Market Overview

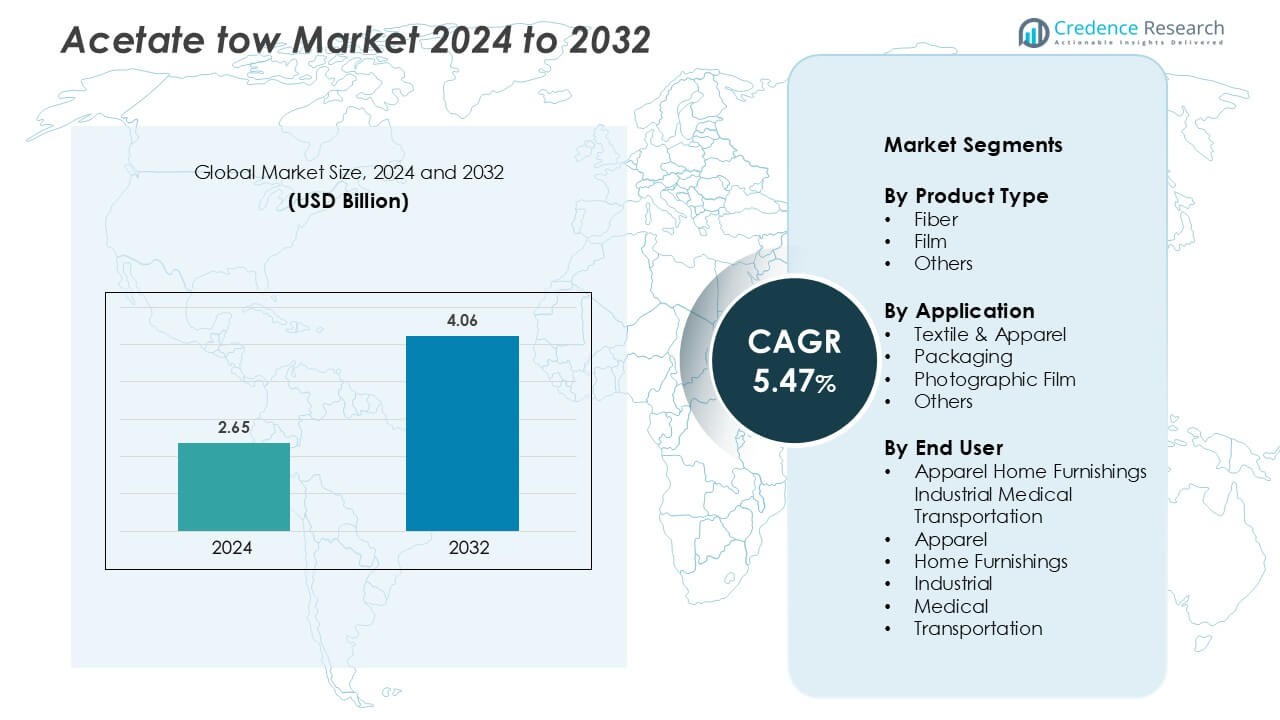

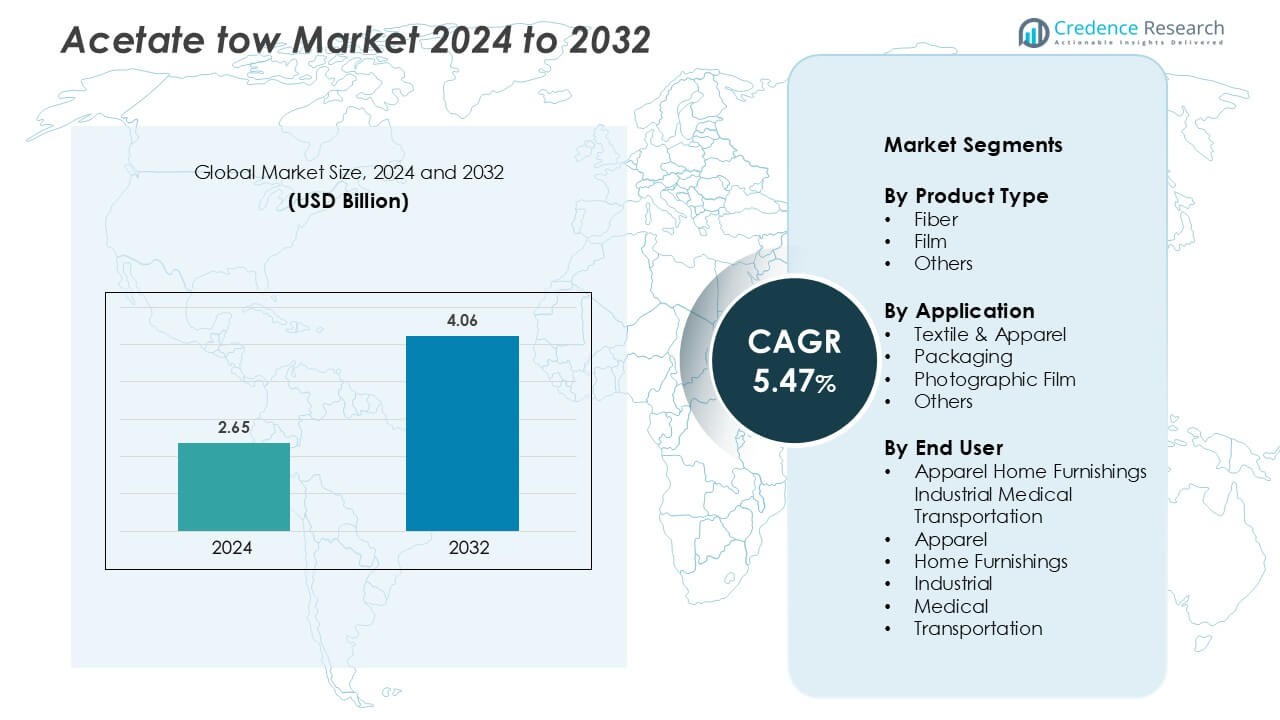

Acetate tow market system market size was valued USD 2.65 billion in 2024 and is anticipated to reach USD 4.06 billion by 2032, at a CAGR of 5.47% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acetate Tow Market Size 2024 |

USD 2.65 Billion |

| Acetate Tow Market, CAGR |

5.47% |

| Acetate Tow Market Size 2032 |

USD 4.06 Billion |

The acetate tow market features strong competition among key global manufacturers emphasizing innovation, sustainability, and capacity expansion. Prominent players include Mitsubishi Chemical Corporation, Celanese Corporation, Cerdia International GmbH, China National Tobacco Corporation (CNTC), Rayonier Advanced Materials Inc., Daicel Corporation, Jinan Acetate Chemical Co., Ltd., Acordis Cellulosic Fibers Inc., Sichuan Push Acetati Co., Ltd., and Eastman Chemical Company. These companies focus on improving fiber quality, process efficiency, and environmental performance through advanced acetylation technologies. Asia Pacific leads the global market with a 38% share, driven by high cigarette production, strong textile manufacturing capacity, and growing industrial applications. Strategic partnerships, sustainable raw material sourcing, and technological advancements continue to define competitive dynamics across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Acetate Tow Market was valued at USD 2.65 billion in 2024 and is projected to reach USD 4.06 billion by 2032, growing at a CAGR of 5.47% during the forecast period.

- Rising demand from the tobacco industry and expanding textile applications are driving steady market growth, supported by innovation in fiber processing and eco-friendly manufacturing practices.

- Increasing adoption of biodegradable and sustainable cellulose-based fibers reflects a key market trend, as manufacturers align with global environmental goals.

- The market remains competitive with leading players such as Mitsubishi Chemical Corporation, Celanese Corporation, Cerdia International GmbH, and CNTC investing in technology upgrades and product diversification.

- Asia Pacific dominates with a 38% market share, followed by North America at 28% and Europe at 24%, while the fiber segment leads overall consumption, accounting for nearly 70% of total acetate tow demand across industries.

Market Segmentation Analysis:

By Product Type

The fiber segment holds the dominant share of the acetate tow market, driven by its extensive use in cigarette filters, textiles, and nonwoven fabrics. Fiber-based acetate tow offers high absorbency, smooth texture, and biodegradability, making it suitable for various applications. Its demand continues to rise in the tobacco industry due to consistent product quality and process efficiency. Film and other variants serve niche uses in decorative laminates, packaging, and coatings but remain secondary. The fiber sub-segment leads with nearly 70% of total market share, supported by global cigarette consumption and expanding textile use.

- For instance, the acetate tow facility in Lanaken, Belgium, was the one with an approximate production capacity of 52,000 metric tons per year.

By Application

The textile and apparel segment dominates the acetate tow market, accounting for the largest share owing to growing demand for premium fabrics with silky texture and breathability. Acetate fibers are valued for their drape, sheen, and dyeing properties, ideal for high-end clothing and linings. Packaging and photographic film applications follow, driven by clarity and chemical resistance benefits. Increased adoption of acetate-based fabrics in sustainable and luxury fashion drives the segment’s leadership. Manufacturers are innovating lightweight and eco-friendly blends, reinforcing the textile and apparel sector’s dominance.

- For instance, Eastman Chemical Company produces Naia™ Renew fibers using 40% certified recycled waste through advanced molecular recycling technology, achieving a product composed of 60% sustainably sourced wood pulp and 40% recycled material. Eastman also offers a specialized product, Naia™ Renew ES, which uses 60% certified recycled waste and 40% sustainably sourced wood pulp.

By End Use

The apparel segment leads the acetate tow market, representing the highest share due to expanding fashion and lifestyle industries. Rising consumer preference for soft, glossy fabrics in dresses, linings, and accessories fuels growth. Home furnishings follow closely, benefiting from use in upholstery and curtains that combine durability with elegance. Industrial, medical, and transportation applications are emerging niches, using acetate tow for filtration and fiber composites. The apparel segment’s dominance is driven by global urbanization, fast fashion trends, and increased investment in premium fiber blends

Key Growth Drivers

Rising Demand from Tobacco Industry

The tobacco industry remains the largest consumer of acetate tow, driving substantial market growth. Acetate tow is the preferred material for cigarette filters due to its high purity, thermal stability, and filtration efficiency. Its ability to provide consistent air permeability and tar retention supports compliance with international quality standards. Manufacturers are expanding production capacities to meet rising demand from developing countries with growing smoking populations. For instance, Celanese Corporation increased its acetate tow output through advanced spinning technology, improving fiber uniformity and reducing manufacturing costs. Government regulations promoting low-tar cigarettes also boost adoption, reinforcing acetate tow’s importance as a key filtration medium in the global tobacco supply chain.

- For instance, in 2016, Eastman sold its 50% stake in the Primester facility to its partner, Solvay. Solvay became the sole owner and continues to operate the plant, while Eastman continues to supply raw materials.

Growing Applications in Textile and Apparel Industry

The textile and apparel sector is a major growth driver, benefiting from acetate tow’s versatility and luxurious fabric properties. The fiber’s soft texture, sheen, and drape make it suitable for high-end clothing, linings, and home furnishings. Increasing consumer demand for lightweight and breathable fabrics supports market expansion. Textile producers are blending acetate with natural and synthetic fibers to enhance performance and sustainability. For instance, Eastman Chemical Company developed eco-efficient acetate fiber grades with improved dye uptake and recyclability, meeting fashion industry sustainability goals. The growth of premium apparel and sustainable fashion trends globally further accelerates acetate fiber consumption in the textile market.

Expansion in Nonwoven and Industrial Applications

Acetate tow is increasingly used in nonwoven fabrics, filtration systems, and medical textiles due to its biodegradability and high absorbency. Its compatibility with modern processing technologies allows applications in air and liquid filtration, wipes, and insulation. Growing environmental awareness drives preference for cellulose-based materials over synthetics. For instance, Mitsubishi Chemical Corporation advanced its nonwoven acetate materials for industrial filtration, offering higher dust-holding capacity and durability. Expanding use in automotive and healthcare sectors strengthens market potential, particularly for filters, wound dressings, and protective materials. This diversification beyond tobacco and apparel ensures long-term growth stability for acetate tow manufacturers.

Key Trends & Opportunities

Shift Toward Sustainable and Biodegradable Fibers

Sustainability has emerged as a core trend in the acetate tow market, driving innovation in eco-friendly production methods. Consumers and manufacturers increasingly favor biodegradable materials to reduce environmental impact. Acetate tow, derived from renewable cellulose, aligns well with these goals. Companies are investing in closed-loop production and recycling systems to minimize waste. For instance, Daicel Corporation adopted an advanced solvent recovery process that cuts chemical emissions and supports green manufacturing. The trend toward sustainable fibers offers opportunities for brand differentiation and compliance with global sustainability standards, especially in fashion, packaging, and personal care applications.

- For instance, as of 2013, one of Daicel’s acetic acid plants had an annual capacity of 450,000 tons. The company reports on overall production and factors affecting sales volumes, such as market demand and plant maintenance.

Technological Advancements in Acetate Tow Production

Ongoing technological improvements in spinning and acetylation processes are enhancing acetate tow performance and cost efficiency. Automation, digital monitoring, and advanced filtration systems improve fiber consistency and reduce production downtime. For instance, Solvay optimized its continuous acetylation technology to achieve superior cellulose conversion and fiber strength. The adoption of AI-driven process control enables predictive maintenance and precise material optimization. These innovations improve product quality and environmental performance, creating new opportunities in medical and high-performance textile markets.

- For instance, a patent application for a digital twin in filtration systems reported a neural-network model achieving a relative L²-norm error of 5% for pressure prediction in a chamber filter press environment.

Expanding Use in Niche and Emerging Applications

The growing use of acetate tow in niche sectors such as filtration, cosmetics, and personal hygiene presents significant opportunities. Its absorbent and hypoallergenic nature makes it ideal for face masks, wipes, and skincare pads. For instance, Sinopec developed advanced acetate nonwovens for air filtration systems, achieving higher particulate capture efficiency and longer filter life. Expanding product versatility across non-traditional segments broadens the revenue base for manufacturers, supporting diversification beyond conventional tobacco-related applications.

Key Challenges

Volatility in Raw Material Prices

Fluctuating costs of acetic acid and cellulose, key raw materials for acetate tow, remain a major challenge. Market dependence on petrochemical feedstocks and supply chain disruptions affect production economics. Rising input prices can reduce profit margins and limit competitiveness against synthetic alternatives. For instance, supply chain constraints in global acetic acid markets during 2024 led to production cost surges for multiple acetate producers. Manufacturers must secure long-term supplier contracts and explore bio-based feedstocks to stabilize costs. Maintaining consistent raw material availability is critical for sustained profitability and uninterrupted supply in the acetate tow market.

Regulatory and Environmental Compliance Pressure

Stringent environmental regulations regarding waste management and chemical emissions pose challenges for acetate tow producers. The acetylation process generates acetic acid and solvent residues that require careful handling to meet compliance norms. For instance, stricter EU directives on volatile organic compound (VOC) emissions have increased operational costs for chemical manufacturers. Companies are investing in cleaner technologies and recovery systems to mitigate these risks. Failure to comply can result in fines and production shutdowns, impacting market growth. Balancing cost efficiency with environmental responsibility remains a central challenge for global acetate tow producers.

Regional Analysis

North America

North America holds a 28% share of the acetate tow market, driven by strong demand from the tobacco and textile industries. The United States remains the key contributor due to the presence of major producers and consistent cigarette consumption. The region also benefits from technological advancements in fiber manufacturing and eco-friendly production processes. Increasing adoption of acetate fibers in luxury apparel and home furnishings strengthens market growth. Environmental compliance initiatives and investments in biodegradable materials are expected to sustain long-term demand across industrial and nonwoven applications.

Europe

Europe accounts for 24% of the acetate tow market, supported by robust textile and filtration sectors. Countries such as Germany, France, and Italy lead adoption due to established fashion industries and stringent sustainability regulations. The region’s focus on bio-based and recyclable materials promotes acetate tow as a preferred alternative to synthetic fibers. Demand for cigarette filters remains stable, while growth in nonwoven and medical applications drives diversification. Major players invest in energy-efficient production and solvent recovery technologies to align with EU environmental standards, ensuring steady market performance.

Asia Pacific

Asia Pacific dominates the acetate tow market with a 38% share, led by China, India, Japan, and South Korea. The region’s dominance stems from high tobacco production, expanding textile manufacturing, and low production costs. Strong presence of leading manufacturers and rising consumer preference for premium fabrics drive steady growth. Governments’ focus on industrial expansion and favorable trade policies further strengthen the supply chain. China serves as a major exporter, while India and Southeast Asia experience rapid growth in apparel and filter applications, reinforcing Asia Pacific’s position as the key global hub.

Latin America

Latin America holds an 6% share of the acetate tow market, primarily driven by increasing tobacco processing and textile production. Brazil and Mexico are the leading contributors, supported by growing domestic demand for cigarette filters and apparel. Expanding middle-class populations and improved manufacturing infrastructure promote consumption across diverse end uses. Regional producers are gradually adopting sustainable cellulose-based materials to meet export standards. Continued investments in industrial and medical nonwovens are expected to create new growth opportunities, particularly in Brazil’s emerging filtration and packaging industries.

Middle East & Africa

The Middle East & Africa region captures a 4% share of the acetate tow market, with gradual expansion driven by industrial diversification and tobacco manufacturing. Key growth centers include the United Arab Emirates, Egypt, and South Africa. Increasing consumer demand for high-quality fabrics and filters supports steady imports. Efforts to establish local processing facilities and promote nonwoven applications in healthcare and automotive sectors are underway. Although consumption remains moderate, the region shows strong potential for future growth as sustainability awareness and textile investments continue to rise.

Market Segmentations

By Product Type

By Application

- Textile & Apparel

- Packaging

- Photographic Film

- Others

By End User

- Apparel Home Furnishings Industrial Medical Transportation

- Apparel

- Home Furnishings

- Industrial

- Medical

- Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The acetate tow market is highly consolidated, with key players focusing on technology advancement, product quality, and sustainable production practices. Mitsubishi Chemical Corporation and Daicel Corporation lead the Japanese segment through advanced cellulose acetate flake manufacturing and environmental compliance initiatives. Eastman Chemical Company and Celanese Corporation strengthen the U.S. market with diversified product portfolios and investments in low-carbon technologies. European firms such as Cerdia International GmbH and Acordis Cellulosic Fibers Inc. emphasize premium-grade tow with consistent filtration performance for tobacco applications. In China, CNTC, Jinan Acetate Chemical Co., Ltd., and Sichuan Push Acetati Co., Ltd. drive large-scale domestic production and export competitiveness through cost-efficient supply chains. Rayonier Advanced Materials focuses on high-purity cellulose integration to support sustainability goals. These companies pursue strategic collaborations, plant expansions, and innovation in biodegradable tow materials, enhancing their global market footprint and aligning with the growing demand for eco-friendly fiber-based filtration products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsubishi Chemical Corporation (Japan)

- Celanese Corporation (United States)

- Cerdia International GmbH (Switzerland)

- China National Tobacco Corporation (CNTC) (China)

- Rayonier Advanced Materials Inc. (United States)

- Daicel Corporation (Japan)

- Jinan Acetate Chemical Co., Ltd. (China)

- Acordis Cellulosic Fibers Inc. (Netherlands)

- Sichuan Push Acetati Co., Ltd. (China)

- Eastman Chemical Company (United States)

Recent Developments

- In October 2025, Celanese announced its intent to cease operations at its acetate tow facility in Lanaken, Belgium, by the second half of 2026. This decision follows a strategic review due to declining demand, regulatory uncertainty, and high operating costs at the site. The closure will impact about 160 employees, but Celanese plans to continue fulfilling customer obligations and working closely with stakeholders during the transition.

- In March 2025, Rayonier Advanced Materials outlined its strategic focus for the year, emphasizing leadership in high purity cellulose and expanding its biomaterials business. The company is shifting toward a value-over-volume approach, optimizing its asset portfolio, and investing in high-margin products. Rayonier reported a 60% increase in EBITDA from 2023 to 2024 and expects continued growth in 2025, with strategic capital investments aimed at enhancing EBITDA margins and reducing debt.

- In March 2025, Mitsubishi Chemical Corporation finalized an agreement with Daicel Corporation to transfer all shares of Toyama Filter Tow Co., Ltd., making it a wholly owned subsidiary of Daicel effective April 1, 2025. This move consolidates Daicel’s acetate tow production and strengthens its global manufacturing base, with Mitsubishi Chemical remaining a key player in the joint venture’s legacy and ongoing supply chain.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The acetate tow market will experience steady growth driven by rising tobacco and textile demand.

- Increasing adoption of biodegradable and sustainable fibers will strengthen market positioning.

- Technological advancements in tow spinning and acetylation processes will improve production efficiency.

- Expanding nonwoven applications in filtration and healthcare will diversify revenue streams.

- Asia Pacific will remain the key production and consumption hub for acetate tow.

- Collaboration between manufacturers and fashion brands will promote eco-friendly fabric innovation.

- Investments in waste recovery and green manufacturing will enhance environmental compliance.

- Market consolidation through mergers and capacity expansions will increase competitiveness.

- Growing use in medical and industrial applications will open new business opportunities.

- Regulatory support for bio-based materials will accelerate acetate tow’s long-term market adoption.