Market Overview

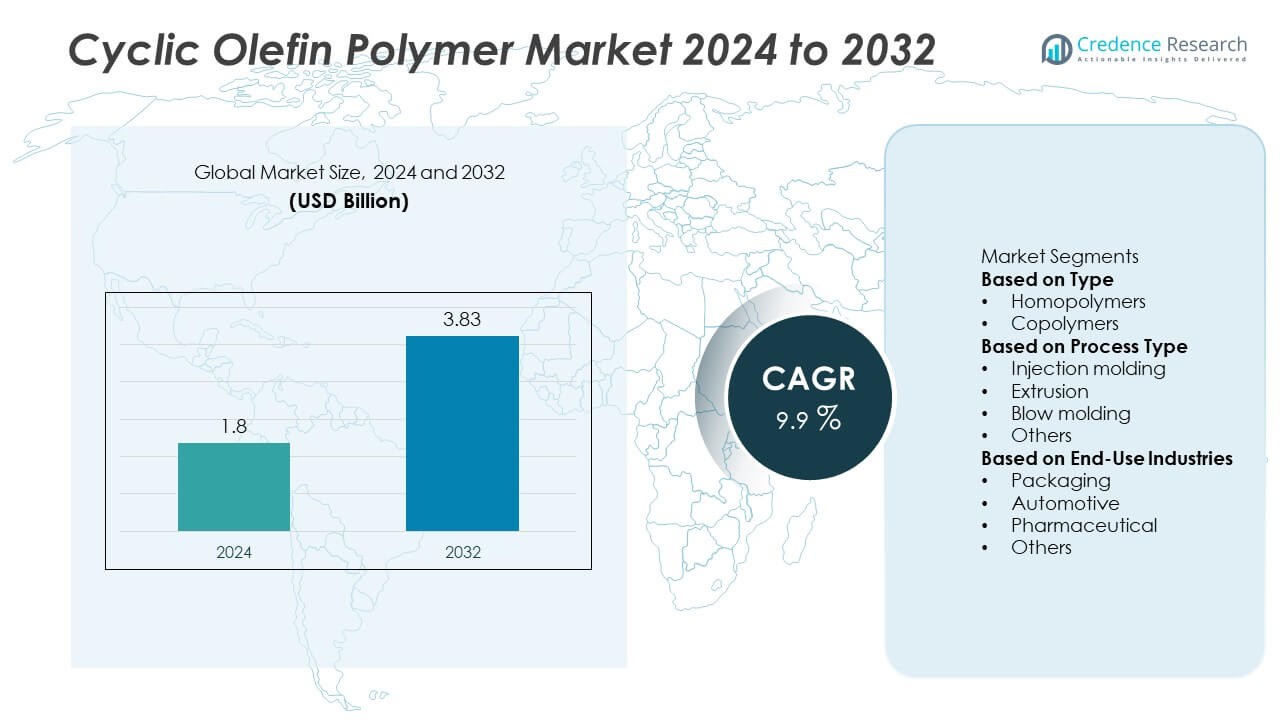

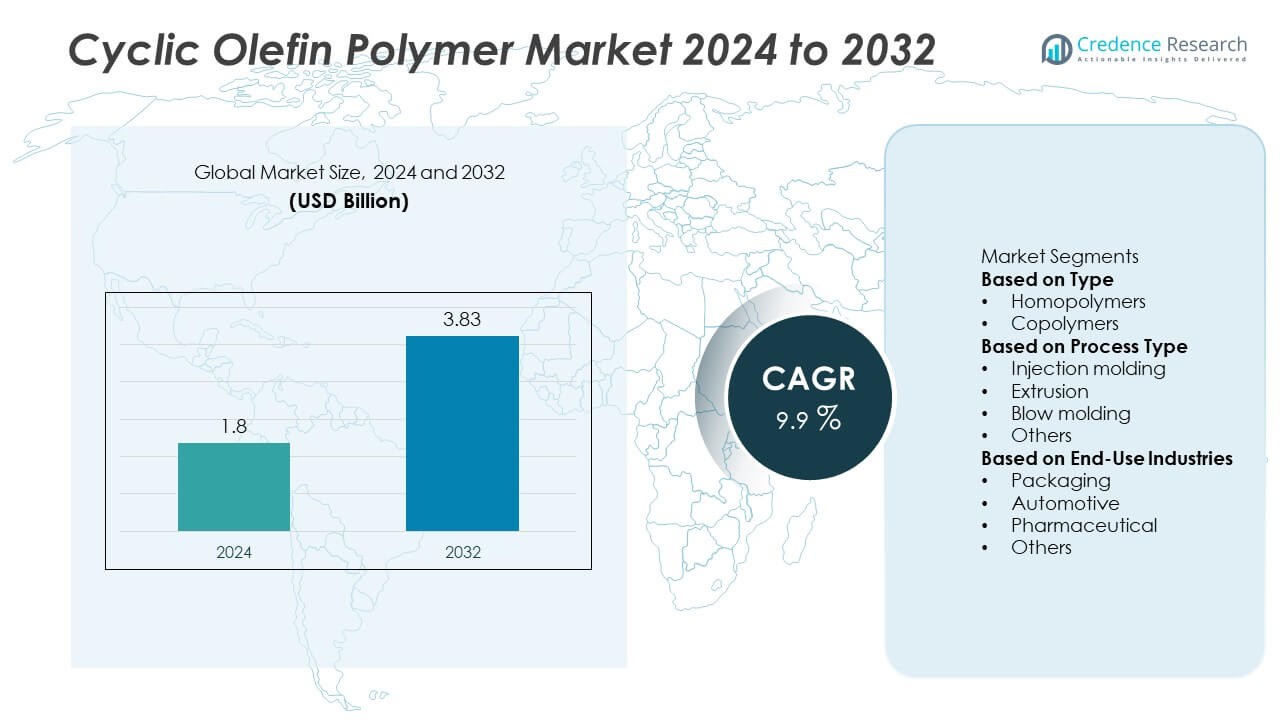

The Cyclic Olefin Polymer (COP) market was valued at USD 1.8 billion in 2024 and is projected to reach USD 3.83 billion by 2032, growing at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cyclic Olefin Polymer (COP) Market Size 2024 |

USD 1.8 Billion |

| Cyclic Olefin Polymer (COP) Market, CAGR |

9.9% |

| Cyclic Olefin Polymer (COP) Market Size 2032 |

USD 3.83 Billion |

The cyclic olefin polymer market is led by major players such as Mitsui Chemicals, SK Chemicals, Dow Chemical Company, Boehringer Ingelheim, JSR, INEOS Group, Polyplastics, SCHOTT, Idemitsu Kosan, and Cyclo Olefin Copolymer (COC) Japan. These companies dominate through advanced product innovation, high-quality polymer production, and strong global distribution networks. Mitsui Chemicals and SK Chemicals lead in medical-grade materials, while Dow and INEOS focus on packaging and optical applications. Asia-Pacific leads the market with a 33% share, driven by robust pharmaceutical and electronics manufacturing, followed by North America with 32% and Europe with 28%, reflecting widespread industrial adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The cyclic olefin polymer market was valued at USD 1.8 billion in 2024 and is projected to reach USD 3.83 billion by 2032, growing at a CAGR of 9.9%.

- Rising demand for high-purity, transparent, and chemical-resistant materials in medical and pharmaceutical packaging drives market growth.

- Key trends include advancements in bio-based COPs, lightweight packaging solutions, and expansion into optical and electronic applications.

- Leading players such as Mitsui Chemicals, SK Chemicals, and Dow Chemical Company focus on innovation, product diversification, and sustainable manufacturing.

- Asia-Pacific leads with a 33% share, followed by North America at 32% and Europe at 28%, while the copolymers segment holds the largest 68% share due to superior performance in healthcare and electronics applications.

Market Segmentation Analysis:

By Type

The copolymers segment dominated the cyclic olefin polymer market with a 68% share in 2024. Its dominance is attributed to superior optical clarity, impact resistance, and moisture barrier properties compared to homopolymers. Copolymers are widely used in pharmaceutical vials, optical lenses, and flexible packaging films due to their excellent processability and chemical stability. Rising demand from medical and electronics industries further supports segment growth. The versatility of copolymers in applications requiring high purity and low extractables continues to drive adoption across healthcare and consumer goods sectors.

- For instance, Mitsui Chemicals developed its APEL™ 5014DP copolymer with a refractive index of 1.53 and a glass transition temperature of 142°C, specifically for precision optical lenses. The material achieves moisture absorption of less than 0.01 % and surface haze below 0.1 %, ensuring high transparency for diagnostic and imaging devices.

By Process Type

Injection molding accounted for the largest 46% share of the cyclic olefin polymer market in 2024. The process enables high-precision manufacturing of medical devices, optical components, and lightweight automotive parts. Its efficiency in producing complex, durable, and transparent components supports increasing preference over conventional plastics. Manufacturers favor injection molding for its compatibility with high-performance COP grades and cost-effective mass production capabilities. Growing adoption of advanced molding technologies in the medical and packaging industries is further strengthening the segment’s leadership in the global market.

- For instance, Polyplastics introduced TOPAS® 5013L-10, optimized for injection molding of microfluidic and diagnostic components, featuring a melt flow rate of 13 g/10 min at 260°C and a modulus of 2.4 GPa. The polymer maintains optical transmission above 92 % at 550 nm and dimensional stability within ±0.02 mm during high-speed molding.

By End-Use Industries

The pharmaceutical segment held a dominant 39% share of the cyclic olefin polymer market in 2024. Demand is driven by the material’s superior chemical resistance, transparency, and biocompatibility, making it ideal for drug packaging, syringes, and diagnostic devices. Its low moisture absorption and compatibility with sterilization processes enhance pharmaceutical product safety. Packaging and automotive industries are also witnessing steady uptake due to the polymer’s lightweight and clarity advantages. Increasing investments in biologics and sterile drug delivery systems continue to reinforce COP’s role as a preferred material in pharmaceutical applications globally.

Key Growth Drivers

Rising Demand in Pharmaceutical and Medical Applications

The growing use of cyclic olefin polymers in pharmaceutical packaging and medical devices is a major growth driver. Their superior moisture barrier, chemical resistance, and optical clarity make them ideal for syringes, vials, and diagnostic containers. Increasing preference for high-purity materials in biologics and injectable drugs enhances adoption. The shift toward transparent, non-reactive polymers over glass reduces contamination risks and improves durability. Expanding healthcare infrastructure and regulatory support for advanced packaging materials are further strengthening market demand across developed and emerging regions.

- For instance, SCHOTT AG produces high-quality prefillable polymer syringes using cyclic olefin copolymer (COC), which are highly break-resistant and offer precise dimensions for consistent dosing, along with excellent oxygen and moisture barrier properties.

Growing Adoption in Optical and Electronic Components

Cyclic olefin polymers are gaining traction in optical and electronic applications due to their high light transmission and dimensional stability. Their use in camera lenses, optical films, and sensors supports product miniaturization and performance consistency. Rising demand for lightweight and transparent materials in consumer electronics accelerates adoption. The growing penetration of advanced imaging systems and high-definition displays also contributes to segment growth. Manufacturers are leveraging COP’s low birefringence and heat resistance to enhance product functionality in precision optical technologies.

- For instance, Zeon Corporation developed an advanced optical-grade cyclo-olefin polymer (COP) resin with light transmittance exceeding 91% across the UVA to NIR wavelengths, and very low birefringence.

Increasing Focus on Sustainable and Lightweight Packaging

Rising environmental awareness and regulatory pressure are driving demand for lightweight, recyclable packaging materials. COPs offer superior mechanical strength and clarity, enabling thinner yet durable packaging films. The food, beverage, and healthcare sectors are adopting these materials to reduce waste and improve product shelf life. Companies are also developing bio-based COPs to align with sustainability goals. The polymer’s compatibility with existing recycling streams and reduced carbon footprint further position it as a preferred alternative to conventional plastics in premium packaging applications.

Key Trends and Opportunities

Advancements in Bio-Based and Recyclable COPs

The development of bio-based cyclic olefin polymers presents a major opportunity for sustainable growth. Manufacturers are investing in renewable feedstocks to reduce dependence on petrochemicals. Emerging production techniques are enhancing recyclability without compromising optical and thermal properties. The trend aligns with global initiatives to promote circular economy models and reduce plastic waste. Companies introducing eco-friendly COP variants are gaining traction among environmentally conscious industries. These innovations not only expand market penetration but also open new avenues in green packaging and medical applications.

- For instance, SK Chemicals offers bio-based copolyesters under its ECOZEN brand derived from plant-based raw materials like corn. ECOZEN materials feature high transparency, heat resistance, and chemical resistance.

Integration in High-Performance Automotive Components

Automotive manufacturers are increasingly adopting COPs for lightweight optical components and sensor covers. The polymer’s transparency, thermal stability, and weather resistance make it suitable for LiDAR lenses and headlight housings. Growing demand for electric and autonomous vehicles enhances the need for advanced materials with optical clarity and low weight. COP’s superior molding capabilities enable complex component design while maintaining precision. As vehicle electronics and sensor technologies evolve, the integration of COP-based materials presents strong opportunities for innovation and market expansion.

- For instance, Idemitsu Kosan produces various high-performance polymers, including Syndiotactic Polystyrene (SPS) and Polycarbonate (PC) for demanding applications like automotive parts and electronics.

Key Challenges

High Production and Material Costs

The high manufacturing cost of cyclic olefin polymers compared to conventional plastics poses a significant challenge. Complex polymerization processes and limited raw material availability contribute to higher prices. This restricts large-scale adoption in cost-sensitive industries such as packaging and consumer goods. Producers are investing in process optimization and large-scale production to reduce costs. However, competition from lower-cost materials like polyethylene and polypropylene continues to pressure market margins, particularly in emerging economies where affordability remains a key purchasing factor.

Limited Awareness and Processing Complexity

Despite strong material advantages, limited awareness among end-users and technical complexity in processing hinder broader adoption. The need for specialized molding and extrusion equipment increases setup costs for manufacturers. Inadequate understanding of COP’s benefits in new applications slows penetration in untapped markets. Additionally, the lack of standardized processing guidelines affects material consistency and performance optimization. Expanding educational initiatives, enhancing technical support, and strengthening supply chain collaboration are essential to overcoming these barriers and achieving sustainable market growth.

Regional Analysis

North America

North America held a 32% share of the cyclic olefin polymer market in 2024, driven by strong demand from pharmaceutical and medical device manufacturing. The United States leads regional growth due to extensive use of COP in vials, syringes, and diagnostic kits. Rising healthcare spending and the presence of key packaging producers support sustained adoption. The region’s emphasis on replacing glass and polycarbonate materials with lightweight, high-performance polymers further enhances market expansion. Continuous R&D efforts in optical-grade applications and stringent safety regulations also contribute to North America’s steady market performance.

Europe

Europe accounted for a 28% share of the cyclic olefin polymer market in 2024, supported by established pharmaceutical, electronics, and packaging industries. Germany, Switzerland, and the United Kingdom are major contributors due to advanced medical technology production and stringent regulatory frameworks. The region’s focus on sustainability and recyclable materials drives increased COP usage in eco-friendly packaging solutions. Demand from optical films, diagnostic devices, and lightweight automotive components continues to grow. Ongoing investment in innovation and government support for clean material technologies further strengthen Europe’s competitive position in the global market.

Asia-Pacific

Asia-Pacific dominated the cyclic olefin polymer market with a 33% share in 2024, led by high production capacities and rapid industrialization in China, Japan, and South Korea. The growing pharmaceutical and electronics manufacturing base supports robust regional consumption. Increasing demand for precision medical packaging and high-clarity optical components drives sustained growth. Favorable government policies and expanding R&D investments in advanced materials encourage domestic production. The rise of consumer electronics and healthcare infrastructure development continues to position Asia-Pacific as the leading hub for COP innovation and export in the global market.

Latin America

Latin America captured a 4% share of the cyclic olefin polymer market in 2024, supported by growing medical and packaging industries. Brazil and Mexico are leading markets, driven by increased pharmaceutical production and the expansion of healthcare infrastructure. The region’s demand for high-performance, transparent materials is strengthening due to modernization in diagnostic and laboratory equipment. Rising imports from Asian manufacturers and gradual adoption of advanced molding technologies are fueling regional growth. Efforts toward establishing local polymer processing capabilities are expected to further improve supply efficiency and market participation in the coming years.

Middle East & Africa

The Middle East & Africa held a 3% share of the cyclic olefin polymer market in 2024. Market growth is supported by rising investments in pharmaceutical packaging and medical device production across the Gulf region. The United Arab Emirates and Saudi Arabia are leading contributors due to ongoing healthcare modernization projects. Growing awareness of high-purity, chemical-resistant polymers in healthcare and diagnostics supports gradual market adoption. In Africa, expanding diagnostic centers and laboratory applications are driving small-scale demand. Government initiatives promoting industrial diversification and advanced material usage continue to shape regional market development.

Market Segmentations:

By Type

By Process Type

- Injection molding

- Extrusion

- Blow molding

- Others

By End-Use Industries

- Packaging

- Automotive

- Pharmaceutical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cyclic olefin polymer market includes key players such as Mitsui Chemicals, SK Chemicals, Dow Chemical Company, Boehringer Ingelheim, JSR, INEOS Group, Polyplastics, SCHOTT, Idemitsu Kosan, and Cyclo Olefin Copolymer (COC) Japan. These companies are focusing on expanding their product portfolios and enhancing production efficiency to meet rising global demand from pharmaceutical, packaging, and electronics sectors. Mitsui Chemicals and SK Chemicals lead with extensive R&D investments and diversified COP grades catering to high-performance applications. Dow and INEOS emphasize material innovation to improve optical clarity, recyclability, and processing stability. Partnerships with medical device manufacturers and advancements in injection molding technologies are strengthening global competitiveness. Additionally, the focus on sustainable manufacturing and bio-based polymer development is shaping strategic initiatives across the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsui Chemicals

- SK Chemicals

- Dow Chemical Company

- Boehringer Ingelheim

- JSR

- INEOS Group

- Polyplastics

- SCHOTT

- Idemitsu Kosan

- Cyclo Olefin Copolymer (COC) Japan

Recent Developments

- In June 2025, INEOS Group (via its Olefins & Polymers Europe business) received first deliveries of pyrolysis oil feedstock at its Lavera site, enabling production of virgin-quality high-performance polymers including COP grades suited for medical packaging.

- In 2025, SK Chemicals did showcase its latest sustainable recycling innovations for the automotive sector at the 2025 Auto Parts Industry ESG∙Net-Zero Expo.

- In May 2024, Dow Chemical Company signed an MOU with SCGC to transform 200 kt/a of plastic waste into circular polymer products by 2030 – this underpins the feedstock security for advanced COC/COP materials.

Report Coverage

The research report offers an in-depth analysis based on Type, Process Type, End-Use Industries and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for cyclic olefin polymers will grow with expanding pharmaceutical and medical packaging needs.

- Adoption in optical and electronic components will increase due to superior transparency and stability.

- Development of bio-based and recyclable COPs will gain momentum in sustainable manufacturing.

- Advanced molding and extrusion technologies will improve production efficiency and precision.

- Rising use in lightweight automotive components will strengthen industrial applications.

- Collaborations between material producers and device manufacturers will drive product innovation.

- Expansion in Asia-Pacific will continue as regional manufacturing capacities grow.

- Research in high-clarity and high-heat-resistant grades will enhance product versatility.

- Stringent regulations for medical safety and purity will support wider market acceptance.

- Investment in R&D for customized polymer formulations will open new commercial opportunities.