective applications.

- For instance, companies like BASF and Evonik are actively developing advanced nanocoatings that offer self-cleaning, anti-microbial, and anti-corrosion properties, catering to both industrial and consumer sectors.

Expansion of Waterborne and Eco-Friendly Coatings

Waterborne coatings are gaining prominence due to low VOC emissions and regulatory compliance. Rising awareness of environmental impact and demand for sustainable products present opportunities for growth in residential and commercial projects. The trend is further reinforced by government incentives and industry adoption of green building standards. Companies focusing on eco-friendly, cost-effective solutions, including powder and UV curable coatings, are well-positioned to capitalize on the growing market for environmentally responsible paints and coatings across Germany.

- For instance, PPG Technologies expanded its Wuppertal plant by $5 million to increase capacity for waterborne coatings, meeting rising demand from automotive and industrial sectors.

Key Challenges

Volatile Raw Material Prices

Fluctuating prices of raw materials, including resins, solvents, and pigments, pose a significant challenge to manufacturers. Increased production costs can reduce profit margins and impact pricing strategies. Dependency on imports for certain chemicals exposes the market to global supply chain disruptions. Companies are compelled to adopt cost-optimization strategies or alternative raw materials, but maintaining consistent quality remains a challenge, particularly in high-performance coatings such as epoxy, PU, and specialty industrial formulations.

Stringent Regulatory Compliance

Compliance with strict environmental and safety regulations adds complexity and costs for paints and coatings manufacturers. Low-VOC mandates, hazardous chemical restrictions, and sustainability standards require continuous process adjustments and innovation in formulations. Non-compliance can lead to penalties, production delays, and reputational risks. Smaller players, in particular, may struggle to invest in research and technology upgrades, limiting market participation. This regulatory pressure represents an ongoing challenge despite driving the adoption of eco-friendly and advanced coating solutions.

Regional Analysis

North Germany

North Germany holds a significant share of the paints and coatings market, accounting for 28% of the total revenue. The region benefits from strong industrial manufacturing hubs, shipbuilding, and growing residential construction activities. Demand for waterborne and acrylic coatings is high due to strict environmental regulations and the focus on sustainable solutions. Automotive and industrial sectors contribute to the consumption of PU and epoxy coatings, while government initiatives promoting green building standards further accelerate adoption. The combination of industrial expansion and residential renovation projects ensures North Germany remains a leading contributor to the overall market growth.

South Germany

South Germany captures 32% of the paints and coatings market, driven by robust automotive manufacturing, commercial construction, and high-tech industrial sectors. Major cities and industrial clusters in Bavaria and Baden-Württemberg create strong demand for high-performance coatings, including solventborne, powder, and UV curable variants. Residential construction and infrastructure development also support the growing adoption of waterborne coatings. Innovation in eco-friendly formulations, along with stringent VOC regulations, promotes sustainable product usage. South Germany’s industrial diversification and construction investments position it as the largest regional contributor to the overall paints and coatings market in Germany.

West Germany

West Germany accounts for 20% of the market, supported by a mix of industrial manufacturing, commercial construction, and urban residential projects. The region shows strong demand for epoxy, acrylic, and PU coatings in automotive and industrial applications. Waterborne and environmentally friendly coatings gain traction due to regulatory compliance and consumer preference for sustainable solutions. Ongoing infrastructure modernization and urban housing projects provide additional growth opportunities, while technological adoption in industrial coatings further strengthens market demand. West Germany’s balanced industrial and construction activities make it a key contributor to Germany’s paints and coatings revenue.

East Germany

East Germany contributes 12% of the paints and coatings market, driven by emerging urban construction and industrial expansion. The region shows increasing adoption of waterborne and powder coatings in residential and industrial projects, supported by government incentives for green buildings. Automotive refurbishment and localized industrial manufacturing also boost demand for epoxy and PU coatings. Though smaller in market share compared to South and North Germany, East Germany is witnessing steady growth due to ongoing infrastructure upgrades, urban housing development, and a gradual shift toward environmentally sustainable coating solutions across both residential and commercial sectors.

Central Germany

Central Germany represents 8% of the market, with growth driven by residential renovations, small-to-medium industrial facilities, and commercial construction projects. Waterborne and acrylic coatings dominate due to regulatory compliance and low environmental impact, while epoxy and PU coatings support localized automotive and industrial needs. The region benefits from ongoing infrastructure modernization and sustainable building initiatives. While Central Germany contributes a smaller market share relative to other regions, increasing urbanization and technological adoption in coatings provide growth opportunities. Strategic investments by manufacturers in eco-friendly and high-performance products are expected to further boost market penetration in the region.

Market Segmentations:

By Type:

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

- UV Curable Coatings

- Others

By Technology:

- Epoxy Coatings

- Polyurethane (PU) Coatings

- Acrylic Coatings

- Alkyd Coatings

- Polyester Coatings

- Others

By End User Industry:

- Residential Construction

- Commercial Construction

- Automotive

- Industrial Manufacturing

- Others

By Region

- North Germany

- South Germany

- East Germany

- West Germany

- Central Germany

Competitive Landscape

The competitive landscape of the Germany paints and coatings market features major players such as BASF SE, Wacker Chemie AG, Sto SE & Co. KGaA, Akzo Nobel Germany, Jotun Germany, Hempel Germany, Sherwin-Williams Germany, PPG Industries Germany, RPM International Germany, and Mankiewicz Gebr. & Co. These companies are actively investing in research and development to introduce innovative, eco-friendly, and high-performance coatings that meet stringent environmental regulations. Strategic partnerships, mergers, and acquisitions are strengthening their market positions, while geographic expansion across urban and industrial hubs enhances distribution reach. Companies are focusing on technological advancements in waterborne, powder, and UV curable coatings to capture demand from automotive, industrial, and residential construction sectors. Intense competition encourages continuous product differentiation, price optimization, and sustainability initiatives, ensuring that both multinational and regional players remain competitive while addressing evolving customer needs in the German market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, BASF agreed to sell a majority stake in its automotive coatings business to Carlyle Group, creating a standalone company while retaining a 40% stake, with the transaction expected to close in Q2 2026 pending regulatory approvals.

- In 2025, Axalta Coating Systems and Dürr Systems AG entered a strategic partnership to commercialize digital paint solutions for automotive OEMs, combining Axalta’s NextJet™ precision paint technology with Dürr’s robotics systems to enable overspray-free, maskless painting and enhance design flexibility while reducing material waste.

- In 2025, Henkel relaunched its Fa brand with a focus on sustainability by incorporating recycled materials, aiming to attract eco-conscious consumers and strengthen its position in the sustainable product segment.

- In 2025, Constantia Flexibles partnered with Watttron to introduce a versatile sealing system for polypropylene (PP) cups, enhancing sealing efficiency and adaptability, streamlining production processes, and reducing material waste in packaging operations.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by increasing residential and commercial construction activities.

- Demand for eco-friendly and low-VOC coatings will continue to rise due to strict environmental regulations.

- Waterborne and powder coatings are likely to gain larger market share over traditional solventborne products.

- Technological innovations in UV curable and high-performance coatings will create new application opportunities.

- The automotive sector will remain a key growth contributor, especially with the rise of electric vehicles.

- Industrial manufacturing and protective coatings will drive steady adoption in commercial and infrastructure projects.

- Regional expansion in North and South Germany will support overall market growth.

- Strategic collaborations, mergers, and acquisitions will strengthen market positions of leading players.

- Sustainability initiatives and green building projects will accelerate the shift to environmentally responsible coatings.

- Investments in research and development will continue to enhance product performance and differentiation.