Market Overview:

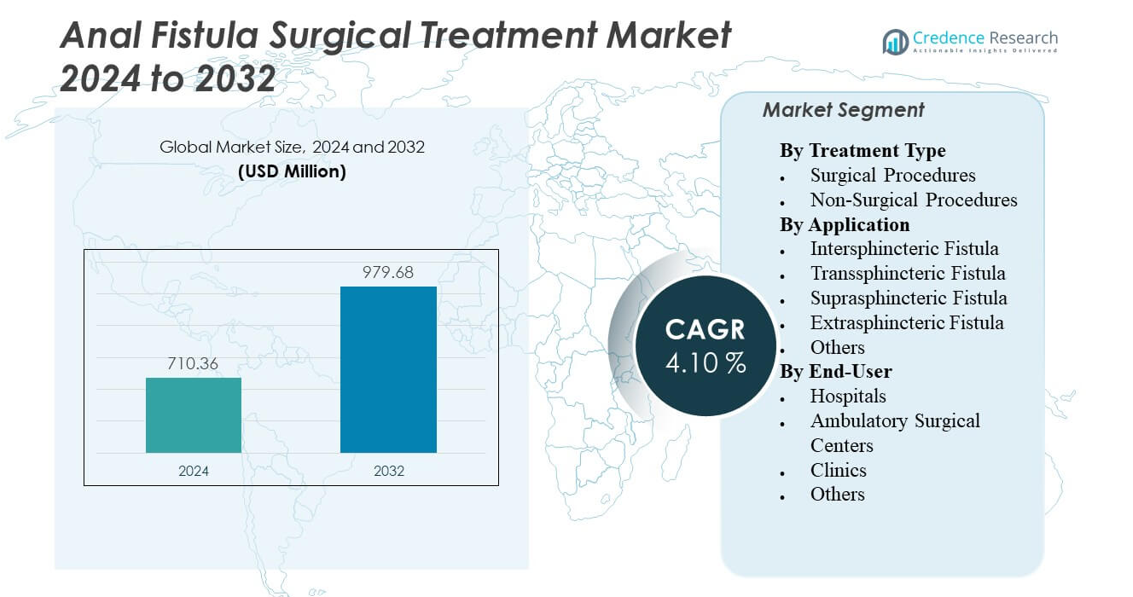

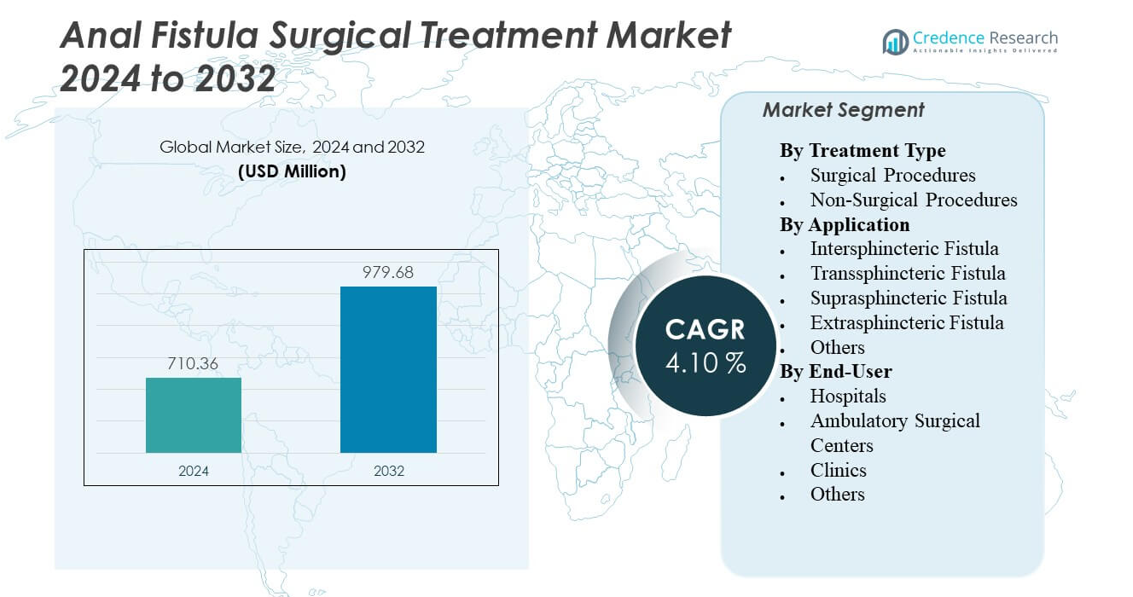

The Anal Fistula Surgical Treatment Market is projected to grow from USD 710.36 million in 2024 to an estimated USD 979.68 million by 2032, with a compound annual growth rate (CAGR) of 4.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anal Fistula Treatment Market Size 2024 |

USD 710 Million |

| Anal Fistula Treatment Market, CAGR |

4.1% |

| Anal Fistula Treatment Market Size 2032 |

USD 979.68 million |

Rising prevalence of inflammatory bowel diseases such as Crohn’s disease and ulcerative colitis is driving demand for surgical interventions in the Anal Fistula Surgical Treatment Market. It encourages healthcare providers to adopt advanced procedures like minimally invasive surgeries and biologic adjuncts. Patient awareness of treatment options and early diagnosis also contributes to higher procedure volumes. Hospitals and clinics expand capacity to meet growing demand, while innovations in surgical devices improve safety, precision, and recovery outcomes, supporting market growth.

North America leads the Anal Fistula Surgical Treatment Market due to established healthcare infrastructure, high awareness, and widespread access to advanced surgical techniques. Europe maintains steady growth with mature systems and strong reimbursement support. Asia Pacific emerges rapidly with increasing healthcare investments, growing patient population, and rising incidence of anal fistulas in countries like India and China. Latin America and the Middle East & Africa show moderate growth, driven by improving access to surgical care and expanding medical facilities, creating new opportunities for market expansion.

Market Insights:

- The Anal Fistula Surgical Treatment Market is valued at USD 710.36 million in 2024 and is projected to reach USD 979.68 million by 2032, growing at a CAGR of 4.1%.

- Rising prevalence of inflammatory bowel diseases like Crohn’s disease and ulcerative colitis is increasing demand for surgical interventions.

- Advancements in minimally invasive procedures and biologic therapies are improving treatment outcomes and reducing recovery times.

- High costs of advanced surgical devices and limited reimbursement in certain regions may restrain market growth.

- North America leads the market with strong healthcare infrastructure, skilled surgeons, and high adoption of advanced techniques.

- Europe shows steady growth supported by established systems, reimbursement frameworks, and mature surgical services.

- Asia Pacific and emerging regions are expanding rapidly due to healthcare investment, increasing patient awareness, and growing incidence of anal fistulas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Prevalence Of Inflammatory Bowel Disorders Driving Demand

The rising incidence of inflammatory bowel diseases such as Crohn’s disease and ulcerative colitis is fueling the need for surgical intervention in the Anal Fistula Surgical Treatment Market. It increases the number of anal fistula cases that require advanced treatment. Healthcare providers respond by offering more tailored surgical options and specialized care pathways. Surgeons adopt newer tools and techniques to manage complex fistulas. The availability of better diagnostics ensures earlier detection of fistulas and prompt surgical treatment. Patient awareness about anal fistulas has improved, encouraging early care. Insurance coverage and reimbursement schemes support access to surgery. Hospitals expand capacity to meet the growing patient pool and avoid delays.

- For instance, Takeda Pharmaceuticals partnered with the Crohn’s & Colitis Foundation in 2016 to launch the “IBD Unmasked” awareness campaign, aiming to educate patients and caregivers about inflammatory bowel disease and improve disease understanding and management.

Advancement In Minimally Invasive Surgical Techniques Enhances Uptake

Innovative techniques such as laser ablation, seton placement and video‑assisted fistula treatments are transforming the treatment landscape. They reduce recovery time, lower complication rates and improve patient satisfaction, which boosts adoption. Surgeons training in these methods enhance hospital service portfolios and attract more cases. Device manufacturers introduce dedicated instruments and energy‑based systems for fistula repair. Clinical studies demonstrate improved outcomes, encouraging adoption of these procedures in the market. Healthcare systems seeking cost‑effective care support such minimally invasive options. Patients now prefer procedures that allow faster return to normal activity and less pain. This dynamic strengthens growth of the surgical segment in the market.

Expansion Of Healthcare Infrastructure In Emerging Markets Opens New Pathways

Emerging economies in Asia‑Pacific and Latin America continue to invest in hospital infrastructure, surgical theatres and colorectal care centres. It expands access to advanced fistula surgical treatments and raises demand in those regions. Government initiatives to improve universal health coverage and subsidise specialised care support uptake. Local medical device manufacturers and global firms collaborate to supply equipment and training. Growing middle‑class populations in countries such as India and China increase demand for advanced surgical care. Medical tourism also contributes to cross‑border treatment flows and raises awareness globally. These shifts drive expansion of the Anal Fistula Surgical Treatment Market beyond established regions.

- For instance, by June 2023, Apollo Hospitals Group expanded its colorectal robotic surgery program to six major Indian cities, completing over 1,000 robotic colorectal procedures with wound infection rates reduced to 1.4% and post-surgery complications to 0.9%, according to hospital outcome data.

Rising Healthcare Expenditure And Reimbursement Support Market Growth

Many developed markets show increasing healthcare spending, particularly on colorectal and surgical disorders. It boosts investment in advanced surgical devices and care pathways for treatment of anal fistulas. Insurance and government reimbursement frameworks increasingly cover minimally invasive fistula surgeries, reducing patient out‑of‑pocket costs. Healthcare providers invest in training, infrastructure and marketing to capitalise on the opportunity. Device companies develop cost‑efficient solutions to meet demand under budget constraints. Hospitals highlight specialised colorectal centres to differentiate services and attract case volume. These financial and structural supports underpin robust growth in the Anal Fistula Surgical Treatment Market.

Market Trends

Adoption Of Laser And Energy‑Based Surgical Modalities Is Accelerating

The Anal Fistula Surgical Treatment Market shows rising usage of laser ablation, radio‑frequency devices and fibrin glue techniques in place of traditional fistulotomy. Surgeons embrace these methods for their precision and reduced tissue damage. Hospital procurement cycles now prioritise energy‑based devices tailored to fistula repair. Clinical literature reports lower recurrence rates, prompting wider adoption. Device manufacturers release new models suited for outpatient settings and shorter operating times. Training programmes include these techniques to upskill colorectal surgeons. Healthcare systems update care protocols to incorporate these less invasive options. Patient preference shifts toward procedures promising faster recovery and less discomfort.

- For instance, meta-analyses of the FiLaC (Fistula Laser Closure) procedure report a weighted mean primary healing rate of 67.3% with complication rates around 4%, demonstrating effective fistula closure and continence preservation.

Integration Of Real‑Time Imaging And Navigation Systems Enhances Surgical Accuracy

Hospitals in advanced markets deploy endoanal ultrasound, MRI‑guided mapping and tracking systems to localise complex fistula tracts intra‑operatively. This trend elevates the standard of care in the Anal Fistula Surgical Treatment Market. Surgeons plan interventions with enhanced precision, reducing complication and recurrence risks. Device firms partner with imaging providers to bundle instruments and software. Hospitals tout these capabilities to attract referrals and improve outcomes. Training centres incorporate navigation technologies into curricula to standardise best practice. Regulatory approvals for integrated surgical-imaging systems accelerate in major geographies. Patients with complex or recurrent fistulas increasingly seek centres offering these advanced modalities.

Growth Of Outpatient And Ambulatory Surgical Settings For Colorectal Procedures

Shifts in healthcare delivery influence the Anal Fistula Surgical Treatment Market as colorectal surgeries migrate to outpatient surgical centres. Providers configure specialised ambulatory facilities to offer fistula repairs with shorter stays. This trend reduces hospital cost burdens and improves patient throughput. Device developers adapt instruments and kits for outpatient environments. Reimbursement models evolve to favour same‑day or short‑stay procedures in place of traditional inpatient treatment. Surgeons refine protocols for minimal sedation and rapid recovery in such settings. Patient demand for convenience grows, driving this structural change. Market participants position themselves to serve this evolving venue of care.

- For instance, in 2025, a study at Changhai Hospital reported that 121 patients undergoing excision or excision with seton in an outpatient setting achieved a 100% cure rate, with minimal complications and a 96.7% patient satisfaction rate, supporting the shift toward outpatient care models.

Increasing Demand For Personalized Treatment Protocols And Patient‑Centric Care

The market moves toward customised treatment pathways in the Anal Fistula Surgical Treatment Market rather than one-size-fits-all approaches. Surgeons tailor procedure choice—laser, seton, plug, fistulotomy—based on fistula complexity, patient comorbidities and preferences. Healthcare providers partner with multidisciplinary teams colorectal surgeons, gastroenterologists, radiologists to optimise outcomes. Patient education programmes improve shared decision‑making and treatment adherence. Outcome tracking and quality‑metrics reporting become standard in high‑performing centres. Manufacturers provide modular instrument systems to support procedural flexibility. Hospitals differentiate themselves with patient‑centric service models and follow-up care packages.

Market Challenges Analysis

Complexity Of Fistula Anatomy And Surgical Risk Limits Adoption

The Anal Fistula Surgical Treatment Market faces a major obstacle in the anatomical complexity of anal fistulas, particularly high‑trans and suprasphincteric types. Surgeons must accurately map tract pathways to minimise risk of incontinence or recurrence. Some healthcare centres lack requisite imaging or surgeon experience, limiting procedure success. Device manufacturers may struggle to provide one‑size‑fits‑all tools given variation in fistula morphology. Patients may delay care due to fear of surgery or potential complications, reducing caseload growth in certain markets. Some insurers hesitate to reimburse newer procedures until long‑term outcome data become available, restricting access. Training programmes may lag behind technology adoption, creating gaps in clinical competence. Surgical centres face cost pressures in acquiring specialized equipment, slowing diffusion.

High Cost Of Advanced Surgical Devices And Limited Reimbursement Pose Barriers

Innovative instruments, laser systems and navigation platforms used in the Anal Fistula Surgical Treatment Market command high capital investment, which may deter smaller hospitals. In emerging economies the high upfront cost limits adoption of minimally invasive modalities. Some payers classify advanced procedures as experimental or off‑label, reducing coverage and increasing patient out‑of‑pocket expense. Lack of reimbursement may force providers to rely on conventional techniques, slowing advancement of care standards. Device firms might reduce regional pricing margins to boost uptake, but this squeezes profitability and limits investment in innovation. Cost‑containment pressures in healthcare systems create resistance to upgrading equipment or expanding surgical services for fistulas. Price sensitivity among patients, especially in lower‑income regions, may impede market expansion.

Market Opportunities

Expansion In Emerging Markets With Improving Healthcare Infrastructure Presents Growth Levers

The Anal Fistula Surgical Treatment Market presents substantial opportunity in Asia‑Pacific, Latin America and Middle East regions where surgical infrastructure is rapidly improving. Governments in these regions increase investment in colorectal and GI care facilities, enabling access to advanced fistula surgeries. Device manufacturers and service providers can partner locally to deploy training, imaging systems and minimally invasive platforms. Lower cost versions of surgical kits and devices tailored for emerging markets can accelerate adoption. Medical tourism destinations in such regions can attract patients from developed countries, boosting volume. Surgeons trained abroad return to their home markets and introduce advanced procedures, creating new demand streams. Strategic alliances between global firms and local hospitals can create bundled service‑offerings and drive growth.

Development Of Regenerative And Biologic Technologies Offers New Revenue Streams

Innovation in stem‑cell therapies, biologic plugs, and tissue regeneration technologies provides new growth avenues for the Anal Fistula Surgical Treatment Market. Surgical device firms can integrate biologic adjuncts with established instruments to enhance outcomes and lower recurrence rates. Clinical studies showing improved healing will stimulate payer support and patient acceptance. Providers can launch programmes focused on complex or recurrent fistulas using biologics, creating specialised service lines. Manufacturers may explore licensing collaborations and modular platforms combining mechanical repair with biological sealants. Expanded use of biologic therapies can shift treatment protocols and increase overall procedure value. Hospitals positioning themselves as centres of excellence can capture higher margins. This technology‑driven growth supports premiumisation of the market.

Market Segmentation Analysis:

By Treatment Type

The Anal Fistula Surgical Treatment Market includes surgical and non-surgical procedures, each addressing different patient needs. Surgical procedures, such as fistulotomy, advancement flap, bioprosthetic plugs, and seton techniques, dominate the market due to their effectiveness in treating complex fistulas and reducing recurrence. Non-surgical procedures, including fibrin glue, adipose stem cell therapy, and pharmacological management, provide alternatives for patients unsuitable for surgery or seeking minimally invasive care. It offers flexibility for healthcare providers to tailor treatment plans based on fistula complexity, patient comorbidities, and recovery expectations, driving adoption across healthcare facilities globally.

- For instance, clinical studies of Cook Medical’s Biodesign Anal Fistula Plug report variable healing rates for complex anal fistulas, demonstrating effectiveness in selected patient populations and supporting its use as a treatment option.

By Application

The market segments by type of fistula include intersphincteric, transsphincteric, suprasphincteric, extrasphincteric, and others. Intersphincteric and transsphincteric fistulas hold the largest share due to higher prevalence among patients. Suprasphincteric and extrasphincteric fistulas require more advanced surgical interventions, promoting adoption of specialized techniques and devices. It encourages the development of targeted treatment strategies and enhances clinical outcomes. The segmentation allows providers to optimise procedural choice, reduce complication rates, and improve patient satisfaction, supporting consistent market growth across regions.

- For instance, clinical trials of video-assisted anal fistula treatment (VAAFT), employed by hospitals internationally, report an overall healing rate of 54.41%, with 73.3% success for simple fistulas and 39.47% for complex fistulas, based on a prospective study of 68 patients followed for up to 31 months.

By End-User

Hospitals, ambulatory surgical centers, clinics, and other healthcare facilities constitute the end-user segment. Hospitals dominate the market with their advanced surgical infrastructure and access to skilled colorectal surgeons. Ambulatory surgical centers and clinics expand access in semi-urban and urban areas, offering minimally invasive procedures with shorter recovery times. It enables efficient patient management and increases the volume of treated cases. The growing presence of outpatient facilities enhances treatment accessibility, while hospitals continue to lead due to superior capabilities and capacity to manage complex cases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Treatment Type

- Surgical Procedures

- Non-Surgical Procedures

By Application

- Intersphincteric Fistula

- Transsphincteric Fistula

- Suprasphincteric Fistula

- Extrasphincteric Fistula

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Clinics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Regional Analysis

North America dominates the Anal Fistula Surgical Treatment Market with a market share of approximately 35%. Strong healthcare infrastructure, high awareness of anal fistula conditions, and advanced surgical techniques support its leading position. It benefits from large numbers of colorectal specialists and widespread adoption of minimally invasive treatment modalities. Insurance coverage and reimbursement policies in countries like the United States enable hospitals to invest in advanced device systems and train staff accordingly. High procedural volume in large hospital networks sustains growth in the region. It also draws patients from abroad seeking expert treatment, which further reinforces its market leadership.

Europe Regional Analysis

Europe holds around 25% of the market share in the global Anal Fistula Surgical Treatment Market. The region demonstrates mature services in colorectal surgery and established reimbursement frameworks across major countries. It features a strong presence of key device manufacturers and high penetration of advanced treatment options. It faces moderate growth compared to emerging markets, but steady innovation and service upgrades maintain relevance. Western European countries lead, while Eastern Europe offers incremental growth opportunities due to healthcare system improvements. The region’s consistent investment in surgical training and patient outcomes supports its stable market share.

Asia Pacific and Rest of World Regional Analysis

The Asia Pacific region accounts for about 30% of the Anal Fistula Surgical Treatment Market share and exhibits the highest growth potential. Rapid expansion of healthcare infrastructure in countries such as India and China drives volume of procedures. It experiences increased incidence of anal fistulas and rising patient demand for advanced surgical care. The region also attracts medical tourism, which further amplifies service uptake. Latin America and Middle East & Africa together contribute approximately 10% of the market share, with growth driven by improving access and modest spending increases. These emerging regions remain key targets for manufacturers and service providers aiming to capture new growth.

Key Player Analysis:

- Medtronic plc

- KARL STORZ SE & Co. KG

- Cook Group (Cook Medical)

- Biolitec AG

- Surtex Instruments

- Gem srl

- Johnson & Johnson

- Becton, Dickinson and Company (BD)

- Abbott

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- AstraZeneca

- Integra LifeSciences

- Mylan N.V.

- Novo Surgical Inc.

Competitive Analysis:

The competitive landscape of the Anal Fistula Surgical Treatment Market features prominent global medical‑device firms and surgical‑care providers driving innovation and expansion. Key players such as Medtronic plc, Cook Medical, KARL STORZ SE & Co. KG and Biolitec AG lead through new product launches, strategic acquisitions and global distribution networks. The market attracts specialised firms offering fistula‑surgery instruments, image‑guided systems and repair plugs, which intensifies competition across treatment modalities. It compels manufacturers to accelerate development of minimally invasive technologies and biologic adjuncts to differentiate their offerings. Hospitals and ambulatory surgical centres evaluate device portfolios, clinical evidence and service support when selecting suppliers, which further raises the bar for innovation. Regional players in Asia‑Pacific and Latin America enter the market with cost‑efficient solutions, expanding competitive pressure. The competitive dynamics hence revolve around technological superiority, regulatory compliance and scale of service networks.

Recent Developments:

- In July 2024, Signum Surgical Ltd. received U.S. Food and Drug Administration De Novo clearance for its BioHealx Anal Fistula Device, a bioabsorbable implant designed to close internal fistula openings and preserve continence.

- In May 2025, Signum Surgical, an Irish medical technology firm, announced the publication of first-in-human clinical data for its BioHealx® Anal Fistula Device in the International Journal of Colorectal Disease. The BioHealx device recently received De Novo clearance from the U.S. Food and Drug Administration (FDA) and launched commercially in the United States.

- In May 2025, ECM Therapeutics received Investigational Device Exemption (IDE) approval from the FDA for its novel hydrogel treatment targeted at anorectal fistulas. This approval permits further clinical investigation of ECM’s hydrogel technology, marking a major milestone in the development of less invasive and potentially more effective surgical solutions for anal fistula patients.

Report Coverage:

The research report offers an in-depth analysis based on Treatment Type, Application and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to expand through greater adoption of minimally invasive surgical techniques.

- Rising prevalence of complex fistula cases will drive demand for advanced treatment solutions.

- Growth in emerging markets will accelerate due to expanding healthcare infrastructure and accessibility.

- Integration of biologic therapies and regenerative technologies will enhance patient outcomes and procedural efficiency.

- Outpatient and ambulatory surgical centres will increase treatment capacity and reduce hospital stays.

- Technological innovation in imaging and navigation systems will improve surgical precision and safety.

- Patient awareness and education initiatives will support earlier diagnosis and timely intervention.

- Strategic partnerships and collaborations between device manufacturers and hospitals will strengthen market reach.

- Regulatory approvals and reimbursement support will enable wider adoption of advanced procedures.

- Data-driven follow-up and outcome tracking will improve treatment standardisation and market credibility.