Market Overview:

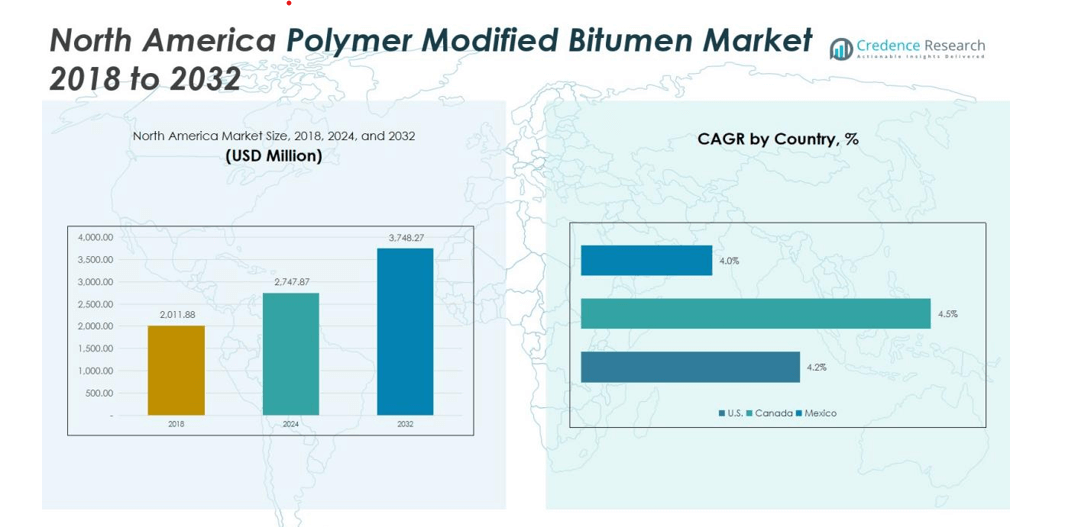

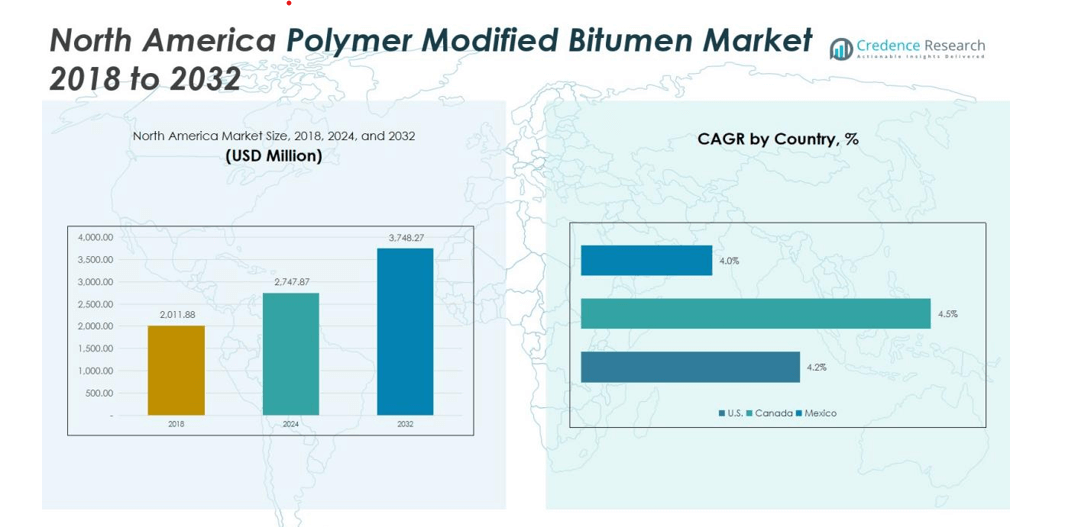

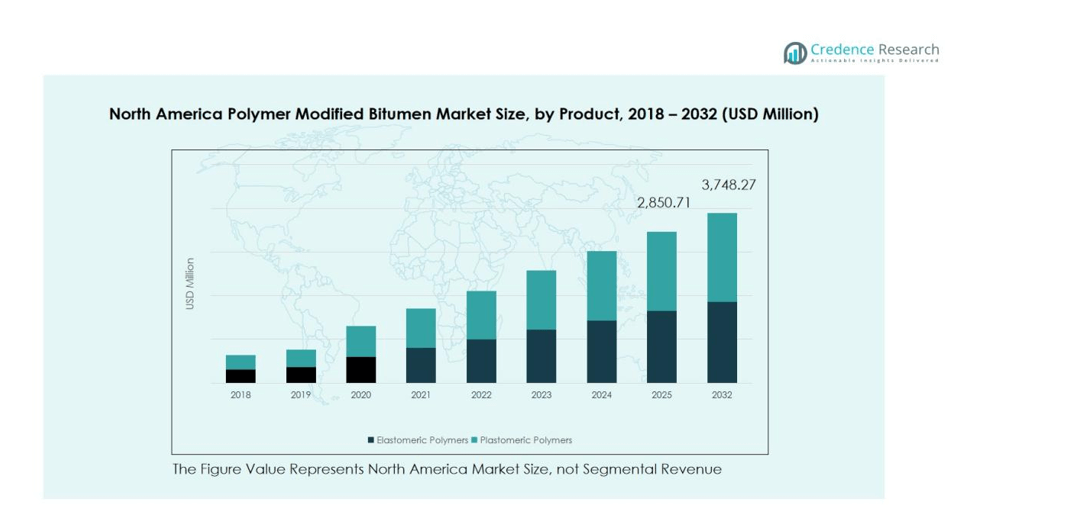

The North America Polymer Modified Bitumen Market size was valued at USD 2,011.88 million in 2018 to USD 2,747.87 million in 2024 and is anticipated to reach USD 3,748.27 million by 2032, at a CAGR of 4.58% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Polymer Modified Bitumen Market Size 2024 |

USD 2,747.87 million |

| North America Polymer Modified Bitumen Market, CAGR |

4.58% |

| North America Polymer Modified Bitumen Market Size 2032 |

USD 3,748.27million |

The rising demand for sustainable and high-performance construction materials is driving market expansion. Governments and private contractors are increasingly using polymer modified bitumen for road rehabilitation, roofing, and waterproofing applications due to its superior performance and cost efficiency. The ongoing investments in infrastructure modernization and the growing focus on reducing maintenance costs further accelerate product adoption across the construction and transportation sectors.

Regionally, the United States dominates the North America Polymer Modified Bitumen Market, driven by extensive highway networks and large-scale federal infrastructure projects. Canada follows closely with rising investments in urban infrastructure and cold-climate road applications that benefit from enhanced thermal resistance. Mexico represents an emerging market, supported by rapid industrialization, growing construction activity, and increased government spending on transportation connectivity and sustainable infrastructure development.

Market Insights:

- The North America Polymer Modified Bitumen Market was valued at USD 2,011.88 million in 2018, reached USD 2,747.87 million in 2024, and is projected to reach USD 3,748.27 million by 2032, registering a CAGR of 4.58% during the forecast period.

- The United States accounted for 58% of the regional share in 2024, supported by large-scale federal infrastructure projects and advanced highway networks. Canada held 27% due to strong adoption in cold-climate applications and sustainable construction programs, while Mexico captured 15% through growing transport and industrial expansion.

- Mexico is expected to be the fastest-growing regional market with a 5.3% CAGR, driven by the National Infrastructure Program and increasing investments in logistics and urban development.

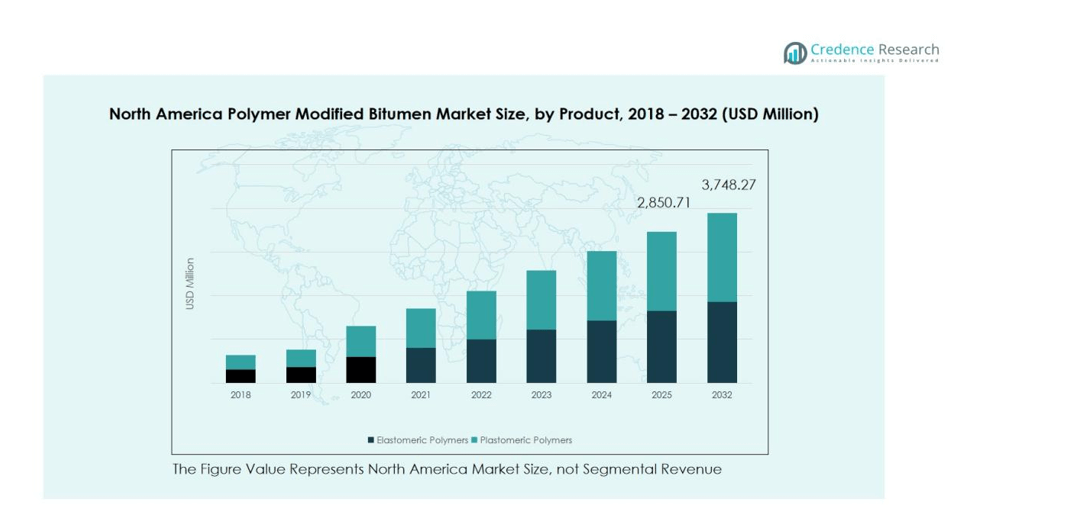

- The elastomeric polymer segment dominated the market with 64% share in 2024, led by the widespread use of SBS and SBR polymers offering high flexibility and thermal resistance.

- Road construction remained the leading application with 71% share, supported by ongoing modernization of transportation infrastructure and rising preference for durable, low-maintenance pavement materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Infrastructure Modernization and Road Rehabilitation Projects

The North America Polymer Modified Bitumen Market benefits from extensive infrastructure modernization across the United States, Canada, and Mexico. Governments are investing heavily in road rehabilitation programs to enhance transportation efficiency and safety. Polymer modified bitumen offers better durability, reduced cracking, and improved load-bearing performance compared to conventional asphalt. It enables longer service life and lower maintenance costs, making it ideal for modern infrastructure projects. The focus on extending the lifespan of existing road networks supports steady market growth.

- For instance, the Volvo FH gas-powered model, updated in May 2025, employs an advanced selective catalytic reduction (SCR) system and can reduce CO₂ emissions by up to 100% on routes with access to renewable biogas.

Rising Demand for Sustainable and High-Performance Construction Materials

Sustainability initiatives are strengthening the demand for advanced bitumen formulations in the region. Polymer modified bitumen aligns with green construction goals due to its recyclability, energy efficiency, and ability to reduce material waste. It enhances pavement performance under temperature variations, minimizing frequent resurfacing. Construction companies are adopting polymer-modified solutions to meet stricter durability standards and environmental regulations. This shift drives consistent adoption across residential, commercial, and industrial infrastructure projects.

- For instance, in April 2025, Kraton Corporation launched its CirKular+ Paving Circularity Series enabling up to 50% reclaimed asphalt use in new surface mixes, significantly cutting greenhouse gas emissions while enhancing mix processability and lifespan.

Increasing Application in Roofing and Waterproofing Solutions

The roofing sector contributes significantly to the expansion of the North America Polymer Modified Bitumen Market. The product is widely used in roofing membranes and waterproofing systems due to its flexibility, UV resistance, and adhesion strength. Rising demand for energy-efficient and weather-resistant building materials fuels its integration in residential and commercial construction. It supports longer roof lifespan and better thermal insulation, improving overall building performance. This versatility broadens its use beyond road construction.

Technological Advancements and Product Innovation by Leading Manufacturers

Continuous innovation in polymer blending and bitumen modification technologies enhances product quality and performance. Manufacturers in the region are developing formulations tailored for diverse climates and heavy-traffic conditions. It improves elasticity, temperature stability, and bonding characteristics in extreme weather environments. The introduction of high-performance elastomers and reactive polymers supports customized applications across transportation and industrial sectors. These advancements strengthen market competitiveness and foster long-term adoption across multiple end uses.

Market Trends:

Adoption of Advanced Polymer Technologies to Enhance Performance and Longevity

The North America Polymer Modified Bitumen Market is witnessing strong growth through the adoption of advanced polymer technologies aimed at improving durability and performance. Manufacturers are developing blends using styrene-butadiene-styrene (SBS), ethylene-vinyl-acetate (EVA), and crumb rubber to achieve greater elasticity and fatigue resistance. It provides superior adhesion and flexibility under temperature variations, reducing surface cracking and rutting in high-stress environments. Research efforts are focused on reactive polymers that bond chemically with bitumen to create more stable mixtures. The shift toward high-modulus and temperature-resistant formulations supports the demand for high-performance road surfacing materials. These innovations align with infrastructure projects emphasizing longer service life and reduced maintenance costs across the region.

- For instance, BASF’s B2Last® reactive liquid polymeric additive chemically crosslinks within bitumen to increase the Useful Temperature Interval (UTI) by 10 to 15 °C.

Growing Focus on Green Construction Practices and Recycled Materials Integration

Sustainability remains a central trend shaping the North America Polymer Modified Bitumen Market. Governments and industry players are prioritizing eco-friendly construction materials to reduce carbon emissions and conserve natural resources. It drives the integration of recycled polymers, tire rubber, and reclaimed asphalt into bitumen modification processes. The trend supports circular economy initiatives while lowering dependence on virgin raw materials. Construction firms are also adopting warm mix asphalt technologies that enable lower production temperatures and reduced energy use. The growing emphasis on sustainable design and life-cycle performance encourages widespread adoption of polymer modified bitumen across highways, airports, and urban infrastructure projects in North America.

- For Instance, Arkema and Holcim’s Warm Mix Asphalt pilot in Boulder County successfully reduced production temperatures by nearly 50°F, lowering energy consumption by 15% while maintaining compaction performance.

Market Challenges Analysis:

High Production Costs and Complex Processing Requirements

The North America Polymer Modified Bitumen Market faces challenges related to high production and processing costs. The modification process demands precise temperature control, specialized mixing equipment, and high-quality polymers, which raise overall manufacturing expenses. It limits adoption among smaller contractors and municipalities with restricted budgets. The fluctuating prices of raw materials, such as styrene and elastomers, further impact profit margins for producers. Maintaining product consistency and performance across varying climates adds to operational complexity. These factors make cost optimization and process standardization key challenges for market participants.

Limited Awareness and Inconsistent Quality Standards Across Regions

Inconsistent regional specifications and limited awareness of polymer modified bitumen benefits hinder broader market penetration. Many local authorities still rely on conventional asphalt due to lack of technical knowledge and standard guidelines. It creates variability in product adoption and project performance outcomes across states and provinces. The absence of uniform testing and performance standards affects credibility among end users. Training initiatives and government-backed awareness programs are required to build trust and promote adoption. Overcoming these structural and educational gaps remains critical for achieving sustained market growth in North America.

Market Opportunities:

Expansion of Smart and Sustainable Infrastructure Projects Across the Region

The North America Polymer Modified Bitumen Market presents strong opportunities through large-scale smart and sustainable infrastructure projects. Governments in the United States, Canada, and Mexico are prioritizing resilient roadways and urban infrastructure designed for climate adaptability. It benefits from the material’s ability to deliver longer pavement life, reduced maintenance, and improved recyclability. Integration of polymer modified bitumen into green construction practices supports national sustainability targets. The growing focus on energy-efficient roads and reduced carbon emissions enhances product demand. These projects create long-term opportunities for manufacturers offering high-performance and eco-friendly formulations.

Rising Investments in Research and Customized Polymer Formulations

Growing research investments in advanced polymer chemistry are opening new prospects for tailored bitumen formulations. Manufacturers are developing solutions that perform effectively under diverse climatic and traffic conditions across North America. It enables wider adoption in cold-weather regions, high-traffic highways, and industrial facilities. The demand for region-specific and high-temperature-resistant products creates potential for niche market expansion. Collaboration between government agencies and research institutions supports innovation and standardization in performance-based materials. This focus on customized product development positions the market for sustained technological advancement and competitive differentiation.

Market Segmentation Analysis:

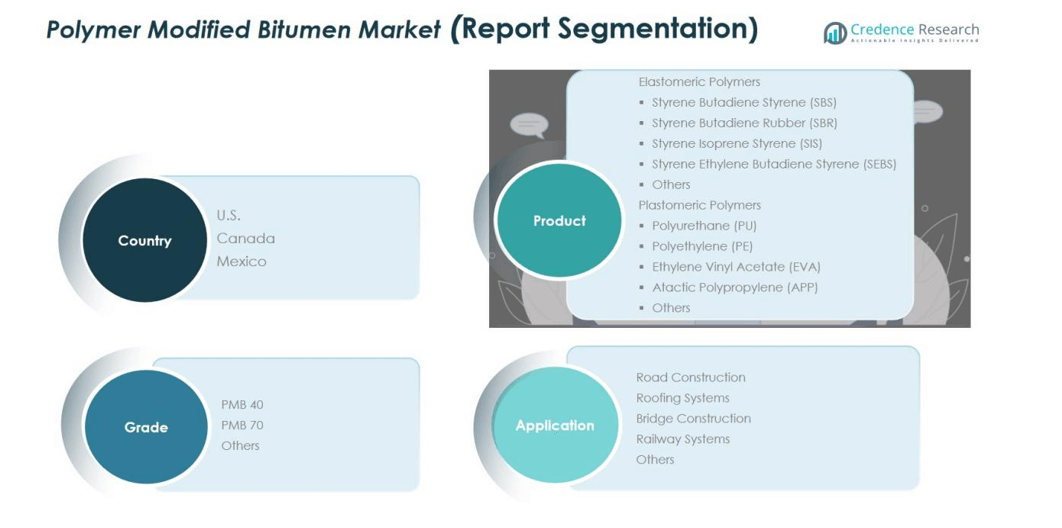

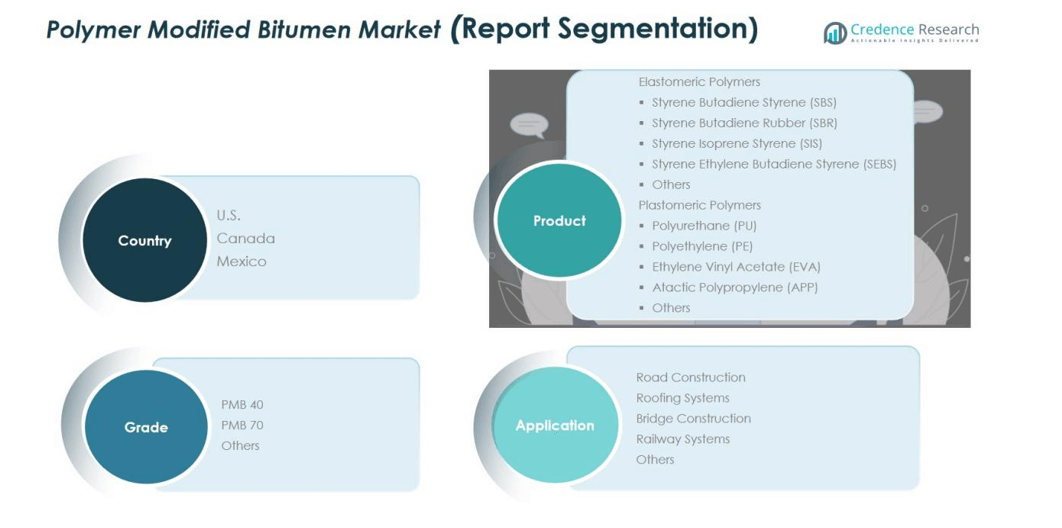

By Product Segment

The North America Polymer Modified Bitumen Market is segmented into elastomeric and plastomeric polymers. Elastomeric polymers, including Styrene Butadiene Styrene (SBS) and Styrene Butadiene Rubber (SBR), dominate the segment due to their superior flexibility, elasticity, and crack resistance. It performs well under heavy traffic and temperature variations, making it preferred for highways and bridges. Plastomeric polymers such as Polyethylene (PE) and Atactic Polypropylene (APP) are gaining traction in roofing and waterproofing applications for their strong adhesion and thermal stability. Continuous innovation in polymer blending enhances performance and widens usage across construction sectors.

- For instance, ExxonMobil’s Paving Bitumen 30/40 AF (an APP-modified grade) retains at least 53% of its original penetration after Rolling Thin Film Oven aging at 163 °C, demonstrating improved aging resistance and adhesion performance.

By Grade Segment

The market is categorized into PMB 40, PMB 70, and others. PMB 40 holds a significant share due to its balanced stiffness and elasticity, suitable for medium-traffic roadways. PMB 70 is favored in regions requiring high load-bearing capacity and extreme temperature resistance. It is widely used in urban highways and industrial pavements. The demand for performance-based grades continues to rise with stricter durability standards and quality specifications in road infrastructure.

- For instance, TotalEnergies’ Styrelf PMB 40 (HYMA) employs an innovative SBS polymer cross-linking process through a high-shear blending technique that enhances adhesion and doubles pavement life in high-stress zones, meeting AASHTO M332:2014 standards and sustaining thermal resistance up to 80°C.

By Application Segment

Road construction dominates the market, accounting for the largest application share driven by extensive rehabilitation and modernization projects. Roofing systems represent a growing segment supported by demand for energy-efficient and waterproof materials in residential and commercial buildings. Bridge and railway applications are expanding through public infrastructure investments. It continues to find diverse end uses due to high performance, longevity, and cost efficiency across multiple construction domains.

Segmentations:

By Product Segment

By Elastomeric Polymers

- Styrene Butadiene Styrene (SBS)

- Styrene Butadiene Rubber (SBR)

- Styrene Isoprene Styrene (SIS)

- Styrene Ethylene Butadiene Styrene (SEBS)

- Others

By Plastomeric Polymers

- Polyurethane (PU)

- Polyethylene (PE)

- Ethylene Vinyl Acetate (EVA)

- Atactic Polypropylene (APP)

- Others

By Grade Segment

By Application Segment

- Road Construction

- Roofing Systems

- Bridge Construction

- Railway Systems

- Others

By Country Segment (North America)

- United States

- Canada

- Mexico

Regional Analysis:

United States Dominating the Regional Market with Strong Infrastructure Investments

The United States holds the largest share of the North America Polymer Modified Bitumen Market, supported by extensive infrastructure development and government-led modernization programs. The U.S. Department of Transportation and state agencies are investing in highway expansion, bridge maintenance, and airport runway upgrades. It benefits from polymer modified bitumen’s superior flexibility, temperature resistance, and long-term durability in diverse climates. The adoption of performance-based asphalt binders is increasing across federal and state projects. Growing emphasis on sustainable and low-maintenance road materials strengthens domestic demand for advanced bitumen solutions.

Canada Focusing on Cold-Climate Road Durability and Sustainable Solutions

Canada represents a significant market driven by the need for resilient road materials capable of withstanding severe freeze-thaw cycles. The country’s infrastructure initiatives emphasize the use of polymer modified bitumen in highways, roofing, and waterproofing systems. It provides better adhesion and crack resistance in cold-weather applications, improving the life cycle of pavements. Canadian construction firms are increasingly adopting elastomer-modified grades to meet performance and environmental standards. Federal programs supporting green construction and infrastructure resilience continue to drive product uptake across provinces.

Mexico Emerging as a High-Growth Market through Industrial and Transport Expansion

Mexico is an emerging contributor to the North America Polymer Modified Bitumen Market, supported by expanding industrial zones and road connectivity projects. Government initiatives such as the National Infrastructure Program are fueling investments in highways and logistics corridors. It offers opportunities for manufacturers supplying temperature-stable and cost-effective bitumen products. Increasing foreign investment and urbanization are boosting demand for roofing and waterproofing materials in commercial buildings. The country’s growing construction sector and improving regulatory environment make it a key future growth center within the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ExxonMobil

- BIOTUM LLC

- Rosneft

- CEPSA

- MOL Group

- NIS Group

- Benzene International Pte Ltd

- Sika AG

- Royal Dutch Shell

- Infinity Galaxy

Competitive Analysis:

The North America Polymer Modified Bitumen Market features strong competition among global and regional players focusing on performance innovation and sustainability. Leading companies such as ExxonMobil, BIOTUM LLC, Rosneft, and CEPSA dominate through extensive distribution networks and advanced production capabilities. Key participants including MOL Group, NIS Group, Benzene International Pte Ltd, and Sika AG emphasize product diversification and customized polymer blends to meet varied climatic and application needs. It shows a clear trend toward partnerships with infrastructure developers and public agencies to expand project-based supply. Companies are investing in research to enhance bitumen flexibility, thermal resistance, and recyclability. The market remains moderately consolidated, with top players leveraging technological advancements and long-term contracts to maintain their competitive advantage across transportation, roofing, and industrial sectors.

Recent Developments:

- In October 2025, ExxonMobil showcased its latest Signature Polymers product portfolio and sustainable chemical innovations at the K 2025 exhibition in Düsseldorf, Germany, marking a significant product launch for its Product Solutions division.

- In September 2025, Rosneft signed a crude supply agreement with Chinese partners to deliver an additional 2.5 million tonnes of oil annually via Kazakhstan, strengthening long-term Sino-Russian energy trade ties.

Report Coverage:

The research report offers an in-depth analysis based on Product Segment, Grade Segment, Application Segment and Country Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Polymer Modified Bitumen Market will experience steady growth driven by infrastructure modernization and sustainability goals.

- Demand will increase for advanced polymer formulations offering high temperature resistance and long-term durability.

- Government programs promoting eco-friendly and resilient road materials will accelerate market adoption.

- Manufacturers will invest in R&D to develop region-specific blends suited for varying climate conditions.

- Recycling technologies integrating waste polymers and rubber into bitumen production will gain traction.

- The roofing and waterproofing segments will expand due to rising urban construction and green building initiatives.

- Public-private partnerships in transportation infrastructure will create new opportunities for material suppliers.

- Automation and digital quality control in asphalt plants will improve production efficiency and product consistency.

- Cross-border trade in modified bitumen between the U.S., Canada, and Mexico will strengthen regional supply chains.

- Sustainability certifications and environmental compliance standards will play a key role in shaping long-term competitiveness.