Market Overview:

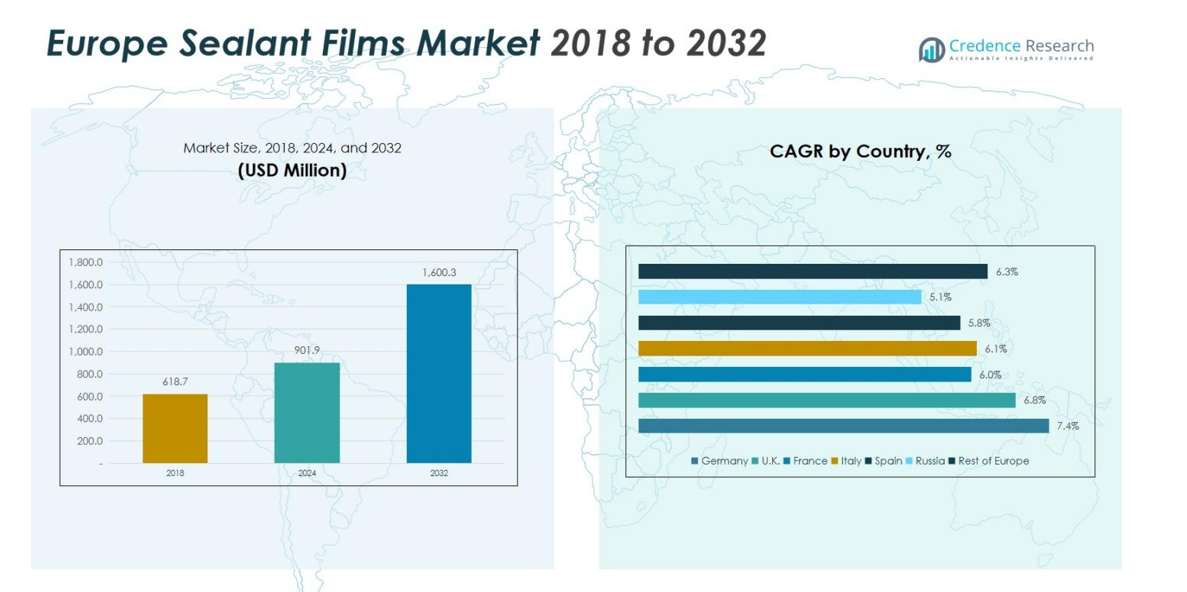

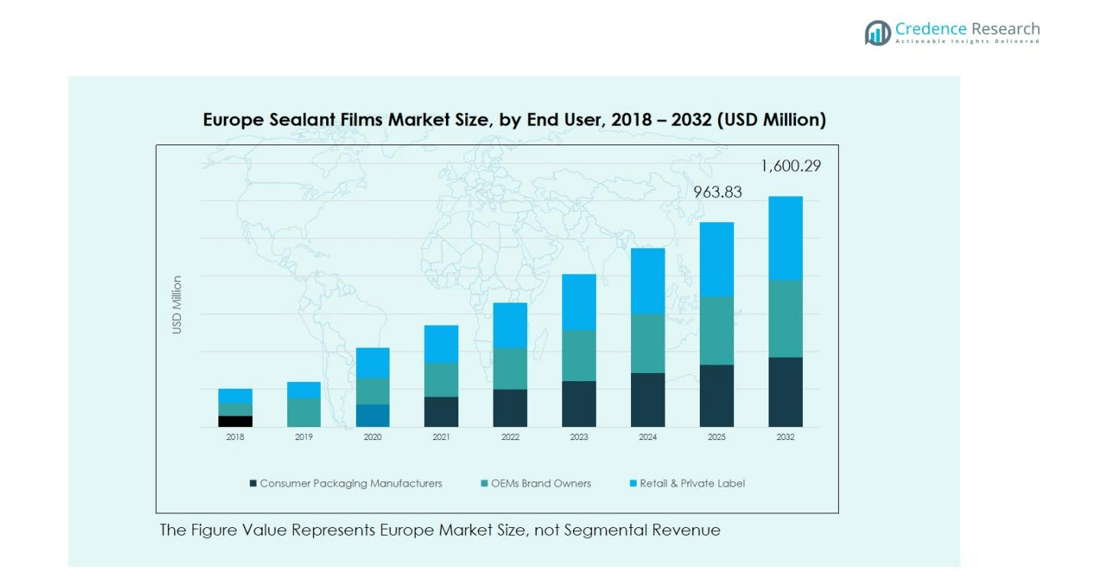

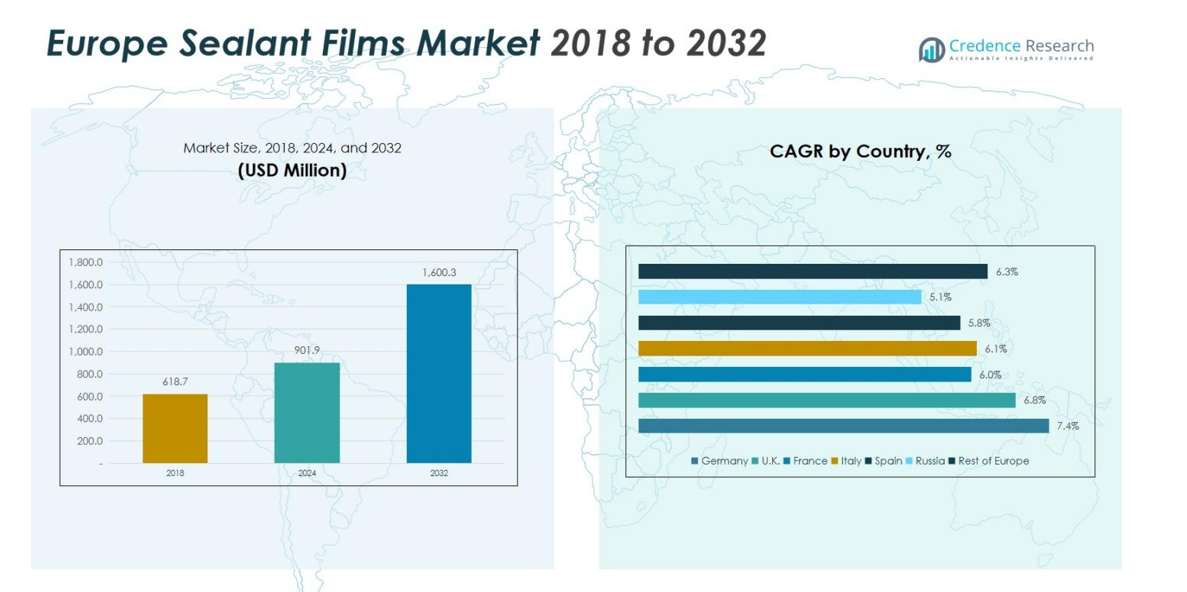

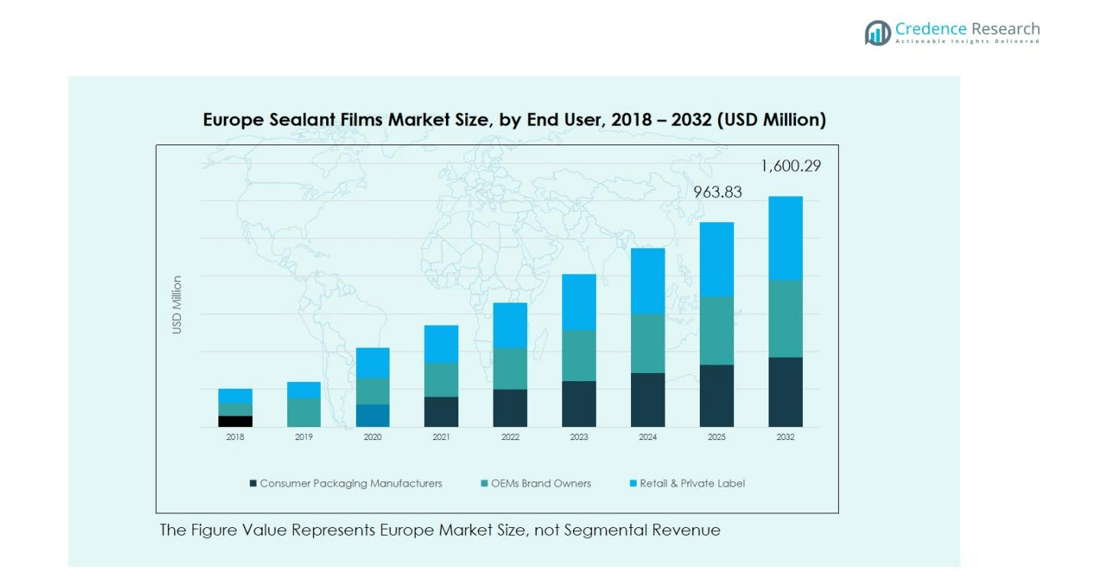

Europe Sealant Films Market size was valued at USD 618.7 million in 2018, growing to USD 901.9 million in 2024, and is anticipated to reach USD 1,600.3 million by 2032, at a CAGR of 7.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Sealant Films Market Size 2024 |

USD 901.9 million |

| Europe Sealant Films Market, CAGR |

7.51% |

| Europe Sealant Films Market Size 2032 |

USD 1,600.3 million |

The Europe Sealant Films Market is highly competitive, with top players including Mitsubishi Polyester Film GmbH, Jindal Films Europe, Polyplex, Amcor plc, Berry Global Group, Inc., Toray Plastics Inc., Sika AG, Henkel AG & Co. KGaA, and POLIFILM GmbH. These companies focus on innovation, high-performance sealant films, and sustainable solutions to strengthen their market positions. Germany leads the regional market with a 22% share, driven by advanced manufacturing, strong demand in processed food and pharmaceuticals, and adoption of eco-friendly packaging. The United Kingdom follows with 18%, supported by consumer demand for convenient, hygienic packaging and regulatory standards. France captures 15%, reflecting growth in premium food, cosmetics, and pharmaceutical applications, while Russia holds 12%, fueled by industrial expansion and rising packaging requirements. The combined efforts of these key players and strong regional demand are shaping the growth trajectory of the Europe Sealant Films Market.

Market Insights

- Europe Sealant Films Market was valued at USD 901.9 Million in 2024 and is projected to reach USD 1,600.3 Million by 2032, growing at a CAGR of 7.51%. Polyethylene leads the material type segment with a 35% share, and thermal heat sealing dominates technology with 50% share.

- Growth is driven by rising demand from food, beverage, and pharmaceutical packaging, coupled with increasing adoption of sustainable and recyclable films across Europe.

- Market trends include the adoption of cold-seal films for delicate packaging, development of high-barrier films, and increasing automation in production lines for efficiency and reduced waste.

- The market is competitive, with key players such as Mitsubishi Polyester Film GmbH, Jindal Films Europe, Polyplex, Amcor plc, and Berry Global Group focusing on R&D, partnerships, and sustainable innovations.

- Regionally, Germany leads with 22% market share, followed by the UK at 18% and France at 15%, with the rest of Europe collectively accounting for 45%, reflecting strong demand across packaging and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

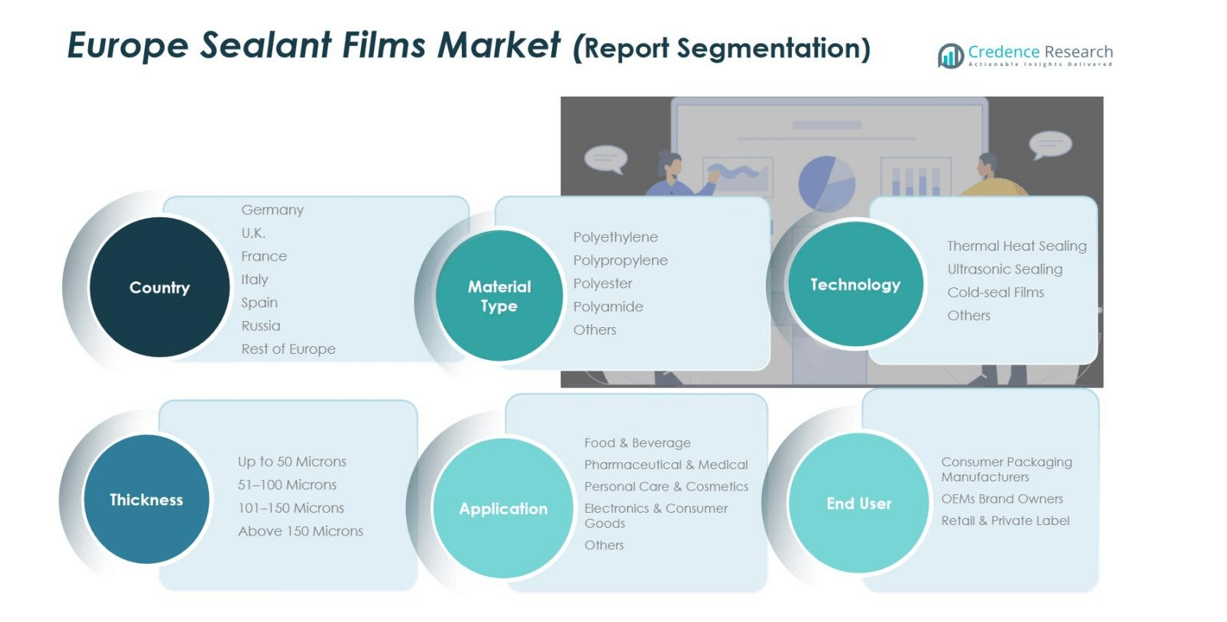

Market Segmentation Analysis:

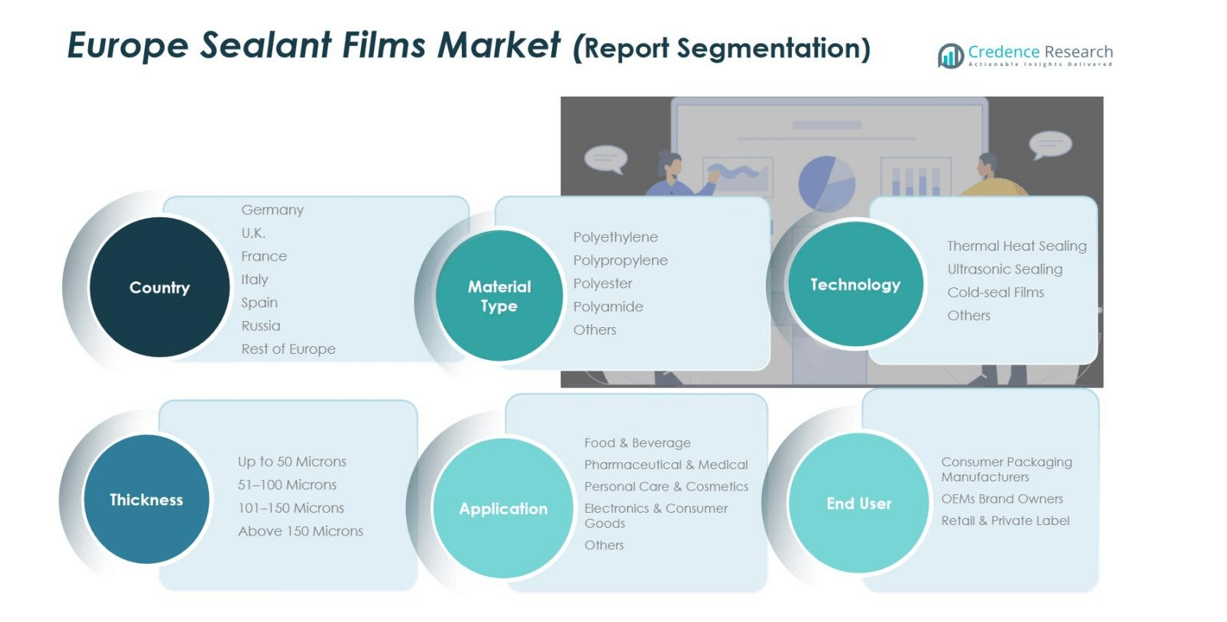

By Material Type

Polyethylene leads the Europe Sealant Films Market by material type, accounting for approximately 35% of the market share. Its dominance is driven by high flexibility, cost-effectiveness, and excellent sealing properties, making it suitable for diverse packaging applications. Polypropylene and polyester follow, benefiting from durability and heat resistance. Polyamide and other specialty films hold smaller shares but are gaining traction in niche applications requiring high barrier performance. Increasing demand from food, beverage, and pharmaceutical packaging continues to propel polyethylene’s growth, supported by the rising adoption of lightweight and recyclable packaging solutions across Europe.

- For instance, Dow Inc. launched its INNATE™ Precision Packaging Resins that enhance toughness and seal integrity for food and healthcare packaging.

By Technology

Thermal heat sealing dominates the technology segment, representing around 50% of the Europe Sealant Films Market. Its widespread adoption is fueled by efficiency, strong bonding, and compatibility with high-speed production lines in the food and pharmaceutical sectors. Ultrasonic sealing and cold-seal films are expanding due to their precise, low-energy sealing and suitability for delicate packaging. Other technologies account for a minor share but are gradually being adopted in specialized industrial applications. The growth of thermal heat sealing is closely linked to increased automation and demand for reliable, tamper-proof packaging solutions across the European market.

- For instance, Amcor employs advanced thermal heat sealing in its AmLite Ultra Recyclable packaging, enhancing shelf life and reducing contamination risks.

By Application

Food & Beverage is the leading application segment, capturing nearly 40% of the Europe Sealant Films Market share. Its dominance stems from the sector’s stringent hygiene standards, need for extended shelf life, and increasing consumer preference for convenient, ready-to-eat packaging. Pharmaceutical & Medical and Personal Care & Cosmetics segments are growing steadily due to strict regulatory requirements and protective packaging needs. Electronics & Consumer Goods hold a smaller share but benefit from protective and anti-static film requirements. The surge in packaged foods, beverages, and medical products is the primary driver behind the growth of sealant films in Europe.

Key Growth Drivers

Rising Demand from the Food and Beverage Industry

The growing consumption of packaged foods and beverages across Europe is a major factor driving the sealant films market. The sector increasingly relies on high-performance films to ensure product freshness, extend shelf life, and enhance aesthetic appeal. The demand for flexible, lightweight, and cost-effective packaging solutions has led to a surge in the use of polyethylene and polypropylene-based sealant films, particularly in Germany, the UK, and France, where processed food consumption continues to grow steadily.

- For instance, KM Packaging launched mono-material lidding films made from polypropylene designed specifically for recyclability and compatible with chilled, frozen, and microwavable food packaging, meeting supermarket and consumer sustainability demands in the UK and other EU markets.

Expansion of Pharmaceutical and Medical Packaging

The expanding pharmaceutical and medical sectors in Europe significantly boost the need for advanced sealant films. These films provide strong barrier protection against moisture, oxygen, and contamination, ensuring product safety and extended storage life. As healthcare regulations tighten and pharmaceutical exports rise, especially in countries like Switzerland and Germany, demand for high-quality, compliant packaging materials continues to strengthen, fostering innovation in film coatings and sealing technologies.

- For instance, Mondi produces multi-layer thermoformable barrier films (up to 18 layers) and has invested in its FunctionalBarrier Paper Ultimate solution to deliver ultra-high barrier protection for sensitive products.

Shift Toward Sustainable and Recyclable Materials

Environmental regulations and consumer preference for eco-friendly packaging are encouraging manufacturers to develop recyclable and bio-based sealant films. Companies across Europe are investing in R&D to reduce carbon footprints and meet the EU’s circular economy goals. The transition from conventional plastics to recyclable polyethylene and biodegradable film materials is opening new growth avenues for market players, reinforcing sustainability as a central pillar of product development strategies.

Key Trends & Opportunities

Adoption of Advanced Sealing Technologies

Technological advancements in sealing processes, such as ultrasonic and cold-seal technologies, are improving production efficiency and reducing energy consumption. These innovations cater to high-speed packaging operations while maintaining strong seal integrity and minimizing waste. The growing preference for these solutions in food and medical packaging provides lucrative opportunities for manufacturers to differentiate their products and expand their technological capabilities across the European market.

- For instance, Tetra Pak’s E3/CompactFlex platform uses a Mini Single Head ultrasonic transducer for transversal sealing, enabling more homogeneous seals and boosting machine capacity to 9,000 packs/hour on targeted formats.

Integration of Smart Packaging Solutions

The integration of smart packaging, including temperature indicators and QR-enabled films, presents emerging opportunities in the Europe sealant films market. These solutions enhance product traceability, safety, and consumer engagement. As e-commerce and logistics sectors expand, the need for intelligent and interactive packaging grows, driving partnerships between film producers and digital solution providers to meet evolving end-user demands across multiple industries.

- For instance, Avery Dennison partnered with Controlant to preview an IoT device that provides real-time, end-to-end visibility for the pharmaceutical supply chain, aimed at improving temperature control and product integrity.

Key Challenges

Volatility in Raw Material Prices

Fluctuations in raw material prices, particularly for polyethylene and polypropylene, continue to challenge market stability. The dependence on petrochemical feedstocks and global supply chain disruptions often result in cost variations, impacting profit margins for manufacturers. These fluctuations also influence production planning and pricing strategies, compelling companies to seek alternative materials and localized sourcing to mitigate supply risks.

Stringent Environmental Regulations

Stringent EU regulations governing plastic waste management and sustainability pose compliance challenges for film producers. The pressure to reduce plastic usage and adopt recyclable or compostable materials requires substantial investment in R&D and production infrastructure. Smaller manufacturers often face financial and technical barriers in meeting these sustainability standards, which may limit market participation and competitiveness in the long term.

Regional Analysis

United Kingdom

The United Kingdom holds a significant share of 18% in the Europe Sealant Films Market. Strong demand from the food and beverage packaging sector, coupled with stringent regulatory standards for hygiene and shelf-life, drives market growth. Consumer preference for convenient, ready-to-eat packaging and the increasing use of recyclable and sustainable materials further support demand. Key players focus on introducing high-performance films tailored to UK manufacturers’ requirements. Additionally, technological advancements in thermal and ultrasonic sealing systems enhance production efficiency, reinforcing the adoption of sealant films across the country’s packaging and industrial segments.

France

France contributes 15% to the Europe Sealant Films Market, driven by robust activity in the food, pharmaceutical, and personal care industries. Rising consumer awareness of product safety and the demand for innovative packaging solutions fuel the adoption of high-quality sealant films. Thermal heat sealing remains the dominant technology, while cold-seal films gain attention for sensitive applications. The growth is also supported by government initiatives promoting sustainable packaging and reducing plastic waste. France’s focus on premium packaged foods and cosmetics encourages manufacturers to adopt durable, flexible, and high-barrier sealant films, maintaining steady market expansion.

Germany

Germany commands the largest market share of 22% in the Europe Sealant Films Market. The country’s advanced manufacturing base, high demand for processed food, and stringent pharmaceutical regulations drive the adoption of sealant films. Polyethylene and polypropylene films dominate due to their versatility and cost-effectiveness. The market benefits from investments in automated production lines and innovative sealing technologies. Growing consumer preference for eco-friendly and recyclable packaging also boosts demand. Germany’s leadership in automotive and electronics packaging contributes to specialized film applications, making it the most prominent market for sealant films in Europe.

Italy

Italy holds a 10% share in the Europe Sealant Films Market, primarily fueled by the food and beverage industry, including bakery, dairy, and ready-to-eat products. The market benefits from increasing demand for visually appealing, hygienic, and easy-to-use packaging solutions. Thermal heat sealing dominates, while cold-seal films see growing adoption in delicate food packaging. Italian manufacturers emphasize innovation, sustainability, and high-barrier films to meet consumer and regulatory requirements. Personal care and pharmaceutical applications also contribute to growth. Overall, Italy’s expanding packaged food sector and the rising adoption of advanced sealant films support consistent market development.

Spain

Spain represents 8% of the Europe Sealant Films Market, driven by the expanding food processing and pharmaceutical sectors. Thermal heat sealing remains the preferred technology due to its efficiency, while ultrasonic sealing is gradually gaining traction. Increasing consumer demand for convenience foods, ready-to-eat meals, and sustainable packaging boosts the adoption of polyethylene and polyester films. The growth is further supported by government regulations promoting recyclable and eco-friendly materials. Spain’s focus on modernizing packaging lines and integrating high-performance films ensures product safety and extended shelf life, establishing it as a key regional market for sealant films.

Russia

Russia holds a 12% share of the Europe Sealant Films Market, supported by rising industrial and consumer packaging requirements. The food and beverage sector drives demand, alongside pharmaceutical and personal care industries. Thermal heat sealing dominates, with cold-seal technologies increasingly used for delicate or high-value products. Polyethylene films remain the preferred choice for cost-effective and flexible solutions, while specialty films gain popularity in medical applications. Government regulations encouraging packaging standardization and safety drive further adoption. Investments in modern manufacturing facilities and growing demand for convenient, sustainable packaging solutions propel Russia’s sealant films market forward.

Rest of Europe

The Rest of Europe accounts for 15% of the Europe Sealant Films Market, encompassing countries like the Netherlands, Belgium, Sweden, and Poland. Market growth is driven by rising demand from food, beverage, and pharmaceutical sectors and increasing adoption of high-barrier films for sensitive products. Thermal and ultrasonic sealing technologies dominate, with cold-seal films gaining popularity in niche applications. Environmental regulations and sustainability initiatives encourage the use of recyclable and biodegradable materials. Growing industrialization, modernization of packaging infrastructure, and rising consumer demand for convenience foods support the steady expansion of sealant films across these European countries.

Market Segmentations:

By Material Type:

- Polyethylene

- Polypropylene

- Polyester

- Polyamide

- Others

By Technology:

- Thermal Heat Sealing

- Ultrasonic Sealing

- Cold-seal Films

- Others

By Application:

- Food & Beverage

- Pharmaceutical & Medical

- Personal Care & Cosmetics

- Electronics & Consumer Goods

- Others

By Thickness:

- Up to 50 Microns

- 51–100 Microns

- 101–150 Microns

- Above 150 Microns

By End User:

- Consumer Packaging Manufacturers

- OEMs / Brand Owners

- Retail & Private Label

By Region

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The competitive landscape of the Europe Sealant Films Market includes key players such as Mitsubishi Polyester Film GmbH, Jindal Films Europe, Polyplex, Amcor plc, Berry Global Group, Inc., Toray Plastics Inc., Sika AG, Henkel AG & Co. KGaA, and POLIFILM GmbH. The market is highly fragmented, with players focusing on product innovation, advanced sealing technologies, and sustainable materials to strengthen their market position. Companies are increasingly investing in R&D to develop high-barrier films, recyclable solutions, and customized packaging for food, pharmaceutical, and personal care applications. Strategic partnerships, mergers, and acquisitions are common to expand geographic presence and enhance production capabilities. Additionally, manufacturers are leveraging thermal and ultrasonic sealing advancements to meet rising automation and efficiency demands. The competitive environment encourages continuous improvement, driving both market growth and adoption of premium, high-performance sealant films across Europe.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Innovia Films introduced a new range of mono-material polypropylene films designed to enhance recyclability and align with the upcoming EU Packaging and Packaging Waste Regulation (PPWR).

- In September 2025, TotalEnergies SE, in collaboration with SML Maschinengesellschaft mbH, developed downgauged polyethylene-based film solutions for barrier stand-up pouches and deep-freeze packaging.

- In March 2024, Jindal Films Europe (JFE) launched new PP mono-material barrier films, BICOR™ 25 and 30 MBH568, for HFFS applications, designed to comply with European recycling guidelines.

- In July 2025, Inteplast Group acquired German film manufacturer Perga GmbH, marking its strategic entry into the European film manufacturing market

Report Coverage

The research report offers an in-depth analysis based on Material Type, Technology, Application,Thickness, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sealant films will continue to rise due to growth in food and beverage packaging.

- Sustainable and recyclable films will see higher adoption driven by environmental regulations.

- Thermal heat sealing will remain the dominant technology, while cold-seal films gain traction in sensitive applications.

- Polyethylene and polypropylene films will maintain strong market preference for flexibility and cost-effectiveness.

- Growth in pharmaceutical and medical packaging will support high-barrier and specialty film demand.

- Automation and advanced sealing technologies will enhance production efficiency and reduce waste.

- Consumer preference for convenient, ready-to-eat, and hygienic packaging will boost market growth.

- Companies will increasingly invest in R&D to develop innovative and eco-friendly sealant films.

- Expansion of packaging infrastructure in emerging European countries will drive regional adoption.

- Strategic partnerships, mergers, and acquisitions will strengthen market presence and distribution networks.