Market Overview:

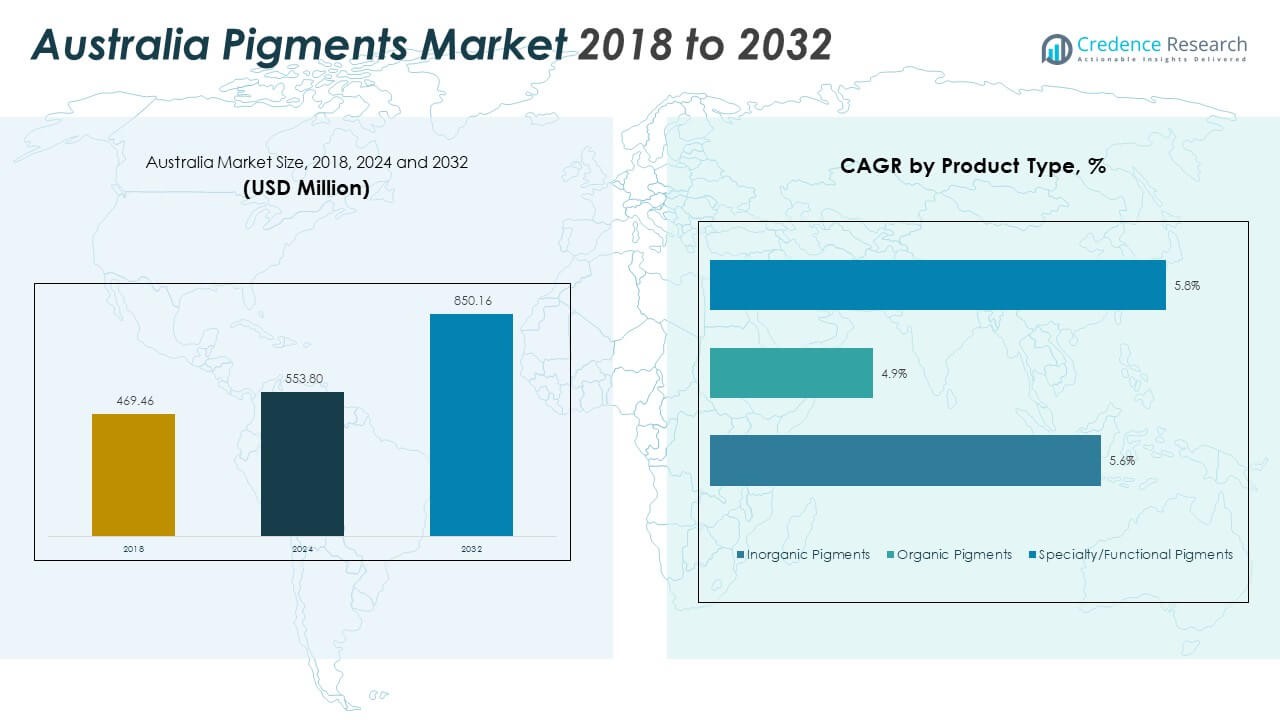

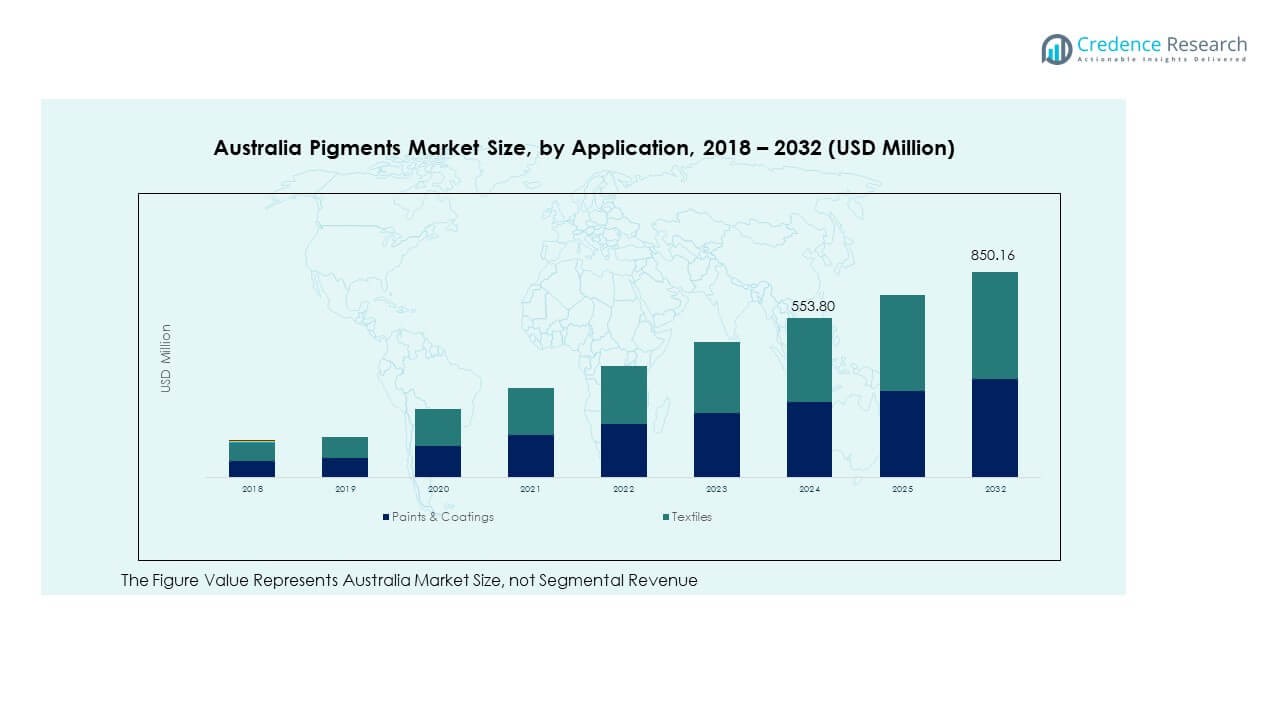

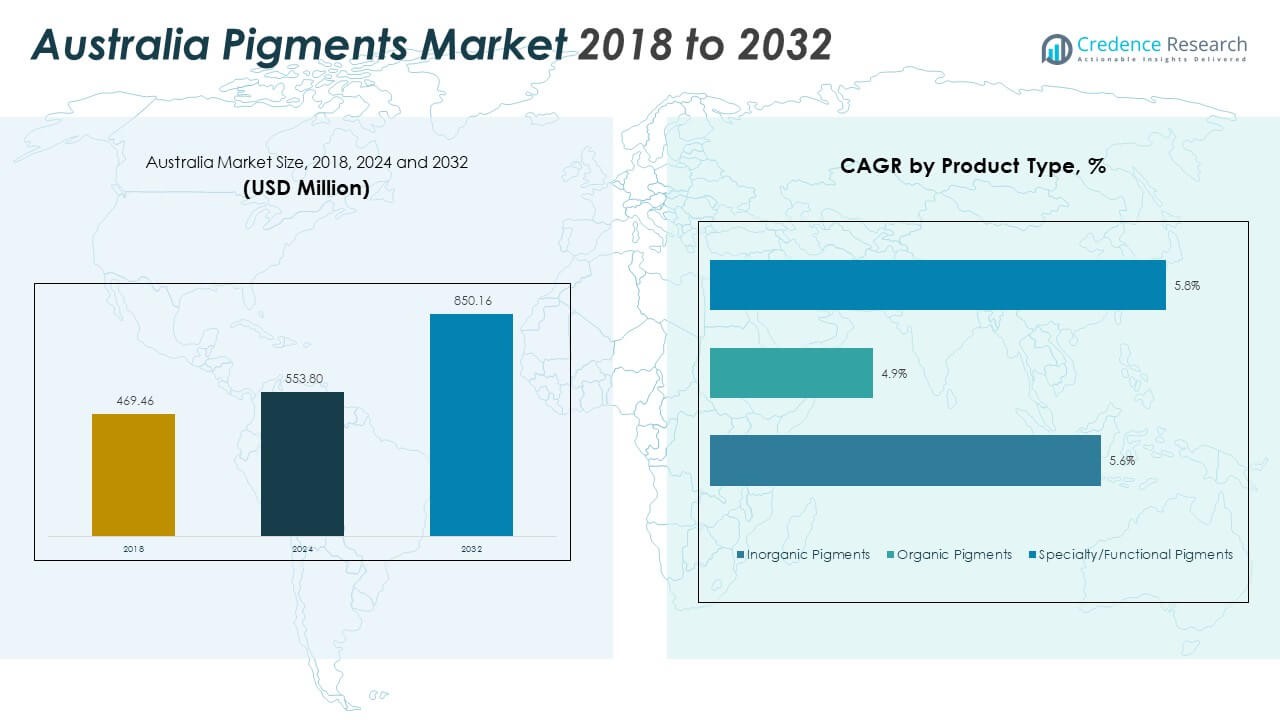

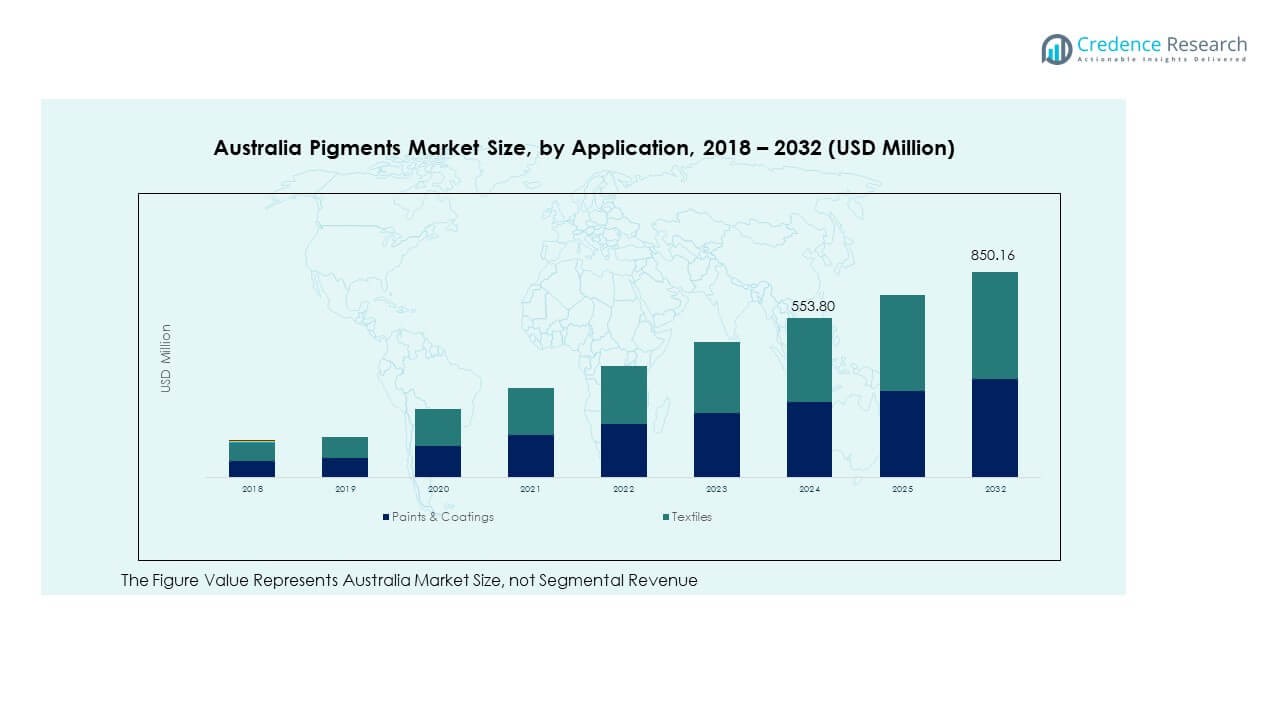

The Australia Pigments Market size was valued at USD 469.46 million in 2018 to USD 553.80 million in 2024 and is anticipated to reach USD 850.16 million by 2032, at a CAGR of 5.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Pigments Market Size 2024 |

USD 553.80 Million |

| Australia Pigments Market, CAGR |

5.50% |

| Australia Pigments Market Size 2032 |

USD 850.16 Million |

Market growth is driven by rising demand from construction, automotive, and packaging industries that use pigments for coatings, plastics, and decorative applications. Expanding infrastructure projects, combined with an increasing preference for eco-friendly and non-toxic pigments, continue to strengthen industry performance. Manufacturers are investing in sustainable formulations and advanced dispersion technologies to meet evolving environmental standards and improve color consistency across end-use sectors.

Regionally, New South Wales and Victoria lead the Australia Pigments Market, supported by a robust industrial base and strong presence of construction and manufacturing activities. Western Australia follows, driven by growth in the mining and marine coatings sectors. Queensland and South Australia are emerging markets with expanding applications in textiles, plastics, and consumer packaging. These regions benefit from rising industrialization, favorable trade conditions, and growing adoption of durable, weather-resistant pigment solutions suited for diverse climatic conditions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Pigments Market was valued at USD 469.46 million in 2018, reached USD 553.80 million in 2024, and is projected to attain USD 850.16 million by 2032, growing at a CAGR of 5.50%.

- Eastern Australia, including New South Wales and Victoria, leads with a 48% share due to its developed manufacturing base and strong construction activity.

- Western Australia holds 27% of the market share, supported by its growing mining and industrial sectors that demand corrosion-resistant pigment formulations.

- Northern and Southern regions collectively account for 25%, marking the fastest growth due to expanding applications in textiles, plastics, and packaging industries.

- Paints and coatings contribute nearly 60% of total pigment demand, while textiles account for around 40%, reflecting the increasing need for durable and vibrant color solutions across both sectors.

Market Drivers

Rising Demand from Construction and Automotive Coating Sectors

The expansion of Australia’s construction and automotive industries strongly drives pigment demand. Rapid infrastructure development and renovation projects boost the use of decorative and industrial coatings. Paints and surface finishes that rely on pigments for durability and color stability are in high demand. The automotive sector contributes significantly through advanced coatings that enhance appearance and corrosion resistance. The Australia Pigments Market benefits from growing domestic vehicle production and aftermarket services. Increased focus on aesthetic appeal in residential and commercial buildings sustains pigment consumption. Local producers invest in advanced dispersion technologies to meet industry requirements. The trend supports strong volume growth in the coming years.

- For instance, DuluxGroup operates an Innovation and Technology Centre in Clayton, Victoria, which serves as its primary hub for research and development of coating technologies. The facility supports innovation across protective, decorative, and industrial coatings used widely in Australia’s construction and manufacturing sectors.

Shift Toward Eco-Friendly and Low-Toxicity Pigments

Environmental regulations and consumer awareness are leading manufacturers to develop sustainable pigments. Government frameworks encouraging low-VOC and heavy-metal-free formulations increase adoption across applications. It has led companies to replace synthetic pigments with organic and biodegradable variants. Producers introduce water-based coatings and renewable pigment formulations to meet eco-standards. Growing awareness of product safety in packaging and textiles accelerates this transition. The Australia Pigments Market gains from regulatory compliance initiatives that support environmental protection. Firms invest in green chemistry to ensure minimal waste during production. These efforts improve market reputation and drive brand preference across industrial users.

Technological Advancements in High-Performance Pigment Manufacturing

New pigment technologies enhance color stability, dispersion quality, and UV resistance in industrial applications. Manufacturers focus on developing nanoscale and functional pigments that perform well under harsh conditions. High-performance pigments find use in automotive coatings, plastics, and aerospace components. The Australia Pigments Market benefits from technological collaborations improving material consistency and application properties. Companies employ automation and digital control systems to optimize production lines. It supports efficiency and reduces batch variation, ensuring uniform quality. Research into hybrid organic-inorganic pigment structures further broadens end-use potential. The ongoing innovation cycle supports long-term competitiveness in the domestic market.

- For instance, Clariant (now Heubach Group) introduced its Hostatint® AU aqueous pigment dispersions in 2021, designed for architectural coatings offering enhanced opacity, color strength, and durability. The pigment portfolio, originally developed under Clariant, is now managed by the Heubach Group following the 2022 acquisition.

Expanding Use in Packaging, Plastics, and Consumer Goods

Demand for colorful, durable, and recyclable packaging materials supports market expansion. The plastics sector adopts advanced pigment solutions for flexible packaging, containers, and films. Food-safe and migration-resistant pigments are increasingly popular among packaging manufacturers. The Australia Pigments Market benefits from lifestyle changes that boost demand for household and personal care packaging. Producers design heat- and light-resistant pigments to maintain color integrity in plastic products. It ensures longer product life and brand consistency in retail displays. The rise of e-commerce packaging and sustainable branding further supports pigment consumption. This diversification into consumer-focused sectors strengthens market resilience.

Market Trends

Market Trends

Adoption of Smart and Functional Pigments for Advanced Coatings

Smart pigments that respond to temperature, light, or chemical changes are gaining momentum. These pigments find applications in security labeling, automotive coatings, and architectural designs. The integration of functional pigments provides added value through self-cleaning and corrosion-resistant features. The Australia Pigments Market sees steady adoption of thermochromic and photochromic pigments in specialty coatings. Manufacturers invest in nanotechnology to improve functional performance. It enables coatings to adapt dynamically to environmental changes. This trend aligns with industries prioritizing efficiency and sustainability. The growing preference for advanced pigment functionalities supports continued R&D investments.

Increased Use of Digital Printing Pigments in Textiles and Packaging

The rise of digital printing drives demand for specialized pigments offering fine particle size and high dispersion. Textile and packaging industries prefer digital inks for precision and design flexibility. The Australia Pigments Market experiences growth in pigment ink applications for custom branding. It leads to stronger use in flexible packaging and decorative textiles. Pigment dispersions with high color strength enhance print durability and fade resistance. Local producers adopt digital inkjet technologies to serve evolving end-user needs. The shift from solvent-based to water-based pigment inks supports environmental goals. The trend enhances production efficiency and design capabilities.

- For instance, KRONOS and Covestro collaborated in 2023 to advance sustainable digital textile printing through the use of KRONOS 9900 Digital White pigment and Covestro’s INSQIN® polyurethane binders. Their joint study demonstrated that digital pigment printing can deliver up to 95% lower CO₂ emissions, 60% water savings, and 55% reduced energy consumption compared to conventional analog printing processes.

Growing Popularity of Specialty Pigments in Industrial and Decorative Use

Specialty pigments offering metallic, pearlescent, and fluorescent effects gain traction in coatings and plastics. Consumers favor aesthetic enhancement in both architectural and automotive applications. The Australia Pigments Market benefits from new product lines combining durability and decorative appeal. Producers expand offerings to meet diverse color requirements in high-end coatings. It reflects a design-oriented consumer trend toward unique finishes. Specialty pigments also improve heat reflection and light stability. Manufacturers leverage premium formulations to differentiate in a competitive environment. The use of effect pigments enhances value perception across several end-use industries.

Integration of Local Production Facilities for Supply Chain Efficiency

Australian pigment manufacturers expand domestic production to reduce import dependency. Establishing localized supply chains helps ensure consistent raw material availability. The Australia Pigments Market benefits from regional investments in pigment processing units. It allows faster response to industrial demands and regulatory shifts. Local production also minimizes logistics costs and improves sustainability credentials. Firms upgrade production equipment to meet high-quality dispersion standards. This development supports job creation and boosts manufacturing competitiveness. Strengthening regional production capabilities enhances the market’s strategic autonomy.

- For instance, BASF officially announced in October 2025 the expansion and commissioning of a new production line dedicated to dispersions for architectural coatings and construction materials at its Dilovası, Türkiye facility. This investment significantly increased BASF’s overall regional production network capacity for low-VOC dispersions, directly improving customer supply reliability across Türkiye and neighboring regions, as verified in BASF’s corporate media releases.

Market Challenges Analysis

Rising Raw Material Costs and Supply Chain Constraints

Fluctuating prices of titanium dioxide, iron oxides, and organic feedstocks challenge production economics. The Australia Pigments Market faces difficulties due to raw material shortages and import delays. It raises manufacturing costs and limits pricing flexibility for producers. Dependence on imported intermediates exposes manufacturers to global trade volatility. Currency fluctuations further affect cost structures across supply networks. Producers struggle to maintain profit margins while ensuring product consistency. The need for alternative raw material sources pushes firms toward regional partnerships. Supply chain instability continues to test operational resilience and planning efficiency.

Stringent Environmental Regulations and Disposal Management Issues

Tightening environmental norms demand continuous upgrades in waste treatment and emission control systems. It increases operational costs for pigment manufacturers, especially in small and mid-size enterprises. The Australia Pigments Market encounters growing scrutiny over wastewater and heavy metal content. Regulatory compliance adds complexity to production and product approval processes. Firms must invest in sustainable water recycling and air filtration technologies. Non-compliance risks include penalties and disrupted production schedules. The challenge lies in maintaining output while achieving sustainability benchmarks. Evolving safety standards require proactive adaptation to minimize environmental impact.

Market Opportunities

Expanding Demand for Biobased Pigments and Circular Economy Practices

The push toward renewable and biodegradable materials creates strong prospects for biobased pigments. Manufacturers invest in plant-derived colorants and natural mineral blends to meet eco-standards. The Australia Pigments Market benefits from the government’s support for green manufacturing programs. It encourages the integration of circular economy practices and sustainable resource utilization. New business models focusing on pigment recycling and low-waste production attract industrial interest. Expanding consumer preference for green products enhances long-term market appeal. Companies emphasizing carbon-neutral pigment operations strengthen their brand positioning.

Emergence of Smart Pigments in Niche and High-Value Applications

Smart pigments capable of responding to temperature, UV exposure, or pH variations offer lucrative prospects. Sectors such as electronics, healthcare, and automotive coatings show growing adoption potential. The Australia Pigments Market explores collaborations in advanced color-changing materials. It supports high-value industrial coatings, functional packaging, and product authentication uses. Technological innovation continues to unlock novel pigment functionalities for niche segments. Companies leveraging digital and responsive pigments can gain competitive advantages. This diversification into intelligent materials expands revenue opportunities.

Market Segmentation Analysis

By Product Type

Inorganic pigments dominate due to their stability, opacity, and cost efficiency. Titanium dioxide (TiO₂) remains the primary choice in coatings and plastics for brightness and durability. Zinc oxide provides UV protection in coatings and rubber products. The Australia Pigments Market benefits from increased construction and industrial activity supporting inorganic pigment demand. Other metal oxides enhance heat resistance and corrosion control. It ensures long-term performance in harsh environmental conditions. Producers prioritize product purity to comply with stringent regulatory standards. Organic pigments gain popularity for offering eco-friendly and vivid color performance. They find use in packaging, textiles, and printing applications requiring high chromatic strength. The Australia Pigments Market witnesses innovation in synthetic organic pigments with improved lightfastness. Specialty or functional pigments such as pearlescent, metallic, and fluorescent varieties enhance product design appeal. It drives adoption across decorative coatings and automotive sectors. Producers develop surface-modified pigments for specialized optical or conductive properties. Demand continues to rise for effect pigments supporting high-end applications.

- For instance, Lanxess AG manufactures Bayferrox® iron oxide pigments, widely used in Australia’s construction, coatings, and plastics sectors. The company emphasizes high heat stability, color consistency, and environmental sustainability in its pigment formulations, supporting durable infrastructure and eco-compliant applications.

By Application

Paints and coatings represent the largest application segment supported by construction growth and renovation activity. The plastics segment grows steadily due to packaging and automotive component use. Textiles and printing inks adopt pigment dispersions that improve color vibrancy and fastness. The Australia Pigments Market sees higher penetration in leather and other industrial applications. It benefits from diverse downstream industries emphasizing performance and appearance. Companies target application-specific pigment grades to expand market coverage. The ongoing shift to sustainable coatings strengthens future application growth.

- For instance, DuluxGroup supplies a range of protective and marine coatings formulated with advanced anti-corrosive pigments to withstand harsh coastal environments. The company focuses on long-term durability, verified performance, and compliance with marine protection standards across Australia’s infrastructure and industrial sectors.

Segmentation

Segmentation

By Product Type

- Inorganic Pigments

- Titanium Dioxide (TiO₂)

- Zinc Oxide

- Others

- Organic Pigments

- Specialty/Functional Pigments

By Application

- Paints & Coatings

- Textiles

- Printing Inks

- Plastics

- Leather

- Other Applications

Regional Analysis

Eastern Australia – New South Wales and Victoria Leading with 48% Share

Eastern Australia dominates the Australia Pigments Market with a combined share of 48%, driven by strong construction, automotive, and manufacturing activity. New South Wales and Victoria hold the highest concentration of pigment-consuming industries, including paints, coatings, and packaging. It benefits from established infrastructure, industrial clusters, and high demand for decorative and protective coatings. The urban expansion across Sydney and Melbourne continues to strengthen pigment consumption in architectural applications. Local manufacturers leverage advanced pigment dispersion facilities to meet regional production standards. Rising demand for eco-friendly pigments further supports market expansion in these states.

Western Australia – Industrial Expansion Driving 27% Market Share

Western Australia accounts for 27% of the national pigment market, supported by mining, industrial coatings, and marine applications. The region’s mineral extraction and heavy engineering sectors generate strong demand for corrosion-resistant pigments. It also benefits from growing infrastructure investments in Perth and regional industrial zones. Local companies focus on high-performance inorganic pigments designed for harsh environmental conditions. The energy and resources sector uses pigment-based coatings for equipment and infrastructure protection. Expanding export-oriented industries further enhance pigment consumption across Western Australia.

Northern and Southern Territories – Emerging Markets with 25% Share

Northern Territory, Queensland, South Australia, and Tasmania collectively represent 25% of the market share. These areas show growth in specialized applications across textiles, printing inks, and consumer packaging. Queensland’s industrial base supports pigment usage in coatings for construction and marine sectors. It benefits from regional trade routes connecting export-oriented industries. South Australia’s focus on manufacturing innovation and renewable projects contributes to pigment demand in sustainable coatings. Tasmania and Northern Territory show rising use in niche segments such as decorative arts and small-scale manufacturing. Increasing regional industrialization is expected to accelerate pigment adoption across these emerging subregions.

Key Player Analysis

- DIC Corporation

- A1 Pigments Australia

- Synergy Pigments Australia

- Pigments Australia

- Just Pigments

- Li Pigments Australia

- Art Spectrum

- Chroma Australia

- Derivan

- Encaustic Australia

Competitive Analysis

Competitive Analysis

The Australia Pigments Market features moderate fragmentation with a mix of global corporations and domestic producers. Key players such as DIC Corporation, A1 Pigments Australia, and Synergy Pigments Australia lead through product diversification and sustainable innovation. It shows strong competition in high-performance inorganic and organic pigment categories serving construction, automotive, and packaging sectors. Local firms including Art Spectrum, Derivan, and Chroma Australia strengthen their position through localized production and eco-friendly pigment formulations. The competitive focus remains on technological advancements, dispersion stability, and regulatory compliance. Companies are investing in color consistency, UV resistance, and bio-based pigment alternatives to meet market expectations. Strategic partnerships, new product launches, and regional expansions define the competitive dynamics, while sustainability and customization continue to shape the industry’s long-term differentiation strategy.

Recent Developments

- In September 2025, Brenntag Material Science announced an expanded partnership with Sudarshan Chemical Industries Limited to supply advanced anticorrosive pigments to the Australian market. This agreement, which builds upon their established collaboration in New Zealand, introduces high-performance pigment products such as Heucophos™ and Heucorin™ to address the needs of Australia’s paints, coatings, and plastic sectors while enhancing durability and sustainability in harsh local environments.

- In March 2025, Sun Chemical made a notable product launch by introducing two new metallic effect pigments Chione Electric Scarlet SR90D and Chione Electric Sienna SC90D for the Australian personal care and cosmetics market. These innovations are positioned to meet rising demands for vibrant, high-performance pigments in beauty and personal care formulations where new color effects and durability are increasingly valued.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand for eco-friendly and low-VOC pigments will drive sustainable production initiatives.

- Expansion in construction and automotive sectors will continue to boost coatings and decorative applications.

- Advancements in nanotechnology will enable the creation of high-performance and functional pigment solutions.

- Increasing digital printing and packaging innovation will expand pigment use in flexible and specialty inks.

- Local pigment manufacturing investments will strengthen domestic supply chains and reduce import dependency.

- The shift toward bio-based pigments will create opportunities for renewable and circular product lines.

- Smart pigments featuring thermochromic and photochromic properties will gain traction in niche markets.

- Growing textile and plastic production will increase demand for durable and color-stable pigment formulations.

- Industry collaboration for waste reduction and carbon-neutral pigment production will enhance market credibility.

- Continuous R&D in dispersion technology and lightfastness improvement will shape the long-term competitive landscape.

Market Trends

Market Trends Segmentation

Segmentation Competitive Analysis

Competitive Analysis