Market Overview

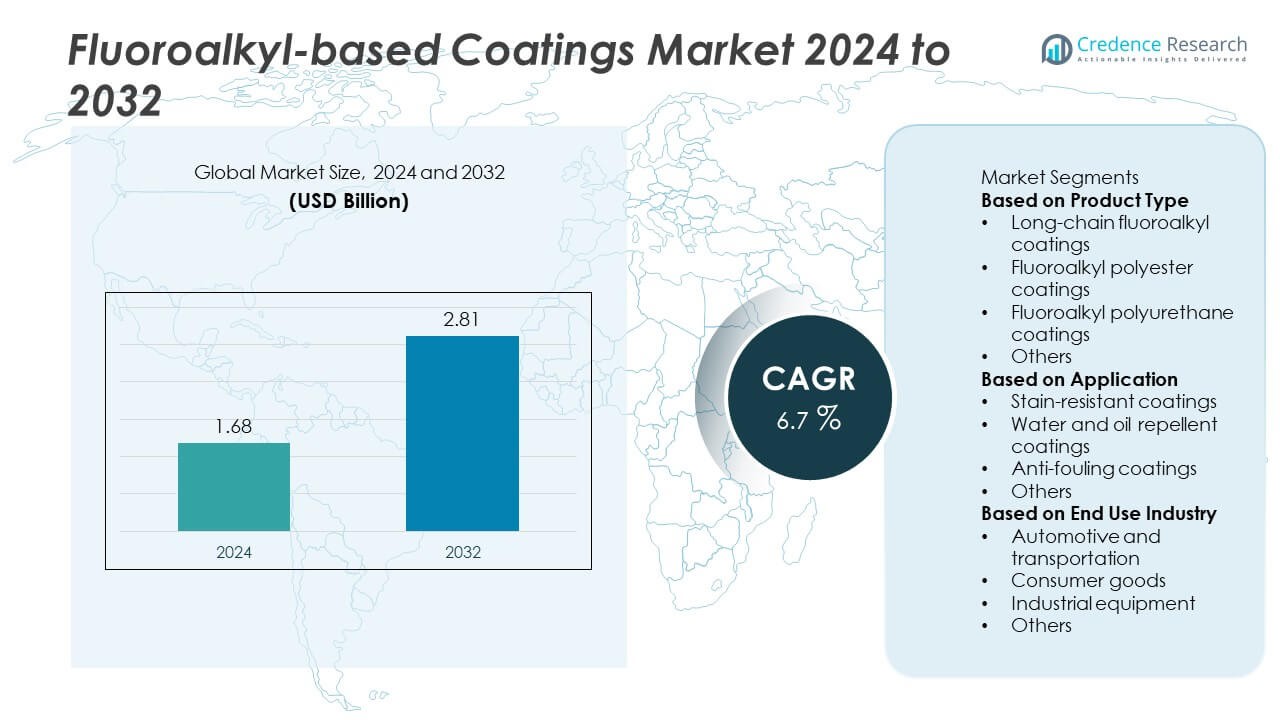

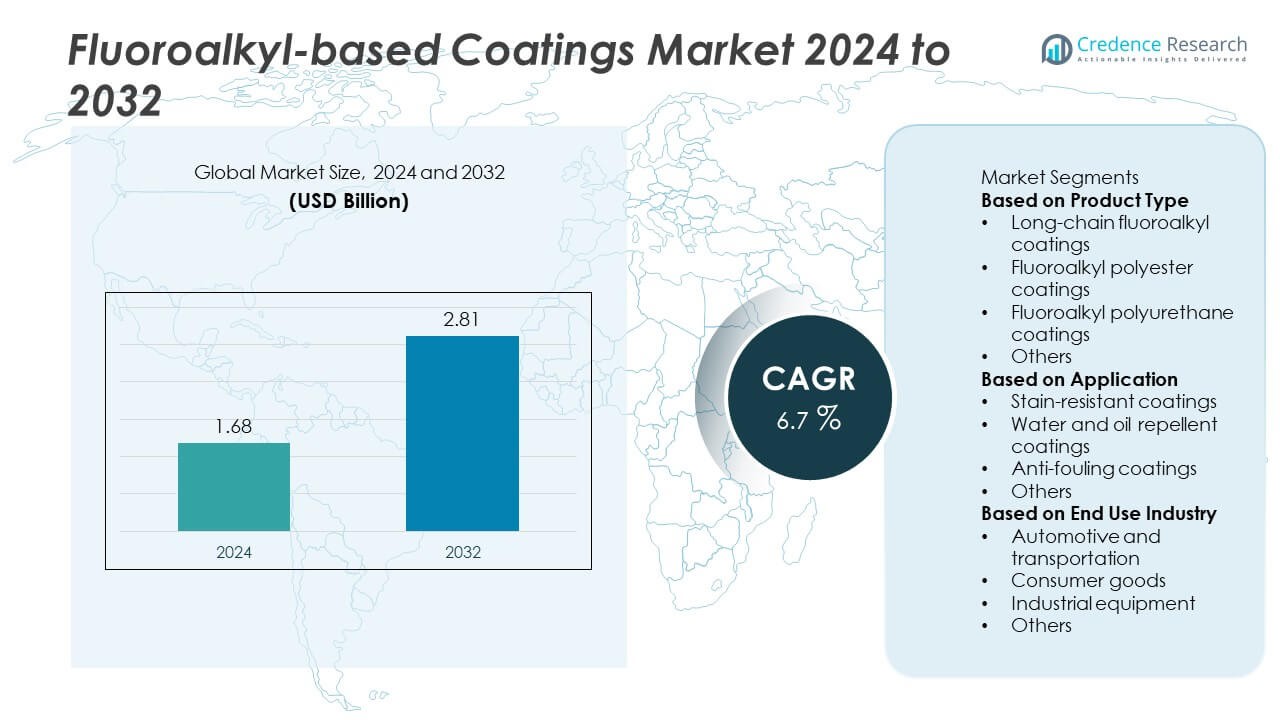

The Fluoroalkyl-based Coatings market was valued at USD 1.68 billion in 2024 and is projected to reach USD 2.81 billion by 2032, growing at a CAGR of 6.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fluoroalkyl-based Coatings market Size 2024 |

USD 1.68 Billion |

| Fluoroalkyl-based Coatings market, CAGR |

6.7% |

| Fluoroalkyl-based Coatings market Size 2032 |

USD 2.81 Billion |

The Fluoroalkyl-based Coatings market is led by major players including Daikin Industries, Ltd., The Chemours Company, 3M Company, AGC Inc., Solvay S.A., Dongyue Group Limited, Asahi Glass Co., Ltd., Gujarat Fluorochemicals Limited, BASF SE, and Arkema S.A. These companies dominate through innovation in fluoropolymer chemistry and sustainable coating technologies. North America held a 38% market share in 2024, driven by strong demand in the automotive and consumer goods sectors. Europe followed with 28%, supported by strict environmental regulations and advanced coating technologies. Asia Pacific accounted for 25%, fueled by rapid industrialization and expanding manufacturing bases in China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Fluoroalkyl-based Coatings market was valued at USD 1.68 billion in 2024 and is projected to reach USD 2.81 billion by 2032, growing at a CAGR of 6.7%.

- Rising demand for stain-resistant, water-repellent, and anti-fouling coatings across automotive, consumer goods, and industrial sectors is driving market growth.

- The long-chain fluoroalkyl coatings segment held a 42% share in 2024, driven by superior durability and chemical resistance in harsh environments.

- Leading players such as Daikin Industries, Chemours, and Solvay are focusing on eco-friendly formulations to meet global sustainability standards.

- North America led with 38% share, followed by Europe at 28% and Asia Pacific at 25%, reflecting strong manufacturing growth and technological advancements in surface protection applications.

Market Segmentation Analysis:

By Product Type

The fluoroalkyl polyurethane coatings segment dominated the Fluoroalkyl-based Coatings market in 2024 with a 46% share. These coatings are widely used due to their superior abrasion resistance, chemical stability, and hydrophobic properties. They provide strong adhesion to metals, plastics, and composites, making them ideal for automotive and industrial applications. Demand for long-lasting and weather-resistant coatings continues to rise, especially in high-performance sectors. Meanwhile, fluoroalkyl polyester coatings are gaining traction in consumer goods and electronics due to their flexibility and glossy finish, supporting moderate growth within the overall product category.

- For instance, Chemours introduced Teflon™ EcoElite, a 60% bio-based, renewably sourced water-repellent finish that is noted for being up to three times more durable than other non-fluorinated finishes. Fabrics treated with Teflon™ EcoElite can withstand multiple washings while maintaining their water repellency and breathability.

By Application

The water and oil repellent coatings segment held the leading 52% share of the Fluoroalkyl-based Coatings market in 2024. These coatings provide exceptional barrier performance, preventing liquid absorption and contamination on various surfaces. They are increasingly adopted in textiles, electronics, and construction materials to enhance durability and cleanliness. Rapid urbanization and growing demand for self-cleaning and anti-stain surfaces are driving the adoption of these coatings globally. The stain-resistant coatings segment is also expanding steadily, supported by rising usage in household appliances and interior decorative materials.

- For instance, AGC Inc. introduced the Lumiflon® FEVE coating system, known for its superior weatherability and gloss retention over decades in real-world architectural and industrial applications. 3M produces various Scotchgard™ products designed to repel spills and block stains on fabrics, though it generally needs to be reapplied after washing to maintain its protective effects.

By End Use Industry

The automotive and transportation segment accounted for the largest 44% share of the Fluoroalkyl-based Coatings market in 2024. These coatings are essential for protecting vehicle components from corrosion, moisture, and chemical exposure. Their ability to reduce surface friction and improve fuel efficiency further enhances their value in automotive design. Expanding electric vehicle production and the need for lightweight, durable materials are boosting market growth. The industrial equipment segment is also witnessing significant adoption due to the need for anti-fouling and low-maintenance coatings in machinery, pipelines, and manufacturing components.

Key Growth Drivers

Rising Demand for Water and Oil Repellent Surfaces

The growing need for advanced surface protection in automotive, electronics, and construction industries is driving demand for fluoroalkyl-based coatings. These coatings provide superior hydrophobic and oleophobic performance, reducing maintenance costs and extending product life. Their ability to resist staining, corrosion, and chemical degradation enhances durability across applications. Increasing consumer preference for easy-to-clean and self-healing surfaces further supports adoption in both industrial and consumer goods sectors.

- For instance, Arkema’s Kynar® 500 PVDF coatings demonstrate superior long-term weatherability, including gloss retention and resistance to degradation from UV rays, based on decades of real-world performance and laboratory testing.

Expansion in Automotive and Transportation Applications

Automotive manufacturers are increasingly using fluoroalkyl-based coatings to improve surface protection and performance. These coatings reduce friction, prevent corrosion, and enhance vehicle aesthetics while maintaining fuel efficiency. As electric and hybrid vehicle production rises, manufacturers seek lightweight, durable coatings that extend component lifespan. The coatings’ compatibility with metals, composites, and polymers strengthens their use in underbody, exterior, and interior applications, boosting market growth across developed and emerging economies.

- For instance, Dongyue Group, a producer of battery-grade PVDF resin, supports the automotive battery market with its materials, which are used to enhance corrosion resistance and electrochemical stability.

Growth in Consumer and Industrial Coatings Demand

Fluoroalkyl-based coatings are gaining traction in consumer goods and industrial machinery for their chemical and thermal resistance. They provide non-stick and easy-clean properties that enhance product quality and user convenience. Increasing use in cookware, electronics, and home furnishings reflects growing awareness of performance and hygiene benefits. In industrial settings, these coatings are applied to pipelines, turbines, and tools to improve efficiency and longevity, driving sustained growth across diverse end-use sectors.

Key Trends and Opportunities

Adoption of Environmentally Friendly and Short-Chain Formulations

Environmental regulations restricting long-chain fluorochemicals are accelerating the shift toward eco-friendly alternatives. Manufacturers are investing in short-chain fluoroalkyl and hybrid coatings that offer similar performance with lower environmental impact. This trend aligns with global sustainability initiatives and corporate commitments to reduce fluorocarbon emissions. The growing preference for non-toxic, regulatory-compliant coatings presents an opportunity for innovation in next-generation fluorinated materials tailored for industrial and consumer use.

- For instance, The Chemours Company launched its Zelan™ R3 water-repellent coating, a non-fluorinated finish made from renewably sourced, plant-based materials. It is marketed as a sustainable and durable alternative to older, fluorine-based chemicals and is featured in the Teflon EcoElite™ brand.

Integration with Nanotechnology for Enhanced Performance

The integration of nanomaterials is enhancing the efficiency and durability of fluoroalkyl-based coatings. Nanostructured formulations improve scratch resistance, self-cleaning ability, and surface uniformity, making them ideal for high-end industrial and electronic applications. Companies are developing multifunctional coatings that combine hydrophobicity with UV, microbial, and abrasion resistance. This trend is creating opportunities for advanced coatings in aerospace, medical devices, and renewable energy sectors, where performance and reliability are critical.

- For instance, coatings with Syensqo’s (formerly Solvay’s) Hylar® PVDF are used for their long-term durability in sectors like construction and chemical processing, offering high resistance to weather, corrosion, and abrasion. These coatings are valued for providing a long-lasting, protective finish for components, including those used in demanding conditions.

Key Challenges

Environmental and Regulatory Concerns

Stringent environmental regulations regarding per- and polyfluoroalkyl substances (PFAS) pose a major challenge to the market. Long-chain fluorochemicals have been linked to persistence and toxicity concerns, prompting restrictions across North America and Europe. Manufacturers face pressure to reformulate products and invest in sustainable alternatives without compromising performance. Regulatory compliance adds to production costs and may slow product commercialization. Transitioning toward greener chemistry remains essential for long-term market growth.

High Production Costs and Raw Material Constraints

Fluoroalkyl-based coatings involve complex synthesis processes and high-cost raw materials, increasing overall production expenses. Limited availability of fluorinated intermediates and rising prices of specialty chemicals affect profitability. Small and medium-sized manufacturers often face scalability issues due to high capital requirements for R&D and manufacturing. Supply chain disruptions and dependence on a few fluorochemical suppliers further challenge consistent material availability, constraining large-scale adoption in cost-sensitive applications.

Regional Analysis

North America

North America led the Fluoroalkyl-based Coatings market in 2024 with a 38% share. The region’s dominance is driven by strong demand from automotive, aerospace, and construction industries seeking durable and weather-resistant coatings. The United States leads adoption due to advanced R&D, regulatory compliance, and growing applications in consumer electronics and industrial equipment. Increasing awareness of stain- and water-resistant surfaces across residential and commercial sectors supports continuous product innovation. Major manufacturers are focusing on short-chain and eco-friendly formulations to meet environmental standards and strengthen market presence.

Europe

Europe accounted for a 30% share of the Fluoroalkyl-based Coatings market in 2024. Growth is supported by stringent environmental regulations encouraging the use of sustainable and low-VOC coating technologies. Countries such as Germany, France, and the United Kingdom are major contributors due to robust automotive production and growing use in industrial coatings. Demand for long-lasting, corrosion-resistant materials in manufacturing and construction sectors continues to expand. European companies are leading R&D investments to develop next-generation short-chain fluorinated coatings that maintain performance while reducing environmental impact.

Asia Pacific

Asia Pacific held a 25% share of the Fluoroalkyl-based Coatings market in 2024 and is the fastest-growing region. Rapid industrialization, infrastructure expansion, and increasing automobile production in China, Japan, and India are key drivers. The region’s electronics and textile industries also use these coatings for surface protection and water repellency. Government support for sustainable manufacturing and rising investments in advanced material technologies contribute to growth. The expanding middle class and demand for high-performance consumer goods further boost adoption across the region.

Latin America

Latin America captured a 4% share of the Fluoroalkyl-based Coatings market in 2024. Market growth is supported by gradual industrial development and increasing use in automotive refinishing and construction applications. Brazil and Mexico dominate regional demand, driven by rising investments in manufacturing infrastructure. The coatings’ ability to resist corrosion and chemical exposure is attracting adoption in energy and industrial equipment sectors. However, limited technological access and higher costs constrain widespread usage. International companies are expanding distribution networks to improve market penetration and support local demand.

Middle East and Africa

The Middle East and Africa together accounted for a 3% share of the Fluoroalkyl-based Coatings market in 2024. The region’s demand is primarily driven by infrastructure projects, oil and gas applications, and the adoption of protective coatings in harsh environmental conditions. Gulf countries such as Saudi Arabia and the UAE lead due to rapid construction and industrial expansion. Growing awareness of coating performance benefits is encouraging adoption across energy and transportation sectors. However, limited local manufacturing and high import dependency continue to restrict faster market growth.

Market Segmentations:

By Product Type

- Long-chain fluoroalkyl coatings

- Fluoroalkyl polyester coatings

- Fluoroalkyl polyurethane coatings

- Others

By Application

- Stain-resistant coatings

- Water and oil repellent coatings

- Anti-fouling coatings

- Others

By End Use Industry

- Automotive and transportation

- Consumer goods

- Industrial equipment

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Fluoroalkyl-based Coatings market features leading players such as Daikin Industries, Ltd., The Chemours Company, 3M Company, AGC Inc., Solvay S.A., Dongyue Group Limited, Asahi Glass Co., Ltd., Gujarat Fluorochemicals Limited, BASF SE, and Arkema S.A. These companies focus on expanding their product portfolios with high-performance, low-VOC, and environmentally compliant coating formulations. Strategic initiatives include mergers, joint ventures, and capacity expansions to strengthen global presence. For instance, major players are investing in PFAS-free alternatives and advanced surface-modification technologies to meet sustainability standards. Continuous R&D efforts target improved durability, stain resistance, and hydrophobic performance for use in automotive, consumer goods, and industrial applications. Collaborations with OEMs and coating formulators also enhance market competitiveness, driving long-term growth through product innovation and regulatory compliance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Daikin Industries, Ltd.

- The Chemours Company

- 3M Company

- AGC Inc.

- Solvay S.A.

- Dongyue Group Limited

- Asahi Glass Co., Ltd.

- Gujarat Fluorochemicals Limited

- BASF SE

- Arkema S.A.

Recent Developments

- In August 2025, The Chemours Company signed strategic agreements with SRF Limited in India. The deal supports regional fluoropolymer supply and application development by 2026. It strengthens Chemours’ downstream access for coatings and linings.

- In August 2025, 3M Company reiterated its plan to exit all PFAS production by end-2025. The company continued customer transition work and portfolio changes. A Kentucky regulator also subpoenaed PFAS records for a 3M plant.

- In July 2025, Daikin Industries, Ltd. hosted a large-scale PFAS-destruction pilot with Claros Technologies at its Decatur, Alabama site.

- In July 2024, NOF Metal Coatings will introduce a new PFAS-free PLUS topcoat series, fulfilling global OEM requirements with improved tribological characteristics, silver appearance, and fluorescent readability to replace PTFE-based coatings before prospective European PFAS regulations.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and PFAS-free fluoroalkyl coatings will rise across industries.

- Automotive and transportation sectors will continue to drive large-scale adoption.

- Advanced R&D will focus on bio-based and low-VOC formulations.

- Asia Pacific will emerge as the fastest-growing regional market.

- Integration of nanotechnology will enhance coating performance and durability.

- Manufacturers will invest in sustainable production processes to meet environmental standards.

- Industrial equipment and consumer goods applications will expand due to performance benefits.

- Strategic partnerships will strengthen product innovation and market presence.

- Regulations on long-chain fluorochemicals will accelerate the shift toward safer alternatives.

- Continuous technological upgrades will improve adhesion, repellency, and lifecycle efficiency.