Market Overview

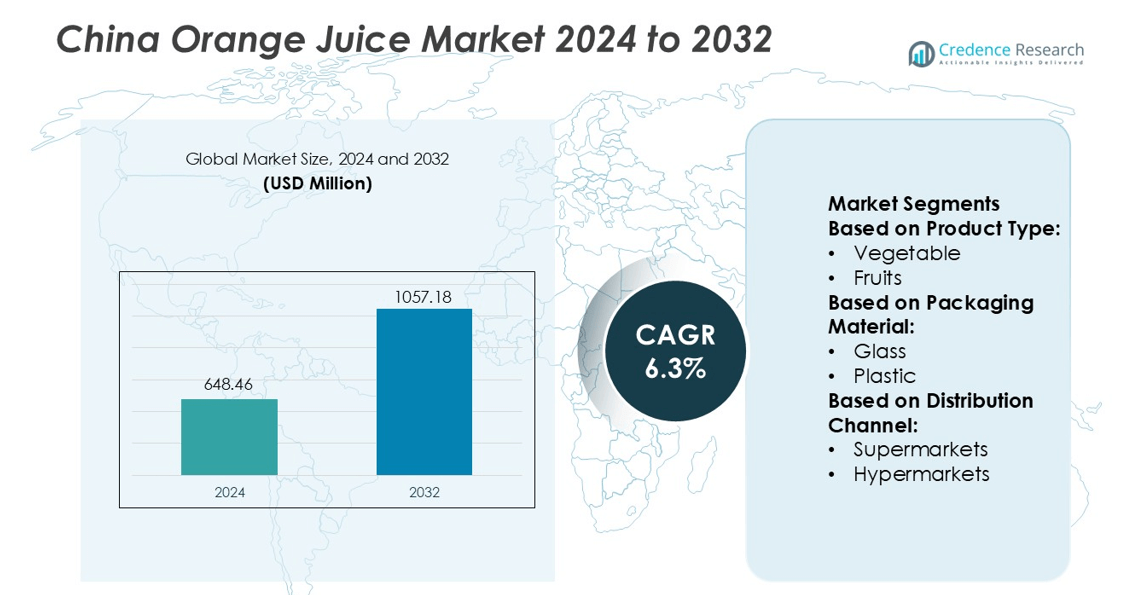

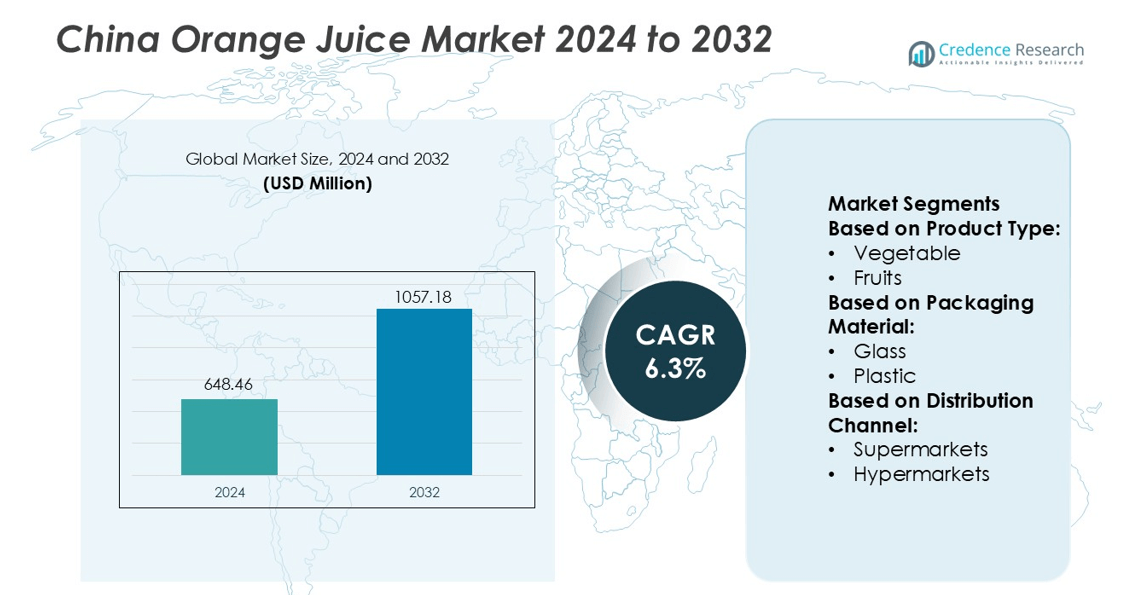

China Orange Juice Market size was valued USD 648.46 million in 2024 and is anticipated to reach USD 1057.18 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Orange Juice Market Size 2024 |

USD 648.46 million |

| China Orange Juice Market, CAGR |

6.3% |

| China Orange Juice Market Size 2032 |

USD 1057.18 million |

The China Orange Juice Market include global beverage manufacturers, fruit processors, and organic juice brands offering NFC, cold-pressed, and fortified products. These players compete through wider retail networks, strong e-commerce partnerships, and frequent product launches focused on sugar-free and vitamin-enriched formulations. Many companies also invest in sustainable sourcing and recyclable packaging to meet consumer expectations for clean-label beverages. East China remains the dominant region with 35% market share, driven by high purchasing power in Shanghai, Zhejiang, and Jiangsu. Strong presence of supermarkets, premium cafes, and high fruit juice consumption patterns allows major brands to scale faster in this region, while emerging cities continue to offer growth potential through online sales and ready-to-drink formats.

Market Insights

- The China Orange Juice Market was valued at USD 648.46 million in 2024 and is projected to reach USD 1057.18 million by 2032, registering a CAGR of 6.3% during the forecast period.

- Health-driven demand for sugar-free, vitamin-enriched, and NFC juices supports market growth, as consumers shift from carbonated drinks to natural beverages.

- Premium brands focus on cold-pressed products, recyclable packaging, and online retail expansion, strengthening competitive positioning across major cities.

- Limited local orange production and fluctuating raw material costs challenge manufacturers, leading to higher dependence on sustainable sourcing and import partnerships.

- East China leads the regional market with a 35% share due to strong retail infrastructure, while ready-to-drink formats drive faster adoption among urban households; NFC products also hold a rising share within the product segment as buyers prefer fresh taste and clean-label ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The fruits segment holds the dominant share in the China orange juice market, capturing close to 70% of total consumption. Consumers prefer fruit-based juices because they offer natural taste, familiar flavors, and higher nutritional trust compared to vegetable blends. Orange juice remains a daily breakfast drink, supported by rising health awareness, vitamin-C intake, and immunity-focused marketing. The mixed category grows steadily as brands launch blends with apple, mango, and pineapple to enhance flavor and create premium options. However, pure fruit orange juice maintains the strongest presence due to broad household acceptance and wider retail availability.

- For instance, Bolthouse Farms, Inc. uses high-pressure processing (HPP) at approximately 87,000 psi (pounds per square inch) for its cold-pressed fruit juices. This non-thermal method effectively preserves heat-sensitive nutrients like vitamin C content and live enzymes without the heat degradation that occurs during traditional thermal pasteurizatio

By Packaging Material

Plastic packaging leads the market with nearly 55% share due to its low cost, lightweight nature, and suitability for bulk production. Bottled orange juice is easy to transport, store, and distribute through large retail chains, making it ideal for high-volume sales. Plastic also supports long shelf life and tamper resistance, which retailers prefer for mass-market demand. Glass packaging attracts premium customers seeking natural and preservative-free juice, but higher cost and fragile handling limit widespread adoption. The “others” category, including paper cartons, continues to gain traction as eco-friendly branding rises among health-conscious buyers.

- For instance, Keurig Dr Pepper Inc. is focused on sustainable packaging innovations, including reducing the amount of plastic used in its bottles (lightweighting) and increasing the use of recycled PET (rPET). The company aims to make 100% of its packaging recyclable or compostable by 2025.

By Distribution Channel

Supermarkets and hypermarkets dominate the distribution landscape with roughly 48% share, driven by strong presence in urban areas, heavy footfall, and large product variety. These stores run price promotions, free samples, and bundled deals that increase orange juice sales among household buyers. Convenience stores show steady growth due to impulse purchases and on-the-go consumption in cities and transport hubs. Online sales grow as platforms offer home delivery, discount offers, and subscription models. However, organized retail remains the leading driver because shoppers prefer seeing product variety, packaging, and expiry dates before purchase.

Key Growth Drivers

Rising Health and Immunity Awareness

Health-conscious Chinese consumers are increasing daily intake of vitamin-rich beverages, especially after heightened focus on immunity and wellness. Orange juice offers natural vitamin C, antioxidants, and no artificial ingredients, which appeals to families and young professionals. Marketing campaigns emphasize immune support, heart health, and energy levels, pushing demand higher. Schools, workplaces, and fitness centers also promote fruit-based drinks as healthier choices over carbonated beverages. As lifestyle diseases rise, consumers shift to products with clean labels, natural sugars, and transparent sourcing. These factors help fuel consistent market growth.

- For instance, Dole Packaged Foods deployed a low-code mobile platform using AWS and the Pillir EdgeReady-Cloud; the material-master data app was built and deployed in fewer than 60 days and helped reduce material-master management costs by 30 %.

Urbanization and Organized Retail Expansion

Rapid urban development has increased supermarket and hypermarket penetration in major cities, making packaged orange juice easier to find. Wider shelf space, visibility, and promotional schemes attract buyers across income groups. Modern retail chains provide cold storage, large inventories, and branded displays that boost sales of premium and value-pack products. Urban consumers prefer ready-to-drink beverages for convenience, especially during busy workdays and commutes. As retail networks move into tier-2 and tier-3 cities, orange juice companies gain access to new customer segments, further supporting long-term market expansion.

- For instance, Kraft Heinz deployed its AI-enabled “Lighthouse” supply-chain control tower and related digital twin technology across its 31 North American manufacturing sites. This system processes real-time data streams to improve operational visibility, enhance forecasting, and prevent supply chain disruptions.

Product Innovation and Premiumization

Brands invest in new flavors, pulp variants, sugar-reduced formulas, and functional blends to attract young customers. Cold-pressed and NFC (not-from-concentrate) orange juice is gaining attention due to its fresh taste and minimal processing. Premium packaging, organic labels, and clear ingredient lists appeal to quality-focused buyers. Marketing through e-commerce, influencer campaigns, and health apps expands brand reach. As consumers experiment with global tastes, imported orange juice and limited-edition blends also gain traction. Innovation differentiates brands in a competitive market and strengthens customer loyalty.

Key Trends & Opportunities

Growth of E-Commerce and Direct-to-Home Delivery

Online platforms offer major opportunities as buyers look for convenience, discount deals, and wider product choices. Subscription deliveries and bundle offers increase purchase frequency among urban households. Cold-chain logistics and quick-commerce apps help deliver fresh products efficiently, supporting premium juice brands. Online reviews and influencer recommendations shape purchasing decisions, especially among young consumers. This shift also enables small and local brands to reach a national audience without large retail investments, increasing market competition and innovation.

- For instance, PepsiCo launched two e-commerce websites—PantryShop.com and Snacks.com—from concept to launch in just 30 days, and committed to fulfilling orders within 2 business days for hundreds of its beverage and snack SKUs.

Rising Demand for Natural and Clean-Label Products

Consumers are selecting juices with no preservatives, artificial flavors, or added sugar. NFC and cold-pressed juice fall under this trend, giving brands a premium identity. Eco-friendly packaging, transparent sourcing, and organic farming certifications further improve trust and brand image. Cafés, hotels, and restaurants also promote natural juice as part of healthy breakfast menus. This trend encourages suppliers to improve raw material quality, upgrade processing techniques, and invest in fresh fruit supply chains, opening new segments in urban premium markets.

- For instance, Citrosuco’s 2023/2024 harvest indicators report achieving a water-consumption rate of 1.69 m³ of water per ton of processed oranges across its industrial operations.

Key Challenges

High Price of Premium and Imported Products

Premium products such as cold-pressed or imported orange juice cost more due to higher production, logistics, and sourcing expenses. Many price-sensitive consumers choose cheaper concentrate-based substitutes or other fruit beverages. As economic conditions fluctuate, buyers shift to low-price brands or reduce consumption. Retailers also push bulk discounts and private labels, intensifying price competition. For premium brands, balancing quality, profit margins, and affordability remains difficult, making large-scale expansion a challenge.

Supply Chain Dependence on Imported Oranges

China relies heavily on imported oranges for large-scale production, especially for high-quality NFC juice. Fluctuating import tariffs, shipping delays, and crop uncertainties in producing countries affect supply and pricing. Seasonal shortages raise production costs and reduce product availability. Weather conditions, global logistics issues, and currency fluctuations also influence procurement plans. Local citrus production is growing, but yields and quality remain lower than international sources. Managing stable supply remains a key operational challenge for major manufacturers.Top of Form

Regional Analysis

North America

North America holds 28% share of the global orange juice market due to strong juice-drinking culture, high per-capita income, and a mature retail ecosystem. The United States drives most demand through supermarkets, cafés, and food chains, while Canada follows with steady adoption of premium organic and NFC products. Breakfast beverage habits and health-focused marketing sustain consumption, although flavored drinks and carbonated beverages compete for share. E-commerce grocery platforms further boost distribution and repeat purchases, making North America one of the most stable and high-value markets.

Europe

Europe leads the global market with 32% share, driven by high household consumption, strict quality standards, and well-developed cold-chain logistics. Germany, France, the Netherlands, and the U.K. are major purchasing countries, with NFC and organic products gaining traction due to clean-label preferences. Private-label brands dominate supermarket shelves, supported by affordable pricing. Cafés, hotels, and restaurants also promote premium imported juices. While overall consumption growth is moderate, Europe remains the most mature and value-rich region in the global orange juice industry.

Asia

Asia accounts for 21% market share with fast-rising consumption driven by urbanization, health awareness, and organized retail growth. China leads regional sales, followed by Japan, India, and South Korea. Younger consumers prefer convenient RTD packaging from convenience stores and online platforms, while premium NFC juice appeals to mid- and high-income households. Domestic manufacturers expand processing capacity and flavor innovation to match regional taste preferences. Despite competition from tea-based beverages, the health positioning of orange juice continues to support long-term growth.

Latin America

Latin America captures 12% market share and remains a global supply hub, with Brazil dominating orange harvesting and concentrate exports. Local consumption remains strong due to wide availability of fresh and affordable juice. Value SKUs and multipacks support household demand, while premium pulp-rich variants grow among urban consumers. Export orientation helps stabilize pricing and ensures steady supply to global brands. Although economic fluctuations affect purchasing power, long-term agricultural strength keeps Latin America strategically important to the orange juice industry.

Middle East & Africa

The Middle East & Africa represent 7% of global market share, supported by growing retail networks, tourism, and western dining trends. The UAE, Saudi Arabia, and South Africa lead consumption, driven by expatriate populations and premium supermarket presence. Hot climates fuel year-round beverage demand, while hotels and food service outlets push imported NFC varieties. Although per-capita intake is still lower than western markets, rising incomes and expanding cold-chain logistics create strong future growth potential for both global and regional brands.

Market Segmentations:

By Product Type:

By Packaging Material:

By Distribution Channel:

- Supermarkets

- Hypermarkets

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Bolthouse Farms, Inc., Keurig Dr Pepper Inc., Fresh Del Monte, Ocean Spray, The Coca-Cola Company, Dole Packaged Foods, LLC, Welch’s, The Kraft Heinz Company, PepsiCo, and Lakewood Organic Juices. The China Orange Juice Market is shaped by product variety, branding strength, and nationwide distribution. Companies develop NFC and cold-pressed juices to meet rising demand for fresh, natural beverages. Brands expand sugar-free, vitamin-enriched, and pulp-rich variants to appeal to health-focused consumers. Many players strengthen sourcing relationships with orange farms to ensure quality and price stability. Retail presence in supermarkets, convenience stores, and hypermarkets supports strong market visibility, while online channels drive sales through major e-commerce platforms and fast-delivery apps. Marketing strategies include social media campaigns, seasonal promotions, and packaging upgrades to attract younger buyers. Brands also adopt eco-friendly cartons and recyclable bottles to align with sustainability trends. The market remains competitive as both international and domestic producers invest in product innovation, digital marketing, and wider distribution to retain consumer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, PIM Brands introduced Welch’s Juicefuls Fusions in the U.S. The dual‑flavor fruit snack featured a chewy fruit exterior paired with a contrasting juicy center, available in Watermelon & Lemon, Green Apple & Peach, and Blueberry & Raspberry. It was gluten‑ and peanut‑free, naturally colored, and fortified with vitamins A, C, and E.

- In December 2024, Ocean Spray Cranberries (USA) partnered with Dyla Brands to launch a zero‑sugar, powdered drink‑mix line. Featuring White Cran × Strawberry, Cran × Grape, and White Cran × Peach flavors made from real cranberry juice powder, the portfolio delivered 100 % daily vitamin C in convenient on‑the‑go stick packs.

- In March 2024, The Coca‑Cola Company’s brand Minute Maid’s Zero Sugar category launched its first global marketing campaign emphasizing the drink’s great taste and zero sugar. The campaign highlights the brand’s success without traditional marketing, showcasing its popularity and quality through lighthearted content.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Packaging Material, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for NFC and cold-pressed orange juice is expected to rise due to premiumization.

- Sugar-free, low-calorie, and vitamin-enriched variants will attract health-conscious consumers.

- Online grocery platforms and quick-commerce delivery will expand direct-to-home sales.

- Brands will invest in sustainable sourcing and recyclable packaging to meet green policies.

- Functional beverages with probiotics and immune-boosting ingredients will gain market share.

- Urban households will drive higher consumption through ready-to-drink and single-serve formats.

- Local manufacturers may expand production capacity to reduce import dependence.

- Cold-chain logistics and improved processing technology will enhance product freshness and shelf life.

- Premium brands will widen presence in convenience stores, hypermarkets, and specialty beverage outlets.

- Marketing through influencers, lifestyle branding, and digital campaigns will improve consumer engagement.