Market Overview

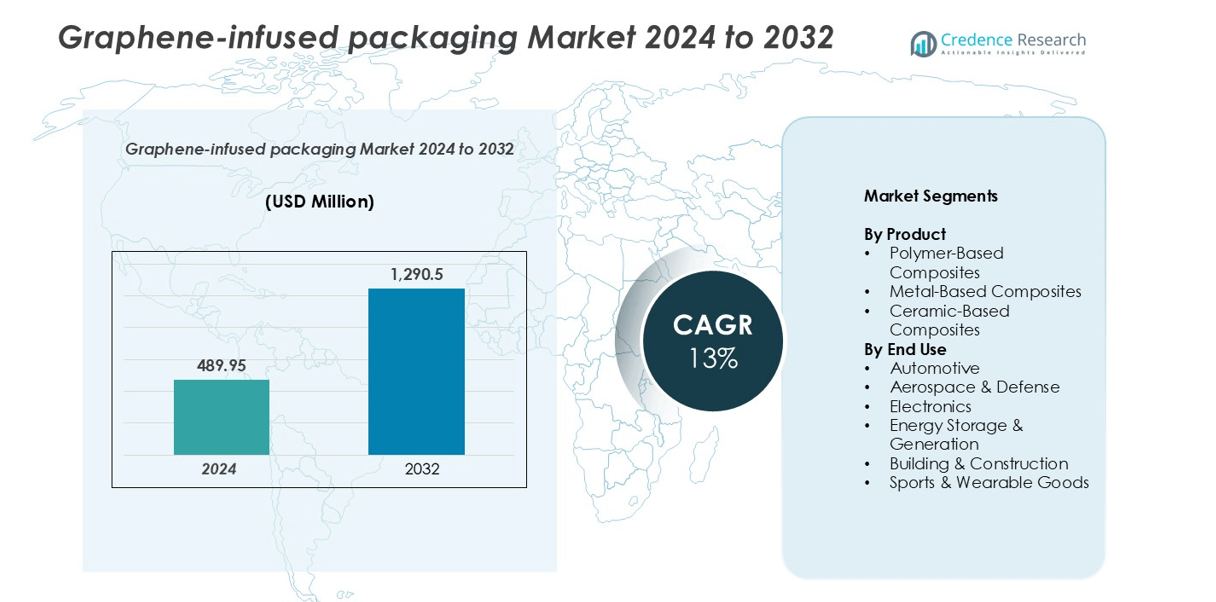

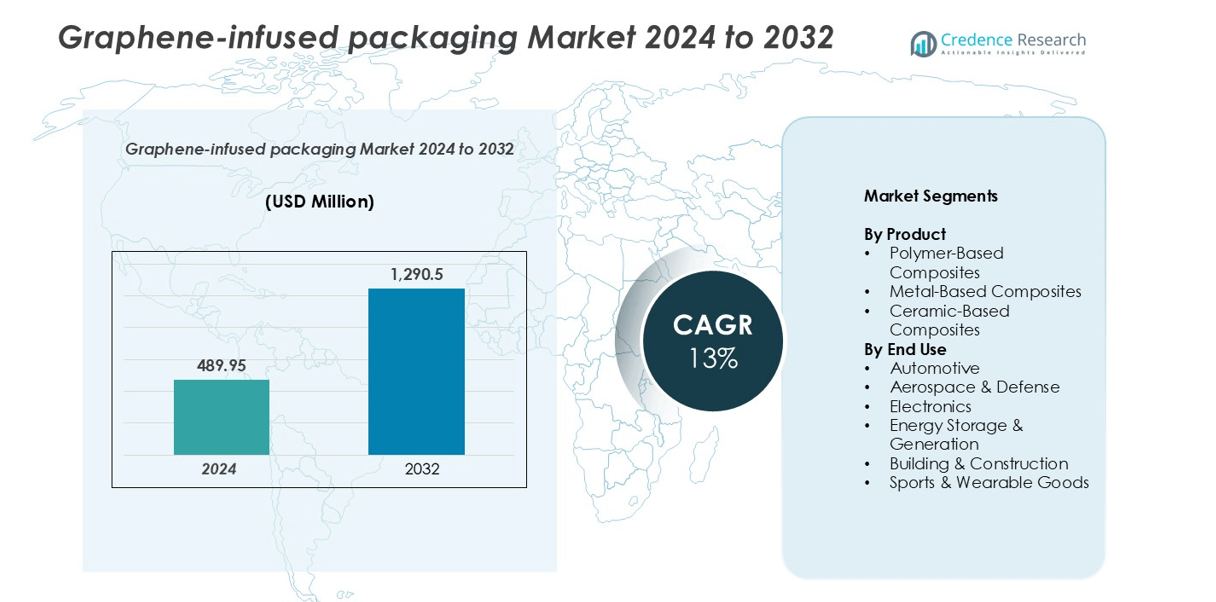

Graphene-infused packaging market size was valued at USD 489.95 million in 2024 and is anticipated to reach USD 1,290.5 million by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Graphene-Infused Packaging Market Size 2024 |

USD 489.95 million |

| Graphene-Infused Packaging Market, CAGR |

13% |

| Graphene-Infused Packaging Market Size 2032 |

USD 1,290.5 million |

The graphene-infused packaging market is led by key players such as Gerdau Graphene, Directa Plus, Haydale Graphene Industries, Graphene Composites Ltd, HydroGraph Clean Power, and Black Swan Graphene, who are driving innovation through advanced polymer, metal, and ceramic-based composites. North America dominates the market with a 36% share, supported by robust R&D infrastructure and high adoption in automotive, electronics, and aerospace sectors. Europe follows with a 26% share, driven by stringent environmental regulations and sustainability initiatives. Asia-Pacific is rapidly growing, accounting for 29% of the market, fueled by large-scale manufacturing, electronics, and energy storage applications. These regions, combined with strategic collaborations, technological advancements, and focus on lightweight, high-performance packaging solutions, allow top players to maintain competitive advantage and capture a significant portion of global demand.

Market Insights

- The graphene-infused packaging market was valued at USD 489.95 million in 2024 and is projected to reach USD 1,290.5 million by 2032, growing at a CAGR of 13% during the forecast period.

- Key drivers include rising demand for lightweight, durable, and high-barrier packaging solutions in automotive, electronics, aerospace, and energy storage sectors, along with increasing sustainability initiatives.

- Market trends highlight the adoption of polymer-based composites as the dominant segment, growth in smart and functional packaging, and expanding applications in electronics and energy storage industries.

- The market is competitive, led by companies such as Gerdau Graphene, Directa Plus, Haydale Graphene Industries, Graphene Composites Ltd, HydroGraph Clean Power, and Black Swan Graphene, focusing on R&D, partnerships, and technological innovations.

- Regionally, North America leads with ~36% share, Asia-Pacific follows with ~29%, Europe holds ~26%, and Latin America and MEA account for the remaining ~9%, reflecting high industrial adoption and technological advancement in leading regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Maret Segmentation Analysis:

By Product

The polymer-based composites segment dominates the graphene-infused packaging market, capturing a significant share due to its versatility, lightweight nature, and excellent barrier properties. These composites enhance mechanical strength and thermal stability, making them ideal for high-performance packaging applications. Metal-based composites hold a smaller share but are gaining traction in specialized packaging requiring superior durability and impact resistance. Ceramic-based composites, while niche, are used for high-temperature or chemical-resistant packaging. Overall, advancements in polymer processing and cost-effective graphene integration are key drivers propelling the adoption of polymer-based composites in this market.

- For instance, Black Swan Graphene’s GEM X23M, a graphene-enhanced masterbatch for polypropylene, has been reported to improve impact resistance by over 20% at a 0.2% loading ratio in some trials.

By End Use

Within the end-use segment, automotive applications lead the market, driven by the demand for lightweight, durable, and sustainable packaging solutions for parts and components. Aerospace & defense follows closely, leveraging graphene-infused composites for packaging sensitive electronics and equipment that require high strength-to-weight ratios. The growth is supported by manufacturers prioritizing fuel efficiency, component safety, and long-lasting material performance. Increasing investment in lightweight materials and innovative packaging designs accelerates adoption, making automotive the dominant sub-segment in terms of market share.

Key Growth Drivers

Rising Demand for Lightweight and Durable Packaging

The growing need for lightweight yet durable packaging solutions is a primary driver for the graphene-infused packaging market. Industries such as automotive, electronics, and aerospace increasingly prefer materials that reduce product weight without compromising strength or protection. Graphene’s exceptional mechanical properties, including tensile strength and flexibility, enable packaging that minimizes material usage while maintaining durability. For instance, polymer-based graphene composites can reduce packaging weight by up to 30% compared to conventional materials, lowering transportation costs and carbon footprint. Additionally, the enhanced barrier properties of graphene protect sensitive products from moisture, gases, and contaminants, further driving adoption. The convergence of sustainability goals and cost efficiency is accelerating investments in graphene-infused materials, particularly in sectors requiring high-performance packaging for fragile or high-value products.

- For instance, OCSiAl has pioneered the first-ever industrial packaging for single-wall carbon nanotubes, transitioning from plastic barrels to 12-liter bags for its TUBALL™ nanotube powder.

Technological Advancements and Manufacturing Innovations

Advancements in graphene production and integration techniques are significantly boosting market growth. Innovations such as scalable chemical vapor deposition, solution-based exfoliation, and in-situ polymerization allow manufacturers to incorporate graphene efficiently into packaging composites at lower costs. These technological developments enhance conductivity, thermal stability, and mechanical strength, making graphene-infused packaging viable for electronics, energy storage, and perishable goods. Companies are also exploring hybrid composites combining graphene with polymers, metals, or ceramics to meet diverse performance requirements. For example, polymer-graphene composites with improved oxygen and moisture barrier properties have enabled longer shelf life for food and pharmaceutical products. As production methods become more cost-effective and quality standards improve, the market is witnessing accelerated adoption across multiple industries.

- For instance, polymer-graphene composites with improved oxygen and moisture barrier properties have enabled longer shelf life for food and pharmaceutical products.

Increasing Regulatory Pressure and Sustainability Awareness

Stringent environmental regulations and rising consumer demand for sustainable packaging are key growth drivers. Graphene-infused composites can reduce material consumption and extend product shelf life, aligning with global sustainability initiatives and circular economy goals. Governments in Europe, North America, and Asia are encouraging biodegradable, recyclable, and lightweight packaging solutions, prompting manufacturers to adopt advanced materials such as graphene. Additionally, corporations are increasingly integrating eco-friendly packaging into corporate social responsibility (CSR) strategies to meet consumer expectations. For instance, graphene-enhanced polymer films can replace multi-layer plastics, reducing waste and energy usage during production. This regulatory push and sustainability trend are accelerating market penetration and fostering long-term adoption of graphene-based packaging solutions.

Key Trends & Opportunities

Expansion in Electronics and Energy Storage Applications

The electronics and energy storage sectors present significant growth opportunities for graphene-infused packaging. Graphene’s high electrical and thermal conductivity makes it ideal for protecting sensitive components, batteries, and supercapacitors while preventing overheating and electrostatic discharge. For example, graphene-enhanced packaging for lithium-ion batteries improves thermal management and safety during transport and storage. As wearable devices, electric vehicles, and smart electronics proliferate globally, demand for high-performance packaging in these sectors is expected to rise. Manufacturers investing in specialized graphene composites tailored to energy storage and electronics applications are poised to capture substantial market share.

- For instance, GMG’s Graphene Aluminium-Ion Battery, based on the company’s research and testing, may eliminate the need for a traditional thermal management system. This could potentially reduce the weight of an electric vehicle battery pack by up to 16%. This weight reduction, in turn, is expected to result in more volumetric energy and a reduction in vehicle mass for an increased range.

Integration of Smart and Functional Packaging

The market is witnessing a trend toward smart and multifunctional packaging incorporating graphene’s unique properties. Graphene enables packaging with enhanced barrier protection, antimicrobial functionality, and real-time monitoring capabilities. For instance, conductive graphene films can be embedded with sensors to track product condition, freshness, or temperature during transit. This convergence of material science and IoT technology presents new opportunities for sectors like food, pharmaceuticals, and high-value electronics. Companies that develop functional graphene-infused packaging solutions can differentiate their offerings and tap into the growing demand for intelligent and interactive packaging.

- For instance, conductive graphene films can be embedded with sensors to track product condition, freshness, or temperature during transit.

Strategic Partnerships and Collaborations

Collaborations between material suppliers, packaging manufacturers, and end-user industries are creating opportunities to accelerate innovation and market adoption. Strategic partnerships help scale production, reduce costs, and improve graphene integration techniques. For instance, joint ventures between graphene producers and polymer composite manufacturers are enabling the production of advanced, cost-effective packaging solutions suitable for global distribution. These collaborations also facilitate knowledge sharing, R&D investment, and faster commercialization, allowing companies to meet the rising demand for sustainable, high-performance packaging solutions across multiple sectors.

Key Challenges

High Production Costs and Scalability Issues

Despite its advantages, graphene production remains expensive and challenging to scale, posing a significant barrier for widespread adoption in packaging. High costs of raw graphene, coupled with complex synthesis and integration processes, increase the overall price of graphene-infused packaging compared to conventional materials. Manufacturers also face difficulties ensuring consistent quality, uniform dispersion, and reproducibility of graphene within composites. These factors limit market penetration, particularly for cost-sensitive sectors such as consumer goods and food packaging. Overcoming production inefficiencies and developing scalable, low-cost manufacturing methods are critical for sustained market growth.

Limited Awareness and Technical Expertise

The adoption of graphene-infused packaging is constrained by limited awareness among end-users and a shortage of technical expertise in handling and integrating graphene into existing production lines. Many manufacturers and industries remain cautious due to perceived risks, unclear performance metrics, and uncertainties about regulatory compliance. Additionally, the lack of standardized testing methods and guidelines for graphene-based composites complicates quality assurance and certification. Educating stakeholders about graphene’s benefits, providing training, and establishing industry standards are essential to drive adoption and ensure consistent performance across applications.

Regional Analysis

North America

North America holds a dominant share in the graphene-infused packaging market, driven by high adoption in automotive, electronics, and aerospace industries. The U.S. leads regional growth, supported by advanced R&D infrastructure, technological innovations, and early adoption of sustainable packaging solutions. Companies are increasingly integrating graphene composites into high-performance packaging to enhance durability, thermal stability, and barrier properties. Strong regulatory support for eco-friendly and lightweight materials, along with rising demand from e-commerce and consumer electronics sectors, further fuels market expansion. North America accounts for approximately 35–37% of the global market, reflecting its technological leadership and robust industrial base.

Europe

Europe represents a significant share of the global market, accounting for nearly 25–27%, driven by stringent environmental regulations and sustainability initiatives. Countries like Germany, France, and the U.K. are focusing on lightweight, durable, and recyclable packaging materials for automotive, food, and pharmaceutical applications. Rising investments in graphene research and pilot production facilities, coupled with increasing consumer awareness of eco-friendly packaging, are key growth enablers. European manufacturers are also adopting polymer-graphene composites to extend product shelf life, reduce material usage, and enhance protection. The region continues to witness steady growth due to government incentives and high industrial adoption of advanced materials.

Asia-Pacific

Asia-Pacific is poised for rapid growth, capturing an estimated 28–30% market share, fueled by expanding automotive, electronics, and energy storage sectors. China, Japan, and South Korea lead regional adoption due to large-scale manufacturing capabilities, growing R&D investments, and favorable government policies promoting advanced materials. The demand for high-performance, lightweight packaging for consumer electronics and lithium-ion batteries is rising, accelerating graphene integration. Cost-effective production and emerging startups focusing on polymer and metal-based graphene composites are also driving adoption. The region presents significant opportunities for market expansion, supported by industrial growth, technological advancement, and increasing sustainability awareness.

Latin America

Latin America accounts for a modest 5–6% share of the graphene-infused packaging market, driven by the gradual adoption of advanced materials in automotive, electronics, and consumer goods sectors. Brazil and Mexico are emerging as key markets due to increasing industrialization, growing e-commerce demand, and rising awareness of sustainable packaging solutions. Market growth is supported by pilot projects and collaborations between global graphene suppliers and regional manufacturers. However, limited technological infrastructure and high production costs remain challenges. Despite this, increasing investments in lightweight, durable, and protective packaging solutions are expected to drive gradual regional adoption in the forecast period.

Middle East & Africa

The Middle East & Africa (MEA) holds approximately 4–5% of the global market, primarily driven by niche applications in aerospace, defense, and energy storage. The adoption of graphene-infused packaging is gradual, supported by initiatives in the UAE, Saudi Arabia, and South Africa to integrate advanced materials into high-performance and specialty packaging. Investments in R&D collaborations with global technology providers are increasing, focusing on energy-efficient, lightweight, and durable packaging solutions. The region faces challenges such as limited local manufacturing capabilities and higher costs, but growing infrastructure development, industrial expansion, and sustainability awareness offer opportunities for market penetration over the forecast period.

Market Segmentations:

By Product:

- Polymer-Based Composites

- Metal-Based Composites

- Ceramic-Based Composites

By End Use:

- Automotive

- Aerospace & Defense

- Electronics

- Energy Storage & Generation

- Building & Construction

- Sports & Wearable Goods

By Geography:

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The graphene-infused packaging market is highly competitive, with key players focusing on strategic collaborations, technological innovation, and product differentiation to maintain market leadership. Companies such as Gerdau Graphene, Directa Plus, Haydale Graphene Industries, Graphene Composites Ltd, HydroGraph Clean Power, and Black Swan Graphene are actively investing in R&D to develop advanced polymer, metal, and ceramic-based graphene composites with superior barrier, mechanical, and thermal properties. Manufacturers are also expanding production capacities and entering partnerships with end-use industries, including automotive, electronics, and aerospace, to accelerate commercialization. Additionally, players are emphasizing sustainable and cost-effective solutions to meet growing regulatory and consumer demand for eco-friendly packaging. Competitive strategies include product innovation, geographic expansion, and licensing agreements, enabling companies to strengthen their market presence and address the increasing demand for high-performance, lightweight, and multifunctional packaging solutions globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2024, HydroGraph Clean Power announced a breakthrough in sustainable plastic packaging by developing a fractal graphene powder (FGA-1) that significantly improves the performance of PET bottles. Tested at the Graphene Engineering Innovation Centre, the technology-enhanced PET bottles made from a 50:50 blend of virgin and recycled PET, achieving a 23% increase in compressive strength, a 20% reduction in weight, and an 83% decrease in water vapor transmission.

- In March 2023, Gerdau Graphene launched a graphene-enhanced polyethylene (PE) masterbatch called Poly-G PE-07GM, marking a world first. The product, designed to improve the strength, durability, and sustainability of packaging materials while reducing costs and waste, was set to be distributed in Japan through a partnership with Sumitomo Corporation.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of lightweight and durable graphene composites will continue to grow across automotive and aerospace sectors.

- Polymer-based graphene packaging will remain the dominant segment due to versatility and high barrier properties.

- Electronics and energy storage applications will drive significant demand for high-performance packaging solutions.

- Manufacturers will increasingly invest in R&D to develop cost-effective and scalable graphene integration techniques.

- Sustainable and eco-friendly packaging solutions will gain traction, aligning with global environmental regulations.

- Smart and functional packaging with sensors and real-time monitoring capabilities will see rising adoption.

- Strategic partnerships and collaborations will expand market reach and accelerate commercialization of graphene composites.

- Emerging markets in Asia-Pacific will witness rapid growth due to industrial expansion and technological advancement.

- Market players will focus on product differentiation through enhanced thermal, mechanical, and barrier performance.

- Continuous innovation and government support will drive long-term growth and adoption across multiple end-use industries.