Market Overview

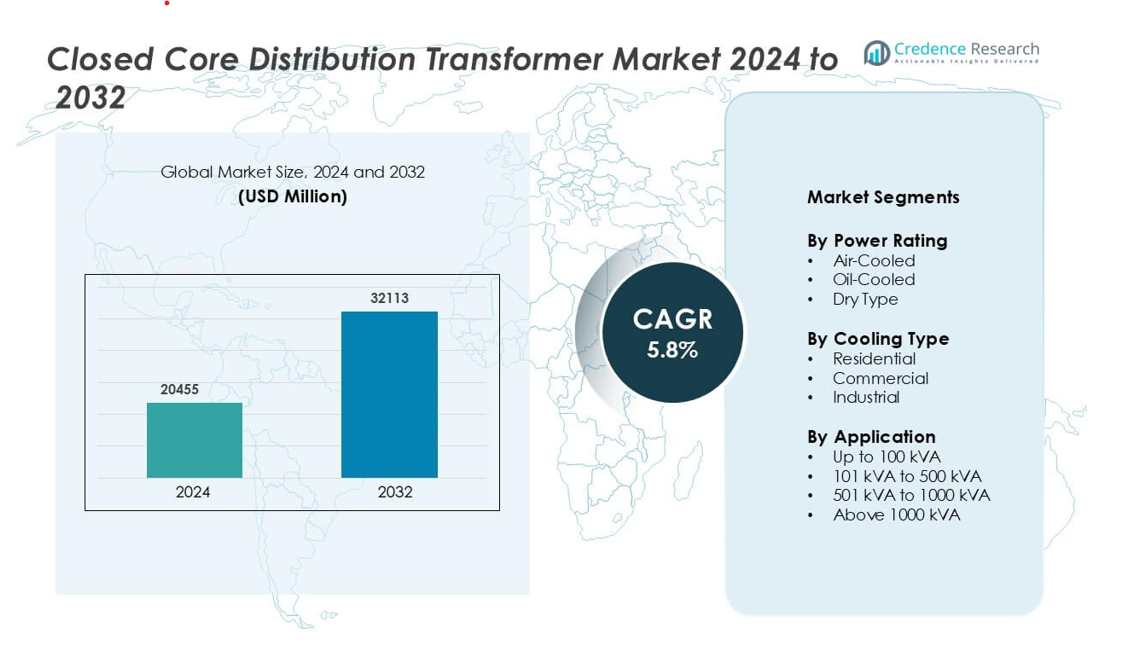

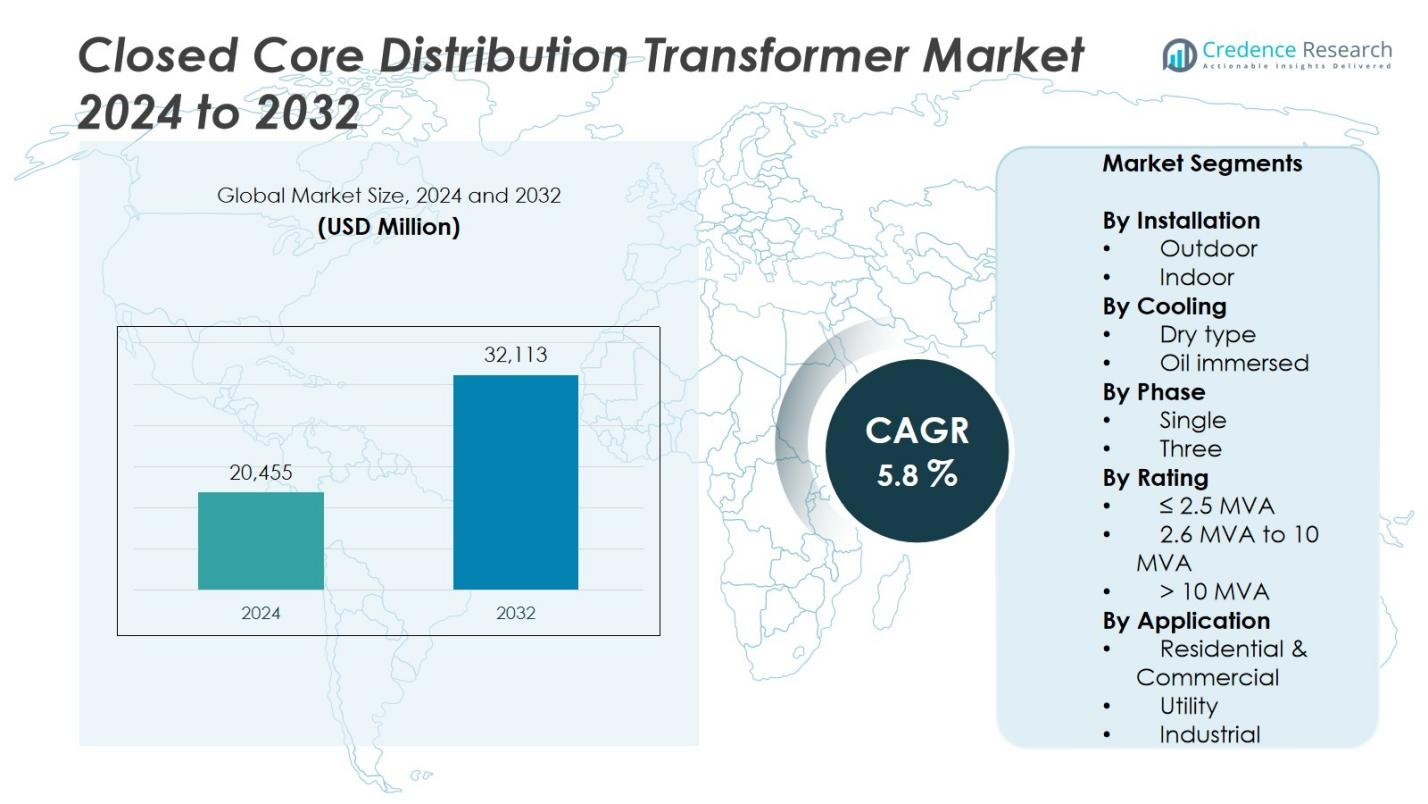

The Global Closed Core Distribution Transformer Market size was valued at USD 20,455 million in 2024 and is anticipated to reach USD 32,113 million by 2032, expanding at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Closed Core Distribution Transformer Market Size 2024 |

USD 20,455 Million |

| Closed Core Distribution Transformer Market, CAGR |

5.8% |

| Closed Core Distribution Transformer Market Size 2032 |

USD 32,113 Million |

The Closed Core Distribution Transformer Market is driven by prominent players such as Hitachi Energy Ltd., ABB, Bharat Heavy Electricals Limited (BHEL), CG Power & Industrial Solutions Ltd., General Electric, Eaton Corporation, Elsewedy Electric, EMCO Limited, Celme S.r.l., and ERMCO. These companies focus on energy-efficient designs, smart grid integration, and advanced insulation technologies to enhance performance and reliability. Strategic mergers, product innovations, and expansion into emerging markets strengthen their global presence. North America leads the market with a 34% share, supported by grid modernization projects, renewable energy expansion, and the presence of major transformer manufacturers.

Market Insights

- The Closed Core Distribution Transformer Market was valued at USD 20,455 million in 2024 and is projected to reach USD 32,113 million by 2032, growing at a CAGR of 5.8% during the forecast period.

- Rising power demand, rural electrification programs, and grid modernization initiatives are driving consistent market expansion across developed and developing economies.

- Smart and digital transformers integrated with IoT monitoring systems are emerging as a major trend, improving operational efficiency and predictive maintenance.

- The market remains moderately consolidated, with players like Hitachi Energy Ltd., ABB, CG Power, and BHEL focusing on energy-efficient technologies and regional expansion.

- North America leads with a 34% market share, followed by Europe at 27% and Asia-Pacific at 29%, while the outdoor installation segment dominates globally with a 65% share due to high usage in utilities and industrial networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Installation:

The outdoor segment dominates the Closed Core Distribution Transformer Market, accounting for around 65% of the total share in 2024. Its dominance stems from extensive use in utility distribution networks, industrial zones, and remote power supply applications. Outdoor transformers are preferred for their robust design, high load-handling capacity, and resistance to environmental stress. Rapid grid expansion in emerging economies and rising renewable power installations further accelerate demand. Indoor transformers, while holding a smaller share, are increasingly adopted in commercial complexes and smart building infrastructure requiring compact and low-noise equipment.

For instance, ABB supplies pole-mounted outdoor transformers widely used in remote power distribution for rural electrification projects, providing reliable service under harsh weather conditions.

By Cooling:

The oil-immersed segment leads the market with 72% share in 2024, driven by superior heat dissipation, efficiency, and longer operational life. These transformers are widely deployed in high-load applications across utilities and industrial facilities. Growing investments in transmission and distribution infrastructure strengthen their adoption. The dry-type segment, though smaller, is gaining traction in urban and indoor settings due to safety, fire resistance, and environmental benefits. The shift toward eco-friendly designs and compact installations is expected to support steady growth of dry-type transformers in coming years.

For instance, Hitachi Energy expanded transformer manufacturing in Turkey by investing $70 million to meet rising global demand for energy infrastructure, emphasizing oil-immersed products.

By Phase:

The three-phase segment holds the largest market share of 68% in 2024, attributed to its higher efficiency and suitability for large-scale power distribution. Industries, utilities, and commercial infrastructures rely on three-phase transformers for balanced voltage supply and reduced energy losses. Rising industrialization and urban power demands continue to reinforce its dominance. Single-phase transformers, covering the remaining market share, are preferred in rural and residential applications where power demand is relatively low. Their affordability and simpler installation make them a steady segment within the overall market landscape.

Key Growth Drivers

Rising Power Demand and Grid Modernization

The global surge in electricity consumption and expansion of distribution networks significantly drive the Closed Core Distribution Transformer Market. Governments and utilities are investing heavily in grid modernization projects to enhance energy efficiency and reliability. Increasing rural electrification programs in developing nations, coupled with the integration of renewable energy sources, further stimulate transformer demand. Upgrades to replace aging infrastructure and the shift toward decentralized power systems strengthen market growth across both developed and emerging regions.

For instance, Hitachi Energy is constructing a new $180 million transformer factory in Finland’s Vaasa region, set to double its production and testing capacity by 2027, directly supporting Finland’s renewable energy infrastructure and export of clean energy technology.

Growing Industrialization and Urban Infrastructure Development

Rapid industrialization and expanding urban infrastructure across Asia-Pacific, the Middle East, and Africa are fueling demand for efficient power distribution equipment. Closed core transformers are preferred for their compact design, low magnetic losses, and operational reliability in industrial and commercial facilities. Large-scale manufacturing, data centers, and smart cities are key contributors to this rising need. Governments’ focus on sustainable industrial development and electrification of new urban zones continues to accelerate market expansion globally.

For instance, Hyundai Electric & Energy Systems Co., Ltd. has been a key player in supplying high-capacity closed core distribution transformers optimized for heavy-duty industrial and utility applications in Asia-Pacific.

Technological Advancements in Transformer Design

Innovation in core materials, insulation systems, and digital monitoring technologies supports the growing adoption of closed core transformers. The use of amorphous steel cores and IoT-enabled sensors enhances energy efficiency and predictive maintenance capabilities. Manufacturers are focusing on optimizing transformer performance to reduce losses and meet stricter regulatory standards. These advancements help utilities and industries achieve lower operating costs and improved grid reliability, further propelling market demand.

Key Trends & Opportunities

Shift Toward Smart and Digital Transformers

The transition toward smart grids and digital monitoring systems presents a major trend in the market. Closed core distribution transformers integrated with sensors, automation, and real-time diagnostics enable predictive maintenance and load optimization. Utilities increasingly prefer such smart solutions to minimize downtime and enhance grid resilience. The growing focus on energy efficiency and data-driven asset management provides opportunities for manufacturers to introduce intelligent transformer systems with advanced analytics capabilities.

For instance, HIOTRON offers a Remote Distribution Transformer Monitoring Solution that combines telemetry, IoT hardware, and cloud connectivity to monitor multiple transformers remotely, ensuring continuous operation even during power or network outages.

Expansion of Renewable Energy Infrastructure

Rapid deployment of solar and wind power projects is creating new opportunities for closed core transformers. These units ensure stable voltage regulation and efficient power distribution from renewable energy generation sites to end-users. Governments’ commitment to carbon neutrality and the growing need for reliable grid integration of renewables strengthen this trend. Demand for transformers with high overload capacity and eco-friendly insulating materials is expected to rise steadily in renewable-rich regions.

For instance, General Electric has deployed dry-type closed core transformers with cast resin insulation in its wind power projects to enhance grid reliability and reduce maintenance needs.

Key Challenges

High Initial Investment and Maintenance Costs

The significant capital cost associated with manufacturing and installing closed core transformers remains a major challenge. High-grade core materials, precision engineering, and strict efficiency standards increase production expenses. Maintenance and replacement of components, especially in high-voltage installations, further add to operational costs. These factors can limit adoption among small-scale utilities and developing economies, slowing market penetration despite strong long-term benefits.

Supply Chain Disruptions and Raw Material Volatility

Fluctuations in the prices of copper, steel, and insulation materials affect the overall cost structure of transformers. Supply chain disruptions due to geopolitical tensions or trade restrictions often delay production and delivery schedules. Limited availability of specialized components can also impact manufacturing efficiency. To counter these challenges, manufacturers are increasingly focusing on local sourcing, recycling initiatives, and long-term supplier partnerships to ensure cost stability and timely production.

Regional Analysis

North America

North America holds the largest share of the Closed Core Distribution Transformer Market with 34% in 2024. Strong grid modernization programs and replacement of aging infrastructure across the U.S. and Canada drive regional demand. The presence of key manufacturers such as General Electric and Eaton Corporation supports continuous technological upgrades. Growing investments in renewable energy integration and the expansion of smart grid systems also boost transformer installations. The U.S. dominates due to high electricity consumption, industrial growth, and regulatory emphasis on improving transmission efficiency and reliability.

Europe

Europe accounts for 27% of the global market, driven by the region’s strong focus on sustainability and energy efficiency. Countries like Germany, France, and the U.K. are investing heavily in upgrading power networks to meet carbon reduction goals. Adoption of eco-friendly and low-loss transformer technologies continues to rise under EU energy directives. Expansion of electric vehicle charging infrastructure and distributed power systems further supports market growth. Local manufacturers and stringent efficiency standards reinforce Europe’s position as a key market for advanced transformer solutions.

Asia-Pacific

Asia-Pacific leads in volume growth and holds 29% market share in 2024, propelled by rapid urbanization, industrial expansion, and growing power consumption in China, India, and Southeast Asia. Governments’ focus on rural electrification and grid expansion programs accelerates demand. Regional players like Hitachi Energy Ltd. and CG Power & Industrial Solutions Ltd. contribute to strong manufacturing output. The rising adoption of renewable power projects and smart city initiatives also fuels transformer deployment. Increasing infrastructure investments and industrial automation make Asia-Pacific the fastest-growing regional market.

Latin America

Latin America represents 6% of the market, supported by steady power sector development in Brazil, Mexico, and Argentina. Modernization of existing grid systems and renewable energy projects are the primary growth drivers. Governments are investing in rural electrification and industrial infrastructure to improve energy access. Local utilities increasingly adopt oil-immersed and compact closed core transformers for distribution efficiency. However, budget constraints and import dependency limit large-scale deployment. Continuous policy reforms and foreign investments are expected to enhance future market expansion in the region.

Middle East & Africa

The Middle East & Africa region holds a 4% market share in 2024, driven by ongoing infrastructure and energy diversification initiatives. GCC countries are investing in power transmission networks to support industrial zones and urban development. Africa’s growing electrification efforts and renewable energy programs, especially in South Africa and Kenya, create new opportunities. The demand for durable and efficient transformers capable of withstanding harsh climatic conditions strengthens regional adoption. Despite challenges such as limited local manufacturing capacity, rising public-private partnerships are fostering steady market growth.

Market Segmentations:

By Installation

By Cooling

By Phase

By Rating

- ≤ 2.5 MVA

- 2.6 MVA to 10 MVA

- > 10 MVA

By Application

- Residential & Commercial

- Utility

- Industrial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Closed Core Distribution Transformer Market is characterized by the presence of leading players such as Hitachi Energy Ltd., ABB, Bharat Heavy Electricals Limited (BHEL), CG Power & Industrial Solutions Ltd., General Electric, Eaton Corporation, Elsewedy Electric, EMCO Limited, Celme S.r.l., and ERMCO. The market is moderately consolidated, with top manufacturers focusing on technological innovation, energy efficiency, and digital monitoring integration to strengthen their portfolios. Companies are investing in smart grid-compatible transformer solutions and eco-friendly insulation materials to meet global sustainability standards. Strategic collaborations, mergers, and regional expansion are common approaches to enhance distribution networks and service reach. Asian manufacturers are increasing their global footprint by offering cost-effective, high-performance transformers, while European and North American players continue to dominate with advanced product quality and strong after-sales support. Continuous R&D investment remains crucial for maintaining competitiveness in this evolving market landscape.

Key Player Analysis

- Hitachi Energy Ltd.

- CG Power & Industrial Solutions Ltd.

- EMCO Limited

- General Electric

- Bharat Heavy Electricals Limited (BHEL)

- ABB

- Elsewedy Electric

- Eaton Corporation

- Celme S.r.l.

- ERMCO

Recent Developments

- In September 2025, Siemens Energy AG announced a €220 million investment to expand its transformer production facility in Nuremberg, increasing capacity by nearly 50% to support growing demand for closed-core distribution transformers worldwide.

- In August 2025, Hitachi Energy India Ltd invested ₹ 300 crore to expand its Mysuru facility, doubling insulation material production and establishing the world’s first fossil-free pressboard line for transformer applications.

- On August 6 2025, Eaton completed the acquisition of Resilient Power Systems Inc., a developer of solid-state transformer-based technology, to strengthen its power-distribution offerings.

- In November 2023, Hitachi Energy unveiled a pioneering solution called Transformers with Transient Voltage Protection (TVP) aimed at safeguarding distribution transformers from transient voltage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Installation, Cooling, Phase, Rating, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth driven by global grid modernization initiatives.

- Demand will rise with increasing renewable energy integration across power networks.

- Smart and IoT-enabled transformers will gain traction for real-time performance monitoring.

- Manufacturers will focus on energy-efficient core materials to reduce operational losses.

- Rapid industrialization and urban expansion will continue to fuel transformer installations.

- Digitalization in power distribution will enhance transformer management and reliability.

- Governments will emphasize eco-friendly and low-emission transformer technologies.

- Asia-Pacific will remain the fastest-growing region due to infrastructure development.

- Strategic collaborations and local manufacturing will strengthen global supply chains.

- Continuous R&D investment will drive innovations in compact and high-capacity designs.