Market Overview:

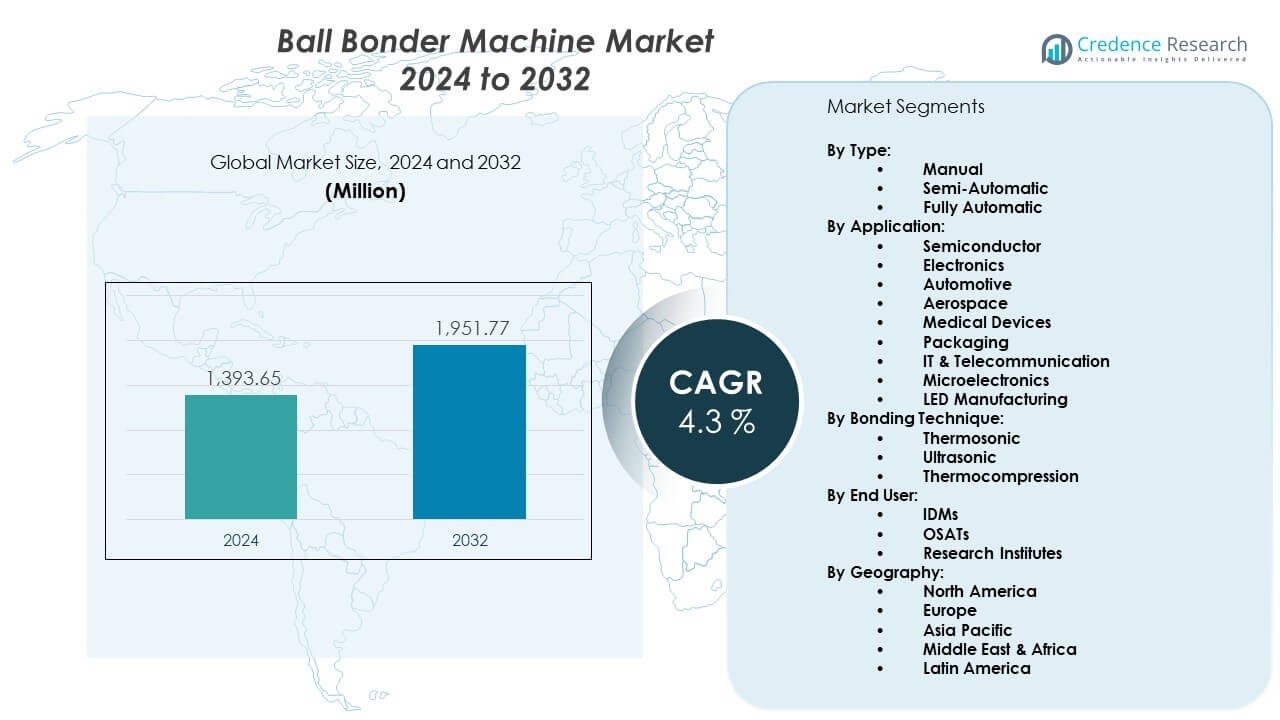

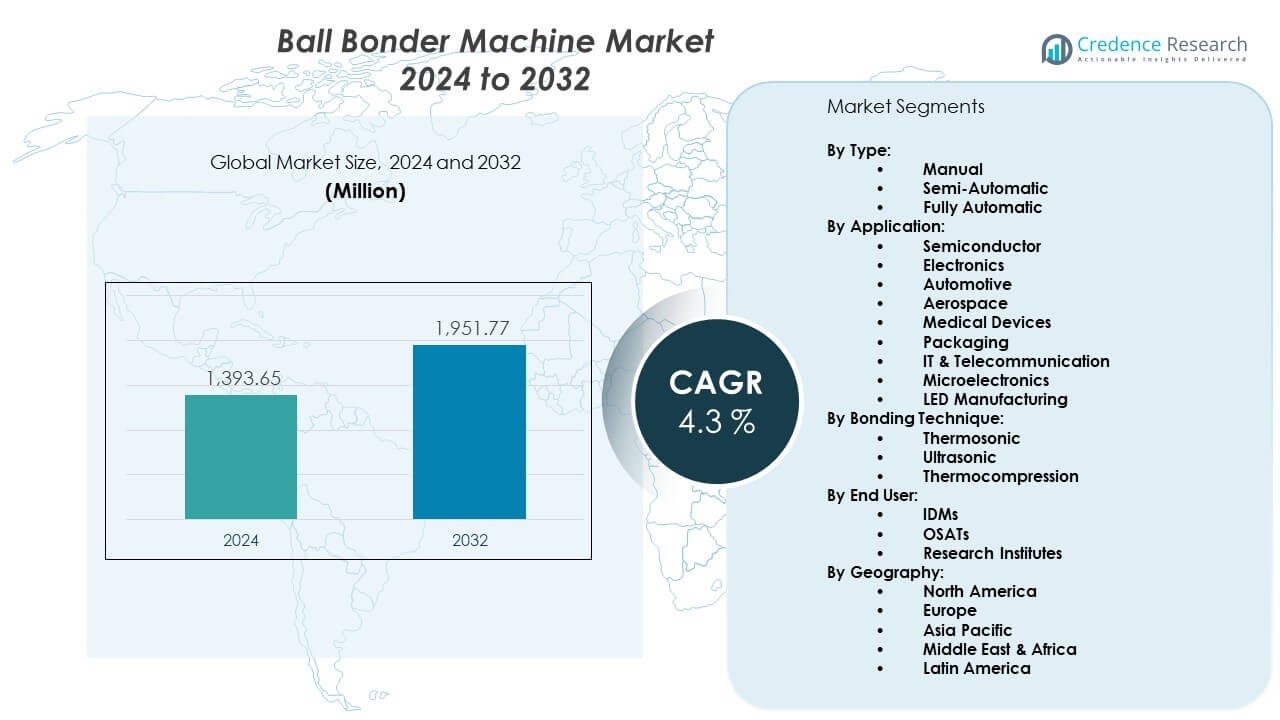

The Ball Bonder Machine Market is projected to grow from USD 1,393.65 million in 2024 to an estimated USD 1,951.77 million by 2032, with a compound annual growth rate (CAGR) of 4.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ball Bonder Machine Market Size 2024 |

USD 1,393.65 Million |

| Ball Bonder Machine Market, CAGR |

4.3% |

| Ball Bonder Machine Market Size 2032 |

USD 1,951.77 Million |

Strong demand from semiconductor packaging drives steady growth as manufacturers adopt finer pitch bonding to support compact device designs. Companies improve wire bonding speed and accuracy to meet production targets across consumer electronics and automotive sectors. Miniaturization trends increase the need for advanced bonding tools that handle tight layouts. The shift toward higher chip complexity pushes firms to enhance automation levels. Rising adoption of power devices strengthens equipment investments across many fabs. Growing focus on process reliability boosts interest in machines with superior alignment control. Expanding electrification across industries further accelerates the need for precise connection technology.

Asia Pacific leads demand due to heavy semiconductor manufacturing activity in China, Taiwan, South Korea, and Japan. North America shows strong uptake because major IDMs and OSATs invest in advanced packaging upgrades. Europe maintains steady adoption through growth in automotive electronics and industrial automation. Southeast Asian countries emerge as fast-growing markets as assembly lines expand with supportive government incentives. Rising local outsourcing in India and Vietnam strengthens equipment demand. Regional competition shapes strategic investments as manufacturers adopt flexible bonding platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Ball bonder machine market stands at USD 1,393.65 million in 2024 and is projected to reach USD 1,951.77 million by 2032, expanding at a 3% CAGR during the forecast period.

- Asia Pacific (45%), North America (25%), and Europe (18%) lead the market due to strong semiconductor fabrication capacity, stable electronics production, and high adoption of advanced packaging technologies.

- Asia Pacific, holding 45%, remains the fastest-growing region driven by large OSAT presence, expanding consumer electronics output, and continuous investment in advanced chip-packaging infrastructure.

- In the type segment, fully automatic systems account for about 60%, driven by demand for high throughput and precision across semiconductor packaging lines.

- In the application segment, the semiconductor category holds nearly 40%, supported by rising wafer-level packaging, higher interconnect density, and strong production volumes across global fabs.

Market Drivers:

Growing Adoption of Advanced Semiconductor Packaging

Rising interest in compact chip designs strengthens the need for fine-pitch bonding tools. The Ball bonder machine market benefits from rising production across logic, memory, and power devices. Manufacturers seek tighter process control to support higher circuit density. Firms upgrade bonding heads to reduce alignment errors during high-volume runs. Automation helps reduce labor pressure in dense assembly floors. Strong demand for high-performance electronics drives investments in flexible platforms. It also supports faster cycle times for advanced packaging lines. Producers focus on precision improvements that stabilize long-term output.

- For instance, ASM Pacific Technology’s AERO CAM Series achieved a bonding accuracy of 0 µm (3σ) and produced bond balls down to 22 µm in size using 0.5-mil wire.

Rising Demand from Automotive and Power Electronics

Automotive suppliers increase bonding needs due to expanding EV platforms. The Ball bonder machine market gains support from greater use of power modules in vehicles. Firms seek tools that handle thicker wires for high-current connections. Safety regulations drive acceptance of systems that enhance bond reliability. Suppliers adopt monitored bonding profiles to reduce field failures. Production growth across inverter and battery systems boosts equipment purchases. It supports continuous upgrades in bonding capability for rugged environments. Manufacturers rely on stable throughput to meet rising automotive volumes.

- For instance, Kulicke & Soffa Industries, Inc. announced its POWERNEXX system, optimized for QFN packages up to 100 mm width and built for high-volume power-device assembly.

Shift Toward Miniaturization Across Consumer Electronics

Consumer brands prefer lightweight devices that demand precise interconnects. The Ball bonder machine market aligns with this shift through improved accuracy features. Makers enhance Z-axis control to support fragile bond pads. Firms deploy ultrasonic systems that reduce damage risk on small dies. Growth in wearables increases use of micro-bonding solutions. It also pushes development of faster multi-head systems for compact layouts. Manufacturers work on versatility to support short production cycles. Demand rises for machines that handle variable formats without long resets.

Greater Focus on Production Efficiency and Reliability

Producers invest in systems that reduce downtime during bonding tasks. The Ball bonder machine market responds with stronger process-monitoring modules. Real-time diagnostics help prevent unexpected failures in busy lines. Bond-quality tracking supports tighter auditing by large OEMs. Firms adopt platforms that shorten operator intervention during shifts. It also supports seamless integration with automated handling systems. Efficiency improvements help reduce overall manufacturing cost. Better stability drives supplier interest across high-mix facilities.

Market Trends:

Expansion of Wafer-Level and 3D Packaging Technologies

Advanced architectures create fresh demand for bonding setups that handle dense stacks. The Ball bonder machine market gains relevance as 3D packaging moves into mainstream production. Producers adopt tools that support higher accuracy at varied heights. Firms shift toward hybrid packaging models to meet next-gen chip needs. Equipment makers refine stages to manage thermally sensitive structures. It improves control during complex device assembly. Engineers seek bonding systems that adapt to new vertical layouts. Adoption rises where multi-layer chips require dependable interconnects.

- For instance, ASMPT’s ultra-precision die bonder series (AMICRA) provides placement accuracy of ±5 µm and cycle times under 15 seconds, supporting vertical multi-chip module assembly.

Growing Integration of AI-Driven Process Monitoring

AI tools help identify pattern deviations during bonding runs. The Ball bonder machine market benefits from stronger predictive control functions. Smart sensors capture force, power, and time profiles in real time. Firms use analytics to cut scrap levels and reduce repetitive faults. Engineers deploy adaptive tuning to stabilize bond formation across materials. It helps speed process qualification across global manufacturing sites. Adoption grows where fabs need consistent results at high speed. The trend supports broader acceptance of autonomous bonding lines.

- For instance, ASMPT’s AERO PRO supports wires from 0.5 to 2.0 mil (≈12.7 to 50.8 µm) and lengths of 0.2 to 8.0 mm, with integrated AI monitoring via its “AERO EYE” system.

Increasing Preference for Flexible, Multi-Material Bonding Capabilities

Producers demand tools that switch across gold, copper, and aluminum wires. The Ball bonder machine market adapts to this shift with multi-mode designs. Firms reduce tool-change time to improve production output. Higher copper adoption pushes vendors to offer stronger ultrasonic systems. It strengthens performance across thick-wire bonding tasks. Manufacturers value chambers that support new alloys. Growth in diverse chip formats accelerates need for adaptable platforms. Demand rises for bonders that handle changing material needs without long resets.

Rising Use of Automated Inline Metrology Systems

Inline sensors track bond height, deformation, and placement accuracy. The Ball bonder machine market aligns with this need for continuous quality checks. Inspection tools reduce manual verification during busy shifts. Firms rely on integrated imaging to cut rework time. It enhances traceability for industries with strict reliability norms. Automation reduces operator errors during long production runs. Consistency increases across global lines using the same calibrated system. Adoption grows where high-volume fabs target defect reduction.

Market Challenges Analysis:

High Technical Complexity and Cost of Advanced Bonding Systems

Modern systems require tight tolerances that raise development difficulty. The Ball bonder machine market faces pressure from high integration costs. Firms need skilled operators to manage advanced features during daily runs. Training gaps slow adoption in facilities with limited resources. Precision components increase maintenance needs across production floors. It challenges small manufacturers with limited capital strength. Buyers evaluate cost impact before adopting newer platforms. Upgrade cycles become slow for regions with tight technology budgets.

Supply Chain Volatility and Material Sensitivity Issues

Producers depend on stable supplies of bonding wires and tooling parts. The Ball bonder machine market experiences delays during material shortages. Copper and gold price swings change equipment operating cost. Sensitive bond pads require controlled production conditions to avoid defects. It pushes firms to upgrade environments that exceed budget limits. Logistics disruptions create long lead times for replacement modules. High performance demands consistent equipment calibration. Global suppliers struggle when transport constraints affect shipment schedules.

Market Opportunities:

Growth in Outsourced Semiconductor Assembly and Test (OSAT) Expansion

OSAT plants expand capacity to meet rising global packaging needs. The Ball bonder machine market benefits from these investments across Asia and North America. Firms increase equipment orders to handle mixed device portfolios. It supports broad adoption among mid-size assembly houses. Automation interest increases as OSATs aim for higher yields. Strong demand for power and RF packaging creates new openings. Equipment suppliers gain new revenue streams from modular upgrades. Scalable platforms become attractive for expanding facilities.

Expansion of Emerging Markets and New Device Categories

Wearables, IoT modules, and compact industrial sensors create fresh bonding needs. The Ball bonder machine market gains momentum where small-form electronics rise. Firms adopt precision tools that handle miniature bond pads. It encourages adoption in new manufacturing clusters. Countries with rising electronics investment emerge as growth hotspots. Production incentives increase equipment uptake among local firms. Emerging categories create steady need for compact bonding tools. The opportunity grows with broader digital hardware adoption.

Market Segmentation Analysis:

By Type

The Ball bonder machine market shows strong adoption of fully automatic systems due to high demand for speed, precision, and repeatability in modern semiconductor packaging lines. Semi-automatic models gain interest across medium-scale facilities that need flexibility without higher capital cost. Manual systems remain suitable for prototyping tasks and training labs. It supports diverse user needs by offering tailored throughput levels across each type.

- For instance, K&S explains that its ball bonders have integrated rail-guided vehicles and autonomous mobile-robot systems to support “Industry 4.0”.

By Application

Semiconductor and electronics segments hold major usage due to their continuous need for reliable micro-interconnects. Automotive and aerospace users adopt advanced bonding systems to support high-reliability modules. Medical device makers rely on precise bonding to meet strict safety norms. Packaging, IT and telecommunication, microelectronics, and LED manufacturing contribute steady demand. The Ball bonder machine market benefits from this broad application footprint.

- For instance, Kulicke & Soffa’s POWERNEXX system addresses power devices for EVs and industrial automation, key in the automotive and power market segment.

By Bonding Technique

Thermosonic bonding remains the dominant technique due to its balance of strength and process efficiency. Ultrasonic bonding gains traction where heat-sensitive components require controlled energy levels. Thermocompression bonding supports niche tasks that demand strong metallurgical joints. Each method strengthens adoption across varied device architectures.

By End User

IDMs lead consumption due to high-volume fabrication needs and strong automation focus. OSATs expand purchases to support outsourced packaging work across global hubs. Research institutes use flexible platforms for advanced material and device development. It reflects diverse usage across production and innovation environments.

Segmentation:

By Type:

- Manual

- Semi-Automatic

- Fully Automatic

By Application:

- Semiconductor

- Electronics

- Automotive

- Aerospace

- Medical Devices

- Packaging

- IT & Telecommunication

- Microelectronics

- LED Manufacturing

By Bonding Technique:

- Thermosonic

- Ultrasonic

- Thermocompression

By End User:

- IDMs (Integrated Device Manufacturers)

- OSATs (Outsourced Semiconductor Assembly and Test)

- Research Institutes

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Dominance and Growth Leadership

The Asia Pacific region commands the largest share of the market, accounting for approximately 45% of total revenue. It benefits from extensive semiconductor fabrication and packaging operations in China, Taiwan, South Korea, and Japan. Rapid expansion in consumer electronics, EVs and industrial automation lifts equipment demand. Suppliers in the region receive strong support from government investment and infrastructure incentives. It also attracts global manufacturers seeking cost efficient capacity and proximity to key OEMs. The high growth rate in this region outpaces mature markets and drives global momentum.

North America and European Market Maturity

North America holds around 25% of the market while Europe contributes about 18%. In North America, advanced technology providers, IDMs and OSATs invest heavily in high-end bonding equipment. Europe shows stable demand driven by automotive electronics, microelectronics and industrial automation. It requires machines with precision, reliability and stricter regulatory compliance. These mature markets favour fully automatic and advanced bonding systems rather than entry-level units. It means vendors face intense competition and must differentiate through performance and service.

Emerging Regions: Latin America, Middle East & Africa

Latin America and Middle East & Africa together account for the remaining share: Latin America approximately 7%, and Middle East & Africa about 5%. These regions show slower but steady growth as manufacturing bases expand and local electronics ecosystems develop. They attract new investment in assembly and test operations and wireless communications infrastructure, which creates rising demand for bonding machinery. It presents opportunities for manufacturers looking to establish presence early. Vendors must tailor solutions to lower-volume, mixed-technology operations while building support networks in these emerging zones.

Key Player Analysis:

- ASM Pacific Technology (ASMPT)

- Kulicke & Soffa Industries, Inc.

- DIAS Automation

- F&K Delvotec Bondtechnik

- Hesse GmbH

- KAIJO Corporation

- Micro Point Pro Ltd (MPP)

- Palomar Technologies

- TPT Wire Bonder GmbH & Co KG

- Ultrasonic Engineering Co. Ltd.

- West Bond, Inc.

- Anza Technologies

- Questar Products

- Mech-EI Industries

- Hybond, Inc.

Competitive Analysis:

The Ball bonder machine market features strong competition led by global semiconductor equipment manufacturers offering advanced bonding technologies. Leading companies focus on automation, precision control and flexible bonding capabilities to serve expanding packaging needs. Vendors differentiate through ultrasonic systems, multi-material support and faster cycle times. It gains strength from suppliers that integrate inline inspection and predictive monitoring in premium models. Mid-tier players target cost-effective tools for research labs and small assembly units. High-end users seek fully automatic platforms that enhance throughput and quality. Competitive pressure pushes firms to advance thermosonic and ultrasonic methods. Strategic partnerships and R&D investment shape long-term positioning across major regions.

Recent Developments:

- In September 2025, ASM Pacific Technology entered a joint development agreement with KOKUSAI ELECTRIC CORPORATION to accelerate innovations in hybrid bonding and thermo-compression bonding solutions for 2.5D and 3D semiconductor packaging. This alliance integrates ASMPT’s high-precision bonding platforms with KOKUSAI’s thin-film technologies, aiming to deliver robust, scalable, and high-quality packaging solutions for next-generation high-performance computing and AI chips.

- May 2024, Kulicke & Soffa received a sizeable order for 1,000 RAPID™ Pro systems featuring new ProSuite response-based bonding and looping capabilities. The fulfillment will occur over several quarters, reflecting a strong rebound in the semiconductor industry and heightened demand for advanced ball-bonding solutions supporting applications like IoT, AI, and high-bandwidth connectivity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growth will rise due to stronger semiconductor packaging needs across advanced electronics.

- Adoption will expand in automotive electronics where high-reliability bonding is essential.

- Process automation will increase across major fabs to reduce labor challenges.

- Vendors will enhance bonding control systems to support finer interconnects.

- Power device manufacturing will create fresh demand for thick-wire bonding tools.

- OSAT expansion will drive higher equipment purchases in key manufacturing hubs.

- AI-driven inspection and predictive monitoring will gain widespread acceptance.

- New materials in chip packaging will require flexible bonding platforms.

- Emerging regions will invest in compact and cost-efficient bonding systems.

- Continuous miniaturization will push vendors to design faster, more precise platforms.