Market Overview:

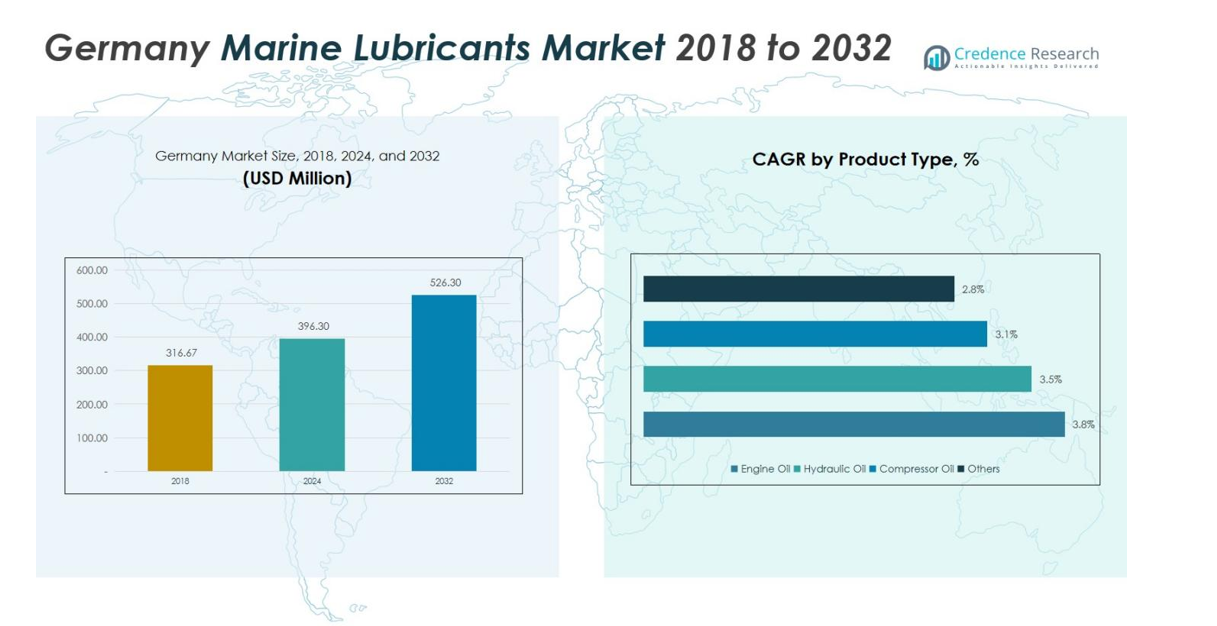

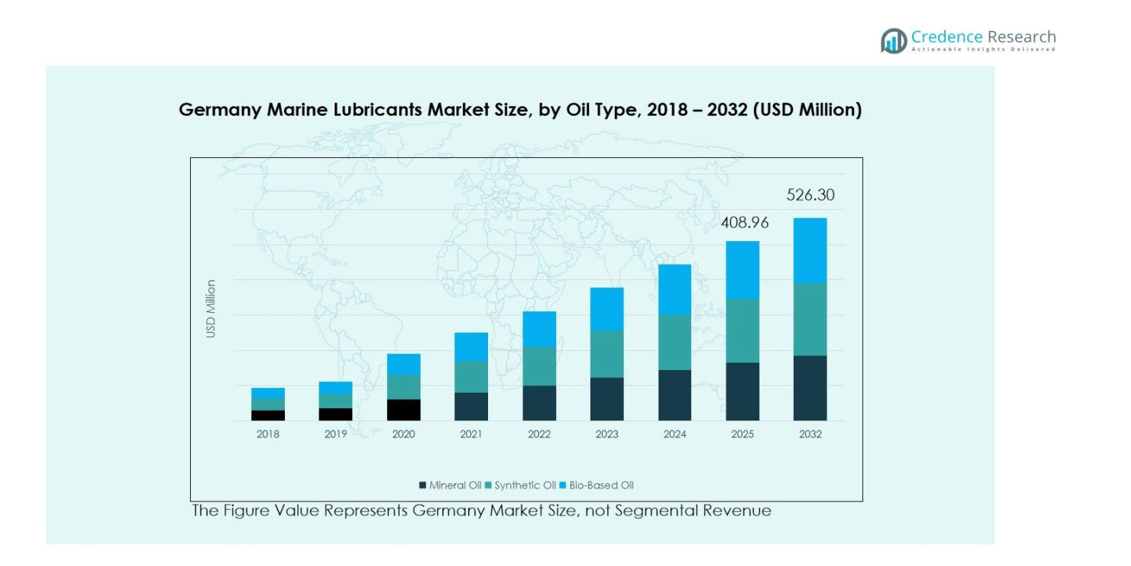

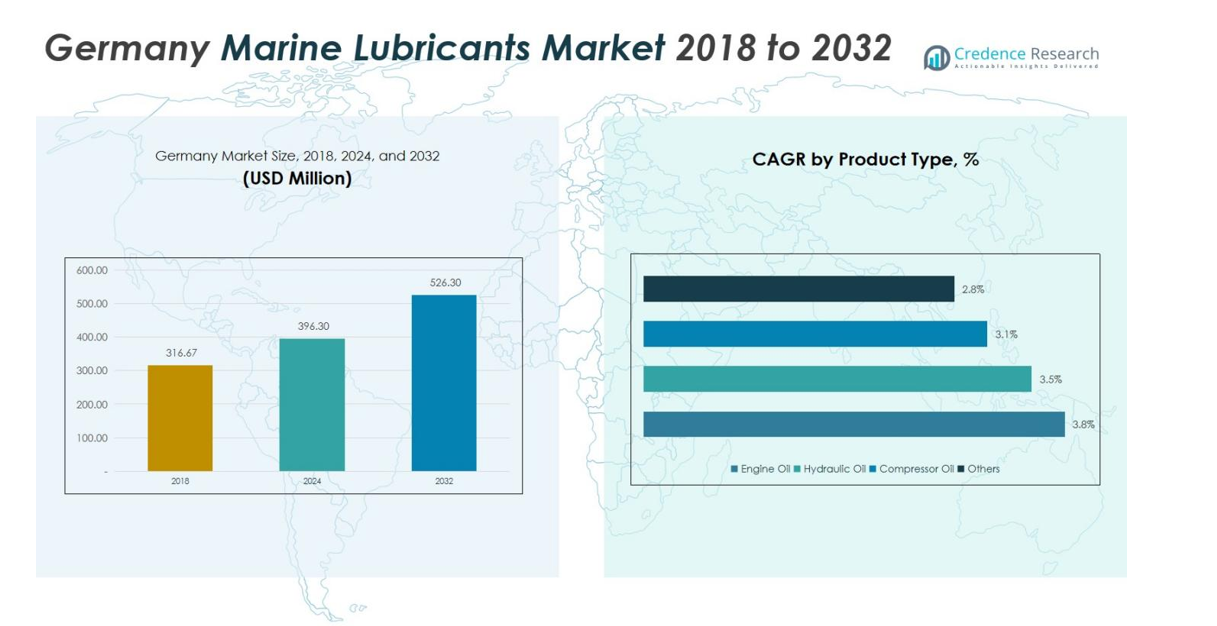

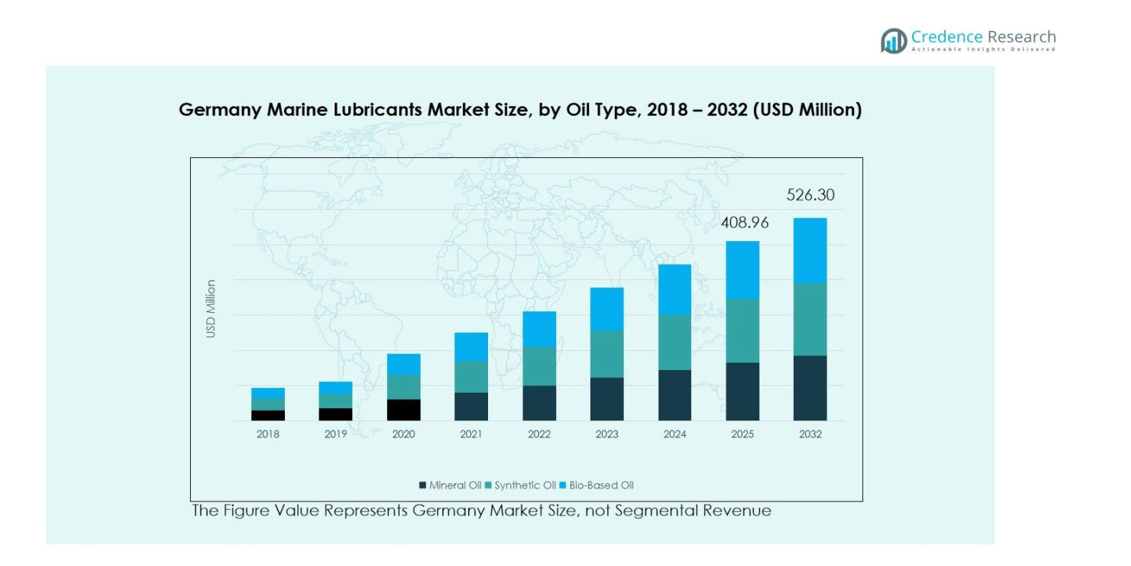

Germany Marine Lubricants Market size was valued at USD 316.67 million in 2018, growing to USD 396.30 million in 2024, and is anticipated to reach USD 526.30 million by 2032, at a CAGR of 3.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Marine Lubricants Market Size 2024 |

USD 396.30 million |

| Germany Marine Lubricants Market, CAGR |

3.55% |

| Germany Marine Lubricants Market Size 2032 |

USD 526.30 million |

The Germany Marine Lubricants Market is led by prominent players such as BP p.l.c., ExxonMobil Marine Limited, Chevron Corporation, Shell Plc, TotalEnergies, Fuchs Lubricants, Klüber Lubrication, and Goldenstone Oils. These companies maintain strong market positions through advanced product portfolios, robust distribution networks, and strategic partnerships with major shipping operators. Continuous innovation in synthetic and bio-based lubricants supports their competitiveness amid tightening environmental regulations. Among all regions, Northern Germany emerges as the leading market, accounting for 42% of total revenue, driven by its major maritime hubs—Hamburg, Kiel, and Bremen—and extensive port infrastructure that supports large-scale vessel operations and maintenance activities.

Market Insights

- The Germany Marine Lubricants Market was valued at USD 396.30 million in 2024 and is projected to reach USD 526.30 million by 2032, growing at a CAGR of 3.55% during the forecast period.

- Market growth is driven by expanding maritime trade, fleet modernization, and rising demand for high-performance lubricants that improve engine efficiency and reduce maintenance costs.

- The market is witnessing a strong shift toward synthetic and bio-based lubricants, supported by sustainability goals and stricter IMO emission regulations across the European shipping industry.

- Leading players such as BP p.l.c., Shell Plc, ExxonMobil Marine Limited, and TotalEnergies dominate the competitive landscape, focusing on innovation, partnerships, and expansion of eco-friendly product lines.

- Northern Germany leads the regional market with 42% share, driven by major ports like Hamburg and Bremen, while the engine oil segment holds 50% share as the most consumed product in vessel operations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Oil Type

In the Germany Marine Lubricants Market, mineral oil dominates the oil type segment with a market share of 58%. Its leadership stems from extensive usage in conventional marine engines owing to cost efficiency, easy availability, and compatibility with legacy systems. Synthetic oils account for 28% of the market, gaining traction due to superior thermal stability, extended oil life, and improved performance under extreme operating conditions. Bio-based oils hold the remaining 14% share, supported by the growing adoption of environmentally acceptable lubricants (EALs) driven by stringent sustainability and emission regulations.

- For instance, major players like Royal Dutch Shell and Castrol are innovating synthetic marine lubricants to meet the rising demand for performance and environmental regulations.

By Product Type

The engine oil segment leads the Germany Marine Lubricants Market with a market share of 50%, reflecting its critical role in propulsion and auxiliary engine systems. This dominance is attributed to high consumption rates, frequent oil replacement intervals, and widespread use across vessel types. Hydraulic oils represent about 22% of the market, used in steering and deck machinery systems, while compressor oils capture 15%, supporting air and gas compression operations. The others category holds around 13%, covering gear oils and specialty lubricants essential for onboard mechanical components.

- For instance, Shell’s Gadinia S3 30 engine oil is optimized for marine diesel engines burning distillate, hybrid, and biofuels, offering excellent wear protection and consumption control, widely approved by leading engine manufacturers.

By Application

Within the application landscape, bulk carriers hold the largest market share of 37% in the Germany Marine Lubricants Market, driven by intensive lubricant consumption for large main engines and auxiliary systems under continuous operation. Container ships follow with 32% share, supported by Germany’s strong container trade activities and port infrastructure. Oil tankers account for about 20%, reflecting demand from energy transport operations, while others, including offshore vessels, ferries, and support ships, contribute the remaining 11%, benefitting from modernization programs and stricter environmental compliance measures.

Key Growth Drivers

Rising Maritime Trade and Fleet Expansion

Germany’s strong maritime logistics sector and increasing seaborne trade volumes are major growth drivers for the marine lubricants market. The expansion of commercial fleets, particularly bulk carriers and container ships, has increased the demand for high-performance lubricants to support continuous operations and engine reliability. Additionally, modernization of shipping fleets and investments in port infrastructure are stimulating lubricant consumption, as operators seek to maintain efficiency, reduce wear, and comply with evolving maintenance standards in one of Europe’s most active maritime economies.

- For instance, Wilhelmsen Ships Service partners exclusively with Klüber Lubrication to distribute speciality marine lubricants in Germany, offering solutions that extend engine life and reduce downtime for growing fleets.

Growing Shift Toward High-Performance Synthetic Lubricants

The growing preference for synthetic marine lubricants is significantly influencing market growth in Germany. These advanced lubricants offer superior viscosity control, oxidation resistance, and longer service intervals, which help reduce maintenance costs and downtime. As German shipowners focus on operational efficiency and performance optimization, the adoption of synthetic lubricants continues to rise. Their ability to perform under extreme temperature and pressure conditions also makes them essential for modern engines, supporting both fuel efficiency and long-term sustainability goals.

- For instance, Klüber Lubrication, a leading German company, has developed biodegradable high-performance lubricants like Klüber BM 32-142, designed for longevity and environmental compliance in maritime applications.

Stringent Environmental Regulations and Sustainability Goals

Germany’s alignment with IMO and EU environmental regulations is accelerating the adoption of eco-friendly and biodegradable lubricants. The increasing enforcement of sulfur emission limits and waste discharge controls has driven demand for bio-based marine lubricants. Ship operators are investing in environmentally acceptable lubricants (EALs) to minimize ecological impact and maintain compliance with regulatory requirements in European waters. This regulatory push, combined with growing awareness of green shipping practices, is creating sustained demand for next-generation marine lubricant solutions in the German market.

Key Trends & Opportunities

Digitalization and Predictive Maintenance Adoption

A major trend shaping the Germany Marine Lubricants Market is the growing integration of digital monitoring and predictive maintenance technologies. Smart sensors and data analytics tools enable real-time tracking of lubricant performance and equipment condition, helping ship operators optimize oil change intervals and reduce downtime. Companies are partnering with digital solution providers to develop condition-based lubrication systems, improving efficiency and cost control. This trend offers new opportunities for lubricant manufacturers to provide data-driven services alongside product offerings.

- For instance, TotalEnergies Lubmarine launched a digital lubrication management platform called LubInsight, which offers vessel operators data-driven insights on lubricant condition and engine performance to optimize operations and reduce costs.

Rising Demand for Environmentally Acceptable Lubricants (EALs)

The increasing focus on sustainable shipping and eco-compliance presents a major opportunity for bio-based lubricant manufacturers. As environmental standards tighten, German ship operators are rapidly shifting toward lubricants that reduce carbon footprint and marine pollution. This shift is driving innovation in biodegradable and low-toxicity lubricant formulations. Manufacturers investing in R&D for EALs and green additives are well-positioned to capture long-term demand, especially in emission control areas (ECAs) where environmental performance directly influences operational approvals.

- For instance, Klüber Lubrication, a pioneer in the field, has developed ester-based EALs like the Klüberbio RM 2 and EG 2 series that are biodegradable, non-toxic, and have received approvals from leading propeller equipment manufacturers, demonstrating high performance in marine applications.

Key Challenges

High Cost of Synthetic and Bio-Based Lubricants

One of the major challenges in the German marine lubricants market is the high cost associated with synthetic and bio-based products. These advanced formulations, though offering better performance and environmental compliance, require complex production processes and specialized raw materials. This cost premium limits their adoption among smaller fleet operators and cost-sensitive segments. The price disparity compared to mineral oils continues to constrain large-scale transition, necessitating industry efforts toward cost optimization and improved value propositions for eco-friendly lubricants.

Fluctuating Crude Oil Prices and Supply Chain Instability

Volatility in crude oil prices and global supply chain disruptions pose a persistent challenge for marine lubricant manufacturers in Germany. Raw material dependency on petroleum derivatives exposes the market to price fluctuations, affecting profit margins and production planning. Additionally, geopolitical tensions and shipping delays have created uncertainty in lubricant availability and logistics. Manufacturers are increasingly focusing on diversifying supply sources, improving local production capabilities, and enhancing inventory management to mitigate risks linked to global supply variability.

Regional Analysis

Northern Germany

Northern Germany holds the largest share of the marine lubricants market, accounting for 42% of total revenue. The dominance is supported by major maritime hubs such as Hamburg, Kiel, and Bremen, which serve as key centers for ship operations, maintenance, and trade logistics. The concentration of shipyards, vessel repair facilities, and lubricant distributors enhances regional demand. Increasing container traffic through the Port of Hamburg and growing investment in sustainable port infrastructure further strengthen lubricant consumption, particularly for engine and hydraulic oils used in large commercial and cargo vessels.

Western Germany

Western Germany captures 27% market share in the marine lubricants sector, driven by its proximity to inland waterways and industrial shipping routes connecting the Rhine River and the North Sea. The region benefits from strong trade activity in ports like Emden and Duisburg, which support both cargo and tanker operations. Demand is fueled by the presence of heavy industries and chemical transport vessels requiring reliable lubrication solutions. Moreover, the region’s adoption of cleaner and more efficient marine lubricants aligns with Germany’s national sustainability targets and the EU’s maritime emission control policies.

Eastern Germany

Eastern Germany represents 16% of the marine lubricants market, with growing importance due to modernization of smaller ports and ship maintenance facilities along the Baltic Sea. The region is witnessing gradual fleet expansion and increased utilization of lubricant products for fishing, ferry, and offshore support vessels. Investments in port infrastructure in Rostock and Stralsund are contributing to higher lubricant demand. Furthermore, the push for bio-based and synthetic lubricants is rising as regional operators transition toward cleaner marine operations in compliance with international environmental regulations.

Southern Germany

Southern Germany accounts for 15% market share in the marine lubricants market, supported by inland waterway transportation along the Danube River. The region’s lubricant demand is primarily driven by commercial barges, logistics vessels, and ferry operations linking Central and Eastern Europe. Growing integration of energy-efficient engines and hybrid propulsion systems is promoting the use of high-quality lubricants with superior performance characteristics. Additionally, rising trade activities through intermodal transport networks and regional maintenance hubs continue to sustain lubricant consumption across industrial shipping and passenger transport sectors.

Market Segmentations:

By Oil Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product Type

- Engine Oil

- Hydraulic Oil

- Compressor Oil

- Others

By Application:

- Bulk Carriers

- Container Ships

- Oil Tankers

- Others

By Region

- Northern Germany

- Western Germany

- Southern Germany

- Eastern Germany

Competitive Landscape

The competitive landscape of the Germany Marine Lubricants Market is characterized by the strong presence of leading players such as BP p.l.c., ExxonMobil Marine Limited, Chevron Corporation, Shell Plc, TotalEnergies, Fuchs Lubricants, Klüber Lubrication, and Goldenstone Oils. These companies compete through a combination of technological innovation, extensive distribution networks, and a focus on sustainability-driven product portfolios. The market is moderately consolidated, with global brands dominating through long-term supply agreements and technical service partnerships with major shipping operators. Companies are investing in research and development to produce advanced synthetic and bio-based lubricants that comply with IMO environmental regulations and enhance fuel efficiency. Local players, including Fuchs Lubricants and Victor International GmbH, are strengthening their market position by offering cost-effective and customized solutions for regional fleets. Strategic collaborations, digital monitoring tools, and port-based service expansions are further shaping competition across Germany’s evolving maritime lubrication landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, FUCHS Lubricants Germany GmbH, in collaboration with LENOL DMCC, launched a new marine lubricant line designed to meet IMO Tier III standards and enhance vessel performance under demanding marine conditions.

- In September 2024, Chevron Corporation entered into an exclusive distribution agreement with Finke Mineralölwerk GmbH in Germany to distribute Texaco-branded lubricants, strengthening its presence in the country’s marine lubricants market.

- In October 2025, Klüber Lubrication and OKS Spezialschmierstoffe (both Germany-based) announced a merger under Freudenberg Chemical Specialities, combining their strengths in specialty lubricants this likely broadens Klüber’s marine and industrial lubricant offerings.

Report Coverage

The research report offers an in-depth analysis based on Oil Type, Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Germany Marine Lubricants Market is projected to experience steady growth driven by expanding maritime trade and fleet modernization.

- Increasing adoption of synthetic and bio-based lubricants will enhance performance efficiency and environmental compliance.

- Stricter emission regulations will continue to influence the transition toward environmentally acceptable lubricants.

- Growth in port infrastructure and ship maintenance activities will boost lubricant demand across coastal regions.

- Digitalization and predictive maintenance technologies will improve lubricant monitoring and consumption efficiency.

- Collaboration between lubricant manufacturers and shipping operators will strengthen customized service offerings.

- Rising investment in research and development will lead to advanced formulations with longer service life.

- The shift toward hybrid and energy-efficient vessels will create new opportunities for specialized lubricants.

- Local producers will expand their presence through sustainable and cost-effective product innovations.

- Germany’s commitment to green shipping initiatives will shape a competitive and environmentally focused lubricant market.