Market Overview:

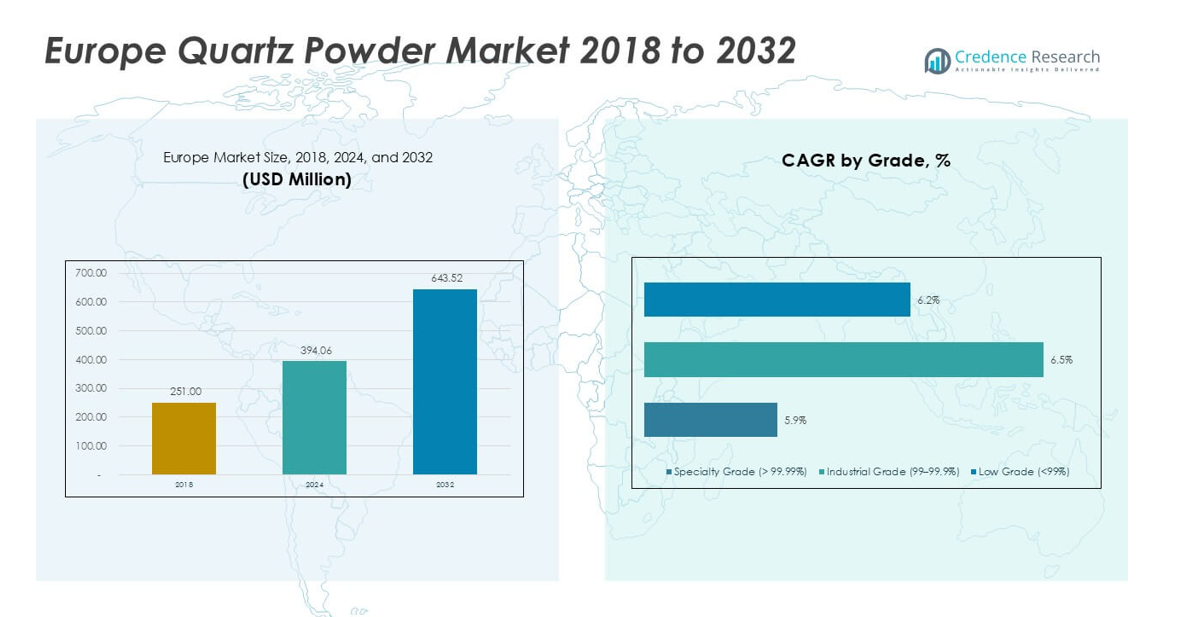

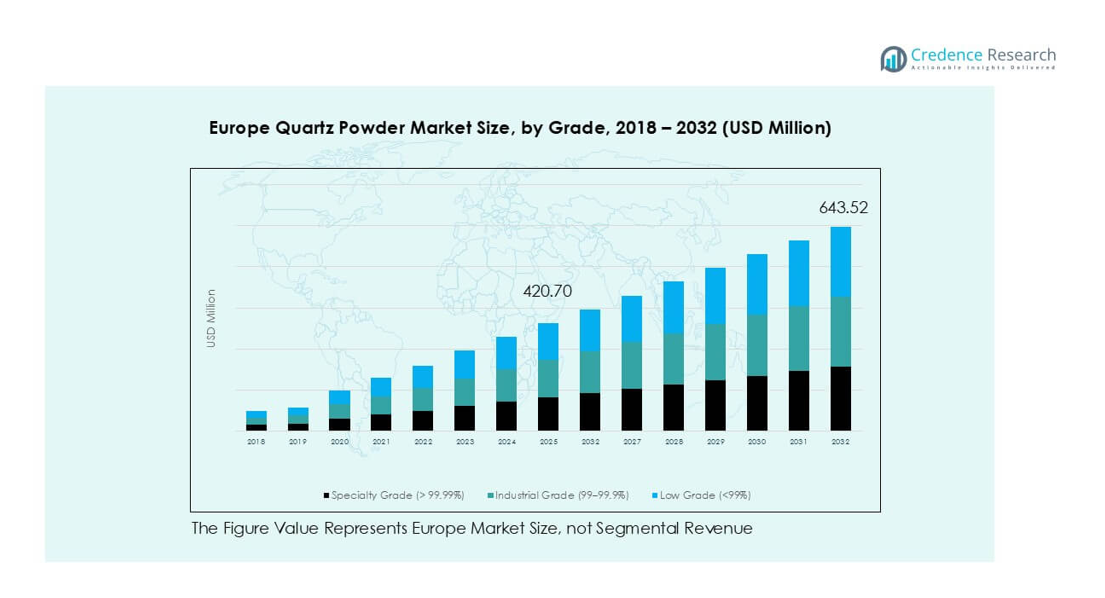

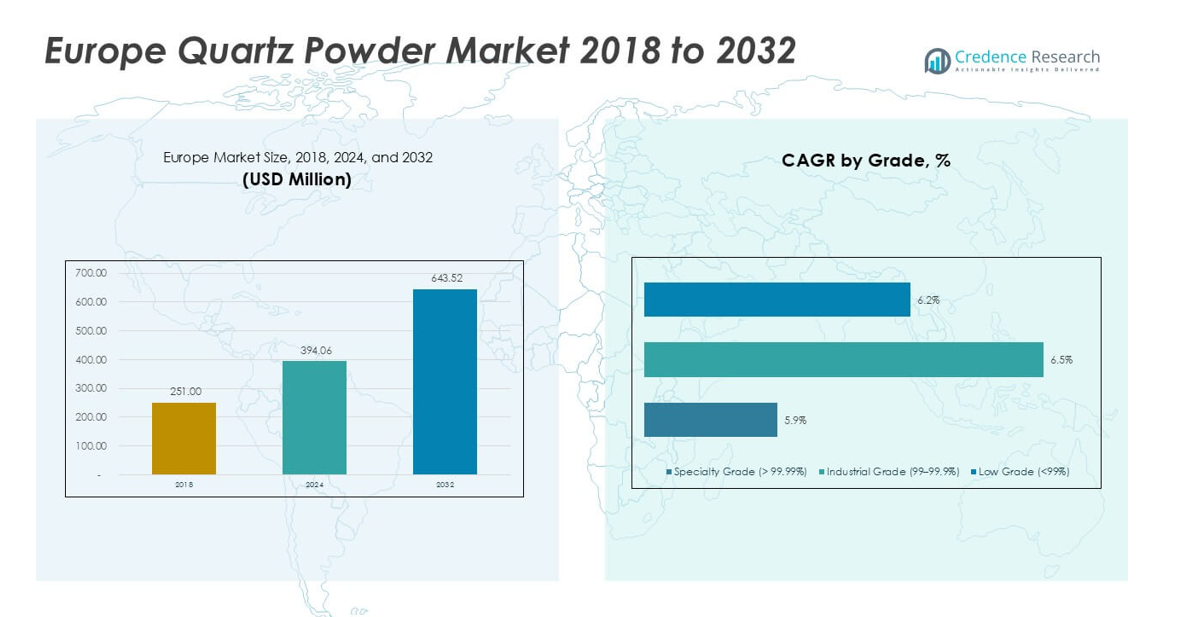

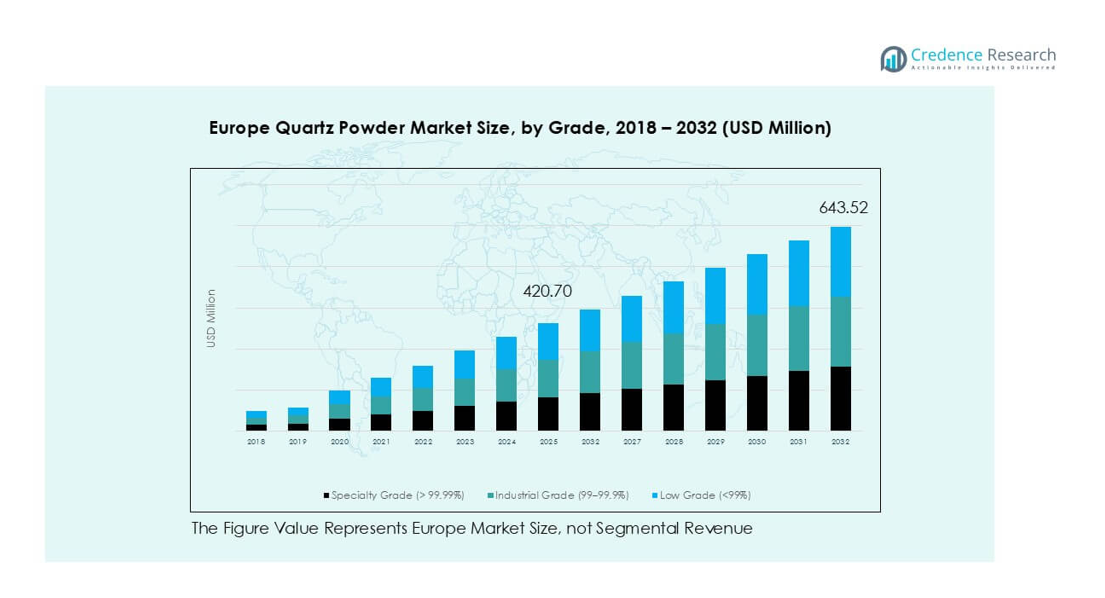

Europe Quartz Powder market size was valued at USD 251.00 million in 2018, increased to USD 394.06 million in 2024, and is anticipated to reach USD 643.52 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Powder Market Size 2024 |

USD 394.06 million |

| Europe Quartz Powder Market, CAGR |

6.3% |

| Europe Quartz Powder Market Size 2032 |

USD 643.52 million |

The Europe quartz powder market is led by major players such as Sibelco, Quarzwerke Group, Imerys S.A., Namoshel LLC, and EUROQUARZ, each holding strong positions through advanced processing technologies and diversified product portfolios. These companies dominate in high-purity and specialty-grade segments catering to semiconductors, solar, and glass manufacturing. Germany, with a 28% share, remains the leading regional market, followed by the United Kingdom (14%) and France (12%), supported by their robust electronics and glass industries. Competitive focus centers on refining efficiency, purity enhancement, and sustainability. Players are also expanding R&D efforts to develop ultra-pure, fine-mesh, and spherical quartz powders for next-generation industrial and electronic applications, reinforcing Europe’s technological and environmental leadership in the global quartz powder industry.

Market Insights

- The Europe quartz powder market was valued at USD 394.06 million in 2024 and is projected to reach USD 643.52 million by 2032, growing at a CAGR of 6.3% during the forecast period.

- Growth is driven by rising demand from electronics and semiconductor industries, supported by expanding solar and glass manufacturing across major economies.

- Key trends include increasing adoption of ultra-pure and spherical quartz powders for high-performance applications and the integration of automated refining systems for improved product quality.

- The market is moderately consolidated, with major players such as Sibelco, Imerys S.A., Quarzwerke Group, and Namoshel LLC focusing on purity enhancement and sustainable production processes.

- Germany leads the regional market with a 28% share, followed by the UK (14%) and France (12%). By grade, specialty grade (>99.99%) holds a 52% share, while electronics and semiconductors dominate by application with a 39% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The specialty grade (>99.99%) segment dominated the Europe quartz powder market with a 52% share in 2024. Its dominance is driven by growing demand from semiconductor, solar, and optical applications that require ultra-pure materials for precision manufacturing. The segment benefits from technological advancements in refining and purification processes, ensuring high purity and consistent particle size. Manufacturers in Germany, France, and the Netherlands are increasingly investing in automated refining technologies to meet stringent quality standards set by electronics and photovoltaic industries.

- For instance, Heraeus Conamic in Germany produces synthetic fused quartz with 99.999% SiO₂ purity and impurity levels below 0.1 ppm for semiconductor crucibles and optical fiber preforms.

By Application

The electronics and semiconductors segment held the largest market share of 39% in 2024, supported by expanding chip fabrication and silicon wafer production across Europe. The rising adoption of electric vehicles and renewable energy systems further fuels demand for high-purity quartz powder in semiconductor-grade silicon production. Strong investments in microelectronics and 5G infrastructure across Germany and the UK also contribute to segment growth. Meanwhile, the glass and ceramics industry continues to be a significant consumer, benefiting from architectural and automotive glass applications.

- For instance, AGC Glass Europe employs high-purity quartz formulations in low-iron glass for solar panels with transmittance exceeding 91%.

Key Growth Drivers

Rising Demand from Electronics and Semiconductor Manufacturing

Europe’s growing semiconductor ecosystem is driving strong demand for high-purity quartz powder. The material’s superior thermal stability, dielectric strength, and low impurity levels make it essential for silicon wafer production and photolithography processes. Increasing investments by companies such as Infineon Technologies and STMicroelectronics in chip fabrication are expanding regional consumption. The shift toward electric vehicles and 5G-enabled devices is further accelerating quartz powder use in integrated circuits, sensors, and optical components. Supportive EU initiatives for semiconductor self-sufficiency are enhancing supply chain resilience, fueling long-term market expansion.

- For instance, Infineon Technologies operates a 300 mm wafer fabrication facility in Villach, Austria, utilizing quartz crucibles with 99.999% purity for monocrystalline silicon growth.

Expansion of Solar and Photovoltaic Installations

Quartz powder is a critical raw material for producing solar-grade silicon, driving demand from Europe’s expanding renewable energy sector. The EU’s carbon neutrality targets for 2050 and rising solar PV installations in Germany, Spain, and Italy are key contributors. The material’s purity and optical transparency improve the efficiency of photovoltaic cells, supporting the development of high-performance modules. Companies are investing in refining technologies to achieve ultra-pure grades for next-generation solar applications. Increasing domestic production capacity and government incentives for clean energy projects continue to strengthen market growth.

- For instance, Wacker Chemie is a global market leader in polysilicon production, using a modified Siemens process to create material for the semiconductor and photovoltaic industries. The company operates production sites in Burghausen and Nünchritz, Germany, and Charleston, Tennessee, with a total annual polysilicon production capacity of up to 80,000 metric tons.

Growth in Glass and Ceramics Manufacturing

The expanding glass and ceramics industries are another major driver of quartz powder demand in Europe. The material’s ability to enhance hardness, clarity, and thermal resistance makes it valuable for manufacturing specialty glass, optical lenses, and high-end ceramics. Growing use of energy-efficient building materials and premium interior products further increases consumption. In countries such as Italy, France, and Germany, rising construction activity and industrial modernization are fueling steady growth. Manufacturers are also developing fine-mesh quartz powder for precision glass molding and advanced ceramic components, ensuring consistent quality and high temperature performance.

Key Trends & Opportunities

Shift Toward Ultrapure and Spherical Quartz Powders

A major trend shaping the market is the increasing preference for ultrapure and spherical quartz powders in high-tech applications. Semiconductor and optical device manufacturers require uniform particle size and exceptional purity to enhance performance and reduce defects. European producers are investing in advanced synthesis technologies, such as plasma fusion and chemical vapor deposition, to meet these demands. The transition to smaller semiconductor nodes and high-frequency electronic components is further driving this shift. This trend offers opportunities for companies developing next-generation refining technologies and specialty powder formulations tailored to emerging electronic applications.

- For instance, Heraeus Conamic in Germany reports that its synthetic fused silica materials contain total metallic contamination below 1 part per million (ppm).

Rising Adoption in Advanced Composite Materials

Quartz powder is finding new opportunities in advanced composites for aerospace, automotive, and industrial applications. Its incorporation improves dimensional stability, mechanical strength, and heat resistance of epoxy resins and coatings. As Europe accelerates its transition to lightweight and sustainable materials, demand for quartz-based composites continues to grow. Manufacturers are exploring nano-quartz formulations for high-performance adhesives, paints, and polymer coatings. Collaborative research between material science institutes and industrial producers is also fostering innovation in composite reinforcement technologies, opening new market avenues across high-value engineering sectors.

Key Challenges

High Energy Consumption and Production Costs

The energy-intensive nature of quartz powder processing remains a major challenge in Europe. Refining and purification processes, especially those achieving >99.99% purity, require high-temperature furnaces and advanced filtration systems that increase operational costs. Rising electricity prices and strict emission regulations further strain profitability for producers. Companies face pressure to invest in cleaner, more efficient manufacturing technologies, such as plasma refining or renewable-powered operations. While these innovations improve sustainability, they also demand significant capital investments, posing barriers for small and mid-sized manufacturers in maintaining cost competitiveness.

Limited Availability of High-Quality Quartz Reserves

Access to high-quality quartz reserves with low iron and aluminum impurities is limited in Europe. This scarcity compels manufacturers to rely on imports from Asia and Africa, leading to supply chain vulnerabilities and fluctuating raw material prices. Environmental restrictions on mining operations also constrain domestic resource expansion. The dependency on imported raw quartz affects pricing stability and production timelines, particularly for specialty-grade powder. Companies are increasingly exploring recycling and synthetic quartz production methods to reduce reliance on mined resources, but scaling these alternatives remains technologically and economically challenging.

Regional Analysis

United Kingdom

The United Kingdom accounted for 14% share of the Europe quartz powder market in 2024. The country’s growing electronics, optical instruments, and construction sectors are major contributors to demand. Rising adoption of energy-efficient building materials and precision components supports market expansion. The semiconductor and solar industries are increasingly sourcing high-purity quartz powder for wafer and photovoltaic applications. Domestic producers are focusing on sustainable refining processes to align with the UK’s net-zero emission goals. The ongoing transition toward advanced manufacturing and renewable energy solutions continues to strengthen long-term market prospects.

France

France held a 12% market share in 2024, supported by a robust glass and ceramics industry. The nation’s architectural, automotive, and luxury glass manufacturing sectors use high-grade quartz powder for enhanced clarity and strength. Growing investments in solar power projects and semiconductor materials further contribute to demand. French manufacturers are integrating automated purification systems to improve material consistency. The government’s emphasis on industrial decarbonization and circular economy initiatives also encourages eco-friendly production practices. Strategic collaborations with electronic component suppliers enhance domestic supply chain stability in specialty-grade quartz powder.

Germany

Germany dominated the regional market with a 28% share in 2024, driven by its advanced electronics, semiconductor, and solar industries. Strong presence of major wafer manufacturers and photovoltaic firms ensures steady consumption of high-purity quartz powder. The country’s focus on technological innovation and precision manufacturing strengthens demand across automotive optics and industrial applications. Ongoing R&D in nanostructured quartz materials supports its role in high-performance coatings and sensors. Moreover, Germany’s sustainability-focused regulations promote the use of eco-efficient refining technologies, ensuring consistent product quality and regional market leadership.

Italy

Italy captured a 10% share of the Europe quartz powder market in 2024, primarily supported by its expanding glass, ceramics, and construction materials industries. The country’s decorative and industrial ceramics manufacturers rely on quartz powder to improve product durability and thermal stability. Growing architectural glass production for sustainable buildings also drives consumption. Investments in advanced milling and particle-sizing technologies enhance competitiveness among domestic producers. Furthermore, Italy’s strong presence in art glass and luxury design segments contributes to steady demand for specialty-grade quartz powder.

Spain

Spain held an 8% market share in 2024, driven by increasing use of quartz powder in solar, construction, and coatings applications. The nation’s rapid adoption of photovoltaic systems and sustainable infrastructure projects fuels growth. Spanish manufacturers are focusing on fine-mesh quartz powder for precision ceramics and paint formulations. Government initiatives promoting renewable energy and building efficiency enhance domestic demand. Additionally, Spain’s proximity to key raw material sources in North Africa strengthens supply reliability for industrial-grade producers, supporting market stability and regional expansion.

Russia

Russia accounted for 11% of the regional market in 2024, led by growing applications in oil and gas, glass manufacturing, and construction materials. The country’s vast industrial base drives steady consumption of industrial-grade quartz powder. Demand is supported by ongoing modernization of energy infrastructure and increased domestic glass production. However, logistical challenges and trade restrictions impact access to advanced refining technologies. Russian producers are gradually improving processing efficiency and exploring export opportunities in Eastern Europe, aiming to enhance market competitiveness in the long term.

Rest of Europe

The Rest of Europe segment, comprising Poland, the Netherlands, Belgium, and Nordic countries, represented a 17% market share in 2024. These nations are witnessing growing adoption of quartz powder in electronics, solar modules, and industrial coatings. The Netherlands and Belgium benefit from strong semiconductor supply chains, while Poland’s construction sector contributes significantly to volume demand. Increasing emphasis on renewable energy integration and high-performance materials enhances regional growth prospects. Manufacturers are investing in precision milling and ultra-pure quartz processing facilities to cater to expanding high-tech manufacturing needs across Northern and Eastern Europe.

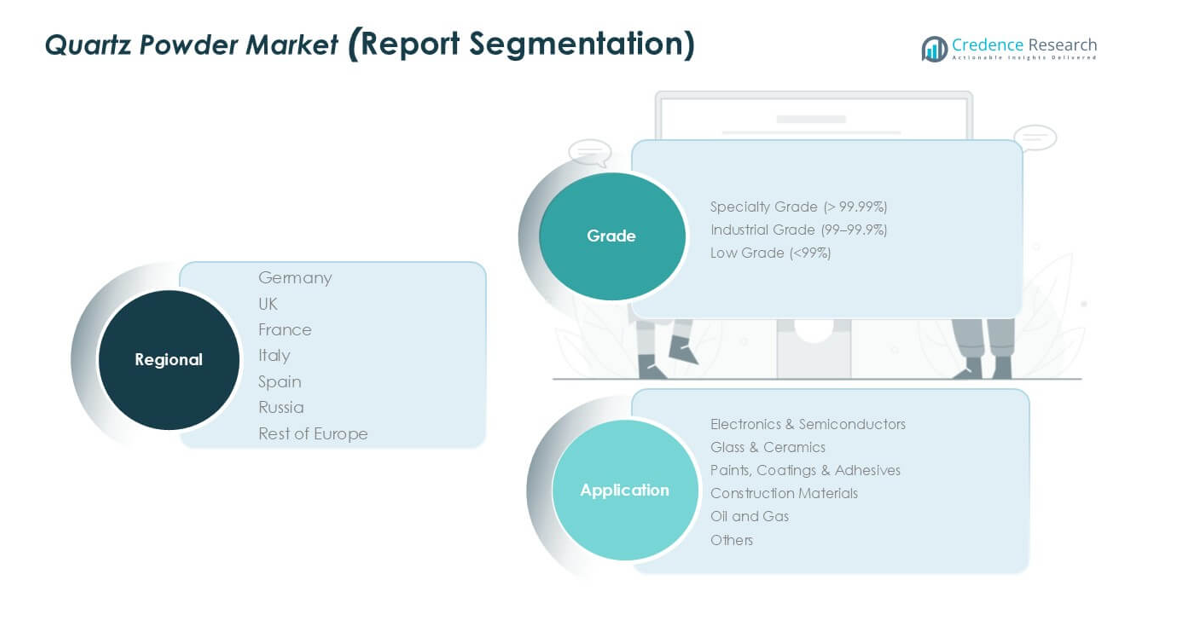

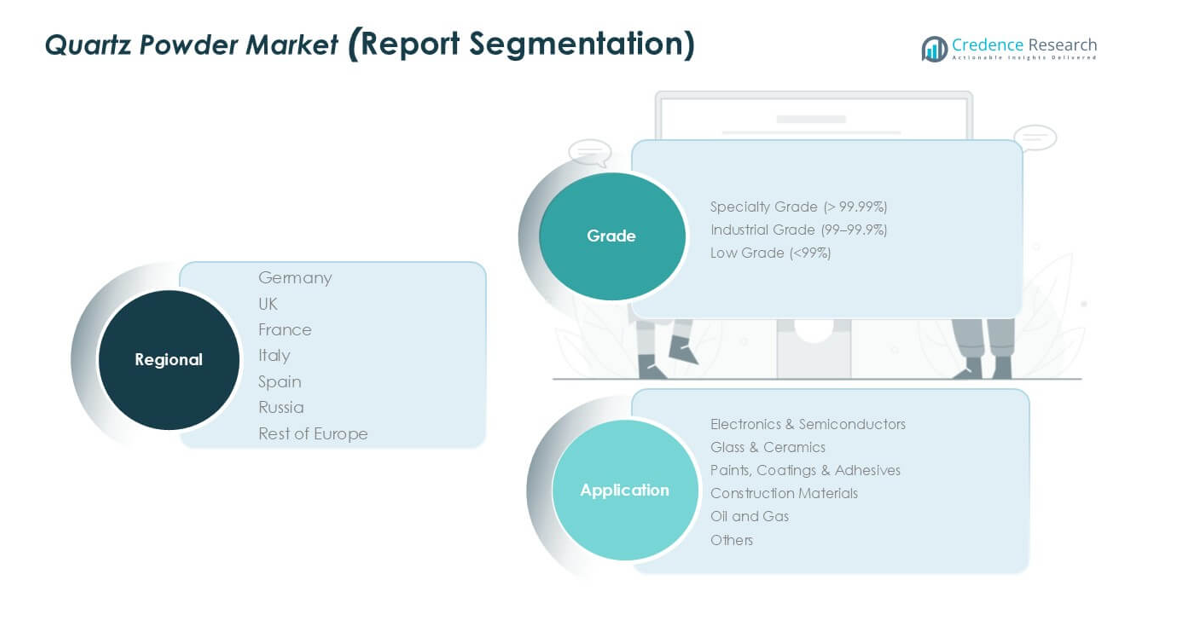

Market Segmentations:

By Grade

- Specialty Grade (> 99.99%)

- Industrial Grade (99–99.9%)

- Low Grade (<99%)

By Application

- Electronics & Semiconductors

- Glass & Ceramics

- Paints, Coatings & Adhesives

- Construction Materials

- Oil and Gas

- Others

By Geography

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe quartz powder market is moderately consolidated, with key players such as Namoshel LLC, Sibelco, Quarzwerke Group, Imerys S.A., and EUROQUARZ leading the regional landscape. These companies focus on high-purity production, advanced refining technologies, and customized powder formulations to serve industries such as electronics, solar energy, and specialty glass. Strategic partnerships and regional expansion are common approaches to enhance supply reliability and product reach. For instance, manufacturers are increasing investments in automated purification systems and clean-energy-based operations to meet EU sustainability targets. Smaller firms like Speciality Geochem and PAL Quartz compete by offering niche grades for ceramics, coatings, and construction materials. Continuous innovation in fine-mesh and spherical quartz powder, along with advancements in nano-processing, is intensifying competition. The competitive emphasis remains on purity, consistency, and cost efficiency, as producers align with Europe’s industrial modernization and green manufacturing initiatives to strengthen market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Namoshel LLC

- Eon Enterprises

- EUROQUARZ

- Sibelco

- The Sharad Group

- Speciality Geochem

- Quarzwerke Group

- Imerys S.A.

- PAL Quartz

- HTMC Group

- Other Key Player

Recent Developments

- In August 2024, Caesarstone introduced The Time Collection, which included ten new items, seven of which were new Porcelain colors and three Mineral Surfaces. These Mineral Surfaces represent a big step forward in surface design and are a testament to Caesarstone’s latest innovation. Using its vast expertise and advanced technology, the company has developed surfaces that combine minerals like Feldspar and Quartz with recycled content to create surfaces that are better performing and better for the environment.

- In January 2023, Caesarstone Ltd. declared the launch of its line of multi-material surfaces, which includes porcelain and natural stone in addition to outdoor quartz.

- In December 2022, Kyocera Corporation announced its purpose to invest 1.3 trillion yen ($9.78 billion), or through March 2026, in novel chip component manufacturing and the evolution of other sectors of its capabilities.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz powder will rise with Europe’s semiconductor and solar expansion.

- Technological advancements in refining and purification will enhance material quality and efficiency.

- Growing renewable energy projects will increase the need for solar-grade quartz powder.

- Adoption of ultra-fine and spherical quartz forms will expand in electronics and optical applications.

- Construction and glass industries will continue driving steady industrial-grade quartz consumption.

- Sustainability goals will push manufacturers toward low-emission and energy-efficient production methods.

- Strategic collaborations will strengthen local supply chains and reduce import dependency.

- Increasing R&D in nano-quartz materials will create opportunities in coatings and composites.

- Automation and digital process monitoring will improve operational consistency and cost control.

- Germany will maintain leadership, while Eastern Europe will emerge as a key growth region.