Market Overview

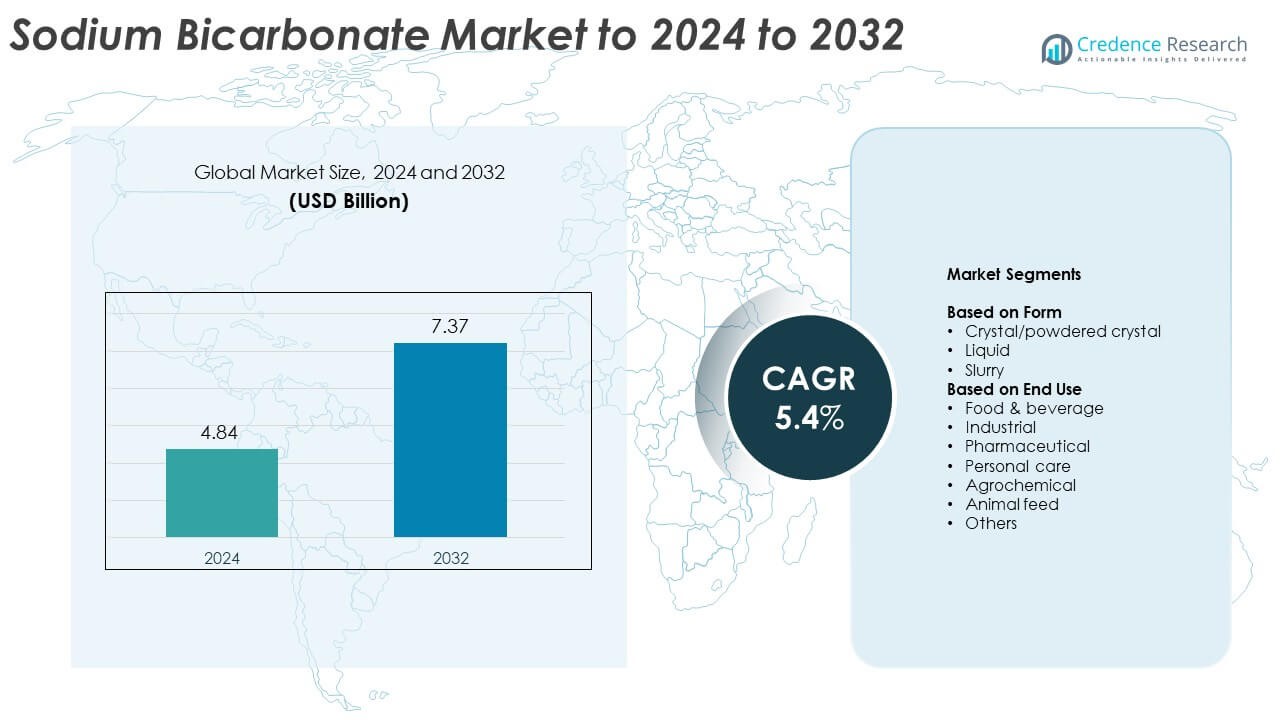

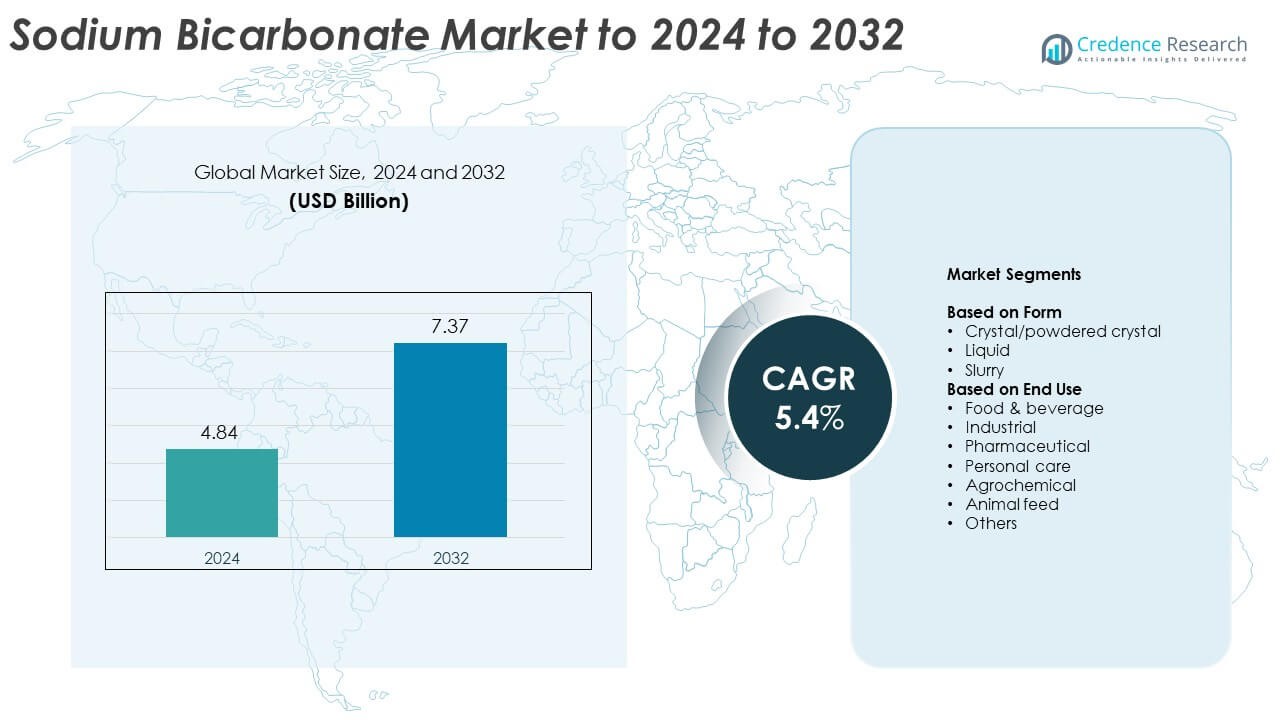

Sodium Bicarbonate Market size was valued USD 4.84 billion in 2024 and is anticipated to reach USD 7.37 billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Bicarbonate Market Size 2024 |

USD 4.84 Billion |

| Sodium Bicarbonate Market , CAGR |

5.4% |

| Sodium Bicarbonate Market Size 2032 |

USD 7.37 Billion |

The sodium bicarbonate market is dominated by major players such as Tata Chemicals, Church & Dwight, Solvay, Ciech SA, AGC Inc., Genesis Energy, Nirma Limited, Seqens, Tosoh Corporation, and Novacap. These companies maintain leadership through large-scale production capacities, strong distribution networks, and continuous process optimization. Strategic investments in sustainable technologies and expansion into high-demand sectors such as food, pharmaceuticals, and industrial treatment have strengthened their market positions. Regionally, North America leads the global market with a 34.2% share in 2024, driven by advanced manufacturing infrastructure and strong consumption in food processing and healthcare industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The sodium bicarbonate market was valued at USD 4.84 billion in 2024 and is projected to reach USD 7.37 billion by 2032, growing at a CAGR of 5.4%.

- Rising demand from food, pharmaceutical, and animal feed industries is driving market expansion, supported by growing applications in pH regulation, leavening, and healthcare.

- Increasing adoption of eco-friendly chemicals in industrial and environmental applications, such as flue gas treatment and wastewater processing, defines current market trends.

- The market is competitive, with leading players focusing on technological innovation, sustainable production, and regional capacity expansion to strengthen global presence.

- North America leads with a 34.2% share, followed by Europe at 28.5% and Asia-Pacific at 26.8%; the crystal or powdered crystal segment dominates with 68.4% market share, reflecting its wide use in food, pharmaceutical, and animal feed applications.

Market Segmentation Analysis:

By Form

The crystal or powdered crystal segment dominated the sodium bicarbonate market in 2024, holding around 68.4% share. Its dominance is driven by widespread use across food processing, pharmaceuticals, and animal feed industries due to ease of storage, long shelf life, and high purity. The powdered form is preferred for precise dosing and uniform blending in baking, drug formulations, and livestock nutrition. Growing demand from bakery, healthcare, and water treatment sectors continues to strengthen this segment. Meanwhile, liquid and slurry forms are used in specific industrial and flue gas treatment applications.

- For instance, the combined production from Church & Dwight’s Green River, Wyoming, and Syracuse, New York, facilities amounted to about 100,000 tons of sodium bicarbonate per year in 1968. More recently, the company’s annual report from 2012 stated that the Old Fort, Ohio, plant had a production capacity of 280,000 tons per year.

By End Use

The food and beverage segment held the largest share of approximately 31.6% in 2024, primarily driven by sodium bicarbonate’s role as a leavening agent, acidity regulator, and pH buffer. Expanding bakery and confectionery production, along with rising demand for ready-to-eat foods, supports its growth. The pharmaceutical and animal feed segments also show strong demand due to applications in antacids, electrolyte balance, and livestock health. Industrial and agrochemical uses further contribute to market expansion, but food and beverage remains the leading revenue-generating segment globally.

- For instance, Tata Chemicals Europe captures 40,000 t/yr of CO2 from its combined heat and power plant emissions to produce pharmaceutical-grade Ecokarb® sodium bicarbonate used in dialysis.

Key Growth Drivers

Expanding Food and Beverage Applications

Growing use of sodium bicarbonate as a leavening and pH-regulating agent drives market growth. Rising demand for bakery and convenience foods, especially in Asia-Pacific and North America, strengthens consumption. The compound’s role in maintaining texture, flavor, and shelf life of processed foods makes it indispensable. Increasing global bakery product consumption supports sustained demand from manufacturers seeking safe, cost-effective, and multifunctional food-grade ingredients.

- For instance, Humens’ Singapore unit (Novabay) runs a 70,000 tonnes/year sodium bicarbonate plant to supply bakery and pharmaceutical customers.

Rising Demand from Pharmaceutical Industry

The pharmaceutical industry significantly contributes to market expansion due to sodium bicarbonate’s role as an antacid and pH stabilizer. It is a key ingredient in effervescent tablets, injectables, and dialysis solutions. Growth in chronic disease prevalence and healthcare spending worldwide is driving its use in drug formulations. Rising production of over-the-counter gastrointestinal medicines further enhances demand, particularly across mature pharmaceutical markets in Europe and North America.

- For instance, Qemetica has a total capacity of approximately 200,000 tonnes per year for specialized sodium bicarbonate across its plants in Germany and Poland, which is certified for pharmaceutical and medical markets.

Increasing Use in Animal Feed and Agriculture

The compound’s adoption in animal feed enhances livestock health and performance by maintaining optimal pH balance and reducing acidosis risk. Growing global meat and dairy consumption has boosted demand from the animal nutrition sector. In agriculture, it acts as a natural fungicide and soil conditioner. These eco-friendly and cost-effective properties align with sustainable farming practices, promoting sodium bicarbonate’s wider adoption across feed and agrochemical applications.

Key Trends & Opportunities

Shift Toward Eco-Friendly Industrial Applications

Industries are increasingly replacing synthetic chemicals with sodium bicarbonate for environmental compliance. Its use in flue gas desulfurization, wastewater treatment, and emission control has expanded significantly. As governments impose stricter pollution norms, sodium bicarbonate’s non-toxic and biodegradable nature positions it as a preferred solution. Rising investments in clean industrial technologies create new opportunities for its application across power generation, metal processing, and waste management industries.

- For instance, Humens is partnering with Suez to build the Novasteam 55 MW SRF plant to supply its Novacarb site, helping to eliminate coal usage by 2026. This complements Humens’ existing Novawood biomass cogeneration plant at the same location, which is responsible for a 150,000 t/yr CO₂ reduction.

Technological Advancements in Production

Advances in production technologies, such as energy-efficient Solvay processes and closed-loop systems, are reducing manufacturing costs. Improved purification techniques enhance product quality for food and pharmaceutical applications. Automation and digital monitoring in production plants ensure consistency and reduce waste. These developments are helping manufacturers expand capacity while meeting stringent quality standards, creating opportunities for long-term cost savings and product innovation.

- For instance, Solvay’s “e.Solvay” program targets up to 50% lower CO₂ emissions and 20% lower energy, water, and salt use in soda ash and bicarbonate.

Key Challenges

Raw Material Price Volatility

Fluctuations in the availability and price of raw materials such as soda ash and carbon dioxide impact production costs. Rising energy costs and supply chain disruptions further increase pricing pressure on manufacturers. Such volatility affects profitability and pricing stability for end-users across food, pharma, and industrial sectors. Long-term contracts and localized sourcing strategies are becoming vital to mitigate cost-related uncertainties.

Environmental and Waste Management Concerns

While sodium bicarbonate is environmentally safe, its large-scale industrial production can generate chemical waste and CO₂ emissions. Inadequate waste treatment and disposal practices raise sustainability concerns among regulators and consumers. Manufacturers face growing pressure to adopt greener production methods and circular economy models. Failure to comply with tightening environmental norms may limit expansion, especially in regions with strict carbon emission policies.

Regional Analysis

North America

North America held the largest share of around 34.2% in the sodium bicarbonate market in 2024. The region’s dominance stems from strong demand across the food and beverage, pharmaceutical, and animal feed industries. The United States accounts for most of the consumption due to advanced food processing and healthcare sectors. Expanding use in emission control systems and industrial cleaning further supports regional growth. The presence of major manufacturers and ongoing adoption of eco-friendly applications strengthen North America’s leadership position in the global market.

Europe

Europe accounted for about 28.5% share in 2024, supported by established industries and stringent environmental regulations. The region’s focus on sustainable industrial processes drives the use of sodium bicarbonate in flue gas treatment and wastewater applications. High demand in pharmaceuticals and food production across Germany, France, and the United Kingdom sustains market growth. Increasing livestock feed usage and adoption in eco-friendly cleaning products also contribute to expansion. Government-backed carbon reduction policies continue to promote sodium bicarbonate as a preferred industrial neutralizing agent.

Asia-Pacific

Asia-Pacific captured approximately 26.8% share in 2024 and is expected to record the fastest growth during the forecast period. Rising consumption in China, India, and Japan drives demand across food, pharmaceutical, and agricultural applications. Expanding bakery production, rapid industrialization, and growth in animal husbandry boost market penetration. Increasing local manufacturing capacity and lower production costs strengthen the region’s competitiveness. Supportive government initiatives promoting sustainable chemicals are also accelerating adoption across end-use industries, positioning Asia-Pacific as the fastest-growing regional market.

Latin America

Latin America represented about 6.4% share in the global market in 2024. Growth is driven by expanding food processing, agricultural, and animal feed industries in Brazil, Mexico, and Argentina. Rising awareness of sodium bicarbonate’s role in clean manufacturing and sustainable farming supports its use. Improved industrial infrastructure and trade relations with global suppliers are enhancing availability across regional markets. Pharmaceutical applications and eco-friendly product adoption are further strengthening Latin America’s market outlook over the forecast period.

Middle East & Africa

The Middle East and Africa accounted for nearly 4.1% share in 2024, supported by increasing industrialization and growing food sector demand. GCC countries lead regional adoption, driven by expanding processed food production and desalination plant usage. Rising healthcare investment and awareness of product safety are also increasing pharmaceutical applications. Ongoing infrastructure projects and emission control measures in industrial sectors are encouraging the use of sodium bicarbonate. However, limited domestic production capacity and dependence on imports slightly constrain market expansion in some parts of the region.

Market Segmentations:

By Form

- Crystal/powdered crystal

- Liquid

- Slurry

By End Use

- Food & beverage

- Industrial

- Pharmaceutical

- Personal care

- Agrochemical

- Animal feed

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The sodium bicarbonate market is led by key players such as Tata Chemicals, Church & Dwight, Solvay, Ciech SA, AGC Inc., Genesis Energy, Nirma Limited, Seqens, Tosoh Corporation, and Novacap. The competitive landscape is characterized by strategic expansion, technological innovation, and increasing production efficiency. Companies are investing in modern manufacturing processes to enhance purity and reduce carbon emissions, aligning with global sustainability goals. The market shows steady consolidation as leading producers strengthen their global supply chains and regional distribution networks. Growing demand from food, pharmaceutical, and industrial sectors is encouraging manufacturers to diversify product portfolios and introduce customized grades. Strategic collaborations with downstream industries and focus on renewable energy use in production are key strategies driving competitiveness. Moreover, firms are emphasizing research and development to improve product performance and cost-effectiveness, enabling them to maintain market leadership while meeting evolving regulatory and consumer standards worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Tata Chemicals Europe announced a capital investment of £60 million to build a new 180,000 tons-per-annum pharmaceutical-grade sodium bicarbonate plant in the UK.

- In 2023, Solvay partnered with ENOWA to develop a carbon-neutral soda ash facility in Saudi Arabia.

- In 2022, Solvay and Sisecam launched a project at their joint venture facility in Devnya, Bulgaria, to boost the production capacity of sodium bicarbonate by 200,000 tons.

Report Coverage

The research report offers an in-depth analysis based on Form, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily, supported by rising demand in food and beverage industries.

- Pharmaceutical applications will expand due to increased production of antacids and injectables.

- Eco-friendly manufacturing processes will gain importance to meet environmental regulations.

- Asia-Pacific will emerge as the fastest-growing regional market during the forecast period.

- Demand from animal feed and agriculture sectors will continue to strengthen.

- Technological improvements in production will reduce costs and enhance product purity.

- Industrial applications in flue gas treatment and wastewater management will increase.

- Strategic partnerships among manufacturers will boost global distribution networks.

- Growing consumer focus on clean-label and safe ingredients will drive food-grade use.

- Expansion of sustainable packaging and chemical industries will further support market growth.