Market Overview:

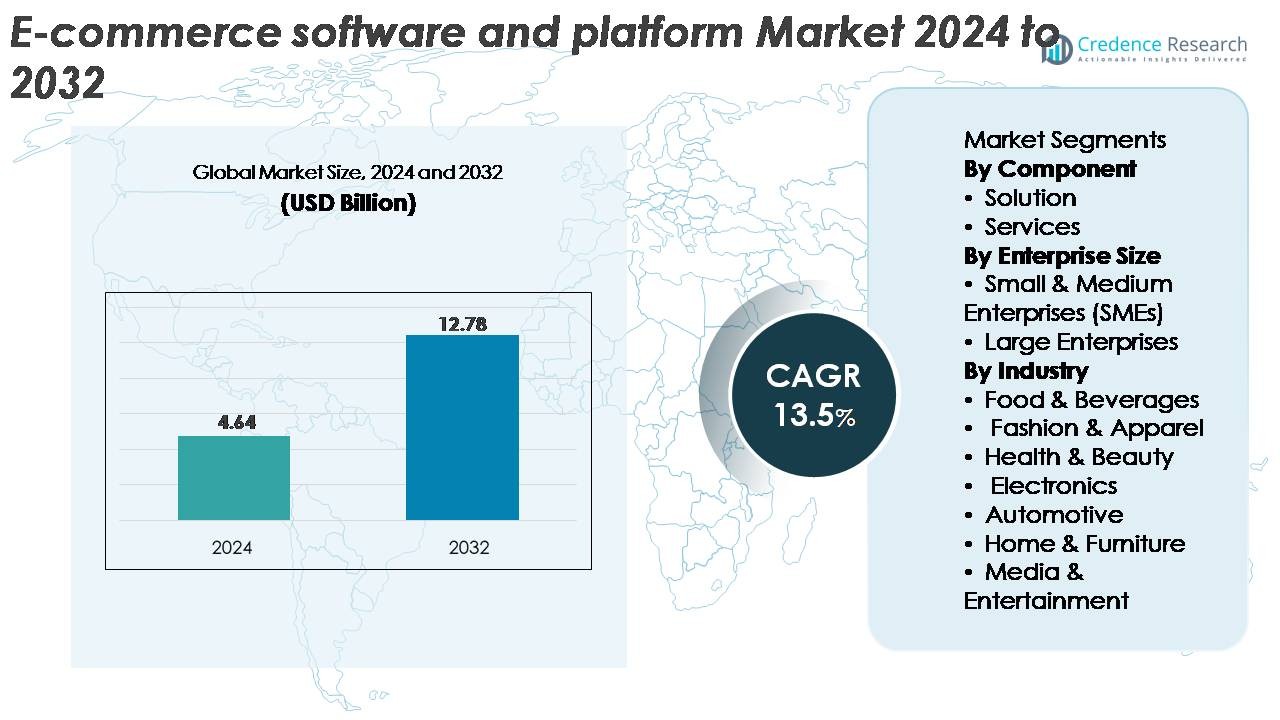

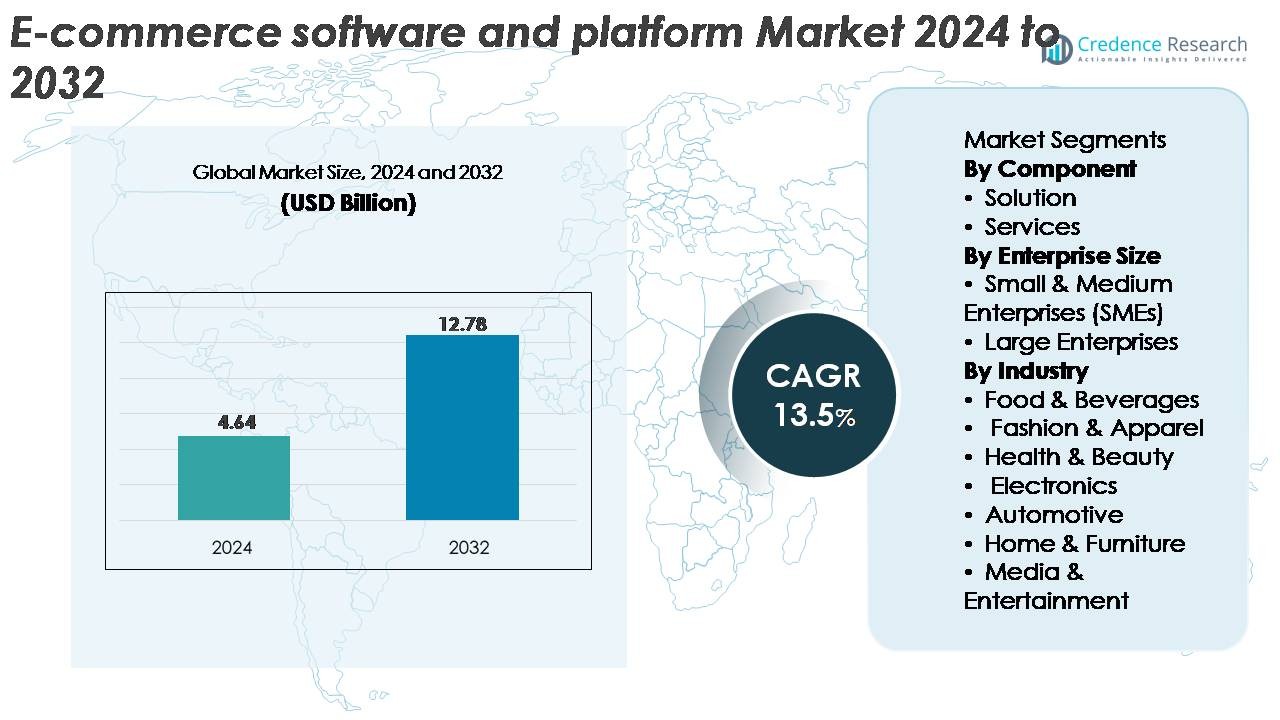

The global e commerce software and platform market was valued at USD 4.64 billion in 2024 and is projected to reach USD 12.78 billion by 2032, reflecting a robust CAGR of 13.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| E-Commerce Software And Platform Market Size 2024 |

USD 4.64 Billion |

| E-Commerce Software And Platform Market, CAGR |

13.5% |

| E-Commerce Software And Platform Market Size 2032 |

USD 12.78 Billion |

The e commerce software and platform market is shaped by leading providers such as Shopify Inc., BigCommerce, WooCommerce, Adobe (Magento), Nuvemshop, Salesforce.com, Inc., Oracle Corporation, SAP, Wix.com, Inc., and MATRIXX Software, each offering scalable solutions tailored for diverse retail and B2B environments. These players compete through innovations in headless commerce, AI driven personalization, secure checkout capabilities, and omnichannel integrations. North America remains the dominant region, accounting for approximately 36% of global market share, driven by its advanced digital retail ecosystem and strong enterprise adoption of cloud based commerce platforms. With increasing investments in automation, analytics, and cross border commerce capabilities, top vendors continue to expand their reach across Europe and Asia Pacific while strengthening their competitive position globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global e commerce software and platform market was valued at USD 4.64 billion in 2024 and is projected to reach USD 12.78 billion by 2032, expanding at a CAGR of 13.5% during the forecast period.

- Strong market drivers include rapid digital commerce adoption, rising omnichannel retail strategies, and increased automation across checkout, inventory, and personalization workflows. SMEs accelerate platform demand as cloud native, subscription based models reduce deployment complexity.

- Key trends include the rise of headless commerce, API first architectures, social commerce integration, and AI enhanced merchandising. Growing investment in cross border e commerce and creator led selling further shapes platform evolution.

- Competition intensifies as players such as Shopify, WooCommerce, Adobe (Magento), SAP, Oracle, BigCommerce, Wix, and Salesforce strengthen capabilities in scalability, multichannel orchestration, security, and analytics. Solution components lead with the highest share, driven by demand for integrated storefront and backend automation tools.

- Regionally, North America holds 36%, followed by Europe at 28% and Asia Pacific at 26%, while the fashion & apparel industry represents the dominant end use segment with the highest adoption rate.

Market Segmentation Analysis:

By Component

The solution segment dominates the e commerce software and platform market, holding the largest share due to strong adoption of integrated storefront management, checkout optimization, inventory control, and multichannel retail suites. Businesses increasingly prefer end to end e commerce platforms that reduce infrastructure complexity and accelerate online store deployment. Advanced capabilities such as real time analytics, automated catalog updates, AI driven personalization, and seamless payment integration further strengthen demand. While services continue to grow with rising needs for implementation, support, and managed operations, solutions remain the primary growth engine as enterprises prioritize scalability and automation driven digital commerce ecosystems.

- For instance, Shopify’s platform handles peak sales that reached a record high $5.1 million per minute during the 2025 Black Friday Cyber Monday period, and Adobe Commerce uses high throughput features like AsyncOrder to support workloads exceeding 200,000 orders per hour during flash sales, demonstrating the high capacity, automation rich infrastructure that enterprise buyers seek in leading e commerce solutions.

By Enterprise Size

Large enterprises lead the market, accounting for the highest share owing to their substantial investment capacity, advanced omnichannel strategies, and the need to support high traffic digital storefronts across multiple geographies. These companies rely on robust platforms that enable enterprise grade security, complex integrations, and high volume order processing. The segment benefits from accelerated digital transformation in retail, consumer goods, and B2B commerce. Meanwhile, SMEs exhibit strong growth momentum driven by affordable cloud native platforms, subscription based pricing, and no code tools. However, large enterprises maintain dominance due to their broader operational scale and emphasis on automation and customer experience optimization.

- For instance, Salesforce Commerce Cloudand SAP Commerce Cloud are both robust, enterprise grade e commerce platforms designed to support the significant operational scale required by global enterprises, including high volume transaction processing and extensive product catalogs.

By Industry

The fashion & apparel segment emerges as the dominant industry, capturing the largest market share due to high online shopping frequency, fast moving inventory cycles, and strong adoption of digital cataloging, virtual try on tools, and AI driven recommendation engines. E commerce platforms in this sector support extensive product variations, rapid seasonal updates, and influencer led marketing strategies. Food & beverages, electronics, and health & beauty continue to expand rapidly as consumers shift toward online purchasing. However, fashion & apparel retains leadership by leveraging dynamic merchandising, mobile first shopping experiences, and high customer engagement across global e commerce channels.

Key Growth Drivers:

Rapid Digital Commerce Expansion Across Retail and B2B

The global shift toward online purchasing continues to fuel strong demand for advanced e commerce platforms. Retailers and B2B enterprises are accelerating digital transformation initiatives to increase market reach, streamline sales processes, and reduce reliance on physical infrastructure. Modern platforms support high traffic environments, personalized shopping experiences, and omnichannel fulfillment models now considered essential for maintaining competitive advantage. Features such as automated catalog management, integrated payment gateways, and real time analytics further enhance operational efficiency. Growth is also reinforced by rising smartphone penetration, improved broadband access, and increased consumer preference for digital checkout experiences. As organizations move from legacy systems to cloud based architectures, scalable and customizable e commerce platforms remain central to improving conversion rates and supporting long term digital commerce strategies.

· For instance, Alibaba’s retail ecosystem handled more than 1.8 billion orders in a single 24 hour period during its peak shopping festival, showcasing the scale and performance expectations shaping modern retail and B2B commerce platforms.

Rising Demand for Omnichannel Commerce and Unified Customer Experiences

Omnichannel retail adoption is a major driver shaping the e commerce platform landscape, as businesses increasingly aim to unify their online and offline touchpoints. Consumers expect seamless transitions between web stores, mobile apps, social channels, and physical stores, prompting retailers to deploy platforms capable of integrating inventory, logistics, and customer data across all channels. Real time syncing of product availability, consistent pricing, and centralized order management significantly improve customer satisfaction and reduce operational bottlenecks. The rise of buy online pickup in store (BOPIS), same day delivery models, and subscription commerce further strengthens the need for flexible software ecosystems. Platforms offering AI based personalization, loyalty program management, and advanced CRM tools enable richer engagement, supporting higher retention rates and revenue growth.

- For instance, Walmart leverages its approximately 4,700 U.S. store locations as local fulfillment hubs to handle a massive volume of e commerce orders, demonstrating the level of synchronization and unified commerce capability that modern e commerce platforms must support”.

Accelerating Adoption of AI, Automation, and Data Driven Commerce

E commerce software increasingly incorporates AI and automation to optimize merchandising, pricing, inventory forecasting, and customer engagement. Retailers use machine learning algorithms to analyze behavioral patterns, automate product recommendations, and refine targeted campaigns. Automated chatbots and virtual assistants improve service responsiveness and reduce support costs. Meanwhile, predictive analytics enhances supply chain visibility and ensures better stock allocation across warehouses. Fraud detection, automated returns processing, and dynamic pricing engines further improve platform efficiency. As businesses prioritize accuracy, speed, and personalization, AI driven commerce capabilities enable higher operational agility and improve conversion performance. This technological evolution strengthens the demand for platforms with integrated automation frameworks and scalable AI modules.

Key Trends and Opportunities:

Expansion of Headless Commerce and API First Architecture

Headless commerce is emerging as a transformative trend, enabling brands to decouple front end experiences from back end systems. This architecture allows businesses to deploy highly customized user interfaces across multiple channels websites, mobile apps, IoT devices, kiosks, and emerging digital touchpoints. API first platforms accelerate development cycles, reduce time to market, and support advanced personalization. Retailers benefit from the agility to run A/B testing, integrate new UX features, and adopt new devices or channels without modifying core commerce logic. As experiential commerce grows, headless solutions provide unmatched flexibility for delivering immersive shopping environments, improving customer satisfaction and supporting rapid business scaling.

- For instance, commercetools, a leading headless commerce provider, has reported that its platform processes over 500 million orders annually, demonstrating the massive computational capacity and real-time responsiveness required to support enterprise-grade, API-driven digital commerce architectures.

Growth of Social Commerce and Creator Led Digital Selling

Social commerce continues to expand as consumers increasingly discover and purchase products through integrated shopping tools on platforms like Instagram, TikTok, and YouTube. E commerce software vendors are building native connectors that enable real time catalog sync, shoppable videos, influencer storefronts, and automated order routing from social channels. The rise of creator led commerce significantly boosts engagement and conversion rates, particularly in beauty, fashion, and lifestyle categories. Platforms integrating social analytics, audience targeting, and performance tracking position retailers to capitalize on this growing revenue stream. As younger consumers gravitate toward social first shopping, businesses leveraging these tools gain strong visibility and competitive advantage.

- For instance, TikTok’s global user base generates more than 30 billion monthly video views on commerce tagged content, and Shopify’s TikTok Shopping integration supports syncing catalogs with up to 20,000 product SKUs per merchant, enabling scalable creator driven product discovery and in app purchasing.

Rising Opportunity in Cross Border E commerce Enablement

Global e commerce expansion is creating new opportunities for platforms supporting cross border trade, localized payments, and multi-currency pricing. Retailers increasingly target international markets to diversify revenue streams, reduce dependency on domestic demand, and reach digitally savvy consumers worldwide. E commerce software vendors are integrating tools for automated tax handling, customs documentation, regional language support, and localized marketing. Enhanced logistics networks and international fulfillment partnerships further simplify delivery. As brands aim for global scale, platforms offering seamless localization, global checkout flows, and regulatory compliance capabilities become strategic enablers of cross border growth.

Key Challenges:

Increasing Cybersecurity Threats and Data Protection Pressures

The rapid expansion of e commerce has heightened concerns around cybersecurity, fraud, and customer data protection. Platforms handling high transaction volumes remain prime targets for phishing attacks, credential theft, and payment fraud. Businesses must implement strong authentication mechanisms, encryption standards, and real time fraud detection tools to mitigate risks. Compliance with evolving data protection regulations including GDPR, CCPA, and cross border data transfer rules adds further complexity. Even minor security lapses can lead to reputational damage and service disruptions. As threats become more sophisticated, e commerce vendors face growing pressure to invest in robust security infrastructures and continuous monitoring frameworks.

Integration Complexity with Legacy Systems and Diverse Technology Stacks

Many enterprises struggle to integrate modern e commerce platforms with their existing ERP, CRM, warehouse management, and financial systems. Legacy infrastructure often lacks API compatibility, causing delays, increased costs, and operational inefficiencies. Businesses face challenges in synchronizing inventory, customer data, pricing rules, and order workflows across multiple systems. Migrating from outdated platforms to cloud native architectures also requires specialized resources and careful planning to minimize downtime. As organizations adopt more digital tools, integration challenges become a critical barrier to scaling e commerce operations. Vendors must therefore provide flexible integration solutions, middleware tools, and strong technical support to ensure seamless adoption.

Regional Analysis:

North America

North America holds the largest share of the e commerce software and platform market at approximately 36%, driven by the strong digital maturity of retailers, high adoption of omnichannel commerce, and extensive penetration of subscription based SaaS platforms. The U.S. leads regional growth, supported by advanced logistics networks, high consumer spending, and early implementation of AI driven personalization tools. Major platform providers continue expanding API first, cloud native architectures that appeal to enterprise and mid-market retailers. Canada contributes steadily, supported by rising cross border commerce and strong uptake of mobile first shopping solutions across key retail verticals.

Europe

Europe accounts for around 28% of the global market, supported by robust adoption of digital commerce solutions across Germany, the U.K., France, and the Nordics. Retailers increasingly prioritize GDPR compliant platforms, localized content delivery, and multichannel integrations to meet evolving consumer expectations. The region benefits from strong uptake in fashion, home goods, and specialty retail, where e commerce platforms enable dynamic merchandising and seamless payment experiences. Rapid penetration of headless commerce and marketplace integrations also accelerates adoption. Eastern Europe shows rising interest as SMEs shift from legacy systems to flexible, cloud based platforms with lower operating costs.

Asia Pacific

Asia Pacific represents the fastest growing region and holds approximately 26% market share, driven by rapid digitalization, mobile first consumer behavior, and expanding online marketplaces. China, India, Japan, and Southeast Asia lead adoption as retailers upgrade to scalable platforms capable of handling high transaction volumes and festival driven surges. Cross border commerce, social commerce, and influencer driven retail ecosystems strengthen platform demand. Local payment integrations, multilingual interfaces, and hyperlocal logistics solutions further accelerate deployment. Strong venture capital investments in digital commerce startups continue to expand the region’s competitive landscape, making APAC a dominant contributor to long term market expansion.

Latin America

Latin America holds roughly 6% of the global market, supported by rising e commerce activity in Brazil, Mexico, Chile, and Colombia. Businesses actively adopt cloud based commerce platforms to overcome infrastructure limitations, enhance store performance, and improve checkout reliability. Growth is fueled by wider smartphone penetration, regional fintech expansion, and increasing preference for digital wallets. Retailers prioritize platforms capable of managing localized taxes, multi-currency pricing, and marketplace integrations. While market fragmentation and logistics constraints persist, improving broadband access and new last mile delivery solutions support continued platform adoption among SMEs and mid-tier enterprises.

Middle East & Africa

The Middle East & Africa region accounts for approximately 4% market share, with adoption concentrated in the UAE, Saudi Arabia, South Africa, and Egypt. Expanding digital infrastructure, supportive government e commerce initiatives, and growth of online fashion, electronics, and grocery sectors are key contributors. Retailers increasingly invest in omnichannel platforms to enhance payment flexibility, mobile first browsing, and Arabic language content delivery. Gulf markets benefit from strong consumer spending and accelerated implementation of AI enabled commerce experiences. In Africa, growth is driven by mobile commerce, emerging fintech ecosystems, and improved access to cloud based retail solutions among fast growing SMEs.

Market Segmentations:

By Component

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry

- Food & Beverages

- Fashion & Apparel

- Health & Beauty

- Electronics

- Automotive

- Home & Furniture

- Media & Entertainment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The e commerce software and platform market features a competitive and innovation driven landscape dominated by global players offering scalable, cloud native, and API first commerce solutions. Leading vendors focus on enhancing omnichannel orchestration, AI driven personalization, and seamless integrations with payment, logistics, and marketing systems. Companies increasingly differentiate through modular architectures, headless commerce capabilities, and enterprise grade security frameworks. Established providers continue to expand their portfolios through strategic partnerships, marketplace integrations, and acquisition of niche technology firms specializing in automation, analytics, and customer experience optimization. Meanwhile, emerging SaaS innovators target SMEs with low code store builders, subscription based pricing, and rapid deployment tools. Competition intensifies as vendors enhance social commerce connectors, multi-currency checkout systems, and cross border enablement features. Overall, the market remains dynamic, with product innovation and service flexibility serving as key competitive levers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- com, Inc.

- Adobe (Magento)

- SAP

- BigCommerce

- Shopify Inc.

- Oracle Corporation

- WooCommerce

- com, Inc.

- Nuvemshop

- MATRIXX Software

Recent Developments:

- In December 2023,Nuvemshop acquired Perfit, an Argentinian startup focused on marketing automation, Perfit offers an AI powered platform that manages and stores customer data and automates email marketing. This will enable company to expand its offering for ecommerce companies and increase its net sales.

- In October 2025, Wix formed a strategic partnership with PayPal to enable AI powered product discovery and agentic commerce, allowing Wix merchants to sync their product catalogs for AI driven shopping and checkout experiences.

- In June 2025, Adobe launched two major offerings: “Adobe Commerce as a Cloud Service” and “Adobe Commerce Optimizer,” designed to boost performance, scalability, and integration flexibility for enterprise customers.

Report Coverage:

The research report offers an in depth analysis based on Component, Enterprise, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market will experience strong adoption of AI driven personalization, predictive analytics, and automated merchandising across all enterprise sizes.

- Headless and composable commerce architectures will become standard as brands seek greater flexibility in designing multichannel experiences.

- Social commerce and creator led selling will expand, pushing platforms to develop deeper integrations with major social networks.

- Cross border e commerce will accelerate as retailers leverage multi currency, multilingual, and localized checkout capabilities to reach global audiences.

- Cloud native platforms will dominate as businesses prioritize scalability, uptime reliability, and faster deployment cycles.

- Omnichannel fulfillment models such as BOPIS, same day delivery, and ship from store will drive demand for unified inventory and order management solutions.

- Cybersecurity investment will intensify as vendors strengthen fraud detection, data encryption, and compliance frameworks.

- SMEs will increasingly adopt low code and no code platforms to shorten store launch times and reduce technical complexity.

- Mobile first commerce strategies will expand, driven by rising smartphone usage and improved app based shopping experiences.

- Competitive dynamics will sharpen as established players acquire niche solutions in analytics, automation, and payment orchestration to expand market reach.