Market Overview

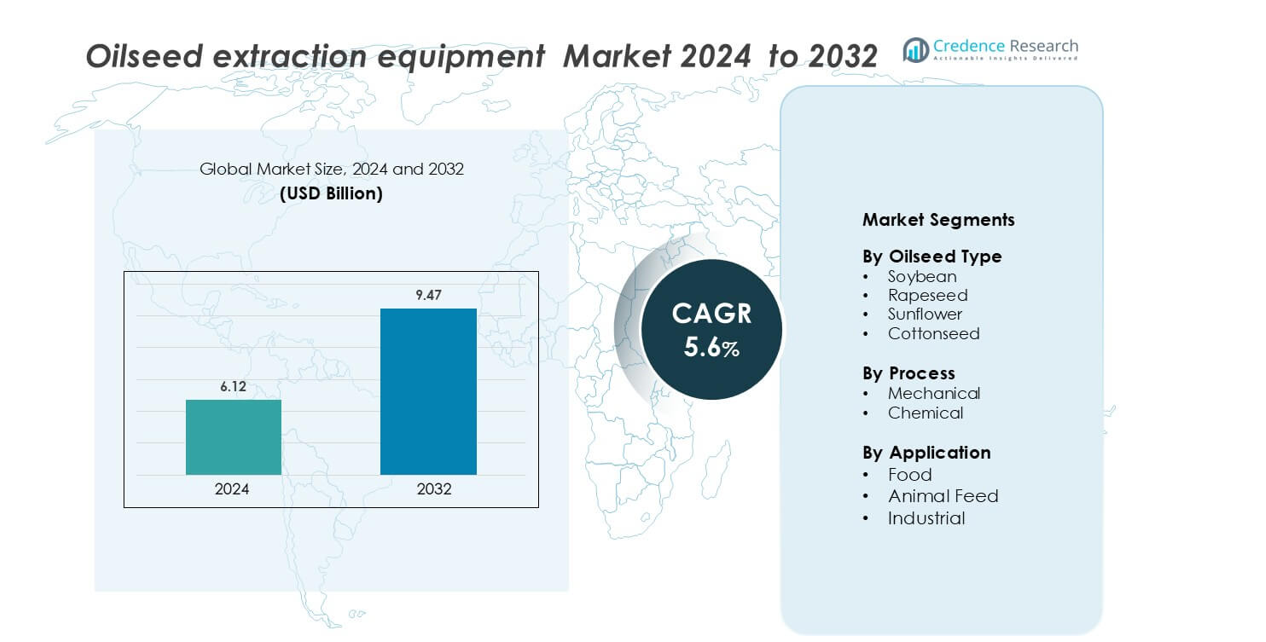

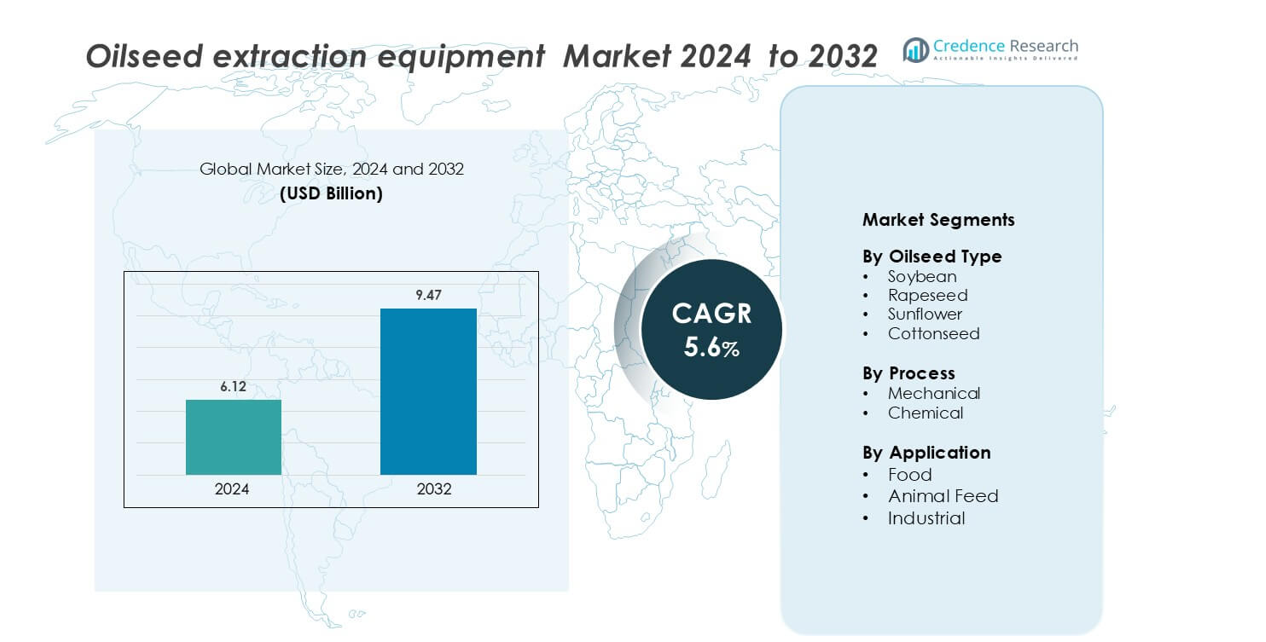

Oilseed extraction equipment Market size was valued USD 6.12 billion in 2024 and is anticipated to reach USD 9.47 billion by 2032, at a CAGR of 5.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Oilseed Extraction Equipment Market Size 2024 |

USD 6.12 billion |

| Oilseed Extraction Equipment Market, CAGR |

5.6% |

| Oilseed Extraction Equipment Market Size 2032 |

USD 9.47 billion |

The oilseed extraction equipment market is characterized by strong competition among leading players such as Alfa Laval, Sulzer Ltd, Waters Corporation, BUCHI Labortechnik, Shimadzu Corporation, Hielscher Ultrasonics, Sonomechanics, Sonics & Materials, Qsonica, and FUST Lab. These companies focus on process automation, energy efficiency, and environmentally friendly extraction technologies to strengthen their global presence. Alfa Laval and Sulzer Ltd lead in large-scale solvent and mechanical extraction systems, while Hielscher Ultrasonics and Sonomechanics specialize in advanced ultrasonic extraction equipment. Asia-Pacific dominates the global market with a 36% share, driven by high oilseed production, industrial expansion, and rising edible oil demand. Continuous R&D and product innovations remain central to maintaining competitiveness and meeting diverse processing needs.

Market Insights

- The oilseed extraction equipment market was valued at USD 6.12 billion in 2024 and is projected to reach USD 9.47 billion by 2032, registering a CAGR of 5.6% during the forecast period.

- Rising demand for edible oils and biofuels drives market expansion, with soybean extraction equipment holding the largest segment share due to high oil yield and global food processing needs.

- Technological advancements such as ultrasonic and solvent-free extraction systems enhance efficiency, energy recovery, and sustainability, shaping modern processing facilities.

- High equipment installation and maintenance costs, along with strict environmental regulations on solvent emissions, restrain market growth in developing economies.

- Asia-Pacific leads with a 36% share, followed by North America at 32% and Europe at 27%, supported by expanding agri-processing industries, modernization initiatives, and strong demand for automated, high-capacity extraction systems across major oilseed-producing countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Oilseed Type

The soybean segment dominates the oilseed extraction equipment market with the largest share. High oil yield, versatility, and widespread industrial demand drive this dominance. Soybean extraction systems are favored for their efficiency and automation compatibility. For instance, Bühler Group’s soybean extraction lines achieve processing capacities exceeding 400 tons per day with optimized solvent recovery systems. Increased adoption in food and biodiesel applications continues to boost equipment demand, especially in regions emphasizing sustainable production and protein-rich derivatives.

- For instance, Crown Iron Works manufactures Continuous Loop Extractors, such as the Model III which are capable of handling up to 8,000 tons of soybeans per day. The claim of 1,200 tons per day is well within this capacity.

By Process

The mechanical extraction process holds a major market share, driven by its lower operational cost and chemical-free output. This method ensures consistent oil quality, making it suitable for small- and medium-scale processors. Continuous screw presses and expellers enhance yield while minimizing energy loss. For instance, French Oil Mill Machinery Company’s Super Press series delivers up to 10% higher oil recovery efficiency compared to standard presses. The growing preference for environmentally friendly and solvent-free extraction further strengthens mechanical process adoption across global markets.

- For instance, Anderson International’s website show that some of their machines can exceed 150 tons per day. For example, the Mega-200™ Pre-Press Expeller has a capacity of 175–200 metric tons per day.

By Application

The food segment leads the market, accounting for the largest share due to rising edible oil consumption. Growing demand for soybean, sunflower, and rapeseed oils in households and processed foods sustains this dominance. Equipment used in this segment prioritizes hygiene, energy efficiency, and automation. For instance, Alfa Laval’s multi-effect extraction systems integrate continuous desolventizing and filtration units, enabling output capacities of 300–600 tons per day. Increasing health awareness and expansion of cooking oil refining facilities globally continue to drive the segment’s strong growth trajectory.

Key Growth Drivers

Rising Global Demand for Edible Oils

The growing consumption of edible oils is a primary driver of the oilseed extraction equipment market. Urbanization, income growth, and shifting dietary habits have increased the demand for vegetable oils such as soybean, sunflower, and rapeseed oils. Advanced extraction equipment enables higher yield, improved oil purity, and reduced energy use. For instance, Crown Iron Works’ continuous solvent extraction systems can process up to 1,000 tons per day while maintaining low solvent losses and high recovery rates. Expansion of large-scale edible oil refineries in Asia-Pacific and Africa further accelerates equipment installation. The need for efficient and automated systems to meet industrial-scale production is fueling market growth worldwide.

- For instance, Crown Iron Works’ Continuous Loop Extractor processes up to 1,200 tons of soybeans per day with solvent losses below 0.15 kilograms per ton, while Desmet Ballestra’s extractor system operates at throughput levels of 1,100 tons daily, ensuring hexane recovery efficiency exceeding 99.5%.

Expansion of Biofuel and Biodiesel Industries

The global transition toward renewable energy is significantly boosting the adoption of oilseed extraction equipment. Biodiesel production relies heavily on vegetable oils, particularly from soybean, rapeseed, and palm sources. Increasing government mandates for biofuel blending and carbon reduction targets drive investment in high-capacity oil extraction facilities. For instance, Desmet Ballestra’s modular extraction units support biodiesel-grade oil production of up to 700 tons per day with optimized solvent circulation. Equipment manufacturers are enhancing efficiency and energy recovery to align with sustainability goals. Growing adoption of clean energy policies in the U.S., Brazil, and the European Union continues to strengthen market opportunities for oilseed extraction solutions.

- For instance, Desmet Ballestra’s modular extraction systems enable biodiesel-grade oil processing of up to 700 tons per day with 98% solvent recovery efficiency.

Technological Advancements and Automation Integration

Continuous innovation in extraction technologies is transforming the oilseed processing landscape. Automation, sensor-based monitoring, and energy-efficient systems are improving operational precision and safety. Equipment manufacturers focus on minimizing solvent usage and ensuring consistent output quality. For instance, Bühler Group’s high-efficiency extractor reduces solvent consumption by up to 25% while maintaining optimal oil yield. Integration of IoT-based predictive maintenance and data-driven control systems enhances uptime and reduces operational costs. These advancements support scalable production and compliance with stringent food safety standards. The adoption of advanced automation technologies positions manufacturers to meet global demand efficiently and maintain competitiveness in a rapidly evolving market.

Key Trends & Opportunities

Shift Toward Sustainable and Green Processing

Sustainability is emerging as a central trend in the oilseed extraction equipment market. Manufacturers are developing eco-friendly solutions that minimize environmental impact and energy use. The shift toward solvent-free and mechanical pressing techniques reduces chemical residues and improves product quality. For instance, Anderson International’s Dox Extruder–Expeller system eliminates hexane usage and achieves over 98% oil recovery. Increasing corporate commitments to carbon neutrality drive adoption of low-emission systems. Additionally, renewable energy integration and waste-heat recovery in extraction plants are gaining traction. This trend aligns with global sustainability goals and provides equipment suppliers with opportunities to innovate greener, energy-efficient designs that attract environmentally conscious investors and producers.

- For instance, Anderson International’s Dox Extruder–Expeller system eliminates the need for hexane and is designed to achieve the lowest possible residual oil in meal for a mechanical process, typically reducing the oil in the meal to under 6% (approximately 94% oil recovery efficiency, depending on the feedstock).

Expansion of Oilseed Processing Capacity in Emerging Markets

Emerging economies in Asia-Pacific, Africa, and Latin America are witnessing rapid expansion of oilseed processing facilities. Population growth and industrialization are increasing demand for vegetable oils in food, biofuel, and animal feed sectors. For instance, India’s Solvent Extractors’ Association reported record investments in new soybean and sunflower extraction units equipped with automated solvent recovery systems. Equipment manufacturers are capitalizing on this growth by offering region-specific solutions tailored to diverse crop varieties and climatic conditions. Government policies supporting agricultural modernization and foreign investment in agribusiness further enhance opportunities. This expansion strengthens global supply chains and boosts the market for technologically advanced oilseed extraction equipment.

- For instance, India’s Solvent Extractors’ Association reported installation of extraction plants by Desmet Ballestra and Crown Iron Works with combined processing capacities exceeding 2,500 tons of oilseeds per day, featuring solvent recovery efficiency of 99.5% and energy consumption below 25 kilowatt-hours per ton.

Adoption of Digital Monitoring and Predictive Maintenance

Digital transformation is reshaping the operational landscape of oilseed extraction plants. Integration of IoT sensors and predictive analytics enables real-time process monitoring, optimizing temperature, pressure, and solvent usage. For instance, Alfa Laval’s digital control systems employ smart diagnostics that reduce downtime by 15% through predictive alerts. Cloud-based dashboards provide remote access for performance tracking and process optimization. Manufacturers benefit from enhanced energy management, reduced waste, and improved safety standards. The move toward Industry 4.0 creates new opportunities for vendors offering smart and connected extraction solutions. This digital shift improves productivity, operational resilience, and cost efficiency, driving long-term competitiveness across the global market.

Key Challenges

High Initial Investment and Maintenance Costs

The oilseed extraction equipment market faces significant barriers due to high capital expenditure and maintenance requirements. Large-scale solvent extraction plants demand substantial investments in technology, infrastructure, and skilled labor. Small and medium enterprises often struggle with the upfront costs of automation and regulatory compliance. For instance, a fully automated solvent extraction line with desolventizing and refining units can exceed USD 5 million in setup cost. Regular maintenance and solvent handling protocols also increase operational expenses. These factors limit market penetration in developing regions. Addressing cost barriers through modular systems, financing support, and leasing models could help widen access to advanced extraction technologies.

Environmental and Regulatory Compliance Challenges

Strict environmental and safety regulations pose challenges for manufacturers and plant operators. Solvent extraction involves hazardous chemicals such as hexane, which require careful handling and disposal to prevent air and water pollution. For instance, compliance with the U.S. EPA’s volatile organic compound (VOC) emission standards demands costly air treatment and solvent recovery equipment. Non-compliance risks heavy penalties and operational shutdowns. Manufacturers are under pressure to redesign equipment to meet evolving emission norms and worker safety standards. Achieving regulatory alignment across multiple jurisdictions increases complexity. These compliance challenges drive the need for continuous innovation in safer, low-emission extraction technologies and sustainable operational practices.

Regional Analysis

North America

North America holds a 32% share of the oilseed extraction equipment market, driven by technological innovation and high edible oil demand. The U.S. and Canada lead with large-scale soybean and canola processing facilities. For instance, Crown Iron Works and French Oil Mill Machinery Co. provide advanced solvent extraction systems supporting industrial-scale production. Government incentives for biofuel expansion and sustainability initiatives also boost demand for efficient extraction technologies. The region’s strong presence of automated plants and integration of energy recovery systems ensures continuous modernization, positioning North America as a key player in global oilseed processing advancements.

Europe

Europe accounts for 27% of the market share, driven by a growing focus on sustainable processing and renewable energy policies. Countries such as Germany, France, and the Netherlands invest heavily in eco-friendly oil extraction systems. Equipment suppliers like Desmet Ballestra and Bühler Group focus on solvent-free and low-emission technologies to meet EU regulations. Increased biodiesel production from rapeseed and sunflower oils further supports market expansion. Manufacturers emphasize efficiency, waste reduction, and carbon-neutral operations. The region’s stringent environmental standards continue to shape technological innovation and maintain Europe’s position as a leader in green oil extraction practices.

Asia-Pacific

Asia-Pacific dominates the oilseed extraction equipment market with a 36% share, supported by abundant oilseed cultivation and expanding food industries. China, India, and Indonesia are the major contributors, investing in high-capacity mechanical and solvent extraction facilities. For instance, Alfa Laval and Goyum Screw Press supply advanced modular extraction units for soybean and palm oil processing. Rapid urbanization, rising disposable incomes, and biofuel demand drive market growth. Governments promote modernization in agri-processing sectors through subsidies and technology upgrades. This strong agricultural base and manufacturing expansion make Asia-Pacific the fastest-growing region in oilseed extraction equipment adoption.

Latin America

Latin America captures 9% of the global market share, driven by extensive soybean and sunflower production in Brazil and Argentina. The region benefits from growing investments in biodiesel and edible oil exports. Companies such as Desmet Ballestra and Anderson International support large-scale installations with energy-efficient solvent recovery systems. Brazil’s National Biodiesel Program further encourages local processing capacity expansion. Rising awareness of value-added agricultural processing promotes regional equipment upgrades. Although challenges such as fluctuating commodity prices persist, Latin America’s resource-rich environment ensures long-term growth potential in the oilseed extraction equipment industry.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the oilseed extraction equipment market, led by increasing industrialization and food sector diversification. Countries such as Egypt, South Africa, and the UAE invest in oilseed processing to reduce import dependence. Local production of sunflower, cottonseed, and soybean oils supports growing domestic demand. For instance, regional processors adopt mid-scale mechanical pressing systems from global players like Bühler and Crown Iron Works. Government initiatives promoting food self-sufficiency and agro-industrial development drive steady growth. Ongoing infrastructure improvements and public-private partnerships enhance the region’s long-term processing capacity.

Market Segmentations:

By Oilseed Type

- Soybean

- Rapeseed

- Sunflower

- Cottonseed

By Process

By Application

- Food

- Animal Feed

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The oilseed extraction equipment market is highly competitive, with key players including Sonics & Materials, Alfa Laval, Qsonica, Sulzer Ltd, BUCHI Labortechnik, Sonomechanics, Hielscher Ultrasonics, Waters Corporation, FUST Lab, and Shimadzu Corporation. These companies focus on technological innovation, efficiency improvement, and sustainability to strengthen their market positions. Leading firms such as Alfa Laval and Sulzer Ltd dominate through advanced solvent extraction and mechanical pressing systems with enhanced energy recovery features. North America leads the market with a 32% share, followed by Asia-Pacific with 36%, driven by rapid industrialization and agricultural processing expansion. Continuous R&D investments, partnerships, and equipment automation are shaping competition, enabling manufacturers to cater to evolving industrial and biofuel applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sonics & Materials

- Alfa Laval

- Qsonica

- Sulzer Ltd

- BUCHI Labortechnik

- Sonomechanics

- Hielscher Ultrasonics

- Waters Corporation

- FUST Lab

- Shimadzu Corporation

Recent Developments

- In June 2025, De Dietrich Process Systems announced a strategic partnership with Alysophil to advance continuous flow chemistry, integrating artificial intelligence and 3D-printed reactors into chemical production. This process will enhance the traditional batch process by enhancing productivity, safety, and automation.

- In July 2024, the Koch Modular Process Systems has expanded its pilot plant in Houston, Texas, tripling its size from 5,000 to 18,000 square feet to meet growing demand for advanced testing and data generation in chemical process development. This expansion includes enhanced lab, office and conferences spaces.

- In January 2024, FUST Lab launched its BEBREX series in Japan following its successful campaign in Korea’s cosmetics and pharmaceutical sector. The company is entering the Japanese market, strategic partnerships and distributor recruitment, with plans to showcase at Tokyo Interphex Week. The company further plans its expansion into other countries to capitalize the success word of mouth among clients.

Report Coverage

The research report offers an in-depth analysis based on Oilseed Type, Process, Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Automation and digital monitoring will enhance process efficiency and reduce production downtime.

- Adoption of solvent-free and eco-friendly extraction technologies will rise due to sustainability goals.

- Emerging economies in Asia-Pacific and Africa will witness strong demand for modern extraction systems.

- Integration of IoT and AI-based predictive maintenance will improve operational reliability.

- Growing biodiesel production will continue to drive investment in large-scale extraction plants.

- Equipment manufacturers will focus on modular and energy-efficient system designs.

- Increasing edible oil consumption will sustain steady demand for high-capacity extraction units.

- Government support for agri-processing industries will expand local manufacturing capabilities.

- Continuous innovation in ultrasonic and enzymatic extraction methods will diversify product applications.

- Strategic collaborations among global players will strengthen technology transfer and market expansion efforts.