Market Overview:

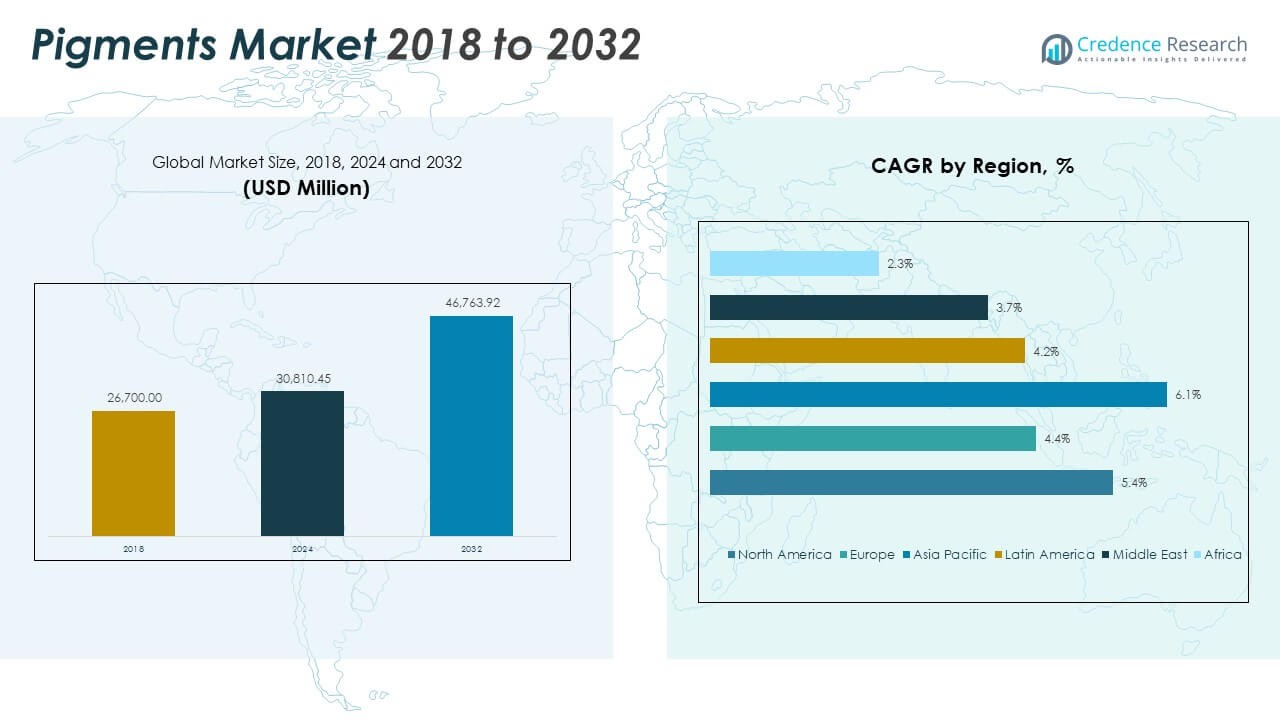

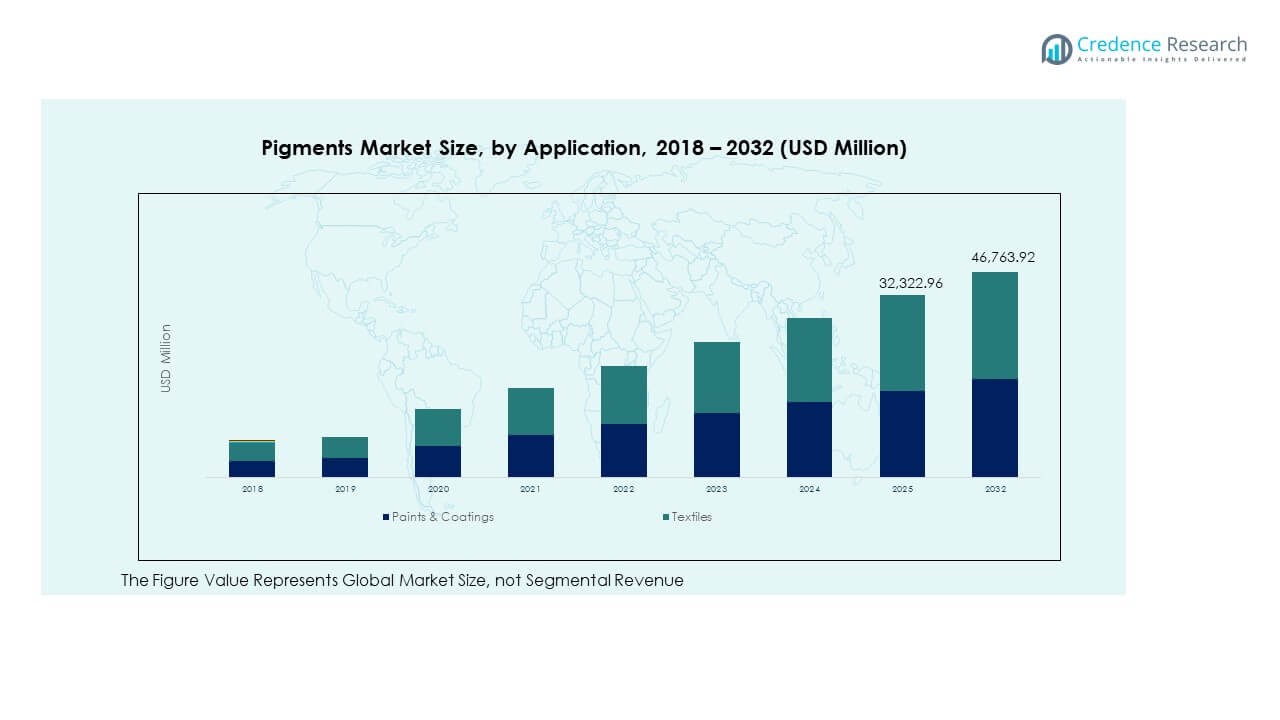

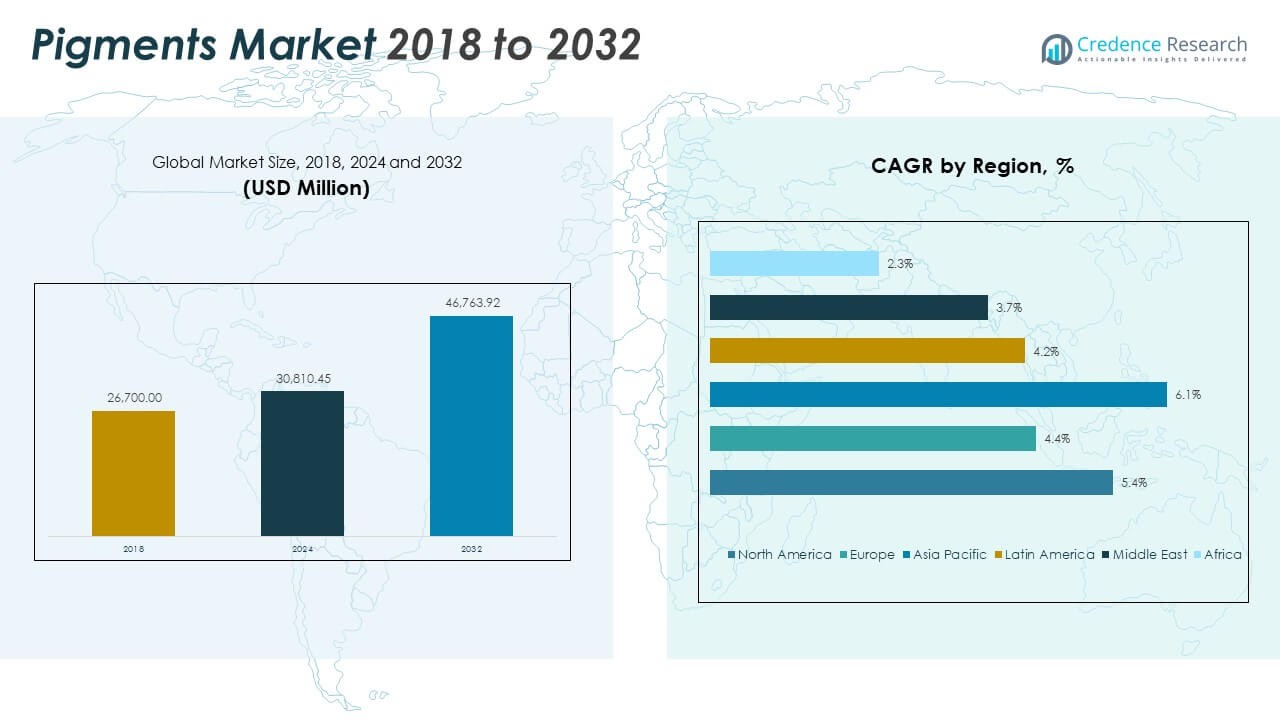

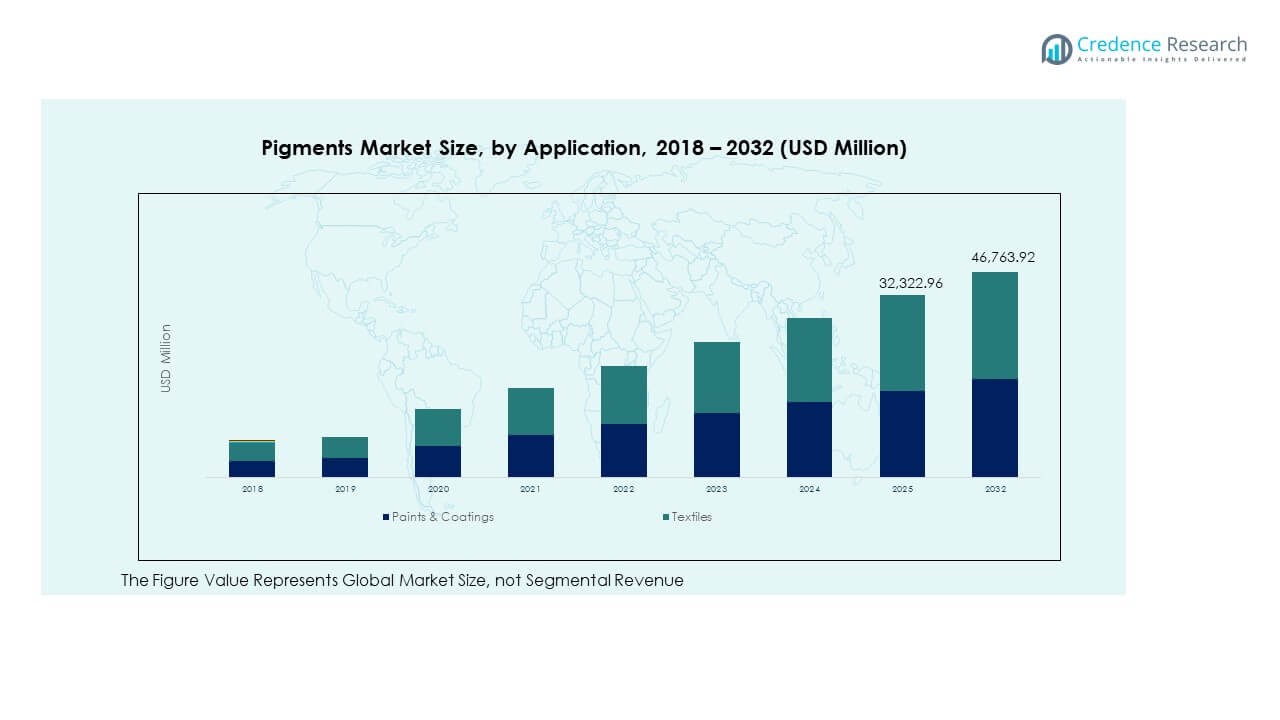

The Global Pigments Market size was valued at USD 26,700.00 million in 2018 to USD 30,810.45 million in 2024 and is anticipated to reach USD 46,763.92 million by 2032, at a CAGR of 5.42% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pigments Market Size 2024 |

USD 30,810.45 Million |

| Pigments Market, CAGR |

5.42% |

| Pigments Market Size 2032 |

USD 46,763.92 Million |

Market growth is driven by rising demand for high-performance pigments in paints, coatings, plastics, and printing applications. Industries favor pigments for their superior durability, color consistency, and heat resistance. Expanding construction, automotive, and packaging sectors further strengthen market adoption. The shift toward sustainable and bio-based pigment solutions also encourages innovation, with producers investing in eco-friendly formulations to meet regulatory and environmental standards.

Asia Pacific leads the Global Pigments Market due to strong manufacturing capacity and growing infrastructure projects in China and India. North America and Europe follow, supported by technological advancement and sustainability-focused production. Latin America and the Middle East show rising potential with rapid industrialization and demand for cost-efficient pigment solutions, while Africa is emerging as a developing region with increased construction and consumer goods activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Pigments Market was valued at USD 26,700.00 million in 2018, reaching USD 30,810.45 million in 2024, and is expected to attain USD 46,763.92 million by 2032, growing at a CAGR of 5.42%.

- North America leads with a 28% share, supported by high demand in paints, coatings, and advanced pigment technologies. Europe follows with 24%, driven by sustainability policies and the adoption of organic pigments.

- Asia Pacific holds the largest 33% share and remains the fastest-growing region due to industrialization, infrastructure expansion, and strong pigment production in China and India.

- Paints & Coatings account for nearly 60% of the total pigment consumption, reflecting high demand from construction and automotive sectors.

- Textiles represent around 25% of the market, with growth driven by color innovation, fashion trends, and eco-friendly fabric processing technologies.

Market Drivers

Rising Demand for High-Performance Pigments in Industrial and Automotive Coatings

The Global Pigments Market is expanding due to strong adoption in automotive and industrial coatings. Manufacturers rely on pigments to enhance durability, gloss retention, and color intensity of surfaces. The demand for UV and heat-resistant coatings drives innovation in pigment formulations. Increasing construction projects and infrastructure investments create consistent consumption of architectural coatings. The push toward corrosion-resistant finishes further accelerates pigment use. Sustainability standards motivate companies to replace heavy metal-based pigments with eco-safe alternatives. The automotive sector benefits from pigments that enable improved aesthetics and performance longevity. It continues to support steady market growth through color customization and protective coating demand.

- For instance, BASF’s Lumina® Royal Blue 6803 H pigment is referenced in BASF’s press releases and product literature as an effect pigment with particle sizes from 6 to 48 μm, offering intense reddish-blue shades. It is applied in automotive coatings for improved color saturation, weather fastness, and overcoating resistance, as confirmed by BASF’s technical staff in direct interviews.

Expanding Applications in Packaging, Plastics, and Consumer Goods

Pigment use in plastics and packaging materials grows with the rise of branded consumer products. Companies use pigments to improve product visibility and achieve desired color consistency in flexible packaging. Rising demand for recyclable plastics promotes research in bio-based and non-toxic pigments. Packaging producers adopt pigments to enhance UV protection and maintain product integrity during storage. The Global Pigments Market benefits from the expansion of FMCG and personal care sectors. Pigments play a critical role in brand differentiation through color stability and visual appeal. It supports marketing and consumer engagement through high-quality aesthetics. The trend of lightweight packaging and rapid e-commerce expansion ensures steady pigment consumption.

Innovation in Eco-Friendly and Organic Pigments

Sustainability drives the transition from synthetic to eco-friendly pigments across industries. Producers focus on low-VOC formulations and renewable pigment sources to meet regulatory standards. The Global Pigments Market benefits from increasing adoption of organic pigments in coatings and textiles. These materials offer superior dispersion, lightfastness, and chemical stability without environmental risks. Manufacturers invest in waste minimization and green chemistry processes for pigment synthesis. It promotes compliance with REACH and EPA regulations across major regions. The textile and printing industries prioritize biodegradable pigment solutions for reduced ecological impact. Growing consumer preference for sustainable colored products further strengthens eco-pigment development.

- For instance, Sun Chemical, a member of the DIC Group, achieved ECO PASSPORT by OEKO-TEX® certification in January 2024 for a select range of pigments, as noted in its official press release. These pigments meet ZDHC Level 3 standards the highest accreditation for ecological integrity in the textile and apparel value chain.

Technological Advancements in Production and Dispersion Techniques

Technological innovation enhances pigment production efficiency and quality consistency. Advanced dispersion technologies allow uniform pigment distribution, improving color performance. The Global Pigments Market benefits from the use of nanotechnology to improve opacity and weather resistance. Producers adopt continuous and automated manufacturing to maintain purity and reduce waste. These improvements increase productivity and reduce operating costs across pigment facilities. It supports the creation of high-value specialty pigments with unique optical properties. Advancements in surface modification extend pigment usability across varied substrates. Continuous R&D ensures manufacturers can meet industry-specific color and performance demands effectively.

Market Trends

Growing Popularity of Functional and Smart Pigments

The Global Pigments Market experiences a rise in smart pigment applications for functional coatings. Thermochromic and photochromic pigments gain attention in packaging, textiles, and automotive designs. These pigments react to heat, light, or pH changes, creating interactive and decorative effects. Demand for functional pigments aligns with innovation in smart labeling and anti-counterfeiting solutions. Industries prefer these pigments for their ability to enhance product security and consumer engagement. It supports sustainability goals by offering multi-functional benefits with reduced resource usage. The trend influences high-tech product design and future color customization. Growing industrial adoption highlights smart pigments as a premium market segment.

- For instance, at the European Coatings Show 2023, Merck KGaA introduced its Colorstream® F20-52 SW Mineral Red pigment for automotive coatings. This effect pigment delivers intense bluish-red tones and maintains color from multiple viewing angles, with industry adoption by automotive manufacturers seeking luxury design differentiation and enhanced product aesthetics.

Shift Toward Digital Printing and Advanced Color Technologies

The printing industry’s transition to digital formats boosts pigment innovation. High-dispersion pigments compatible with inkjet and laser technologies gain demand. The Global Pigments Market evolves with nano-dispersion pigments offering stable color delivery on multiple substrates. Advanced pigments enable sharper image reproduction, higher print speed, and consistent color quality. Printing ink producers focus on low-migration and food-safe pigments for packaging use. It supports cost efficiency through improved pigment yield and reduced maintenance cycles. The shift enhances supply chain flexibility for small-volume, custom printing orders. Manufacturers leverage automation and digital workflows to achieve consistent pigment performance globally.

Increased Focus on Sustainable Manufacturing and Waste Recovery

Sustainable pigment production becomes a key market trend amid strict environmental policies. Companies invest in closed-loop systems to recycle wastewater and chemical residues. The Global Pigments Market benefits from renewable raw materials replacing heavy metal derivatives. Major producers implement energy-efficient processes and carbon-neutral production lines. These initiatives lower environmental impact and improve regulatory compliance. It strengthens market positioning among eco-conscious consumers and industries. Sustainability certifications become an important differentiator in pigment supply chains. The trend promotes partnerships for technology transfer and circular economy practices.

- For instance, Clariant received OK compost INDUSTRIAL certification by TÜV AUSTRIA for its PV Fast® and Graphtol™ pigment ranges, officially permitted for compostable plastics under the EU EN 13432:2000 standard. This certification documents Clariant’s pigment formulations’ full suitability for composting, aligning with the circular economy and eco-conscious regulatory goals.

Rising Demand from Construction and Infrastructure Sectors

Global construction activities drive pigment use in paints, coatings, and concrete applications. The Global Pigments Market grows as infrastructure projects adopt long-lasting, weather-stable color solutions. Pigments improve the visual and protective performance of building materials. Increasing use of colored concrete and energy-efficient facades enhances pigment adoption. Urbanization in emerging economies supports demand for decorative and industrial paints. It leads to greater pigment penetration across residential and commercial projects. The emphasis on durable and heat-reflective pigments increases with green building initiatives. Consistent development in real estate and public works continues to sustain pigment consumption worldwide.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuating prices of raw materials such as titanium dioxide and petrochemical derivatives affect production costs. The Global Pigments Market faces uncertainty due to supply chain instability and logistics constraints. Disruptions in mining and transportation hinder consistent pigment manufacturing. Dependence on limited suppliers increases risk exposure for pigment producers. It pressures manufacturers to diversify sourcing and maintain large inventories. Rising energy and fuel costs further inflate operating expenses. Supply delays impact timely delivery to downstream industries, affecting profitability. Strategic procurement, local sourcing, and contract management become essential to stabilize production.

Stringent Environmental Regulations and Complex Waste Management Requirements

Tight environmental laws restrict the use of hazardous chemicals in pigment production. The Global Pigments Market must adapt to global standards set by agencies like EPA and REACH. Compliance increases manufacturing costs due to additional filtration, testing, and waste treatment. It also limits production flexibility for inorganic pigments containing heavy metals. Disposal of pigment sludge and effluents presents environmental and operational challenges. Manufacturers face penalties for non-compliance, pushing them to adopt clean technologies. High capital investment for green transition creates barriers for smaller producers. Continuous monitoring and certification remain critical for maintaining international trade access.

Market Opportunities

Growing Investment in Bio-Based and Recyclable Pigment Production

The shift toward bio-based pigments creates opportunities for sustainable innovation. The Global Pigments Market benefits from rising investment in algae-derived and plant-based colorants. These materials provide safer alternatives for packaging, food, and textile sectors. It allows producers to meet consumer preference for eco-conscious products. Government initiatives promoting green chemistry drive technology adoption. Research partnerships focus on enhancing performance and scalability of natural pigments. The push for biodegradable formulations opens new industrial applications. Long-term growth potential lies in cost reduction and high-volume production capabilities.

Expansion of Emerging Markets and New Application Segments

Emerging economies in Asia-Pacific, Latin America, and Africa offer new growth frontiers. The Global Pigments Market expands with rising construction, automotive, and consumer goods demand. Localized production reduces cost barriers and improves accessibility for regional manufacturers. It enables broader pigment adoption across plastic, ink, and coating industries. Strategic investments in R&D and infrastructure accelerate pigment innovation. Collaborations with local distributors strengthen market penetration and brand recognition. The potential for pigment integration into 3D printing and nanocoatings enhances application diversity. Continuous market expansion supports future value creation across industries.

Market Segmentation Analysis:

The Global Pigments Market is segmented

By product type into inorganic pigments, organic pigments, and specialty or functional pigments. Inorganic pigments dominate due to their strong opacity, heat resistance, and durability, making them ideal for paints, coatings, and construction materials. Titanium Dioxide (TiO₂) remains the most widely used pigment for its high refractive index and brightness, followed by zinc oxide for UV protection and antimicrobial benefits. Organic pigments are gaining traction due to environmental compliance, offering superior color vibrancy for packaging, textiles, and printing. Specialty and functional pigments such as pearlescent, metallic, and luminescent types are expanding across automotive and electronics applications to enhance visual and functional appeal.

- For instance, Sun Chemical launched two new effect pigments Paliocrom® Premium Orange L 2900 and Lumina HD Exterior Sienna S3903V at the European Coatings Show in March 2025, with the Lumina HD line offering enhanced chroma and distinctness of image for high-definition mica effects in motorcycle and automotive coatings.

By application, pigments find significant use in paints and coatings, which account for the largest share due to global infrastructure and housing projects. Textiles and plastics industries follow, driven by aesthetic and performance requirements in consumer and industrial products. Printing inks continue to use high-quality pigments for sharper color definition and sustainability compliance. It finds further use in leather finishing, packaging, and specialized manufacturing sectors that demand long-lasting and high-performance color solutions. Expanding product innovation and shifting preferences toward eco-friendly pigments continue to strengthen overall market growth.

- For instance, the Azo pigment segment leads the organic pigments category with a 39.6% share in 2025. Its dominance comes from extensive use in printing inks, offering strong opacity, vivid color strength, and consistent performance for commercial printing and packaging.

Segmentation:

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Pigments Market size was valued at USD 6,888.60 million in 2018 to USD 7,813.35 million in 2024 and is anticipated to reach USD 11,836.03 million by 2032, at a CAGR of 5.39% during the forecast period. North America holds a 28% market share, driven by strong demand in paints, coatings, and plastic manufacturing sectors. The U.S. dominates the regional landscape due to its robust industrial base and innovation in high-performance pigments. Canada and Mexico contribute through expanding automotive and construction industries. It benefits from the presence of major producers focused on advanced pigment formulations and sustainable production. The region’s focus on environmentally compliant materials and nanotechnology-based pigments strengthens market positioning. Continuous investment in R&D and high consumer awareness sustain pigment adoption across multiple industries.

Europe

The Europe Global Pigments Market size was valued at USD 5,126.40 million in 2018 to USD 5,600.50 million in 2024 and is anticipated to reach USD 7,844.77 million by 2032, at a CAGR of 4.33% during the forecast period. Europe represents a 24% share of the market, led by Germany, France, and the UK. The region benefits from stringent environmental policies that encourage the use of organic and bio-based pigments. Demand growth is supported by the expansion of the automotive coatings and packaging industries. It remains a hub for premium-quality pigment production, with companies emphasizing sustainability and advanced color solutions. The shift toward recyclable and low-VOC materials enhances product development. Continuous innovation in high-durability pigments supports the region’s leadership in specialized coatings. The focus on sustainable manufacturing and compliance with REACH regulations further drives long-term market growth.

Asia Pacific

The Asia Pacific Global Pigments Market is projected to lead in value and volume, supported by strong industrialization and infrastructure development. China, India, and Japan represent the key production and consumption centers. It benefits from a vast manufacturing base and growing adoption in construction, textiles, and packaging sectors. The presence of cost-efficient producers enhances global supply competitiveness. Demand for decorative and automotive coatings accelerates pigment consumption in urbanizing economies. Rising investment in eco-friendly pigment plants strengthens regional exports. Continuous capacity expansion and raw material availability provide Asia Pacific with a strategic cost advantage. The region’s technological advancement in dispersion and coloring efficiency continues to shape the market’s global dominance.

Latin America

The Latin America Global Pigments Market grows steadily due to industrial development in Brazil, Argentina, and Mexico. The region experiences rising demand for pigments across automotive coatings, construction, and plastic industries. It benefits from increased infrastructure spending and local pigment manufacturing initiatives. Market players focus on distribution partnerships to enhance product accessibility. The adoption of energy-efficient production systems strengthens pigment competitiveness. Expanding export activities and trade reforms encourage international collaborations. Demand for environmentally friendly pigments grows due to evolving regional regulations. The region continues to emerge as a key supplier in low-cost pigment production with improving quality standards.

Middle East

The Middle East Global Pigments Market shows consistent growth supported by construction, coatings, and packaging industries. GCC countries lead in pigment consumption due to large-scale urban projects and rising decorative paint demand. It gains traction from government-backed industrial diversification programs and foreign investments. The expansion of polymer and plastic production facilities creates new pigment opportunities. Regional manufacturers adopt sustainable technologies to reduce production waste. Strategic partnerships with European and Asian pigment suppliers enhance local output. The region’s climatic conditions drive demand for UV-stable and heat-resistant pigments. Continuous development in building infrastructure and industrial materials sustains pigment market growth.

Africa

The Africa Global Pigments Market is developing, driven by rising urbanization and industrialization across South Africa, Egypt, and Nigeria. Infrastructure projects and housing developments boost demand for architectural coatings and decorative pigments. It benefits from the growth of regional plastic, textile, and construction sectors. Governments promote local manufacturing to reduce dependency on imports. The market shows increasing interest in eco-friendly and cost-effective pigment alternatives. Technological collaborations with international pigment producers enhance product availability and quality. Expanding middle-class consumption supports the adoption of colored consumer goods. The region’s improving trade networks and resource accessibility indicate long-term market potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- DIC Corporation

- Kronos Worldwide, Inc.

- Sudarshan Chemical Industries Limited

- Heubach GmbH

- The Chemours Company

- Tronox Holdings Plc

- ALTANA AG

- Lanxess AG

- LB Group

- Shepherd Color Company

- Trust Chem Co., Ltd.

- Venator Materials PLC

Competitive Analysis:

The Global Pigments Market features strong competition among multinational manufacturers and regional suppliers. Major players such as DIC Corporation, Kronos Worldwide, The Chemours Company, and Lanxess AG lead through product innovation, capacity expansion, and global distribution networks. Companies invest heavily in R&D to develop sustainable and high-performance pigment formulations that meet regulatory and environmental standards. It focuses on mergers, acquisitions, and strategic alliances to strengthen supply chains and broaden product portfolios. Emerging participants from Asia-Pacific intensify competition through low-cost production and localized pigment manufacturing. Market leaders emphasize digital color technology and customized solutions to retain industrial clients. Technological differentiation and sustainability-driven innovation remain key to maintaining competitive advantage.

Recent Developments:

- In August 2025, DIC Corporation established a new sustainable production facility in Indonesia for coatings designed for direct food contact materials. This state-of-the-art facility, operated by subsidiary PT. DIC Graphics, demonstrates DIC’s commitment to sustainable manufacturing in the coatings and pigments domain. The investment supports growing demand for sustainable packaging solutions worldwide.

- In March 2025, Sudarshan Chemical Industries Limited finalized the acquisition of Germany-based Heubach Group through a combination of asset and share deals. This strategic move creates a global pigment leader, expanding Sudarshan’s portfolio and presence to 19 global sites, with enhanced technologies and market strength, especially in Europe and the Americas.

Report Coverage:

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing adoption of sustainable and bio-based pigments will shape long-term market innovation.

- Demand for high-performance pigments will rise due to expansion in automotive and construction sectors.

- Increasing digital printing and packaging applications will strengthen pigment consumption across industries.

- The shift toward nanotechnology and advanced dispersion systems will enhance pigment efficiency and quality.

- Expansion of pigment manufacturing in Asia Pacific will improve global supply stability and cost advantage.

- Technological upgrades in eco-friendly production will support compliance with strict environmental standards.

- Rising demand for functional pigments in electronics and smart coatings will create new market opportunities.

- Strategic mergers and capacity expansion by key producers will consolidate the competitive landscape.

- Growing consumer preference for visually enhanced and durable products will sustain pigment innovation.

- Expansion in infrastructure, textiles, and polymer applications will drive continuous growth across emerging economies.