Market Overview

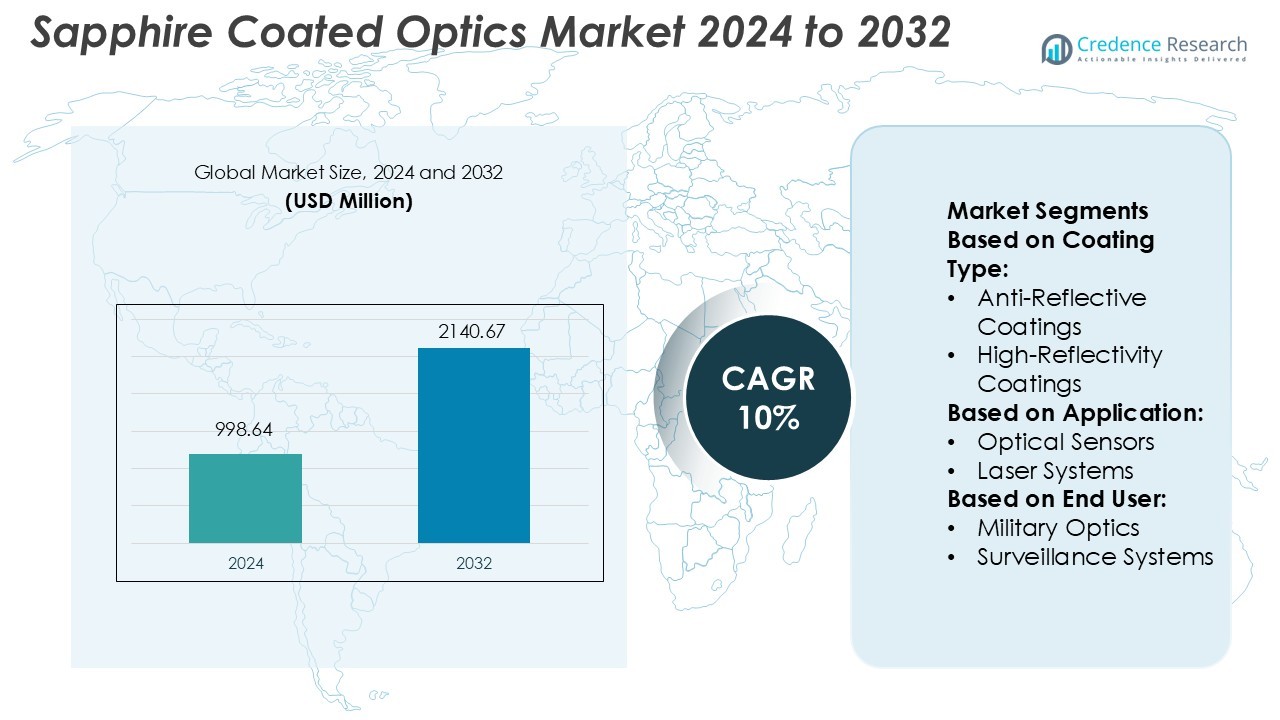

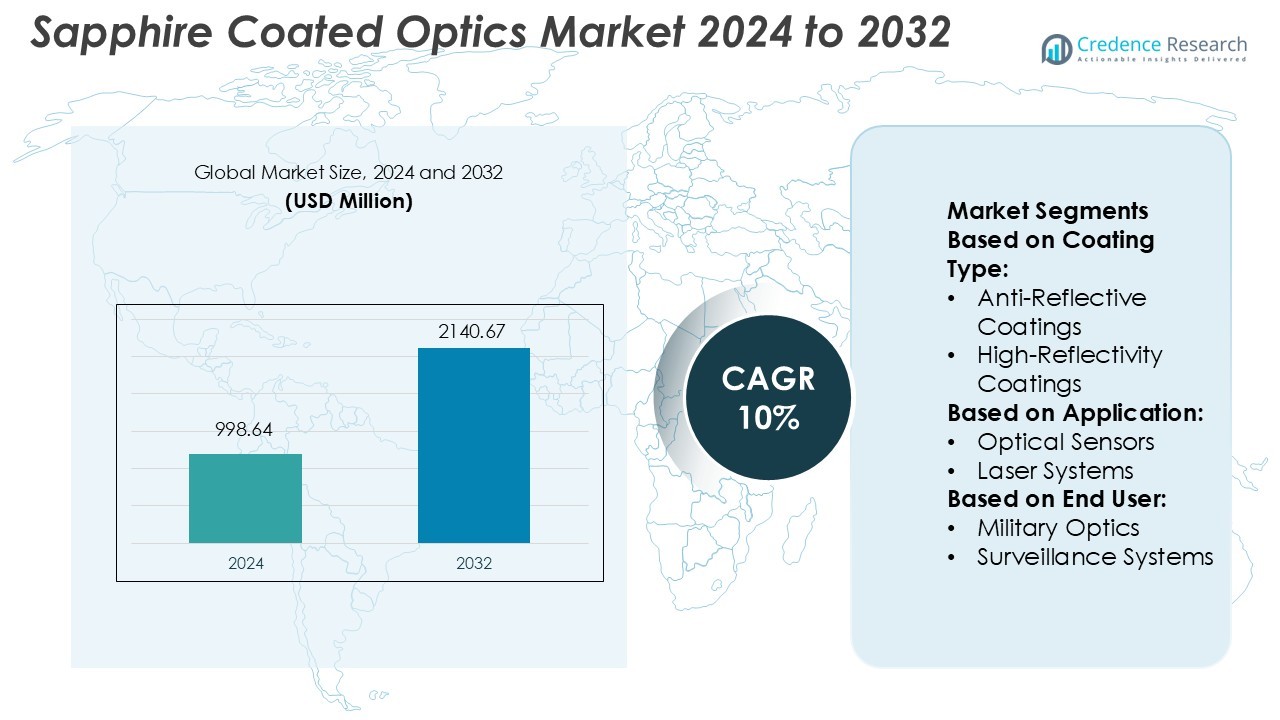

Sapphire Coated Optics Market size was valued USD 998.64 million in 2024 and is anticipated to reach USD 2140.67 million by 2032, at a CAGR of 10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sapphire Coated Optics Market Size 2024 |

USD 998.64 Million |

| Sapphire Coated Optics Market, CAGR |

10% |

| Sapphire Coated Optics Market Size 2032 |

USD 2140.67 Million |

The Sapphire Coated Optics Market is driven by prominent players such as Murata Manufacturing Co. Ltd., Konoshima Chemical Co., Ltd., CeraNova Corporation, Schott AG, Kyocera Corporation, Shenzhen Crystal Optoelectronics Technology Co. Ltd., CoorsTek, Inc., Ohara Corporation, CeramTec GmbH, and CoorsTek Corporation. These companies emphasize precision coating technologies, high-transmission optics, and thermal-resistant materials to meet the growing demand from defense, aerospace, medical, and semiconductor sectors. North America leads the global market with a 34% share, supported by advanced manufacturing infrastructure, strong R&D investments, and extensive use of sapphire optics in military and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sapphire Coated Optics Market was valued at USD 998.64 million in 2024 and is projected to reach USD 2140.67 million by 2032, growing at a CAGR of 10%.

- Market growth is driven by rising demand for sapphire-coated optics in defense, aerospace, and semiconductor applications due to their superior durability, heat resistance, and optical precision.

- Emerging trends include advancements in thin-film deposition, ion-beam sputtering, and atomic layer coating technologies that enhance optical performance and energy efficiency.

- Competitive dynamics are shaped by leading companies focusing on R&D, product innovation, and strategic collaborations to expand their technological capabilities and market reach.

- North America dominates with a 34% market share, while Asia-Pacific rapidly expands production capacity; the anti-reflective coatings segment leads overall adoption, supported by strong demand in laser systems and infrared imaging across industrial and military sectors.

Market Segmentation Analysis:

By Coating Type

The anti-reflective coatings segment holds the dominant share in the Sapphire Coated Optics Market. Its high demand stems from superior light transmission and minimized reflection losses across optical and laser systems. Sapphire’s hardness ensures durable coatings suitable for harsh environments and high-energy lasers. These coatings enhance optical performance in imaging, aerospace, and defense applications. High-reflectivity and filter coatings follow, addressing laser mirrors and wavelength selection requirements. Specialized coatings serve niche needs such as UV resistance and infrared applications, while uncoated components are used for cost-sensitive systems prioritizing thermal and mechanical strength.

- For instance, Edmund Optics and other optics suppliers offer high-purity sapphire optical components, which can achieve very low surface roughness (below 0.3 nm RMS with super-polishing) and high transmittance (over 99.8% with appropriate anti-reflective coatings) at wavelengths such as 1,064 nm.

By Application

Laser systems dominate the sapphire coated optics market due to their precision, energy efficiency, and durability under high-intensity operations. Sapphire coatings enhance beam quality, reduce energy loss, and improve system stability across industrial and defense-grade lasers. Optical sensors and imaging systems are growing segments, driven by automation, robotics, and advanced manufacturing uses. Spectroscopy and infrared optics benefit from sapphire’s broad wavelength range and heat resistance, ensuring accurate data capture in demanding environments. Other applications, including metrology and biomedical devices, leverage the material’s optical clarity and corrosion resistance.

- For instance, Encirc reduced the weight of Belu Mineral Water’s bottles by 20g, which helped save 850,000 kg of glass annually for that specific client. This was achieved through new techniques and the production of lighter containers.

By End User

Defense and aerospace represent the leading end-user segment, holding the major market share due to sapphire’s robustness and optical precision. Military optics and surveillance systems rely on sapphire-coated lenses for clarity and durability under extreme conditions. Aircraft and spacecraft components use sapphire optics to endure radiation and temperature fluctuations. The medical and healthcare segment is expanding, with sapphire coatings used in surgical lasers, diagnostic instruments, and endoscopic imaging for precise light transmission. Growing adoption in advanced medical imaging and minimally invasive procedures further accelerates this segment’s demand.

Key Growth Drivers

- Rising Demand for High-Performance Optical Systems

The growing use of sapphire-coated optics in aerospace, defense, and semiconductor industries drives market expansion. Sapphire coatings deliver superior hardness, thermal stability, and scratch resistance, making them ideal for harsh environments. These coatings enhance optical transmission and reduce reflection losses across ultraviolet to infrared ranges. Their adoption in laser targeting, surveillance, and precision imaging strengthens demand. The increasing focus on high-performance optics in satellites, sensors, and autonomous systems further boosts sapphire coating utilization across advanced technology platforms.

- For instance, Ardagh commissioned its NextGen hybrid furnace in Obernkirchen, achieving a 64 % reduction in emissions per bottle at that line.It built a hydrogen electrolyser in Limmared (Sweden) to feed low-carbon hydrogen into its glass melting system.

- Expanding Use in Medical and Healthcare Applications

Sapphire-coated optics are gaining importance in medical lasers, diagnostic imaging, and endoscopy tools due to their biocompatibility and resistance to sterilization chemicals. Their durability under high temperatures and corrosive environments enhances performance consistency during surgical procedures. Hospitals and clinics increasingly prefer sapphire-coated lenses and windows for their optical precision and reliability. The global shift toward minimally invasive surgeries and precision diagnostics has accelerated sapphire coating adoption. This expansion strengthens the material’s position across medical device manufacturing and healthcare instrumentation markets.

- For instance, Gerresheimer’s Lohr site now uses an oxy-hybrid furnace that can operate with up to 50% electricity input, reducing CO₂ emissions by up to 40% compared to conventional furnace technology.

- Technological Advancements in Coating Techniques

Continuous innovations in thin-film deposition methods, including ion-beam sputtering and atomic layer deposition, are improving sapphire coating performance. These technologies enable uniform coating layers with enhanced adhesion and optical clarity. Manufacturers are investing in automation and plasma-assisted processes to achieve greater coating efficiency and reduced defects. The result is improved durability and light transmission across optical systems. Enhanced production precision supports wider adoption in defense, laser optics, and industrial instrumentation. This technological evolution significantly contributes to the long-term growth of sapphire-coated optics.

Key Trends & Opportunities

- Integration with Infrared and Laser-Based Systems

Sapphire coatings are increasingly integrated into infrared imaging and high-energy laser systems due to their wide wavelength transmission range. Infrared detectors, military sensors, and LiDAR modules rely on sapphire’s superior optical clarity and mechanical strength. This trend supports emerging defense and autonomous navigation technologies. Growing investments in surveillance drones and laser communication systems further create opportunities for sapphire optics. The combination of thermal resilience and optical precision makes sapphire a preferred material in advanced photonic applications.

- For instance, Anchor Glass’s catalog lists a 12 fl oz long-neck bottle (model 812V6A) with a weight of 198.45 g and height of 228.60 mm. The company’s New Product Development (NPD) team designs custom bottles and utilizes its in-house mold-making facility to streamline the process from design to pilot samples.

- Rising Adoption in Semiconductor and Electronics Manufacturing

The semiconductor industry presents a growing opportunity for sapphire-coated optics, particularly in photolithography and wafer inspection equipment. Sapphire’s chemical stability and high thermal conductivity ensure accurate light control in high-power processes. Optics with sapphire coatings improve system reliability and lifespan under intense UV exposure. The trend aligns with increasing production of advanced chips and microelectronic components. Expanding global semiconductor fabrication capacity continues to drive demand for precision optical materials with superior performance consistency.

- For instance, BPL Offset offers a variety of glass bottles, including 300 ml juice bottles and 500 ml transparent water bottles. Freezer-safe bottles are also part of its product lineup.

- Sustainable Coating and Recycling Innovations

Manufacturers are focusing on eco-friendly coating technologies to minimize waste and energy use during sapphire processing. Advancements in vacuum deposition and chemical vapor processes improve coating efficiency and reduce material loss. Recyclable sapphire substrates and energy-efficient production lines align with global sustainability goals. This shift toward green optics manufacturing opens new opportunities in defense, healthcare, and consumer electronics sectors. The emphasis on sustainability also enhances brand reputation and compliance with environmental regulations.

Key Challenges

- High Production and Material Costs

The sapphire coating process involves complex fabrication and high-temperature deposition, significantly increasing production costs. Sapphire’s hardness also makes cutting and polishing more difficult compared to other optical materials. These challenges limit adoption among cost-sensitive industries such as consumer electronics and automotive. The dependence on precision machinery and skilled labor further adds to expenses. Although performance benefits are clear, the high capital investment required for sapphire coating technologies remains a major barrier to broader market penetration.

- Technical Complexity and Limited Customization

Sapphire coatings require precise control of thickness and uniformity to maintain optical performance, which increases manufacturing complexity. Small variations can impact reflectivity, wavelength accuracy, or coating durability. Moreover, customization for diverse applications such as infrared sensors and laser systems demands specialized processes. Limited flexibility in adapting coatings for unique wavelengths restricts rapid scalability. Manufacturers must overcome these engineering limitations to enhance sapphire optics’ accessibility and adaptability across different high-performance industries.

Regional Analysis

North America

North America holds the leading share of 34% in the Sapphire Coated Optics Market, driven by strong demand from defense, aerospace, and semiconductor sectors. The U.S. leads regional adoption with major investments in laser communication, infrared imaging, and optical sensor systems. The presence of key manufacturers and R&D facilities accelerates product innovation. Rising deployment of sapphire-coated optics in surveillance, LiDAR, and industrial lasers strengthens regional dominance. Canada contributes through healthcare and scientific research applications. Government-funded defense modernization programs and technology upgrades continue to support long-term market growth in North America.

Europe

Europe accounts for 28% of the Sapphire Coated Optics Market share, supported by its robust aerospace, automotive, and photonics industries. Countries such as Germany, France, and the U.K. lead in optical innovation, emphasizing precision manufacturing and sustainable coating solutions. Strong research initiatives and collaborations between universities and optical companies drive technological advancements. The region’s growing focus on renewable energy and high-performance imaging further boosts sapphire coating adoption. Defense contracts and expansion of infrared optics manufacturing enhance Europe’s competitive position, ensuring steady demand across commercial and industrial applications.

Asia-Pacific

Asia-Pacific captures a 27% market share, fueled by rapid industrialization and technological advancements in China, Japan, and South Korea. The region’s semiconductor and electronics industries rely heavily on sapphire-coated optics for photolithography and inspection systems. Japan leads in precision optics manufacturing, while China expands defense and communication-based applications. The growing use of sapphire optics in medical devices and industrial automation strengthens regional demand. Increasing foreign investments and government support for photonics R&D contribute to market growth. Asia-Pacific remains the fastest-growing region, driven by production scalability and cost-efficient manufacturing.

Latin America

Latin America represents a 6% share of the Sapphire Coated Optics Market, with gradual adoption in aerospace, defense, and industrial automation sectors. Brazil and Mexico lead the region’s demand, supported by expanding research institutions and optical component suppliers. Sapphire-coated optics are increasingly used in satellite imaging, energy, and healthcare applications. Local industries are integrating sapphire components into laser and spectroscopy systems for better accuracy and durability. Though the market is still emerging, rising investments in defense modernization and medical technology indicate steady growth potential in Latin America.

Middle East & Africa

The Middle East & Africa region holds a 5% market share, driven by defense, surveillance, and energy infrastructure projects. The UAE and Saudi Arabia are major adopters, focusing on sapphire-coated optics for aerospace and thermal imaging systems. Investments in optical sensor development for border control and smart security applications boost market growth. In Africa, sapphire-coated optics find applications in research and healthcare imaging systems. Although regional production capacity is limited, partnerships with global optics manufacturers are increasing. Continued investment in security modernization and precision optics sustains steady market expansion.

Market Segmentations:

By Coating Type:

- Anti-Reflective Coatings

- High-Reflectivity Coatings

By Application:

- Optical Sensors

- Laser Systems

By End User:

- Military Optics

- Surveillance Systems

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sapphire Coated Optics Market is highly competitive, featuring key players such as Murata Manufacturing Co. Ltd., Konoshima Chemical Co., Ltd., CeraNova Corporation, Schott AG, Kyocera Corporation, Shenzhen Crystal Optoelectronics Technology Co. Ltd., CoorsTek, Inc., Ohara Corporation, CeramTec GmbH, and CoorsTek Corporation. The Sapphire Coated Optics Market features intense competition driven by continuous technological innovation and precision manufacturing advancements. Companies focus on developing high-quality sapphire coatings that enhance optical transmission, durability, and resistance to extreme environments. Increasing demand from defense, aerospace, medical, and semiconductor industries pushes manufacturers to improve coating uniformity and performance reliability. Investments in advanced thin-film deposition techniques such as ion-beam sputtering and atomic layer deposition enhance coating precision and scalability. The competitive landscape is shaped by rising automation, sustainable production methods, and strategic collaborations aimed at expanding global reach and addressing high-performance optical requirements.

Key Player Analysis

- Murata Manufacturing Co. Ltd.

- Konoshima Chemical Co., Ltd.

- CeraNova Corporation

- Schott AG

- Kyocera Corporation

- Shenzhen Crystal Optoelectronics Technology Co. Ltd.

- CoorsTek, Inc.

- Ohara Corporation

- CeramTec GmbH

- CoorsTek Corporation

Recent Developments

- In April 2025, Titomic, the developer of Titomic Kinetic Fusion cold spray additive manufacturing, collaborated with Northrop Grumman to develop and manufacture high-performance pressure vessels.

- In May 2024, Edmund Optics collaborated with Quartus Engineering to offer highly integrated and complex precision opto-mechanical solutions. They will leverage their extensive engineering and manufacturing capabilities to collaborate on the development of new optically empowered products for advanced applications.

- In March 2024, Meller Optics became DFARS compliant and started supplying flat sapphire windows aimed at commercial aircraft, drones, and military systems. The products have hardness of around nine on the Mohs scale, custom-mount configurations, and suit a range of salt-fog and ballistic-impact specifications with multispectral AR coatings.

- In January 2024, Sapphire Tuff, a leading player in the glass industry, has inaugurated its second facility in Pune, India, equipped with state-of-the-art technology. This milestone underscores the company’s commitment to innovation and market responsiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Coating Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sapphire-coated optics will grow with increased use in laser and infrared systems.

- Advancements in thin-film deposition technologies will enhance coating precision and durability.

- Defense and aerospace sectors will remain major consumers of sapphire-coated optical components.

- Medical imaging and surgical devices will increasingly adopt sapphire optics for precision and reliability.

- Semiconductor manufacturing will drive consistent demand for sapphire-coated inspection and lithography optics.

- Integration of sapphire optics in autonomous vehicles and LiDAR systems will expand market scope.

- Sustainability goals will push manufacturers toward eco-friendly coating and recycling processes.

- Rising investments in photonics research will accelerate product innovation and commercialization.

- Emerging economies in Asia-Pacific will strengthen sapphire optics production and export capacity.

- Strategic partnerships and technological collaborations will shape the competitive and innovation landscape.