Market Overview

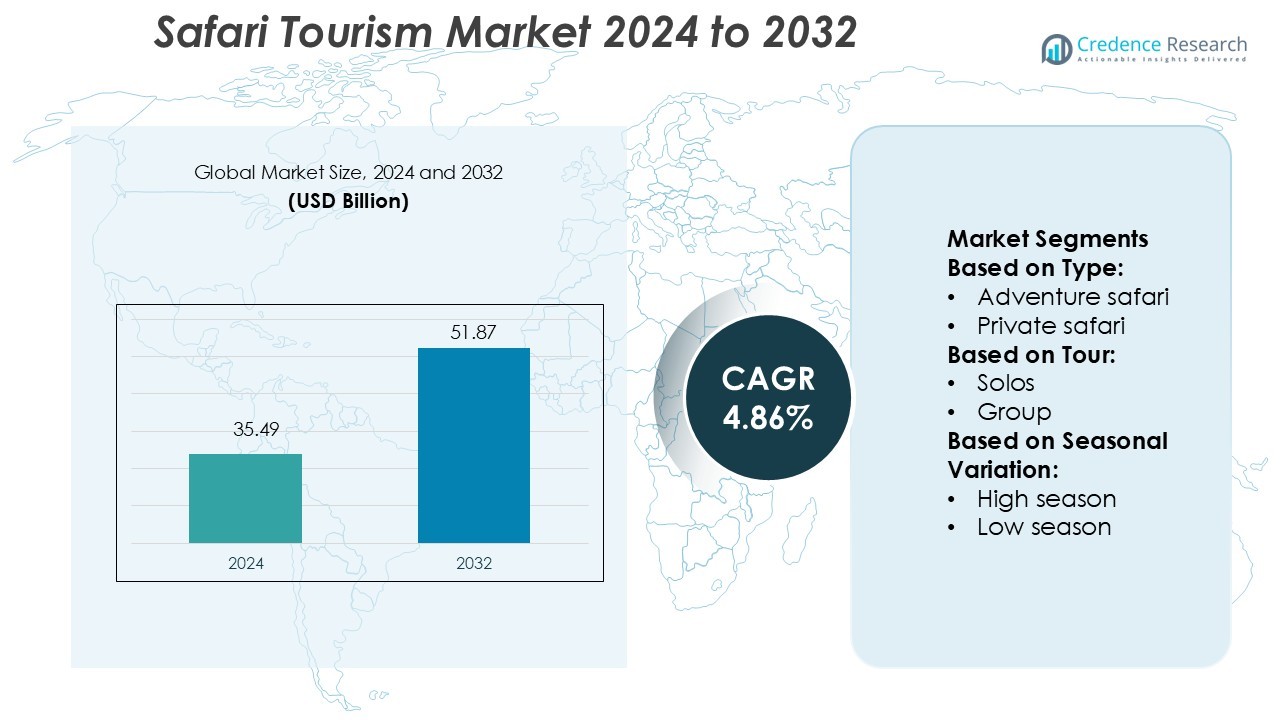

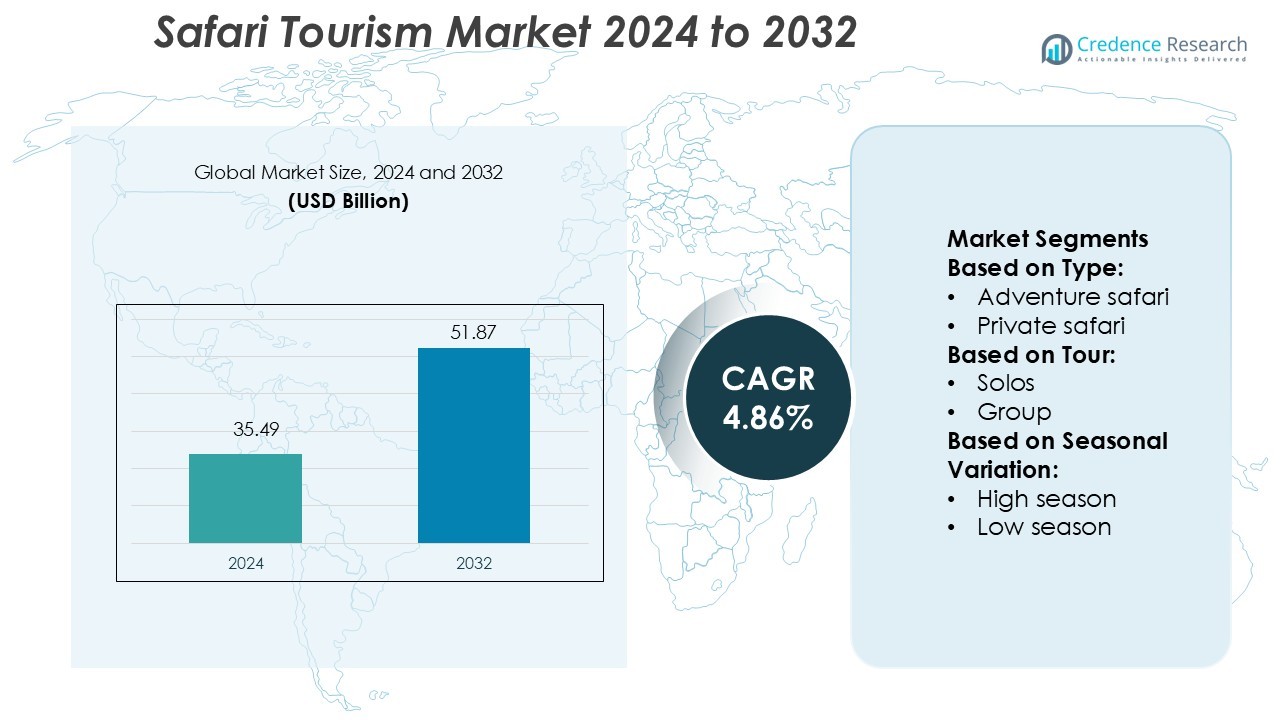

Safari Tourism Market size was valued USD 35.49 billion in 2024 and is anticipated to reach USD 51.87 billion by 2032, at a CAGR of 4.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Safari Tourism Market Size 2024 |

USD 35.49 Billion |

| Safari Tourism Market, CAGR |

4.86% |

| Safari Tourism Market Size 2032 |

USD 51.87 Billion |

The safari tourism market is shaped by prominent players such as Micato Safari, Backroads, Singita, Abercrombie & Kent Ltd., Rothchild Safaris, Great Plains, Scott Dunn, Gamewatchers Safaris, Butterfield & Robinson, and Enchanting Travels. These companies focus on luxury travel experiences, sustainable tourism practices, and personalized itineraries to strengthen their competitive position. They leverage digital platforms, strategic partnerships, and exclusive lodge offerings to attract high-value travelers worldwide. Europe leads the market with a 32% share, driven by strong outbound travel, high spending capacity, and a growing preference for eco-tourism. This regional dominance is supported by well-developed travel infrastructure, seamless connectivity, and rising demand for premium adventure experiences.

Market Insights

- The Safari Tourism Market was valued at USD 35.49 billion in 2024 and is expected to reach USD 51.87 billion by 2032, growing at a CAGR of 4.86%.

- Rising demand for sustainable travel, wildlife conservation experiences, and luxury safari packages is driving strong market growth.

- Digital transformation, eco-friendly lodges, and exclusive tour offerings are shaping key trends, with leading operators focusing on premium personalized travel.

- High travel costs, strict wildlife regulations, and environmental challenges may restrain expansion in some destinations.

- Europe leads the market with a 32% share, followed by North America at 27% and Asia Pacific at 22%, while luxury safari tours dominate the segment share with strong demand from high-spending travelers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Adventure safari holds the dominant share in the Safari Tourism Market. Travelers prefer immersive wildlife experiences, off-road explorations, and guided treks in national parks. This segment benefits from rising demand for authentic, nature-based adventures. Operators focus on customized routes and sustainable practices to attract eco-conscious tourists. Adventure safari packages often include expert-led game drives and overnight stays in lodges or camps. The segment grows steadily due to strong international interest in African and Asian safari destinations. Private safari follows, appealing to luxury travelers seeking exclusivity and privacy during their trips.

- For instance, Singita is a leader in sustainable tourism that uses solar power and other eco-friendly practices across its lodges and reserves. The company has a 2025 target to power its off-grid lodges with 80% on-site renewable energy.

By Tour

Group tours account for the largest market share in the Safari Tourism Market. These tours offer cost-effective packages, shared experiences, and guided schedules. Travelers often prefer group safaris for enhanced safety, structured itineraries, and cultural interaction. Tour operators design group packages with fixed routes and professional guides, ensuring smooth coordination. The growing popularity of organized travel and wildlife photography tours drives this segment. Solo tours remain a niche but growing segment, attracting independent travelers seeking flexibility and personalized experiences in remote locations.

- For instance, Sitatunga Private Island camp is powered by 146 high-performance solar panels, delivering 220 volts to run the entire camp’s operations, including guest suites and main amenities.

By Seasonal Variation

High season dominates the Safari Tourism Market due to favorable weather and better wildlife viewing. Tourists prefer this period for clear visibility, dry landscapes, and increased animal activity near water sources. Operators maximize capacity and offer premium experiences during peak months, boosting revenue. National parks also see higher visitor numbers and longer average stays in this season. Low season, though less crowded, attracts budget travelers and adventure seekers interested in quieter safaris. Dynamic pricing and targeted promotions help operators maintain demand throughout the year.

Key Growth Drivers

Rising Demand for Wildlife and Nature Experiences

Growing interest in authentic wildlife experiences fuels safari tourism growth. Travelers seek close encounters with animals and natural habitats, driving bookings for guided safaris and conservation tours. Governments and private operators invest in sustainable infrastructure to support this demand. National parks and reserves benefit from increased tourism revenue, strengthening preservation efforts. Improved accessibility and eco-friendly lodges enhance visitor experiences, encouraging repeat travel. This shift in tourist behavior boosts the global appeal of safari destinations, making wildlife-based tourism a strong economic driver.

- For instance, Scott Dunn increased its global conversion rate by 48 % after integrating call-tracking technology and cut cost-per-acquisition by 35 %. National parks and reserves benefit from increased tourism revenue, strengthening preservation efforts.

Expansion of Sustainable and Eco-Tourism Initiatives

Safari operators adopt sustainable practices to meet the rising demand for responsible travel. Governments and NGOs promote eco-tourism through protected area management, community partnerships, and conservation projects. These efforts attract environmentally conscious travelers seeking low-impact experiences. Investment in renewable energy, eco-lodges, and conservation-led safaris strengthens destination competitiveness. Tourism policies focused on sustainability increase visitor trust and brand value. This trend positions safari tourism as a key segment in the broader eco-tourism landscape, driving market growth.

- For instance, Butterfield & Robinson invests in community and conservation technology innovation. It directs roughly 5 % of annual profits into projects that support biodiversity, cultural heritage, education and community equity.

Technological Advancements in Safari Operations

Technology enhances the safari experience and operational efficiency. Digital booking platforms, virtual previews, and mobile apps simplify planning for travelers. Advanced tracking systems and AI-based wildlife monitoring improve safety and wildlife visibility. Tour operators use drones and GPS for guided routes, reducing environmental impact. Virtual safaris expand access to remote audiences, creating new revenue streams. Data-driven insights help optimize tourist flows and protect fragile ecosystems. These innovations increase customer satisfaction and boost market expansion.

Key Trends & Opportunities

Growth of Luxury and Customized Safari Experiences

Luxury safari tourism is gaining traction among high-spending travelers. Premium lodges, private guides, and exclusive wildlife tours attract niche markets. Personalized itineraries enhance customer satisfaction and loyalty. Operators focus on offering unique experiences such as hot-air balloon safaris and private conservancies. These offerings increase revenue margins and support community-based conservation. Luxury tourism also drives investment in infrastructure and service quality, improving the overall safari ecosystem.

- For instance, Levare’s product brochures specify that its Harsh Duty ESP systems, which can feature Packet pumps, use TC bearings spaced at 1.1 ft (0.35 m) intervals along the shaft.

Integration of Digital and Immersive Experiences

Digital innovations enhance the safari tourism experience before, during, and after trips. Virtual reality previews allow travelers to explore destinations remotely, building interest and trust. Real-time wildlife tracking apps provide guided navigation and educational content. Tour operators use AI and analytics to personalize travel itineraries. This integration of digital tools boosts engagement, reduces operational costs, and broadens market reach. It also creates opportunities for hybrid experiences combining physical tours and virtual access.

- For instance, JJ Tech’s ULTRA-FLOW® system pairs a downhole jet pump (with no moving parts) and surface diaphragm pump, allowing retrieval via reverse circulation and enabling run-times of 3 to 5 years without a full workover.

Community-Based Tourism Opportunities

Local communities play a growing role in safari tourism. Community-managed conservancies and cultural programs create immersive experiences for travelers. Revenue-sharing models support livelihoods and wildlife conservation. Tourists increasingly prefer experiences that benefit local communities, enhancing destination appeal. These partnerships promote cultural preservation and sustainable development. Community engagement also strengthens conservation outcomes, making it a core element of future safari strategies.

Key Challenges

Environmental and Conservation Concerns

Safari tourism depends heavily on fragile ecosystems, making environmental protection crucial. Over-tourism, habitat degradation, and poaching threaten wildlife populations. Uncontrolled vehicle access and infrastructure expansion can disrupt ecosystems. Climate change worsens these risks, reducing wildlife visibility and damaging biodiversity. Conservation measures often require high investments, limiting growth for smaller operators. Addressing these concerns is critical to sustaining long-term market expansion.

Political Instability and Safety Risks

Many popular safari destinations face political instability, safety concerns, or poor infrastructure. Conflicts, natural disasters, and health crises can rapidly reduce tourist arrivals. Unpredictable regulations and weak governance add operational challenges for tour operators. Insurance costs and travel advisories discourage travelers from high-risk areas. Ensuring traveler safety and stability remains a major hurdle for market growth. These factors make risk management essential for sustained investment and tourism development.

Regional Analysis

Regional Analysis

North America

North America holds a 27% market share in the safari tourism market. The region benefits from a high concentration of outbound travelers and strong demand for luxury experiences. U.S. and Canadian tourists prefer well-organized, sustainable safari tours in Africa and Asia. Growing interest in wildlife photography and personalized tours drives market expansion. The presence of specialized tour operators and digital booking platforms enhances accessibility. Increased disposable income and vacation preferences for adventure tourism further boost regional demand. Airlines and hospitality providers strengthen the safari tourism value chain through strategic partnerships and bundled travel packages.

Europe

Europe accounts for a 32% market share, making it the leading region in safari tourism. The strong market position comes from a large outbound travel base, particularly from the UK, Germany, and France. European travelers show a strong preference for eco-friendly safaris and cultural experiences. High awareness of wildlife conservation encourages bookings in African destinations. The region benefits from advanced travel infrastructure, seamless flight connectivity, and experienced tour operators. Marketing campaigns promoting sustainable travel further boost participation. Luxury safari lodges and exclusive tour packages enhance travel experiences, attracting high-spending tourists from the region.

Asia Pacific

Asia Pacific captures a 22% market share in the safari tourism market. The region is witnessing rapid growth due to rising middle-class income and expanding travel infrastructure. Countries like China, Japan, India, and Australia contribute significantly to outbound safari travel. Younger travelers increasingly seek adventure experiences, driving strong demand for affordable safari packages. Digital platforms and flexible itineraries make booking easier. Governments and private operators invest in eco-tourism initiatives that attract interest in African and domestic wildlife reserves. Travel influencers and online campaigns are also helping to increase awareness and participation.

Latin America

Latin America represents a 4% market share in the global safari tourism market. While smaller in volume, the region is showing steady growth driven by adventure travel demand. Brazil, Costa Rica, and Argentina are emerging as eco-tourism hotspots. Rich biodiversity and rainforest reserves offer alternative safari experiences. Local governments are promoting wildlife tourism through conservation programs and infrastructure improvements. The growing number of specialized tour operators and adventure agencies is expanding access to safari-style experiences. Increased global marketing and flight connectivity are expected to boost the region’s participation in the market.

Middle East & Africa

The Middle East & Africa region holds a 15% market share but plays a dominant role as the primary safari destination. Countries such as Kenya, South Africa, Tanzania, and Botswana attract millions of tourists annually. Strong conservation efforts and wildlife diversity make the region a global safari hub. High-value experiences, including luxury lodges and exclusive game drives, drive revenue. Investments in airport connectivity and security have improved accessibility. Safari parks offer year-round attractions, increasing tourist inflow. Local operators collaborate with international agencies to expand tour packages and enhance travel experiences.

Market Segmentations:

By Type:

- Adventure safari

- Private safari

By Tour:

By Seasonal Variation:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The safari tourism market features strong competition with key players such as Micato Safari, Backroads, Singita, Abercrombie & Kent Ltd., Rothchild Safaris, Great Plains, Scott Dunn, Gamewatchers Safaris, Butterfield & Robinson, and Enchanting Travels. The safari tourism market is becoming increasingly competitive as operators focus on differentiation through unique experiences, sustainable practices, and premium service offerings. Companies are investing in advanced digital platforms to enhance booking convenience and improve customer engagement. Strategic collaborations with airlines, hospitality providers, and local communities help expand tour options and strengthen market reach. Many operators are emphasizing eco-tourism, luxury lodges, and guided wildlife tours to attract high-value travelers. Personalized travel itineraries, conservation-focused packages, and immersive cultural experiences are driving customer loyalty. This competitive landscape encourages continuous innovation, service quality enhancement, and global expansion strategies.

Key Player Analysis

- Micato Safari

- Backroads

- Singita

- Abercrombie & Kent Ltd.

- Rothchild Safaris

- Great Plains

- Scott Dunn

- Gamewatchers Safaris

- Butterfield & Robinson

- Enchanting Travels

Recent Developments

- In May 2025, Westin Resort and Spa Ubud promoted slower, more immersive wellness travel with a new extended-stay offer anchored in nature and local tradition. Westin Ubud is putting ‘slow wellness’ in focus.

- In May 2025, Marriott and Hilton announced their plans to expand their spa presence across Asia in response to the region’s rapid surge in wellness tourism, driven by rising disposable incomes, health-conscious travelers, and growing preference for holistic, preventive care.

- In April 2025, Thailand expanded into the Middle East market, highlighting luxury and wellness tourism at the Arabian Travel Market 2025. The business expansion is a beneficial contribution to the wellness tourism market.

- In September 2024, EaseMyTrip announced its entry into the rapidly growing wellness tourism sector through acquisitions of Pflege Home Healthcare and Rollins International with a total investment of Rs. 90 crores.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Tour, Seasonal Variation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see rising demand for sustainable and eco-friendly safari experiences.

- Luxury safari packages will gain traction among high-net-worth travelers.

- Digital booking platforms will enhance accessibility and customer engagement.

- Wildlife conservation initiatives will drive responsible travel practices.

- Emerging destinations in Asia and Latin America will expand global safari offerings.

- Personalized and small-group tours will become a preferred travel format.

- Strategic partnerships with airlines and hotels will boost package diversity.

- Government support and conservation funding will strengthen destination infrastructure.

- Immersive technology will enhance traveler experiences through virtual previews and smart tours.

- Community-based tourism will play a larger role in sustainable safari growth.

Regional Analysis

Regional Analysis