Market Overview

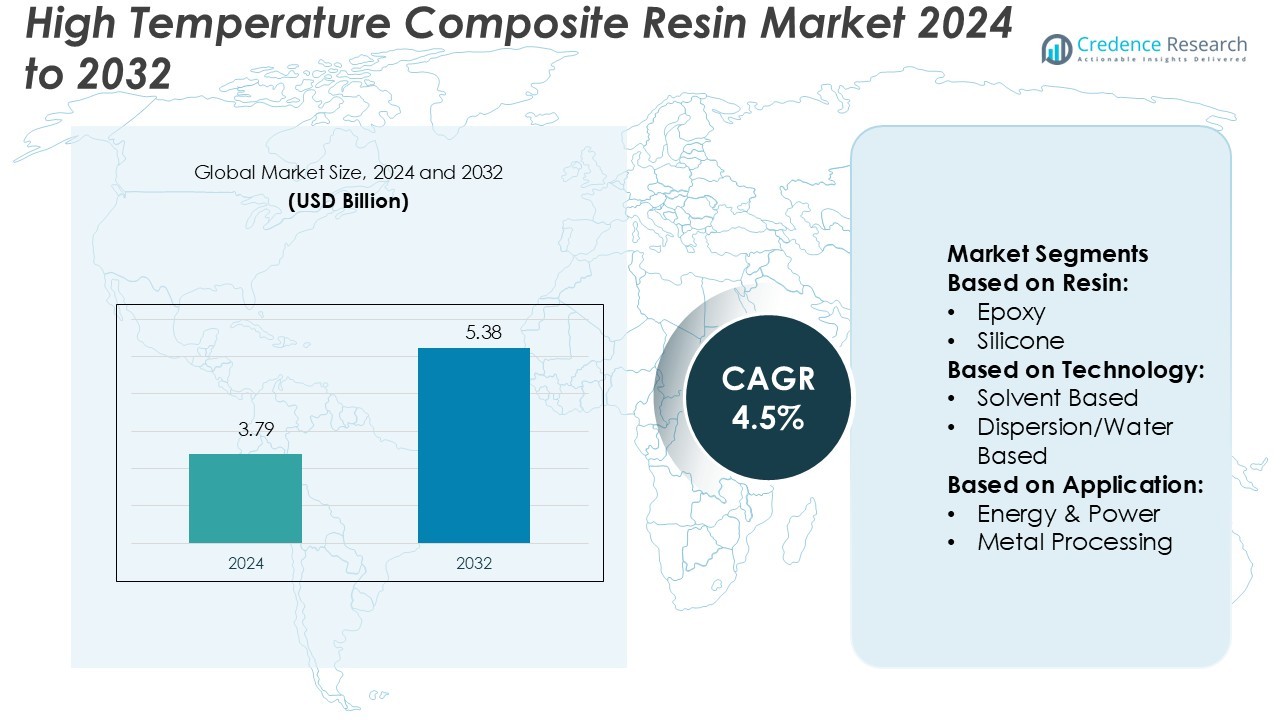

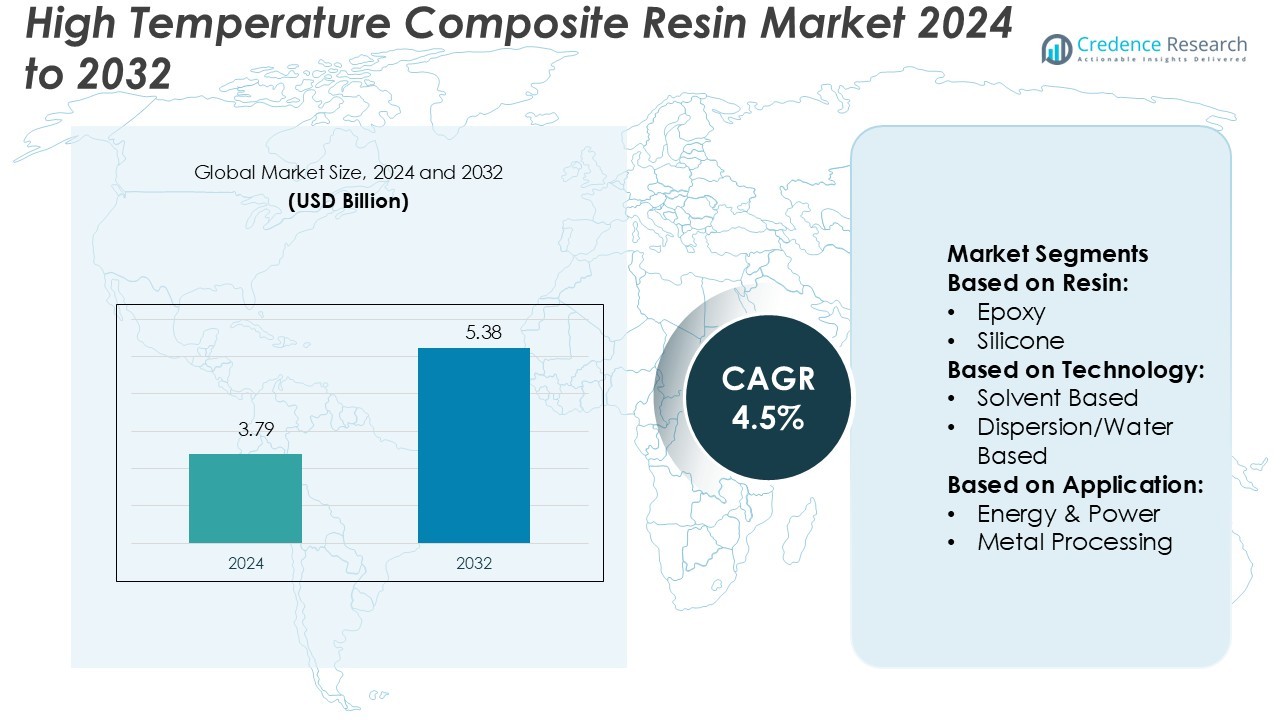

High Temperature Composite Resin Market size was valued USD 3.79 billion in 2024 and is anticipated to reach USD 5.38 billion by 2032, at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Temperature Composite Resin Market Size 2024 |

USD 3.79 Billion |

| High Temperature Composite Resin Market, CAGR |

4.5% |

| High Temperature Composite Resin Market Size 2032 |

USD 5.38 Billion |

The High Temperature Composite Resin Market is driven by top players such as Huntsman International LLC, Henkel AG & Co., UBE Industries, Ltd., Nexam Chemical Holding AB, Mitsui Chemicals Inc., Arkema S.A., Royal Tencate N.V., Hexion Inc., Solvay S.A., and DIC Corporation. These companies focus on advanced resin formulations, strategic R&D investments, and sustainable manufacturing processes to maintain a competitive edge. North America leads the market with a 36.8% share, supported by strong aerospace and automotive industries, advanced production capabilities, and a robust supply network. Regional dominance is reinforced by high demand for lightweight, high-performance materials and rapid adoption of innovative resin technologies.

Market Insights

- The High Temperature Composite Resin Market was valued at USD 3.79 billion in 2024 and is projected to reach USD 5.38 billion by 2032, at a CAGR of 4.5%.

- Market growth is supported by strong demand in aerospace and automotive sectors, where high-performance and heat-resistant materials are essential for lightweight structural components.

- Advancements in resin formulations and sustainable production methods are creating new opportunities, while leading players continue to invest in R&D and automation.

- North America holds the largest regional share at 36.8%, followed by Europe and Asia Pacific, supported by strong manufacturing bases and technological capabilities.

- Epoxy resin remains the dominant segment due to its superior thermal stability and mechanical strength, driving its wide adoption across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Resin

Epoxy resin dominates the High Temperature Composite Resin Market with the largest share. This segment holds a strong position due to its superior mechanical strength, thermal stability, and chemical resistance. Epoxy resins support structural applications in aerospace, automotive, and energy sectors where performance at extreme temperatures is critical. Their ability to maintain dimensional stability and adhesion at temperatures above 200°C drives widespread adoption. Polyethersulfone and silicone resins follow, supported by their use in specialized coatings and lightweight components.

- For instance, Huntsman’s Araldite® LY 8615 system can achieve a glass transition temperature (Tg) of 210–220 °C and a tensile strength of 40–45 MPa, depending on the curing schedule.

By Technology

Solvent-based technology leads the High Temperature Composite Resin Market with the highest market share. Solvent-based formulations deliver superior film quality, faster curing, and better adhesion on complex surfaces. These features make them ideal for aerospace coatings, coil coatings, and automotive parts. Strong penetration in industrial and high-temperature applications supports their leadership. Powder-based and water-based technologies are gaining traction as eco-friendly alternatives, driven by stricter emission standards and sustainable manufacturing goals.

- For instance, Henkel’s adhesive film product LOCTITE® EA 9696 AERO (a modified epoxy film for bonding metal-to-metal and honeycomb) delivers service temperature performance up to 121 °C (250 °F) while retaining bond strength above 6.9 MPa (1,000 psi) as specified in its technical data sheet.

By Application

Aerospace dominates the High Temperature Composite Resin Market, supported by its high demand for heat-resistant structural components. This segment accounts for the largest market share due to the growing use of composite materials in aircraft fuselage, engine parts, and interior panels. The resins provide excellent thermal stability, weight reduction, and durability, meeting strict performance standards. Automotive and energy & power follow as key segments, driven by rising adoption in EV components, turbines, and insulation systems.

Key Growth Drivers

Rising Demand in Aerospace and Automotive Industries

The increasing use of lightweight, heat-resistant materials in aerospace and automotive applications is a major growth driver. High temperature composite resins offer superior strength-to-weight ratios, enabling improved fuel efficiency and performance in critical components. Aerospace manufacturers rely on these resins for engine parts, structural panels, and thermal insulation. Automotive OEMs also integrate these resins into EV batteries and under-the-hood applications. Growing air traffic, rising EV production, and stricter emission norms support sustained demand for advanced composite solutions.

- For instance, UBE’s polyimide oligomer product PETI®‑330 melts at 200 °C, exhibits a low viscosity of 2 Pa·s, and when cured achieves a glass transition temperature (Tg) of 330 °C.

Advancements in Resin Formulations and Performance

Continuous innovation in resin chemistry enhances temperature resistance, durability, and processing efficiency. Modern formulations can withstand extreme thermal cycling without losing structural integrity, making them ideal for high-stress environments. Manufacturers are focusing on resin systems with improved curing profiles, higher glass transition temperatures, and better adhesion properties. These developments enable broader use in advanced manufacturing sectors. Enhanced performance characteristics also reduce maintenance costs, supporting greater adoption across industries.

- For instance, Nexam’s imidized oligomer resin NEXIMID® R331 offers a melt viscosity well below 1,000 mPa·s at processing temperature and a glass-transition temperature (Tg) above 330 °C for low-void carbon-fibre composites.

Expansion of Energy and Power Infrastructure

The growth of the energy sector, including power generation, transmission, and renewable projects, drives market expansion. High temperature composite resins are widely used in insulation systems, turbine blades, and electrical housings. Their ability to endure harsh environments improves operational safety and system reliability. With global investments in renewable energy and grid modernization, demand for advanced composite materials is rising. These resins support energy efficiency goals and extend the lifespan of critical infrastructure.

Key Trends & Opportunities

Shift Toward Sustainable and Low-Emission Technologies

Environmental regulations are pushing industries to adopt eco-friendly production methods. Manufacturers are developing low-VOC, solvent-free, and water-based resin technologies to comply with emission standards. This shift creates opportunities for innovation in green coatings and sustainable composites. The trend aligns with global decarbonization efforts and attracts investment from aerospace, automotive, and construction sectors. Companies that integrate sustainable production can strengthen their competitive advantage.

- For instance, Arkema achieved ISCC PLUS mass-balance certification across nine sites worldwide in its Coating Solutions segment, enabling product carbon-footprint reduction of up to 100% for selected resins.

Integration with Advanced Manufacturing Processes

The adoption of additive manufacturing, automated layup, and RTM (Resin Transfer Molding) is reshaping composite resin applications. High temperature composite resins are being tailored to work efficiently with these advanced production methods. This integration reduces manufacturing time, improves precision, and enables complex designs. Growing interest in automation and digital production systems opens new opportunities for resin suppliers to develop customized solutions for high-performance industries.

- For instance, Toray Cetex® TC1200 PEEK thermoplastic unitape system, when combined with AS-4 carbon fiber, features a tensile strength of 2,280 MPa and a tensile modulus of 130 GPa.

Increasing Adoption in Emerging Economies

Emerging economies are investing heavily in infrastructure, renewable energy, and mobility solutions. This creates strong growth potential for high temperature composite resins in local manufacturing sectors. Aerospace component production, electric vehicle assembly, and energy projects are expanding rapidly in regions like Asia Pacific and the Middle East. Local sourcing and technology transfer agreements further support market expansion, creating opportunities for global suppliers to scale their presence.

Key Challenges

High Production and Processing Costs

High temperature composite resins involve complex formulations and precision manufacturing, which increase production costs. Advanced curing processes and high-performance additives add to the expense, making them less accessible for cost-sensitive industries. This cost barrier limits adoption in small and medium-scale applications. Manufacturers face challenges in balancing quality with affordability while meeting performance standards.

Stringent Regulatory and Performance Standards

Aerospace, automotive, and energy industries impose strict quality and safety regulations. Meeting these standards requires rigorous testing, certification, and compliance, which can delay product launches and increase operational costs. Failure to meet regulatory benchmarks can restrict market entry. The need for consistent thermal performance and durability places additional pressure on suppliers to maintain high production standards.

Regional Analysis

North America

North America holds the largest share in the High Temperature Composite Resin Market with 36.8%. The strong presence of aerospace and automotive manufacturing supports market leadership. The U.S. leads in advanced composite research, focusing on high-performance epoxy and silicone resins. Major OEMs adopt these materials to reduce weight and improve thermal performance in aircraft and EV components. Government initiatives promoting renewable energy and infrastructure modernization further drive regional demand. Strong R&D investments and established production networks enhance North America’s competitive position.

Europe

Europe accounts for 29.6% of the High Temperature Composite Resin Market. The region benefits from a well-developed aerospace and defense sector, particularly in France, Germany, and the U.K. Stringent environmental regulations promote the use of sustainable and low-VOC resin systems. Automotive electrification also drives strong demand, especially for heat-resistant epoxy and powder-based coatings. Growth in wind energy installations increases resin consumption in turbine blade manufacturing. Collaborative R&D programs and circular economy goals strengthen Europe’s innovation landscape.

Asia Pacific

Asia Pacific captures 24.2% of the High Temperature Composite Resin Market and shows the fastest growth rate. Rapid industrialization, infrastructure expansion, and increasing EV production boost resin demand. China, Japan, and South Korea lead in high-performance materials manufacturing and adoption. Expanding aerospace production, particularly in China and India, supports market expansion. Growing investments in renewable energy and advanced manufacturing drive opportunities for local suppliers. Rising export capacity and cost-effective production enhance Asia Pacific’s global presence.

Latin America

Latin America holds 5.2% of the High Temperature Composite Resin Market. The region experiences steady growth due to rising construction activities and growing energy projects in Brazil and Mexico. Adoption of high temperature resins remains moderate but is gaining pace in automotive and infrastructure applications. Government support for renewable energy and industrial development encourages market penetration. Increasing foreign investments in manufacturing are expected to improve resin availability and reduce costs over time.

Middle East & Africa

The Middle East & Africa account for 4.2% of the High Temperature Composite Resin Market. The region’s demand is driven by energy, oil and gas, and infrastructure projects. High temperature resins are increasingly used in insulation systems, pipelines, and coatings for harsh environments. Countries like Saudi Arabia and the UAE are expanding their manufacturing capabilities, supporting adoption of advanced materials. Strategic investments in construction and power generation further boost demand. However, limited local production capacity creates reliance on imports.

Market Segmentations:

By Resin:

By Technology:

- Solvent Based

- Dispersion/Water Based

By Application:

- Energy & Power

- Metal Processing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The High Temperature Composite Resin Market is shaped by key players including Huntsman International LLC, Henkel AG & Co., UBE Industries, Ltd., Nexam Chemical Holding AB, Mitsui Chemicals Inc., Arkema S.A., Royal Tencate N.V., Hexion Inc., Solvay S.A., and DIC Corporation. The High Temperature Composite Resin Market is defined by strong innovation, advanced manufacturing capabilities, and strategic expansion. Companies focus on developing high-performance resin systems that offer superior thermal resistance, structural integrity, and durability. Product differentiation through enhanced formulations, low-VOC content, and sustainable technologies strengthens market positioning. Many firms invest heavily in R&D to meet strict aerospace, automotive, and energy industry standards. Strategic alliances with OEMs help increase market reach and application versatility. Expansion into emerging markets, capacity upgrades, and cost optimization further enhance competitiveness. Growing demand for lightweight and heat-resistant materials encourages continuous product advancement and market consolidation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In December 2024, Carlisle Companies Inc. announced that it has agreed to acquire the expanded polystyrene (EPS) insulation segment of PFB Holdco, Inc., a portfolio company of the Riverside Company.

- In April 2024, YOFC announced the acquisition of RFS Suzhou and RFS Germany to expand its presence in the international cable markets. Both companies are known for their significant international brand presence and robust customer base.

- In June 2023, PPG Industries, Inc. introduced PPG ENVIRO-PRIME EPIC 200R coatings, a range of electrocoat (e-coat) products that offer lower temperature curing compared to alternative technologies. These coatings deliver sustainability advantages to customers by reducing energy consumption and minimizing CO2 emissions during the manufacturing process.

- In May 2023, Huntsman announced new epoxy materials designed to enhance electric vehicle battery integration, offering quick curing, high strength, and reduced weight. These epoxy resins enable faster production up to 30% quicker of high-performance battery protection components, improving durability and design flexibility.

Report Coverage

The research report offers an in-depth analysis based on Resin, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising adoption in aerospace and defense applications.

- Demand will grow steadily in electric vehicles and renewable energy projects.

- Manufacturers will focus on developing eco-friendly and recyclable resin systems.

- Advanced automation and digital manufacturing will support production efficiency.

- Asia Pacific will emerge as a major hub for high-performance resin manufacturing.

- Strategic collaborations with OEMs will drive application diversification.

- R&D investments will increase to enhance thermal stability and material strength.

- Regulatory pressure will push companies toward sustainable and low-emission technologies.

- Emerging economies will offer strong growth opportunities through infrastructure expansion.

- Product innovations will strengthen market competitiveness and global presence.