Market overview

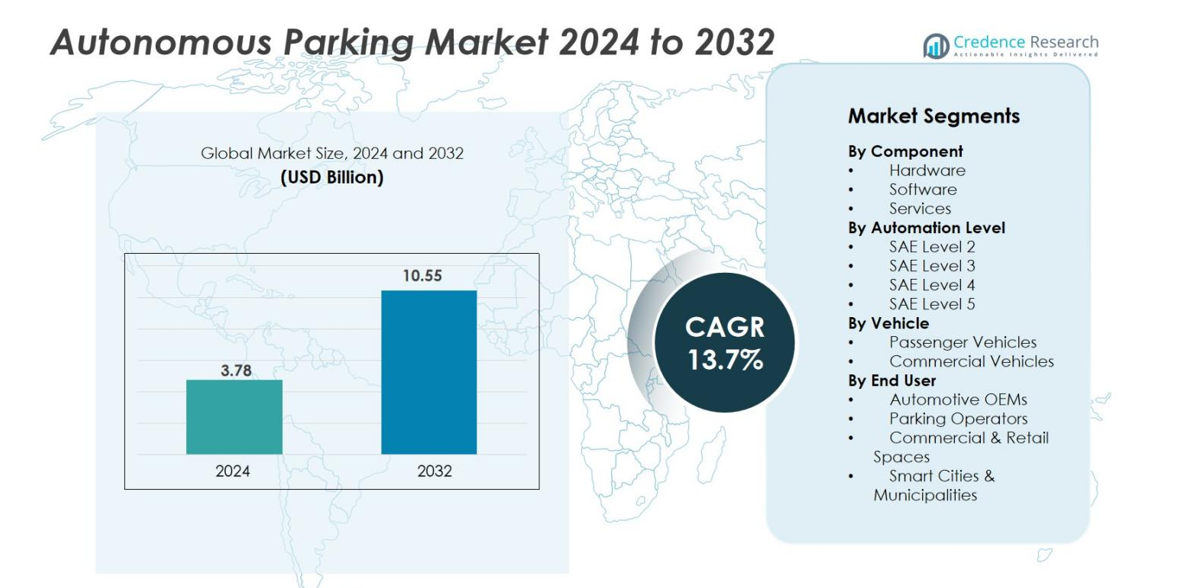

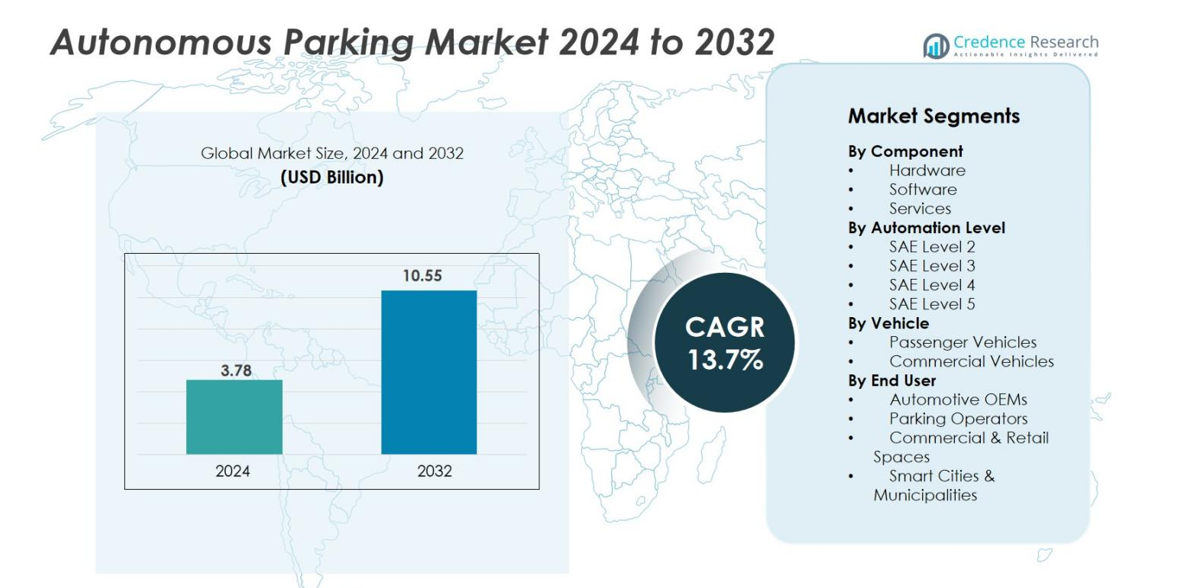

Autonomous Parking market size was valued at USD 3.78 Billion in 2024 and is anticipated to reach USD 10.55 Billion by 2032, at a CAGR of 13.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Autonomous Parking Market Size 2024 |

USD 3.78 Billion |

| Autonomous Parking Market, CAGR |

13.7% |

| Autonomous Parking Market Size 2032 |

USD 10.55 Billion |

The Autonomous Parking market is driven by strong competition among global automotive and parking automation companies. Leading players include Tesla, Daimler AG, Robert Bosch GmbH, FCA USA LLC, Skyline Parking AG, Robotic Parking Systems Inc., Unitronics (1989) (R G) Ltd., Klaus Multiparking GmbH, Westfalia Parking, and City Lift Parking LLC. These companies invest in advanced sensors, AI software, and robotic lifts to improve precision and space utilization. North America leads the market with 36% share in 2024, supported by high adoption of premium vehicles and smart parking infrastructure. Europe follows with 31% share due to strong regulatory support and advanced automotive manufacturing. Asia-Pacific holds 24% share and remains the fastest-growing region due to rising urbanization and EV expansion.

Market Insights

- The market was valued at USD 3.78 billion in 2024 and is projected to reach USD 10.55 billion by 2032, growing at a CAGR of 13.7%.

- Demand rises due to higher adoption of ADAS and AI-powered parking systems that reduce collisions in crowded urban areas, while automakers add autonomous parking as a comfort and safety feature in mid-range and premium vehicles.

- SAE Level 4 leads the automation level segment with 44% share, supported by autonomous valet features in commercial complexes and residential buildings, while hardware holds 52% share due to strong usage of sensors and cameras.

- Key companies such as Tesla, Daimler AG, Bosch, and Skyline Parking AG expand adoption through advanced sensing technology, software algorithms, robotic lifts, and cloud-connected parking solutions.

- North America leads the regional share with 36%, followed by Europe at 31% and Asia-Pacific at 24%, supported by smart infrastructure, EV growth, and dense urban development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

Hardware led the Autonomous Parking market with 52% share in 2024. The hardware group includes sensors, cameras, ultrasonic modules, and radar units. These devices support precise vehicle movement and safe navigation in tight spaces. Rising adoption of sensor-rich ADAS platforms boosts demand. Software held 31% share, driven by real-time mapping and AI-based path planning. Services held 17% share, supported by system maintenance and over-the-air upgrades. Automakers invest in sensor fusion units and high-resolution cameras to improve detection accuracy.

- For instance, Volkswagen Group invested $2.33 billion in Beijing-based robotics company Horizon to advance sensor fusion technology for autonomous vehicle safety systems.

By Automation Level

SAE Level 4 held 44% share in 2024, making it the dominant level. Level 4 systems offer near-full automation without driver input inside parking zones. This segment grows due to automated valet systems in residential and commercial lots. SAE Level 3 accounted for 28%, supported by semi-autonomous steering and braking. SAE Level 2 held 18%, and SAE Level 5 captured 10%, as it is still in early testing. Advancements in AI and edge computing drive Level 4 adoption.

- For instance, Mercedes-Benz and WeRide received official approval in 2024 to test Level 4 automated driving in Beijing with sensor-rich S-Class vehicles capable of fully autonomous driving under specific scenarios.

By Vehicle

Passenger vehicles held 67% share in 2024, making it the leading vehicle category. Carmakers integrate autonomous parking to improve premium comfort and reduce parking stress in cities. Electric vehicles also support this feature due to advanced sensor suites. Commercial vehicles captured 33%, driven by automated fleet operations in logistics hubs and airports. Growing demand for space-efficient parking in urban areas pushes OEMs to add smart parking tech across mid-range and luxury passenger cars.

Key Growth Drivers

Growing Adoption of Advanced Driver Assistance Systems (ADAS)

Rising demand for advanced driver assistance systems fuels autonomous parking adoption across the automotive sector. Automakers integrate parking sensors, high-resolution cameras, and radar modules to reduce collisions in crowded parking spaces. Urban congestion increases the need for automation, especially in smart cities. Automakers also focus on hands-free parking functions to enhance comfort and reduce driver stress. Electric vehicle manufacturers deploy sensor-rich platforms that support automated movement and real-time obstacle detection. Strong investment in AI-based perception and localization improves system accuracy. These developments make autonomous parking a standard feature in premium and mid-range vehicles, supporting market growth.

- For instance, Continental has produced over 200 million radar sensors, which are pivotal in parking assistance and lane departure warnings with ranges up to 300 meters.

Expansion of Smart Infrastructure and Connected Parking Facilities

Demand rises as commercial complexes, airports, and residential towers adopt automated parking systems to maximize space. Property developers deploy smart parking garages with robotic lifts and guided paths to reduce land use and operational cost. Integration of vehicle-to-infrastructure communication ensures controlled movement through connected lanes. The shift toward autonomous valet solutions improves parking efficiency and reduces human error. Governments promote smart mobility programs to support intelligent transport networks. Cloud-based platforms help operators monitor vehicle flow and manage space in real time. This trend accelerates system deployment across developed and emerging regions.

- For instance, Los Angeles International Airport (LAX) expanded its smart parking services by integrating valet and online reservations with real-time space availability and contactless payment, improving user convenience and reducing congestion.

Rising Consumer Demand for Convenience and Safety Features

Consumers prefer features that reduce vehicle damage risks and simplify daily transport. Autonomous parking reduces minor accidents caused by tight urban spaces, poor visibility, and parallel parking challenges. Car buyers view automated parking as a high-value feature that improves comfort and increases brand appeal. Luxury and mid-range vehicle manufacturers add autonomous parking to differentiate products and improve customer experience. Fleet owners also adopt automated solutions to prevent parking-related damage. The emphasis on safety regulations and driver assistance guidelines helps accelerate market expansion. As awareness improves, more vehicle categories integrate fully automated parking technology.

Key Trends & Opportunities

Growth of Software-Driven Parking Intelligence

Software becomes a major value driver as vehicles rely on real-time mapping, AI-based decision making, and cloud connectivity. Automakers deploy algorithms that detect pedestrians, measure space, and execute parking maneuvers with little human input. Over-the-air updates improve system performance without hardware replacement. Companies integrate 3D mapping and machine learning to handle complex indoor environments. This trend shifts market focus from hardware-only solutions to intelligent software platforms. The shift also accelerates subscription-based service models, unlocking recurring revenue opportunities for automakers and parking system providers.

- For instance, BMW uses OTA technology to provide quarterly map updates to its Connected Drive system, enabling real-time navigation adjustments without dealership visits.

Surge in Autonomous Valet Parking Systems

Autonomous valet parking emerges as a high-impact trend in smart cities, airports, malls, and residential towers. Vehicles can drop passengers at the entrance and park themselves without a driver. Commercial parking operators deploy robotic platforms, conveyors, and automated lifts to maximize space. Integration with mobile apps lets drivers request vehicles remotely. Real estate developers adopt automated systems to reduce land requirements and provide premium services. These systems also support electric vehicle charging and fleet parking in restricted spaces. As costs decline and infrastructure improves, autonomous valet solutions gain wider adoption across urban mobility networks.

- For instance, companies such as Valeo and Continental have independently developed and introduced their own modular autonomous valet parking platforms that support various vehicle types and configurations, reducing integration costs and potentially accelerating deployment through separate partnerships.

Key Challenges

High System Cost and Limited Affordability in Mass-Market Vehicles

Autonomous parking systems require cameras, radar units, ultrasonic sensors, computing modules, and high-performance software. These components increase manufacturing cost, making deployment difficult in low and mid-range vehicles. OEMs face price pressure in cost-sensitive markets where buyers prioritize affordability. Infrastructure requirements in public parking lots also restrict adoption. Operators must invest in connectivity, sensors, and intelligent platforms to support automated movement. Small developers may not justify these costs, slowing market penetration. As a result, adoption remains concentrated in premium vehicle categories and metropolitan regions.

Regulatory and Safety Compliance Barriers

Regulations for autonomous driving vary across countries, delaying standardization for automated parking. Automakers must prove reliability of obstacle detection, pedestrian safety, and emergency control. Tests require complex validation across different parking layouts and climate conditions. Liability concerns arise in case of collision or system failure. Lack of unified safety standards slows commercial rollout of Level 4 and Level 5 parking systems. Public parking operators also require compliance with cybersecurity and data privacy rules, adding operational complexity. These regulatory challenges limit fast commercialization in global markets.

Regional Analysis

North America

North America led the Autonomous Parking market with 36% share in 2024. The region benefits from strong adoption of ADAS features, premium vehicles, and smart parking infrastructure. Automakers in the United States invest in AI-based parking algorithms and real-time navigation to reduce collision risks in dense urban spaces. Commercial complexes and airports deploy connected parking platforms to improve space management and reduce vehicle damage. High demand for luxury vehicles and electric cars also supports system integration. Strong presence of technology companies and early regulatory support strengthens market leadership.

Europe

Europe held 31% share in 2024, driven by rapid smart mobility adoption and strict safety standards. Germany, the U.K., and France invest in autonomous driving programs, encouraging OEMs to deploy advanced parking technologies. Urban congestion and limited parking areas push consumers toward automated valet systems and robotic platforms. Automakers integrate autonomous parking as a standard feature in premium brands. European smart city projects and EV expansion provide a strong base for system deployment. Leading automotive manufacturers also test Level 4 parking capabilities in controlled environments, supporting wider rollouts.

Asia-Pacific

Asia-Pacific accounted for 24% share in 2024 and represents the fastest-growing region. China, Japan, and South Korea lead production of sensor-rich vehicles and smart parking solutions. Growing urban populations and rising vehicle ownership increase demand for automated parking in high-density areas. Property developers adopt robotic parking systems to manage space in residential towers and commercial zones. Government programs for intelligent transport systems encourage technology adoption. Automakers collaborate with tech providers for AI-based mapping and automated valet features, expanding system deployment across mid-range vehicle categories.

Middle East & Africa

Middle East & Africa captured 5% share in 2024, supported by premium vehicle adoption and smart infrastructure investment in Gulf countries. Airports, malls, and luxury residential complexes deploy automated parking systems to provide high-end mobility services. Government focus on smart cities in the UAE and Saudi Arabia accelerates pilot projects for autonomous valet platforms. However, limited integration in mass-market vehicles and smaller automotive ecosystems restrict widespread use. Vendors target commercial hubs and tourism zones where automated parking offers strong operational efficiency.

Latin America

Latin America held 4% share in 2024. Brazil and Chile lead adoption in urban mobility programs, where congestion and shortage of parking areas drive interest in automation. Premium vehicle imports support initial deployment, while commercial complexes explore robotic parking options to optimize space. High system cost and limited infrastructure slow mass-market expansion. However, rising consumer interest in driver-assist features and growing EV presence create long-term opportunities. Regional adoption is expected to improve with declining sensor costs and increased support from smart transportation initiatives.

Market Segmentations

By Component

- Hardware

- Software

- Services

By Automation Level

- SAE Level 2

- SAE Level 3

- SAE Level 4

- SAE Level 5

By Vehicle

- Passenger Vehicles

- Commercial Vehicles

By End User

- Automotive OEMs

- Parking Operators

- Commercial & Retail Spaces

- Smart Cities & Municipalities

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Autonomous Parking market features a mix of automotive OEMs, technology developers, and robotic parking solution providers. Leading players focus on sensor integration, high-resolution cameras, and AI-driven perception systems to improve vehicle control in confined areas. Companies such as Tesla, Daimler AG, Bosch, and FCA USA LLC deploy autonomous parking as a premium feature in passenger vehicles to enhance convenience and safety. Parking automation specialists like Skyline Parking AG, Robotic Parking Systems Inc., and Klaus Multiparking GmbH develop robotic lifts and automated valet platforms for commercial complexes and residential towers. Unitronics (1989) (R G) Ltd. and City Lift Parking LLC offer smart garage solutions for space optimization and remote vehicle retrieval. Partnerships between automakers, AI developers, and infrastructure providers accelerate deployment of Level 4 parking systems. Vendors invest in real-time mapping, cloud connectivity, and machine learning to improve precision and reduce human intervention. As competition intensifies, companies differentiate through software performance, safety validation, and seamless integration with electric and connected vehicles.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Volkswagen Group, Valeo SA, and Mobileye Global Inc. announced a partnership to develop sensors, control units, and parking solutions, including “parking assist” features and higher autonomy for vehicles.

- In February 2023, BMW and Valeo signed a strategic cooperation agreement to co-develop next-generation Level 4 automated parking and valet systems, which will offer fully automated parking solutions.

- In November 2022, Bosch and Mercedes-Benz Group AG received regulatory approval in Germany for their Level 4 driverless parking system, which was implemented at Stuttgart Airport, providing a commercial solution for autonomous parking in a designated garage

Report Coverage

The research report offers an in-depth analysis based on Component, Automation Level, Vehicle, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Autonomous parking will become a standard feature in premium and mid-range vehicles.

- AI-based mapping and object detection will improve accuracy in congested areas.

- Automakers will increase investment in Level 4 systems for self-parking without driver input.

- Cloud connectivity will enable remote parking management and vehicle retrieval through mobile apps.

- Robotic parking facilities will expand in airports, malls, and residential towers.

- Over-the-air software updates will enhance system performance without hardware changes.

- Integration with electric vehicles will support automated parking and charging alignment.

- Subscription-based parking services will create new revenue opportunities for OEMs.

- Partnerships between automakers and infrastructure providers will accelerate smart parking deployment.

- Declining sensor costs will support wider adoption in mass-market vehicles.