Market overview

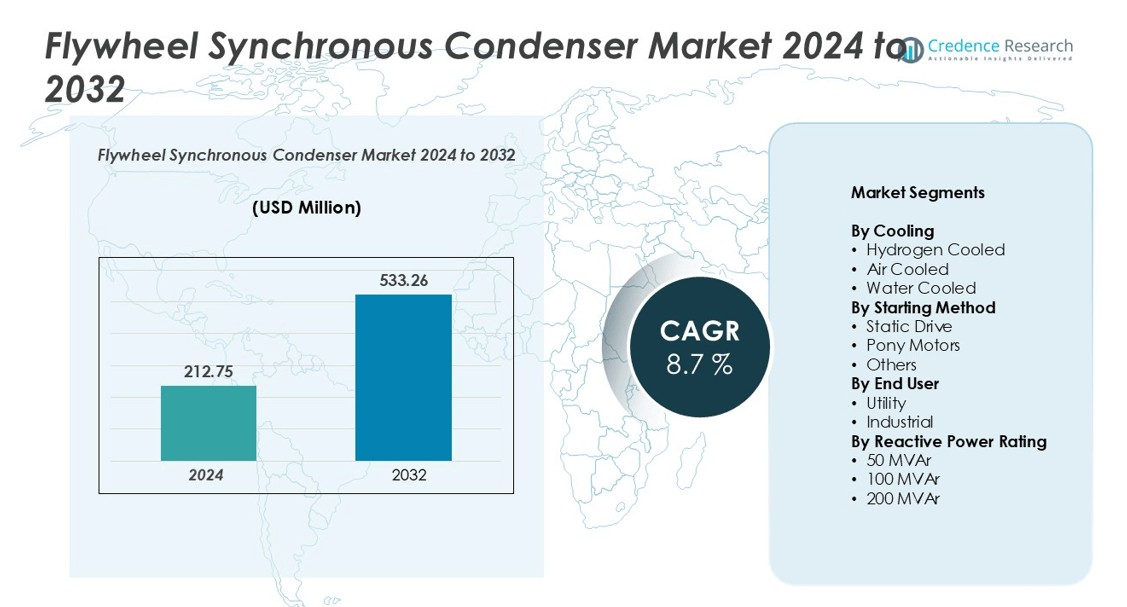

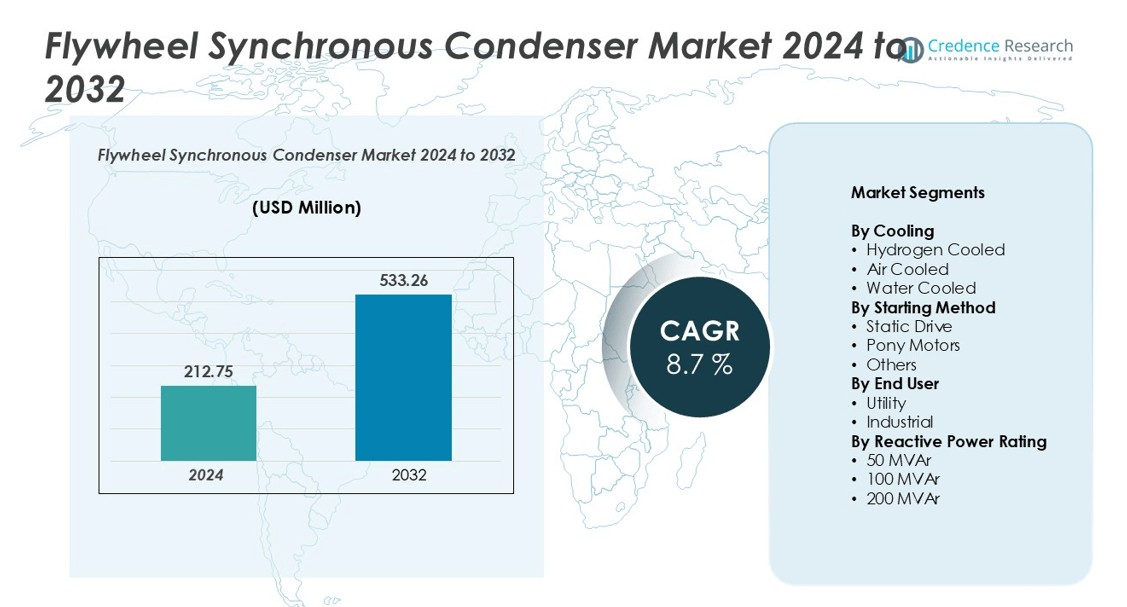

The flywheel synchronous condenser market size was valued at USD 212.75 million in 2024 and is anticipated to reach USD 533.26 million by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flywheel Synchronous Condenser Market Size 2024 |

USD 212.75 million |

| Flywheel Synchronous Condenser Market, CAGR |

8.7% |

| Flywheel Synchronous Condenser Market Size 2032 |

USD 533.26 million |

The flywheel synchronous condenser market is led by prominent players including ABB, Siemens Energy, General Electric, Mitsubishi Electric Power Products, ANDRITZ, Ansaldo Energia, Baker Hughes, Doosan Škoda Power, and Ingeteam. These companies focus on technological innovation, high-efficiency hydrogen-cooled systems, and digital monitoring solutions to strengthen their competitive positions. North America emerges as the leading region, capturing approximately 35% of the global market, driven by extensive grid modernization and renewable energy integration. Europe follows with a 25% share, supported by decarbonization initiatives and stringent grid codes, while Asia-Pacific holds around 20%, fueled by rapid industrialization and expanding renewable capacity. Middle East & Africa and Latin America account for 15% and 5%, respectively, with growth driven by infrastructure development and utility modernization. Together, these regions and top players shape the dynamic global market landscape.

Market Insights

- The flywheel synchronous condenser market was valued at USD 212.75 million in 2024 and is projected to reach USD 533.26 million by 2032, growing at a CAGR of 8.7% during the forecast period.

- Increasing renewable energy integration, grid modernization, and demand for voltage stabilization are driving market growth, particularly for hydrogen-cooled and high-capacity static drive systems.

- Key trends include adoption of digital monitoring and smart grid integration, expansion in industrial and utility applications, and growing preference for hydrogen-cooled condensers over air- and water-cooled systems.

- The market is highly competitive, led by ABB, Siemens Energy, General Electric, Mitsubishi Electric Power Products, ANDRITZ, Ansaldo Energia, Baker Hughes, Doosan Škoda Power, and Ingeteam, focusing on innovation, partnerships, and advanced technology.

- North America dominates with a 35% share, Europe holds 25%, Asia-Pacific 20%, Middle East & Africa 15%, and Latin America 5%; hydrogen-cooled condensers lead segment share due to efficiency and high-capacity applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Cooling

The hydrogen-cooled segment dominates the flywheel synchronous condenser market, holding the largest share due to its superior thermal efficiency and ability to handle high-capacity operations. Hydrogen cooling reduces energy losses and enables higher reliability in continuous operations, making it the preferred choice for large-scale utility installations. Air-cooled and water-cooled subsegments are witnessing steady growth, driven by smaller industrial applications and cost-sensitive projects. Increasing adoption of hydrogen-cooled condensers in renewable integration and grid stabilization projects further fuels the segment’s expansion.

- For instance, Siemens Energy supplied synchronous condensers for a major project at the Intermountain Power Project (IPP) in Delta, Utah, to enhance grid stability in regions with high renewable energy penetration.

By Starting Method

Static drive systems lead the market by a significant margin, offering precise control, reduced mechanical stress, and faster synchronization with the grid. Their adoption is particularly strong in industrial setups requiring frequent start-stop cycles and high operational stability. Pony motors and other starting methods serve niche applications, mainly in legacy installations and smaller-scale units, but are gradually being replaced due to limitations in efficiency and maintenance demands. Investments in automation and advanced control technologies further boost the static drive segment’s market penetration.

- For instance, the statement that Siemens Energy’s integration of advanced control systems in their static drive synchronous condensers has enhanced operational stability and reduced maintenance.

By End User

Utility companies represent the dominant end-user segment, accounting for the majority of flywheel synchronous condenser installations. The segment’s growth is driven by increasing grid modernization, renewable energy integration, and the need for voltage regulation and reactive power support at scale. Industrial applications, though smaller in share, are expanding due to rising energy-intensive operations and the adoption of advanced energy storage solutions. The utility segment benefits from long-term contracts and higher-capacity installations, positioning it as the key driver of overall market growth.

Key Growth Drivers

Increasing Renewable Energy Integration

The growing deployment of renewable energy sources, such as solar and wind, is a primary driver for the flywheel synchronous condenser market. Grid operators require advanced reactive power support and voltage stabilization to manage the intermittent nature of renewable generation. Flywheel synchronous condensers provide rapid response capabilities, enabling efficient frequency regulation and system balancing. Utilities increasingly invest in high-capacity condensers to ensure grid reliability, particularly in regions with high renewable penetration. Moreover, government incentives and regulatory mandates for renewable adoption are accelerating the deployment of energy storage and power conditioning technologies, further boosting demand for flywheel synchronous condensers across both utility-scale and industrial applications.

- For instance, In Ireland, Siemens Energy’s supplied a synchronous condenser system to the Moneypoint power station. This system, which incorporates the world’s largest flywheel, strengthens grid stability by providing inertia, short-circuit power, and reactive power, which is critical for regions with high renewable energy integration.

Technological Advancements in Flywheel Systems

Innovations in high-speed flywheel technology and magnetic bearing systems are enhancing efficiency, durability, and operational lifespan of synchronous condensers. These advancements allow condensers to handle higher reactive power loads while reducing maintenance requirements and energy losses. The integration of digital monitoring and predictive maintenance systems ensures real-time performance optimization, increasing reliability for grid operators. Companies investing in research and development to improve rotor design, cooling methods, and energy density are expanding the market by making flywheel synchronous condensers more suitable for diverse applications, including urban grids, industrial facilities, and renewable energy integration projects.

- For instance, GE Vernova’s air-cooled synchronous condenser, rated up to 300 MVAR, is utilized for reactive power compensation and voltage support in various installations.

Rising Demand for Grid Stability and Voltage Regulation

The need for stable and reliable electricity supply is intensifying as grids become more complex due to distributed generation and electrification trends. Flywheel synchronous condensers help maintain voltage stability, support reactive power compensation, and prevent blackouts or system disturbances. Utilities and industrial operators are increasingly adopting these condensers to comply with stringent grid codes and enhance system resilience. The technology’s ability to provide rapid reactive power support and seamless integration with existing infrastructure positions it as a preferred solution for modern power networks, driving widespread adoption and market growth.

Key Trends & Opportunities

Shift Toward Hydrogen and Advanced Cooling Technologies

The flywheel synchronous condenser market is witnessing a trend toward hydrogen-cooled systems and innovative cooling solutions to enhance efficiency and capacity. Hydrogen cooling allows higher thermal management capabilities, supporting larger units with lower energy losses. Air-cooled and water-cooled systems are being optimized for smaller industrial applications, offering cost-effective alternatives. This trend provides opportunities for manufacturers to develop customized solutions targeting both utility and industrial segments, leveraging technological differentiation to capture market share while addressing sustainability requirements.

- For instance, Siemens Energy has installed synchronous condensers in Ireland, including at the Moneypoint and Shannonbridge sites, to enhance grid stability and enable higher penetration of renewables. These systems provide inertia, short-circuit power, and reactive power for voltage support, but their specific cooling method and reactive power rating differ from the initial claim.

Expansion in Industrial and Utility Applications

Industrial facilities and utilities are increasingly adopting flywheel synchronous condensers to manage reactive power, stabilize voltage, and improve energy efficiency. Opportunities exist in industrial sectors such as manufacturing, mining, and data centers, where high-load operations require reliable grid support. Additionally, urban grid modernization projects in emerging economies create significant potential for market expansion. Companies that develop scalable, modular condensers can capitalize on these opportunities by offering tailored solutions that meet both large-scale and distributed grid requirements.

- For instance, GE Vernova’s air-cooled synchronous condenser, rated up to 300 MVAR, is utilized for reactive power compensation and voltage support in various installations.

Integration with Smart Grid and Digital Monitoring Solutions

The integration of flywheel synchronous condensers with smart grid technologies and digital monitoring platforms is creating new avenues for market growth. Real-time performance tracking, predictive maintenance, and automated control systems enhance operational efficiency and reduce downtime. These solutions enable utilities to optimize reactive power management and improve grid resilience. Companies that leverage IoT and AI-enabled platforms for flywheel monitoring are well-positioned to differentiate themselves and capture opportunities in the evolving energy ecosystem.

Key Challenges

High Capital Investment and Installation Costs

One of the main challenges limiting the adoption of flywheel synchronous condensers is the high upfront cost associated with manufacturing, installation, and integration. Advanced rotor systems, high-speed bearings, and hydrogen-cooling infrastructure contribute to substantial capital expenditure. This can deter small-scale industrial users and utilities in cost-sensitive regions from adopting the technology. Additionally, project financing and ROI considerations require long-term planning, which may slow market expansion despite clear operational benefits.

Technical Complexity and Maintenance Requirements

Flywheel synchronous condensers require specialized expertise for installation, operation, and maintenance due to their high-speed rotating components and advanced control systems. Improper handling or insufficient technical knowledge can result in operational inefficiencies or safety hazards. While modern designs reduce maintenance frequency, ongoing monitoring and skilled personnel remain essential. The technical complexity can challenge adoption, particularly in emerging markets where local expertise is limited, creating a barrier to rapid market penetration.

Regional Analysis

North America:

North America dominates the flywheel synchronous condenser market, holding approximately 35% of global share. Strong investments in grid modernization, renewable energy integration, and voltage regulation drive demand. The U.S. and Canada are leading adopters of hydrogen-cooled condensers and high-capacity static drive systems for reactive power management. Industrial sectors also deploy these condensers to handle large reactive loads efficiently. Regulatory frameworks, government incentives, and technological advancements reinforce the region’s market leadership. Early adoption of smart grid initiatives and reliability-focused infrastructure projects continue to sustain North America’s dominance in global market share.

Europe:

Europe accounts for around 25% of the global flywheel synchronous condenser market, led by Germany, France, and the U.K. Demand is fueled by renewable energy integration, decarbonization targets, and stringent grid codes requiring voltage stabilization. The region favors hydrogen-cooled systems and digital monitoring technologies to improve operational efficiency. Industrial sectors, including manufacturing and heavy industries, increasingly adopt these condensers for reactive power support. Strong R&D investment, government incentives, and early adoption of advanced technology help Europe maintain its position as a key regional contributor with a significant share of the market.

Asia-Pacific:

Asia-Pacific captures roughly 20% of the flywheel synchronous condenser market, driven by rapid industrialization, urbanization, and renewable energy expansion in China, India, and Japan. Utilities are investing in high-capacity condensers to stabilize grids under fluctuating renewable generation. Industrial facilities adopt condensers to enhance energy efficiency and reactive power support for heavy machinery. Government initiatives, infrastructure modernization projects, and increasing electricity demand bolster adoption. Asia-Pacific’s market share is expected to grow further as both utility and industrial sectors prioritize reliability, efficiency, and integration of advanced condenser technologies.

Middle East & Africa:

The Middle East & Africa region holds approximately 15% of the global market. Growth is driven by grid expansion, industrialization, and large-scale energy projects in Gulf countries and South Africa. Utilities and industrial operators deploy hydrogen-cooled and static drive condensers to ensure reactive power compensation and voltage stability. Investments in modern energy infrastructure, electrification initiatives, and renewable energy integration support market expansion. Although smaller than North America or Europe, MEA’s share is rising due to strategic government policies and increasing adoption in industrial and utility applications.

Latin America:

Latin America represents around 5% of the global flywheel synchronous condenser market, with Brazil, Mexico, and Chile as leading countries. Utilities focus on grid upgrades to support growing renewable energy capacity, while industrial sectors in mining and manufacturing adopt condensers for reactive power management. Infrastructure modernization projects, government incentives, and renewable energy initiatives are driving gradual adoption. Although the regional market share is smaller, Latin America offers growth opportunities for manufacturers and service providers to expand installations in both utility and industrial applications.

Market Segmentations:

By Cooling

- Hydrogen Cooled

- Air Cooled

- Water Cooled

By Starting Method

- Static Drive

- Pony Motors

- Others

By End User

By Reactive Power Rating

- 50 MVAr

- 100 MVAr

- 200 MVAr

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The flywheel synchronous condenser market is highly competitive, dominated by global energy and power equipment manufacturers such as ABB, Siemens Energy, General Electric, Mitsubishi Electric Power Products, ANDRITZ, Ansaldo Energia, Baker Hughes, Doosan Škoda Power, and Ingeteam. These players focus on technological innovation, product differentiation, and strategic partnerships to strengthen their market position. Companies are investing in advanced hydrogen-cooled systems, high-speed flywheels, and digital monitoring solutions to enhance efficiency, reliability, and grid integration capabilities. Mergers, acquisitions, and collaborations with utility providers and industrial firms are common strategies to expand regional presence and service offerings. Continuous R&D efforts and customization for specific industrial and utility applications enable companies to meet diverse customer requirements, maintain competitive advantage, and capture growing opportunities in emerging and mature markets globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ABB

- ANDRITZ

- Ansaldo Energia

- Baker Hughes

- Doosan Škoda Power

- General Electric

- Ingeteam

- Mitsubishi Electric Power Products, Inc.

- Siemens Energy

Recent Developments

- In March 2023, ABB executed a significant turnkey project in collaboration with Statkraft, Europe’s largest renewable power producer. The project’s objective was to reinstate crucial system inertia, necessary for ensuring the stable operation of the UK power grid. This has become increasingly vital as the country transitions from traditional fossil fuels to renewable energy sources including wind & solar power.

- In August 2022, Siemens Energy was awarded a contract by TenneT, the German-Dutch grid operator, to deliver three grid stabilization system solutions for the German power grid. Two of the three systems supplied by Siemens Energy were synchronous condensers. Siemens Energy constructed the synchronous condensers in Würgassen & Großkrotzenburg.

Report Coverage

The research report offers an in-depth analysis based on Cooling, Starting Method, End-User, Reactive Power Rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily due to rising renewable energy integration worldwide.

- Adoption of hydrogen-cooled and high-capacity static drive systems will expand across utilities and industrial sectors.

- Digital monitoring and predictive maintenance solutions will enhance operational efficiency and reliability.

- Utilities will increasingly deploy condensers for voltage stabilization and reactive power management.

- Industrial facilities will adopt condensers to improve energy efficiency and manage high reactive loads.

- Emerging economies will present growth opportunities through grid modernization and infrastructure development.

- Research and development will focus on improving rotor design, cooling technologies, and energy density.

- Smart grid and IoT-enabled integration will create new operational and service opportunities.

- Strategic partnerships and collaborations will drive market expansion and regional penetration.

- Continuous innovation will position flywheel synchronous condensers as a key solution for modern power networks.