Market Overview

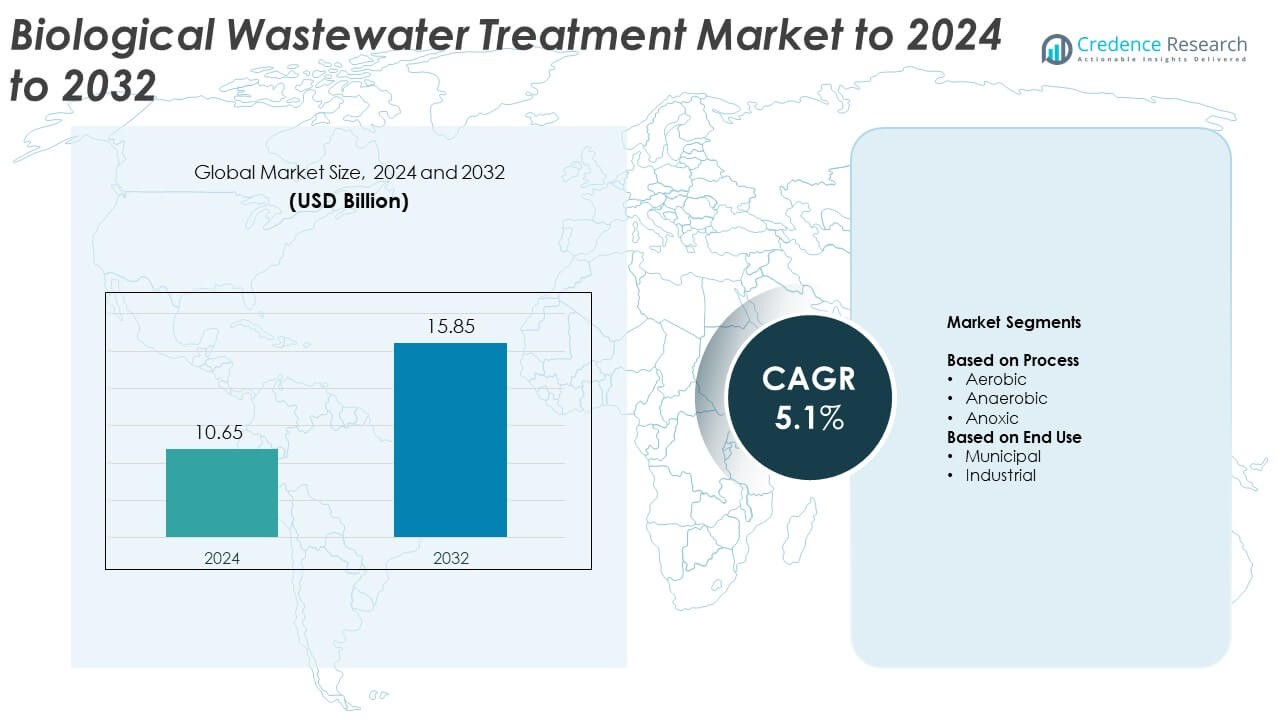

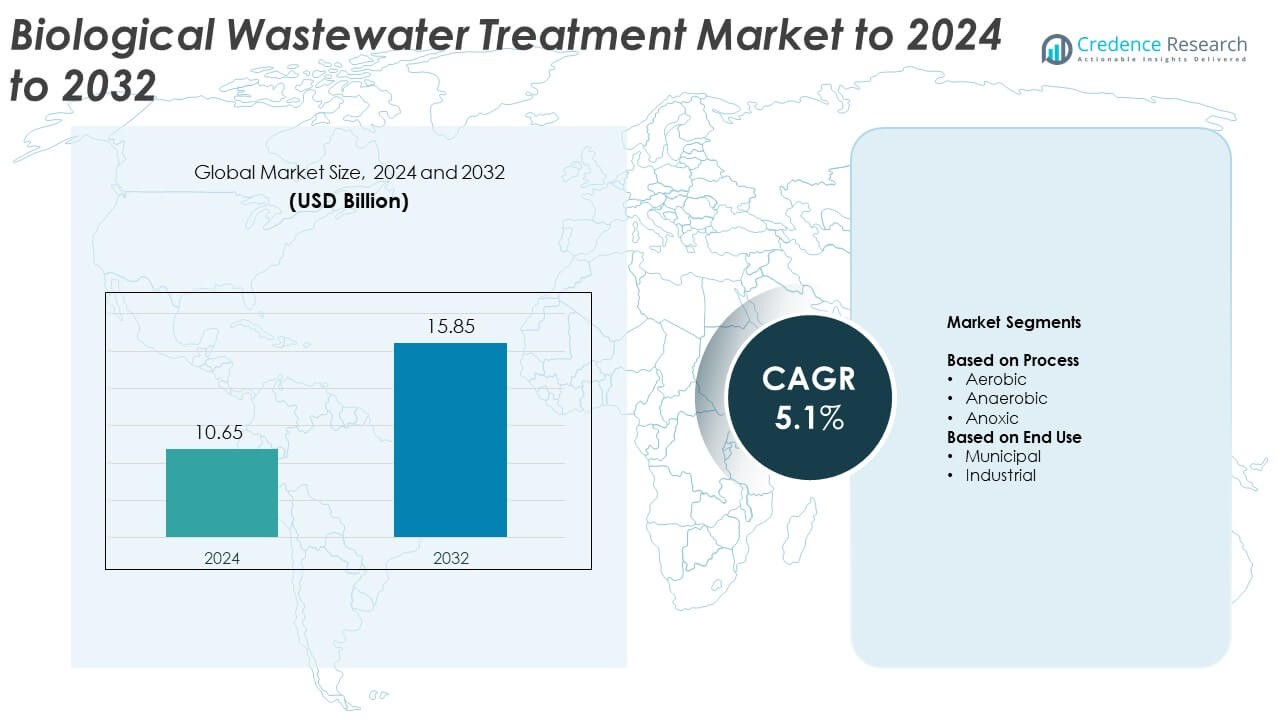

Biological Wastewater Treatment Market size was valued USD 10.65 Billion in 2024 and is anticipated to reach USD 15.85 Billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biological Wastewater Treatment Market Size 2024 |

USD 10.65 Billion |

| Biological Wastewater Treatment Market, CAGR |

5.1% |

| Biological Wastewater Treatment Market Size 2032 |

USD 15.85 Billion |

The Biological Wastewater Treatment market is shaped by major players such as DAS Environment Expert GmbH, Pentair plc, Ilim Group, Evoqua Water Technologies LLC, Aquatech International, Veolia Environment SA, Calgon Carbon Corporation, Samco Technologies Inc., Xylem Inc., and Ecolab Inc. These companies compete through advanced biological systems, energy-efficient designs, and expanding service portfolios for municipal and industrial facilities. North America led the market in 2024 with about 37% share, supported by strict regulations and strong infrastructure investment. Europe followed with nearly 31% share, driven by nutrient-removal standards and mature wastewater networks. Asia Pacific held about 24% share, growing rapidly due to rising urbanization and industrial expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Biological Wastewater Treatment market was valued at USD 10.65 Billion in 2024 and is projected to reach USD 15.85 Billion by 2032, growing at a CAGR of 5.1%.

- Market growth is driven by rising municipal wastewater loads, strict discharge limits, and increasing industrial adoption across food processing, chemicals, and pharmaceuticals, where biological systems support stable pollutant removal and lower operating costs.

- Key trends include the shift toward energy-efficient aerobic and anaerobic processes, wider use of membrane bioreactors, and strong interest in digital automation that improves treatment reliability and reduces manual control.

- The competitive landscape includes leading companies investing in nutrient-removal upgrades, sludge-reduction technologies, and service-based models that support long-term plant performance across municipal and industrial users.

- North America led with around 37% share in 2024, followed by Europe at 31% and Asia Pacific at 24%, while the aerobic process held about 52% segment share, and municipal use accounted for nearly 58% of total demand.

Market Segmentation Analysis:

By Process

The aerobic process dominated the Biological Wastewater Treatment market in 2024 with about 52% share. This process led due to its strong efficiency in removing organic pollutants and its wide use in municipal treatment plants. Aerobic systems support faster biodegradation, lower odor levels, and stable operation, which drives adoption across both large and mid-scale facilities. Anaerobic and anoxic processes expanded at steady rates as industries focused on energy recovery and nutrient removal, but aerobic treatment remained the preferred choice for meeting strict discharge norms and handling high-volume municipal loads.

- For instance, Ovivo Inc. supplied its ecoBLOX-360 MBR wastewater treatment system to a remote mining site in Quebec, which is designed to treat up to 320 cubic meters per day of sanitary wastewater, as documented on the Ovivo Industrial website.

By End Use

The municipal segment held the largest share in 2024 with nearly 58% of the Biological Wastewater Treatment market. Municipal facilities adopted advanced biological systems to handle rising urban wastewater volumes and comply with tighter environmental regulations. Growing population density, aging sewer networks, and government-funded upgrades supported the strong demand. Industrial end users increased adoption as well, especially in food processing, chemicals, and pharmaceuticals, driven by the need for reliable pollutant reduction and lower sludge generation, but the municipal sector remained the dominant user due to its scale and regulatory pressure.

- For instance, the Saur Group, through its engineering subsidiary Stereau, opened the new drinking water plant at Orly 2, which has a processing capacity of 150,000 cubic meters per day, as confirmed in an official press release on the Saur website.

Key Growth Drivers

Rising Urban Wastewater Volumes

Population growth and rapid urban expansion increased wastewater loads across cities. Municipal bodies invested heavily in biological treatment systems to meet strict discharge limits and improve water reuse. Rising stress on freshwater resources also pushed local authorities to upgrade old infrastructure with efficient aerobic and anaerobic solutions. This shift supported steady market growth as cities prioritized reliable pollutant removal and sustainable water management.

- For instance, Kelda Water Services oversees the Knostrop Wastewater Treatment Works, which serves a population equivalent of 990,000 and has a full flow to treatment of approximately 483.84 million liters per day (5,600 liters per second), as documented in technical data from Xylem and WaterProjectsOnline.

Strict Environmental Regulations

Governments enforced tighter norms on biochemical oxygen demand, nitrogen, and phosphorus discharge. These regulatory pressures encouraged both municipal and industrial facilities to adopt advanced biological treatment systems. Compliance needs strengthened demand for high-performance processes with lower sludge output and better removal efficiency. Industries upgraded systems to avoid penalties and ensure safer environmental footprints. This trend made regulation one of the strongest market growth drivers.

- For instance, a GE membrane bioreactor installation at the Calls Creek plant in Georgia reduced influent ammonia from 14.8 mg/L to effluent values near 0.21 mg/L, while effluent BOD averaged about 1 mg/L, according to U.S. EPA case data supplied by GE.

Industrial Expansion Across Key Sectors

Growth in food processing, pharmaceuticals, textiles, and chemicals increased wastewater generation. These sectors relied on biological systems for effective treatment and lower operational costs. Rising industrial investments in zero-liquid-discharge goals and water recycling supported wider adoption. Companies preferred energy-efficient biological processes to meet sustainability targets. This broad industrial footprint positioned sectoral expansion as a major driver of market demand.

Key Trends and Opportunities

Adoption of Energy-Efficient Treatment Technologies

Biological treatment systems shifted toward solutions that reduced aeration power and improved microbial efficiency. Demand rose for advanced bioreactors, membrane bioreactors, and optimized nutrient-removal designs that enhanced performance. Growing interest in sludge reduction and process automation created opportunities for engineering firms. Facilities sought smart monitoring and biological control tools to lower energy use and operational costs, supporting strong uptake of next-generation systems.

- For instance, Aquatech reports a Gulf-region plant using its low-energy design with measured specific energy consumption below 3.0 kilowatt-hours per cubic meter of produced water, verified after commissioning.

Growth in Water Reuse and Circular Economy Initiatives

Rising water scarcity and sustainability goals encouraged wider use of treated wastewater in agriculture, industry, and landscaping. Utilities upgraded biological processes to fit water reuse standards and support safe non-potable applications. Governments and private firms explored circular models emphasizing resource recovery, including biogas, nutrients, and clean water. These initiatives opened new opportunities for biological systems optimized for recycling and recovery.

- For instance, Utilities Development Company’s Sulaibiya Wastewater Treatment and Reclamation Plant in Kuwait was expanded to treat up to 600,000 cubic meters of wastewater per day, with all reclaimed water sold to the government for agricultural and industrial reuse.

Integration of Digital Monitoring and Automation

Facilities adopted digital platforms that tracked microbial activity, oxygen demand, and treatment stability. Automated controls improved process accuracy and reduced manual intervention. This trend created opportunities for suppliers offering AI-enabled monitoring, early-warning tools, and predictive maintenance. Digital support enhanced reliability, helping users maintain treatment quality under varying loads.

Key Challenges

High Operational and Energy Costs

Biological wastewater treatment required significant energy, especially in aeration-heavy systems. Many small municipalities and industrial units struggled with operating expenses, slowing adoption. Upgrading to advanced systems also demanded skilled labor and higher upfront investment. These cost burdens remained a major challenge for market expansion, pushing facilities to seek more efficient technologies.

Sludge Management and Disposal Issues

Biological processes generated large volumes of sludge that required handling, treatment, and safe disposal. Many regions lacked adequate sludge-processing infrastructure, creating compliance risks. Disposal costs added financial pressure for both municipal and industrial users. These issues limited system performance and raised environmental concerns, making sludge management a persistent challenge across the market.

Regional Analysis

North America

North America held the largest share of the Biological Wastewater Treatment market in 2024 with about 37%. Strong regulatory enforcement and large municipal upgrades supported wide adoption across the United States and Canada. Growing investments in nutrient-removal systems and expanding reuse projects strengthened the regional demand. Industrial sectors such as food processing and pharmaceuticals also increased adoption of biological solutions to meet discharge norms. Advancements in digital monitoring and energy-efficient aeration further improved system efficiency. Public funding for sustainable infrastructure positioned North America as a consistent leader in the market.

Europe

Europe accounted for nearly 31% of the Biological Wastewater Treatment market in 2024, driven by strict environmental rules and strong wastewater recycling initiatives. Countries such as Germany, France, and the U.K. expanded biological treatment capacity, focusing on nutrient removal and advanced sludge management. Industrial users in chemicals and manufacturing upgraded facilities to align with EU Water Framework Directive goals. Demand for membrane-based systems and low-energy treatment increased as utilities moved toward carbon-neutral operations. Strong policy support and circular-economy programs helped Europe maintain a major role in market development.

Asia Pacific

Asia Pacific captured about 24% share of the Biological Wastewater Treatment market in 2024, supported by rapid urbanization and rising wastewater loads in China, India, and Southeast Asia. Governments invested in new treatment plants and modernization projects to meet national discharge standards. Expanding industrial zones increased demand for biological systems with stable pollutant removal. The region saw strong interest in high-capacity aerobic and anaerobic processes due to large population clusters and growing water-reuse efforts. Infrastructure gaps continued to present challenges, yet large-scale upgrades kept Asia Pacific among the fastest-growing markets.

Latin America

Latin America held nearly 5% share in 2024, driven by growing municipal investments and regulatory improvements across Brazil, Mexico, and Colombia. Urban centers focused on expanding centralized treatment capacity to manage rising wastewater loads. Adoption increased in industries such as food processing, beverages, and textiles, which sought reliable compliance solutions. Budget constraints limited large-scale upgrades in some countries, but public-private partnerships supported steady progress. Emphasis on pollution control and water-resource protection sustained moderate market growth across the region.

Middle East & Africa

Middle East and Africa accounted for around 3% share of the Biological Wastewater Treatment market in 2024. Water scarcity encouraged governments to adopt advanced biological systems for reuse in irrigation, landscaping, and industry. Gulf countries invested in modern treatment plants with high-efficiency aerobic and anaerobic processes. African nations progressed slowly due to funding limitations but expanded decentralized treatment in urban clusters. Industrial growth in mining, petrochemicals, and food sectors supported gradual adoption. Long-term plans for water-security improvement continued to create growth opportunities across the region.

Market Segmentations:

By Process

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Biological Wastewater Treatment market includes major companies such as DAS Environment Expert GmbH, Pentair plc, Ilim Group, Evoqua Water Technologies LLC, Aquatech International, Veolia Environment SA, Calgon Carbon Corporation, Samco Technologies Inc., Xylem Inc., and Ecolab Inc. Market competition strengthened as participants focused on advanced treatment technologies that improved pollutant removal and reduced operational costs. Suppliers expanded portfolios with systems designed for nutrient reduction, sludge minimization, and higher energy efficiency. Many firms invested in digital process control, automation, and real-time monitoring to enhance treatment stability. Partnerships with municipal utilities and industrial facilities supported wider deployment of biological systems across regions. Companies also increased R&D efforts targeting low-carbon processes that aligned with sustainability goals. Growing interest in water reuse, stricter discharge norms, and infrastructure modernization continued to drive strategic collaborations, product upgrades, and long-term service contracts across the industry.

Key Player Analysis

- DAS Environment Expert GmbH

- Pentair plc

- Ilim Group

- Evoqua Water Technologies LLC

- Aquatech International

- Veolia Environment SA

- Calgon Carbon Corporation

- Samco Technologies Inc.

- Xylem Inc.

- Ecolab Inc.

Recent Developments

- In 2025, DAS Environmental Experts showcased innovative scalable wastewater treatment solutions at SEMICON Europa, underscoring their ongoing commitment to smart, flexible biological treatment processes.

- In 2025, Veolia announced a major strategic plan to expand its hazardous waste treatment capacity by organically adding 530,000 tonnes of new capacity annually by 2030.

- In 2024, Ilim Group announced it is nearing completion of the largest KLB Mill in Ust-Ilimsk, which will be the first in Russia’s pulp and paper sector to implement a two-stage biological wastewater treatment system.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Process, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as cities upgrade aging wastewater treatment systems.

- Adoption of energy-efficient biological processes will increase across municipal plants.

- Industrial users will invest more in biological treatment to meet strict discharge norms.

- Water-reuse projects will raise demand for high-performance biological systems.

- Digital monitoring and automation will improve process control and reliability.

- Membrane-based biological technologies will gain wider acceptance for advanced treatment.

- Governments will strengthen regulations that support pollutant-removal efficiency.

- Decentralized biological systems will expand in developing regions with limited infrastructure.

- Focus on sludge-reduction methods will shape new product innovation.

- Public-private partnerships will drive investment in sustainable treatment facilities.