Market Overview

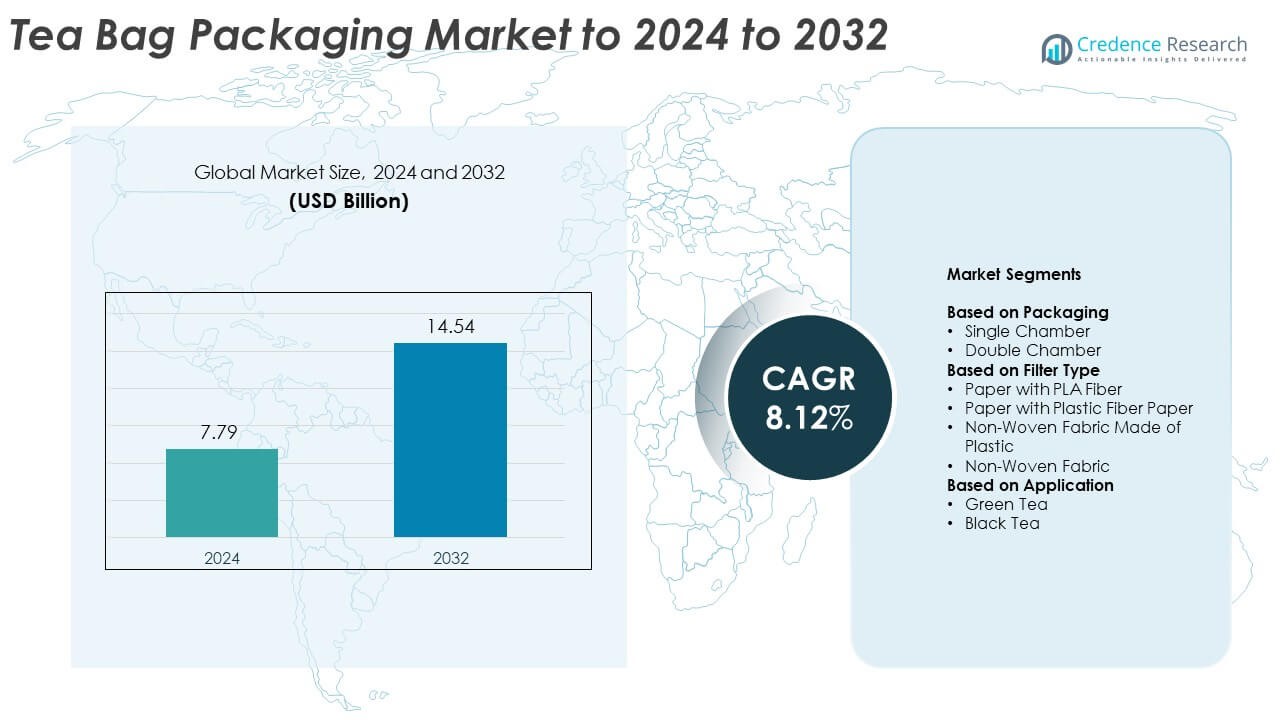

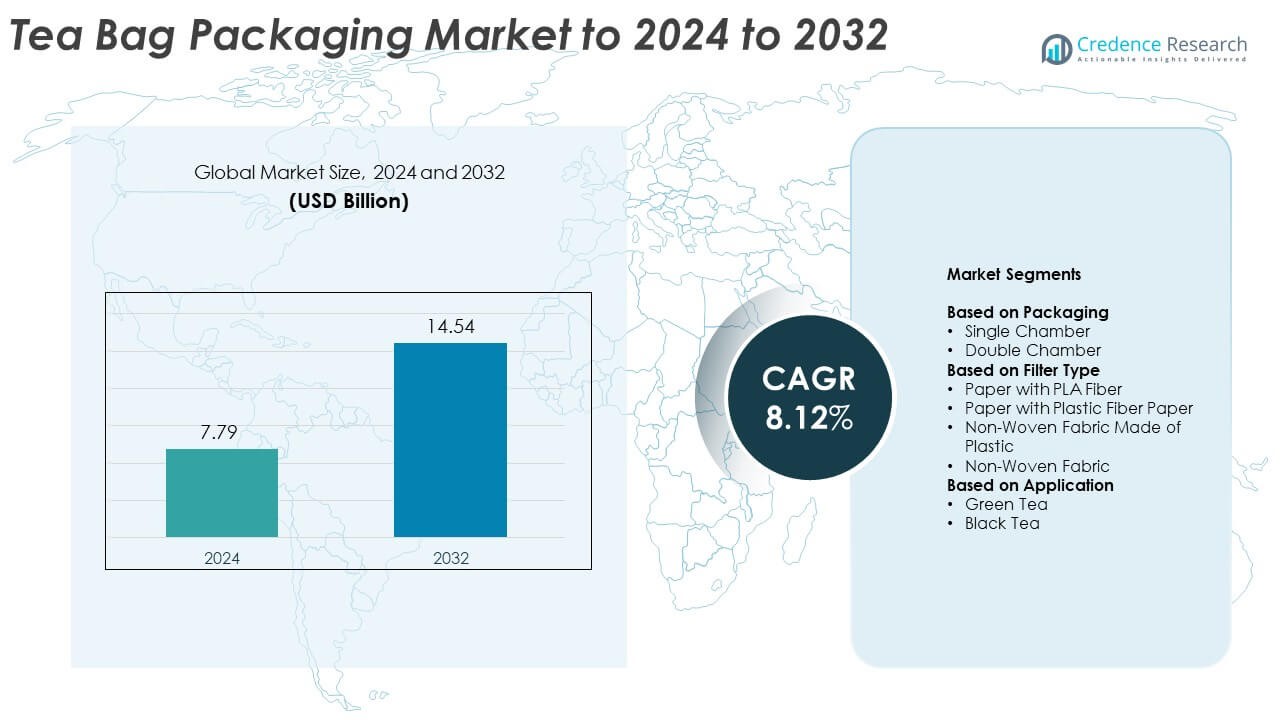

The Tea Bag Packaging Market size was valued at USD 7.79 billion in 2024 and is anticipated to reach USD 14.54 billion by 2032, at a CAGR of 8.12% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tea Bag Packaging Market Size 2024 |

USD 7.79 Billion |

| Tea Bag Packaging Market, CAGR |

8.12% |

| Tea Bag Packaging Market Size 2032 |

USD 14.54 Billion |

The tea bag packaging market is led by major players such as Huhtamaki, Smurfit Kappa Group, ProAmpac, DS Smith, WestRock Company, Mondi Group, Sealed Air Corporation, Global Packaging Solutions, Syntegon Technology, Tetra Pak, and Amcor. These companies focus on sustainable materials, advanced sealing technology, and innovative design solutions to enhance product quality and brand appeal. Europe dominated the global market in 2024, holding approximately 30.6% share, driven by high tea consumption and strong environmental regulations promoting biodegradable packaging. Asia-Pacific followed closely, supported by rising demand for premium and health-focused tea varieties.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The tea bag packaging market was valued at USD 7.79 billion in 2024 and is expected to reach USD 14.54 billion by 2032, growing at a CAGR of 8.12%.

- Rising tea consumption and preference for convenient brewing formats are driving demand for advanced and sustainable packaging solutions.

- Key trends include the adoption of biodegradable materials such as PLA fiber and paper blends, along with smart and premium packaging designs.

- The market is competitive, with leading players focusing on eco-friendly innovations, automation, and strategic partnerships with tea producers to strengthen brand presence.

- Europe led the market with 30.6% share, followed by Asia-Pacific with 33.2%, while the double chamber segment dominated with 64.7% share in 2024, supported by high infusion efficiency and global consumer preference for quality and convenience.

Market Segmentation Analysis:

By Packaging

The double chamber segment dominated the tea bag packaging market in 2024, accounting for around 64.7% of the total share. This dominance is due to its superior infusion capability, which allows water to circulate freely, enhancing flavor and aroma extraction. Double chamber bags are preferred by premium tea brands as they maintain consistency and quality in every brew. The growing popularity of convenience-focused packaging and automated filling systems further strengthens this segment’s leadership, particularly in Europe and North America, where high-end tea consumption continues to expand.

- For instance, Teepack offers the Perfecta line, a series of packaging machines for double-chamber bags. Certain models, such as the PERFECTA TAG, are capable of reaching production speeds of up to 420 double-chamber bags per minute.

By Filter Type

The paper with PLA fiber segment held the largest share of approximately 41.2% in 2024, driven by the rising demand for biodegradable and compostable materials. PLA fibers derived from renewable corn starch offer excellent strength, heat sealability, and filtration efficiency. Manufacturers increasingly adopt this filter type to comply with sustainability goals and plastic reduction regulations. Growing consumer preference for eco-friendly packaging, combined with the global shift toward circular economy practices, supports steady expansion of this segment across major tea-producing regions such as Asia-Pacific and Africa.

- For instance, Tetley GB released over 1 billion plant-based teabags as of the end of fiscal year 2023. This was part of a larger company initiative that aimed to convert 9 billion Tetley teabags in the UK to renewable packaging.

By Application

The green tea segment emerged as the leading application category in 2024, capturing about 53.6% of the global tea bag packaging market. Rising health awareness and preference for antioxidant-rich beverages have boosted green tea consumption worldwide. Tea brands are introducing innovative packaging formats that preserve freshness and aroma while offering convenient brewing options. The segment’s growth is further driven by expanding retail availability, premium organic product lines, and rising adoption of eco-conscious packaging solutions among consumers in Japan, China, and Western markets.

Key Growth Drivers

Rising Global Tea Consumption

The increasing global demand for tea, especially specialty and herbal blends, is driving the need for advanced packaging solutions. Consumers are shifting toward convenient, ready-to-use tea formats that preserve freshness and flavor. This shift encourages manufacturers to adopt innovative materials and designs that extend shelf life and enhance brewing experience. Rapid urbanization and the growing café culture further accelerate packaged tea adoption, particularly in Asia-Pacific and Europe, where single-serve packaging formats are becoming a preferred choice among younger consumers.

- For instance, Twinings sources tea from a restricted list of 160 carefully selected tea gardens and smallholder farms globally, based on ethical and quality standards.

Shift Toward Sustainable Packaging Solutions

Growing environmental awareness has led to rising adoption of eco-friendly and biodegradable packaging materials. Brands are replacing conventional plastic-based filters with compostable fibers such as polylactic acid (PLA) and paper blends. Governments and regulatory bodies are enforcing stricter plastic usage limits, prompting companies to invest in sustainable alternatives. This transition not only meets regulatory requirements but also improves brand perception and aligns with consumer preferences for environmentally responsible products, strengthening long-term market growth prospects.

- For instance, In 2019, Unilever’s CEO Alan Jope announced that the company used approximately 700,000 tonnes of virgin plastic annually and pledged to halve its use by 2025. However, this target was subsequently revised. As of 2024, the company’s new goal is to reduce its virgin plastic footprint by 30% by 2026 and 40% by 2028, citing challenges in scaling new packaging solutions

Expansion of Premium and Functional Tea Segments

The growth of premium tea varieties, including organic, detox, and wellness-infused blends, fuels demand for high-quality packaging that maintains flavor integrity. Packaging innovations such as double-chamber bags and aroma-lock pouches support the premiumization trend. Consumers associate refined packaging with better taste and purity, increasing brand loyalty. Manufacturers leverage this trend by offering visually appealing, resealable, and eco-safe packaging designs that cater to the rising global preference for healthier and luxury tea products across retail and online channels.

Key Trends & Opportunities

Adoption of Smart and Innovative Packaging

Technological advancements in packaging design are reshaping the tea industry. Smart packaging solutions integrate freshness indicators, aroma-seal mechanisms, and QR codes that enhance transparency and traceability. These innovations allow brands to communicate product origin, sustainability, and brewing instructions directly to consumers. The rise of digital engagement tools and interactive packaging also supports brand differentiation, creating new opportunities for premium players to attract health-conscious and tech-savvy consumers across competitive markets.

- For instance, Zhejiang Kan Special Paper Co., Ltd. (a Zhejiang Kain entity) manufactures heat-sealable tea bag filter papers that can contain PLA fibers, with PLA content typically ranging from 15–40% when used with natural fibers like wood pulp or abaca.

Growth in E-commerce Distribution Channels

The increasing shift toward online retailing offers significant opportunities for tea bag packaging manufacturers. E-commerce platforms favor lightweight, durable, and visually appealing packaging that ensures safe delivery and strong shelf presentation. Global tea brands and niche startups alike are leveraging digital platforms to expand their reach and product visibility. This trend accelerates the demand for flexible, protective, and custom-designed packaging that enhances consumer experience and reinforces brand identity in the online retail space.

- For instance, Based on statements made in 2025, Tata Consumer Products’ e-commerce revenue has grown significantly and now accounts for approximately 15% of its total turnover. Within this channel, quick commerce is a major driver, contributing a substantial portion of e-commerce revenue—around 7.5% of total turnover, or half of the total e-commerce share.

Key Challenges

High Cost of Sustainable Materials

The use of biodegradable and compostable materials, though environmentally beneficial, significantly increases production costs. Sustainable fibers such as PLA and non-woven organic fabrics are more expensive compared to synthetic alternatives. Small and medium-sized producers often struggle to absorb these costs, limiting large-scale adoption. The challenge lies in balancing eco-friendly packaging goals with affordability and performance, compelling companies to invest in material innovation and supply chain efficiency to remain competitive.

Limited Recycling and Disposal Infrastructure

Despite growing demand for sustainable packaging, many regions lack adequate recycling and composting facilities. Improper disposal practices reduce the effectiveness of biodegradable solutions, undermining environmental benefits. This challenge is more prominent in developing countries where waste management systems are underdeveloped. Manufacturers face difficulties ensuring end-of-life sustainability, which hinders full circular economy implementation. Addressing this issue requires collaboration among governments, packaging firms, and consumers to establish efficient collection and recycling frameworks.

Regional Analysis

North America

North America accounted for around 27.4% of the global tea bag packaging market in 2024, driven by strong demand for premium and organic tea products. The U.S. leads regional growth due to rising consumer preference for convenient, on-the-go beverage solutions. Sustainable packaging adoption is accelerating as brands transition toward compostable and recyclable materials. Major players focus on product differentiation through advanced barrier coatings and user-friendly designs. The region’s robust retail infrastructure and growing online tea sales further strengthen packaging innovation, with eco-conscious consumers influencing material and design trends across the market.

Europe

Europe held a significant market share of approximately 30.6% in 2024, emerging as the largest regional market. The region’s dominance is attributed to the high consumption of black and herbal teas and strong sustainability regulations. Countries such as the United Kingdom, Germany, and France lead in adopting biodegradable and plastic-free tea bags. Packaging manufacturers are investing in paper-based and non-woven filter materials that comply with EU environmental standards. Growing demand for premium and functional teas also fuels packaging innovation, with a focus on preserving freshness, aroma, and brand aesthetics across retail and specialty stores.

Asia-Pacific

Asia-Pacific captured nearly 33.2% of the global market in 2024, making it the fastest-growing region. The region’s expansion is driven by the large tea-producing economies of China, India, and Japan. Rising middle-class populations, urbanization, and health-conscious consumers are increasing packaged tea consumption. Local manufacturers are investing in modern packaging technologies to cater to both export and domestic markets. The growing popularity of green and herbal teas, coupled with sustainable packaging adoption, supports long-term growth. Increasing e-commerce penetration and rising export demand for value-added tea products further enhance regional market development.

Latin America

Latin America represented about 5.2% of the tea bag packaging market share in 2024, supported by growing awareness of health and wellness beverages. Countries like Brazil, Argentina, and Chile are experiencing gradual increases in tea consumption, particularly green and herbal blends. Manufacturers are focusing on cost-effective yet sustainable packaging formats to meet shifting consumer preferences. Expanding retail networks and the entry of international tea brands enhance market accessibility. The regional market is also witnessing a rise in locally produced organic teas, stimulating demand for paper-based and biodegradable packaging options.

Middle East & Africa

The Middle East & Africa accounted for approximately 3.6% of the global market in 2024, with steady growth driven by evolving beverage consumption habits. Countries such as Saudi Arabia, the United Arab Emirates, and South Africa are leading adopters of packaged tea products. Demand is growing for convenient, single-serve tea bags that suit fast-paced lifestyles. International brands are expanding their presence through modern retail channels and online platforms. The increasing preference for flavored and wellness teas, along with gradual shifts toward sustainable packaging materials, is expected to drive regional market expansion.

Market Segmentations:

By Packaging

- Single Chamber

- Double Chamber

By Filter Type

- Paper with PLA Fiber

- Paper with Plastic Fiber Paper

- Non-Woven Fabric Made of Plastic

- Non-Woven Fabric

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Key players in the tea bag packaging market include Huhtamaki, Smurfit Kappa Group, ProAmpac, DS Smith, WestRock Company, Mondi Group, Sealed Air Corporation, Global Packaging Solutions, Syntegon Technology, Tetra Pak, and Amcor. The market is highly competitive, characterized by strong emphasis on sustainable materials, automation, and design innovation. Companies focus on developing biodegradable and compostable solutions to meet global sustainability goals and evolving consumer preferences. Technological advancements in heat sealing, aroma preservation, and lightweight structures enhance product performance and brand differentiation. Strategic partnerships with tea producers and retailers support tailored packaging development and wider distribution. Additionally, rising investments in recyclable paper filters and PLA-based materials drive production efficiency while maintaining compliance with regional regulations. Increasing competition also encourages diversification in packaging formats such as pyramid, double chamber, and sachet styles, aligning with the demand for convenience and premiumization across major tea-consuming regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, ProAmpac introduced ProActive Intelligent Moisture Protect MP-1000, a patent-pending technology to control moisture without desiccant sachets.

- In 2024, Smurfit Kappa acquired a Bag-in-Box plant in Bulgaria, expanding its production capacity for a format that can be used for liquid teas.

- In 2023, Mondi invested in FunctionalBarrier Paper Ultimate, an ultra-high barrier paper-based packaging solution suitable for tea and coffee packaging.

Report Coverage

The research report offers an in-depth analysis based on Packaging, Filter Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by increasing global tea consumption.

- Sustainable and biodegradable materials will dominate future packaging developments.

- Premiumization in tea products will boost demand for high-quality and aesthetic packaging.

- Asia-Pacific will remain the fastest-growing region due to rising urbanization and exports.

- Technological innovations such as smart packaging will enhance consumer engagement.

- E-commerce expansion will create strong opportunities for customized tea bag packaging.

- Strategic collaborations between tea producers and packaging firms will rise.

- Manufacturers will focus on cost optimization to offset sustainability expenses.

- Flexible and lightweight materials will gain preference for better transport efficiency.

- Brand differentiation through eco-labeling and recyclable designs will shape market competitiveness.