Market Overview

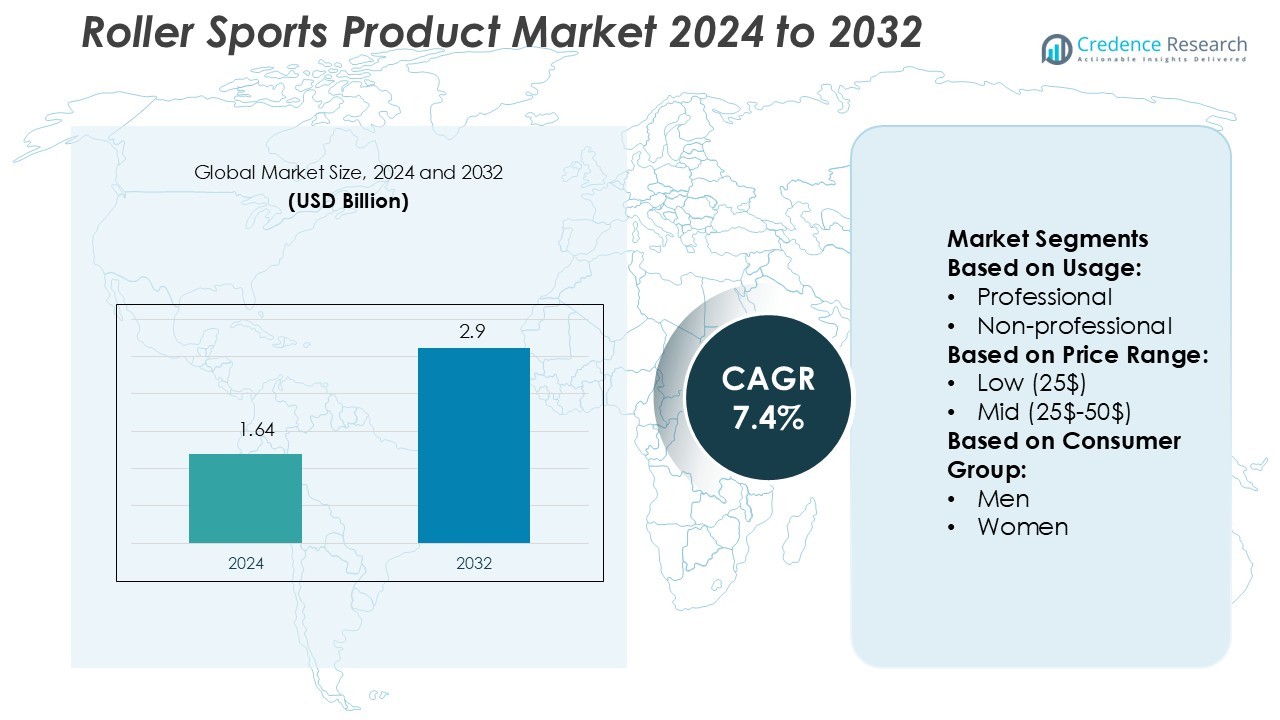

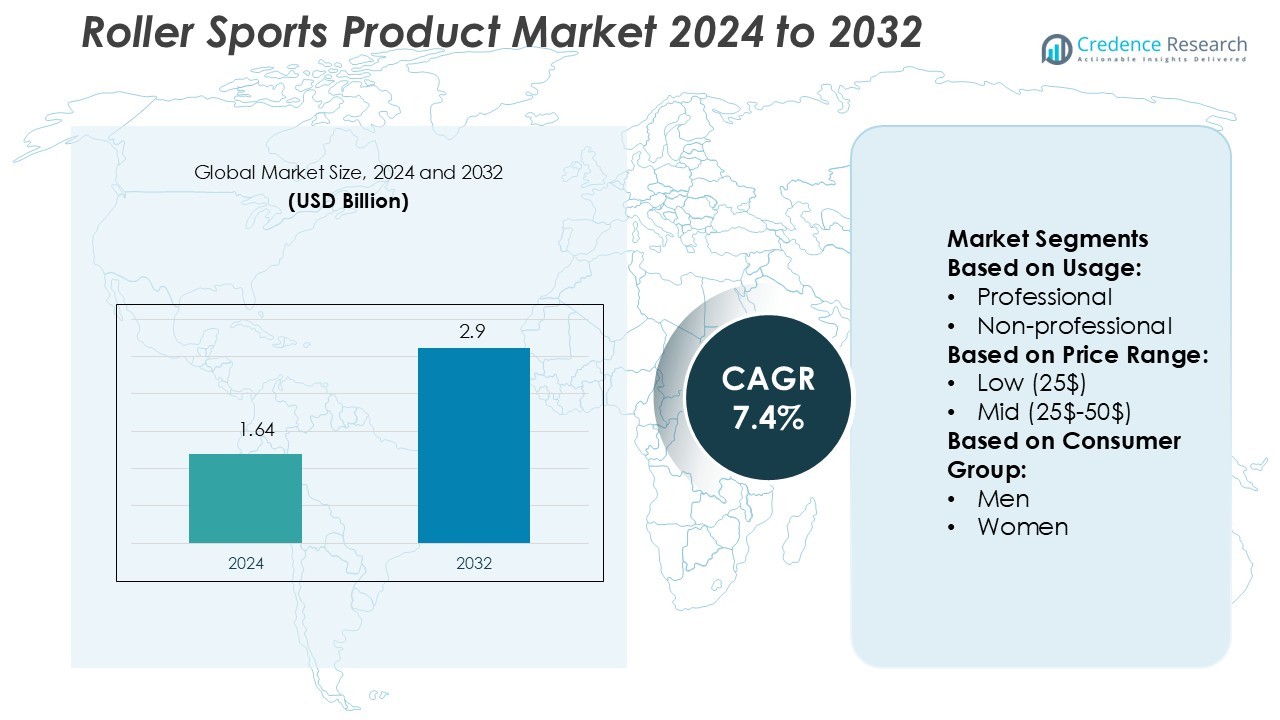

Roller Sports Product Market size was valued USD 1.64 billion in 2024 and is anticipated to reach USD 2.9 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roller Sports Product Market Size 2024 |

USD 1.64 Billion |

| Roller Sports Product Market, CAGR |

7.4% |

| Roller Sports Product Market Size 2032 |

USD 2.9 Billion |

The Roller Sports Product Market is driven by leading companies such as Adidas, Nike, Puma, Amer Sports, Bauer Hockey, BRG Sports, Mizuno, McDavid, Harrow Sports, and Rawlings Sporting Goods. These players focus on innovation, advanced material use, and enhanced design for improved performance and comfort. Strategic collaborations, digital marketing, and product diversification strengthen their global presence. Adidas and Nike dominate through strong brand recognition and extensive retail networks, while Bauer Hockey and BRG Sports lead in professional-grade equipment. Regionally, North America leads the global market with a 34.6% share in 2024, supported by high participation rates, robust sports infrastructure, and strong consumer demand for premium roller sports products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Roller Sports Product Market was valued at USD 1.64 billion in 2024 and is projected to reach USD 2.9 billion by 2032, growing at a CAGR of 7.4% during the forecast period.

- Increasing health awareness and recreational sports participation are major drivers, with rising youth engagement and fitness-oriented lifestyles supporting steady product demand.

- Technological advancements in lightweight materials, ergonomic designs, and eco-friendly manufacturing trends are shaping product innovation across all categories.

- Strong competition among leading brands such as Adidas, Nike, and BRG Sports drives product differentiation, while smaller players focus on affordable and niche offerings.

- North America leads the market with a 34.6% share, supported by robust infrastructure and high consumer spending, while the professional usage segment dominates due to growing participation in competitive skating and fitness-based roller sports activities worldwide.

Market Segmentation Analysis:

By Usage

The professional segment dominated the Roller Sports Product Market in 2024, accounting for 58.3% of total revenue. The segment’s growth is driven by the rising popularity of competitive roller sports leagues and international events. Demand for high-performance equipment designed for speed, durability, and precision continues to rise among athletes and sports clubs. Manufacturers are investing in performance-based product lines that enhance maneuverability and reduce friction, appealing to professionals who seek advanced features for better control and safety in competitive environments.

- For instance, FLSmidth’s HPGR Pro line offers models (e.g. “PM10 30/20”) with throughput up to 25,000 tonnes per hour and roll widths of 2,000 mm. Their “rotating side-plates” upgrade yields roughly 20% higher throughput, while roll wear life improves by about 30% under standard proving conditions.

By Price Range

The mid-range segment, priced between $25 and $50, leads the market with a 46.5% share. This range balances affordability with quality, attracting both casual users and semi-professional players. Consumers prefer products in this range for their enhanced comfort, durability, and value for money. The growing middle-income population and expanding retail access further support this segment’s dominance. Manufacturers are emphasizing improved materials and ergonomic designs within the mid-price range to increase consumer satisfaction and drive long-term demand.

- For instance, Adidas’ 4DFWD 3 lists a 3D-printed midsole and weighs 289 grams (UK 5.5). Adizero SL 2 specifies a 9 mm drop with 36 mm heel and 27 mm forefoot. Duramo RC2 lists 246 grams (UK 8.5) and a 6 mm drop, heel 27 mm and forefoot 21 mm.

By Consumer Group

The men’s segment holds the largest share of 49.7% in the global roller sports product market. This dominance stems from higher participation in organized roller sports events and recreational activities. Increased awareness of fitness and outdoor exercise among male consumers also supports market growth. The availability of customized designs, performance-focused gear, and wider product variety further strengthens male consumer interest. However, the women and kids segments are expected to witness faster growth with the rise of family-oriented sports and youth training programs.

Key Growth Drivers

Rising Popularity of Recreational and Fitness Activities

The increasing participation in outdoor recreational and fitness activities drives the roller sports product market. Consumers view roller skating and inline skating as enjoyable ways to improve balance, stamina, and cardiovascular health. Fitness-focused individuals are adopting roller sports for low-impact exercise. For instance, Rollerblade Inc. reported a 25% increase in its fitness skate line sales, showing a surge in demand among health-conscious consumers. Growing government support for sports programs also boosts market expansion across both urban and suburban regions.

- For instance, Pulsemaster has developed PEF systems that apply microsecond high-voltage pulses ranging from 10 to 60 kV at repetition rates up to 1,000 pulses per second, in systems of up to 100 kW, and industrial units capable of processing up to 10 tons per hour of produce.

Expanding Youth and Sports Participation

Youth engagement in skating clubs, schools, and community events significantly contributes to market growth. Governments and local bodies are investing in skating tracks and training centers, encouraging participation. Skating competitions and championships further promote product adoption. For instance, Decathlon introduced new youth-focused inline skates with adjustable sizing, accommodating rapid foot growth and enhancing usability. Rising awareness of skill-based sports and increased sports funding enhance product demand, especially in North America and Europe.

- For instance, Rollerblade Inc., a subsidiary of the Tecnica Group S.p.A., produces the “Macroblade 100 3WD” fitness skate. This model uses a 100mm wheel diameter with a Twinblade aluminum frame.

Technological Advancements in Product Design

Innovation in materials and performance engineering fuels market growth. Manufacturers are using lightweight alloys, improved bearings, and shock-absorbing wheels for better stability and durability. These innovations cater to both professional and recreational users. For instance, Powerslide developed the Trinity Mount System, improving frame stiffness and energy transfer efficiency during high-speed skating. Continuous product upgrades aimed at enhancing comfort and performance foster customer retention and expand brand competitiveness.

Key Trends & Opportunities

Growing E-commerce and Online Retail Presence

The rise of e-commerce platforms offers strong opportunities for global market reach. Online channels provide easy access to product comparisons and customization. For instance, Amazon and Decathlon report double-digit growth in roller sports sales driven by digital promotions and influencer marketing. Manufacturers are partnering with online retailers to expand distribution and enhance visibility, especially among Gen Z and millennial consumers who prefer online purchasing.

- For instance, Nike’s “Project Amplify” powered-footwear system integrates a lightweight motor that delivers assistance to users walking or running at a 10- to 12-minute-per-mile pace, with testing across 400+ participants and over 2.4 million steps logged.

Sustainability and Eco-friendly Material Adoption

Brands are shifting toward sustainable materials to meet environmental goals. Recycled plastics, biodegradable components, and renewable energy in manufacturing are becoming standard. For instance, Impala Rollerskates introduced vegan-friendly skates made with water-based glues and recycled materials. These initiatives align with global sustainability movements and appeal to environmentally conscious buyers, creating long-term brand loyalty and differentiation in competitive markets.

- For instance, Bauer Hockey partnered with EOS GmbH to deploy 3D-printed Digital Foam in helmet liners: a 20 % density reduction and tailored cell-structure printing in under 2 hours per part.

Expansion into Emerging Markets

Rising disposable incomes and urban development in Asia-Pacific and Latin America present new growth avenues. Companies are entering untapped cities with affordable products. For instance, Micro Mobility Systems expanded its retail network in India and Brazil to capture first-time users. Increasing local sports sponsorships and government incentives for youth sports programs further accelerate adoption across developing regions.

Key Challenges

High Product Costs and Limited Affordability

The premium pricing of advanced roller sports products restricts market penetration in low-income regions. Custom materials and performance-grade designs raise production costs, limiting accessibility. For instance, professional-grade inline skates from Seba retail above USD 400, discouraging casual users. Manufacturers face challenges balancing performance innovation with affordability while sustaining profit margins in competitive global markets.

Safety Concerns and Injury Risks

Accidents and injuries related to roller sports participation deter some consumers, especially beginners. The absence of protective gear usage increases risks during outdoor activities. For instance, the U.S. Consumer Product Safety Commission recorded over 35,000 roller sports-related injuries annually, highlighting safety gaps. Manufacturers are focusing on enhanced braking systems, stability control, and educational campaigns to improve safety awareness and reduce accident rates.

Regional Analysis

North America

North America holds the largest share of the Roller Sports Product Market with a 34.6% share in 2024. The region’s dominance is driven by strong participation in recreational and competitive skating activities, especially across the United States and Canada. Major brands such as Rollerblade, Riedell, and Sure-Grip expand their offerings through online retail and sports clubs. Growing health awareness and government initiatives promoting outdoor fitness further support market growth. The presence of well-developed sports infrastructure and rising demand for premium skates among youth continue to strengthen regional leadership during the forecast period.

Europe

Europe accounts for a 28.3% share of the global Roller Sports Product Market, supported by growing sports culture and strong consumer engagement in outdoor activities. Countries such as Germany, France, and the United Kingdom exhibit high adoption rates for roller skating and inline skating. The region benefits from organized events, community clubs, and product innovation from brands like Powerslide and Roces. Increased investments in eco-friendly sports equipment and sustainable materials are also fueling market growth. Government-backed youth sports programs and urban recreational developments continue to enhance Europe’s demand for roller sports products.

Asia-Pacific

Asia-Pacific commands a 24.7% share of the Roller Sports Product Market, showing the fastest growth rate among all regions. Expanding urban populations, rising disposable incomes, and growing interest in recreational fitness drive adoption across China, Japan, India, and South Korea. Manufacturers are introducing affordable and adjustable skates to cater to beginner and youth users. The increasing popularity of roller skating competitions and social media influence is expanding brand awareness. Local and international players are expanding distribution channels to meet growing demand, positioning Asia-Pacific as a high-potential market in the coming years.

Latin America

Latin America captures a 7.8% share of the Roller Sports Product Market, led by Brazil, Mexico, and Argentina. Rising youth participation in outdoor and recreational sports fuels steady growth. Local sports events and skating clubs are promoting awareness and accessibility across urban centers. Manufacturers are focusing on affordable models and partnerships with retail chains to boost sales. The growing influence of social media fitness trends also supports adoption among younger consumers. Although price sensitivity remains a concern, increasing investments in sports infrastructure are expected to enhance market presence across the region.

Middle East & Africa

The Middle East & Africa region accounts for a 4.6% share of the Roller Sports Product Market. Growth is primarily driven by the rising popularity of recreational sports and youth fitness activities in countries like the UAE, South Africa, and Saudi Arabia. Retail expansion by international brands and the introduction of indoor skating arenas contribute to increasing visibility. Government-backed wellness campaigns and youth engagement initiatives also stimulate interest in roller sports. While the market is still in its early development stage, growing urbanization and tourism-related sporting activities are likely to boost future market potential.

Market Segmentations:

By Usage:

- Professional

- Non-professional

By Price Range:

By Consumer Group:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Roller Sports Product Market is highly competitive, with key players including Harrow Sports, Adidas, BRG Sports, Nike, Bauer Hockey, Rawlings Sporting Goods, Puma, McDavid, Mizuno, and Amer Sports. The Roller Sports Product Market features intense competition characterized by continuous innovation and expanding product portfolios. Companies are focusing on advanced design engineering, sustainability, and improved comfort to attract a diverse consumer base. Growing demand for high-performance and customizable skates has encouraged manufacturers to adopt lightweight materials and ergonomic designs. Many brands are also leveraging digital channels, influencer marketing, and online retail partnerships to enhance market reach. Strategic collaborations with sports organizations and event sponsorships further boost visibility and consumer trust. Continuous investment in R&D, coupled with expanding youth participation in roller sports, continues to define competitive strategies across global markets.

Key Player Analysis

- Harrow Sports

- Adidas

- BRG Sports

- Nike

- Bauer Hockey

- Rawlings Sporting Goods

- Puma

- McDavid

- Mizuno

- Amer Sports

Recent Developments

- In April 2025, Riddell significantly strengthened its foothold in the football equipment market by acquiring assets from Xenith, a prominent competitor. This strategic move not only enhances Riddell’s technological capabilities but also diversifies its product portfolio, reinforcing its leadership in protective equipment innovation within the competitive football segment.

- In October 2024, Bauer Hockey expanded its partnership with Hockey Canada by becoming the official team apparel partner while continuing to supply critical protective equipment, including helmets, visors, face masks, neck guards, and gloves, for national teams. This enhanced three-year agreement extends through the 2026 Olympic and Paralympic Winter Games, further solidifying Bauer Hockey’s role in supporting elite athletes.

- In June 2024, Under Armour, Inc. entered a partnership with the USA Football Team as the official and exclusive outfitter for its national teams. The company will provide premium performance gear and protective equipment, focusing on improving player safety and performance. This collaboration ensures athletes are equipped with advanced protective gear for training and competitions.

- In April 2023, Wilson Sporting Goods Co, a U.S.-based sports equipment company, launched its Gen Green product range. The new collection includes footballs, soccer balls, basketballs, and volleyballs manufactured using sustainable materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Usage, Price Range, Consumer Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness increasing adoption of roller sports as a mainstream fitness activity.

- Manufacturers will focus on lightweight materials and ergonomic designs to enhance performance.

- Online retail and e-commerce channels will continue to drive strong product sales growth.

- Youth participation in roller sports programs and school activities will rise steadily.

- Sustainability initiatives will push brands to use recycled and eco-friendly materials.

- Smart and connected roller sports equipment will gain popularity among tech-savvy consumers.

- Emerging markets in Asia-Pacific and Latin America will offer new growth opportunities.

- Collaborations with sports organizations and influencers will strengthen brand visibility.

- Safety gear innovations will reduce injury risks and attract beginner-level users.

- Increasing urban recreational infrastructure will expand the global consumer base for roller sports.