Market overview

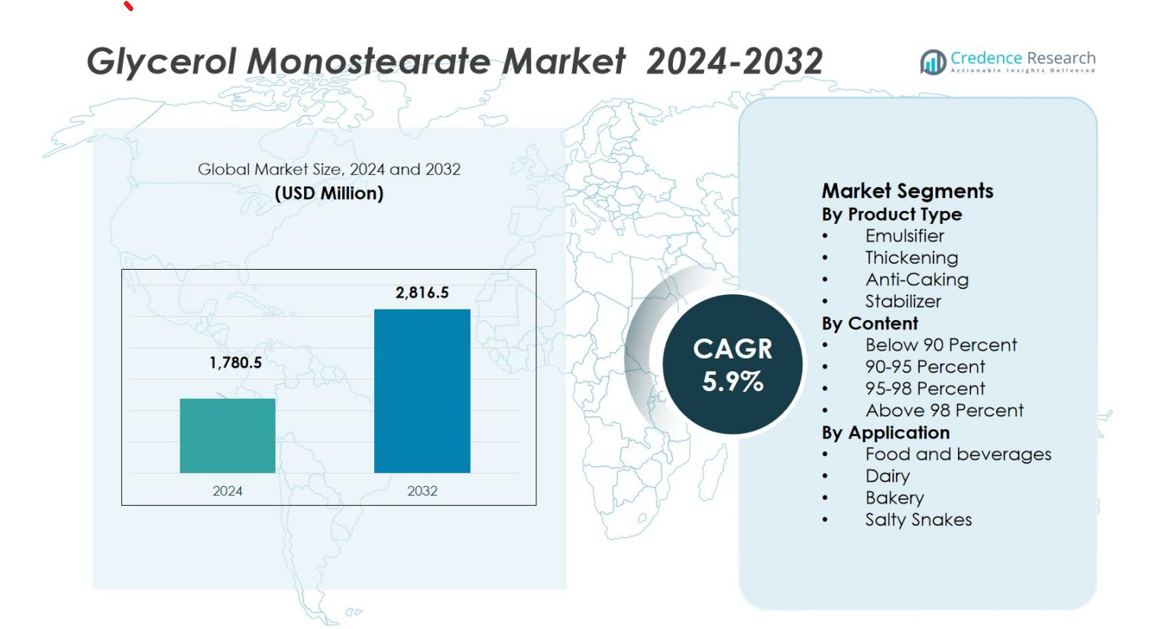

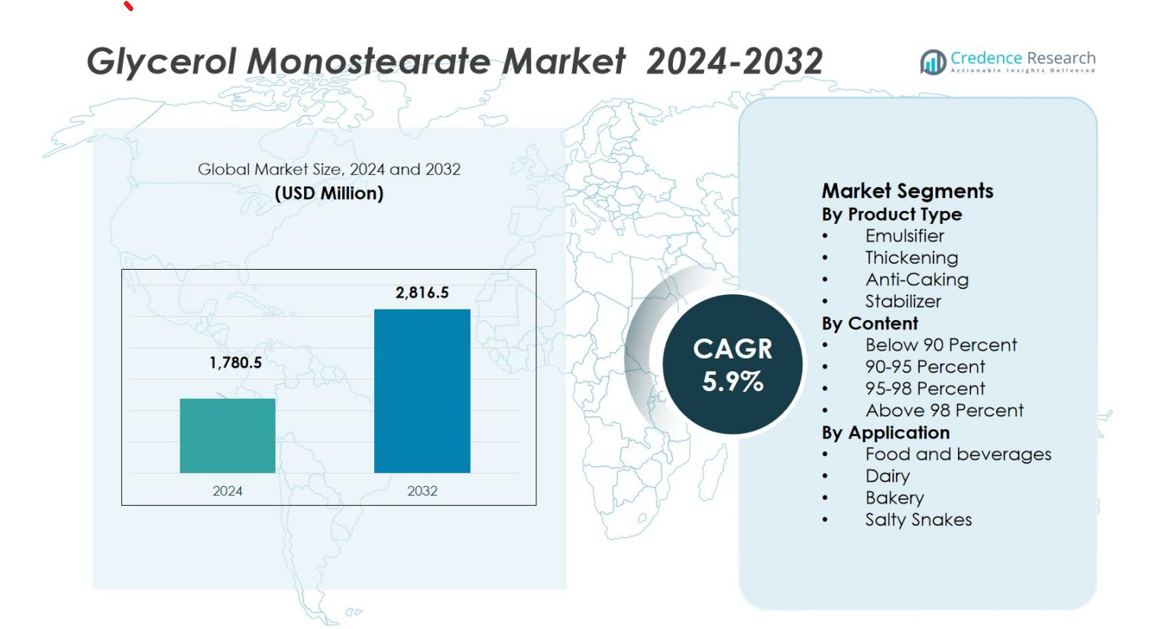

The Glycerol Monostearate Market size was valued at USD 1,780.5 Million in 2024 and is anticipated to reach USD 2,816.5 Million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glycerol Monostearate Market Size 2024 |

USD 1,780.5 Million |

| Glycerol Monostearate Market, CAGR |

5.9% |

| Glycerol Monostearate Market Size 2032 |

USD 2,816.5 Million |

The Glycerol Monostearate Market is dominated by key players such as BASF SE, Nouryon, Croda International Plc, Evonik Industries AG, and The DOW Chemical Company, who collectively hold a significant portion of the market share. These companies leverage their extensive geographical presence, advanced product portfolios, and strong distribution networks to cater to diverse industries, including food & beverage, personal care, and pharmaceuticals. Asia Pacific leads the market with a share of 32.1% in 2024, driven by the growing demand for processed foods and advancements in food processing technology. North America follows with 30.2%, while Europe holds 29.3% of the market share, benefiting from high standards for ingredient safety and the widespread use of glycerol monostearate in dairy and bakery applications.

Market Insights

- The Glycerol Monostearate Market was valued at USD 1,780.5 Million in 2024 and is projected to grow at a CAGR of 5.9% to reach USD 2,816.5 Million by 2032.

- Demand for processed and convenience foods is driving the market’s growth, as Glycerol Monostearate is widely used as an emulsifier and stabiliser in these products.

- A strong trend toward clean‑label and plant‑based formulations is creating opportunities for the ingredient’s use in food, bakery and snack applications.

- Key restraint includes fluctuations in raw material costs which may impact production margins and pricing stability across the supply chain.

- Regionally, Asia‑Pacific leads with a 32.1% share in 2024, followed by North America at 30.2% and Europe at 29.3%, highlighting these as major markets while Latin America and MEA remain emerging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

In the Glycerol Monostearate Market, the emulsifier segment dominates, accounting for 42.3% of the market share in 2024. This is primarily driven by the growing demand for emulsifiers in food and beverage applications, where they are essential in stabilizing mixtures of oil and water. The increasing consumer preference for processed and convenience foods, which require effective emulsification, is expected to fuel the growth of this segment. The thickening, anti-caking, and stabilizer sub-segments contribute to the market but at a smaller scale, holding shares of 29.1%, 16.4%, and 12.2%, respectively.

- For instance, GMS 40 is widely used in ice cream and whipped toppings to enhance creaminess and prevent ice crystal formation, notably in products by major dairy brands.

By Content

The segment of glycerol monostearate with 90-95 percent content holds the largest market share at 39.5% in 2024. This content range is particularly favored in the food and beverage industry due to its optimal balance of functionality and cost-efficiency. The high percentage content provides better stability and effectiveness, making it ideal for emulsification, thickening, and other applications. The 95-98 percent and above 98 percent content categories follow with shares of 32.3% and 18.7%, respectively, while the below 90 percent content category represents a smaller share of 9.5%.

- For instance, Croda’s Cithrol GMS 40, widely utilized in personal care, leverages this content range to provide effective emulsification and consistency in creams and lotions.

By Application

The food and beverages segment is the dominant application in the Glycerol Monostearate Market, commanding a share of 52.1% in 2024. This segment benefits from the widespread use of glycerol monostearate as an emulsifier, stabilizer, and thickening agent in various processed foods and beverages. Dairy applications come next with a market share of 21.3%, driven by the increasing demand for dairy products that require effective emulsification. The bakery and salty snacks applications hold shares of 14.6% and 12%, respectively, driven by the need for texture improvement and shelf-life extension in these products.

Key Growth Drivers

Increasing Demand for Processed and Convenience Foods

The growing global demand for processed and convenience foods is a significant driver of the Glycerol Monostearate Market. As consumer lifestyles become busier, the preference for ready-to-eat and easy-to-prepare food products has surged. Glycerol monostearate, widely used as an emulsifier, stabilizer, and thickening agent, plays a crucial role in enhancing the texture, shelf-life, and overall quality of these foods. This trend is expected to continue as more consumers seek convenient food options that maintain high quality and consistency, driving further market growth.

- For instance, in ice cream production, it prevents ice crystal formation, resulting in a smoother texture, which is critical as U.S. ice cream makers produced around 1.3 billion gallons in 2023.

Growth in the Dairy Industry

The dairy sector is another key driver for the glycerol monostearate market. As the global demand for dairy products continues to rise, particularly in emerging economies, glycerol monostearate’s role in improving texture, preventing separation, and enhancing stability becomes increasingly vital. It is extensively used in milk-based drinks, ice cream, and cheese products, where it enhances creaminess and shelf-life. With the expanding dairy product portfolio and rising consumption in both developed and developing markets, this sector is expected to remain a key contributor to market growth.

- For instance, in cheese production, GMS helps blend fats and water uniformly, resulting in consistent texture and extended freshness in the final products.

Technological Advancements in Food Processing

Advancements in food processing technologies are driving the Glycerol Monostearate Market by enabling more efficient and cost-effective production. Innovations in processing methods, including improved emulsification techniques, allow for the enhanced performance of glycerol monostearate in various applications. These advancements help meet the increasing consumer demand for high-quality processed foods while optimizing manufacturing efficiency. As food processing continues to evolve, the need for ingredients like glycerol monostearate that improve product consistency and stability will continue to rise, further propelling market expansion.

Key Trends & Opportunities

Shift Toward Clean Label Products

One of the key trends in the glycerol monostearate market is the growing shift toward clean-label products. Consumers are increasingly seeking transparency in the ingredients used in food products, driving the demand for natural and minimally processed ingredients. Glycerol monostearate, due to its status as a safe and effective emulsifier, is gaining traction in clean-label formulations, particularly in dairy and bakery products. This trend presents opportunities for manufacturers to innovate and offer products that cater to health-conscious consumers looking for clean, natural ingredients without sacrificing quality or functionality.

- For instance, Chemsino promotes its food-grade glyceryl monostearate (GMS, E471) for clean-label bakery and ice cream formulations, highlighting its role in improving dough quality, stabilizing fat–protein emulsions, and delivering smoother textures at low inclusion levels.

Rising Demand for Plant-Based and Vegan Products

As the plant-based and vegan food market grows, glycerol monostearate presents an opportunity to support the texture and consistency of plant-based food alternatives. With plant-based diets becoming more popular, particularly in Western markets, glycerol monostearate is increasingly used to create stable emulsions in plant-based dairy substitutes, vegan baked goods, and meat alternatives. This trend is driving the demand for glycerol monostearate in plant-based formulations, opening up new market opportunities for companies to cater to the growing vegan and plant-based consumer base.

- For instance, food‑ingredients supplier FIC Chem highlights that GMS is utilised in vegan‑friendly plant‑based meat alternatives (such as burgers or sausages) to help “mimic the mouth‑feel and juiciness of meat‑based products” through stabilising fat/water phases.

Key Challenges

Fluctuations in Raw Material Prices

One of the major challenges facing the Glycerol Monostearate Market is the fluctuation in raw material prices, particularly for fatty acids and glycerol. These fluctuations can lead to price instability in the final product, making it difficult for manufacturers to maintain consistent pricing for consumers. Volatile raw material costs can impact the profitability of glycerol monostearate production and create challenges in pricing strategies, especially in cost-sensitive markets. This uncertainty can hinder the ability of companies to scale production and meet growing demand efficiently.

Regulatory Challenges and Compliance

As the food and beverage industry faces increasing scrutiny regarding ingredient safety, regulatory challenges also affect the glycerol monostearate market. Stringent regulations on food additives, emulsifiers, and other ingredients can vary by region, creating challenges for companies seeking to maintain compliance while expanding into new markets. Additionally, evolving regulations and consumer concerns around food safety and ingredient transparency may lead to more rigorous testing and certification requirements. This poses challenges for manufacturers in terms of time, costs, and resource allocation needed to ensure their products meet all necessary regulatory standards.

Regional Analysis

Asia Pacific

In the Glycerol Monostearate market, the Asia Pacific region captured a market share of 32.1% in 2024. Growth in this region is underpinned by the expansion of the food & beverage, pharmaceutical and personal care sectors across key countries such as China and India. Rising disposable income and urbanisation drive consumer consumption of processed foods, baked goods and ready‑to‑eat products that require emulsification and stabilisation. Additionally, industrialisation of oleo‑chemical supply chains in the region provides favourable manufacturing economics, strengthening Asia Pacific’s position as the largest regional market.

North America

North America held a market share of 30.2% in 2024 for glycerol monostearate. The region’s strong food processing industry, high consumption of convenience and packaged foods, and a mature pharmaceutical sector fuel demand for emulsifier and thickening functionalities. In particular, consumer trends toward clean‑label and natural additives support growth of glycerol monostearate as a preferred ingredient. The presence of established manufacturers and distribution networks further bolsters market capacity and end‑user accessibility in the North American region.

Europe

Europe accounted for a market share of 29.3% in 2024 in the glycerol monostearate market. Demand in the region is driven by the advanced food processing sector, high standards for ingredient safety, and substantial usage in personal care and cosmetics applications. European regulatory focus on natural emulsifiers and stabilisers enhances acceptance, while the widespread consumption of bakery, dairy and processed food products supports sustained use of glycerol monostearate. Germany, France and the UK stand out as strong national markets within the region.

Latin America

In Latin America, the glycerol monostearate market accounted for 12.4% of the global market share in 2024. Growth is supported by rising processed food consumption, expanding bakery and snack manufacturing, and increasing urbanisation across countries such as Brazil and Mexico. As consumer demand for convenience foods grows, so does the need for emulsifiers, thickeners, and stabilisers like glycerol monostearate. However, the market remains less mature compared to North America, Europe, and Asia Pacific, providing significant opportunities for suppliers to expand their regional presence and cater to a growing food processing industry.

Middle East & Africa

The Middle East & Africa (MEA) region contributed 6.5% to the global glycerol monostearate market in 2024, reflecting its early-stage market development. Demand is driven by emerging food processing industries, growth in snack and bakery sectors, and improving manufacturing infrastructure in countries such as UAE, Saudi Arabia, and South Africa. As disposable incomes rise and urban populations increase, the adoption of emulsifiers, thickeners, and stabilisers like glycerol monostearate is expected to grow, positioning the MEA region as an opportunity zone for future market expansion.

Market Segmentations:

By Product Type

- Emulsifier

- Thickening

- Anti-Caking

- Stabilizer

By Content

- Below 90 Percent

- 90-95 Percent

- 95-98 Percent

- Above 98 Percent

By Application

- Food and beverages

- Dairy

- Bakery

- Salty Snakes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the global Glycerol Monostearate (GMS) market include BASF SE, Nouryon, Croda International Plc, Evonik Industries AG and The DOW Chemical Company, which together hold a substantial portion of the market share. These firms leverage broad geographic footprints, diversified application portfolios and ongoing investments in research and development to maintain competitive advantage. They frequently pursue product innovation—such as higher‑purity or plant‑derived GMS—alongside strategic partnerships and capacity expansions to address rising demand in food, beverage, personal care and pharmaceutical sectors. Market fragmentation remains moderate: while several regional players and niche manufacturers compete on cost and regional supply, the leading companies dominate through scale, brand recognition and distribution networks. Going forward, competitive pressure will centre on sustainability credentials, clean‑label formulation support and backward integration into raw materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Stepan Company

- BASF SE

- Huntsman Corporation

- Evonik Industries AG

- Godrej Industries Limited

- Wilmar International Limited

- AkzoNobel NV

- Croda International Plc

- The DOW Chemical Company

- Lonza Group AG

Recent Developments

- In March 2023, Croda International plc, represented in India by its Indian subsidiary ‘ Croda India’, announced the decision to invest USD 5.4 million in building a greenfield manufacturing facility in Dahej, Gujarat. The new facility will aid in catering to the rising consumption of pharma and consumer care products.

- In February 2023, Palsgaard, a leading supplier of plant-based additives for plastics, conducted a study in Malaysia to qualify its Einar 201 mold release agent for automotive PP applications. Einar 201, derived from renewable sources, offers excellent performance, denesting, and sustainability benefits, contributing to reduced carbon footprints in the plastics industry.

- In May 2022, Evonik Industries AG inaugurated its Applied Technology Center (ATC) in Sao Paulo, Brazil. The new facility would include new laboratories and two pilot plants, strengthening its interface & performance business line

Report Coverage

The research report offers an in-depth analysis based on Product Type, Content, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising global demand for processed and convenience foods will drive increased adoption of glycerol monostearate in emulsifier and stabiliser roles across food and beverage applications.

- Growth in personal care and cosmetics formulations will create new opportunities for glycerol monostearate, as companies seek multi‑functional ingredients to enhance texture and stability.

- Expansion of the pharmaceutical sector particularly in excipients and drug delivery systems will support incremental use of glycerol monostearate in non‑food applications.

- Development of clean‑label, plant‑based, and sustainable variants of glycerol monostearate will appeal to health‑ and environment‑conscious consumers and unlock new market segments.

- Emerging markets in Asia‑Pacific, Latin America and Middle East & Africa will increasingly contribute to global demand as urbanisation and disposable incomes rise.

- Manufacturers will increasingly invest in process optimisation and product innovation to deliver higher‑purity grades of glycerol monostearate tailored for specialised applications.

- Strategic collaborations and supply‑chain integration (including raw‑material sourcing and backward integration) will enhance competitiveness and reduce cost pressure.

- As regulatory scrutiny intensifies, glycerol monostearate producers will need to align with evolving food‑additive and cosmetic‑ingredient standards to sustain market growth.

- Volatility in raw‑material and energy costs will remain a risk factor, making cost‑efficiency and operational resilience a critical business success factor.

- Substitution threats from emerging emulsifiers and stabilisers will force glycerol monostearate suppliers to emphasise functionality, performance differentiation and application‑support services.