Market Overview

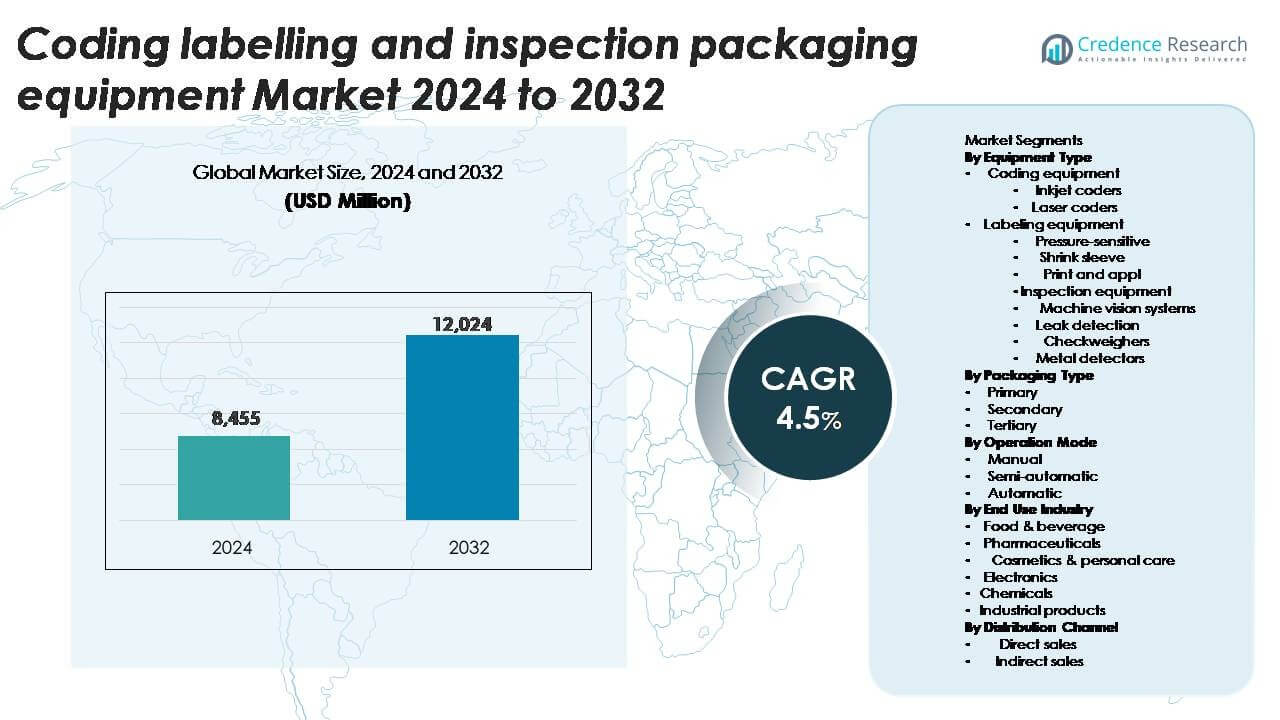

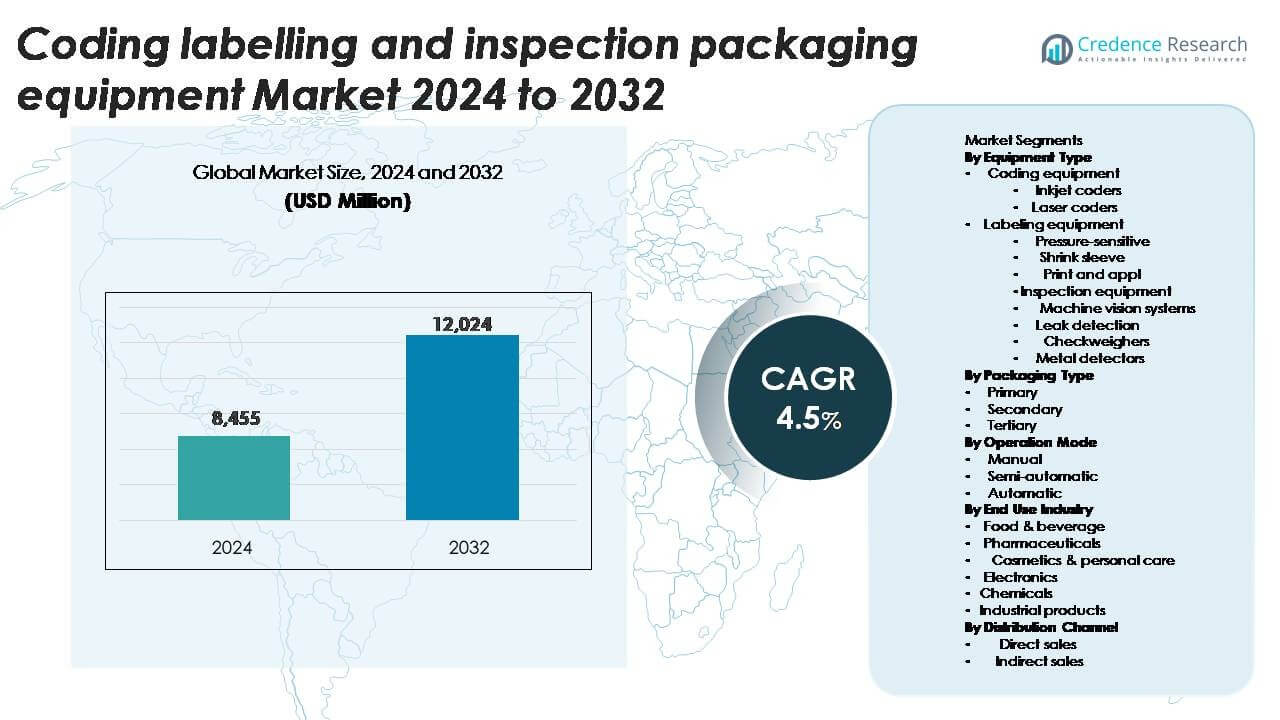

The Coding, Labelling, and Inspection Packaging Equipment market was valued at USD 8,445 million in 2024. It is expected to reach USD 12,024 million by 2032, growing at a CAGR of 4.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Coding, Labelling, and Inspection Packaging Equipment Market Size 2024 |

USD 8,445 million |

| Coding, Labelling, and Inspection Packaging Equipment Market, CAGR |

4.5% |

| Coding, Labelling, and Inspection Packaging Equipment Market Size 2032 |

USD 12,024 million |

The leading companies in the coding, labelling and inspection packaging equipment market include Videojet Technologies (part of Danaher Corporation), Markem‑Imaje Corporation (under Dover Corporation) and Domino Printing Sciences (a subsidiary of Brother Industries). Videojet holds approximately 20% of the global market, driven by its strong presence in food, beverage and pharmaceutical end‑use categories. Markem‑Imaje and Domino together account for nearly 30% of market share thanks to their advanced laser marking and high‑resolution coding technologies. Regionally, North America and Europe lead the market with shares around 29% and 27% respectively, bolstered by strict regulatory compliance and advanced manufacturing capacities.

Market Insights

- The coding, labelling, and inspection packaging equipment market was valued at USD 8,445 million in 2024 and is set to reach USD 12,024 million by 2032 at a CAGR of 4.5%.

- Automation remains the main market driver, supported by demand for high-speed production and accurate coding across food, pharmaceutical, and e-commerce supply chains.

- Asia Pacific leads global trends with a 35% share, driven by industrialisation and rising packaged goods demand, while smart and IoT-enabled systems gain rapid traction.

- Market restraints include high capital investment, equipment integration complexity, and the need for trained technical staff despite strong competition among Videojet, Markem-Imaje, and Domino, which together control nearly 50% of global share.

- Asia Pacific holds 35% of regional share, followed by Europe at 25% and North America at 21%, while coding equipment leads by segment with 38% share and primary packaging holds 45%, supported by strict traceability and compliance needs across key industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Equipment Type

The coding, labelling, and inspection packaging equipment market is dominated by coding equipment, which held the largest share of 38% in 2024. Inkjet coders lead within this sub-segment due to their high-speed printing, flexibility across packaging types, and low maintenance requirements. Laser coders are gaining traction for permanent, high-precision marking. Growth in e-commerce, strict traceability regulations, and rising demand for serialized pharmaceutical and food products drive adoption. Labeling and inspection equipment also grow steadily, supported by increasing quality assurance requirements and automation trends in packaging lines across food, beverage, and pharmaceutical industries.

- For instance, Domino’s Ax-Series continuous inkjet printer offers models that deliver fast print speeds, with some capable of reaching up to 9,000 millimeters per second (9 meters per second), and can operate with drop sizes as small as 40 micrometers (40µm), enabling clear codes on glass, metal, film, and flexible plastics.

By Packaging Type

Primary packaging dominates the market with a 45% share, driven by the need for direct product protection and regulatory compliance. Secondary packaging, including cartons and sleeves, follows due to its role in branding and bulk handling efficiency. Tertiary packaging supports logistics and transportation needs but contributes a smaller share. Growth in food, pharmaceutical, and cosmetic sectors propels demand for robust primary packaging equipment. Increasing consumer preference for tamper-evident and traceable packaging further drives investment in automated coding and labeling solutions, ensuring product safety and supply chain integrity.

- For instance, the Videojet 1880 continuous inkjet printer integrates smart sensors that detect nozzle buildup and can restore optimal print quality in under 90 seconds(or with a push of a button for the auto-rinse feature), ensuring uninterrupted coding for primary packaging applications.

By Operation Mode

Automatic equipment leads the market with a 42% share, favored for high-volume production lines requiring efficiency, accuracy, and minimal labor. Semi-automatic machines are chosen by mid-sized operations for flexibility and moderate throughput, while manual equipment remains relevant for small-scale or niche production. Rising labor costs, demand for consistent coding and inspection accuracy, and industry focus on minimizing human error fuel adoption of automated systems. Companies increasingly integrate IoT-enabled monitoring and machine vision technologies to enhance productivity and compliance across food, pharmaceutical, and electronics packaging segments.

Key Growth Drivers

Rising Demand for Automation Across Packaging Lines

Automation is a primary driver for the coding, labelling, and inspection packaging equipment market, as manufacturers seek higher efficiency, speed, and accuracy in operations. Automated systems reduce human error, improve product traceability, and enhance quality control across food, pharmaceutical, and cosmetic production lines. High-speed production and growing e-commerce fulfillment demands further encourage automation adoption. Companies increasingly integrate machine vision systems, checkweighers, and leak detection technologies to ensure compliance with stringent regulations and maintain brand integrity. Rising labor costs also make automated solutions economically attractive, while technological advancements in robotics and smart sensors allow seamless integration into existing packaging lines. These factors collectively accelerate investment in automatic coding, labeling, and inspection solutions, positioning automation as a core growth engine in the market.

- For instance, the Cognex’s In-Sight 3800 vision system has a maximum frame rate of 125 frames per second (fps) at full resolution and the product line supports resolutions up to 5-megapixels (or higher with the Line Scan models), enabling high-speed defect detection and code verification on fast-moving packaging lines.

Regulatory Compliance and Product Traceability Requirements

Strict regulatory standards across pharmaceuticals, food, and beverage sectors are driving market growth. Governments mandate accurate coding and labeling for product identification, batch tracking, and expiration monitoring, ensuring consumer safety and legal compliance. Inspection equipment, such as metal detectors and machine vision systems, supports adherence to hygiene and quality norms, reducing product recalls and liability risks. The increasing prevalence of serialization requirements, particularly in pharmaceuticals, compels manufacturers to invest in advanced coding and labeling systems. Traceability solutions also enhance supply chain visibility and facilitate recall management. Regulatory pressures combined with rising consumer awareness about product authenticity and safety motivate companies to upgrade their packaging lines, making compliance a key growth driver in the coding, labeling, and inspection equipment market.

- For instance, METTLER-TOLEDO’s Profile Advantage metal detector uses dual-frequency technology and detects stainless steel contaminants as small as 0.3 millimeters in packaged foods, meeting global HACCP and FDA compliance standards.

Expansion of Food, Pharmaceutical, and E-commerce Sectors

arket expansion in food, pharmaceuticals, and e-commerce sectors is boosting demand for coding, labeling, and inspection equipment. Rapid urbanization, rising disposable incomes, and growing health-conscious consumer behavior increase packaged food and beverage consumption. The pharmaceutical industry’s focus on patient safety, serialization, and tamper-evident packaging drives investment in labeling and inspection technologies. E-commerce growth necessitates efficient secondary and tertiary packaging solutions with precise labeling for logistics and delivery tracking. These sectors require high-speed, reliable equipment capable of handling diverse product formats, from liquids to powders and fragile items. Manufacturers prioritize solutions that combine coding, labeling, and inspection functionalities, enabling streamlined operations and reduced downtime. Continuous sectoral growth across geographies reinforces the market’s expansion trajectory, making it a critical driver for the industry.

Key Trends & Opportunities

Integration of Smart and IoT-Enabled Packaging Equipment

The adoption of IoT-enabled coding, labeling, and inspection equipment is reshaping market dynamics. Smart devices offer real-time monitoring, predictive maintenance, and data-driven insights, improving operational efficiency and reducing downtime. Machine vision integration allows detailed inspection, defect detection, and quality assurance, aligning with Industry 4.0 practices. Cloud connectivity enables remote management of multiple production lines, enhancing scalability for multinational operations. Demand for traceability and transparency in food, pharmaceuticals, and cosmetics fuels these innovations, allowing manufacturers to meet regulatory and consumer expectations. This trend opens opportunities for equipment vendors to provide value-added solutions, including predictive analytics, remote troubleshooting, and automated compliance reporting, thereby enhancing equipment ROI and customer satisfaction.

- For instance, Domino’s R-Series vision inspection system integrates with IoT platforms and performs print code validation at line speeds up to 1,000 items per minute, using 8-megapixel sensors to detect print defects and missing labels.

Rising Focus on Sustainable and Eco-Friendly Packaging

Sustainability is emerging as a key trend driving adoption of advanced labeling and inspection equipment. Manufacturers are increasingly using eco-friendly packaging materials that require precise coding and labeling to communicate recyclability, organic certification, and reduced carbon footprint. Inspection systems ensure packaging integrity while minimizing waste and material loss. Regulatory emphasis on sustainable packaging in Europe and North America further accelerates market demand. Vendors offering equipment compatible with biodegradable, recyclable, and lightweight packaging formats gain a competitive advantage. The trend toward environmentally responsible production encourages investment in versatile, energy-efficient machinery that supports both regulatory compliance and consumer preference, creating significant growth opportunities in sustainable packaging segments.

- For instance, Markem-Imaje’s SmartLase C600 laser coder operates with a 60-watt CO₂ laser and produces high-resolution codes on compostable and biodegradable films without requiring ink or consumables, reducing material waste while maintaining code clarity.

Key Challenges

High Capital Investment and Operational Costs

One of the primary challenges in the coding, labeling, and inspection equipment market is the significant capital expenditure required for automated systems. High initial costs, along with maintenance and operational expenses, can deter small and medium-sized manufacturers from adopting advanced equipment. Integration with existing production lines may require additional investment in training, software, and infrastructure upgrades. Rapid technological advancements can also render older systems obsolete, increasing replacement costs. Companies must balance ROI expectations with compliance, efficiency, and production speed requirements. High cost barriers can slow adoption rates, particularly in emerging economies, posing a challenge for market growth despite increasing demand for automation and regulatory compliance.

Complexity of Equipment Integration and Technical Expertise Requirement

Integrating coding, labeling, and inspection systems into existing production lines requires specialized technical expertise. Complex machinery, software configurations, and calibration of inspection systems demand skilled operators and maintenance personnel. Lack of trained workforce can lead to operational inefficiencies, downtime, and reduced equipment performance. Additionally, compatibility issues between equipment from different vendors can complicate integration, slowing deployment and increasing support costs. Manufacturers face challenges in aligning production line speed, product variety, and quality standards with sophisticated equipment. The need for technical know-how, coupled with rapid advancements in automation and IoT-enabled devices, presents a critical barrier to seamless market adoption.

Regional Analysis

North America

In 2024, the North American region captured a dominant share of approximately 21% of the global market for coding, labelling and inspection packaging equipment. Strong regulatory requirements for product traceability, especially in pharmaceuticals and food & beverage, drive demand for advanced inspection and labelling solutions. The U.S., representing about 64% of the regional demand, leads with investments in high‑speed automation and machine‑vision systems. Manufacturing excellence, an integrated supply chain, and growing e‑commerce logistics further support growth in this region.

Europe

Europe held roughly 25% of the global market share for the coding, labelling and inspection packaging equipment sector in 2024. The region’s mature manufacturing base, especially in Germany, the U.K., and France, places strong emphasis on equipment capable of meeting quality, sustainability and automation benchmarks. Stringent packaging, labelling and anti‑counterfeit regulations across the region drive adoption of both labelling and inspection systems. Additionally, growing demand for smart packaging and Industry 4.0‑ready lines underpin Europe’s steady share in the market.

Asia Pacific

The Asia Pacific region accounted for approximately 35% of the global market for coding, labelling and inspection packaging equipment in 2024. Rapid industrialisation, rising consumption of packaged food & beverages, and expanding e‑commerce networks in countries such as China and India fuel growth. The region’s manufacturing shift toward automation and the increasing requirement for traceability in pharmaceuticals boost demand for coding and inspection systems. This dynamic environment positions Asia Pacific as the fastest‑growing region in the forecast period.

Latin America

Latin America held around 7% of the global market for coding, labelling and inspection packaging equipment in 2024. Growth is supported by manufacturing expansion in Brazil and Mexico, increasing packaged goods consumption, and rising logistics investment. However, slower automation uptake and cost sensitivity among smaller manufacturers moderate the region’s share. Firms targeting Latin America often focus on cost‑effective systems and retrofit solutions to meet local demand for labelling and inspection capabilities.

Middle East & Africa (MEA)

The Middle East & Africa region captured approximately 12% of the global market for coding, labelling and inspection packaging equipment in 2024. The region’s growth is driven by increased investment in food & beverage processing, pharmaceuticals, and logistical infrastructure in Gulf Cooperation Council (GCC) countries. Nonetheless, fragmented regulatory frameworks and lower adoption of fully automated systems compared to developed markets restrict share expansion. Opportunities exist for mid‑range equipment models tailored to regional manufacturing and quality‑control needs.

Market Segmentations:

By Equipment Type

- Coding equipment

- Inkjet coders

- Laser coders

-

- Pressure-sensitive

- Shrink sleeve

- Print and apply

- Others

- Inspection equipment

- Machine vision systems

- Leak detection

- Checkweighers

- Metal detectors

By Packaging Type

- Primary

- Secondary

- Tertiary

By Operation Mode

- Manual

- Semi-automatic

- Automatic

By End Use Industry

- Food & beverage

- Pharmaceuticals

- Cosmetics & personal care

- Electronics

- Chemicals

- Industrial products

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the global coding, labelling and inspection packaging equipment market features a blend of established global players and niche specialists. Key companies such as Videojet Technologies, Domino Printing Sciences, Markem‑Imaje and Körber AG compete by leveraging their broad geographical footprints, strong service networks and integrated technology solutions. These firms invest heavily in R&D to introduce IoT‑enabled systems, machine vision inspection and high‑speed coding/printing modules, enhancing their value proposition. Strategic moves such as partnerships, acquisitions and modular product launches enable these players to extend their reach into emerging markets and cater to vertical‑specific requirements. Meanwhile, mid‑sized and regional manufacturers focus on cost‑effective solutions tailored for small and medium production lines, creating a tiered competitive dynamic across global and localized markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Leibinger

- HERMA

- Marchesini Group

- CVC Technologies

- Accutek Packaging Equipment

- Markem‑Imaje

- Domino

- GEA

- Hitachi IESA

- Körber AG

Recent Developments

- In September 2024, Herma and Norwalt launched 211RHC labeling cell, that features fully integrated servo gripper and performs up to 25 percent faster than comparable semi-automatic machines.

- In July 2024, Videojet unveiled 9560 print and apply labeler featuring increased processing speeds and expanded connectivity options. The system operates by printing and applying labels onto the top or side of a passing pack without the need for a tamp or air blast applicator.

- In August 2023, Linx launched a simple-to-install laser coder, that features a 30W CO2 laser with an IP54 rated stainless steel and anodized aluminum enclosure, protecting it from water splashes.

Report Coverage

The research report offers an in-depth analysis based on Equipment type, Packaging type, Operation mode, End use industry, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with stronger automation adoption, as more manufacturers deploy automatic coding, labelling and inspection systems to boost throughput.

- A rise in IoT‑enabled and machine‑vision inspection equipment will enable real‑time monitoring, predictive maintenance and deeper integration across packaging lines.

- Increasing regulatory requirements for traceability, anti‑counterfeiting and labelling accuracy will drive demand for advanced coding and inspection solutions across food, pharma and consumer goods sectors.

- Growth in e‑commerce and logistics will elevate demand for packaging lines that support secondary and tertiary packaging with precise labelling and inspection capabilities.

- Sustainability initiatives will push adoption of equipment compatible with eco‑friendly packaging materials, and demand for lighter, energy‑efficient labelling and inspection machines will rise.

- Expansion in emerging regions—such as Asia Pacific and Latin America—will open new opportunities as manufacturers upgrade legacy equipment and adopt modern solutions.

- Modular and flexible equipment designs that support rapid changeovers for diverse packaging formats will become a competitive necessity for OEMs and end‑users alike.

- Service‑based business models—such as equipment‑as‑a‑service and remote monitoring subscriptions—will gain traction, enabling lower upfront costs and enhanced lifecycle support.

- The cost of advanced systems and complexity of integration will remain important considerations, driving demand for mid‑tier solutions that balance price and performance.

- Vendors that offer end‑to‑end solutions—coding, labelling and inspection in one platform—will secure larger market share by simplifying integration and reducing supplier complexity.