Market Overview:

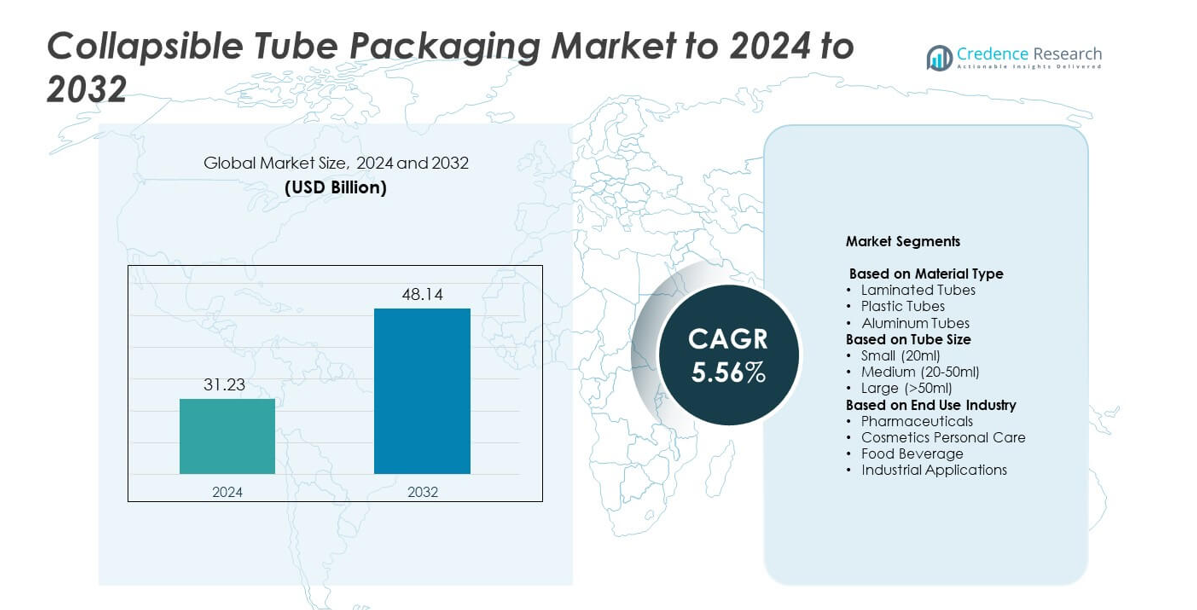

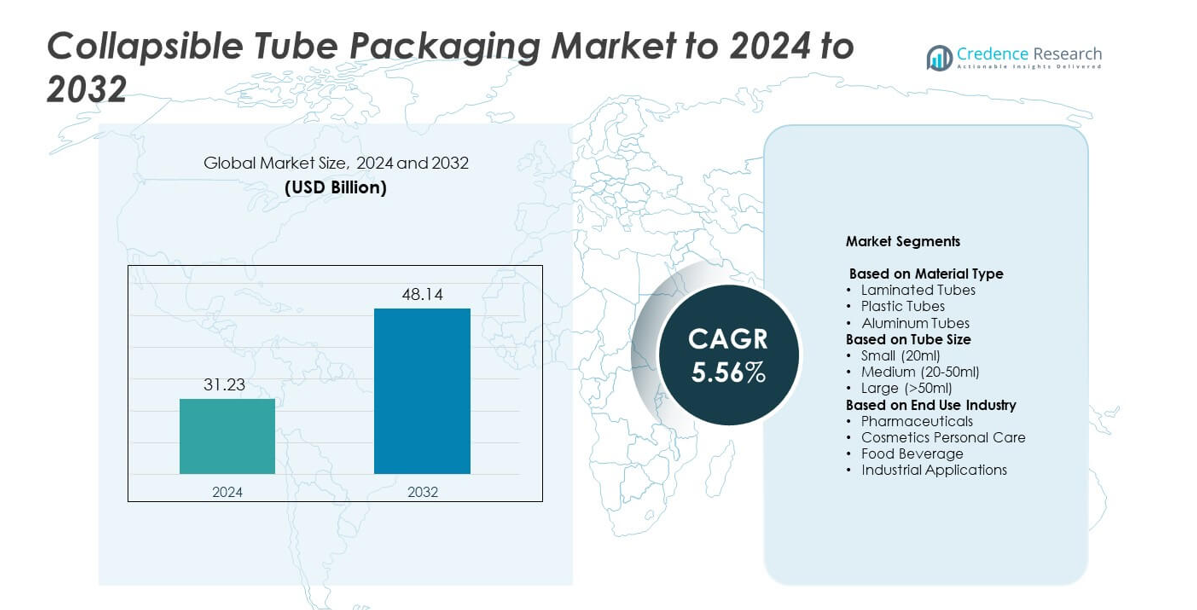

Collapsible Tube Packaging Market size was valued USD 31.23 Billion in 2024 and is anticipated to reach USD 48.14 Billion by 2032, at a CAGR of 5.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Collapsible Tube Packaging Market Size 2024 |

USD 31.23 Billion |

| Collapsible Tube Packaging Market, CAGR |

5.56% |

| Collapsible Tube Packaging Market Size 2032 |

USD 48.14 Billion |

The collapsible tube packaging market is led by major companies including Amcor, Essel Propack, Huhtamaki, Linhardt Group, Montebello Packaging, Albea, and UFlex, which collectively shape the industry through innovation, sustainability, and global reach. These players focus on advanced laminates, recyclable materials, and premium tube designs to meet evolving consumer and regulatory demands. North America dominated the global market in 2024, holding a 33.8% share, supported by strong demand from pharmaceuticals and personal care industries. Europe followed closely due to strict sustainability mandates, while Asia-Pacific emerged as the fastest-growing region, driven by expanding manufacturing capacity and increasing consumer demand.

Market Insights

- The collapsible tube packaging market was valued at USD 31.23 Billion in 2024 and is projected to reach USD 48.14 Billion by 2032, growing at a CAGR of 5.56%.

- Growth is driven by rising demand in pharmaceuticals and personal care, supported by hygienic, portable, and tamper-resistant packaging solutions.

- Key trends include adoption of recyclable mono-material tubes, digital printing for customization, and eco-friendly packaging innovations.

- The market is highly competitive with major players focusing on sustainable materials, smart closures, and capacity expansion across emerging economies.

- North America led the market with a 33.8% share in 2024, followed by Europe at 28.6% and Asia-Pacific at 25.4%, while laminated tubes dominated the material segment with a 46.7% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

The laminated tubes segment dominated the collapsible tube packaging market in 2024, accounting for 46.7% of the total share. Their superior barrier properties against oxygen, moisture, and UV radiation make them ideal for pharmaceuticals and personal care products. The demand for laminated structures combining plastic and aluminum layers continues to rise due to enhanced printability and aesthetic appeal. Growing use in toothpaste and topical medication packaging strengthens this segment’s leadership. Manufacturers such as Essel Propack and Albea Group focus on multilayer laminates to ensure durability and improved product shelf life.

- For instance, Albéa Tubes is a leading global producer of plastic and laminated tubes, manufacturing approximately 8 billion tubes annually.

By Tube Size

Medium-sized tubes between 20–50ml held the leading 51.2% share of the market in 2024. This size range balances portability and capacity, making it popular in cosmetics, skincare, and travel-size pharmaceutical applications. Brands prefer medium tubes for lotions, gels, and ointments due to consumer convenience and reduced material use. Rising demand for compact, easy-to-use packaging in e-commerce and retail drives this segment. Companies like Huhtamaki and Hoffmann Neopac have expanded production lines to support diverse mid-size tube formats catering to global beauty and healthcare brands.

- For instance, ALLTUB runs 60+ production lines and manufactures over 1.4 billion tubes annually, covering popular diameters and volumes used for 20–50 ml formats.

By End Use Industry

The pharmaceuticals segment emerged as the largest end-use category in 2024, contributing 39.5% of the global market share. Strong demand stems from the need for sterile, tamper-proof, and contamination-resistant packaging for ointments, creams, and gels. Collapsible tubes offer precise dosage control and protection against environmental exposure, which enhances product safety. Growth in prescription dermatological formulations and OTC products further supports expansion. Key manufacturers such as Berry Global and Hoffmann Neopac invest in specialized barrier laminates and child-resistant closures to meet pharmaceutical compliance and performance standards.

Key Growth Drivers

Rising Demand from Pharmaceutical and Personal Care Industries

Increasing consumption of ointments, creams, and topical medications is fueling the use of collapsible tubes. These tubes ensure product protection, hygiene, and controlled dispensing. Growth in skincare and cosmetics products has further expanded demand for durable, lightweight, and barrier-efficient tubes. Manufacturers focus on improving sterility and tamper resistance, enhancing suitability for pharmaceutical applications. Expanding healthcare infrastructure and higher disposable incomes in emerging economies strengthen market growth for tube-based packaging solutions.

- For instance, Amcor operated 212 locations in 40 countries in FY 2024, enabling global supply of compliant tube and closure systems for health and beauty brands.

Shift Toward Sustainable and Recyclable Packaging Materials

Growing environmental awareness has driven manufacturers to adopt recyclable and eco-friendly materials such as aluminum and biodegradable plastics. Laminated and mono-material tube designs minimize waste and improve recyclability. Consumers increasingly prefer brands that emphasize sustainability, influencing packaging choices across cosmetics and food sectors. Companies are also investing in circular packaging models and renewable material sources to reduce carbon emissions. These efforts align with global regulations promoting eco-conscious packaging adoption.

- For instance, In March 2024, Berry Global’s flexibles division announced an expansion across three European recycling facilities, with a capacity increase of 6,600 tonnes annually.

Expansion of E-commerce and Digital Printing Capabilities

Rapid e-commerce growth has increased demand for travel-friendly and visually appealing packaging formats. Digital printing on collapsible tubes allows faster customization, smaller batch runs, and better branding flexibility. Advanced printing technologies improve label accuracy and design variety, meeting consumer expectations for personalization. E-commerce brands prefer collapsible tubes for lightweight shipping and product protection during transit. The integration of aesthetic and functional features supports brand differentiation and drives overall market expansion.

Key Trends & Opportunities

Adoption of Smart and Functional Tube Designs

Smart packaging technologies such as QR codes and tamper-evident seals are enhancing consumer engagement. These features improve traceability and product authentication, especially in pharmaceuticals and premium cosmetics. Functional upgrades like easy-open caps and precision dispensing mechanisms increase convenience. Manufacturers are using advanced laminates to provide superior protection while maintaining flexibility. Integration of smart labeling supports digital marketing and transparency across the supply chain.

- For instance, Schreiner MediPharm’s NFC solutions use NXP NTAG chips with 144-byte or 416-byte user memory, enabling item-level authentication and tamper-evidence on medical packs.

Growth of Premium and Aesthetic Packaging Solutions

Premiumization trends are reshaping packaging preferences in personal care and beauty industries. Brands emphasize glossy finishes, metallic effects, and intricate prints to attract high-end consumers. The combination of visual appeal and functionality enhances brand recognition. Increasing competition among cosmetic manufacturers drives innovation in decorative tubes. Companies offering premium-looking yet recyclable packaging gain a strong market position, catering to both sustainability and aesthetics.

- For instance, LINHARDT operates 3 German plants with in-house TEC.Point toolmaking, enabling high-precision decorated tubes for beauty and healthcare programs.

Key Challenges

High Production Costs of Sustainable Materials

The shift to recyclable and bio-based materials has raised production costs. Bioplastics and aluminum require specialized processing and supply chain investments, affecting profitability. Smaller manufacturers often struggle to balance eco-innovation with price competitiveness. Limited availability of advanced materials further slows large-scale adoption. Overcoming cost constraints remains essential for ensuring the long-term viability of sustainable tube packaging solutions.

Stringent Regulatory and Recycling Standards

Global packaging regulations are becoming more restrictive, particularly concerning plastic waste and recyclability. Manufacturers must comply with labeling, chemical safety, and material recovery rules. Adapting existing designs to meet regional recycling standards demands continuous R&D. Non-compliance risks brand reputation and market access limitations. Harmonizing sustainability goals with regulatory frameworks presents a major operational challenge for packaging producers worldwide.

Regional Analysis

North America

North America held the largest share of 33.8% in the collapsible tube packaging market in 2024. Strong demand from pharmaceutical and personal care industries supports market leadership in the United States and Canada. The presence of leading manufacturers and advanced production technologies contributes to steady growth. Increasing adoption of sustainable packaging materials and premium tube designs strengthens market competitiveness. Rising consumption of skincare, oral care, and OTC medical products further drives regional demand. Favorable recycling regulations and strong consumer awareness promote continuous product innovation across the packaging sector.

Europe

Europe accounted for a 28.6% share of the global market in 2024, driven by strict packaging sustainability standards. Countries such as Germany, France, and the United Kingdom lead in eco-friendly and recyclable tube production. The demand for aluminum and laminated tubes has grown significantly in the personal care and food sectors. Innovation in decorative finishes and lightweight materials enhances regional adoption. The European Green Deal’s sustainability goals encourage brands to adopt recyclable and bio-based solutions, further boosting the collapsible tube packaging market.

Asia-Pacific

Asia-Pacific captured a 25.4% share of the market in 2024 and is the fastest-growing regional segment. Expanding pharmaceutical manufacturing in India, China, and Japan fuels packaging demand. Rising disposable incomes and urbanization drive strong growth in personal care and food packaging. Local players are investing in cost-efficient production to meet regional consumer preferences. Increasing e-commerce penetration also supports flexible and durable packaging formats. Government support for sustainable packaging and rapid industrialization contribute to the region’s expanding market presence.

Latin America

Latin America represented an 8.1% share of the collapsible tube packaging market in 2024. Brazil and Mexico are the key contributors, supported by strong growth in cosmetics and oral care products. Expanding healthcare access and local pharmaceutical production boost tube packaging demand. Manufacturers focus on cost-effective laminated and plastic tubes to cater to mid-range product categories. Increasing environmental awareness is encouraging the adoption of recyclable packaging solutions. Regional modernization of retail networks also drives product diversification and packaging innovation.

Middle East and Africa

The Middle East and Africa held a 4.1% share of the global market in 2024. Growing pharmaceutical manufacturing in South Africa, Saudi Arabia, and the UAE supports demand. Rising investment in healthcare infrastructure and personal care products enhances tube packaging adoption. The shift toward lightweight and moisture-resistant packaging formats strengthens regional usage. Local producers are improving supply chains to reduce import dependency. Gradual adoption of sustainable materials and increasing consumer awareness create new opportunities for long-term market expansion.

Market Segmentations:

By Material Type

- Laminated Tubes

- Plastic Tubes

- Aluminum Tubes

By Tube Size

- Small (20ml)

- Medium (20-50ml)

- Large (>50ml)

By End Use Industry

- Pharmaceuticals

- Cosmetics Personal Care

- Food Beverage

- Industrial Applications

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The collapsible tube packaging market is characterized by strong competition among global and regional manufacturers such as Amcor, Essel Propack, Huhtamaki, Linhardt Group, Montebello Packaging, Albea, UFlex, Gerresheimer, Raepak, Schur Flexibles, CCL Industries, AptarGroup, B. Braun Melsungen, Neopac, Tubex Packaging, Isonex Packaging, and DKL Holdings. Market participants focus on advanced barrier technologies, recyclable materials, and digital printing to enhance functionality and visual appeal. Many firms are expanding manufacturing capacity in emerging markets to reduce logistics costs and serve regional brands efficiently. Strategic mergers, product innovations, and investments in automation drive operational efficiency and sustainable production. Companies are also emphasizing circular packaging solutions and lightweight materials to meet regulatory and environmental standards. Continuous innovation in tube design, closure systems, and eco-friendly laminates strengthens product differentiation, while partnerships with cosmetic, pharmaceutical, and food manufacturers help expand end-use applications across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor

- Essel Propack

- Huhtamaki

- Linhardt Group

- Montebello Packaging

- Albea

- UFlex

- Gerresheimer

- Raepak

- Schur Flexibles

- CCL Industries

- AptarGroup

- Braun Melsungen

- Neopac

- Tubex Packaging

- Isonex Packaging

- DKL Holdings

Recent Developments

- In 2024, Neopac expanded its Polyfoil Mono-Material Barrier (MMB) tube line by launching MMB mini tubes for the pharmaceutical, dental, and oral care markets.

- In 2024, Linhardt expanded its global presence in the aluminum tube market by acquiring India’s Pioneer Group through a share purchase agreement

- In 2024, UFlex developed and successfully implemented aluminum-free tubes as part of its FlexiTubes sustainable product lineup.

Report Coverage

The research report offers an in-depth analysis based on Material Type, Tube Size, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recyclable and mono-material tubes will continue to rise across industries.

- Pharmaceutical and personal care applications will remain the dominant growth drivers.

- Digital printing and customization technologies will gain wider commercial adoption.

- Manufacturers will expand production capacities in Asia-Pacific to meet regional demand.

- The shift toward lightweight aluminum and bio-based plastics will strengthen sustainability goals.

- E-commerce packaging requirements will accelerate innovation in portable and durable designs.

- Smart packaging features such as QR codes and tamper indicators will see greater integration.

- Regulatory pressure on plastic waste reduction will shape material innovation strategies.

- Premium cosmetic brands will drive demand for aesthetically advanced collapsible tube designs.

- Global partnerships between packaging firms and brand owners will enhance supply chain resilience.