Market overview

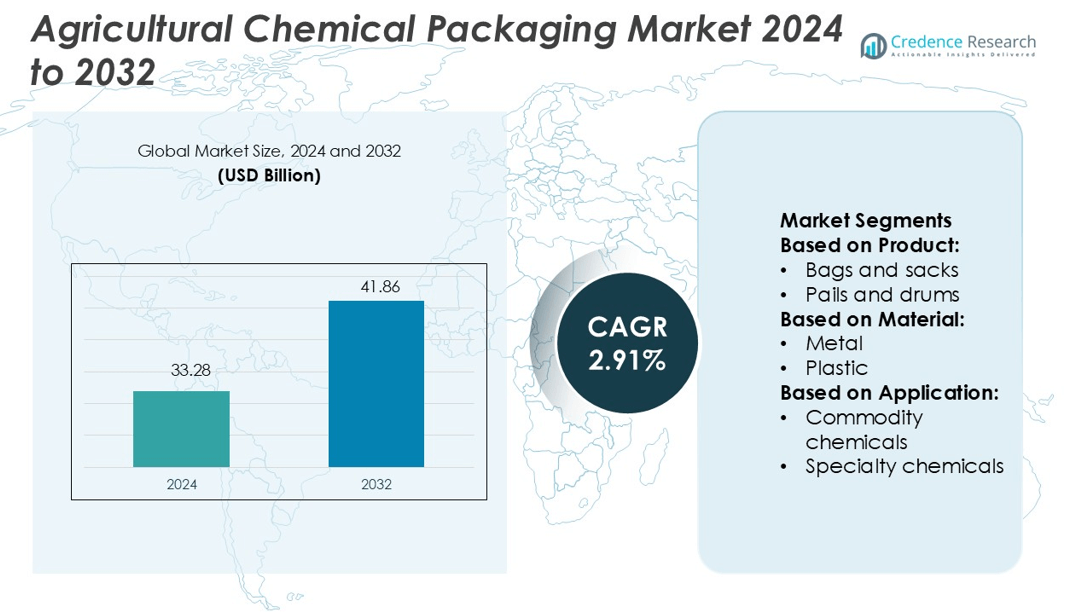

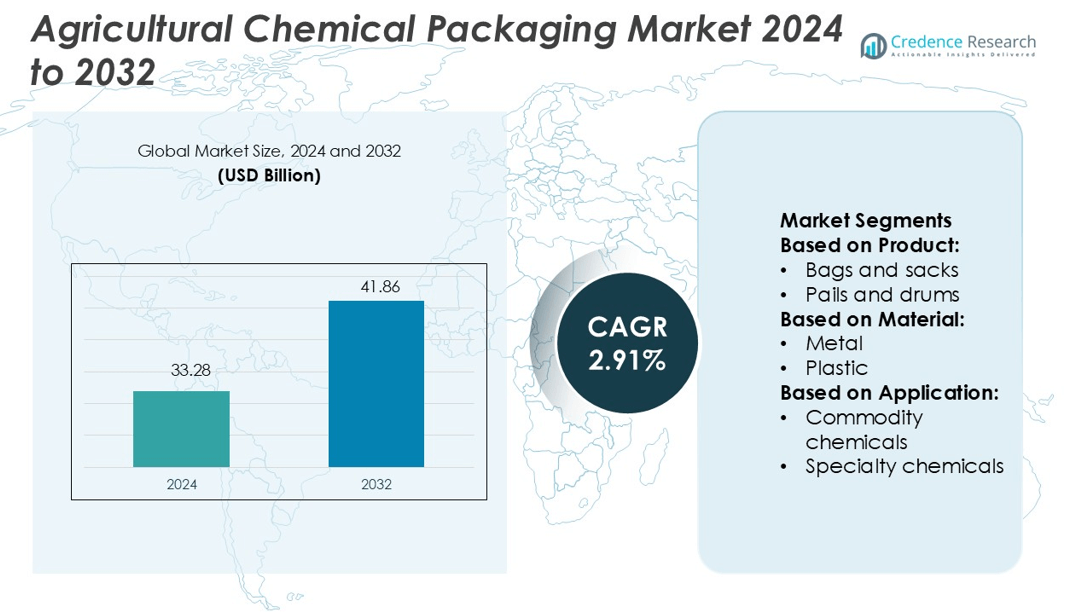

Agricultural Chemical Packaging Market size was valued USD 33.28 billion in 2024 and is anticipated to reach USD 41.86 billion by 2032, at a CAGR of 2.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Agricultural Chemical Packaging Market Size 2024 |

USD 33.28 billion |

| Agricultural Chemical Packaging Market, CAGR |

2.91% |

| Agricultural Chemical Packaging Market Size 2032 |

USD 41.86 billion |

The agricultural chemical packaging market is shaped by prominent players such as Kaufman Container, DS Smith, Hoover CS, Codefine, Advanced Industries Packaging, Champion Plastics, ILC Dover, CDF, LC Packaging, and Fres-co. These companies focus on innovative packaging solutions that ensure product safety, regulatory compliance, and sustainability. They are investing in smart labeling, recyclable materials, and bulk packaging formats to meet rising agrochemical demand. North America emerges as the leading region in this market, holding a 32% share, driven by advanced farming practices, strict safety regulations, and high adoption of sustainable packaging technologies. This leadership reinforces strong competitive positioning and market expansion.

Market Insights

- The agricultural chemical packaging market was valued at USD 33.28 billion in 2024 and is projected to reach USD 41.86 billion by 2032, growing at a CAGR of 2.91% during the forecast period.

- Rising agrochemical use, strict regulatory compliance, and the shift toward sustainable packaging are key drivers supporting steady market growth across major farming economies.

- Smart labeling, bulk packaging, and recyclable materials are shaping new trends, enhancing product traceability and supply chain efficiency.

- The market is dominated by leading players such as Kaufman Container, DS Smith, Hoover CS, Codefine, Advanced Industries Packaging, Champion Plastics, ILC Dover, CDF, LC Packaging, and Fres-co, creating strong competitive pressure.

- North America leads with a 32% regional share, supported by advanced farming practices, while plastic-based packaging dominates segment share due to its durability and cost efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Bags and sacks hold the dominant share in the agricultural chemical packaging market with 38%. Their widespread use in storing and transporting fertilizers, pesticides, and herbicides drives this leadership. The segment benefits from cost-effective production, easy handling, and compatibility with bulk quantities. Manufacturers favor bags and sacks due to their lightweight structure and durability in varying weather conditions. The demand is further supported by increased mechanized farming and efficient supply chains. Their reusability and ease of labeling make them preferred for both commodity and specialty chemicals.

- For instance, DS Smith’s chemical-industry packaging design supports dynamic stacking of 1,300 kg per container during transport of hazardous and bulk materials, and includes RFID‐enabled corrugated solutions that permit tracking of each unit throughout the supply chain.

By Material

Plastic dominates the material segment with a 42% market share. Its high chemical resistance, lightweight structure, and lower production cost make it a preferred choice for agricultural packaging. Plastic containers ensure long shelf life and protection against moisture and contamination. Their adaptability for various product types, including bottles, drums, and IBCs, enhances their use. Growing adoption of advanced polymers and recyclable plastics strengthens this segment’s position. Farmers and distributors rely on plastic for efficient storage, safe transport, and cost control in large-scale farming operations.

- For instance, Hoover CS’s 10-gauge 304 stainless-steel IBC models support maximum gross weights of up to 13,456 lbs (approximately 6,104 kg) in its 793-gallon (3,000 L) unit, as described in its handling manual.

By Application

Commodity chemicals lead the application segment with a 47% market share. Fertilizers and bulk pesticides require durable and cost-effective packaging solutions, making this segment dominant. Bags, sacks, and plastic containers are extensively used to handle high-volume chemical products. Rising demand for crop protection products in commercial agriculture boosts this segment’s growth. Large-scale distribution networks and storage facilities also favor packaging that ensures product stability and easy handling. The increasing use of nitrogen-based fertilizers further fuels packaging demand in this segment.

Key Growth Drivers

Rising Demand for Agrochemicals

The rapid expansion of modern agriculture is driving agrochemical consumption. Farmers are increasingly using pesticides, herbicides, and fertilizers to boost crop yield and quality. This rise in chemical use directly increases demand for durable and safe packaging solutions. Agricultural chemical packaging protects products from contamination and ensures easier transport and storage. It also supports compliance with safety regulations in different countries. Growing global food demand further fuels this packaging market, especially in regions with intensive farming practices and large-scale crop production.

- For instance, Codefine supplies FIBC (Flexible Intermediate Bulk Container) bulk bags tailored for agrochemical and fertilizer transport. The company offers bags with Safe Working Loads (SWL) up to 2,000 kg, and standard single-trip bags are manufactured with a 5:1 Safety Factor, meaning they are tested to withstand five times their rated load before bursting.

Increased Focus on Product Safety and Compliance

Stricter regulations on chemical handling are pushing manufacturers to adopt high-quality packaging. Advanced packaging solutions reduce leakage risks and ensure chemical stability during transportation and storage. Companies are using UN-certified containers, tamper-proof seals, and chemical-resistant materials to meet compliance standards. This trend is especially strong in North America and Europe. Clear labeling and secure closures also enhance traceability, improving overall supply chain safety. As governments tighten safety rules, demand for specialized packaging continues to rise across major agricultural markets.

- For instance, Champion Plastics offers polyethylene film and bags with width ranges from 2 inches up to 200 inches, and gauges from 0.0005″ to 0.010″, enabling high-precision containment for industrial and chemical applications.

Expansion of Sustainable Packaging Solutions

Growing environmental awareness is driving the adoption of sustainable packaging materials. Producers are shifting toward recyclable plastics, biodegradable films, and paper-based containers to meet green packaging targets. Major agrochemical companies are partnering with packaging suppliers to reduce carbon footprints. These solutions appeal to both regulators and environmentally conscious consumers. Advanced sustainable designs also offer durability, chemical resistance, and cost efficiency. This shift supports brand reputation and aligns with global sustainability goals, boosting growth opportunities for eco-friendly packaging providers.

Key Trends & Opportunities

Integration of Smart and Trackable Packaging

The packaging industry is adopting smart technologies to improve product safety and traceability. RFID tags, QR codes, and NFC sensors are increasingly used to monitor agrochemical distribution and prevent counterfeiting. This trend allows real-time tracking of product movement through the supply chain. It enhances regulatory compliance and builds farmer trust. Digital labeling also improves inventory management for distributors. As the agricultural sector embraces digitalization, smart packaging solutions present a strong opportunity for market expansion.

- For instance, DoverPac® High Containment FIBC System meets containment levels of < 0.5 µg/m³, and is built using ArmorFlex® film for robust static-dissipative and solvent-resistant performance.

Growth in Bulk and Refillable Packaging Formats

Large-scale farming operations are driving demand for bulk and reusable packaging solutions. Intermediate bulk containers (IBCs) and pails are becoming popular for efficient chemical handling. These solutions reduce packaging waste and lower logistics costs. Refillable systems also support sustainability targets for agrochemical producers. Many companies are offering returnable container programs to reduce single-use plastics. This trend aligns with operational cost savings and environmental goals, creating new revenue opportunities for packaging manufacturers.

- For instance, CDF launched a new Form-Fit IBC liner manufacturing line in Lienen, Germany, that supports bulk packaging volumes ranging from 220 litres to 1,500 litres.

Rising Adoption of Barrier-Coated and High-Performance Materials

Manufacturers are developing advanced packaging materials with strong chemical resistance and extended shelf life. Barrier-coated plastics and multi-layer laminates protect agrochemicals from moisture, sunlight, and degradation. These innovations improve product stability and minimize spillage. High-performance packaging also helps companies comply with international shipping standards. As agricultural trade expands globally, such material advancements offer competitive advantages. This trend strengthens market growth prospects in regions with diverse climatic conditions.

Key Challenges

Volatile Raw Material Costs

Fluctuating raw material prices pose a major challenge for packaging manufacturers. Most packaging solutions rely on plastic resins and metals, which are sensitive to global oil price changes. These fluctuations impact production costs and profit margins. Smaller manufacturers often face difficulties in absorbing these price shifts. Sudden cost spikes can also delay delivery schedules and strain supplier contracts. This volatility forces companies to explore cost-efficient and alternative materials while maintaining quality standards.

Environmental Regulations and Waste Management

Stringent environmental rules on plastic waste and chemical disposal are challenging for the industry. Many regions are introducing restrictions on single-use plastics and non-recyclable materials. Compliance with these evolving regulations requires high investments in sustainable product development. Waste collection and recycling infrastructure also remain limited in several countries. This creates additional burdens for packaging producers and agrochemical companies. Meeting these regulations without increasing costs is a key challenge that affects overall market expansion.

Regional Analysis

North America

North America leads the agricultural chemical packaging market with a 32% share. The region benefits from advanced farming practices, strong regulatory frameworks, and a high adoption rate of smart packaging solutions. Manufacturers prioritize UN-certified containers, bulk packaging formats, and sustainable materials to meet compliance and environmental goals. Large agrochemical producers rely on durable and tamper-proof packaging for safe transport and handling. Growing demand for precision agriculture and improved chemical traceability supports market growth. The United States dominates regional revenue, with Canada contributing steadily through large-scale crop protection initiatives.

Europe

Europe holds a 27% market share, driven by strict environmental regulations and strong sustainability initiatives. The region has high demand for eco-friendly packaging solutions made from recyclable and biodegradable materials. Agrochemical producers focus on compliance with EU safety standards, leading to increased use of advanced barrier-coated and smart packaging. Bulk and refillable formats are growing rapidly, particularly in Germany, France, and the Netherlands. Rising emphasis on reducing plastic waste and improving supply chain traceability further strengthens market demand across the region, supported by widespread technological adoption in agriculture.

Asia-Pacific

Asia-Pacific accounts for a 24% market share, supported by rapid agricultural expansion and increasing chemical usage. High population growth and rising food demand are driving agrochemical consumption in countries like China, India, and Japan. Manufacturers focus on cost-effective, lightweight packaging suitable for small and bulk quantities. Government initiatives promoting modern farming and pest control boost the adoption of advanced packaging formats. Local players are also investing in sustainable packaging solutions to meet export standards. The region’s strong manufacturing base and expanding farming infrastructure make it a major growth hub.

Latin America

Latin America represents a 10% market share, led by Brazil and Argentina’s large-scale farming operations. The region’s agricultural sector is highly export-oriented, increasing demand for secure and durable agrochemical packaging. Producers prefer intermediate bulk containers (IBCs) and pails to reduce handling costs. Growing adoption of smart labeling and traceability solutions supports compliance with international trade standards. However, limited recycling infrastructure creates barriers for sustainable packaging. Despite this, ongoing investments in modern agriculture and improved logistics networks are driving steady market expansion in the region.

Middle East & Africa

The Middle East & Africa region holds a 7% market share, supported by growing investments in agriculture and irrigation. Countries like Saudi Arabia, South Africa, and the UAE are adopting chemical-based crop protection to increase food security. Packaging demand is rising for both imported and locally produced agrochemicals. Cost-efficient plastic containers and bulk packaging dominate due to affordability and ease of transport. Sustainability adoption is slower compared to other regions, but regulatory changes are encouraging eco-friendly solutions. Expanding agricultural modernization initiatives are expected to boost future market potential.

Market Segmentations:

By Product:

- Bags and sacks

- Pails and drums

By Material:

By Application:

- Commodity chemicals

- Specialty chemicals

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the agricultural chemical packaging market features leading players such as Kaufman Container, DS Smith, Hoover CS, Codefine, Advanced Industries Packaging, Champion Plastics, ILC Dover, CDF, LC Packaging, and Fres-co. The agricultural chemical packaging market is defined by continuous innovation and strong regulatory compliance. Companies are focusing on developing advanced packaging formats that enhance product safety, traceability, and sustainability. Eco-friendly materials, including recyclable plastics and biodegradable films, are becoming standard in product lines to meet environmental targets. Bulk and refillable containers are gaining popularity, reducing transportation costs and packaging waste. Many market participants are integrating smart technologies such as RFID tags and QR codes to improve supply chain visibility and reduce counterfeiting. Strategic partnerships with agrochemical manufacturers enable customized packaging solutions. This competitive approach strengthens market growth and encourages consistent technological advancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kaufman Container

- DS Smith

- Hoover CS

- Codefine

- Advanced Industries Packaging

- Champion Plastics

- ILC Dover

- CDF

- LC Packaging

- Fres-co

Recent Developments

- In January 2025, Borouge secured supply agreements with Bericap, Taghleef Industries, INDEVCO Group, and ALPLA, allocating 80% of contracted polyethylene and polypropylene volumes to fast-growing sectors including agriculture.

- In September 2024, Greif, Inc. opened a new manufacturing facility for Intermediate Bulk Containers (IBCs) used in various industries such as food, chemicals, lubricants, flavors, and fragrances in Pasir Gudang, Johor, Malaysia. The new facility uses advanced manufacturing technologies, including blow molding and cage line technologies, to ensure production meets Greif’s quality and sustainability standards.

- In August 2024, Mauser Packaging Solutions expanded its presence in South Africa by acquiring a plastic drum manufacturing business in Pinetown, Kwa-Zulu Natal. This acquisition extends Mauser’s production capacities and footprint in South Africa, enabling the company to offer comprehensive solutions and packaging excellence from five manufacturing and reconditioning facilities.

- In January 2024, StePac, a fresh produce packaging manufacturer, launched a sustainable packaging solution that prolongs the shelf life of exotic mushrooms. This latest advancement in its packaging formats is specifically designed to maintain the freshness of whole and sliced white mushrooms, as well as other exotic varieties, such as oyster, shiitake, lion’s mane, and portabell

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Sustainable packaging adoption will increase as regulatory pressure and consumer awareness grow.

- Smart packaging with tracking features will enhance supply chain transparency.

- Bulk and refillable packaging solutions will gain stronger demand among large farms.

- Advanced barrier coatings will improve chemical stability and product shelf life.

- Investment in recyclable and biodegradable materials will accelerate.

- Digital labeling and QR codes will become standard across major agrochemical brands.

- Automation in filling and sealing processes will improve operational efficiency.

- Strategic partnerships will drive product innovation and regional expansion.

- Emerging economies will become key growth hubs for packaging demand.

- Circular economy practices will reshape packaging design and disposal methods.