Market Overview

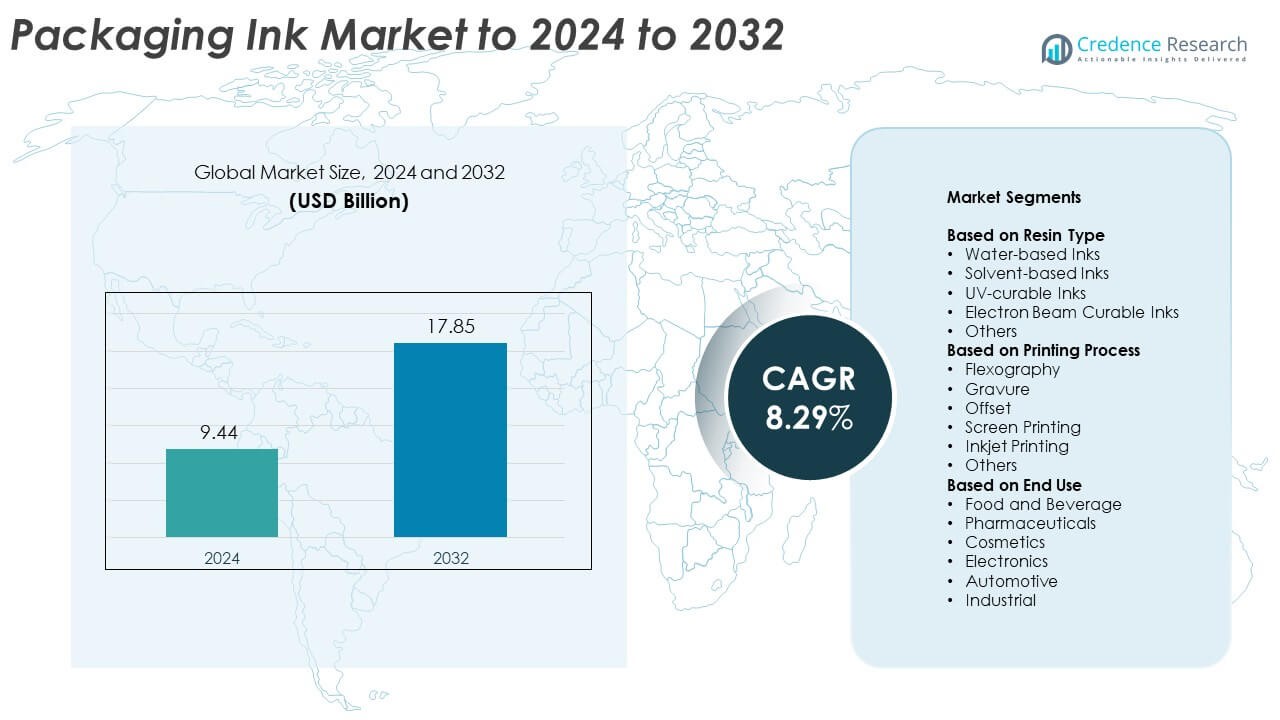

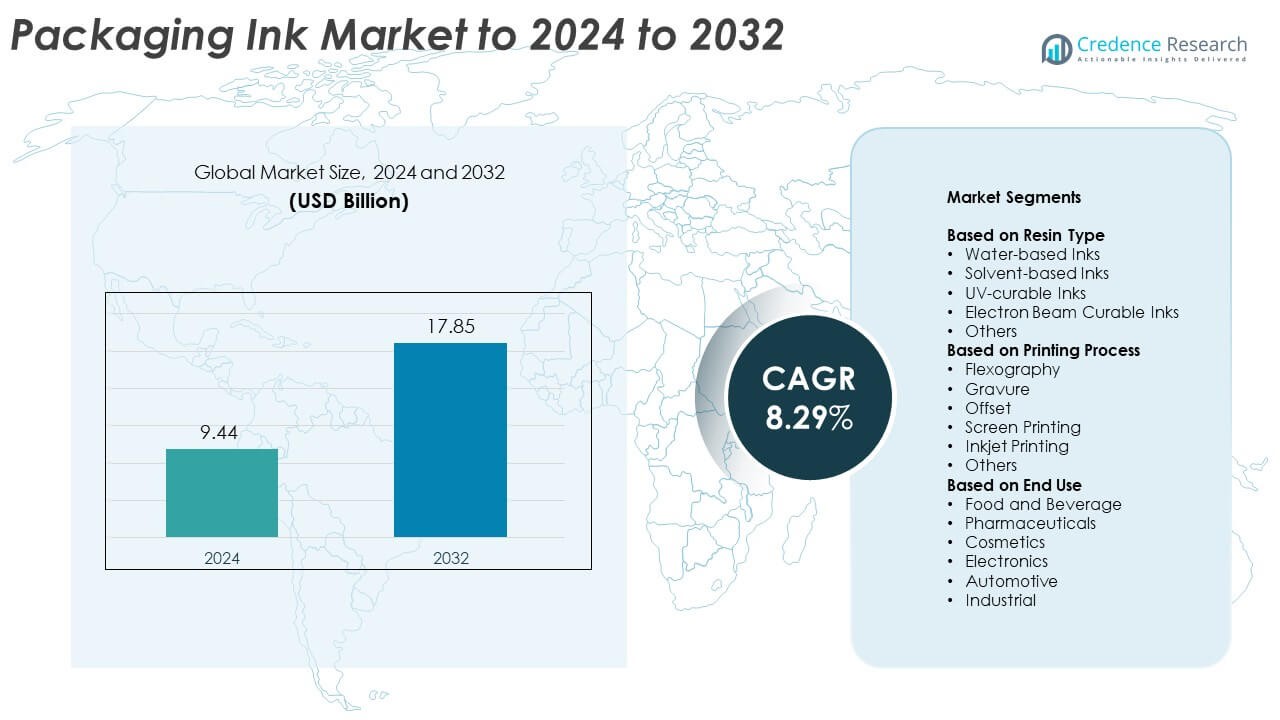

The Packaging Ink Market size was valued at USD 9.44 Billion in 2024 and is anticipated to reach USD 17.85 Billion by 2032, at a CAGR of 8.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Packaging Ink Market Size 2024 |

USD 9.44 Billion |

| Packaging Ink Market, CAGR |

8.29% |

| Packaging Ink Market Size 2032 |

USD 17.85 Billion |

The Packaging Ink Market is highly competitive, with major players such as DIC Corporation, BASF SE, Siegwerk Druckfarben, Eastman Chemical Company, and Sun Chemical leading global operations. These companies focus on sustainable ink formulations, including water-based and UV-curable products, to meet growing environmental standards and customer preferences. Continuous investments in R&D and technological innovation support enhanced print quality and substrate compatibility. Regionally, Asia-Pacific dominated the market in 2024 with a 33.6% share, driven by expanding manufacturing capacity, strong demand from the food and beverage sector, and rapid adoption of flexible packaging solutions across emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Packaging Ink Market was valued at USD 9.44 billion in 2024 and is expected to reach USD 17.85 billion by 2032, growing at a CAGR of 8.29%.

- Increasing demand for flexible and sustainable packaging solutions is the primary driver, supported by advancements in water-based and UV-curable inks.

- The market is witnessing strong trends toward bio-based formulations, digital printing technologies, and low-migration inks for food packaging.

- Competition remains intense as leading manufacturers invest in R&D, sustainability, and capacity expansions to strengthen global presence.

- Asia-Pacific leads with a 33.6% share, followed by North America at 31.4% and Europe at 27.8%, while the solvent-based inks segment accounted for the largest 42.6% share in 2024.

Market Segmentation Analysis:

By Resin Type

The solvent-based inks segment dominated the packaging ink market in 2024, holding a 42.6% share. This dominance stems from their superior adhesion properties, fast drying time, and compatibility with diverse substrates such as plastics, metals, and foils. These inks are preferred in flexible packaging for food and beverage and industrial applications. Water-based inks are also gaining momentum due to growing sustainability mandates and reduced volatile organic compound emissions. Increasing regulatory focus on eco-friendly packaging solutions continues to drive the shift toward low-VOC formulations and resin innovations across regions.

- For instance, Sun Chemical’s SunVisto AquaGreen lists a pH range of 8.5–9.5 for water-based inks, supporting stable press control on paper packaging.

By Printing Process

Flexography led the packaging ink market in 2024, capturing a 46.1% share. The process remains favored for high-speed printing on corrugated boxes, flexible films, and paper-based packaging. Its versatility and cost efficiency make it the preferred choice for large-volume packaging production. Advancements in anilox roll technology and digital integration have improved print resolution and ink transfer. Meanwhile, inkjet printing is expanding in short-run and custom packaging applications. The ongoing adoption of automation and hybrid printing systems continues to reshape process dynamics in the global market.

- For instance, BOBST’s MASTER CI wide-web flexo press is specified for up to 800 m/min production speed on flexible packaging lines.

By End Use

The food and beverage segment held the largest share of 51.7% in 2024, driven by the rising demand for flexible and sustainable packaging formats. Ink formulations offering excellent resistance to heat, moisture, and abrasion are essential for maintaining product safety and branding. Regulatory compliance with food contact standards has encouraged the use of low-migration inks. Pharmaceutical and cosmetics packaging also show steady growth due to expanding demand for high-definition labeling and traceability solutions. Increasing consumer preference for packaged and convenience food continues to strengthen the dominance of this segment.

Key Growth Drivers

Rising Demand for Flexible and Sustainable Packaging

The shift toward flexible packaging formats such as pouches and sachets is a major growth driver for the packaging ink market. Consumers prefer lightweight, durable, and eco-friendly materials that reduce waste and improve shelf appeal. Manufacturers are responding with inks compatible with biodegradable films and recyclable laminates. Growing sustainability commitments among FMCG and food producers continue to boost the use of low-VOC, water-based, and UV-curable inks to meet evolving environmental regulations and consumer expectations globally.

- For instance, Domino’s N610i digital label press features a 600 dpi native resolution and a maximum 333 mm print width.

Technological Advancements in Printing Processes

Continuous innovation in printing technologies such as digital, flexographic, and inkjet systems is accelerating ink demand. These modern processes enable high-resolution graphics, variable data printing, and faster turnaround times. Improved pigment dispersion and polymer chemistry enhance ink performance and adhesion on multiple substrates. Additionally, automation and AI-driven color management systems are optimizing efficiency in large-scale packaging production. Such technological progress is pushing converters to adopt advanced ink formulations for both short-run and mass customization needs.

- For instance, the Fujifilm Jet Press 750S High-Speed Model offers flexible printing capabilities, including a maximum speed of 5,400 B2 sheets per hour in a 1,200 x 600 dpi High Performance mode, and an Ultra-High Quality mode that delivers 1,200 x 1,200 dpi resolution at a speed of 3,600 B2 sheets per hour.

Expansion of E-commerce and Packaged Goods Industry

The booming e-commerce sector has significantly increased the demand for printed corrugated boxes, labels, and flexible packaging. Brand owners focus on high-quality visuals and durable inks that maintain aesthetics during shipping and handling. The rise in online grocery and meal delivery services has further expanded packaging requirements across categories. This trend supports consistent ink consumption in corrugated and folding carton applications, particularly in Asia-Pacific and North America, where logistics and retail packaging investments remain strong.

Key Trends & Opportunities

Shift Toward Bio-based and Low-Migration Inks

Sustainability remains a core trend, with brands adopting bio-based inks derived from renewable materials such as soy or algae. Low-migration inks are also gaining popularity in food, pharmaceutical, and personal care packaging to meet safety and compliance standards. Ongoing R&D in resin systems and green solvents is improving print performance without compromising recyclability. This shift aligns with circular economy goals and government initiatives aimed at reducing the carbon footprint of packaging materials and inks.

- For instance, Siegwerk’s UniNATURE range is verified for bio-renewable content via ASTM D6866 and designed with low VOC concentrates for food-contact printing.

Growth in Digital and Smart Packaging Applications

Rising adoption of digital printing technologies has opened opportunities for customized, interactive, and smart packaging designs. QR codes, track-and-trace features, and augmented reality elements are being integrated into packaging to enhance consumer engagement. Ink manufacturers are developing UV-curable and hybrid formulations to support these high-speed, variable-data printing needs. The trend toward short-run, on-demand production provides additional growth potential for digital ink solutions in the evolving packaging landscape.

- For instance, Avery Dennison supports large-scale item-level tracking, as demonstrated by a case study with Levi Strauss & Co. reported in December 2020. At that point, Avery Dennison had enabled 100% of Levi’s US stores with RFID technology, and over 50 million Levi’s products were tagged.

Key Challenges

Volatility in Raw Material Prices

Frequent fluctuations in the cost of pigments, resins, and solvents pose major challenges for ink manufacturers. Price instability impacts production planning and profit margins, especially in regions dependent on imports. Supply chain disruptions and geopolitical factors further intensify cost pressures. Manufacturers are seeking long-term supplier partnerships and investing in alternative materials to stabilize operations and ensure continuous product availability in volatile market conditions.

Stringent Environmental Regulations and Compliance

Increasing environmental regulations on VOC emissions and chemical safety have created compliance challenges across the packaging ink industry. Manufacturers must continually reformulate inks to meet global and regional environmental standards, including REACH and EPA guidelines. These changes often increase R&D costs and extend product development timelines. Ensuring consistent quality while maintaining eco-friendly formulations requires ongoing innovation and significant capital investment from leading ink producers.

Regional Analysis

North America

North America held a 31.4% share of the packaging ink market in 2024, driven by high consumption of packaged food, beverages, and pharmaceuticals. The United States leads the regional market due to advanced printing technologies and strong demand for sustainable inks. Growing investments in flexible packaging and e-commerce have expanded applications across labels and corrugated boxes. Ink manufacturers are focusing on low-VOC and UV-curable formulations to meet regulatory requirements. The region’s well-established printing infrastructure and emphasis on eco-friendly materials continue to support market expansion.

Europe

Europe accounted for a 27.8% share of the global packaging ink market in 2024. Demand is largely influenced by stringent environmental regulations and a strong shift toward bio-based inks. Germany, Italy, and the United Kingdom dominate production and consumption due to mature packaging and printing industries. The rise in sustainable packaging adoption across food, beverage, and cosmetic sectors is boosting water-based and low-migration ink usage. Ongoing innovation in recyclable packaging materials is expected to further accelerate regional ink development and adoption over the forecast period.

Asia-Pacific

Asia-Pacific led the packaging ink market in 2024 with a 33.6% share, making it the largest regional market. Expanding manufacturing bases in China, India, and Japan are driving demand for flexible packaging inks. Rapid urbanization, growing disposable incomes, and a surge in packaged food consumption continue to stimulate market growth. Government support for sustainable production and advancements in digital printing technology enhance regional competitiveness. Increasing exports of packaged goods also contribute to higher ink consumption across industrial and commercial packaging applications.

Latin America

Latin America captured a 4.2% share of the global packaging ink market in 2024. Brazil and Mexico lead regional demand due to growing processed food and beverage sectors. The shift toward cost-effective flexographic and gravure printing supports ink usage in flexible packaging. Manufacturers are focusing on expanding local production to reduce import dependency and meet environmental standards. Increasing adoption of eco-friendly and water-based inks in consumer goods packaging is expected to create additional growth opportunities in the coming years.

Middle East & Africa

The Middle East & Africa region held a 3% share of the packaging ink market in 2024. Rapid expansion of the food processing, pharmaceutical, and personal care industries is driving steady demand. The United Arab Emirates and South Africa are emerging as key markets with rising packaging modernization efforts. Growing interest in premium packaging solutions for retail and export products supports the adoption of advanced printing technologies. However, limited infrastructure and raw material import reliance remain key challenges restraining faster market growth in the region.

Market Segmentations:

By Resin Type

- Water-based Inks

- Solvent-based Inks

- UV-curable Inks

- Electron Beam Curable Inks

- Others

By Printing Process

- Flexography

- Gravure

- Offset

- Screen Printing

- Inkjet Printing

- Others

By End Use

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Electronics

- Automotive

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

DIC Corporation, BASF SE, Siegwerk Druckfarben, Eastman Chemical Company, Sun Chemical, TOYO INK SC HOLDINGS, Arkema Group, Flint Group, Avery Dennison Corporation, Dow, Epple Druckfarben AG, Sakata INX, INX International Ink, hubergroup, and AkzoNobel dominate the competitive landscape of the packaging ink market. The competition is characterized by continuous innovation, product differentiation, and sustainability-driven strategies. Companies are prioritizing low-VOC, water-based, and UV-curable ink developments to align with evolving environmental standards. Strategic collaborations with packaging converters and brand owners help strengthen market positioning and expand regional reach. Mergers, acquisitions, and capacity expansions are key tactics to enhance production efficiency and global footprint. Firms are investing heavily in R&D to improve print quality, substrate compatibility, and color performance. The ongoing shift toward digital and flexible packaging continues to reshape the market dynamics, favoring innovation-led and sustainability-focused manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DIC Corporation

- BASF SE

- Siegwerk Druckfarben

- Eastman Chemical Company

- Sun Chemical

- TOYO INK SC HOLDINGS

- Arkema Group

- Flint Group

- Avery Dennison Corporation

- Dow

- Epple Druckfarben AG

- Sakata INX

- INX International Ink

- hubergroup

- AkzoNobel

Recent Developments

- In 2024, Sun Chemical launched the Xennia Jade pigment ink, designed to address challenges in the direct-to-film (DTF) market

- In 2024, Flint Group opened a new, state-of-the-art facility in India to produce water-based inks and coatings for the paper and packaging industry.

- In 2023, Sun Chemical showcased new ink and coating product lines for digital, inkjet, screen, and specialty printing at trade shows such as FESPA and Printing United

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Printing Process, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing adoption of sustainable and bio-based inks will remain a primary market focus.

- Demand for water-based and UV-curable formulations will rise due to environmental compliance.

- Digital and inkjet printing technologies will expand in short-run and customized packaging.

- Flexible packaging applications will continue driving major ink consumption globally.

- Advancements in pigment and resin chemistry will enhance print quality and durability.

- E-commerce growth will boost demand for high-quality labeling and corrugated printing inks.

- Integration of smart and interactive packaging designs will create new ink opportunities.

- Asia-Pacific will maintain market leadership with increasing manufacturing and export activity.

- Strategic mergers and R&D investments will strengthen competitive positioning among key players.

- Regulatory pressures will accelerate innovation toward low-VOC and food-safe ink formulations.