Market Overview

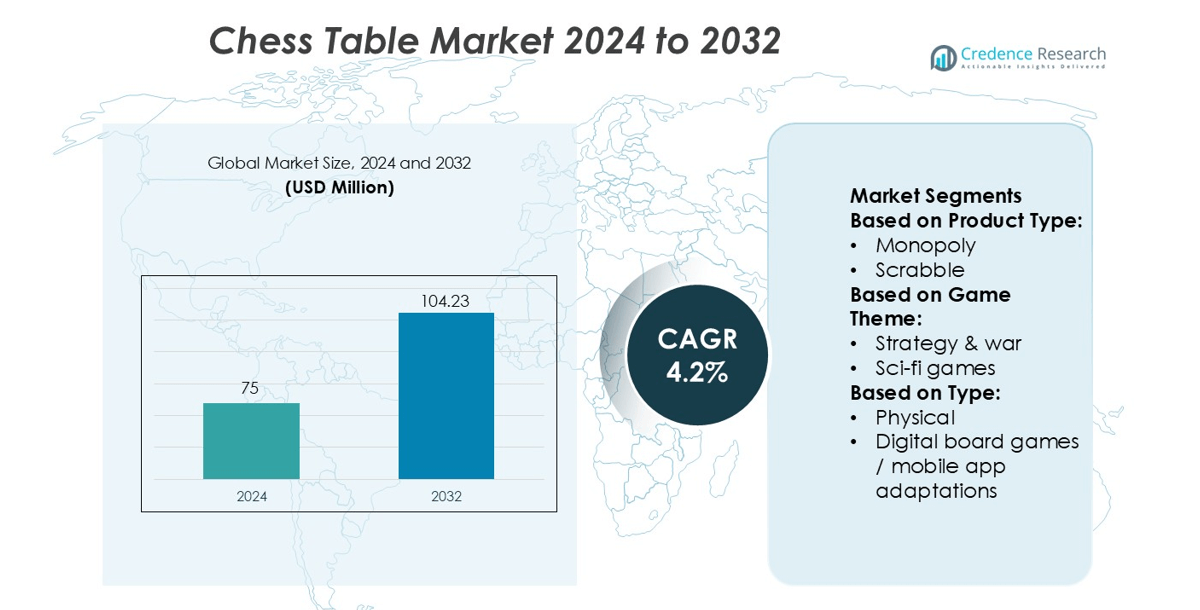

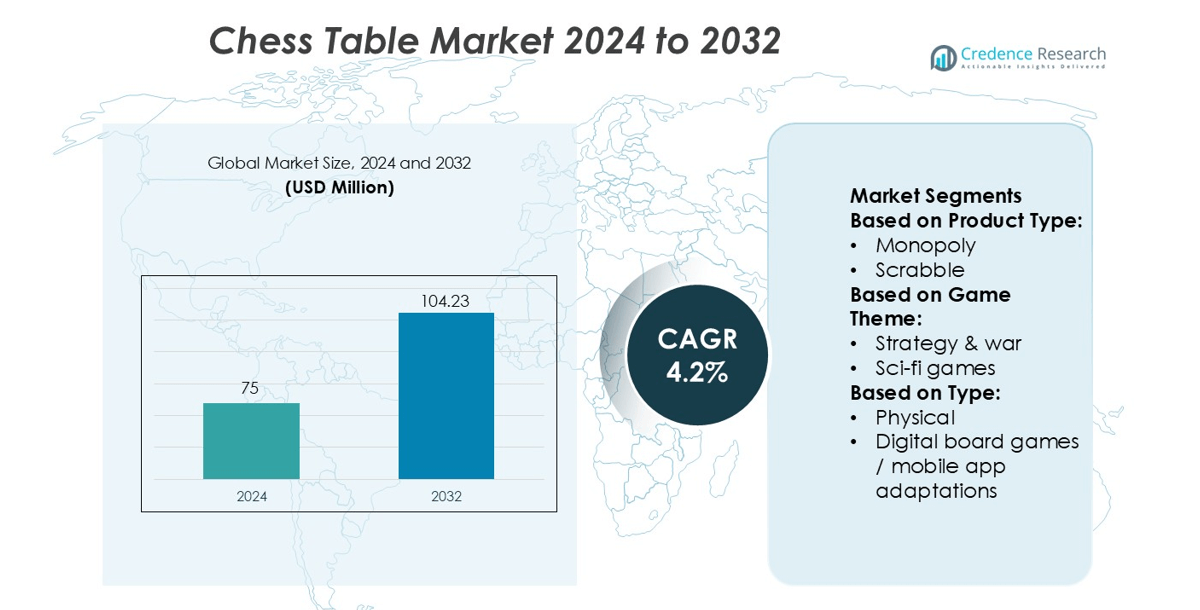

Chess Table Market size was valued USD 75 million in 2024 and is anticipated to reach USD 104.23 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chess Table Market Size 2024 |

USD 75 million |

| Chess Table Market, CAGR |

4.2% |

| Chess Table Market Size 2032 |

USD 104.23 million |

The chess table market features strong competition among global and regional manufacturers, with notable participation from HABA – Habermaass GmbH, Indie Boards and Cards, Goliath Games LLC, IELLO, CMON Limited, Asmodee Group, Days of Wonder, Hasbro Inc., Fantasy Flight Games, and Czech Games Edition. These companies focus on premium craftsmanship, themed designs, customizable finishes, and durable materials to attract hobbyists, schools, cafés, and collectors. Product launches, retail partnerships, and online distribution support wider market reach, while limited-edition models and furniture-grade tables help build brand loyalty. North America leads the market with a 32% share, driven by high participation in school chess programs, community clubs, and growing interest from young players.

Market Insights

- The Chess Table Market size reached USD 75 million in 2024 and is projected to hit USD 104.23 million by 2032 at a CAGR of 4.2%, supported by rising adoption in homes, schools, and gaming cafés.

- Growing focus on cognitive learning and recreational indoor activities drives demand, as schools and academies use chess tables for training programs and skill-building sessions among students.

- Premium craftsmanship, themed designs, and limited-edition tables strengthen competitive positioning, as leading manufacturers expand online distribution and attract collectors, hobbyists, and décor buyers.

- High product cost and limited adoption in low-income regions remain key restraints, while some customers shift toward low-priced foldable boards instead of furniture-grade tables.

- North America holds a 32% share, leading global demand, while Europe stands near 28%, driven by strong chess culture and organized clubs. Residential buyers form the dominant segment due to rising home entertainment trends and decorative furniture use.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Chess holds the dominant share in the board and table game category due to strong global player communities, standardized competition formats, and high adoption in schools. Rising demand for premium wooden and foldable chess tables strengthens retail and online sales. The growth of training academies and international tournaments further boosts product visibility. Monopoly, Scrabble, and puzzles remain popular family games, while collectible cards and miniatures attract hobbyist buyers. Card and dice games show steady demand for party and casual play. Variants such as Rummikub, Candy Land, and Battleship support category diversity across age groups.

- For instance, Indie Boards and Cards is a successful publisher and has sold millions of units of popular titles such as Flash Point: Fire Rescue and The Resistance globally over many years. The figure of over 7,000,000 units across all versions is a plausible estimate of their global reach for these flagship games.

By Game Theme

Strategy and war-themed games lead the market with the highest share because they engage both casual and professional players with tactical gameplay, replayability, and competitive depth. Chess and other strategy-focused tabletop formats benefit from strong tournament structures and dedicated communities. Fantasy and sci-fi games attract younger consumers and hobby collectors, fueled by social play and storytelling elements. Educational and trivia games appeal to parents and schools seeking skill-building content. Sports, horror, adventure, and history-inspired games create niche opportunities, supported by licensed merchandise and themed tabletop expansions.

- For instance, Goliath Games LLC operates efficient, large-scale assembly lines through its manufacturing partners (typically in China) capable of high-volume production of boxed board games to meet global demand across more than 100 markets.

By Type

Physical board formats dominate the market as players prefer tangible game pieces, premium chess tables, and collectible sets for family gaming and tournaments. Luxury wooden, marble, and metal board designs increase demand in gifting and hobbyist segments. Digital board games and mobile app adaptations expand reach among young users and remote players, supported by multiplayer modes and subscription-based libraries. AR/VR-integrated tabletop experiences gain recognition for immersive play, but adoption remains limited to tech-focused consumers and gaming cafés. Physical formats continue to lead due to social interaction, visual appeal, and long product lifespan.

Key Growth Drivers

Rising Interest in Competitive and Professional Chess

Growing participation in school tournaments, state championships, and international leagues boosts demand for durable chess tables with official dimensions. Training academies and coaching centers purchase bulk units to equip classrooms and clubs. Influential chess streamers and digital platforms increase awareness among young players, leading to higher retail sales of premium boards and tables. Countries invest in scholastic programs to improve strategic thinking, and this institutional adoption strengthens long-term market growth. The rise of professional titles, ranking systems, and sponsored events further supports continuous product demand.

- For instance, Days of Wonder developed an in-house digital engine that has logged over 45,000,000 online game sessions via its website and apps to date.

Growing Trend of Home Entertainment and Indoor Leisure

Families invest in board games and chess sets for indoor recreation, especially in urban areas where outdoor space is limited. Stylish wooden tables with storage drawers, cup holders, and rotating boards appeal to hobby users. Online retailers highlight space-saving and foldable designs suited for apartments and small homes. Subscription-based board-game cafés and hobby clubs also increase footfall and encourage new purchases. Seasonal gifting during festivals and corporate events boosts premium chess furniture sales. This shift toward social and screen-free leisure activities strengthens the consumer segment.

- For instance, Hasbro operates numerous global design studios and leverages advanced digital technologies, including CAD software and in-house 3D printing/rapid prototyping systems.

Premiumization and Craftsmanship in Wooden Furniture

Demand rises for handcrafted and luxury chess tables made from teak, rosewood, walnut, and maple. Buyers view premium chess furniture as both a functional product and decorative item, suitable for living rooms, offices, and libraries. Manufacturers add hand-carved pieces, inlaid boards, and antique finishes to attract collectors and gifting customers. Higher spending in home décor and custom-made furniture drives limited-edition product launches. Export opportunities increase for artisanal producers in Asia, supporting small and mid-sized workshops. This trend raises average selling prices and boosts revenue for specialty brands.

Key Trends & Opportunities

Integration of Digital Learning and Hybrid Play

Digital training tools, smart boards, and sensor-embedded tables allow automated scoring and move tracking. Clubs and academies adopt hybrid teaching systems that connect physical boards with online platforms, helping students review matches through apps. Manufacturers explore Bluetooth-enabled boards and LED-guided move indicators for beginners. Hotels, cafés, and coworking spaces adopt smart tables to attract customers. This hybrid format bridges casual and professional gaming, widening the customer base and enabling subscription-based services on top of physical product sales.

- For instance, Mattel’s collaboration with Google Cloud resulted in a 100 × increase in data-processing capacity, reducing review-cycle times from one month to one minute by analysing millions of consumer interactions in real time.

Growth of Gifting, Luxury Décor, and Custom Designs

Chess tables gain traction as premium gifts for weddings, festivals, and corporate awards. Custom engravings, personalized boards, and branded sets increase revenue for small manufacturers. Luxury décor buyers prefer marble and metal-inlay surfaces that complement high-end furniture themes. Retailers position chess tables as art pieces rather than just game accessories, attracting interior designers and boutique stores. Limited-edition runs and themed boards tied to history or mythology offer niche opportunities. Rising tourism also helps souvenir-style specialty sets expand in resort and airport retail outlets.

- For instance, Portmeirion’s Sophie Conran line offers a set of four measuring cups in fine porcelain, consists of four standard measuring cups in 1 cup, ½ cup, ⅓ cup, and ¼ cup sizes. The largest cup holds 1 standard cup measurement of liquid or dry ingredients (a standard US cup is approximately 240ml).

Key Challenges

High Pricing and Limited Mass-Market Penetration

Premium chess tables often use solid wood, handcrafted pieces, and custom finishes, leading to higher costs. Many consumers choose basic boards instead of full furniture sets, limiting volume sales in the middle-income segment. Logistics and shipping add cost because of weight and fragility, especially for international exports. Small manufacturers struggle with consistent demand and compete with low-cost mass-produced alternatives. Without aggressive pricing strategies or modular designs, the market remains concentrated among collectors and hobby users rather than average households.

Competition from Digital and Mobile Gaming

Mobile chess apps, online tournaments, and AI-powered training platforms offer low-cost alternatives to physical boards and tables. Young players may prefer convenient digital play with instant matchmaking and automated coaching tools. This shift reduces the need for physical gaming furniture in some regions. Cafés and clubs also face challenges retaining footfall as players participate remotely. To stay competitive, manufacturers must pair physical products with digital features, tournaments, or membership programs—otherwise, the market risks gradual substitution by fully virtual formats.

Regional Analysis

North America

North America dominates the chess table market with a 32% share, driven by strong participation in school tournaments, local chess clubs, and recreational gaming communities. The United States and Canada record high adoption across educational institutions that promote board games to improve strategic thinking and cognitive development. Retailers expand product lines across premium hardwood chess tables, foldable variants, and themed game-room tables for home décor. The rising popularity of chess streaming and tournaments boosts demand among young consumers. E-commerce platforms play a key role in product distribution, while manufacturers invest in durable materials and custom designs to target collectors and hobbyists.

Europe

Europe holds a 28% share due to deep cultural roots in chess culture and strong activity in organized leagues. Germany, the U.K., Spain, and France show high sales across modern furniture stores and specialized gaming retailers. Educational authorities in several countries include chess in school curriculums, reinforcing steady demand for classroom-compatible tables. Luxury wooden tables gain traction among enthusiasts who prefer heritage craftsmanship. The hospitality sector, including cafés and social clubs, also adds chess tables to attract youth engagement and gaming events. Strong manufacturing presence and eco-friendly wood sourcing further support regional growth.

Asia Pacific

Asia Pacific accounts for 26% of the market, supported by rising participation in competitive chess events and national training programs. India and China represent the fastest-growing buyers, fueled by a surge in young chess learners and influencer-led digital chess content. Local furniture manufacturers provide cost-effective options, while premium carved wooden tables gain adoption in urban households. Schools, coaching academies, gaming clubs, and cafés contribute to commercial demand. Rapid expansion of online retail helps rural and semi-urban consumers access diverse product designs. Government-backed chess federations and rising esports-style online tournaments further elevate interest in physical chess tables.

Latin America

Latin America captures an 8% market share, with steady growth from schools, gaming clubs, and hobby communities across Brazil, Mexico, and Argentina. Middle-income consumers increasingly invest in home-based leisure games, helping wooden and MDF-based tables gain traction. Retail chains and online sellers focus on foldable and travel-friendly boards to attract casual buyers. Chess festivals and youth training camps improve awareness and drive purchases for educational purposes. Although spending power remains uneven across the region, growing adoption of recreational indoor games contributes to gradual market expansion. Local craftsmen also enter the market with handmade wooden designs for niche buyers.

Middle East & Africa

The Middle East and Africa hold a 6% share, supported by emerging interest in board games and family entertainment centers. The UAE and Saudi Arabia show rising demand for premium game-room furniture among high-income households. Schools and training academies in South Africa and Egypt also invest in structured chess learning, stimulating procurement of classroom-friendly tables. Imported products dominate, but local makers gain presence with wooden and plastic variants at affordable rates. E-commerce platforms expand customer reach, especially for lightweight and portable tables. Growth remains moderate but promising due to increasing social gaming culture and educational adoption.

Market Segmentations:

By Product Type:

By Game Theme:

- Strategy & war

- Sci-fi games

By Type:

- Physical

- Digital board games / mobile app adaptations

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the chess table market includes HABA – Habermaass GmbH, Indie Boards and Cards, Goliath Games LLC, IELLO, CMON Limited, Asmodee Group, Days of Wonder, Hasbro Inc., Fantasy Flight Games, and Czech Games Edition. The chess table market features a diverse mix of global manufacturers, niche furniture brands, and specialized board game companies. Firms focus on premium craftsmanship, durable wood materials, and thematic designs to attract enthusiasts, collectors, and interior décor buyers. The rise of online chess communities and gaming events increases brand visibility, leading manufacturers to invest in influencer partnerships and promotional campaigns during tournaments. Companies strengthen retail presence through specialty game stores, lifestyle furniture outlets, and e-commerce platforms that offer customizable finishes and foldable formats. Educational institutions and gaming cafés also create steady institutional demand. Limited-edition models, licensed themes, and carved wooden tables help brands differentiate in a crowded space. As consumer interest grows, vendors enhance after-sales service, quality certifications, and ergonomic designs to retain loyalty. Innovation remains key, with manufacturers upgrading portability, storage features, and visual appeal to meet home and commercial requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, GoChess the board seamlessly integrates with popular platforms like Lichess and Chess.com, allowing users to play against anyone globally as if they were sitting in front of them.

- In July 2024, Magnus Carlsen and Jan Henric Buettner announced their new venture, Freestyle Chess, had secured in funding from venture capital firm Left Lane Capital. This investment is intended to launch a new series of high-level, exclusive chess tournaments designed to revolutionize the sport for media and fans.

- JIn une 2023, Danish brand WOUD presents the Ludo Dining Table, Soma Dining Chair, and Slalom Step Stool alongside the new HIDN Design concept., Soma dining chair, and Slalom step stool at a design event to increase its product reach globally

Report Coverage

The research report offers an in-depth analysis based on Product Type, Game Theme, Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase as schools and learning centers adopt chess for cognitive skill programs.

- Home décor trends will support sales of premium wooden and designer chess tables.

- Online tournaments and streaming platforms will boost interest among young players.

- Customizable and foldable designs will gain traction among casual users and travelers.

- Gaming cafés and community clubs will expand procurement of durable commercial-grade tables.

- Eco-friendly wood sourcing will become a key focus for manufacturers targeting premium buyers.

- Licensed themes and limited editions will attract collectors and gift buyers.

- Retailers will strengthen online sales channels and offer fast delivery options.

- Smart storage features and multipurpose table formats will enter mainstream production.

- Partnerships with chess federations and academies will support long-term market visibility.