Market Overview

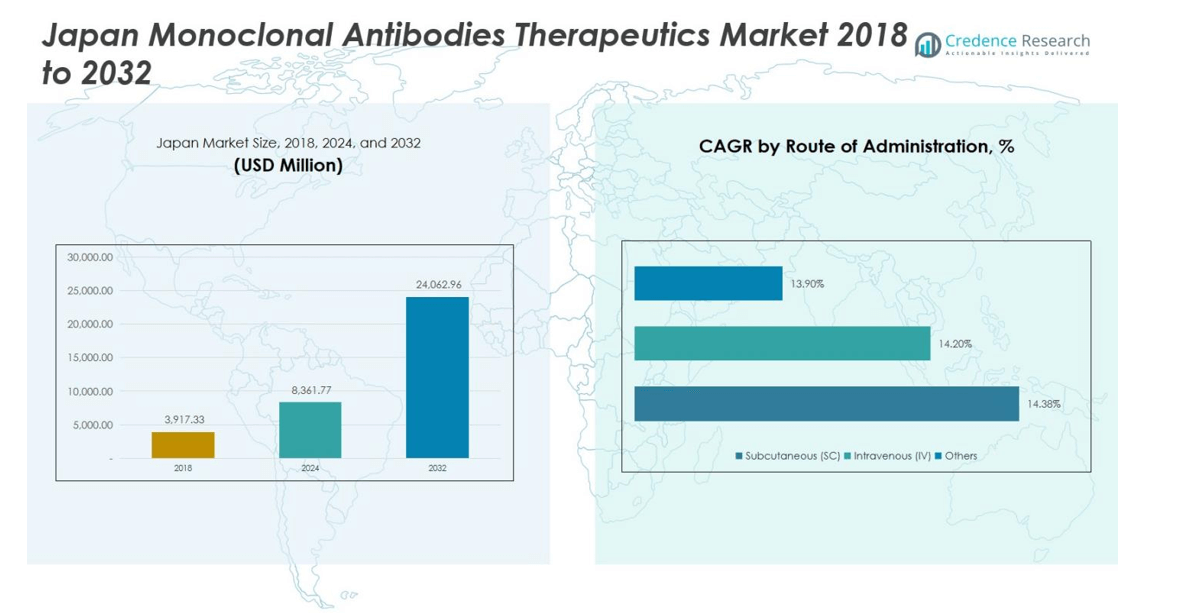

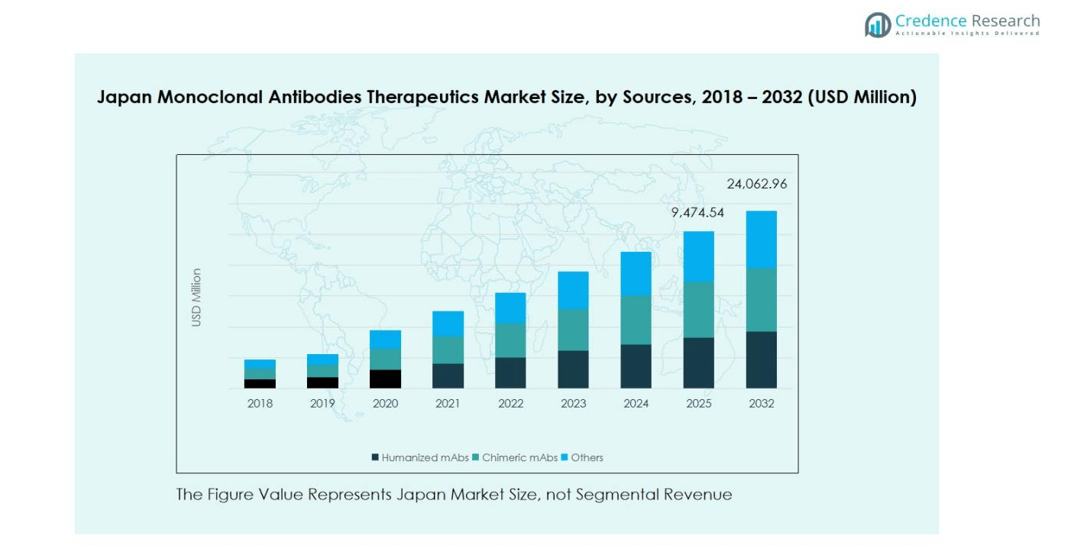

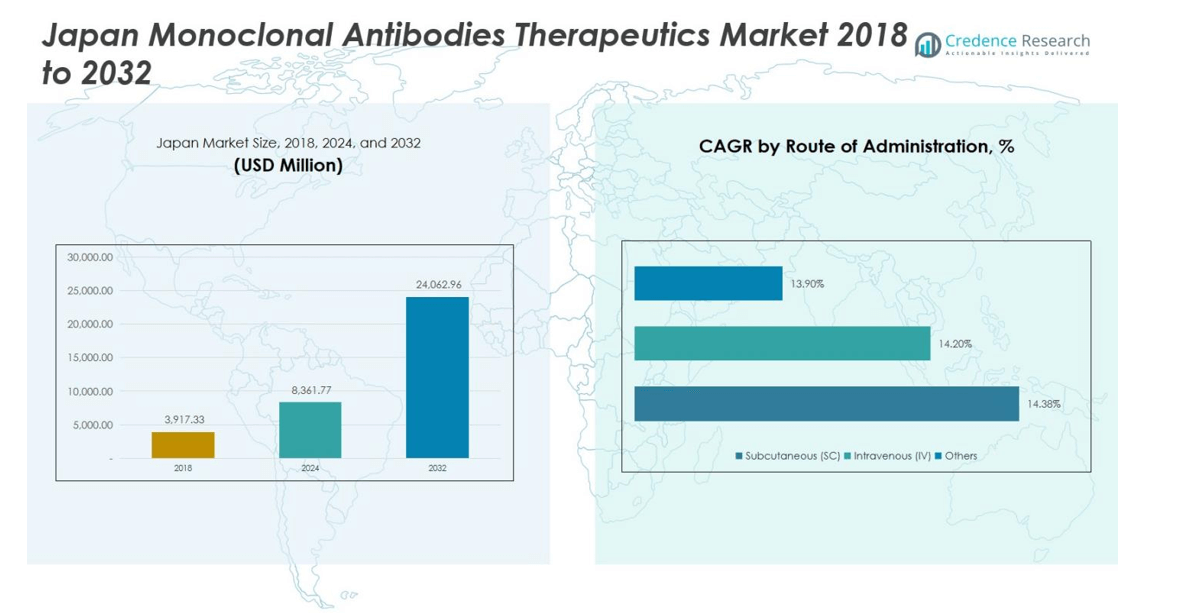

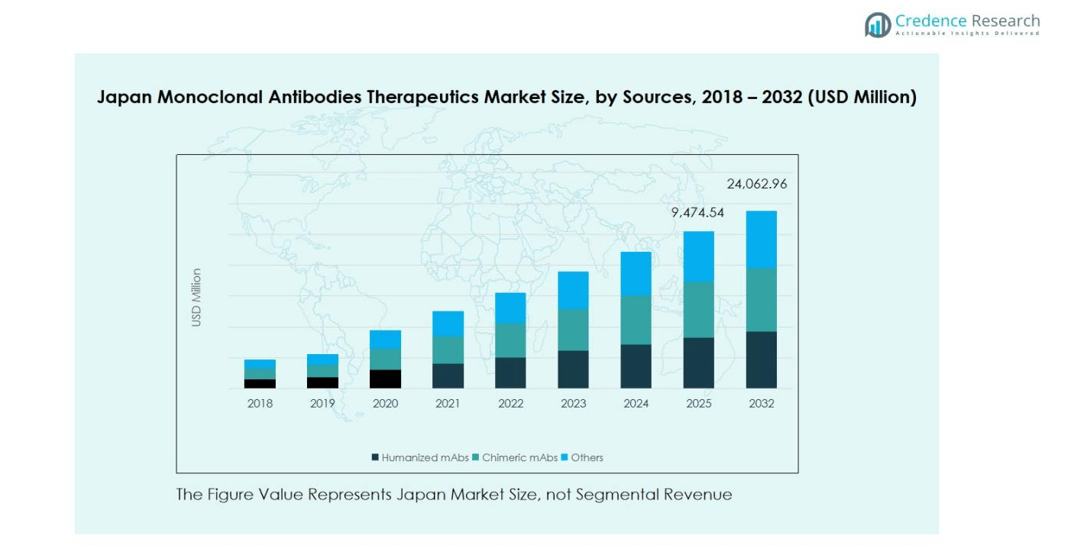

Japan Monoclonal Antibodies Therapeutics Market size was valued at USD 3,917.33 million in 2018, is projected to reach USD 8,361.77 million by 2024, and is anticipated to reach USD 24,062.96 million by 2032, growing at a CAGR of 13.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Monoclonal Antibodies Therapeutics Market Size 2024 |

USD 8,361.77 million |

| Japan Monoclonal Antibodies Therapeutics Market, CAGR |

13.6% |

| Japan Monoclonal Antibodies Therapeutics Market Size 2032 |

USD 24,062.96 million |

The Japan Monoclonal Antibodies Therapeutics Market is led by key players including Ono Pharmaceutical Co., Ltd., Sanofi, AbbVie Inc., Bristol Myers Squibb, CSL Behring, AstraZeneca, Amgen Inc., Eli Lilly and Company, Regeneron Pharmaceuticals, and Kyowa Kirin Co., Ltd. These companies strengthen their market presence through continuous product innovation, strategic partnerships, and expansion of manufacturing and distribution networks. They focus on developing humanized and subcutaneous monoclonal antibodies, particularly targeting oncology and autoimmune therapies, while leveraging collaborations with hospitals and specialty clinics to enhance patient access. Regionally, the Kanto region dominates the market with a 35% share, driven by advanced healthcare infrastructure, concentration of research institutes, and strong government support. Kansai follows with 25%, supported by robust hospital networks and regional biotech investments, making these regions the primary contributors to the Japan monoclonal antibodies therapeutics market.

Market Insights

- The Japan Monoclonal Antibodies Therapeutics Market was valued at USD 8,361.77 million in 2024 and is projected to reach USD 24,062.96 million by 2032, growing at a CAGR of 13.6%. Humanized mAbs dominate the sources segment with a 55% share, while oncology leads the therapeutic area with 45%.

- Rising prevalence of cancer, autoimmune, and infectious diseases, along with an aging population, is driving demand for targeted monoclonal antibody therapies across Japan. Expansion of disease screening programs and early diagnosis initiatives further fuels adoption.

- The market is witnessing a shift toward subcutaneous administration and personalized therapies. Growth in home-based treatments, precision medicine, and biomarker-driven strategies supports patient convenience and better treatment outcomes.

- Key players such as Ono Pharmaceutical, Sanofi, AbbVie, Bristol Myers Squibb, and AstraZeneca focus on R&D, product innovation, strategic collaborations, and expanding distribution through hospitals and specialty clinics to maintain market leadership.

- Regionally, Kanto leads with a 35% share, followed by Kansai at 25%, Chubu 15%, Tohoku 10%, Kyushu 8%, and Hokkaido 7%, reflecting strong infrastructure and healthcare networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

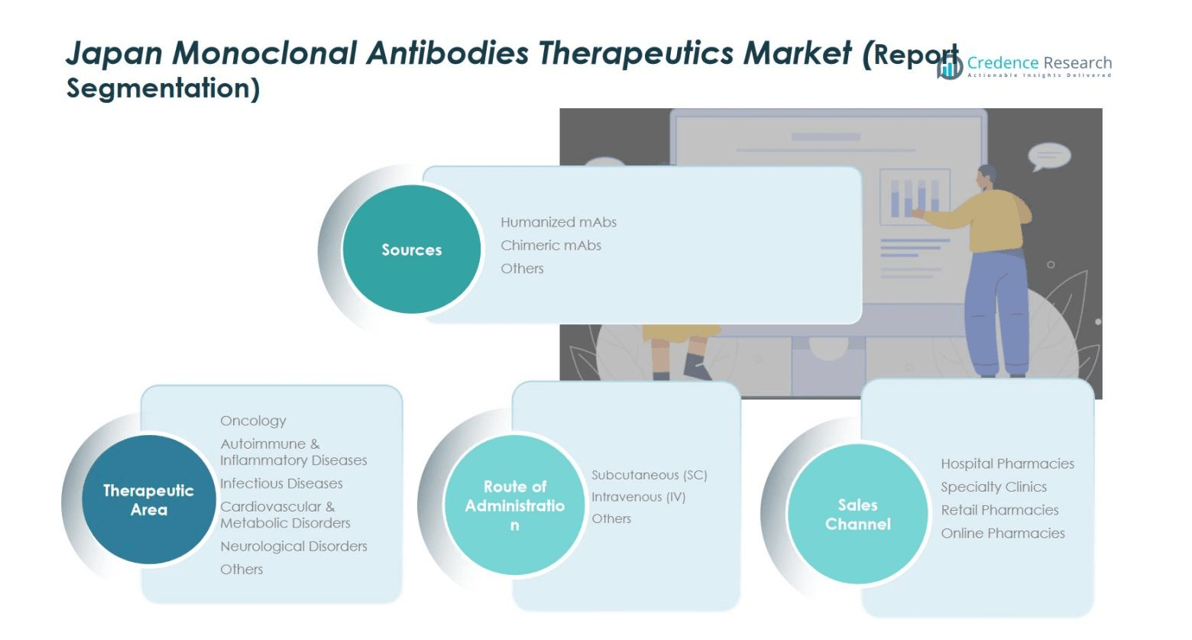

Market Segmentation Analysis:

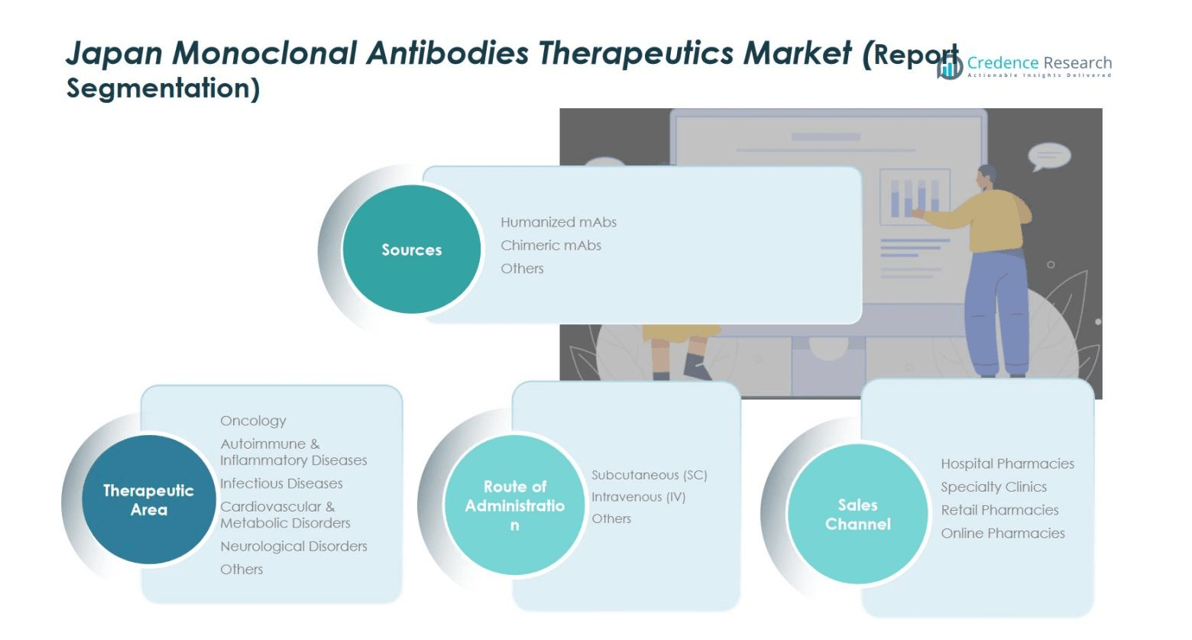

By Sources

The Japan monoclonal antibodies therapeutics market is primarily driven by the growing adoption of humanized monoclonal antibodies (mAbs), which dominate the sources segment with an estimated market share of 55%. Humanized mAbs are preferred due to their reduced immunogenicity and enhanced efficacy in treating chronic and complex diseases. Chimeric mAbs account for approximately 30%, while other sources make up the remaining 15%. Increasing prevalence of oncology and autoimmune disorders, along with ongoing research and development activities in Japan, are fueling demand for humanized mAbs, making them the primary growth driver within the sources segment.

- For instance, Takeda Pharmaceutical’s fully human monoclonal antibody mezagitamab (TAK-079) showed positive Phase 2 results in treating primary immune thrombocytopenia, highlighting progress in autoimmune disease therapeutics .

By Therapeutic Area

Oncology is the leading therapeutic area in Japan, holding a market share of 45% in the monoclonal antibodies therapeutics segment. The segment growth is driven by the rising incidence of cancer, increased government funding for oncology research, and introduction of targeted antibody therapies. Autoimmune and inflammatory diseases follow with a share of 25%, while infectious diseases, cardiovascular & metabolic disorders, and neurological disorders collectively account for 30%. The focus on precision medicine and the approval of novel monoclonal antibodies for cancer treatment reinforce oncology as the dominant sub-segment and the main growth engine.

- For instance, the anti-PD-1 monoclonal antibody nivolumab, developed by Ono Pharmaceutical and Bristol-Myers Squibb, received approval in Japan following the ATTRACTION-2 trial demonstrating survival benefits in advanced gastric cancer patients.

By Route of Administration

Subcutaneous (SC) administration leads the Japan market, capturing a market share of 60% due to its convenience, patient compliance, and suitability for self-administration. Intravenous (IV) delivery represents approximately 35%, while other routes account for 5%. The growing preference for outpatient care, home-based treatment, and reduced hospital visits are key drivers for the SC route. Pharmaceutical companies are increasingly developing monoclonal antibodies with SC formulations to meet patient needs and reduce administration-related complications, further strengthening its dominance in the route of administration segment.

Key Growth Drivers

Rising Prevalence of Chronic and Oncology Diseases

The increasing incidence of cancer, autoimmune disorders, and infectious diseases in Japan is a primary growth driver for the monoclonal antibodies therapeutics market. A growing elderly population and lifestyle-related health conditions contribute to heightened demand for targeted therapies. Monoclonal antibodies offer higher specificity and effectiveness compared to traditional treatments, making them the preferred choice among healthcare providers. Expansion of disease screening programs and early diagnosis initiatives further supports adoption, reinforcing sustained market growth and boosting investor confidence in the Japanese healthcare sector.

For instance, MBL, a leading Japanese antibody manufacturing company, has pioneered diagnostic reagents for autoimmune diseases and companion diagnostics to support personalized therapy, reflecting strong industry innovation in this area.

Advancements in Biopharmaceutical Research and Development

Ongoing innovation in biopharmaceutical R&D is accelerating the development of novel monoclonal antibodies in Japan. Pharmaceutical companies are investing heavily in next-generation therapies, including humanized and bispecific antibodies, to address complex diseases. Collaboration between research institutes and biotech firms facilitates faster clinical trials and regulatory approvals. Additionally, improvements in antibody engineering and formulation technologies enhance efficacy, stability, and patient compliance. These advancements strengthen the pipeline of therapeutic options and position Japan as a key hub for monoclonal antibodies innovation, driving long-term market expansion.

- For instance, Chugai Pharmaceutical launched satralizumab (ENSPRYNG), a humanized monoclonal antibody for neuromyelitis optica spectrum disorder, which received fast-track approval in Japan due to joint research with Roche.

Favorable Government Policies and Reimbursement Support

Supportive government initiatives and reimbursement policies are boosting the market in Japan. Streamlined regulatory pathways and incentives for innovative biologics encourage pharmaceutical companies to introduce new therapies. Reimbursement coverage for monoclonal antibodies under public healthcare schemes ensures patient access and affordability. Additionally, national health programs targeting oncology, autoimmune, and infectious diseases are driving adoption across hospitals and specialty clinics. This regulatory and financial support fosters confidence among stakeholders, accelerating market penetration and sustaining consistent growth throughout the forecast period.

Key Trends and Opportunities

Shift Toward Targeted and Personalized Therapies

The Japanese market is witnessing a strong trend toward targeted and personalized monoclonal antibody therapies. Precision medicine initiatives and biomarker-driven treatment strategies are gaining traction, allowing clinicians to tailor therapies to individual patient profiles. This trend improves treatment outcomes, minimizes side effects, and enhances patient adherence. Increasing investment in companion diagnostics and molecular profiling provides new growth opportunities for pharmaceutical companies, enabling the development of highly effective, patient-specific treatments and expanding the therapeutic scope of monoclonal antibodies across oncology and autoimmune disease segments.

- For instance, Chugai Pharmaceutical’s Actemra® (tocilizumab), the first therapeutic antibody developed in Japan, is used in rheumatoid arthritis and cytokine release syndrome with dosing increasingly guided by biomarker levels and therapeutic drug monitoring to optimize efficacy and reduce adverse events.

Expansion of Subcutaneous and Home-Based Treatments

There is growing adoption of subcutaneous (SC) monoclonal antibody formulations, supporting outpatient and home-based administration. This trend enhances patient convenience, reduces hospital dependency, and lowers healthcare costs. Pharmaceutical companies are increasingly developing SC therapies with pre-filled devices, auto-injectors, and simplified dosing schedules to meet patient preferences. Expansion of home healthcare services and telemedicine initiatives further accelerates this opportunity. As patients and healthcare providers prioritize convenience and self-administration, the SC route is emerging as a key growth area within Japan’s monoclonal antibodies therapeutics market.

- For instance, Roche’s trastuzumab (Herceptin®) is approved for subcutaneous use in HER2-positive breast cancer, offering a convenient alternative to intravenous infusions.

Key Challenges

High Treatment Costs and Accessibility Barriers

The high cost of monoclonal antibody therapies remains a major challenge in Japan. Expensive production processes and complex biologic formulations contribute to elevated prices, limiting patient access, particularly in non-oncology segments. While reimbursement helps, out-of-pocket expenses and insurance coverage gaps can restrict adoption. Additionally, the need for specialized storage and administration infrastructure increases healthcare system burdens. These cost-related barriers may slow market growth and necessitate strategies focused on affordable manufacturing, biosimilar development, and enhanced insurance coverage to improve accessibility.

Stringent Regulatory Requirements

Strict regulatory requirements for clinical trials, approval, and post-market surveillance pose challenges for monoclonal antibody developers. Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) mandates rigorous safety and efficacy evaluations, extending product launch timelines. Compliance with local guidelines, quality standards, and pharmacovigilance obligations requires substantial investment and technical expertise. These regulatory hurdles can delay commercialization, increase costs, and reduce short-term profitability. Companies must navigate these frameworks efficiently while maintaining high-quality standards to ensure successful market entry and sustained growth in Japan.

Regional Analysis

Kanto

The Kanto region dominates the Japan monoclonal antibodies therapeutics market, holding a market share of 35%. The presence of major pharmaceutical companies, advanced healthcare infrastructure, and high concentration of research institutes in Tokyo and surrounding areas drive adoption. Strong government support for oncology and autoimmune disease programs, coupled with high patient awareness, fuels demand for monoclonal antibodies. Kanto’s established hospital networks and specialty clinics facilitate widespread therapy distribution, making it a key revenue contributor. Continuous investment in biopharmaceutical research further strengthens Kanto’s position as the leading regional market within Japan.

Kansai

Kansai contributes significantly to the market with a share of 25%. The region benefits from a robust healthcare ecosystem in cities such as Osaka and Kyoto, along with growing hospital and specialty clinic networks. Rising prevalence of chronic diseases, particularly cancer and autoimmune disorders, drives adoption of monoclonal antibody therapies. Regional research collaborations and local biotech investments support the development and commercialization of novel biologics. Government-backed initiatives to enhance patient access and reimbursement for high-cost therapies further bolster market growth. Kansai remains a vital growth hub for the monoclonal antibodies therapeutics segment in Japan.

Chubu

Chubu accounts for a market share of 15% in Japan, driven by increasing healthcare investments and expanding hospital networks. Nagoya and surrounding cities serve as key centers for research, manufacturing, and distribution of monoclonal antibodies. The region is witnessing growing awareness of targeted therapies for oncology and autoimmune diseases, enhancing adoption rates. Collaboration between local biotech firms and academic institutions accelerates development of novel treatments. Infrastructure improvements and supportive policies facilitate patient access to monoclonal antibodies, contributing to steady growth and reinforcing Chubu’s strategic importance in the Japanese market.

Tohoku

The Tohoku region holds a market share of 10%, supported by increasing demand for advanced therapies in major cities such as Sendai. Healthcare modernization initiatives and regional investments in clinical research are driving monoclonal antibody adoption. The rising prevalence of chronic diseases, particularly autoimmune and inflammatory disorders, further fuels market growth. Public healthcare schemes and regional hospital programs enhance accessibility and affordability of therapies. While Tohoku faces challenges of lower population density compared to Kanto or Kansai, government support, local infrastructure development, and growing patient awareness contribute to steady expansion in the monoclonal antibodies therapeutics market.

Kyushu

Kyushu contributes a market share of 8%, benefiting from growing healthcare infrastructure and expansion of specialty clinics and hospital networks. Fukuoka serves as a regional hub for biopharmaceutical research and clinical trials, supporting monoclonal antibody adoption. The increasing prevalence of oncology and infectious diseases drives demand, while government reimbursement policies ensure therapy accessibility. Collaboration between local research institutions and pharmaceutical companies encourages development of innovative treatments. Though smaller than Kanto and Kansai, Kyushu is emerging as an important regional market, with ongoing investments in healthcare and biotechnology sectors strengthening its role in Japan’s monoclonal antibodies therapeutics landscape.

Hokkaido

Hokkaido holds a market share of 7%, with steady growth driven by rising awareness of targeted therapies and expanding healthcare services. Sapporo and surrounding cities are key centers for clinical research and distribution of monoclonal antibodies. Increasing prevalence of chronic and autoimmune diseases, coupled with government initiatives to improve healthcare access in northern regions, supports market expansion. Investment in hospital infrastructure, specialty clinics, and patient education programs further promotes adoption. Despite geographic challenges and lower population density, Hokkaido continues to strengthen its position in the Japanese market, contributing meaningfully to overall monoclonal antibodies therapeutics revenues.

Market Segmentations:

By Sources

- Humanized mAbs

- Chimeric mAbs

- Others

By Therapeutic Area

- Oncology

- Autoimmune & Inflammatory Diseases

- Infectious Diseases

- Cardiovascular & Metabolic Disorders

- Neurological Disorders

- Others

By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Others

By Sales Channel

- Hospital Pharmacies

- Specialty Clinics

- Retail Pharmacies

- Online Pharmacies

By Region

- Kanto

- Kansai

- Chubbu

- Kyushu

- Tohoku

- Hokkaido

Competitive Landscape

The competitive landscape of the Japan monoclonal antibodies therapeutics market features key players including Ono Pharmaceutical Co., Ltd., Sanofi, AbbVie Inc., Bristol Myers Squibb, CSL Behring, AstraZeneca, Amgen Inc., Eli Lilly and Company, Regeneron Pharmaceuticals, and Kyowa Kirin Co., Ltd. These companies focus on product innovation, strategic partnerships, and expansion of manufacturing capabilities to strengthen their market presence. Increasing investments in research and development support the launch of novel humanized and subcutaneous monoclonal antibodies, particularly in oncology and autoimmune therapies. Competitive strategies also include collaborations with local hospitals and specialty clinics to improve distribution and patient access. Additionally, mergers, acquisitions, and licensing agreements enable companies to enhance their product portfolio and pipeline. Continuous emphasis on regulatory compliance, advanced formulation technologies, and patient-centric solutions positions these key players to maintain a strong foothold in Japan’s evolving monoclonal antibodies therapeutics market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 17, 2025, Rani Therapeutics entered a licensing agreement with Japan’s Chugai Pharmaceutical to develop and commercialize an oral version of Chugai’s experimental antibody for a rare disease. The deal also includes options to expand to five additional drugs, potentially totaling up to $1.09 billion.

- In October 14, 2025, Takeda expanded its partnership with Nabla Bio to accelerate the development of multi-specific antibodies, receptor decoys, and other custom biologics for hard-to-treat diseases using AI-driven antibody design.

- In May 2025, Formycon and Fresenius Kabi launched Otulfi, an ustekinumab biosimilar, while Biocon Biologics, through its partner Yoshindo Inc, launched Ustekinumab BS Subcutaneous Injection [YD] in Japan, providing cost-effective options for inflammatory and bone-related conditions.

- In October 10, 2025, Lotte Biologics entered a strategic partnership with Rakuten Medical to collaborate on the manufacturing of monoclonal antibodies, aiming to enhance their global presence in antibody-based therapies.

Report Coverage

The research report offers an in-depth analysis based on Sources, Therapeutic Area, Route of Administration, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to experience sustained growth driven by rising demand for targeted therapies.

- Oncology will continue to lead therapeutic areas due to increasing cancer prevalence.

- Humanized monoclonal antibodies are projected to dominate the sources segment.

- Subcutaneous administration will gain traction owing to patient convenience and home-based treatment adoption.

- Technological advancements in antibody engineering and formulation will expand therapeutic applications.

- Government support and favorable reimbursement policies will enhance market accessibility.

- Increasing collaborations between pharmaceutical companies and research institutions will accelerate innovation.

- Adoption of personalized and precision medicine will drive development of targeted therapies.

- The growth of specialty clinics and hospital networks will strengthen distribution channels.

- Emergence of biosimilars will create competitive opportunities and improve affordability for patients.