Market Overview:

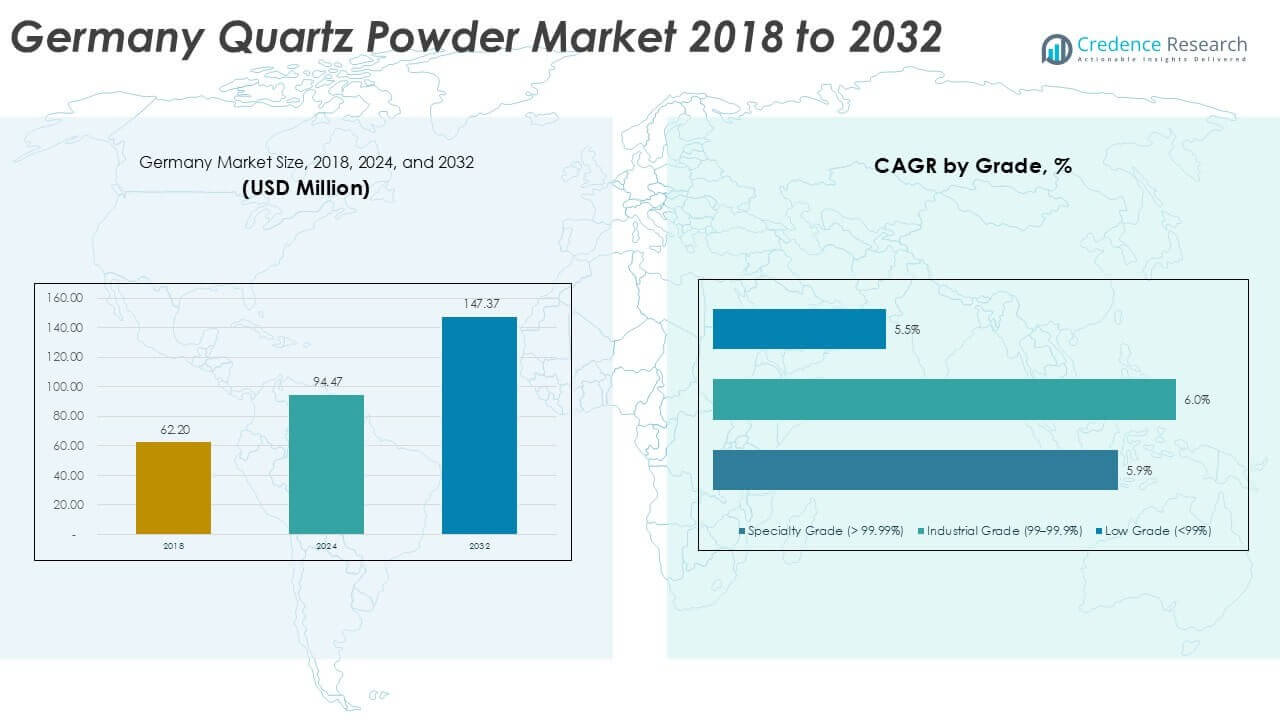

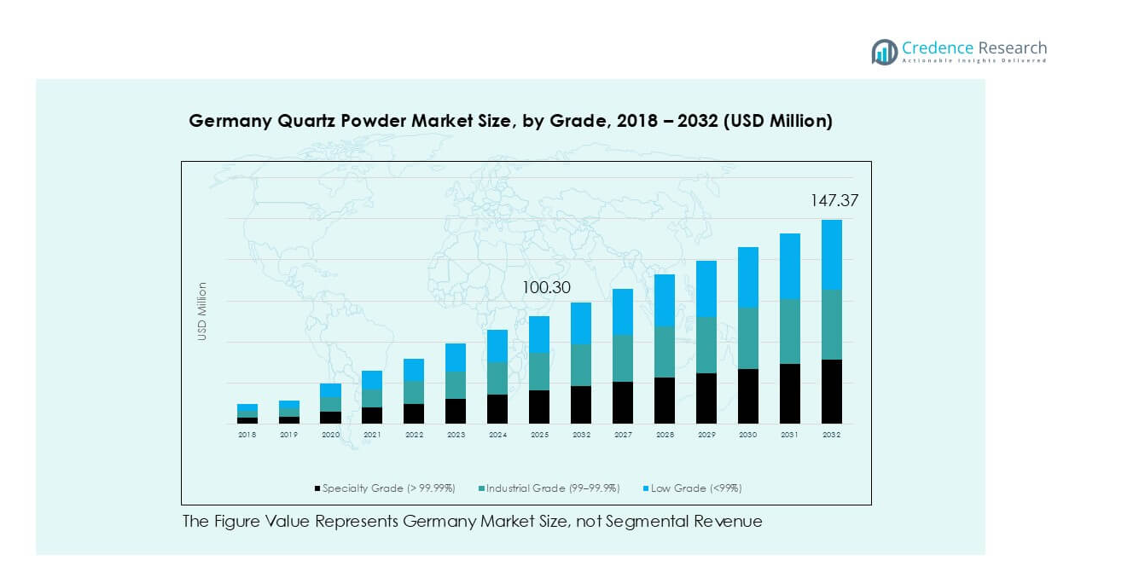

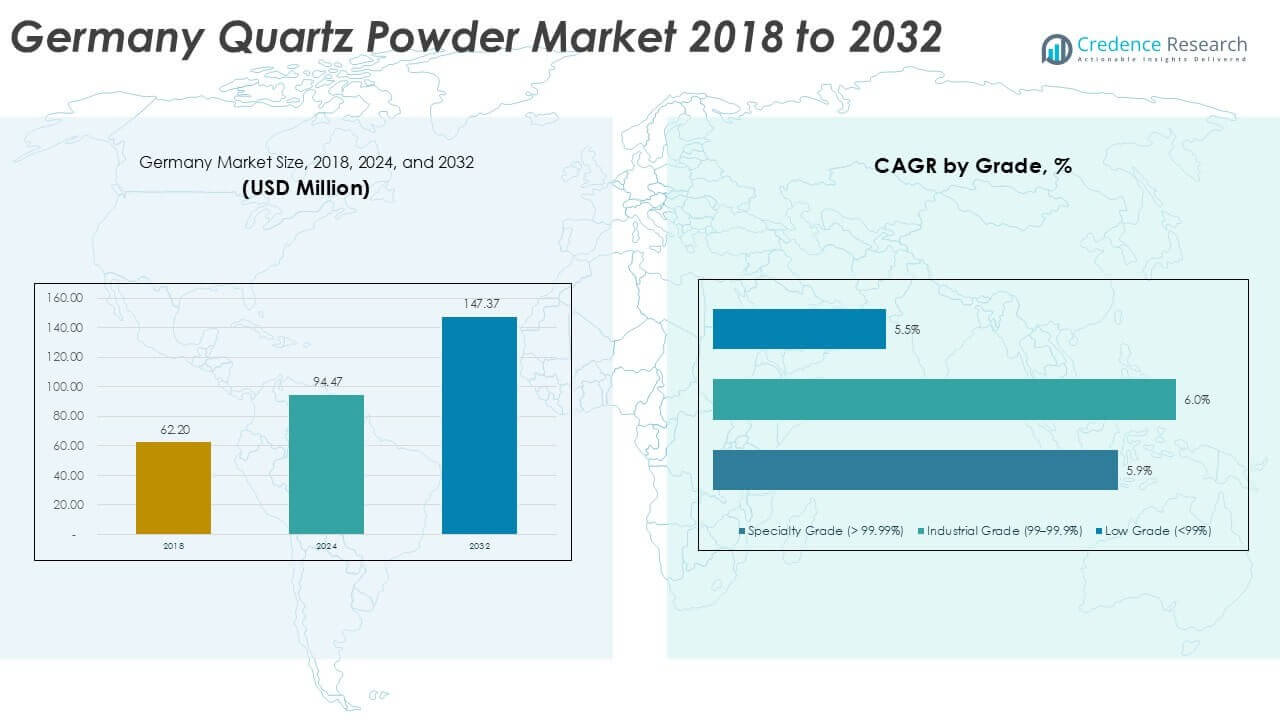

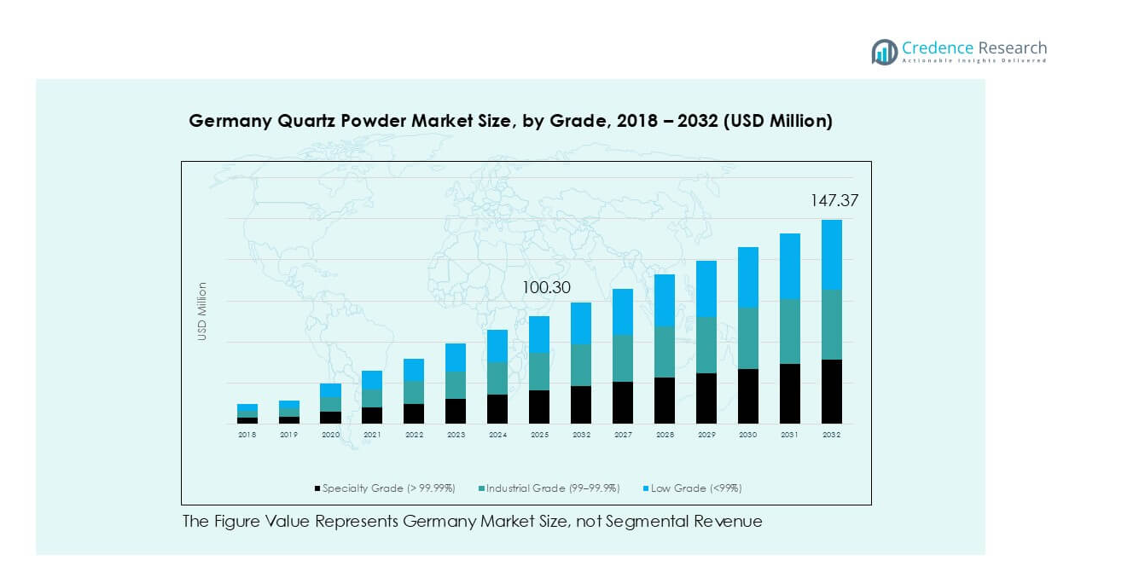

Germany Quartz Powder market size was valued at USD 62.20 million in 2018, reaching USD 94.47 million in 2024, and is anticipated to reach USD 147.37 million by 2032, growing at a CAGR of 5.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Quartz Powder Market Size 2024 |

USD 94.47 million |

| Germany Quartz Powder Market, CAGR |

5.7% |

| Germany Quartz Powder Market Size 2032 |

USD 147.37 million |

The Germany quartz powder market is led by major players such as Quarzwerke Group, Sibelco, Imerys S.A., BritEx Enterprises, and Advanced Ceramics, which collectively account for over 60% of the market share in 2024. These companies dominate through strong production capabilities, advanced purification technologies, and long-term supply partnerships with glass and semiconductor manufacturers. Southern Germany emerged as the leading region, holding a 33% share, driven by a robust electronics and automotive base. Northern and Western regions followed, supported by growing solar glass and construction applications. Continuous innovation, energy-efficient processing, and high-purity product development remain key competitive priorities among top producers.

Market Insights

- The Germany quartz powder market was valued at USD 94.47 million in 2024 and is projected to reach USD 147.37 million by 2032, growing at a CAGR of 5.7% during the forecast period.

- Growth is driven by rising demand in electronics and semiconductors, which held 42% of the market share, supported by expanding wafer production and cleanroom manufacturing.

- The market trend favors high-purity specialty grade quartz, accounting for 48% of total demand, as industries shift toward advanced materials for precision components and solar glass.

- The market is moderately consolidated, with Quarzwerke Group, Sibelco, and Imerys S.A. leading through technological innovation and sustainable refining practices, while smaller players target niche industrial and construction applications.

- Southern Germany led the market with a 33% share in 2024, followed by Northern Germany at 28%, driven by semiconductor and glass manufacturing clusters supported by strong regional infrastructure and export capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

The specialty grade segment held the largest share of the Germany quartz powder market in 2024, accounting for over 48%. This dominance is driven by its ultra-high purity level above 99.99%, which is essential for semiconductor fabrication and solar cell production. Specialty-grade quartz powder offers superior thermal stability and minimal trace metal contamination, making it ideal for high-end electronics. Industrial-grade quartz, with 99–99.9% purity, follows closely due to its use in precision glass and ceramics manufacturing. Meanwhile, low-grade quartz remains limited to low-cost construction and filler applications.

- For instance, Heraeus Conamic (now operating as Heraeus Covantics) produces ultra-high purity synthetic fused silica with metallic contamination well below 1 part per million (ppm) for the semiconductor industry, including materials used in EUV lithography.

By Application

The electronics and semiconductors segment dominated the German quartz powder market in 2024, capturing nearly 42% of total demand. This leadership results from growing investments in wafer fabrication and advanced microchip production, particularly within Germany’s semiconductor clusters. Quartz powder is used in crucibles, diffusion tubes, and high-purity glass components. The glass and ceramics segment ranks second, driven by strong demand for optical and technical glass. Other applications, including paints, coatings, and construction, continue to expand gradually with infrastructure modernization and energy-efficient building materials.

- For instance, Infineon Technologies employs quartz crucibles with 99.999% SiO₂ purity at its Dresden and Villach fabs for 300 mm wafer crystal growth.

Key Growth Drivers

Expanding Electronics and Semiconductor Manufacturing

Germany’s strong semiconductor base fuels quartz powder demand, particularly in wafer production, diffusion tubes, and crucibles. The growing adoption of electric vehicles and advanced chips in automotive systems increases domestic silicon wafer output. Companies are investing heavily in cleanroom facilities requiring ultra-pure quartz materials. The EU’s Chips Act and Germany’s support for local semiconductor fabs, such as Infineon and GlobalFoundries, reinforce market growth. High-purity quartz powder’s ability to withstand extreme thermal and chemical environments makes it vital for maintaining manufacturing precision in next-generation electronics applications.

- For instance, Heraeus Conamic supplies synthetic quartz glass for Deep Ultraviolet (DUV) lithography optics, where the material’s high transmission rates (over 90%) in the deep ultraviolet range are critical for improving chip yield consistency.

Rising Demand in Glass and Ceramics

The glass and ceramics segment contributes significantly to the market’s expansion due to its use in high-performance products. Germany’s advanced glass manufacturing sector relies on quartz powder for producing optical glass, labware, and high-temperature resistant materials. The push toward energy-efficient windows and renewable energy components, like photovoltaic glass, also drives demand. Moreover, the shift toward lightweight, durable glass in automotive and architectural applications supports long-term growth. Manufacturers are investing in refining processes that enhance powder uniformity and purity to meet strict European quality standards.

- For instance, SCHOTT AG utilizes high-purity quartz formulations in specialty and optical glass, achieving thermal stability above 1,000 °C for automotive and labware products.

Industrial Modernization and Infrastructure Development

Germany’s focus on sustainable construction and industrial modernization supports quartz powder consumption in coatings, adhesives, and construction materials. The mineral’s excellent hardness and chemical stability make it ideal for use in engineered stones, floorings, and polymer fillers. Increasing renovation projects across industrial and residential buildings boost the need for high-durability materials. Additionally, investments in energy-efficient industrial facilities promote the use of quartz-based composites. The integration of quartz in advanced industrial coatings also enhances resistance to corrosion and wear, improving product lifecycle and performance reliability.

Key Trend & Opportunities

Growing Integration of Quartz in Renewable Energy Systems

The expansion of renewable energy technologies presents a major opportunity for quartz powder applications. Quartz is a vital raw material in photovoltaic cell production, used for crucibles and silicon melting. Germany’s growing solar energy installations and government-backed incentives are increasing demand for locally sourced, high-purity quartz. Advancements in solar glass coatings and encapsulants are also opening new niches. As renewable energy infrastructure grows, suppliers are developing low-contamination quartz to enhance module efficiency and longevity, aligning with Germany’s carbon neutrality targets for 2045.

- For instance, Wacker Chemie’s global polysilicon production capacity is up to 80,000 metric tons annually, and the company produces different grades of ultra-pure polysilicon with metal impurity levels significantly lower than 0.1 ppm for its semiconductor and solar industry customers.

Advancements in High-Purity Processing Technologies

Technological progress in refining and purification processes offers strong opportunities for market players. Advanced beneficiation techniques now enable quartz with impurity levels below 10 ppm, improving its suitability for electronics and optical applications. German manufacturers are increasingly adopting automated and eco-friendly processing lines that reduce waste and improve consistency. This trend supports higher product value and aligns with EU environmental regulations. Collaborations between quartz producers and semiconductor manufacturers are fostering innovation in surface treatment and particle-size control, enhancing material compatibility with ultra-clean industries.

Key Challenges

Limited Availability of High-Purity Quartz Reserves

One of the major challenges for the German quartz powder market is the limited availability of natural high-purity quartz deposits. Dependence on imports from countries like Norway and the U.S. exposes producers to supply risks and fluctuating costs. Extracting and refining domestic quartz to meet semiconductor-grade purity is both capital-intensive and technically complex. Environmental restrictions on mining activities further constrain production scalability. As a result, manufacturers face higher operational costs and must rely on advanced beneficiation technologies or long-term sourcing agreements to ensure consistent material quality.

High Energy and Processing Costs

Quartz purification and micronization require significant energy input, leading to high production costs in Germany’s industrial setting. The country’s elevated electricity prices and strict environmental standards increase operational burdens for local manufacturers. Maintaining purity above 99.99% demands advanced heating and chemical processes, which drive up costs further. These challenges limit the competitiveness of domestic producers compared to low-cost Asian suppliers. To address this, companies are investing in energy-efficient processing technologies and renewable power integration to balance sustainability with cost competitiveness.

Regional Analysis

Northern Germany

Northern Germany accounted for around 28% of the Germany quartz powder market in 2024, supported by strong demand from the glass and solar industries. The region hosts major manufacturing hubs for photovoltaic components and specialty glass production, particularly in Lower Saxony and Schleswig-Holstein. Ports such as Hamburg facilitate quartz imports and exports, ensuring stable supply chains for high-purity materials. The rising deployment of solar energy projects and sustainable infrastructure initiatives continues to enhance consumption of high-grade quartz powder for industrial and renewable applications.

Southern Germany

Southern Germany dominated the quartz powder market with a 33% share in 2024, driven by its advanced electronics and semiconductor ecosystem. Bavaria and Baden-Württemberg serve as key industrial centers, hosting companies engaged in wafer fabrication, precision glassmaking, and high-performance ceramics. Strong automotive and engineering clusters further contribute to demand for high-purity quartz in coatings and adhesives. Regional emphasis on technological innovation and clean manufacturing supports continuous product quality improvements. The presence of leading R&D facilities and high-tech manufacturers sustains Southern Germany’s leadership in quartz powder utilization.

Western Germany

Western Germany held approximately 24% of the national quartz powder market in 2024. The region’s dominance stems from its well-developed construction, coatings, and chemical industries concentrated in North Rhine-Westphalia. Quartz powder is extensively used in advanced building materials, paints, and polymer composites across industrial corridors. The ongoing modernization of chemical facilities and emphasis on sustainable construction materials support long-term market growth. Access to major transportation networks and a skilled workforce further enhance the region’s competitiveness, enabling efficient distribution and industrial-scale manufacturing of quartz-based products.

Eastern Germany

Eastern Germany captured about 15% of the quartz powder market in 2024, showing steady growth supported by expanding renewable energy and industrial projects. States like Saxony and Brandenburg are emerging as semiconductor and solar manufacturing hubs under national reindustrialization programs. Investments in photovoltaic glass and energy-efficient material production are increasing local quartz consumption. The availability of lower-cost land and government incentives for technology industries attract new entrants. While smaller in scale than other regions, Eastern Germany’s industrial diversification and infrastructure development are strengthening its role in the country’s quartz powder value chain.

Market Segmentations:

By Grade

- Specialty Grade (> 99.99%)

- Industrial Grade (99–99.9%)

- Low Grade (<99%)

By Application

- Electronics & Semiconductors

- Glass & Ceramics

- Paints, Coatings & Adhesives

- Construction Materials

- Oil and Gas

- Others

By Geography

- Northern Germany

- Southern Germany

- Western Germany

- Eastern Germany

Competitive Landscape

The competitive landscape of the Germany quartz powder market is moderately consolidated, featuring both multinational corporations and regional producers focusing on purity, particle uniformity, and application-specific performance. Leading companies such as Quarzwerke Group, Sibelco, Imerys S.A., and BritEx Enterprises dominate through advanced refining technologies and strong supply networks. These players invest in process automation, mineral beneficiation, and sustainable mining practices to maintain high product standards. Domestic firms like The Sharad Group, Speciality Geochem, and PAL Quartz strengthen local supply by serving niche applications in ceramics, coatings, and construction materials. Strategic collaborations with semiconductor and glass manufacturers enhance long-term contracts for high-purity grades. Companies are also emphasizing eco-efficient production and circular material usage to align with EU sustainability goals. Intense competition centers on quality consistency, technological integration, and cost optimization, with ongoing R&D focusing on ultra-pure and renewable-energy-compatible quartz materials to meet growing industrial and energy sector demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BritEx Enterprises

- Eon Enterprises

- Advanced Ceramics

- Sibelco

- The Sharad Group

- Speciality Geochem

- Quarzwerke Group

- Imerys S.A

- PAL Quartz

- HTMC Group

- Other Key Players

Recent Developments

- In August 2024, Caesarstone introduced The Time Collection, which included ten new items, seven of which were new Porcelain colors and three Mineral Surfaces. These Mineral Surfaces represent a big step forward in surface design and are a testament to Caesarstone’s latest innovation. Using its vast expertise and advanced technology, the company has developed surfaces that combine minerals like Feldspar and Quartz with recycled content to create surfaces that are better performing and better for the environment.

- In January 2023, Caesarstone Ltd. declared the launch of its line of multi-material surfaces, which includes porcelain and natural stone in addition to outdoor quartz.

- In December 2022, Kyocera Corporation announced its purpose to invest 1.3 trillion yen ($9.78 billion), or through March 2026, in novel chip component manufacturing and the evolution of other sectors of its capabilities.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz powder will increase with the expansion of semiconductor fabrication in Germany.

- The glass and ceramics industry will continue adopting refined quartz grades for energy-efficient production.

- Renewable energy projects will boost the use of quartz in photovoltaic components and solar glass.

- Technological advancements in purification and particle-size control will enhance material quality.

- Local sourcing and recycling of quartz materials will gain importance under EU sustainability goals.

- Construction and coatings sectors will increasingly use quartz-based composites for durability and strength.

- Strategic alliances between quartz producers and electronics manufacturers will grow to secure long-term supply.

- Investments in eco-friendly mining and low-emission processing will become key competitive priorities.

- Regional players will expand production capacity to reduce dependence on imported quartz.

- Continued government support for green manufacturing will strengthen domestic quartz industry development.