Market Overview

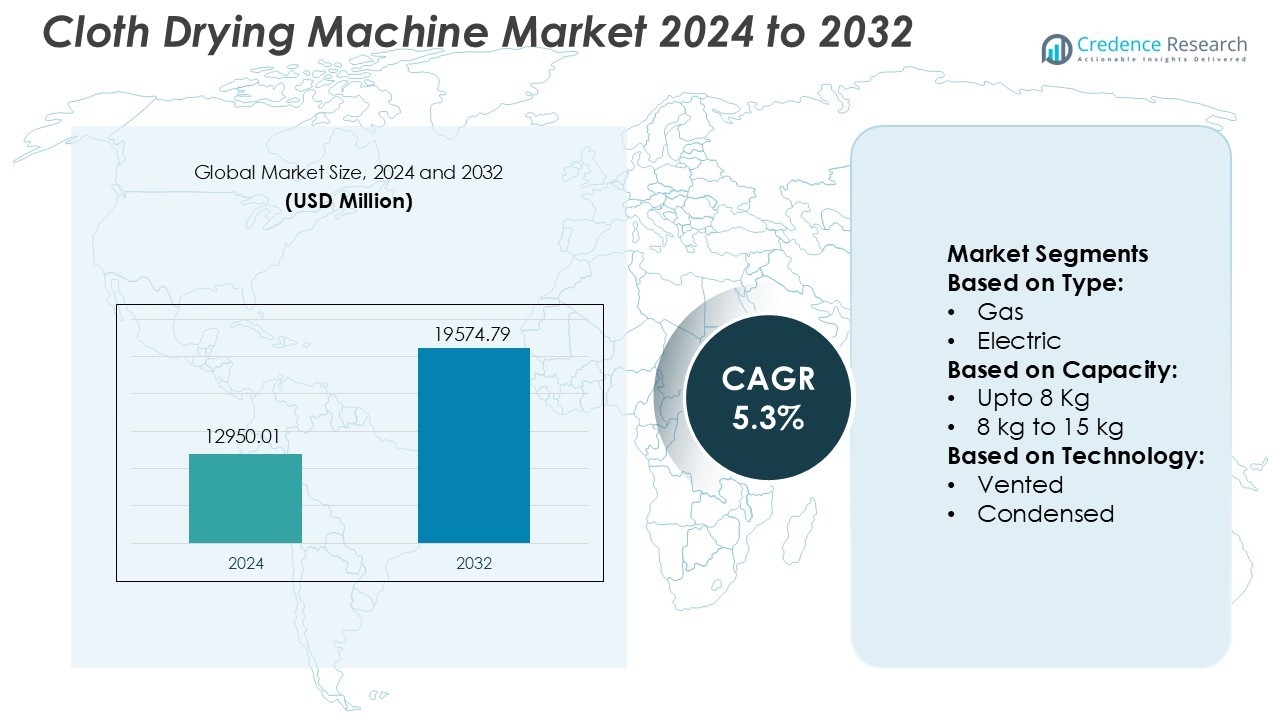

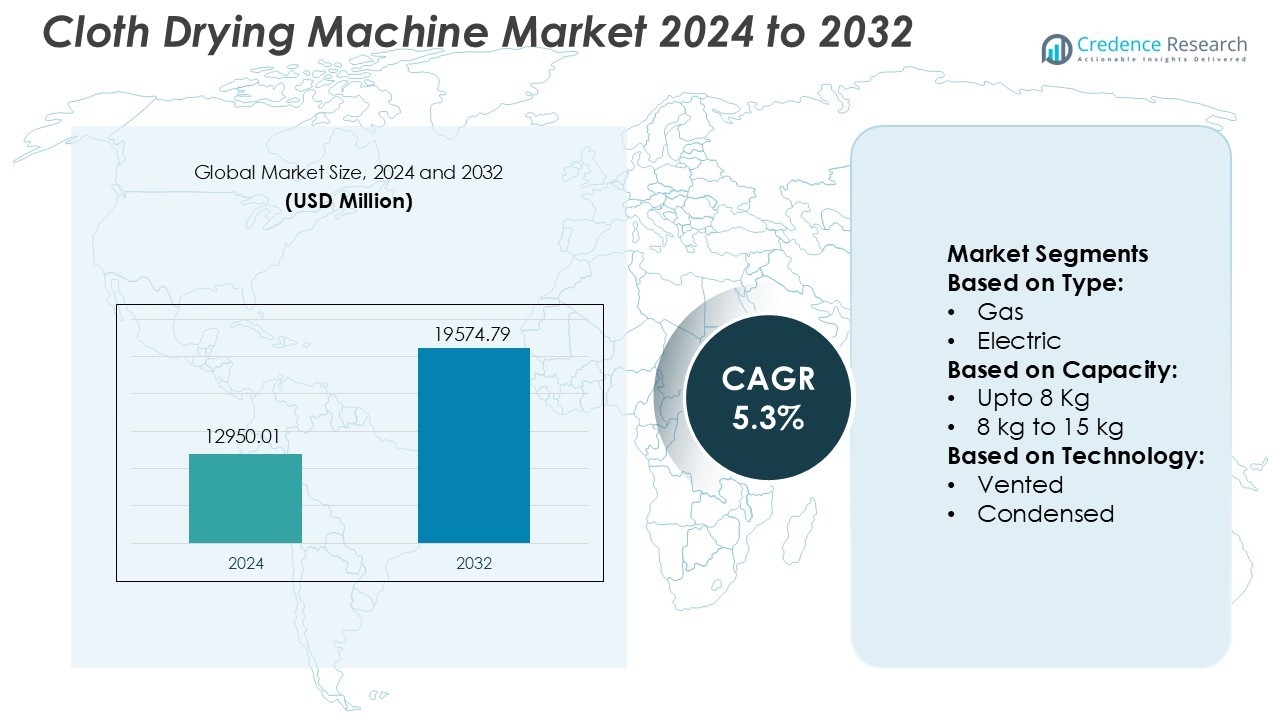

Cloth Drying Machine Market size was valued USD 12950.01 million in 2024 and is anticipated to reach USD 19574.79 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloth Drying Machine Market Size 2024 |

USD 12950.01 Million |

| Cloth Drying Machine Market, CAGR |

5.3% |

| Cloth Drying Machine Market Size 2032 |

USD 19574.79 Million |

The Cloth Drying Machine Market features strong competition among global appliance manufacturers focusing on energy efficiency, faster drying cycles, and smart automation. Leading companies offer products with heat pump technology, advanced moisture sensors, and low-noise performance to serve residential and commercial users. North America remains the dominant region with a 38% market share, supported by high adoption of automatic dryers, strong replacement demand, and preference for smart home appliances. European brands continue to expand their premium product lines, while Asia-Pacific players strengthen distribution networks to capture rising urban consumers and growing laundry service providers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cloth Drying Machine Market was valued at USD 12950.01 million in 2024 and will reach USD 19574.79 million by 2032, growing at a CAGR of 5.3%.

- Energy-efficient drying systems and smart automation drive demand, as households and commercial laundries shift from manual drying to faster machine-based solutions.

- Heat pump dryers and moisture-sensor models gain popularity as consumers seek low-power use, better fabric care, and quieter operation, supporting premium segment growth.

- Strong competition pushes manufacturers to introduce compact, low-noise, and high-capacity models, while price sensitivity in developing countries slows adoption and limits premium sales.

- North America leads the market with a 38% share due to high installation rates of automatic dryers, while Asia-Pacific grows fastest as urbanization increases and laundry service providers expand.

Market Segmentation Analysis:

By Type

Electric dryers hold the dominant share due to lower upfront cost and simple installation. Households prefer electric units because they do not require gas pipelines or complex ventilation. Easy availability of spare parts and higher energy-efficient models also support adoption. Electric dryers suit apartments and small homes, where ventilation and gas connections are limited. Growth in smart home appliances and IoT-enabled dryers further boosts demand. Gas dryers grow in commercial laundries and large households seeking faster drying cycles, but adoption remains lower due to higher installation and maintenance cost.

- For instance, Fuji Electric supplies its 7th-generation IGBT small Dual-In-Line Package IPMs (rated from 15 A to 70 A at 600 V) designed for appliance motor drives, enabling dryer motor systems to run at continuous junction temperatures of 150 °C with time-limited peaks to 175 °C.

By Capacity

Dryers with 8 kg to 15 kg capacity hold the largest market share, driven by family usage and multi-person households. These machines balance load size, energy efficiency, and cost, making them suitable for both urban and suburban homes. Manufacturers focus on mid-capacity models with sensor-based drying, quick cycles, and fabric protection features. The up to 8 kg category serves small apartments and single users, especially in cities with limited space. Above 15 kg units remain niche, mainly used in hotels, shared laundry services, and commercial facilities.

- For instance, Torrid expanded its in-store size range up to size 30 across its nationwide network of over 600 retail locations, ensuring broader representation and accessibility for diverse body types.

By Technology

Vented dryers dominate the market due to affordable pricing, simple technology, and faster drying cycles. Many households prefer vented units because they easily connect to existing exhaust ducts and require lower maintenance. Their lower entry cost makes them attractive in developing regions. Condensed dryers continue to grow among apartment users and homes without external ventilation. This segment benefits from heat-pump and moisture recycling features that reduce electricity consumption. Energy-efficient condensed dryers appeal to eco-conscious consumers seeking lower utility bills and improved drying performance.

Key Growth Drivers

Increasing Urbanization and Rising Home Appliance Adoption

Rapid urbanization and growth in multi-family housing increase the need for efficient laundry solutions. Compact apartments leave little room for outdoor drying, pushing demand for electric and gas dryers. Consumers prefer faster drying cycles and convenience, especially in cold or humid regions. Expanding middle-class income and higher living standards encourage buyers to replace basic washers with fully automated laundry systems. Retailers promote bundled sales of washers and dryers, boosting household penetration in developing economies. Government incentives supporting energy-efficient appliances also support market expansion.

- For instance, Dia & Co operates through a subscription box and e-commerce platform that serves women primarily aged 25–45. This demographic is a key driver in the broader plus-size clothing market, which Dia & Co addresses by offering a wide range of clothing items to this growing customer base.

Growing Preference for Energy-Efficient and Smart Appliances

Manufacturers develop energy-efficient models with heat pump technology, moisture sensors, and low-temperature drying to cut utility costs. Smart dryers feature Wi-Fi connectivity, remote control, energy monitoring, and self-diagnostics through mobile apps. Rising awareness of electricity consumption and carbon footprints drives households to upgrade older vented units to modern condensed systems. Energy-star certified dryers gain traction in Europe and North America. Consumers choose smart appliances that reduce fabric damage, improve safety, and deliver better drying performance. This shift strengthens premium segment growth worldwide.

- For instance, the United States represented a key market for ASOS in 2022, accounting for approximately 10% of its total global sales, driven by strong online consumer purchasing across its extensive range of product categories, including the Curve and Plus Size division.

Expansion of Commercial Laundry and Hospitality Industries

Hotels, hospitals, laundromats, and student housing require high-capacity dryers for continuous operations. Tourism growth raises laundry volumes for linens, towels, and uniforms. Healthcare facilities demand hygienic drying to meet infection-control standards. Commercial dryers with faster load handling and steam-assisted wrinkle removal support operational efficiency. Industrial users prefer durable stainless-steel drums, programmable controls, and lower maintenance costs. Growth of shared laundry services in urban regions further increases bulk equipment sales. Manufacturers partner with service providers to supply smart commercial models with remote diagnostics and predictive maintenance.

Key Trends & Opportunities

Rising Popularity of Heat Pump and Ventless Dryers

Heat pump dryers reduce energy consumption by recycling hot air, making them ideal for eco-conscious households. Ventless systems simplify installation in apartments and buildings with no ducting. European markets lead adoption, and demand is expanding in Asia and North America. Manufacturers introduce compact, stackable models for small living spaces. Regulatory pressure for low-emission appliances increases opportunities for heat pump-based products. Growing electricity tariffs also push consumers toward low-power drying technologies.

- For instance, H&M reported that it collected and recycled more than 16,800 tonnes of textiles through its global Garment Collecting program in 2023, equivalent to tens of millions of T-shirts being diverted from landfills.

Growth of Smart Connected Laundry Ecosystems

Home automation drives integration of dryers with IoT platforms and voice-assistant control. Apps offer remote start, cycle alerts, and fault detection. Predictive maintenance reduces repair downtime and improves user convenience. Smart home retailers promote bundled connected washer-dryer solutions with energy-management features. AI-based drying cycles optimize temperature and moisture settings for various fabrics. Demand for premium smart machines is especially strong in developed markets.

- For instance, Levi Strauss & Co. uses its innovative Water<Less® process for many of its products, a technique that cuts water usage by up to 96% for certain garments compared to traditional finishing methods.

Key Challenges

High Purchase Cost of Advanced and Smart Models

Smart dryers and heat pump systems cost more than traditional vented units, limiting adoption in price-sensitive markets. Consumers in developing countries still prefer air drying due to budget constraints and mild weather. Installation costs rise when electrical upgrades or plumbing changes are needed. Commercial users also face higher upfront expenses for industrial units. These factors slow market penetration, especially among first-time buyers.

Regulatory Standards and Energy Compliance Requirements

Manufacturers must meet strict energy-efficiency regulations, safety certifications, and environmental standards across regions. Compliance increases testing, R&D, and production expenses. Frequent policy updates force companies to redesign models or upgrade components. Smaller appliance brands struggle to match efficiency benchmarks set by major players, creating cost and competition pressure. Energy labeling rules affect product visibility and consumer purchasing decisions.

Regional Analysis

North America

North America holds the largest share in the cloth drying machine market with 36%. High household appliance penetration, widespread urban living, and strong demand for smart home products drive purchases. Consumers prefer condenser and heat pump dryers with sensor-based energy controls. Replacement sales remain strong as buyers upgrade older vented units. The United States dominates due to large residential construction activity, rising electricity efficiency standards, and high online retail presence. Commercial laundries and hospitality facilities also increase investments in high-capacity dryers. Energy Star regulations encourage adoption of low-emission and energy-efficient models across the region.

Europe

Europe accounts for 30% share and remains a leading market for heat pump and ventless dryers. Strict energy efficiency regulations, carbon reduction goals, and sustainability policies accelerate adoption of eco-friendly systems. Countries like Germany, the U.K., and France show strong preference for compact, built-in models suited for apartments. High electricity prices push consumers toward low-energy drying technologies. Smart connectivity and Wi-Fi-enabled monitoring also gain popularity. Commercial demand continues to grow from hotels, student housing, and institutional laundries. Government rebates for energy-labeled appliances further support market expansion across the region.

Asia-Pacific

Asia-Pacific holds 24% market share and represents the fastest-growing regional segment. Urbanization, rising middle-class income, and reduced availability of outdoor drying space boost household dryer purchases. China, Japan, South Korea, and Australia lead adoption, supported by smart home penetration and premium laundry systems. Heat pump and ventless dryers expand rapidly in compact city apartments. Growth of e-commerce and retail chains increases affordability and accessibility. Commercial laundry services also gain momentum due to tourism, hospitality, and residential complexes. Manufacturers invest in localized production and energy-efficient technology to meet diverse pricing needs across emerging markets.

Latin America

Latin America holds 6% share driven by rising appliance ownership and lifestyle modernization. Brazil, Mexico, and Argentina show steady adoption, especially in colder and high-rainfall regions where air drying is less practical. Consumers lean toward cost-effective vented and condenser dryers rather than high-end heat pump systems. Retail financing and promotional discounts support household penetration. Commercial laundromats and hospitality facilities gradually shift to automatic dryers for faster turnaround. Limited consumer awareness of energy-efficient models and import dependency still constrain market growth. However, expanding e-commerce platforms improve product availability across urban centers.

Middle East & Africa

Middle East & Africa contribute 4% market share, supported by rising residential construction, premium appliance adoption, and strong presence of multinational brands. Gulf countries, including UAE and Saudi Arabia, lead purchases due to high disposable income and preference for fully automatic laundry systems. Urban households and rental apartments show growing demand for compact ventless dryers. Commercial growth comes from hospitality, healthcare, and large laundry service companies. Market expansion remains slower in African nations due to high product cost and electricity reliability issues. Manufacturers focus on energy-efficient and durable models tailored for regional climate conditions.

Market Segmentations:

By Type:

By Capacity:

By Technology:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The cloth drying machine market players such as Seaga Manufacturing Inc., Glory Ltd., Selecta Group, Sellmat s.r.l., Fuji Electric Co., Ltd., Westomatic Vending Services Limited, Orasesta S.p.A, Azkoyen Group, Royal Vendors, Inc., and Sanden Holding Corp. The cloth drying machine market features strong competition between global appliance manufacturers, regional brands, and commercial laundry equipment providers. Companies focus on energy-efficient dryers with heat pump systems, faster drying cycles, and smart connectivity to attract modern households and premium buyers. Compact and ventless units gain popularity in apartments and rental properties, pushing brands to offer smaller footprints and low-noise operation. Commercial suppliers target hotels, hospitals, and laundromats with high-capacity machines designed for 24/7 use, lower maintenance cost, and stainless-steel durability. Partnerships with online retailers and large electronics chains improve distribution, while extended warranties and service networks enhance customer loyalty. Sustainability regulations drive companies to upgrade designs, obtain energy certifications, and reduce water and power consumption. Price competition remains high in developing markets, where manufacturers promote mid-range models with essential features, flexible financing, and competitive after-sales support.

Key Player Analysis

- Seaga Manufacturing Inc.

- Glory Ltd.

- Selecta Group

- Sellmat s.r.l.

- Fuji Electric Co., Ltd.

- Westomatic Vending Services Limited

- Orasesta S.p.A

- Azkoyen Group

- Royal Vendors, Inc.

- Sanden Holding Corp.

Recent Developments

- In March 2025, Coca-Cola Bottlers Japan Inc. and its partner, Fuji Electric, launched the world’s first hydrogen-powered vending machine at EXPO 2025 in Osaka, Japan. This technology allows the vending machine to function in any location or weather condition without emitting COâ.

- In September 2024, Samsung Electronics announced that it is launching the Bespoke AI Laundry Combo™ to the European market at IFA 2024 in Berlin. First introduced last year at IFA 2023, the all-in-one washer and dryer combo is set to redefine laundry experiences across Europe by combining a washer and dryer into a single, space-efficient appliance that completes washing and drying in one device.

- In April 2024, GE Appliances’ all-new washer designed for Hispanic consumers in the U.S. is launched on April 15, 2024, ahead of National Laundry Day on April 15. The GE® 4.5 cu. ft. Capacity Washer with Spanish-Language Panel with Soaking and Agitation Wash Modes is the first washer of its kind in the U.S.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Manufacturers will introduce more energy-efficient dryers to meet sustainability goals.

- Smart dryers will gain demand due to app-based controls and remote monitoring.

- Heat pump dryers will expand across residential and commercial sectors.

- Consumers will prefer low-noise and compact models for small living spaces.

- Automatic moisture sensors will improve fabric care and reduce energy use.

- Commercial laundries will upgrade to high-capacity machines for faster turnaround.

- Asia-Pacific will witness strong growth due to urbanization and rising incomes.

- Government energy-label regulations will influence product design and sales.

- Hybrid solar-powered dryers will create opportunities in eco-friendly households.

- Manufacturers will invest in faster drying cycles without increasing power consumption.