Market Overview

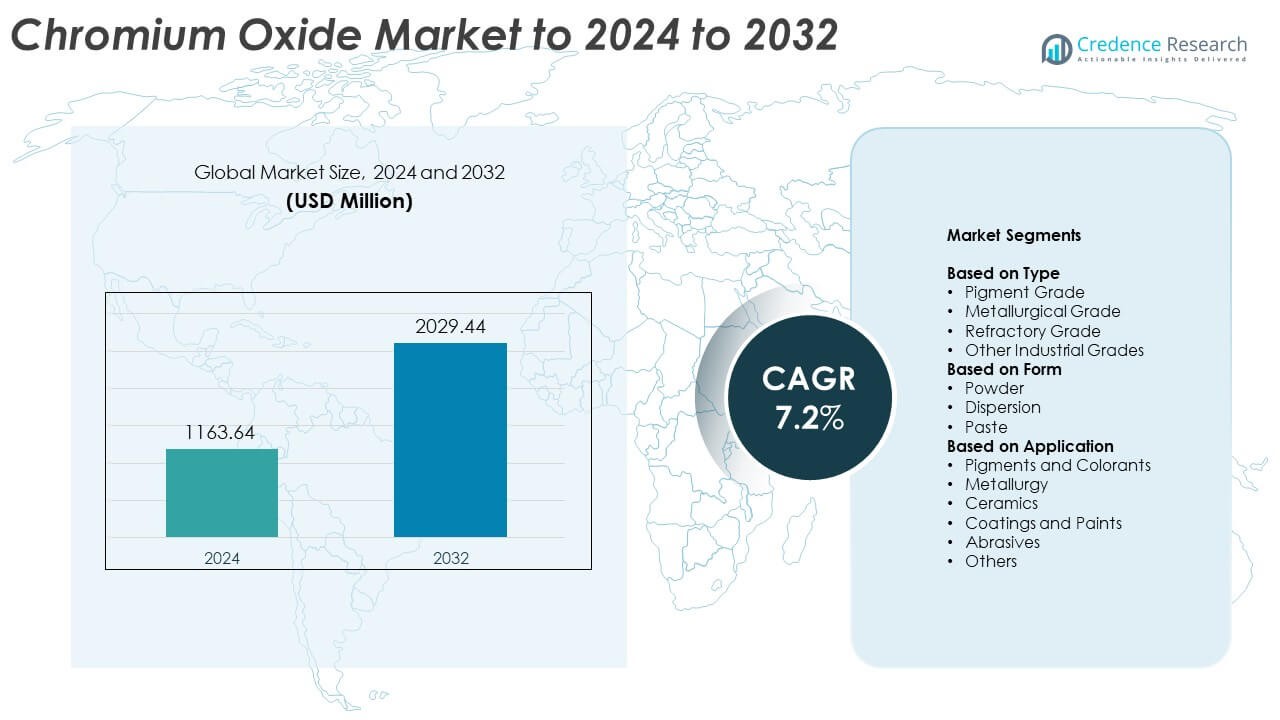

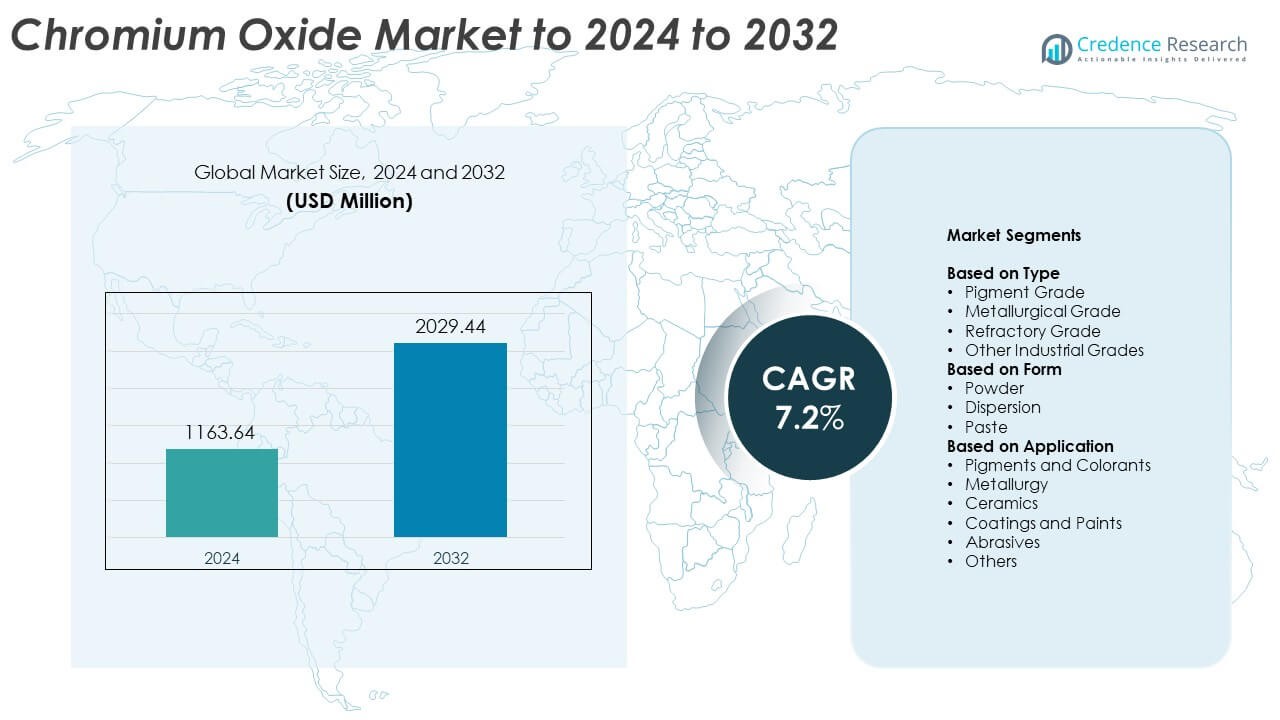

Chromium Oxide Market size was valued at USD 1163.64 million in 2024 and is anticipated to reach USD 2029.44 million by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chromium Oxide Market Size 2024 |

USD 1163.64 Million |

| Chromium Oxide Market, CAGR |

7.2% |

| Chromium Oxide Market Size 2032 |

USD 2029.44 Million |

The chromium oxide market is characterized by strong competition among major players including Tronox Limited, Lanxess AG, Elementis plc, Sibelco, and Hunter Chemical LLC. These companies dominate global supply through advanced manufacturing capabilities, wide product portfolios, and sustainable production initiatives. Asia Pacific leads the market with about 35% share in 2024, driven by expanding construction, coatings, and metallurgical industries in China and India. Europe follows with around 25% share, supported by demand for eco-friendly pigments and ceramics. North America accounts for nearly 27%, benefiting from advanced industrial infrastructure and consistent demand in high-performance coatings and refractory applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The chromium oxide market was valued at USD 1163.64 million in 2024 and is projected to reach USD 2029.44 million by 2032, growing at a CAGR of 7.2% during the forecast period.

- Growth is driven by increasing demand for pigment-grade chromium oxide, which accounts for about 48% share, supported by expanding applications in paints, coatings, and ceramics.

- Rising adoption of eco-friendly and high-performance pigments, along with nanotechnology integration in coatings, is shaping key market trends.

- The market is moderately consolidated, with leading companies focusing on capacity expansion, product purity, and sustainable production practices.

- Asia Pacific leads with 35% share, followed by Europe at 25% and North America at 27%, driven by strong industrial growth, infrastructure expansion, and rising demand from metallurgy and construction sectors.

Market Segmentation Analysis:

By Type

The pigment grade segment dominates the chromium oxide market, accounting for around 48% share in 2024. Its dominance is driven by widespread use in paints, plastics, ceramics, and construction materials due to high thermal stability and strong green coloration. This grade’s excellent weather and chemical resistance makes it a preferred choice for decorative coatings and architectural finishes. Growing demand from automotive and industrial coatings industries further supports segment growth, while metallurgical and refractory grades expand steadily with increasing use in alloy and refractory brick production.

- For instance, LANXESS states its chromium-oxide pigments stay stable up to 1,000 °C, suiting coil and powder coatings.

By Form

The powder form leads the market with approximately 57% share in 2024, owing to its extensive use across pigment, ceramics, and metallurgy applications. Powder chromium oxide provides superior dispersion, consistent particle size, and enhanced color strength, making it ideal for paints, plastics, and glass formulations. Its fine texture also enables efficient sintering in refractory and metal alloy processes. The dispersion and paste forms are gaining traction for specialized coatings and printing inks where high uniformity and surface adhesion are required.

- For instance, Heubach’s AQUIS™ Green 90170 N dispersion lists 73% pigment content, 2.6 g/cm³ density, and lightfastness 8/8.

By Application

The pigments and colorants segment holds the largest market share of about 44% in 2024, primarily driven by rising demand from construction, automotive, and plastics sectors. Chromium oxide’s unique green hue, opacity, and weather resistance make it essential for durable coatings, ceramics, and decorative materials. Its non-reactive and heat-resistant properties enhance performance in architectural paints and industrial finishes. Other applications, including metallurgy, abrasives, and ceramics, are expanding steadily with the growing need for high-temperature and corrosion-resistant materials in industrial operations.

Key Growth Drivers

Rising Demand from Coatings and Pigments Industry

The coatings and pigments industry remains the major driver of the chromium oxide market. Its exceptional stability, UV resistance, and vibrant green shade make it ideal for industrial coatings, automotive finishes, and architectural paints. Rapid urbanization and infrastructure development have accelerated the consumption of chromium oxide-based pigments. The demand for durable and corrosion-resistant coatings in construction and transportation sectors continues to boost production and sales of pigment-grade chromium oxide globally.

- For instance, Shepherd Color’s GR0010C650 reports heat stability up to 800 °C, and can achieve a TSR (Total Solar Reflectance) of up to 40%.

Expanding Use in Metallurgical and Refractory Applications

Chromium oxide plays a vital role in producing stainless steel, superalloys, and refractory bricks due to its high melting point and thermal stability. Industries such as metallurgy and foundry operations increasingly depend on chromium oxide for enhancing metal hardness and oxidation resistance. Growing steel production in developing economies and the expansion of high-temperature industrial processes are key factors propelling this demand. The metallurgical grade continues to see consistent adoption in heavy engineering and metallurgical manufacturing.

- For instance, RHI Magnesita chrome-corundum bricks contain 10–70% Cr₂O₃ for glass and metallurgical linings.

Increasing Demand for Advanced Ceramics and Abrasives

The ceramics and abrasives industries are witnessing steady growth supported by chromium oxide’s superior hardness and wear resistance. It is extensively used in sintered ceramics, grinding wheels, and polishing compounds. The trend toward high-performance ceramics in electronics, aerospace, and energy sectors further strengthens its market position. Ongoing investments in advanced manufacturing technologies and demand for precision components are fostering the adoption of chromium oxide-based materials across several high-value industrial applications.

Key Trends & Opportunities

Shift Toward Eco-Friendly Production Processes

Manufacturers are shifting toward sustainable and low-emission production methods to meet tightening environmental regulations. The adoption of eco-friendly synthesis routes and recycling of chromium-bearing waste supports cleaner manufacturing. The growing preference for sustainable pigments and coatings in green building projects presents new opportunities. This transition not only reduces environmental impact but also improves compliance with global sustainability standards and increases acceptance in markets with strict environmental norms.

- For instance, AkzoNobel Interpon D Low Solar Absorption coatings reach TSR up to 65%, aiding energy-efficient, low-VOC projects.

Integration of Nanotechnology in Pigment and Coating Development

The use of nanotechnology is reshaping the performance of chromium oxide pigments and coatings. Nano-sized particles enhance color uniformity, opacity, and dispersion properties while reducing pigment usage. These innovations are improving coating durability, corrosion resistance, and heat reflection. The growing application of nano-chromium oxide in high-performance paints, plastics, and defense coatings is expanding new commercial opportunities for manufacturers focused on advanced material solutions.

- For instance, Sigma-Aldrich lists Cr₂O₃ nanopowder with particle size <100 nm (TEM), enabling high-uniformity formulations.

Key Challenges

Environmental and Health Concerns

The production and handling of chromium compounds pose environmental and occupational health risks. Despite chromium oxide being less toxic than other chromium variants, improper waste disposal and exposure can lead to safety concerns. Strict regulatory frameworks, particularly in Europe and North America, have increased compliance costs for producers. Companies must invest in advanced filtration and waste management systems to reduce emissions and maintain sustainable operations, which can limit profitability for smaller manufacturers.

Volatility in Raw Material Prices

Fluctuations in raw material prices, especially chromium ore, affect the overall production cost of chromium oxide. Market instability caused by supply chain disruptions and mining restrictions in key producing regions has created pricing challenges. Manufacturers face difficulties maintaining stable profit margins while ensuring quality and competitiveness. The dependency on limited chromium reserves further intensifies cost pressures, encouraging companies to explore recycling and alternative raw material sourcing strategies to stabilize long-term operations.

Regional Analysis

North America

North America holds around 27% share of the chromium oxide market in 2024, driven by robust demand from coatings, automotive, and aerospace industries. The United States leads the region with strong consumption in industrial coatings and ceramics due to advanced manufacturing infrastructure. Rising adoption of eco-friendly pigments and stringent environmental standards also support market expansion. Continuous investments in construction and infrastructure renovation projects are contributing to stable pigment-grade chromium oxide demand. The growing shift toward sustainable material production further enhances regional competitiveness.

Europe

Europe accounts for approximately 25% share of the global chromium oxide market in 2024. The region benefits from mature industrial infrastructure and strong demand from automotive coatings, ceramics, and metallurgy sectors. Germany, France, and Italy remain key markets owing to the presence of major pigment and coating manufacturers. Environmental regulations promoting low-emission and sustainable production processes are encouraging the use of eco-friendly chromium oxide. Rising investments in green buildings and architectural coatings continue to boost pigment-grade demand across European economies.

Asia Pacific

Asia Pacific dominates the chromium oxide market with around 35% share in 2024, led by strong industrial activity in China, India, and Japan. The region’s expanding steel, construction, and automotive industries significantly drive demand for metallurgical and pigment-grade chromium oxide. Rapid infrastructure growth and manufacturing expansion are fueling consumption across coatings and ceramics applications. Cost-effective production capabilities and abundant raw material availability strengthen Asia Pacific’s leadership. Increasing government support for industrial modernization and environmental sustainability continues to enhance regional market prospects.

Latin America

Latin America holds about 8% share of the chromium oxide market in 2024, with growing demand from construction and metallurgy sectors. Brazil and Mexico lead regional consumption due to industrial growth and urban infrastructure development. The region is gradually expanding its coatings and ceramics industries, contributing to rising pigment-grade use. However, limited domestic production and dependence on imports pose challenges for price stability. Ongoing industrialization and foreign investments in metal processing are expected to support moderate growth in the coming years.

Middle East & Africa

The Middle East & Africa region captures nearly 5% share of the chromium oxide market in 2024. Demand is mainly driven by infrastructure development, construction projects, and industrial coatings. The United Arab Emirates, Saudi Arabia, and South Africa are key consumers, supported by increasing investments in energy and metallurgy sectors. Rising focus on durable, weather-resistant coatings and high-temperature materials in industrial facilities boosts market uptake. However, limited production facilities and high import dependency remain key restraints to faster regional expansion.

Market Segmentations:

By Type

- Pigment Grade

- Metallurgical Grade

- Refractory Grade

- Other Industrial Grades

By Form

By Application

- Pigments and Colorants

- Metallurgy

- Ceramics

- Coatings and Paints

- Abrasives

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The chromium oxide market features a moderately consolidated competitive landscape with key players such as Tronox Limited, Lanxess AG, Sibelco, ChromaMet Tech, Hunter Chemical LLC, Elementis plc, and others. Leading manufacturers focus on expanding production capacities, enhancing process efficiency, and developing sustainable product variants to meet growing industrial demand. The market competition is influenced by advancements in pigment technology, rising adoption of eco-friendly coatings, and innovations in nanomaterial-based applications. Companies are emphasizing research and development to improve product purity and performance while ensuring compliance with stringent environmental standards. Strategic mergers, acquisitions, and partnerships are common approaches to strengthen regional presence and expand end-use portfolios. Moreover, growing collaborations with downstream industries in coatings, metallurgy, and ceramics sectors are fostering long-term customer relationships. The competitive environment remains dynamic, with firms investing in cleaner manufacturing and supply chain resilience to maintain profitability in an increasingly sustainability-driven marketplace.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tronox Limited

- Lanxess AG

- Sibelco

- ChromaMet Tech

- Hunter Chemical LLC

- Elementis plc

- Midural Group

- Goodfellow Corporation

- Sachtleben Chemie GmbH

- Hunan Sunward Industrial Co.

- Bayer MaterialScience

- Shanghai Jiuling Chemical Co., Ltd.

- American Elements

- Sisecam Group

- Elementis Specialties

Recent Developments

- In 2024, Lanxess introduced a novel production method for chromium trioxide incorporating advanced environmental protection techniques.

- In 2024, ChromaMet Tech installed a pilot plant for producing high-surface-area chromium oxide granules and began exporting.

- In 2022, Elementis agreed to sell its chromium business to the Yildirim Group for a $170 million enterprise value, a deal that followed a strategic review announced in April 2022

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The chromium oxide market is expected to witness steady growth driven by rising industrial applications.

- Demand from coatings, paints, and construction sectors will continue to strengthen pigment-grade dominance.

- Expanding metallurgy and refractory industries will sustain demand for high-purity chromium oxide.

- Growing preference for eco-friendly and low-emission pigment production will shape market innovation.

- Asia Pacific will maintain its leadership due to rapid industrialization and manufacturing expansion.

- Technological advances in nanomaterial-based pigments will enhance product performance and versatility.

- Increasing adoption of durable and corrosion-resistant coatings in infrastructure will support market stability.

- Strategic collaborations among manufacturers will promote sustainable production and global capacity expansion.

- Price volatility of raw materials will encourage investment in recycling and alternative sourcing methods.

- Continued regulatory focus on environmental safety will drive modernization and process optimization in production.