Market Overview

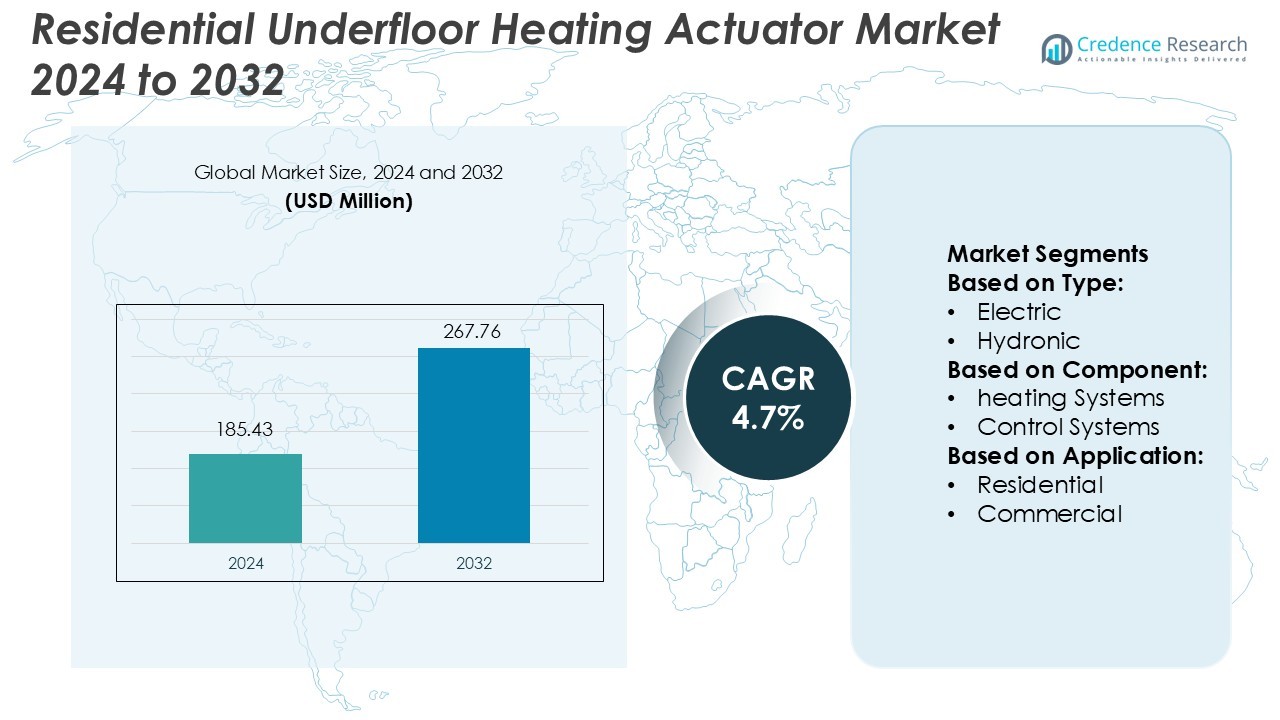

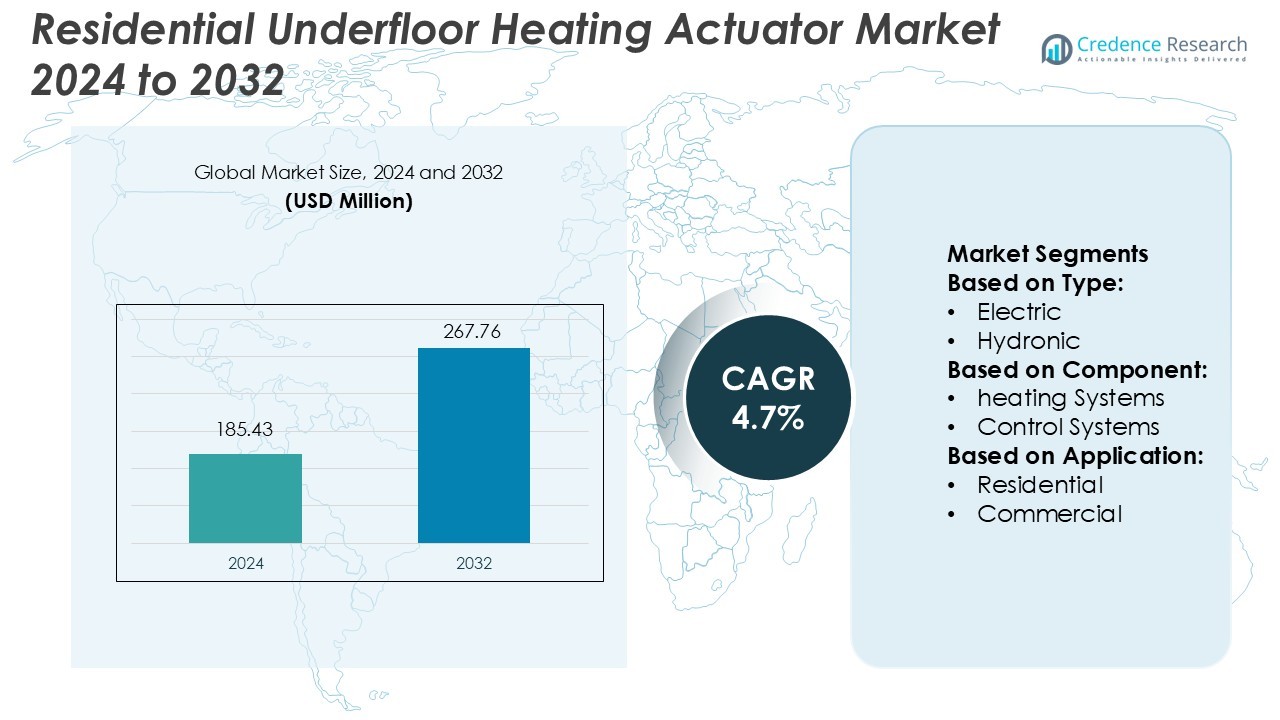

Residential Underfloor Heating Actuator Market size was valued USD 185.43 million in 2024 and is anticipated to reach USD 267.76 million by 2032, at a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Underfloor Heating Actuator Market Size 2024 |

USD 185.43 Million |

| Residential Underfloor Heating Actuator Market, CAGR |

4.7% |

| Residential Underfloor Heating Actuator Market Size 2032 |

USD 267.76 Million |

The residential underfloor heating actuator market is shaped by leading firms such as Siemens AG, Honeywell International Inc., Oventrop GmbH & Co. KG, SMLGHVAC, Danfoss, Möhlenhoff GmbH, Heatmiser, Eberle Controls GmbH, Uponor and Sauter AG. These companies emphasise smart‑home compatibility, energy‑efficient designs and regional distribution expansion. Europe emerges as the dominant region, holding a precise market share of 45% of the global market, driven by stringent building‑codes, mature retrofit activity and high smart‑home penetration.

Market Insights

- The residential underfloor heating actuator market was valued at USD 185.43 million in 2024 and is projected to reach USD 267.76 million by 2032, growing at a CAGR of 4.7%.

- Increasing adoption of smart-home systems and energy-efficient heating solutions is driving market growth globally. Homeowners prefer automated temperature control and remote monitoring features, boosting actuator demand across new and retrofit constructions.

- Technological trends include IoT integration, predictive maintenance, and mobile app-enabled control, enabling precise temperature regulation and energy optimization. Low-noise and modulating actuators are becoming standard for premium residential applications.

- The market is highly competitive, with leading companies such as Siemens, Honeywell, Danfoss, and Möhlenhoff focusing on product innovation, regional expansion, and strategic partnerships to capture market share and strengthen brand presence.

- Regionally, Europe dominates with 45% share due to high smart-home penetration, strict building codes, and active retrofit projects. Asia Pacific and North America follow, while Latin America and MEA show growing adoption potential, particularly in new residential developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the residential underfloor heating actuator market, the hydronic (water‑based) segment dominates, accounting for approximately 61.3% of the system type share. This dominance stems from hydronic systems offering efficient heat distribution across larger floor areas and compatibility with varied floor coverings. Drivers for this segment include retrofit demand in colder climates, favourable energy‑efficiency regulations, and the ability of hydronic actuators to integrate with traditional HVAC systems without major electrical upgrades.

- For instance, Siemens’ Acvatix™ electro-hydraulic actuator model SKD62U is engineered for hydronic control and delivers a nominal force of 1000 N (approximately 225 lbf) for a 20 mm stroke, enabling reliable valve control in commercial and industrial hydronic heating and cooling systems [4, 7, 8].

By Component

Within the actuator market, control systems—including actuators, sensors, thermostats and communication modules—comprise the leading component sub‑segment, driven by demands for precise zone‑by‑zone temperature regulation. The control system segment captures the largest share because homeowners increasingly adopt smart home-enabled actuators that integrate remote control, feedback loops and IoT connectivity. Key drivers here include rising energy costs, regulatory encouragement of smarter building management systems, and the need for reduced cycle times and improved user comfort.

- For instance, Honeywell’s ML7420A6009 linear valve actuator supports a 20 mm stroke and delivers 600 N thrust at 24 V AC and 50/60 Hz.

By Application

The residential application segment commands roughly 59.7% of the market share in 2024, making it the dominant sub‑segment of the underfloor heating actuator market. This strong position is propelled by homeowners choosing underfloor heating for comfort, low maintenance and improved indoor air quality, particularly in new builds and high‑end renovations. Supporting drivers include growing consumer awareness of sustainable heating solutions, incentives for energy‑efficient home systems and increasing smart‑home integration of heating controls.

Key Growth Drivers

Rising Adoption of Smart Home Technologies

The growing integration of smart home solutions is driving demand for residential underfloor heating actuators. Homeowners increasingly prefer automated climate control systems for energy efficiency, comfort, and convenience. Advanced actuators enable remote temperature monitoring, scheduling, and real-time adjustments via mobile apps or smart home hubs. For instance, companies like Honeywell and Siemens offer actuators compatible with IoT platforms, allowing precise energy management and predictive maintenance. This trend encourages residential builders and retrofit projects to adopt intelligent heating solutions, expanding market penetration globally.

- For instance, Oventrop’s wireless actuator “mote 420” uses the EnOcean radio standard, operates with a M 30 × 1.5 thread, and is battery‑powered for room‑temperature control under adjustable time programmes.

Energy Efficiency Regulations and Incentives

Government initiatives promoting energy conservation are accelerating market growth. Policies mandating reduced energy consumption in buildings encourage adoption of underfloor heating systems with efficient actuators. These systems optimize heat distribution, minimizing energy waste while maintaining comfort levels. For instance, Legrand’s actuators integrate temperature sensors that adjust flow rates to reduce energy usage by up to 15%. Financial incentives, rebates, and tax credits in regions like Europe and North America further stimulate adoption among homeowners, driving the market forward.

- For instance, SMLGHVAC’s thermal actuators operate at only 2 W power consumption, deliver a thrust of 100 ± 10 N, and achieve opening/closing in 3‑5 minutes, making them well‑suited for efficient zone‑by‑zone heating regulation.

Increasing Renovation and Construction Activities

The surge in residential construction and renovation projects is boosting actuator demand. Modern housing developments and retrofit projects prioritize advanced underfloor heating for enhanced comfort and sustainability. For instance, Danfoss actuators feature low-noise operation and modulating control, making them ideal for new and refurbished homes. Rising urbanization and high disposable incomes in emerging economies support the adoption of premium heating solutions. As developers and homeowners invest in energy-efficient systems, the actuator segment experiences consistent revenue growth across both mature and emerging markets.

Key Trends & Opportunities

Trend of Integration with IoT and Home Automation

Residential underfloor heating actuators increasingly integrate with IoT devices and smart home platforms. This enables users to control heating remotely, monitor energy consumption, and automate schedules. For instance, Siemens’ Smart Heating Actuators connect with cloud-based platforms to offer real-time diagnostics and predictive maintenance. Such integration enhances operational efficiency, user convenience, and system reliability. The trend opens opportunities for manufacturers to differentiate products through advanced features, data analytics, and compatibility with diverse home automation ecosystems, driving long-term market adoption.

- For instance, Danfoss’s digital actuator line Danfoss NovoCon® Digital Actuator supports communication protocols such as BACnet MS/TP or Modbus RTU, offers position feedback with accuracy of ±0.1 mm and stroke resolution of at least 450 steps.

Opportunity in Retrofitting Older Homes

Retrofit projects in older residential buildings present significant growth potential. Upgrading traditional heating systems to smart underfloor solutions improves energy efficiency and comfort. For instance, Honeywell offers retrofit-friendly actuators that fit existing piping without major modifications, reducing installation time and cost. Regions with aging housing stocks, such as Europe, represent lucrative markets for actuator providers. Leveraging these retrofit opportunities allows manufacturers to expand their customer base beyond new constructions and establish recurring service and maintenance revenue streams.

- For instance, Möhlenhoff’s OEM Actuator 5: Standard supports strokes of 4 mm, 5 mm or 6.5 mm, offers an actuating force of 100 N to 125 N, and draws just 1 W (or 1.2 W for 6.5 mm version) of operating power.

Key Challenges

Challenge of High Initial Investment

The upfront cost of installing underfloor heating actuators remains a significant barrier. High-quality actuators, control systems, and installation labor contribute to elevated capital expenditure, deterring price-sensitive homeowners. For instance, premium actuators from Danfoss or Legrand involve complex integration with smart home systems, increasing total project cost. Although long-term energy savings exist, the initial investment can limit adoption in emerging markets. Manufacturers must balance cost with performance and explore financing or incentive programs to encourage wider acceptance.

Challenge of Technical Complexity and Maintenance

Complex actuator systems require specialized installation and maintenance, posing adoption challenges. Improper setup can reduce system efficiency and increase operational issues. For instance, smart actuators with IoT integration, such as Siemens’ models, demand skilled technicians for calibration and network configuration. Limited technical expertise in certain regions may delay market penetration. Manufacturers need to provide robust training, support services, and user-friendly interfaces to mitigate complexity concerns, ensuring reliable operation and customer satisfaction.

Regional Analysis

North America

The North America region held an estimated market share of approximately 20% in the global residential underfloor heating actuator market in 2024. The United States and Canada drove growth due to homeowners’ rising demand for smart‑home climate control and energy‑efficient systems. Developers increasingly integrate underfloor heating actuators during new construction and retrofits, responding to stricter efficiency regulation and consumer comfort expectations. The region’s infrastructure and technology readiness support actuator adoption, while local manufacturers and service providers ensure accessible installation and maintenance services.

Europe

Europe dominated the regional landscape with a market share of around 45% in 2024, underpinned by strong regulatory support for building decarbonisation and retrofit activity. Countries such as Germany, France and the UK led actuator uptake due to established underfloor heating systems and high smart‑home penetration. Manufacturers in Europe capitalise on integrated wireless solutions and zoning actuators tailored for modern renovations. Growth remains vigorous as homeowners pursue energy savings and comfort upgrades, backed by government incentives and eco‑friendly construction mandates.

Asia Pacific

Asia Pacific captured nearly 20% of the market in 2024, driven by rapid urbanisation, rising disposable incomes and increasing adoption of smart home systems in China, Japan, South Korea and India. Governments in the region promote energy‑efficient technologies and new housing developments favour advanced underfloor heating configurations. While infrastructure and retrofit awareness still lag the West, regional manufacturers are localising actuator product lines and forging partnerships with HVAC integrators to gain market traction. Robust growth is expected as penetration deepens and smart‑home ecosystems expand.

Latin America

Latin America accounted for about 8% of the residential underfloor heating actuator market in 2024, with Brazil and Mexico emerging as key contributors. Growth stems from rising residential construction and growing interest in comfort heating solutions in mid‑to‑premium homes. Market uptake remains moderate due to cost constraints and limited awareness of actuator‑based systems, but retrofit potential and luxury housing developments offer opportunity. Regional vendors focusing on value‑priced actuators and local service support stand to benefit as adoption accelerates.

Middle East & Africa (MEA)

The MEA region held approximately 7% share of the market in 2024, reflecting nascent yet growing demand for advanced heating solutions in domestic and expatriate housing segments. In the Gulf Cooperation Council (GCC) countries and South Africa, increasing investment in high‑end residential projects creates opportunity for smart underfloor heating actuator adoption. Challenges include high upfront costs and constrained technical servicing. Nonetheless, rising smart‑home penetration and green‑building mandates are expected to propel growth in MEA over the coming years.

Market Segmentations:

By Type:

By Component:

- heating Systems

- Control Systems

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Residential Underfloor Heating Actuator Market is highly competitive, with key players including Siemens AG, Honeywell International, Inc., Oventrop GmbH & Co. KG, SMLGHVAC, Danfoss, Möhlenhoff GmbH, Heatmiser, Eberle Controls GmbH, Uponor, and Sauter AG. The Residential Underfloor Heating Actuator Market is highly competitive, driven by rapid technological advancements and increasing demand for energy-efficient solutions. Companies are focusing on smart-home integration, IoT-enabled control, and predictive maintenance features to enhance system performance and user convenience. Product differentiation through low-noise operation, precise temperature control, and retrofit-friendly designs is becoming critical to capture market share. Strategic partnerships, regional expansion, and targeted marketing support growth in both mature and emerging markets. Continuous investment in research and development ensures innovation, enabling manufacturers to meet evolving consumer preferences and regulatory requirements while strengthening their position in the global market.

Key Player Analysis

- Siemens AG

- Honeywell International, Inc.

- Oventrop GmbH & Co. KG

- SMLGHVAC

- Danfoss

- Möhlenhoff GmbH

- Heatmiser

- Eberle Controls GmbH

- Uponor

- Sauter AG

Recent Developments

- In April 2025, Schneider Electric South Africa, introduced the full variety of innovative EasyLogic and SpaceLogic actuators and ball valves. These are further designed to optimize HVAC system performance, reducing operational costs and ensuring energy efficiency. Moreover, the products reflect the company’s commitment to excellence and sustainability in energy management.

- In February 2025, Danfoss showcased a wide range of energy efficient solutions including Icon2 and Ally smart heating control ecosystems for multi-zone systems. Further, they are integrated via the Ally App to provide intelligent balancing, enhanced energy efficiency and seamless configuration across the hydronic HVAC systems.

- In June 2023, Ambiente exhibited new products to support both cooling and heating circuits. The self-balancing actuator reduces the requirement for a complete system design. Moreover, the additional costs are repaid directly with the installation due to the time savings. Further, it allows the integration of AI, thereby making the installations quicker and easier.

- In January 2023, The Timken Company acquired Nadella Group, a European manufacturer of actuators & systems, telescopic rails, linear guides, and other industrial motion solutions from ICG plc to expand its linear motion portfolio.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of smart home systems will accelerate demand for residential underfloor heating actuators.

- Integration with IoT and mobile apps will enhance remote monitoring and energy management.

- Retrofit projects in older homes will drive incremental growth in mature markets.

- Energy efficiency regulations will continue to promote advanced actuator adoption.

- Rising urbanization and new residential construction in Asia Pacific will boost market penetration.

- Manufacturers will focus on low-noise, precise, and user-friendly actuator designs.

- Strategic collaborations and partnerships will expand regional presence and distribution networks.

- Advances in predictive maintenance and analytics will improve system reliability and customer satisfaction.

- Growing awareness of sustainability will increase demand for energy-saving heating solutions.

- Expansion in emerging markets will create long-term growth opportunities for manufacturers.