Market Overview:

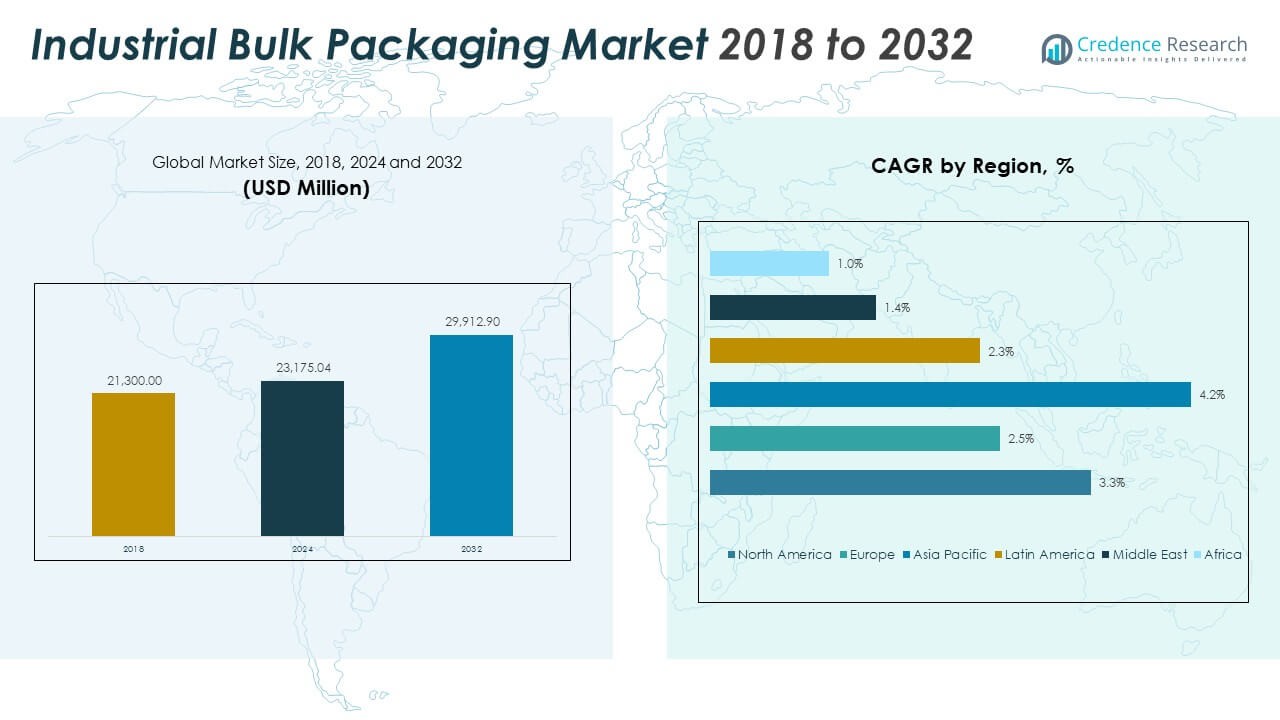

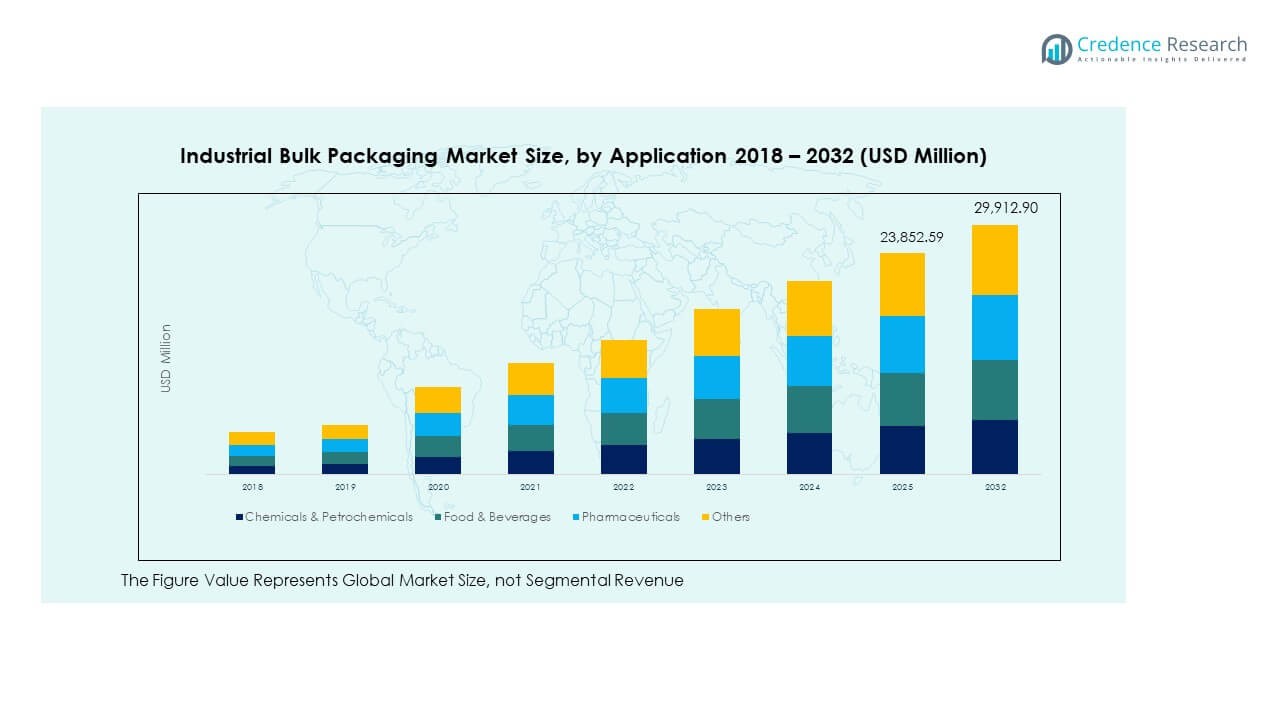

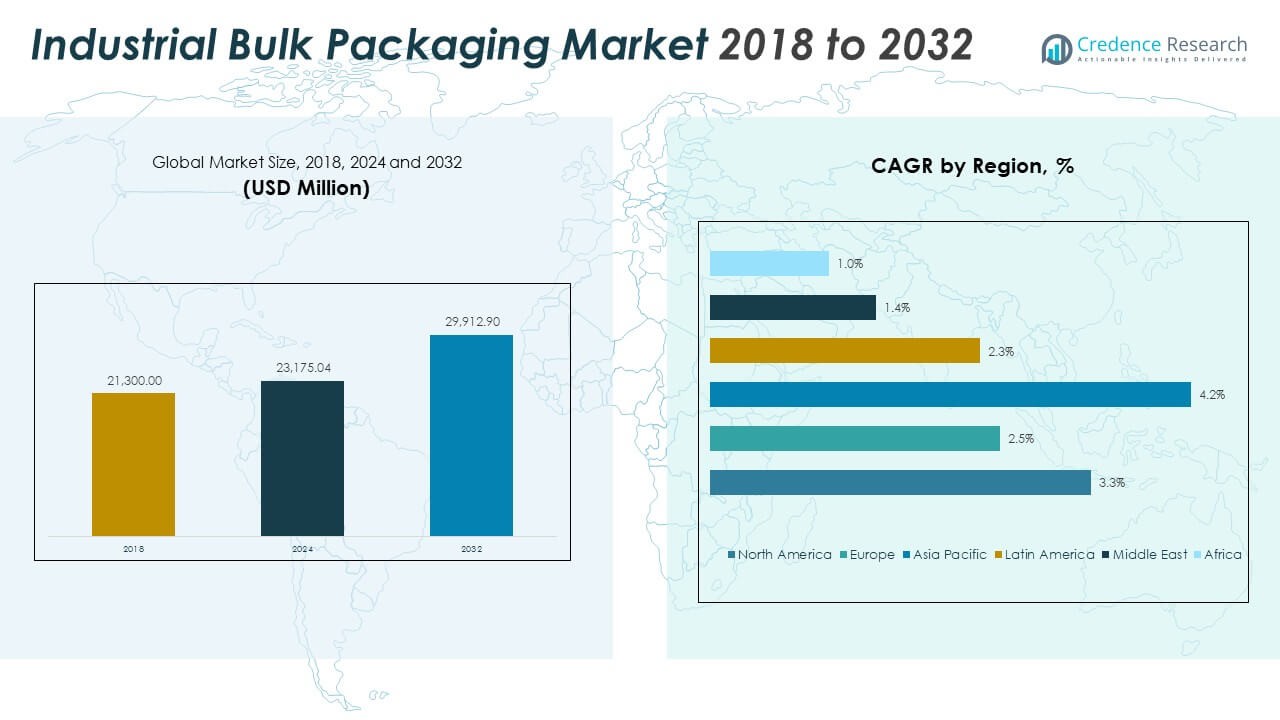

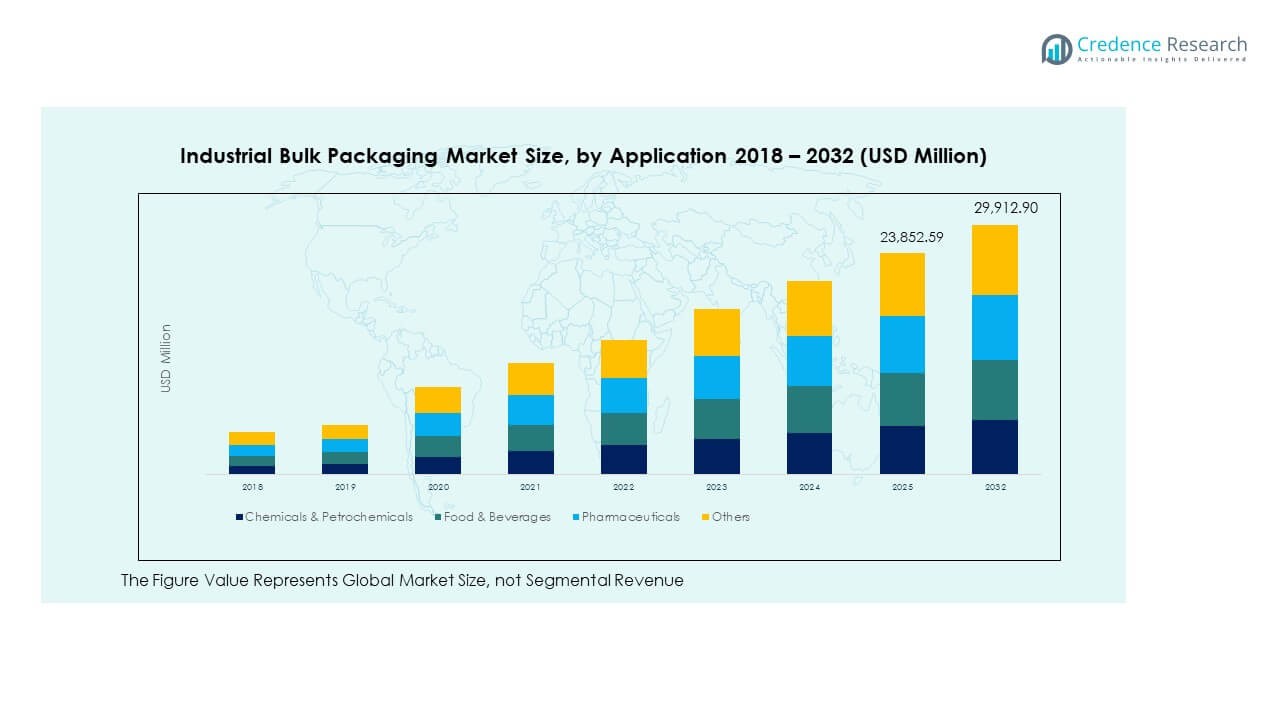

The Global Industrial Bulk Packaging Market size was valued at USD 21,300.00 million in 2018 to USD 23,175.04 million in 2024 and is anticipated to reach USD 29,912.90 million by 2032, at a CAGR of 3.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Bulk Packaging Market Size 2024 |

USD 23,175.04 Million |

| Industrial Bulk Packaging Market, CAGR |

3.29% |

| Industrial Bulk Packaging Market Size 2032 |

USD 29,912.90 Million |

The market growth is driven by rising demand for cost-efficient, durable, and sustainable packaging solutions across key industries such as chemicals, food and beverages, pharmaceuticals, and construction. Increasing international trade and industrialization in emerging economies have accelerated the use of bulk containers, drums, and IBCs. The shift toward eco-friendly and reusable packaging materials further enhances product innovation and adoption across sectors.

North America and Europe lead the market due to established manufacturing sectors, strong logistics infrastructure, and strict packaging standards. The Asia-Pacific region is emerging rapidly, supported by industrial expansion in China, India, and Southeast Asia. Latin America and the Middle East show steady growth driven by rising exports, growing construction activities, and increasing investment in industrial goods packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Industrial Bulk Packaging Market was valued at USD 21,300.00 million in 2018, reaching USD 23,175.04 million in 2024 and projected to hit USD 29,912.90 million by 2032, growing at a CAGR of 3.29%.

- Asia Pacific held the largest share of 38%, driven by rapid industrialization, expanding exports, and a strong manufacturing base in China and India. North America followed with 27%, supported by advanced infrastructure and strong chemical and food industries. Europe accounted for 23%, benefiting from regulatory compliance and adoption of sustainable packaging.

- Asia Pacific is the fastest-growing region, supported by increasing industrial output, expanding trade networks, and government initiatives promoting eco-friendly and cost-efficient packaging.

- Based on the chart, chemicals and petrochemicals accounted for nearly 40% of total application revenue in 2024, maintaining dominance through consistent demand across global industries.

- The food and beverages segment represented around 25%, reflecting the rising need for hygienic, durable, and export-ready bulk packaging solutions to support international food trade.

Market Drivers:

Rising Demand for Durable and Cost-Effective Industrial Packaging Solutions

The Global Industrial Bulk Packaging Market is witnessing steady growth due to the rising preference for strong, cost-efficient packaging materials that can handle large-volume goods. Industries such as chemicals, oil and gas, construction, and food processing are increasingly adopting drums, intermediate bulk containers (IBCs), and flexible bulk bags. These solutions reduce handling costs, improve storage efficiency, and ensure product safety during long-distance transport. It benefits manufacturers by reducing product losses and improving operational efficiency. The growing adoption of reusable and recyclable packaging designs further strengthens long-term value for users.

- For instance, Greif’s GCUBE IBC range incorporates multilayer polymer structures, offering increased chemical resistance and meeting UN 1.9G hazardous goods ratings, as independently certified and confirmed by Greif’s official documentation.

Expansion of Manufacturing and Trade Activities Across Emerging Economies

Rapid industrialization and increasing trade volumes in Asia-Pacific, Latin America, and parts of Africa have created strong demand for large-scale packaging systems. Expanding export activities in chemicals, automotive parts, and food products have raised the use of rigid and flexible containers. Manufacturers in these regions seek reliable packaging that meets international shipping standards. It enhances cross-border trade efficiency and maintains product integrity. This growing industrial base and improved logistics network are key to market expansion. Continuous government support for industrial output and export-oriented sectors is reinforcing this momentum.

- For instance, Mauser Packaging Solutions announced in January 2025 the expansion of its production capabilities for UN-rated IBCs in its Haiyan, China facility, supporting the surge in the regional chemicals, food, and additives sectors with a wide range of IBC options.

Growing Shift Toward Sustainable and Reusable Packaging Materials

Sustainability is transforming the packaging landscape, driving innovation in bulk packaging materials. Companies are investing in recyclable plastics, biodegradable polymers, and reconditioned metal containers to meet global environmental goals. The push for circular economy practices has encouraged the development of reusable packaging systems that minimize waste. It enables industries to comply with environmental regulations and enhance brand responsibility. Large players are integrating sustainability targets into supply chains, improving material efficiency. Rising consumer awareness and corporate sustainability goals are propelling this long-term transformation.

Technological Advancements and Design Innovation in Bulk Containers

Innovation in product design, material strength, and digital monitoring systems has improved container performance and safety. Smart packaging solutions with IoT-enabled sensors are enhancing real-time tracking, temperature monitoring, and shipment visibility. It supports companies in managing logistics and inventory with higher accuracy. Modern IBCs and bulk bags are now designed for higher load capacity, reduced leakage risk, and easier handling. The integration of automation in filling, sealing, and transport processes has also improved productivity. This ongoing technological development is strengthening global competitiveness among packaging manufacturers.

Market Trends:

Increased Adoption of Smart Packaging and IoT-Enabled Tracking Systems

The integration of smart sensors and IoT technologies is reshaping packaging operations across industries. Companies are increasingly using connected containers for better shipment tracking, temperature control, and load monitoring. The Global Industrial Bulk Packaging Market benefits from real-time data insights that reduce logistics errors and enhance transparency. It allows operators to detect leaks or damages early, lowering product waste. These digital tools also improve supply chain accountability and customer service. Demand for smart, traceable packaging is rising among multinational manufacturers aiming for efficient global operations.

- For instance, industry deployments of IoT-enabled container monitoring and related digital technologies in specific case studies have demonstrated significant operational improvements.

Rising Popularity of Lightweight and High-Strength Material Compositions

Manufacturers are focusing on producing packaging materials that balance weight reduction with strength and durability. Lightweight containers reduce transportation costs while maintaining structural reliability. It helps companies improve sustainability targets and reduce fuel consumption during shipment. The growing preference for advanced polymers and composite materials is enhancing product performance. These innovations provide resistance against corrosion, moisture, and high pressure. Market leaders are investing in R&D to optimize weight-to-capacity ratios for improved logistics performance.

- For instance, Greif’s latest EcoBalance™ IBCs utilize post-consumer resin and lighter plastics that help lower carbon emissions per unit transported, as documented in company technical publications.

Growing Penetration of Reconditioned and Refurbished Packaging Systems

The demand for refurbished drums, totes, and IBCs is increasing due to rising environmental awareness. Reconditioned products lower costs and minimize waste generation in industrial operations. The Global Industrial Bulk Packaging Market is witnessing expanded adoption of container cleaning, reusing, and recycling services. It enables firms to meet sustainability certifications and reduce carbon footprints. This trend supports a closed-loop packaging economy, where materials circulate efficiently within industrial networks. Companies offering reconditioning services are gaining a competitive advantage through cost savings and regulatory compliance.

Integration of Automation and Robotics in Packaging Operations

Automation has become a vital trend across the bulk packaging value chain. Automated filling, stacking, and palletizing systems are improving productivity and reducing manual errors. It ensures consistent product handling and faster turnaround times. Robotics and AI tools are also streamlining warehouse management and quality control processes. These solutions support high-volume packaging applications, especially in chemical and food manufacturing. The integration of automation not only increases efficiency but also enhances worker safety and product precision.

Market Challenges Analysis:

Fluctuating Raw Material Costs and Supply Chain Disruptions

Volatile prices of raw materials such as plastics, metals, and composites continue to pressure profit margins. The Global Industrial Bulk Packaging Market depends heavily on stable input supplies, yet frequent fluctuations disrupt production schedules. Rising energy costs and trade restrictions have also added complexity to material procurement. It challenges manufacturers to maintain pricing stability while ensuring quality. Supply chain delays caused by geopolitical tensions and transportation bottlenecks further impact delivery timelines. Companies are now focusing on supply diversification to manage cost volatility. Maintaining material quality amid instability remains a critical challenge for packaging producers.

Environmental Regulations and Disposal Concerns Limiting Plastic Use

Strict regulations on plastic packaging waste are creating operational and compliance challenges. Governments across major markets are enforcing bans, taxes, and recycling mandates to control pollution. The Global Industrial Bulk Packaging Market faces growing pressure to shift from traditional polymers to sustainable materials. It requires heavy investment in R&D and retooling of production processes. Balancing cost efficiency with environmental compliance has become difficult for small and medium manufacturers. Limited infrastructure for large-scale recycling and collection adds further hurdles. Market participants must accelerate sustainability adaptation to avoid regulatory penalties and reputational risks.

Market Opportunities:

Expansion of Industrialization and Cross-Border Trade in Emerging Regions

The rapid growth of industrial production and export trade across developing economies presents major expansion opportunities. The Global Industrial Bulk Packaging Market is gaining traction in regions such as Asia-Pacific, Africa, and Latin America. It benefits from large-scale manufacturing projects, infrastructure development, and export-driven growth policies. Governments are investing in industrial corridors and trade networks that require reliable packaging solutions. This trend creates long-term potential for manufacturers offering high-quality, standardized containers for export goods.

Rising Demand for Eco-Friendly Packaging and Circular Economy Solutions

Sustainability initiatives are opening new growth avenues for environmentally responsible packaging. Companies are innovating with recyclable polymers, bio-based materials, and reusable bulk containers. It aligns with corporate sustainability commitments and green procurement programs across industries. Governments and global buyers now prefer suppliers with eco-friendly product portfolios. Manufacturers adopting circular economy models and closed-loop logistics systems are likely to capture higher market share in coming years.

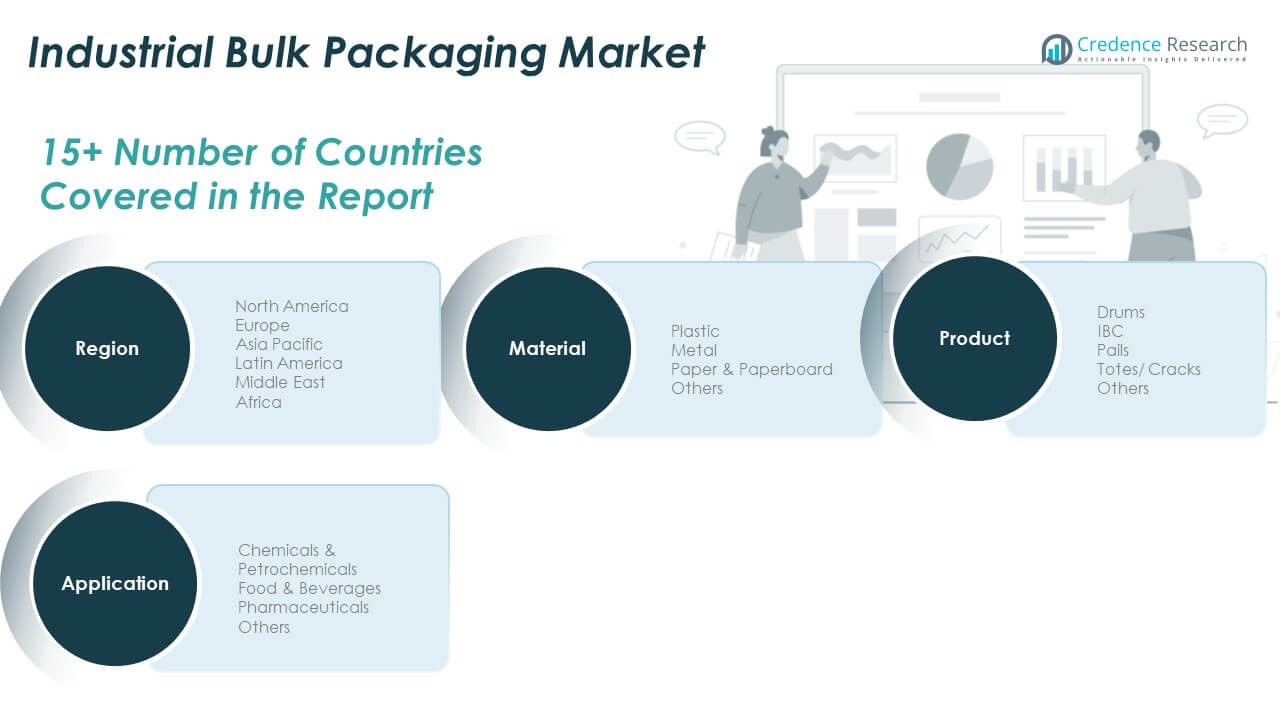

Market Segmentation Analysis:

By Type

The Global Industrial Bulk Packaging Market is segmented by type into drums, intermediate bulk containers (IBCs), flexitanks, bulk bags, rigid bulk containers, and others. Drums continue to dominate due to their high durability and suitability for transporting liquids and chemicals. IBCs are gaining popularity for their efficiency in storing and handling large liquid volumes. Flexitanks are expanding use in the food and beverage export sector for bulk liquid shipments. Bulk bags and rigid containers cater to dry goods and construction materials, supporting cost-effective logistics across regions.

- For instance, Environmental Packaging Technologies and leading peers now offer flexitanks that carry up to 24,000 liters per unit, significantly optimizing bulk shipment efficiency for food exports and other liquid commodities.

By End-use

The market serves diverse industries, including chemicals, food and beverages, pharmaceuticals, oil and lubricants, construction, agriculture, and others. The chemical sector remains the largest consumer, driven by growing global trade and stringent packaging safety standards. Food and beverage applications are rising with increasing exports and demand for hygienic bulk storage. Oil, lubricants, and construction industries rely on durable and corrosion-resistant containers. It shows strong adoption in agriculture for packaging fertilizers, grains, and seeds.

- For instance, Schütz’s 1000L IBC containers achieve UN Y1.9 certification and utilize high-density polyethylene to support safe storage of chemicals and fertilizers, as confirmed by authorized distributor records and product datasheets.

By Application

Key applications include liquid packaging, dry goods packaging, hazardous and non-hazardous materials, and export and logistics packaging. Liquid packaging dominates due to rising transport of chemicals, edible oils, and fuels. Dry goods packaging supports manufacturing, food, and agriculture industries. Hazardous material packaging focuses on compliance with international safety standards, while non-hazardous and export packaging enhance supply chain efficiency. It supports consistent protection and long-distance transport reliability.

By Material

Based on material, the market includes plastic, metal, paperboard, composite, and others. Plastic remains the most used material for flexibility and cost advantages. Metal containers are preferred for high-strength and chemical-resistant packaging needs. Paperboard and composite materials are gaining attention due to sustainability preferences and recycling initiatives. It reflects a balanced shift toward lightweight, reusable, and eco-friendly solutions across industrial packaging operations.

Segmentation:

By Type:

- Drums

- Intermediate Bulk Containers (IBCs)

- Flexitanks

- Bulk Bags

- Rigid Bulk Containers

- Others

By End-use:

- Chemicals

- Food & Beverages

- Pharmaceuticals

- Oil & Lubricants

- Construction

- Agriculture

- Others

By Application:

- Liquid Packaging

- Dry Goods Packaging

- Hazardous Materials Packaging

- Non-Hazardous Materials Packaging

- Export & Logistics Packaging

- Others

By Material:

- Plastic

- Metal

- Paperboard

- Composite

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Industrial Bulk Packaging Market size was valued at USD 5,878.80 million in 2018 to USD 6,294.20 million in 2024 and is anticipated to reach USD 8,109.44 million by 2032, at a CAGR of 3.3% during the forecast period. North America accounts for around 27% of the total market share. Strong demand from chemical, oil, and food industries drives market expansion across the region. It benefits from advanced logistics infrastructure and high adoption of sustainable packaging. The United States leads the regional market, supported by growing industrial output and trade activities. Manufacturers are investing in automation and digital monitoring systems to enhance container traceability. Environmental regulations continue to push innovation in reusable and recyclable materials. Canada and Mexico show consistent growth with the expansion of export-oriented industries and bulk commodity trade.

Europe

The Europe Global Industrial Bulk Packaging Market size was valued at USD 5,180.16 million in 2018 to USD 5,399.15 million in 2024 and is anticipated to reach USD 6,549.51 million by 2032, at a CAGR of 2.5% during the forecast period. Europe holds approximately 23% of the global market share. The region’s demand is supported by strong regulatory standards and a focus on circular economy models. Germany, France, and the UK remain major contributors, driven by chemical and pharmaceutical exports. It demonstrates steady adoption of smart and lightweight packaging solutions to reduce carbon footprint. The European Union’s sustainability directives encourage the use of recyclable plastics and composite materials. Technological innovations in bulk handling systems are also improving supply chain efficiency. Growth is moderate due to market maturity, but sustainability-focused investments are rising.

Asia Pacific

The Asia Pacific Global Industrial Bulk Packaging Market size was valued at USD 7,838.40 million in 2018 to USD 8,779.77 million in 2024 and is anticipated to reach USD 12,123.72 million by 2032, at a CAGR of 4.2% during the forecast period. Asia Pacific represents the largest regional share at about 38% of the global market. It is driven by rapid industrialization, export-oriented economies, and expanding chemical and food industries. China dominates regional production due to its strong manufacturing base and cost-effective operations. India, Japan, and South Korea are investing in modern logistics and sustainable packaging innovations. Rising exports in agricultural and industrial goods fuel the need for durable, high-capacity containers. The growing e-commerce sector also supports secondary demand for bulk packaging solutions. It remains the fastest-growing region with substantial opportunities for international and local players.

Latin America

The Latin America Global Industrial Bulk Packaging Market size was valued at USD 1,329.12 million in 2018 to USD 1,431.99 million in 2024 and is anticipated to reach USD 1,713.11 million by 2032, at a CAGR of 2.3% during the forecast period. Latin America holds nearly 7% of the total market share. Demand is rising from the food, beverage, and construction industries, supported by urbanization and growing trade flows. Brazil and Argentina lead regional consumption with steady export activities in agricultural and chemical sectors. It benefits from increased industrialization and the adoption of cost-efficient bulk containers. Local manufacturers are focusing on flexible and reusable packaging formats to improve logistics performance. Currency fluctuations and import dependencies remain challenges but encourage regional production. The region’s expanding trade agreements continue to enhance export packaging needs.

Middle East

The Middle East Global Industrial Bulk Packaging Market size was valued at USD 596.40 million in 2018 to USD 593.13 million in 2024 and is anticipated to reach USD 661.24 million by 2032, at a CAGR of 1.4% during the forecast period. The region accounts for around 3% of the global share. Growth is supported by increasing industrial activities in oil, gas, and construction sectors. GCC countries lead demand for bulk liquid containers and drums used in petrochemical transport. It is gradually shifting toward sustainable and reusable packaging materials to align with green energy initiatives. Regional diversification programs are expanding manufacturing and logistics capacity. The UAE and Saudi Arabia remain key investment hubs for bulk packaging manufacturers. Import dependency for packaging materials poses a challenge, but regional production is strengthening steadily.

Africa

The Africa Global Industrial Bulk Packaging Market size was valued at USD 477.12 million in 2018 to USD 676.80 million in 2024 and is anticipated to reach USD 755.88 million by 2032, at a CAGR of 1.0% during the forecast period. Africa contributes around 2% of the total market share. It is experiencing growing demand from mining, agriculture, and construction sectors. South Africa leads adoption due to established manufacturing and export channels. Nigeria, Egypt, and Kenya are emerging with rising industrial investments and infrastructure development. The need for affordable, high-strength packaging supports demand for bulk bags and drums. It faces challenges related to limited recycling systems and logistics infrastructure. International partnerships and industrial policy reforms are expected to boost future capacity and regional production efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Shandong Anthente New Materials Technology Co. Ltd

- My Flexitank Industries Sdn Bhd

- Greif, Inc.

- International Paper Company

- Büscherhoff Spezialverpackung GmbH & Co. KG

- Bulk Lift International, Inc.

- Bemis Company, Inc.

- Environmental Packaging Technologies, Inc.

- Hoover Ferguson Group

- Schuetz GmbH & Co. KGaA

Competitive Analysis:

The Global Industrial Bulk Packaging Market is highly competitive, featuring a mix of global leaders and regional manufacturers. It is dominated by companies focusing on innovation, sustainability, and advanced logistics solutions. Major players emphasize material efficiency, smart packaging integration, and customization to meet varied industrial demands. Strategic mergers and capacity expansions strengthen market presence and supply chain resilience. Firms compete through product differentiation, price optimization, and environmental compliance. Continuous investment in lightweight and reusable packaging technologies remains a key focus among industry participants.

Recent Developments:

- In September 2025, Greif, Inc. finalized the sale of its containerboard business to Packaging Corporation of America (PCA) for $1.8 billion. The deal, first announced in July 2025, covered two mills with a combined capacity of 800,000 tons and eight related U.S. facilities. The transaction enabled Greif to accelerate its focus on high-margin industrial packaging and sustainable products, while PCA gained significant operational synergies and production scale within the industrial bulk packaging sector.

- In the same industry landscape, My Flexitank Industries Sdn Bhd was listed as a key global operator and continued to focus on flexitank innovation and service partnerships across international markets throughout 2025. Although no specific headline product launch or acquisition by My Flexitank was publicized in 2025, the industry overall saw ongoing material innovations—such as Qingdao BLT Flexitank Solution’s FDA-compliant oil bags and increased collaborative franchise models for after-sales services—as major trends in the sector during May 2025.

Report Coverage:

The research report offers an in-depth analysis based on type, end-use, application, and material segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for sustainable packaging materials will drive industry transformation.

- Technological advancements in smart tracking and automation will enhance operational efficiency.

- Reconditioning and recycling services will expand across developed and emerging regions.

- Asia Pacific will remain the fastest-growing region due to rapid industrialization.

- Chemical and food sectors will continue leading end-use industries.

- Adoption of circular economy models will strengthen brand and compliance value.

- Increased government focus on waste management will influence material choice.

- New product designs emphasizing lightweight durability will gain traction.

- Strategic mergers will boost global reach and production capacity.

- Continuous R&D investment will foster innovation in flexible and reusable bulk solutions.